In Malaysia, the Securities Commission (SC) plays a crucial role in protecting investors from potential fraudulent activities and unregulated entities. As part of their efforts, the SC maintains an Investor Alert List, cautioning investors about companies that may not comply with regulatory requirements or pose significant risks to investors.

This article highlights eight entities currently listed on the TOP 7 SC INVESTOR ALERT LIST in MALAYSIA 2024: Aximtrade, TriumphFX, Yunikon FX, Herzen, Wise Markets, Juno Markets, and MFM Securities. Investors are urged to exercise caution when dealing with these entities and conduct thorough research before making any investment decisions.

Why on the SC Investor Alert List in Malaysia?

Carrying on capital market activities of dealing in derivatives without a licence

more

What is Investor Alert List in Malaysia?

The Investor Alert List contains a list of unauthorized websites, investment products, companies and individuals, including:

Persons carrying on or holding themselves out as carrying on the following regulated activities without a licence from the SC:

· Dealing in securities

· Dealing in derivatives

· Fund management

· Advising on corporate finance

· Investment advice

· Financial planning

· Dealing in private retirement schemes

· Persons operating a recognized market without authorization

· Persons issuing or offering securities without approval, authorization or recognition

· Persons misusing the SCs logo and misrepresenting the SC

Please take note that this list is not exhaustive and only serves as a guide to investors before making any investment decisions.

WikiFX Ratings and Regulatory Status

| Broker | Score | Regulatory status | Licenses |

| Aximtrade | 2.01/10 | Regulatory blacklist | ASIC (Regulated), NFA (Unauthorized), ASIC (Suspicious Clone) |

| TriumphFX | 2.05/10 | Regulatory blacklist | BaFin/CYSEC (Regulated), FCA/VFSC (Revoked) |

| Yunikon FX | 1.41/10 | Regulatory blacklist | N/A |

| Herzen | 1.35/10 | Regulatory blacklist | N/A |

| Wise Markets | 1.31/10 | No regulation | N/A |

| Juno Markets | 4.95/10 | Regulatory blacklist | VFSC (Offshore regulated), ASIC (Exceeded) |

| MFM Securities | 1.45/10 | Regulatory blacklist | VFSC (Suspicious clone) |

WikiFX Score Evaluation Criteria

· License Index: Reliability and Value of Acquired Licenses

· Business Index: Company stability, operational capabilities, etc.

· Risk Management Index: degree of asset guarantee at the time of bankruptcy, low possibility of fraudsters, etc

· Software Index: Usage environment such as a trading platform

· Regulatory Index: Strength of License Acquisition Regulations

Risk Disclosure of These Eight Dealers

1. Aximtrade

Carrying on unlicensed capital market activities of dealing in securities

WikiFX Rating: 2.01/10

Aximtrade does indeed have legitimate licensing from the Australian Securities & Investment Commission (ASIC, No. 001294600), which lends some credibility to its operations.

However, there are major areas of concern as well. The unauthorized Common Financial Service License from the National Futures Association (NFA, No. 0539713) and the potentially cloned Straight Through Processing (STP) license from the ASIC (No. 435746) raises red flags about the legitimacy of its operations.

Furthermore, the disclosure by the Securities Commission Malaysia emphasizes these concerns.

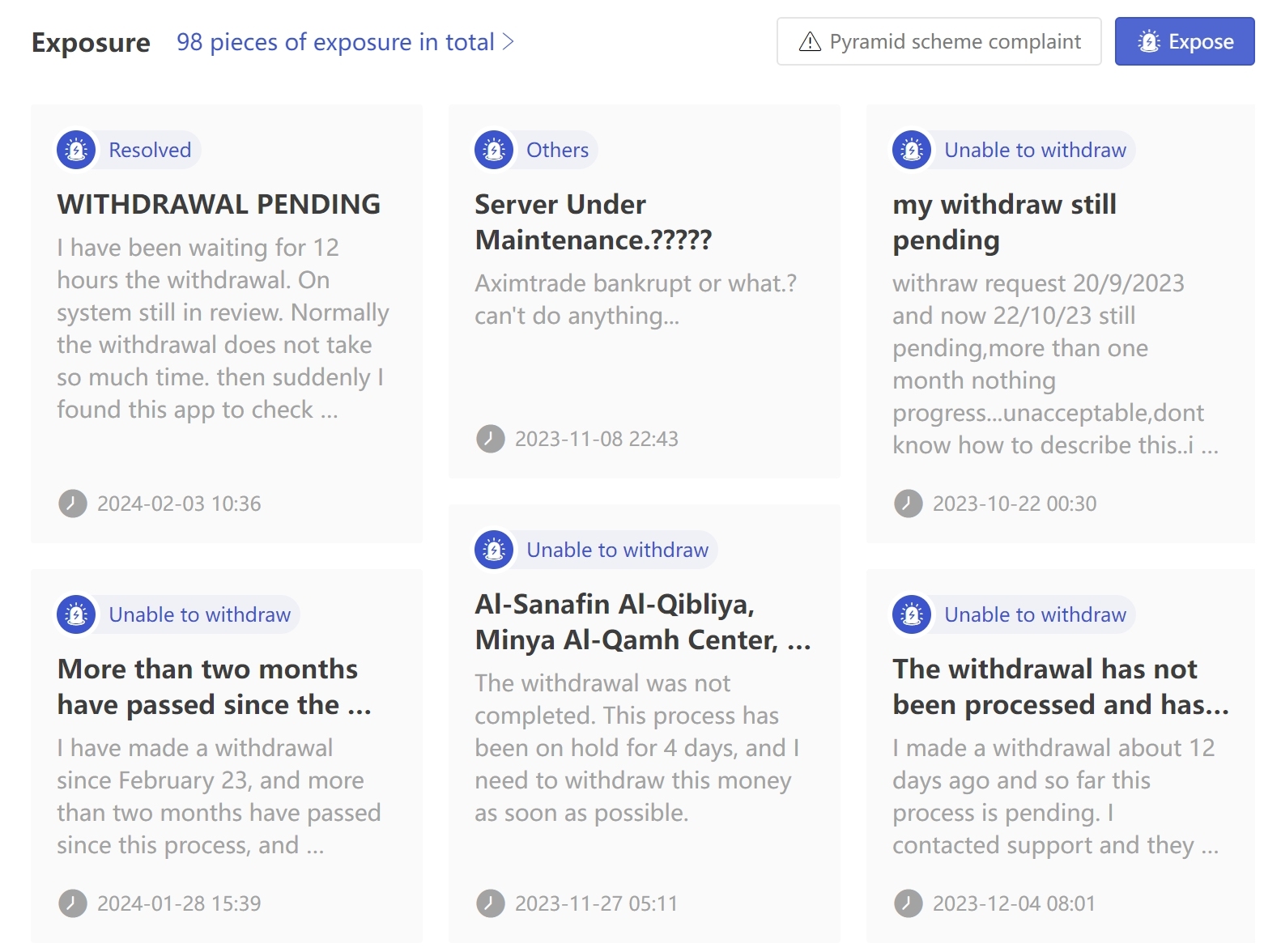

Moreover, a high number of complaints received by WikiFX - 98 in the past 3 months - suggests a significant level of customer dissatisfaction and potential misconduct.

Therefore, it's of utmost importance for anyone considering doing business with this platform to be vigilant and to consider these warning signs seriously.

2. TriumphFX

Carrying on capital market activities of dealing in derivatives without a licence

WikiFX Rating: 2.05/10

TriumphFX's situation is quite worrisome. It has run afoul of regulatory bodies, with its status being flagged by the Securities Commission Malaysia.

Furthermore, its inclusion on WikiFX's Scam Brokers list indicates critical credibility concerns.

The fact that TriumphFX has been identified as a Ponzi Scheme is extremely troubling. This type of scheme, which relies on payments from new members to satisfy obligations to existing ones, is not sustainable and can potentially cause significant losses for those who participate in it.

Despite having a regulated Retail Forex License from the Federal Financial Supervisory Authority (BaFin, No. 151993) and a Straight Through Processing (STP) license from the Cyprus Securities and Exchange Commission (CYSEC, No. 293/16), the other two licenses it holds from the Financial Conduct Authority (FCA, No. 763697) and the Vanuatu Financial Services Commission (VFSC, No. 17901) have both been revoked.

Finally, with 29 complaints lodged against them on WikiFX in just the last three months, investors should exercise extreme caution when dealing with TriumphFX. This raises numerous red flags and anyone considering investing with TriumphFX should be fully aware of these risks.

3. Yunikon FX

Carrying on unlicensed capital market activities of dealing in securities

WikiFX Rating: 1.41/10

Yunikon FX has been flagged by the Securities Commission Malaysia, which is a serious cause for concern.

Also, it has no valid regulations at present. This lack of regulation means that there may be no oversight of their operations, which raises the risk level for potential investors or traders.

It's always strongly recommended to deal only with fully regulated and credible financial entities.

4. Herzen

Carrying on unlicensed capital market activities of dealing in securities

WikiFX Rating: 1.35/10

Herzen has also been disclosed by the Securities Commission Malaysia and currently does not have any valid regulation. This is a strong warning signal for potential investors, as the lack of regulatory oversight can make transactions risky and provides little protection against potential fraud or mismanagement. It's wise for anyone considering investing or trading with this entity to proceed with extreme caution and to conduct diligent research to ensure its credibility.

5. Wise Markets

Carrying on unlicensed capital market activities of dealing in securities

WikiFX Rating: 1.31/10

Wise Markets currently has no valid regulations and the inclusion on the Investor Alert List warrants careful consideration from investors. Please be aware of the risk!

6. Juno Markets

Carrying out unlicensed capital market activities of dealing in securities and derivatives; Misrepresentation, misusing SCs name and logo

WikiFX Rating: 4.95/10

Juno Markets has been recently disclosed by the Securities Commission Malaysia and holds an offshore regulated Retail Forex License from the Vanuatu Financial Services Commission (VFSC, No. 40099) and an exceeded Investment Advisory License from the Australia Securities & Investment Commission (ASIC, No. 540205).

It's crucial to keep in mind that abnormal licenses can not provide the same level of oversight and protection as local regulatory bodies.

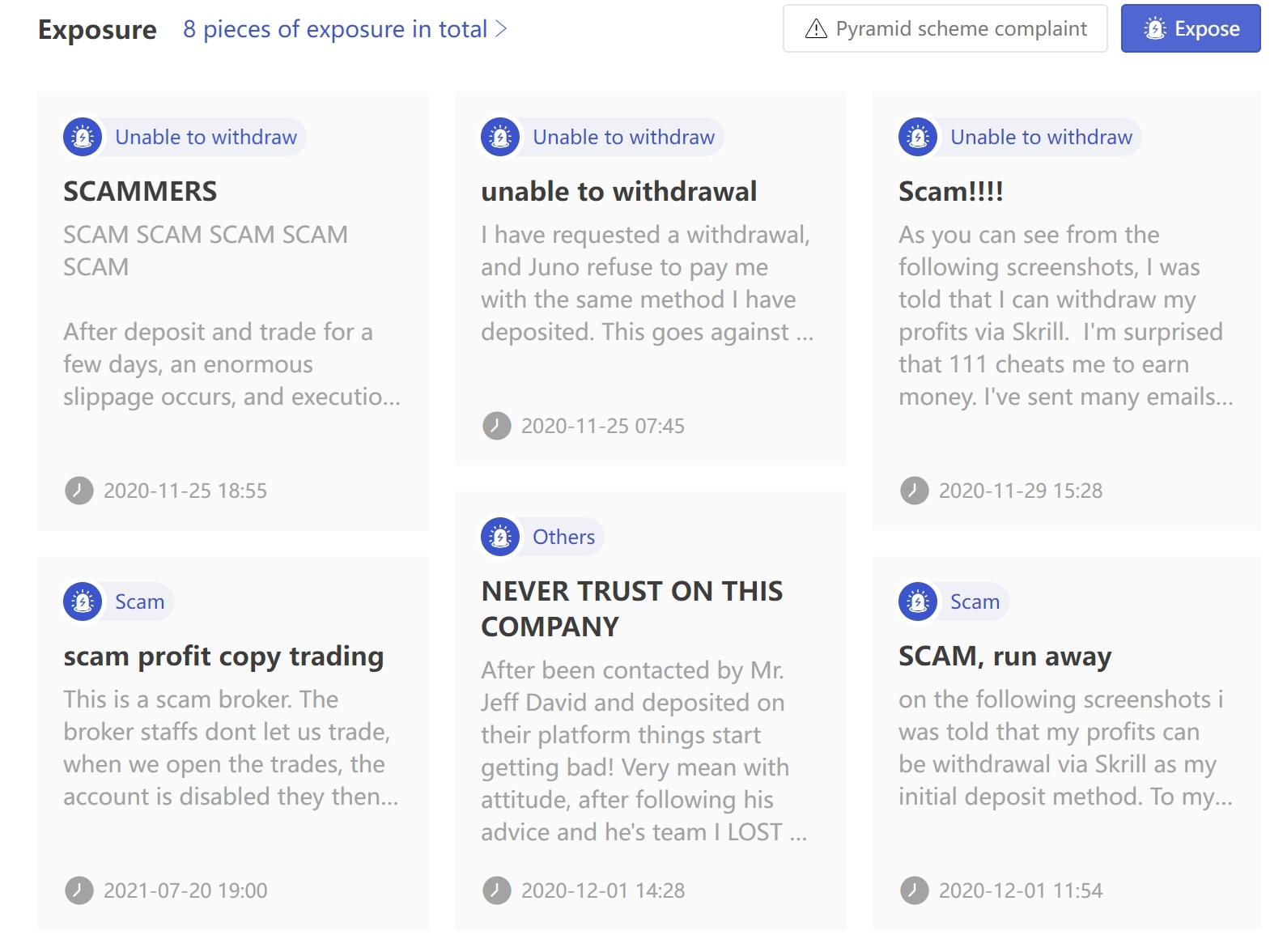

Furthermore, the fact that Juno Markets has reportedly received 8 complaints through WikiFX in the past 3 months could potentially be a cause for concern.

Complaints can sometimes be a sign of unsatisfactory practices and should not be overlooked when deciding whether to engage with a brokerage.

It is highly recommend to conduct further research and reach out to the appropriate regulatory bodies for more information before deciding to trade with Juno Markets.

7. MFM Securities

Carrying on unlicensed capital market activities of dealing in securities

WikiFX Rating: 1.45/10

Caution is advised when considering trading with MFM Securities. MFM Securities has been recently disclosed by the Securities Commission Malaysia and holds a suspicious clone license from the Vanuatu Financial Services Commission (VFSC, No. 700451). The notion of a “clone” license raises the concern of potential fraudulent activity or misrepresentation.

Furthermore, the exposure of a scam involving the company is noteworthy and could potentially be indicative of broader security and integrity problems within the company.

The absence of trading software is equally alarming as it brings into question the ability of the firm to provide reliable, safe, and efficient trading services.

It's highly recommended that potential traders thoroughly investigate these red flags and verify the facts, possibly seeking information from reliable regulatory authorities before deciding to engage with MFM Securities. Your due diligence is crucial when it comes to mitigating potential trading risks.

The Bottom Line

The TOP 7 SC INVESTOR ALERT LIST in MALAYSIA serves as a vital tool for protecting investors from potential fraudulent schemes and non-compliant entities. Investors should carefully consider these warnings and conduct extensive research before engaging with any company listed on the alert list. Staying informed about regulatory updates and seeking official guidance can help safeguard investors' interests and ensure a safer investment environment in Malaysia.

SC Investor Alert List in Malaysia FAQs

| Q 1: | What is SC Investor Alert List in Malaysia? |

| A 1: | The SC Investor Alert List in Malaysia is a list maintained by the Securities Commission (SC) to warn investors about companies that may not comply with regulatory requirements or pose significant risks to investors in Malaysia. |

| Q 2: | Why are these companies listed on the SC Investor Alert List in Malaysia? |

| A 2: | These companies are listed on the Investor Alert List due to concerns about their regulatory compliance or potential risks associated with their operations in Malaysia. |

| Q 3: | Should I invest in these companies despite their listing on the alert list? |

| A 3: | The SC advises investors to exercise caution and conduct thorough research before dealing with any company listed on the alert list. It is essential to verify the legitimacy of their business practices and seek guidance from official sources. |

| Q 4: | How can I verify the legitimacy of these companies? |

| A 4: | To verify the legitimacy of these companies, investors can check the official website of the Securities Commission Malaysia (SC) or other reputable financial regulatory authorities. They can also seek advice from licensed financial professionals. |

| Q 5: | Are these companies banned from operating in Malaysia? |

| A 5: | The Investor Alert List is a cautionary measure, and being listed does not necessarily mean that the companies are banned from operating. However, it serves as a warning for investors to be vigilant and conduct due diligence. |

| Q 6: | Can I report suspicious activities related to these companies? |

| A 6: | Yes, the SC encourages investors to report any suspicious activities related to these companies or any other potentially fraudulent schemes. Reports can be made to the SC or other relevant authorities. |

| Q 7: | How can I protect myself from investment scams? |

| A 7: | To protect yourself from investment scams, always verify the legitimacy of the company before investing. Deal only with licensed entities and seek independent advice from financial professionals. Be cautious of high-return investment offers that sound too good to be true. |

| Q 8: | What should I do if I have already invested with one of these companies? |

| A 8: | If you have invested with any of the companies listed on the alert list, and you have concerns about your investment, seek advice from licensed financial professionals and consider reporting the matter to the SC or relevant authorities. |

You Also Like

Best Forex Brokers for Beginners in Nigeria for 2024

Select the top forex brokers for beginners in Nigeria from many companies to ensure a safe trading environment.

Best Forex Trading Time in India 2024

Optimize your Forex trading in India by understanding prime trading times and exploring broker options.

What Time the Forex Market Opens in South Africa

Boost your Forex trading in South Africa with our guide on peak market hours for optimal trade activity!

6 Best No Deposit Bonus Forex Brokers in Malaysia in 2024

Start Forex trading risk-free in Malaysia! Discover the six top brokers, featuring attractive no-deposit bonuses.

7 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 7 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Top 10 Unregulated Forex Brokers 2024

Examine unregulated forex brokers, analyzing their distinguishing characteristics, inherent risks, and possible benefits for certain traders.

4 Best Forex Brokers Accepting US Traders in 2024

Discover top forex brokers accepting US traders, assessing their pros and cons to provide helpful guidance.

Best UK Forex Brokers for 2024

Review the top 10 forex brokers in UK, evaluating their trading pros and cons to provide traders with helpful guidance.