In the UAE, forex trading has become increasingly popular, drawing in numerous investors and traders. The regulatory framework for forex trading is supervised by two main entities: the Central Bank of the UAE (CBUAE), responsible for overseeing the country's financial sector, including activities related to forex trading. Another is Dubai Financial Services Authority (DFSA), traders more familiar with, overseeing financial activities within the Dubai International Financial Centre (DIFC), operating under a distinct regulatory framework. Within UAE, big numbers of brokers operate, making it challenging to identify the genuine ones. Here, we've curated a list of the best Forex Brokers for beginners, focusing on key aspects such as trading fees, platforms, and customer services, for your reference.

7 Best Forex Brokers for beginners in UAE

$10 to start trading with a reputable broker, competitve spreads offered.

Leading international regulators licence and regulate traders, ensuring financial security.

Advanced platforms including MT4 and MT5, in addition to its proprietary app.

Rich educational resources are provided, with support available 24/7 in over 30 languages.

Processing times for deposits and withdrawals are minimal.

FP Markets offers consistently tighter spreads from 0.0 pips, 24/7 Multi-lingual support .

more

Comprison of the Best Forex Brokers for Beginners in UAE

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Brokers for beginners in UAE OVerall

| Broker | Logo | Why are they listed as the Best Forex Brokers for Beginners in UAE? |

| Exness |  |

✅Globally regulated, a strong regulatory framework means a lot for beginners who are just starting out in the forex industry. ✅ Low minimum deposit, user-friendly trading platforms, and quality educational resources, incredibly beneficial for beginners. ✅ On various review platforms, Exness has earned high scores indicating sound user satisfaction, including 9.03 ( full score of 10) on WikiFX. |

| XM |  |

✅Regulate in multiple jurisdications, including DFSA in UAE, knowing traders in this region better. ✅ High user satisfaction worldwide, gaining a high score of 9.14 on WikiFX. ✅$5 to start real trading, user-friendly trading platforms, invaluable eductaional tools, including demo accounts. |

| FP Markets |  |

✅ Regulated by CYSEC and ASIC, a long-standing player in the forex industry. ✅ User-friendly MT4 and MT5, copy trading feature offered for beginners to copy the strategies of experienced traders, enhancing their profitability. ✅ 7/24 multilingual customer services, catering to beginners' concerns and trading problems. |

| FBS |  |

✅$0 to start real trading, competitive trading fees, making trading easier for beginners. ✅ Beginner-focused educational resources including webinars, video lessons, articles. ✅24/7 support in 8 languages, deposit and withdrawal in 200+ ways, great advantages for beginners. |

| FXTM |  |

✅ A respected play in the forex industry, heavily regulated, well operated so far. ✅Micro and demo accounts offered, targeting beginners who are just starting out in their trading journey. ✅ “FXTM INvest” copy trading feature allows beginners to copy trades of sucessful traders easily. |

| HFM |  |

✅ Regulated in five jurisdictions, including DFSA in UAE, knowing traders within this area better. ✅ Micro accounts from $5 to start real trading, making forex trading more easily accessible for beginners. ✅ Copy trading features, allowing beginners to replicate successful traders' trades. |

| Axi |  |

✅Regulated in multiple jurisdictions, including DFSA in UAE, knowing traders within this area better. ✅ Low threshold to enter into global financial markets, making it easier for beginners. ✅ Serving over 60,000 traders so far, bagged numerous prestigious prizes in the industry. |

Exness

Overall: ⭐⭐⭐⭐⭐

Regulation: FCA, CYSEC, FSCA, FSA

Best for both beginners and seasoned traders, extremely transparent fees

Exness is an online forex and CFD broker that was established in 2008. Registered in Cyprus, this company has expanded its reach to become a well-known brokerage firm, providing trading services to clients around the world. Exness is renowned for its intuitive trading platforms and extensive selection of financial instruments, which have made it a favoured option for traders in the foreign exchange and financial markets.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

XM

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, CYSEC, FSC, DFSA

Best for all-round offerings, quality educational resources

XM was established in 2009 and is a CFD and forex broker operating online. With its headquarters in Cyprus and under the watchful eye of the Cyprus Securities and Exchange Commission (CySEC), this firm is a respected member of the brokerage community. XM provides trading services to customers all around the world and provides access to a wide variety of trading instruments, such as foreign exchange, commodities, equities, and indices.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

FP Markets

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, CYSEC

Best for copy trading, diversified products available

FP Markets, an Australian forex and CFD broker, was established in 2005. Based in Sydney, FP Markets is regulated by the Australian Securities and Investments Commision (ASIC) and holds an Australian Financial Services Licence. Throughout its extensive history of more than 15 years, FP Markets has established itself as a trusted name in the industry, known for its highly competitive pricing, lightning-fast execution speeds, and top-notch trading platforms such as MetaTrader 4, MetaTrader 5, and Iress. FP Markets provides a wide range of trading options, including forex trading on over 60 currency pairs and CFDs across various assets such as indices, commodities, shares, and cryptocurrencies. Traders have the option to select between raw spread accounts that offer access to deep liquidity or ECN accounts that provide tight variable spreads. FP Markets welcomes clients from around the world and is renowned for its round-the-clock customer support in multiple languages.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

Overall: ⭐⭐⭐⭐⭐

Regulation: CYSEC,FSC

Best for low-cost trading, promotions and bonuses offered

FBS is a forex and CFD broker established in 2009. With its headquarters in Cyprus, the company maintains a global presence through offices in various countries like Indonesia, Malaysia, and Thailand.The broker offers access to a bulk of markets encompassing currency pairs, precious metals, CFDs on stocks, and cryptocurrencies. Clients of FBS have access to the widely respected MetaTrader 4 and MetaTrader 5 trading platforms to have a superb trading environement.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

FXTM

Overall: ⭐⭐⭐⭐⭐

Regulations: CYSEC, FCA

Best MetaTrader broker for copy trading and mobile trading.

FXTM, a notable global online brokerage regulated by multiple jurisdictions like the UK, Cyprus, South Africa, and Mauritius, was established in 2011 in Cyprus. Since its inception, FXTM has seen considerable expansion, serving over 2 million accounts across more than 180 countries. The broker offers access to a vast array of tradable assets exceeding 250 in count, encompassing forex, stocks, indices, commodities, cryptocurrencies, and ETFs. Traders can benefit from leverage up to 1:1000, competitive spreads, and swift execution on the widely adopted MetaTrader 4 and 5 platforms. FXTM is recognized for its commitment to trader education, multi-lingual customer support, and an extensive suite of trading resources that equip traders with necessary confidence.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

HFM

Overall: ⭐⭐⭐⭐⭐

Regulation: FCA, CYSEC, DFSA, FSA, CNMV

Best for small amount and secure trading, competitive trading fees

HFM (formerly HotForex) was launched in 2010 and is now a reputable online forex and CFD broker. The Cyprus-based company has become well-known in the financial sector for its extensive selection of trading products and simple-to-navigate interfaces, making it a favourite among traders of all experience levels. HFM is a global trading firm that is regulated by a number of governing bodies to protect its customers' money.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

Axi

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, FCA, FMA, DFSA

Best for providing great currency pairs, demo trading allowed

Axi (formerly AxiTrader) offers a bunch of over 220 trading options, forex, CFDs for stocks, indices, commodities, and even cryptocurrencies. They start at a $0 deposit, offer competitive spreads from 0.0 pips on major currencies, and here is the cool part: using ECN execution for direct market orders. As for the platform, it's none other than the legendary MetaTrader 4. With a touch of pride, they claim to have served more than 600,000 traders across 100 countries.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

Forex Trading Knowledge Questions and Answers

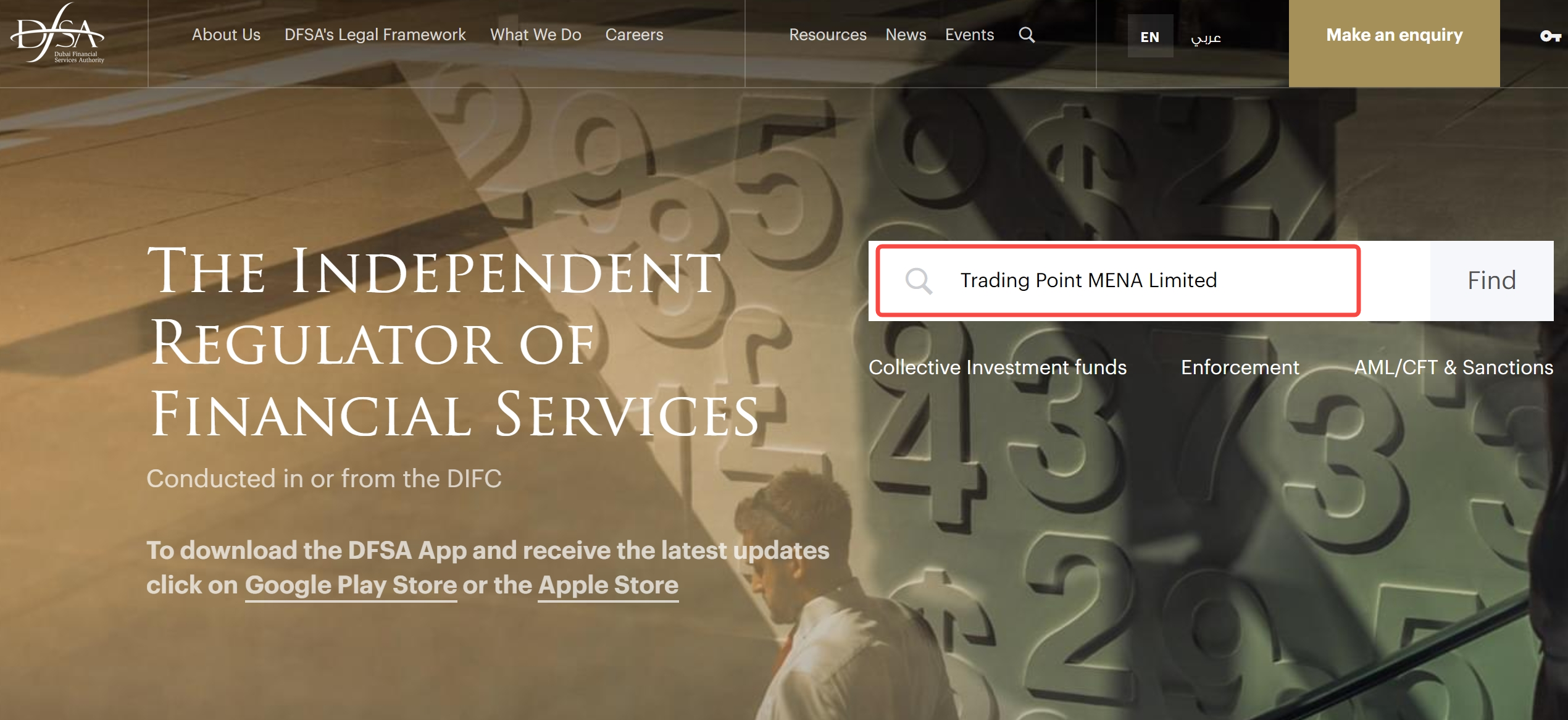

How to verify a broker's DFSA regulations for beginners?

Since its establishment in 2004, the Dubai Financial Services Authority (DFSA) remains a trusted regulatory body governing financial services within or from the Dubai International Financial Centre (DIFC), an exclusive financial free zone in Dubai, UAE. Verifying if a broker falls under this authority's regulation involves three simple steps.

First, visit the official website of DFSA at https://www.dfsa.ae.

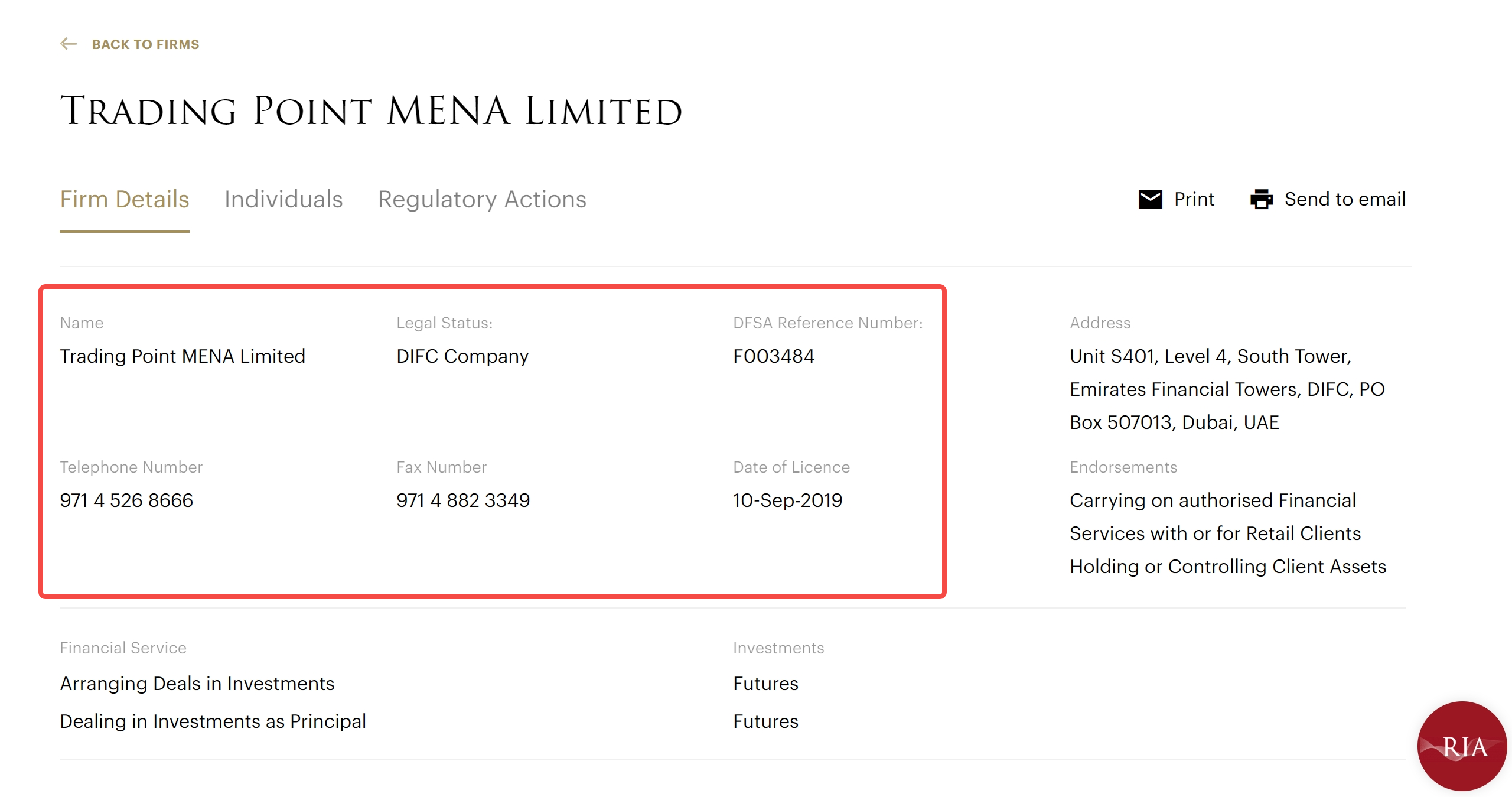

Next, type in the name of any broker you wish to verify, for instance, Trading Point MENA Limited, representing XM in UAE, into the search bar.

The search result confirms that XM is regulated in the United Arab Emirates. Therefore, traders can confidently engage in trading with this broker.

What is the best trading app for beginners in the Arab United Emirates?

Exness ranks the best trading app for beginners in UAE. And let's see why:

Strong Regulatory Framework- Being one of the most established brokers, XM endeavors to assure clients by seeking authorizations from various regulators worldwide. Presently, it holds regulation from tier-1 regulators like ASIC in Australia, CYSEC in Cyprus, DFSA in the United Arab Emirates, and FSC in Belize. This robust regulatory framework can instill more confidence in traders, particularly beginners.

$5 Micro Account - XM provides a Micro account, an offering not commonly found among reputable brokers, allowing for an account opening with just $5. For beginners with limited trading experience, the hesitancy to commit a substantial initial deposit is common. The Micro account suits them well, ensuring easy access—a is a vital factor for beginners.

XMTrading MT4 & MT5 App - XM's trading app is both advanced and intuitive, offering access to over 1000 instruments, all consolidated in one place and compatible with both MT4 and MT5. For beginners, it's convenient to customize settings and fund their accounts—all in one app.

XM Copy Trading Feature - Many beginners often think, “If I could just copy successful traders, my losses would decrease significantly.” That's why Copy trading exists. XM also offers copy trading to enhance the trading experience for beginners.

Quality and rich Educational Resources - XM secures the top spot for its educational resources, providing an extensive suite of beneficial tools, particularly for beginners. These resources include XM TV, Podcasts, and a learning center, featuring various video resources such as XM Live, Live Education, Educational Videos, Forex & CFDs Webinars, and Platform Tutorials. For beginners, gainning direct instructions and insights from industry experts can save time instead of wasting it on less informative content.

Responsible Customer Support- XM's official website supports 25 languages, covering a vast majority of global languages. XM's customer service team receives mostly positive reviews, saying that they can address clients' trading inquiries and trading problems swiftly and professionally. This matters a lot for beginners.

What are the most easily accessible trading markets for beginners in the Arab United Emirates?

The UAE has developed a strong foundation for financial trading given its strategic geographic location and open economy. For beginners, the most practical path is to start trading in the Dubai Gold and Commodities Exchange (DGCX).

As compared to foreign exchange or stock markets, DGCX offers newbie traders lower barriers to entry:

DGCX allows smaller contract sizes and investment amounts that suit novice traders' capital limitations. One can start with a few hundred dollars.

Trading in familiar commodities like gold and oil gives beginners an intuitive understanding unlike complex currency pairs or exotic derivatives.

Settlement currency being the UAE Dirham minimizes currency risk exposure.

Trading costs and commissions are reasonable.

DGCX provides educational resources, tools and dedicated account managers to guide beginners.

What are scam brokers that traders should avoid in the Arab United Emirates?

| Broker | Logo | Registered Country | Regulation | Establishment of Years | Trading Platform | Customer Support | Additional Notes |

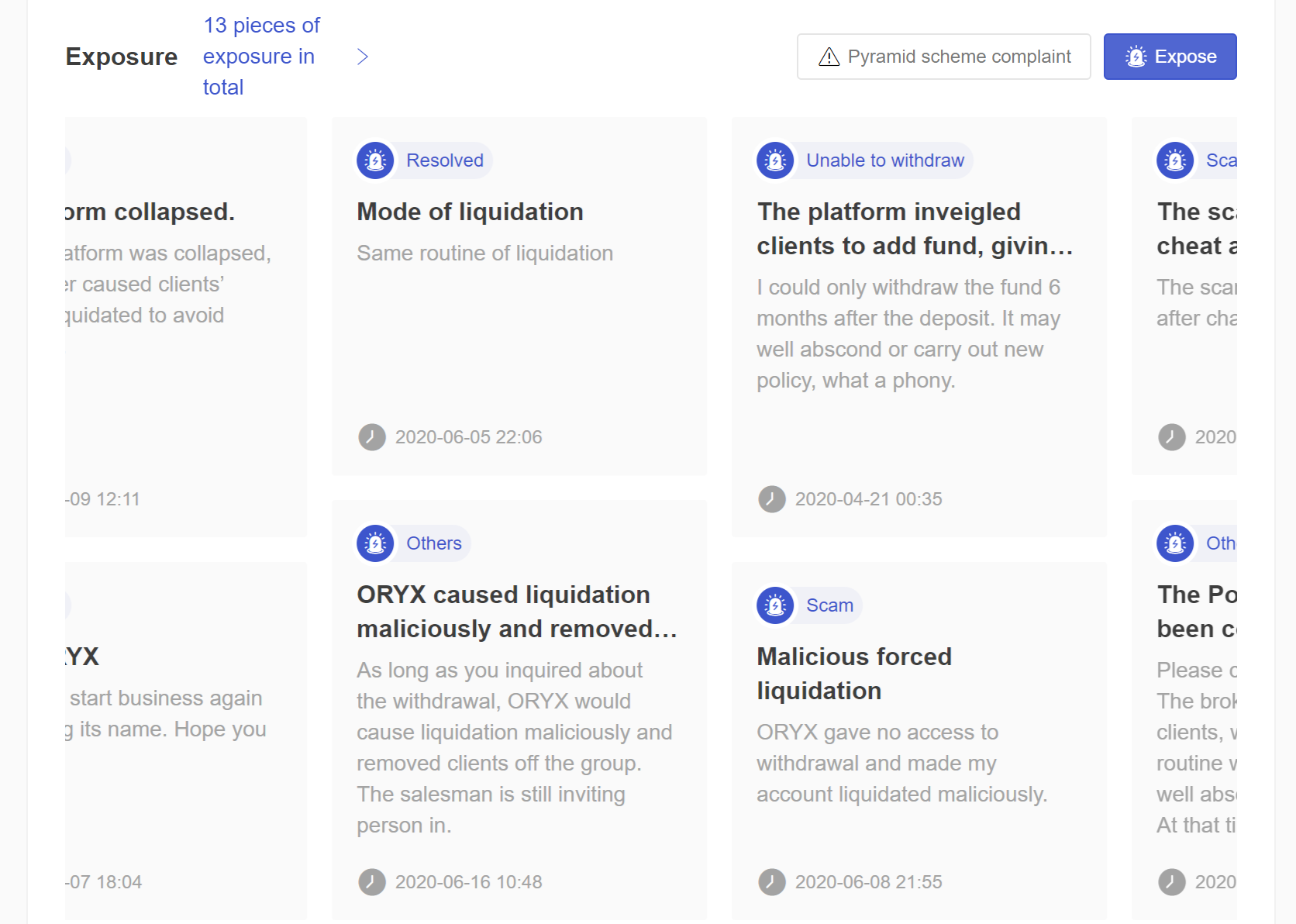

| ORYX |  |

United Arab Emirates |  |

2-5 years | MT5 | Phone & Email | No license, 13 scam exposures |

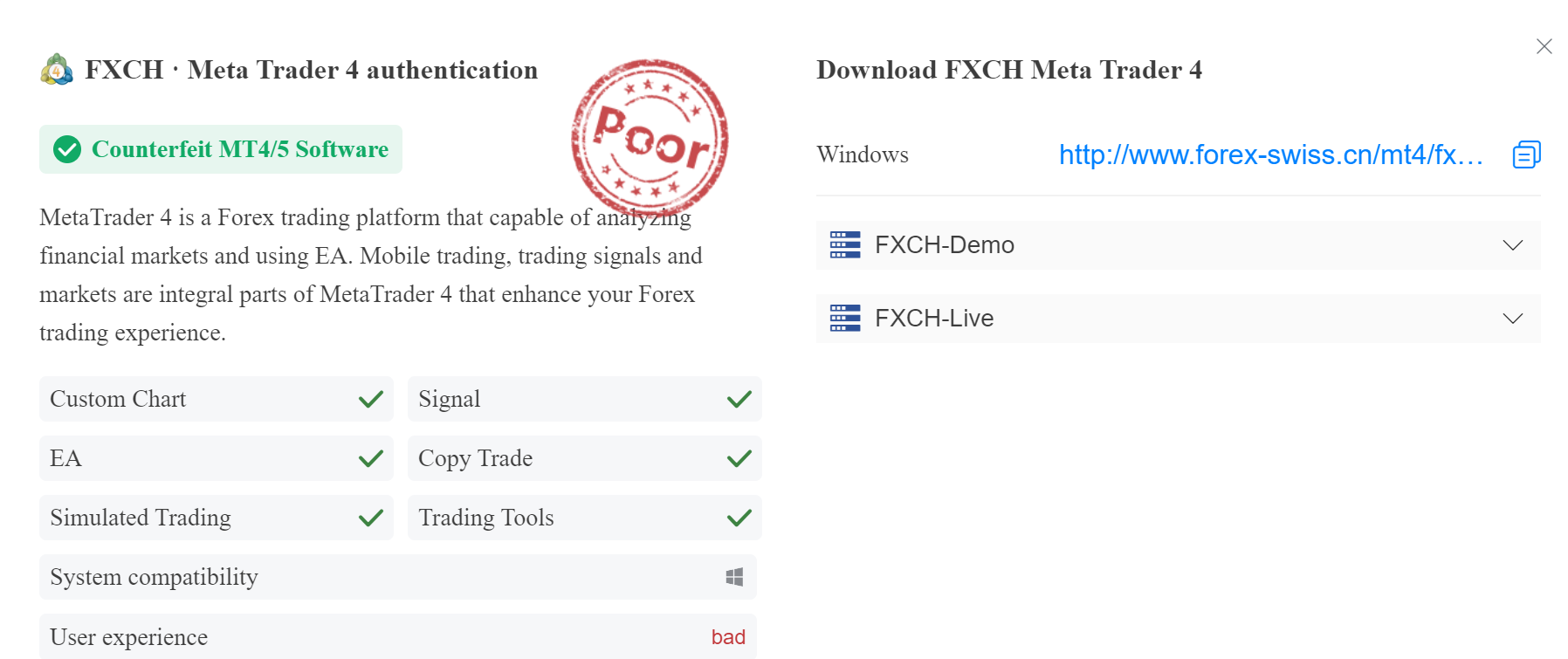

| FXCH |  |

United Kingdom |  |

5-10 years | MT4, counterfeit version | Email Only | Fake license, no physical office, poor MT4 trading experience |

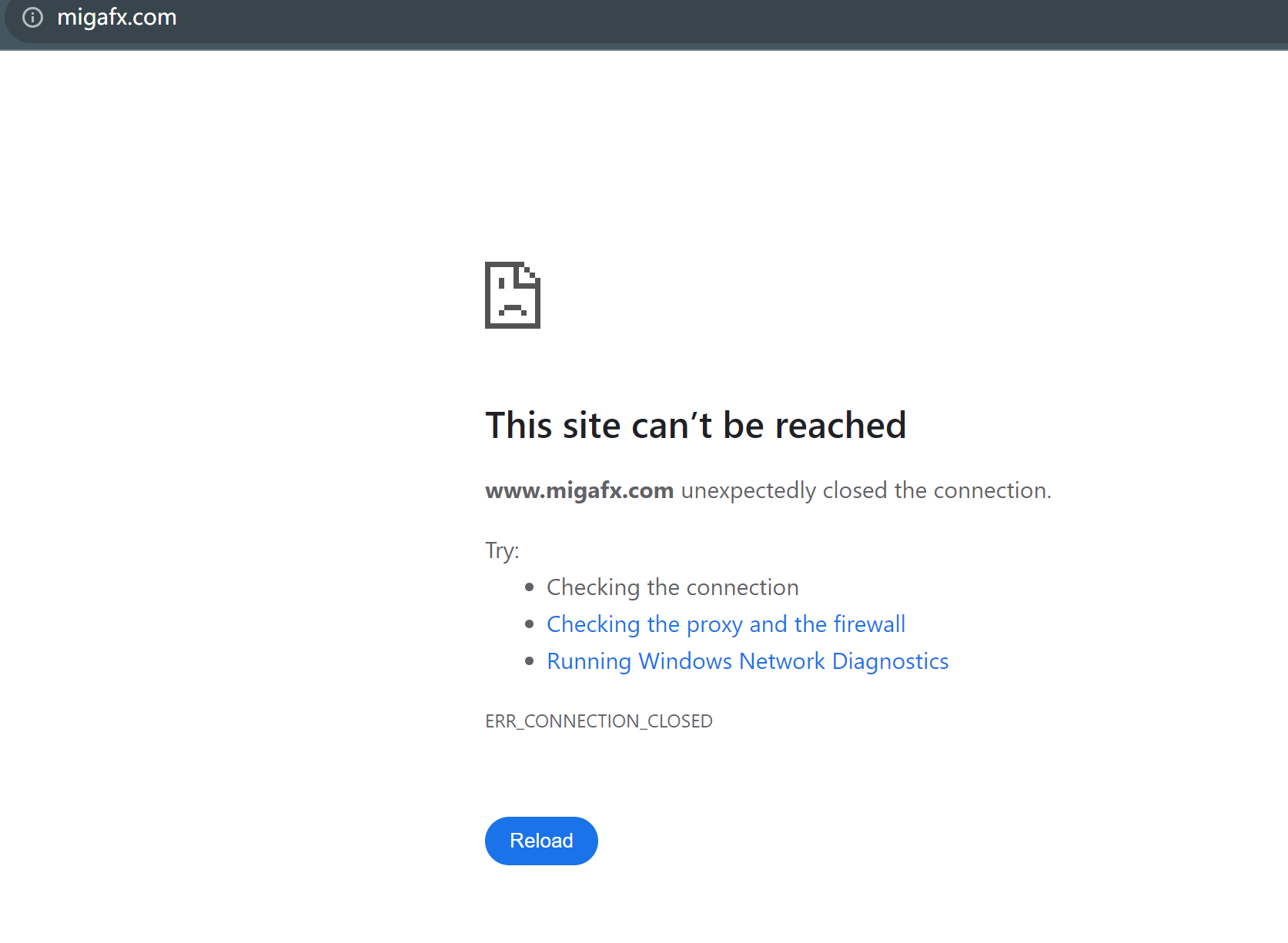

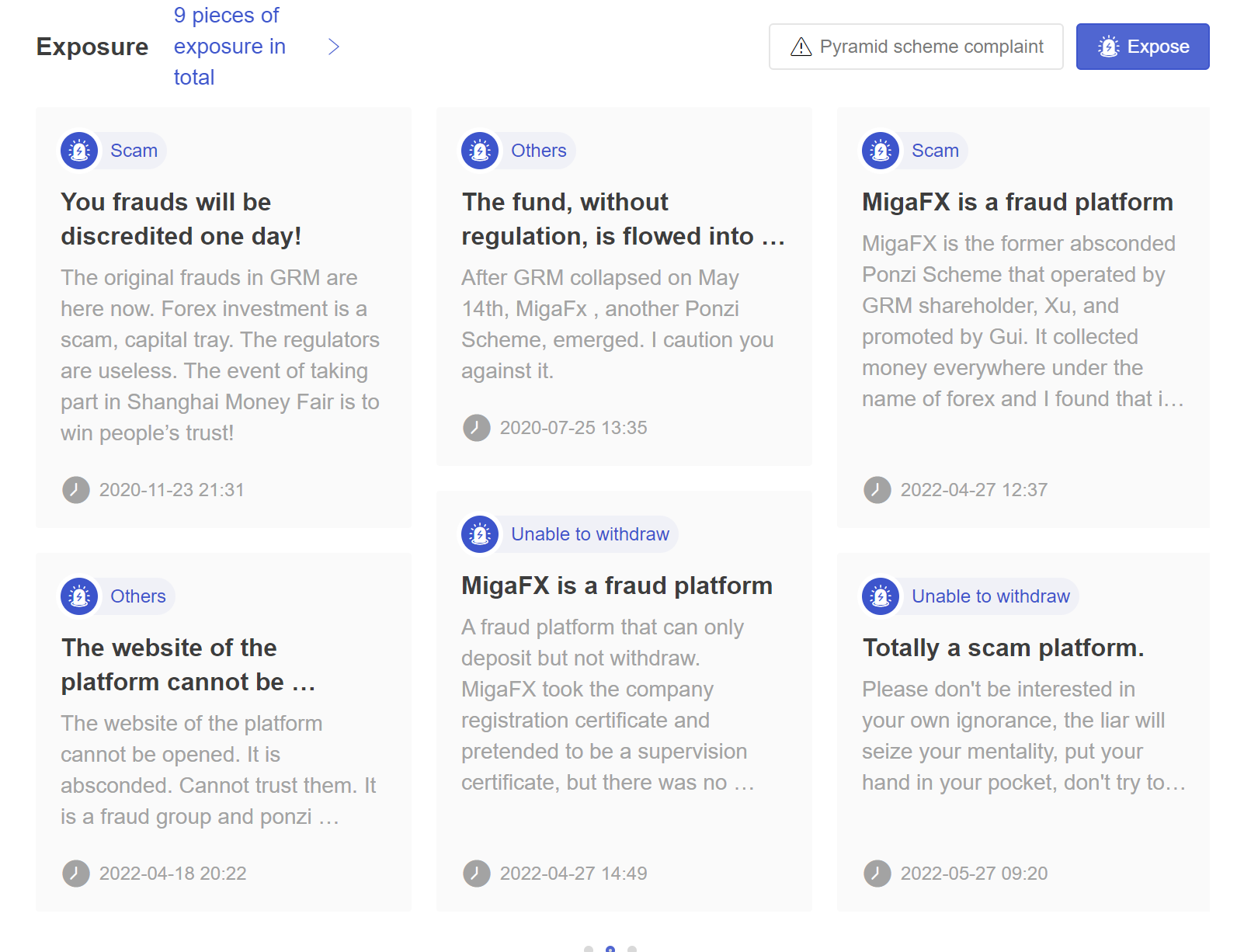

| MigaFx |  |

MigaFx |  |

2-5 Years | Unknown | Email only | Unaccessible URL, 9 scam exposures |

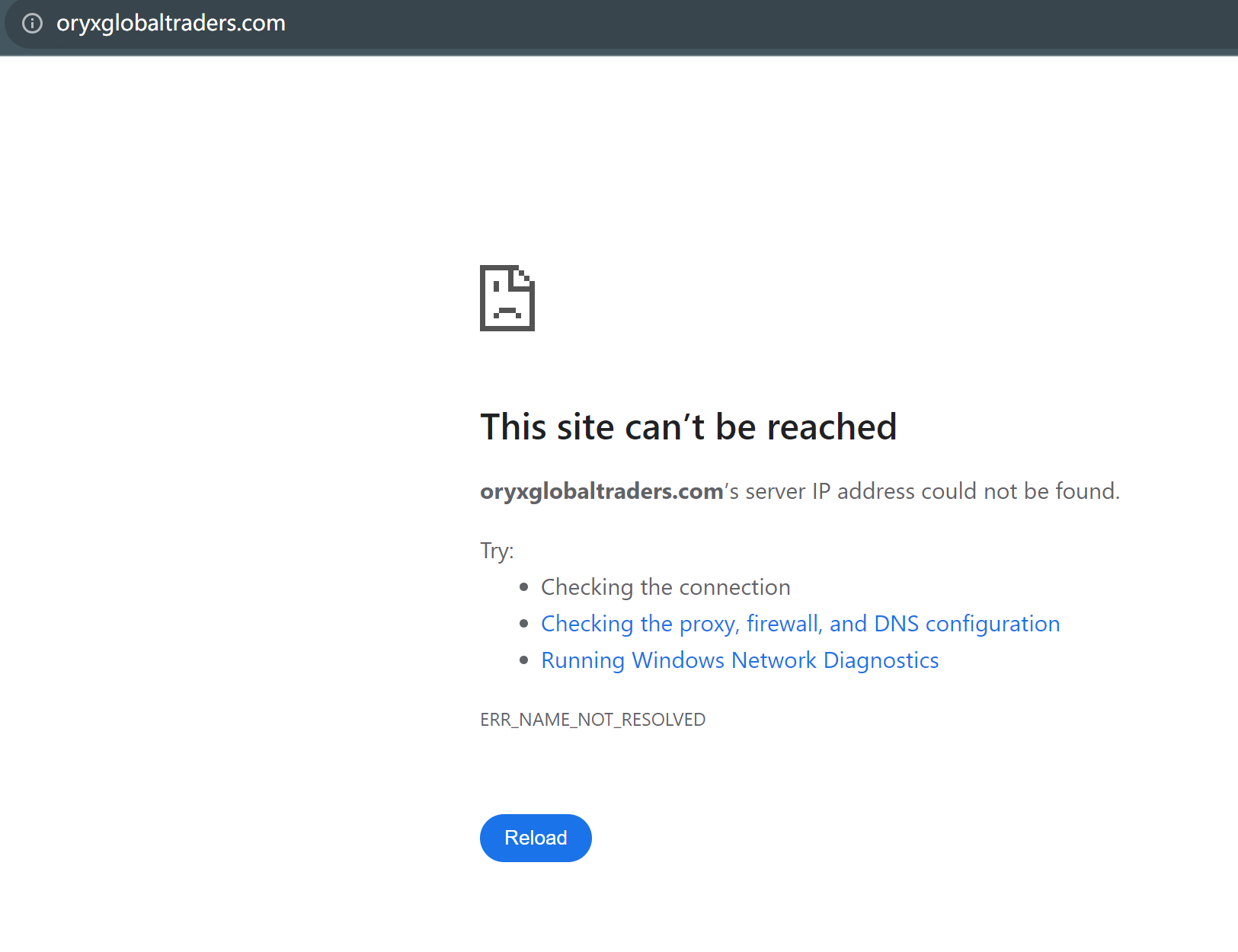

ORYX, operated by ORYX Global Traders DMCC, operates without any regulation, and currently, its official website cannot be accessed. Adding to the concern is the remarkably high scam exposure rate, recorded at 13 instances. Traders in the UAE, particularly beginners, should exercise caution and steer clear of this broker.

FXCH (Foreign Exchange Clearing House)is an unauthorized firm confirmed by the FCA, and an attempt to locate its claimed physical office address was unsuccessful. Furthermore, its MT4 trading platform has been identified as a counterfeit version. Traders in the UAE, particularly beginners, should take heed and avoid this broker.

MigaFx is yet another unregulated scam broker, posing a risk to your hard-earned funds. Presently, the broker's official website can not be accessed. Additionally, the platform has accumulated a total of 9 scam exposures from victims, casting a dark shadow over its credibility.

What are some tips for beginners in the Arab United Emirates?

Learn before you earn:Invest time in improving your skills through forex e-books, online courses, expert trader podcasts, and similar resources. Acquiring theoretical knowledge before investing real capital is crucial for success in forex trading. Many reputable brokers like Exness, XM, and FP Markets offer quality educational resources and tools for beginners to learn for free.

Start small:Consider opening a micro account and initiating trades with small volumes to mitigate initial risks. Gaining a sense of market movements is crucial in the early stages of trading.

Stick to simpler trades initially:Specifically, beginning to gain expertise in major currency pairs, such as EUR/USD or USD/JPY, before delving into more exotic ones like USD/TRY or EUR/ZAR, will be a wise move. Similarly, concentrating on a select few commodities, such as gold or crude oil, can be more effective than randomly navigating various commodities.

Manage risks: Overleveraging your account, aiming for swift profits, can be risky. For instance, let's say you've initiated trade in a volatile market without setting a stop loss. Suddenly, market conditions shift unfavorably, and without a predefined limit, the loss could surpass your risk tolerance, resulting in significant financial setbacks.

Choose an regulated broker:Trading with a regulated broker, no matter locally regulated or internationally, can make your trading activities conducted in a transparent way, fund safety and complaint resolution against misconduct. Home-regulated brokers canunderstand local landscape better. While internationally regulated brokers give traders more choices, offering more favorable trading features.

Trade panic-free:Don't be emotional while trading. Emotionally charged decisions, such as setting stop losses too close out of panic or extending losing trades in the hope of a reversal, often lead to further losses. Stay calm, as impulsive actions can exacerbate losses, hindering your trading progress.

Analyze your trades:Maintain a journal recording your trades, targets, exits and results. Review periodically to improve trading plans. Periodically revisiting this journal allows for a thorough review of your trading strategies and helps in refining future trading plans.

What are the most used payment methods for forex trading in the Arab United Emirates?

The most commonly used payment methods for funding forex trading accounts in the United Arab Emirates are:

Bank Wire Transfer – This allows direct transfer of AED or USD from UAE bank accounts to broker accounts. Wires are facilitated quickly for local transfers. Instructions are provided by brokers.

Debit/Credit Cards - Major debit/credit cards like Emirates NBD, Dubai Islamic Bank, ADCB and ENBD cards can be used to deposit funds. Convenient for smaller deposits.

Online Payment Systems - Payment gateways like PayPal, Neteller and Skrill are popular in UAE to transfer funds without sharing bank details. Fast processing.

Cash Deposits - Some regulated brokers provide facilities to directly deposit cash at affiliated local branches and chains. Useful when instant transfers are required.

Mobile Wallets - Platforms like Apple Pay and Payit mobile wallet help UAE traders fund accounts using smartphone apps to easily scan QR codes or make direct account deposits.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects.

We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

You Also Like:

Best Forex Brokers for Beginners in Nigeria for 2024

Select the top forex brokers for beginners in Nigeria from many companies to ensure a safe trading environment.

Best Forex Trading Time in India 2024

Optimize your Forex trading in India by understanding prime trading times and exploring broker options.

What Time the Forex Market Opens in South Africa

Boost your Forex trading in South Africa with our guide on peak market hours for optimal trade activity!

6 Best No Deposit Bonus Forex Brokers in Malaysia in 2024

Start Forex trading risk-free in Malaysia! Discover the six top brokers, featuring attractive no-deposit bonuses.

7 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 7 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Top 10 Unregulated Forex Brokers 2024

Examine unregulated forex brokers, analyzing their distinguishing characteristics, inherent risks, and possible benefits for certain traders.

4 Best Forex Brokers Accepting US Traders in 2024

Discover top forex brokers accepting US traders, assessing their pros and cons to provide helpful guidance.

Best UK Forex Brokers for 2024

Review the top 10 forex brokers in UK, evaluating their trading pros and cons to provide traders with helpful guidance.