Forex trading is becoming increasingly popular in India, and finding the right trading app is crucial for success. In 2025, several top-notch Forex trading apps offer Indian users a convenient and efficient trading experience. In this article, we'll highlight the best Forex trading apps in India, helping you make the most informed choice in a rapidly evolving market.

Best Forex Trading Apps in India

Praised for its transparency, tight security measures, and a clean, user-friendly design

Offers an intuitive interface with a demo account feature and supports a variety of cryptocurrencies

Provides a straightforward mobile trading experience with a focus on security and ample educational materials

more

Best Forex Trading Apps in India Compared

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Trading Apps In India Reviewed

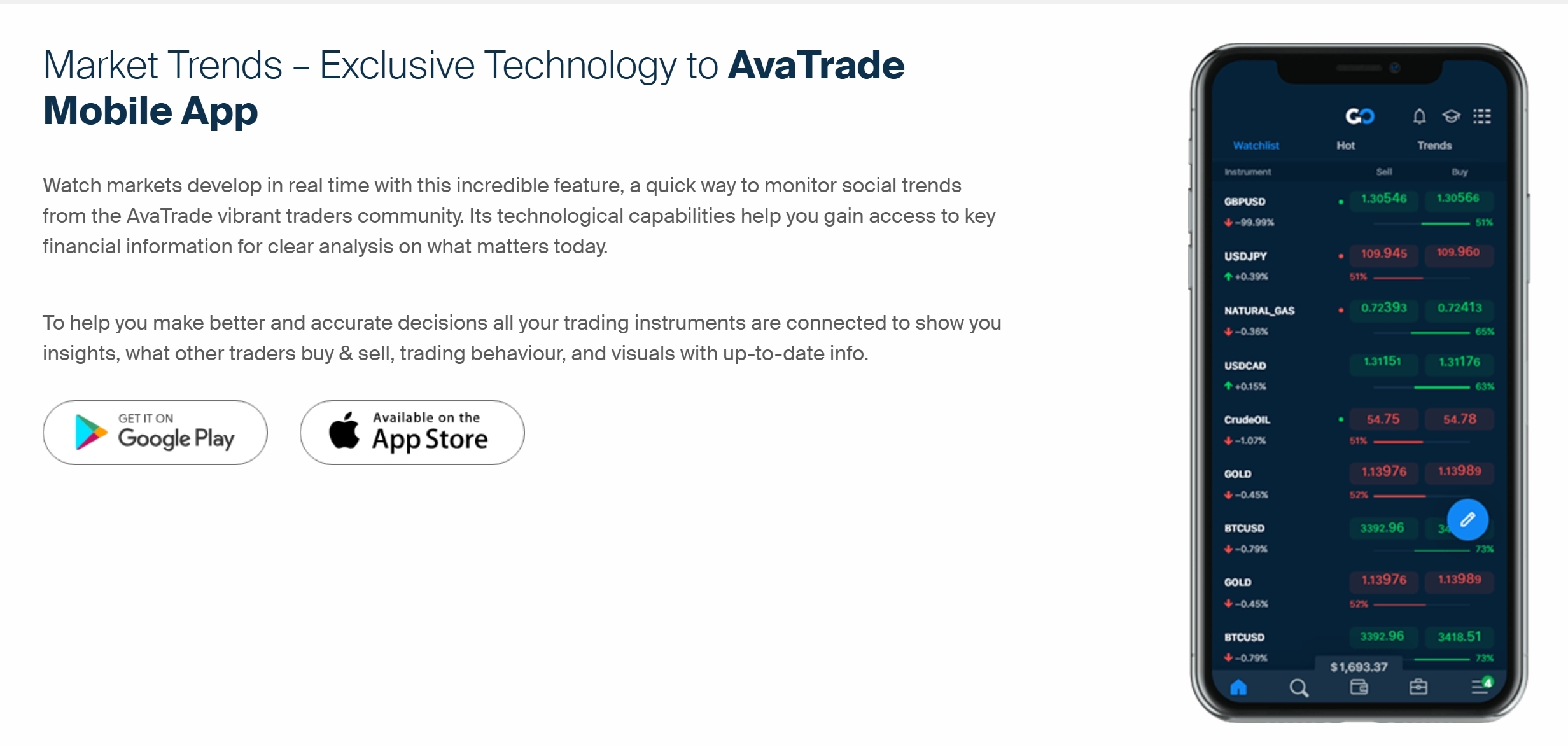

① AvaTrade Mobile App

Known for its user-friendly interface and extensive educational resources

Why We Chose It?

AvaTrade Mobile App tops the list due to its exceptional user-friendly interface. It is recognized for a wide variety of trading instruments, allowing traders to diversify their portfolio. Also, it offers extensive learning resources, which is beneficial for traders to continue enhancing their trading skills.

|

||

| App Rating | ⭐⭐⭐⭐⭐ | |

| Min. Deposit | $100 | |

| Regulation | ASIC, FSA, FFAJ, ADGM, CBI, FSCA | |

| Trading Instruments | Forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, FX options | |

| Demo Account | ✅ ($10,000 in virtual capital, lasts for 21 days and can be renewed upon request) | |

| Max. Leverage | 1:30 (retail)/1:400 (professional) | |

| Trading Platforms | AvaTrade Mobile App, Mobile WebTrader, AvaSocial, AvaOptions, DupliTrade, MT4/5 | |

| Fees | Spreads & Commissions (Forex) | Typical 0.9 pips on (EUR/USD) & commission-free |

| Inactivity Fee | $/€/£50 after 3 consecutive months of non-use | |

| Open AvaTrade Account | ||

AvaTrade Mobile App Pros & Cons

Pros

User-friendly interface: The app is designed to be intuitive and easy to navigate, making trading accessible for both new and experienced traders.

Educational Resources: AvaTrade Mobile App offers a wide range of learning resources, including webinars, video tutorials, and articles to help traders enhance their trading skills.

Wide Range of Trading Instruments: AvaTrade Mobile App offers a broad spectrum of trading instruments, including forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, and FX options.

Highly Regulated: AvaTrade is regulated in many jurisdictions, offering an added layer of security for its users.

Cons

Limited Technical Analysis Tools: Compared to some other trading platforms, AvaTrade Mobile App has fewer technical analysis tools available.

Inactivity Fee: After 3 consecutive months of non-use (“Inactivity Period”), and every successive Inactivity Period, an inactivity fee will be deducted from the value of the Customers trading account. This fee is outlined below and subject to client relevant currency based account:

USD Account: $50

EUR Account: €50

GBP Account: £50

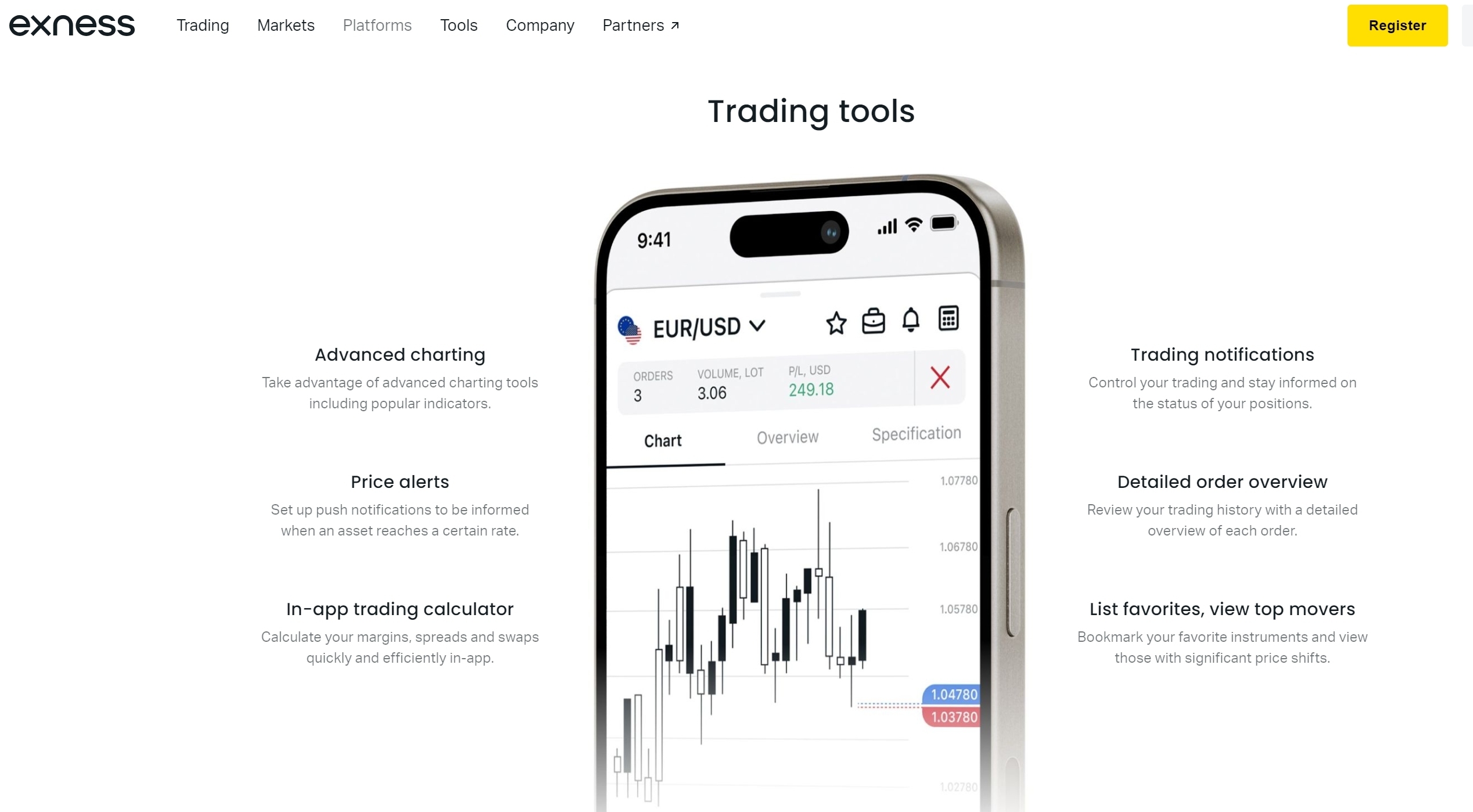

② Exness Trade App

Stands out due to advanced charting tools and low spreads

Why We Chose It?

Exness stands out with its advanced charting tools that aid in efficient analysis of the Forex market. It is well suited for both novice and seasoned traders as it provides rich educational resources. Trading with Exness gives traders an edge with its highly competitive spreads.

|

||

| App Rating | ⭐⭐⭐⭐ | |

| Min. Deposit | $10 | |

| Regulation | CySEC, FCA, FSCA, FSA (Offshore) | |

| Trading Instruments | CFDs on forex, commodities, stocks, indices, cryptos | |

| Demo Account | ✅($10,000 virtual funds) | |

| Max. Leverage | 1: Unlimited | |

| Trading Platforms | Exness Trade App, MT4/5, Exness Terminal | |

| Fees | Spreads & Commissions (Forex) | From 0.2 pips & commission-free (Standard account) |

| Open Exness Account | ||

Exness Trade App Pros & Cons

Pros

Advanced Charting Tools: Exness provides a plethora of charting tools that help in making efficient market analysis.

Wide Range of Educational Resources: Whether you're a starter or an experienced trader, Exness offers educational materials to enrich your trading knowledge and skills.

Competitive Spreads: Exness offers tight spreads allowing cost-effective trading.

Multiple Account Types: Exness offers multiple types of accounts, catering to various trading needs.

Cons

Deposit and Withdrawal Fees: Depending on the method of transaction, they may charge fees on deposits and withdrawals.

Regional Restricitons: Exness does not offer services to clients from the USA, Canada, Iran, North Korea, Europe, the UK, Russia, Belarus and others.

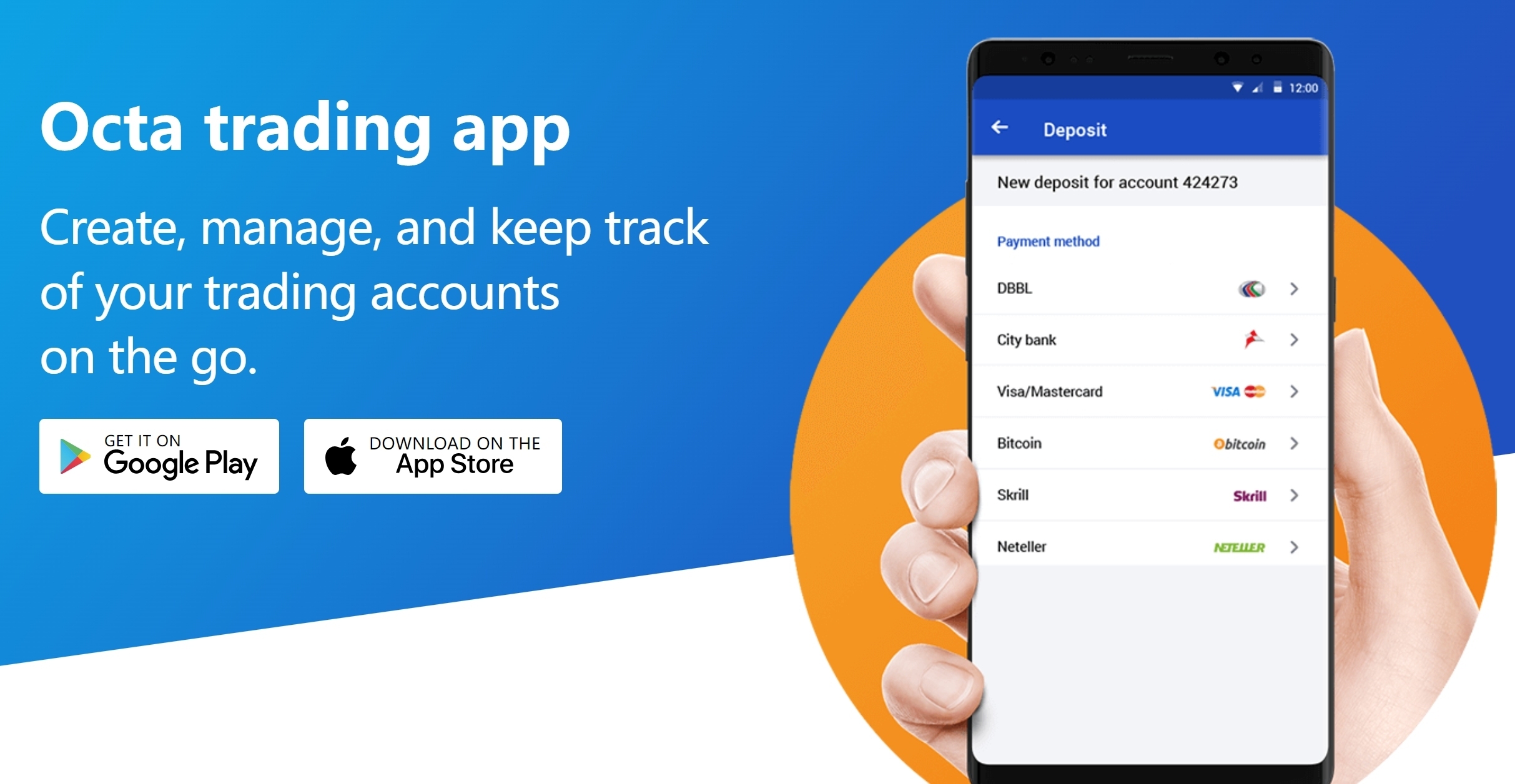

③ Octa Trading App

Praised for its transparency, tight security measures, and a clean, user-friendly design

Why We Chose It?

The defining features of the Octa Trading App are the transparency it offers its users and its tight security measures. The app remains user-friendly with a clean design for seamless navigation and offers a range of tools and charts for detailed market analysis.

|

||

| App Rating | ⭐⭐⭐⭐ | |

| Min. Deposit | $25 | |

| Regulation | CySEC | |

| Trading Instruments | Currrency pairs, gold/silver, commodities, indices, cryptos | |

| Demo Account | ✅ | |

| Max. Leverage | 1:500 | |

| Trading Platforms | Octa Trading App, OctaTrader | |

| Fees | Spreads & Commissions (Forex) | From 0.6 pips & commission-free (all account types) |

| Deposit Fee | ❌ | |

| Withdrawal Fee | ❌ | |

| Open Octa Account | ||

Octa Trading App Pros & Cons

Pros

Transparency: Octa is highly transparent with their processes, making it easy for traders to understand the system.

Strong Security Measures: Users' safety is prioritized with robust security measures, offering a secure trading environment.

Clean, User-Friendly Design: The platform is easy to navigate with a sleek design and intuitive organization.

Wide Tool Selection: It offers a plethora of charts and tools for detailed market analysis.

Cons

Regional Restrictions: Clients from Belgium, the USA, Canada, Spain, and the UK, as well as jurisdictions outside the European Economic Area (EEA) except Switzerland are not allowed.

Limited Customer Support: The customer service is only available from 9 a.m. to 6 p.m. UTC+3 via email.

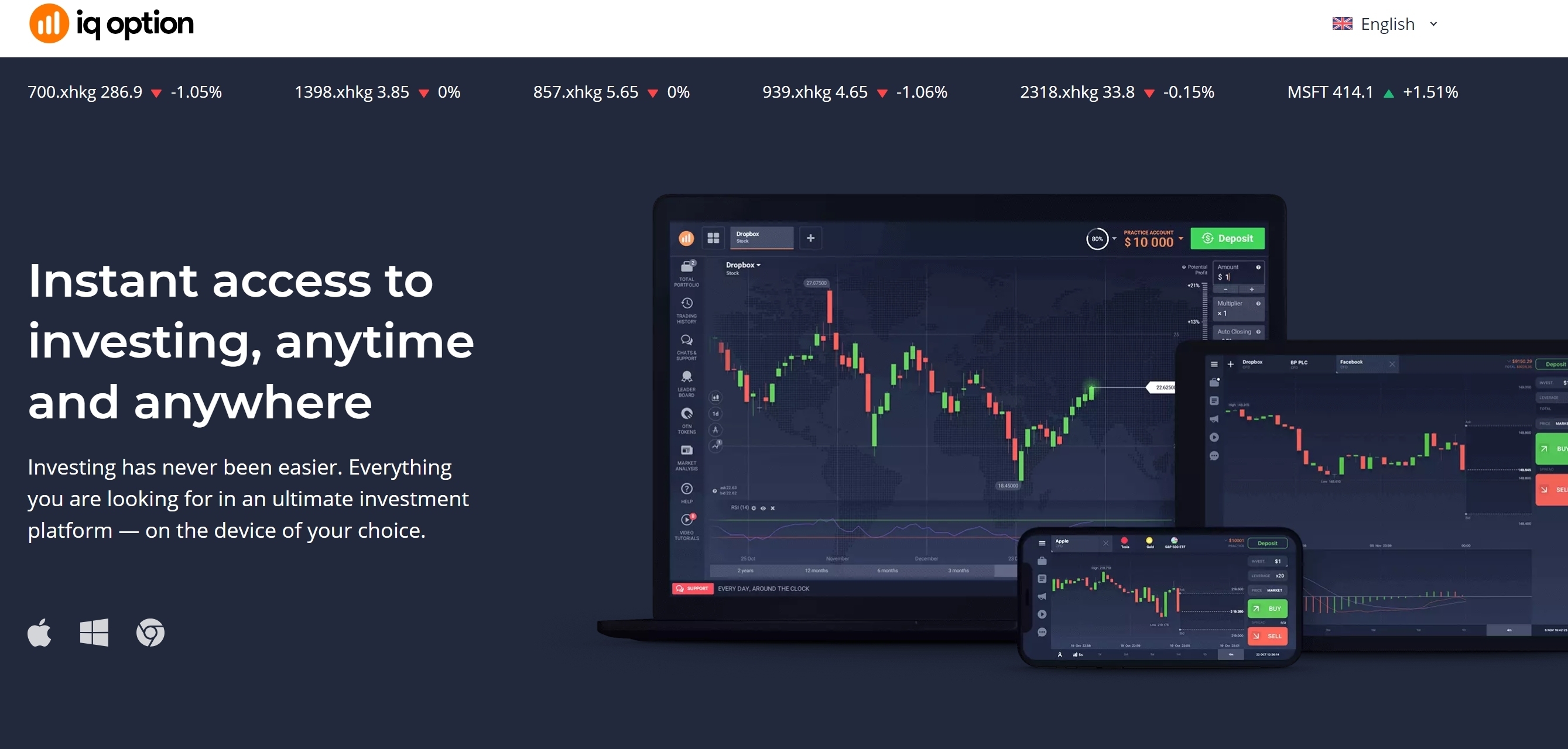

④ IQ Option Mobile App

Offers an intuitive interface with a demo account feature and supports a variety of cryptocurrencies

Why We Chose It?

IQ Option Mobile App is another top contender, given its refined and intuitive user interface. This app goes the extra mile by offering a demo account for traders to get familiarized with forex trading before investing real money. With a wide variety of charting tools and the support of various cryptocurrencies, IQ options remain a versatile option for many.

|

||

| App Rating | ⭐⭐⭐⭐ | |

| Min. Deposit | $10 | |

| Regulation | CySEC | |

| Trading Instruments | 300+ CFD assets, Forex, Stocks, Cryptocurrencies, Commodities, ETFs | |

| Demo Account | ✅ ($10,000 virtual capital) | |

| Max. Leverage | 1:500 | |

| Trading Platforms | IQ Option Mobile App, IQ Option Desktop | |

| Fees | Spreads & Commissions (Forex) | From 0.6 pips (EUR/USD) & commission-free |

| Open IQ Option Account | ||

IQ Option Mobile App Pros & Cons

Pros

Intuitive Interface: Known for its sleek and user-friendly design, making it easy for traders to navigate and execute trades.

Demo Account: Offers a demo account feature that allows new traders to practice before they start trading with real money.

Variety of Assets: It provides a long list of different assets, including a variety of cryptocurrencies, to trade.

Educational Materials: IQ Option is known for its comprehensive educational resources that cater to both new and experienced traders.

Cons

Limited Technical Analysis Tools: Although it provides several charting tools, some advanced traders might find the technical resources limited.

Restrictions on Withdrawal: There are some conditions and limitations on the withdrawal of funds.

⑤ HFM App

Provides a straightforward mobile trading experience with a focus on security and ample educational materials

Why We Chose It?

HFM App offers a straightforward mobile trading experience which suits traders who prefer a minimalist approach. The app also prioritizes safe trading, incorporating advanced encryption technology to protect user information. Like others on the list, it also provides a bounty of educational materials.

|

||

| App Rating | ⭐⭐⭐⭐ | |

| Min. Deposit | $0 | |

| Regulation | CySEC, FCA, DFSA, FSA (Offshore) | |

| Trading Instruments | 500+ CFDs on Forex, Commodities, Metals, Bonds, Energies, ETFs, Indices, Cryptos, Stocks | |

| Demo Account | ✅ | |

| Max. Leverage | 1:2000 | |

| Trading Platforms | HFM Trading App, MT4/5 | |

| Fees | Spreads & Commissions (Forex) | From 1.2 pips & commission-free (Cent account) |

| Deposit Fee | ❌ | |

| Withdrawal Fee | ❌ | |

| Open HFM Account | ||

HFM App Pros & Cons

Pros

Straightforward Mobile Trading Experience: The app is designed to be simple and easy to use, catering to all types of traders.

Security Measures: With advanced encryption technology, HFM App ensures absolute security, safeguarding users' personal information and transactions.

Learning Resources: HFM app provides several educational materials that cover the basics of forex trading and advanced strategies.

Customer Support: Users praise the app for its prompt and professional customer support, ready to assist at any time.

Cons

Limited Technical Analysis Tools: HFM does not offer as many technical analysis tools as some of the more advanced platforms.

Regional Restrictions: Clients from the USA, Canada, Sudan, Syria, Iran, and North Korea are not accepted.

Frequently Asked Questions

What are the top forex trading apps in India for 2025?

Some of the best Forex trading apps in India for 2025 include AvaTrade Mobile App, Exness Trade App, Octa Trading App, IQ Option Mobile App, and HFM App. These apps are selected based on their user-friendliness, features, and reliability.

Is forex trading legal in India?

Yes, Forex trading is legal in India, but with specific restrictions. Retail traders are allowed to trade currency pairs where the Indian Rupee (INR) is one of the currencies, such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. Trading other currency pairs, such as EUR/USD or GBP/JPY, is prohibited for retail traders under Indian law.

How do I choose the best forex trading app for my needs?

When selecting a Forex trading app, consider factors such as ease of use, range of trading instruments, security features, regulatory status, customer support, and the availability of educational resources. It's important to choose an app that matches your trading experience and goals.

Are these forex trading apps beginner-friendly?

Yes, many of the apps mentioned, like AvaTrade Mobile App and IQ Option, are designed with beginners in mind. They offer intuitive interfaces and extensive educational resources to help new traders learn the basics and start trading confidently.

Disclaimer

Trading Forex (foreign exchange) carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, risk appetite, and the possibility of incurring losses. There is a possibility that you may sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

You Also Like

7 Best Platforms for Copy Trading in India 2026

India's leading copy trading platforms allows you to automatically copy the trades of top performers, enhancing profitbility.

Beware: 10 Fake Forex Brokers in the UK in 2026

With the need for caution in the UK's flourishing forex market, this article points out 10 fake brokers to avoid amidst numerous reputable entities.

Best Forex Brokers in Denmark for 2026

Discover top regulated forex brokers, trading platforms and broker reviews for reliable trading in Denmark.

Best Forex Brokers Ireland in 2026

Compare top forex brokers in Ireland with robust regulation, excellent platforms and broker reviews for secure trading.

7 Best Platforms for Copy Trading in India 2026

India's leading copy trading platforms allows you to automatically copy the trades of top performers, enhancing profitbility.

Best Forex Brokers in Denmark for 2026

Discover top regulated forex brokers, trading platforms and broker reviews for reliable trading in Denmark.

Best Forex Brokers Ireland in 2026

Compare top forex brokers in Ireland with robust regulation, excellent platforms and broker reviews for secure trading.

Best Forex Brokers with Trading APIs for 2026

Dive into top Forex Brokers with exceptional trading APIs, offering benefits, security, and a variety of platforms.