Dreaming of becoming a stock market whiz but wary of diving in with real money? You're not alone! In India, the interest in trading is surging, fueled by growing personal wealth and the accessibility of mobile apps. Yet, many hesitate to take the plunge due to financial constraints or a lack of experience. Fortunately, innovative technology offers a solution: trading apps without investment.

These apps provide a safe and engaging environment where you can hone your skills, learn the ropes, and gain market knowledge without risking a single rupee. Whether you're a complete beginner or a curious investor, these apps cater to various learning styles and goals. Some offer realistic simulations of real-world trading, while others gamify the experience with badges, points, and leaderboards. You can even tap into the wisdom of experienced traders through social features and community forums.

This article delves into the best trading apps without investment in India. WikiFX will explore different categories, evaluate key features, and recommend best options for each. By the end, you'll be equipped to choose the perfect app to launch your trading journey with confidence and clarity.

Best Apps for Learning to Trade in India (without Investment)

| Best Trading Apps Without Investment in India | Best for | Strengths | |

|

Tickertape | Serious investors seeking a realistic simulation experience |

|

|

|||

|

|||

|

TradeIdeas | Technically-oriented users who want to explore advanced trading strategies |

|

|

|||

|

|||

|

StockGro | Beginners and young investors who prefer a fun and engaging way to learn |

|

|

|||

|

|||

|

eToro | Investors seeking community-driven insights and automated copy trading options |

|

|

|||

|

ZuluTrade | Investors comfortable with a higher risk profile and interested in following professional traders |

|

|

|||

|

Vested | Indian investors interested in diversifying their portfolio with US stocks |

|

|

|||

① Virtual Trading Platforms

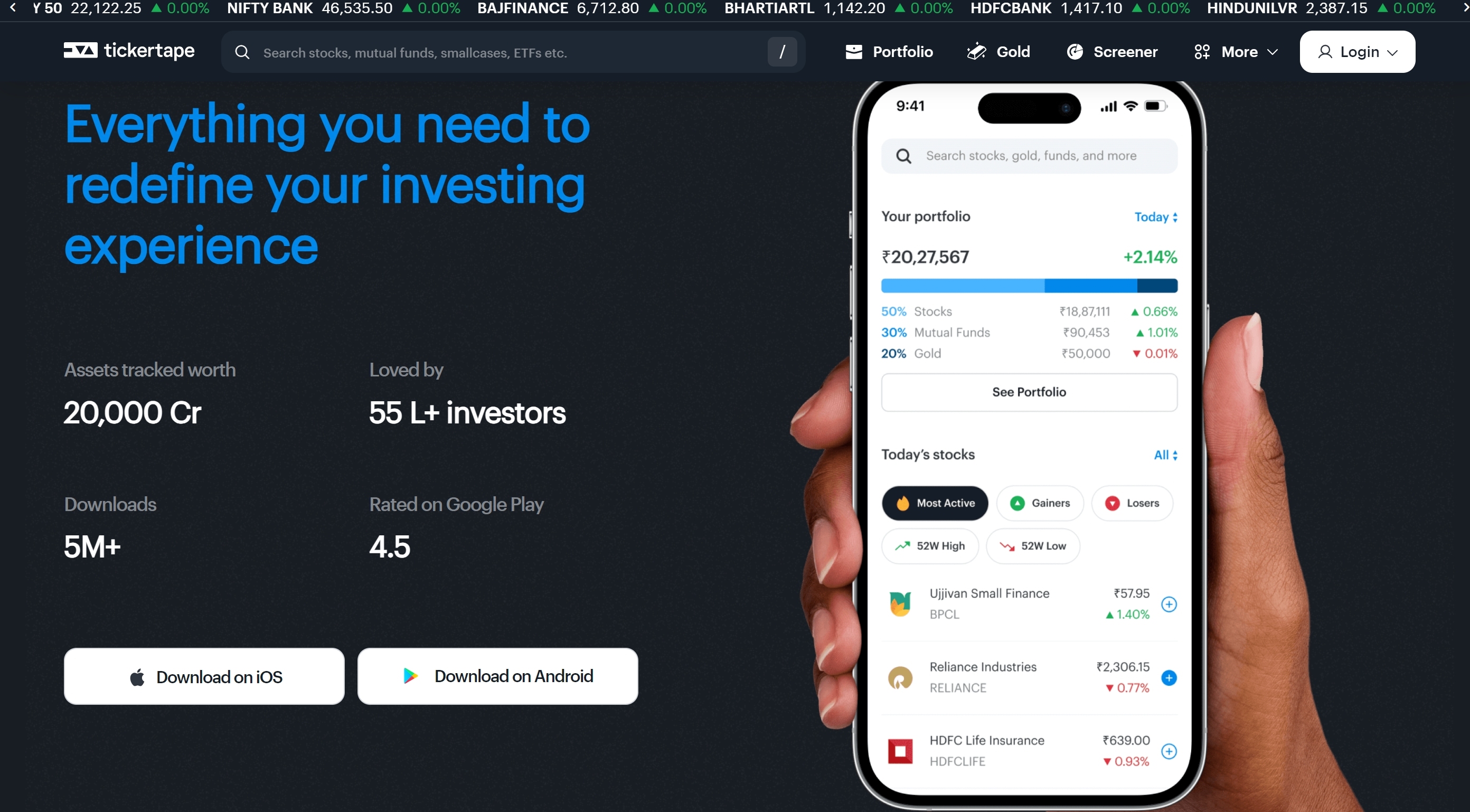

Tickertape

Best for serious investors seeking a realistic simulation experience

Tickertape is an online platform offering resources and tools for individuals interested in investing in Indian financial markets. It caters to both novice and experienced investors, aiming to provide information, analysis, and tools to aid in informed decision-making.

Key Features:

Real-time market data: Tickertape provides live data for Indian equities, futures, and commodities, along with global market information. Users can access detailed price charts, news updates, and analyst opinions.

Investment tools: The platform offers various tools for analysis, including screeners, technical analysis indicators, and fundamental data. These tools can help users identify potential investment opportunities and develop trading strategies.

Educational resources: Tickertape provides a library of educational content such as articles, webinars, and video tutorials. This content covers various aspects of investing, from basic concepts to more advanced strategies.

Community forum: The platform hosts an active online community where users can connect with other investors, discuss investment ideas, and ask questions.

Portfolio management: Tickertape allows users to track their investments across various asset classes, including stocks, mutual funds, and ETFs.

TradeIdeas

Best for technically-oriented users who want to explore advanced trading strategies

TradeIdeas is a technology company providing stock market intelligence and analysis tools primarily catered to investors and traders. Their flagship platform, also called TradeIdeas, leverages artificial intelligence (AI) and other algorithms to offer various features.

Key Features:

Stock Scanning: Powered by AI algorithms, TradeIdeas scans the market for potential trading opportunities based on user-defined criteria, such as technical indicators, chart patterns, or news sentiment.

Advanced Charting: The platform offers comprehensive charting tools with diverse indicators, drawing tools, and customizable layouts for in-depth technical analysis.

Paper Trading: Users can simulate real-world trading within the platform using virtual currency, allowing them to test strategies and build confidence before risking real capital.

Community Features: TradeIdeas provides a community forum where users can connect, share ideas, and learn from other traders and investors.

Integration with Brokers: The platform integrates with various brokerage firms, enabling users to seamlessly place trades directly from the TradeIdeas interface.

② Stock Market Games

StockGro

Best for beginners and young investors who prefer a fun and engaging way to learn

StockGro is a smartphone application designed to introduce users to the Indian stock market through gamified learning experiences. It aims to educate individuals, particularly young adults and beginners, about stock market basics and investing concepts in a fun and engaging way.

Key Features:

Virtual Trading Simulator: Users manage a virtual portfolio with simulated currency, buying and selling stocks based on real-time data. This allows them to practice trading strategies and understand market dynamics without financial risk.

Gamification Elements: Points, badges, leaderboards, and challenges create a competitive and engaging learning environment, motivating users to learn and progress.

Educational Content: The app integrates educational articles, quizzes, and tutorials alongside the simulation, covering fundamentals like stock analysis, company research, and risk management.

Social Features: Users can connect with friends and participate in virtual competitions, fostering a sense of community and encouraging learning through interaction.

③ Social Trading Platforms

eToro

Best for investors seeking community-driven insights and automated copy trading options

eToro is a social trading and multi-asset investment platform headquartered in Israel. Established in 2007, it focuses on providing financial services to retail investors and traders around the world.

Key Features:

Social Trading: eToro is known for its innovative CopyTrading feature, allowing users to automatically copy the trades of experienced investors on the platform. This can be helpful for beginners or those seeking guidance in their investment decisions.

Investment Options: eToro offers a diverse range of assets for investment, including stocks, ETFs, commodities, currencies, and even cryptocurrencies. This allows users to build diversified portfolios based on their preferences and risk tolerance.

Fractional Shares: eToro allows users to invest in fractions of shares, enabling them to invest in high-priced stocks with smaller amounts of capital. This can be beneficial for diversifying portfolios and making more accessible investments.

Educational Resources: eToro provides educational resources such as articles, webinars, and video tutorials to help users learn about investing and the markets. This can be valuable for newcomers or those seeking to improve their knowledge.

Community Features: The platform boasts a large and active community where users can interact, discuss investment strategies, and share ideas. This can be a valuable resource for learning and building confidence.

ZuluTrade

Best for investors comfortable with a higher risk profile and interested in following professional traders

ZuluTrade is a multi-broker, social, and copy-trading platform connecting investors with experienced traders worldwide. Established in 2007, it facilitates trading in various asset classes across major and minor currency pairs, forex, cryptocurrencies, and popular stocks.

Key Features:

Social Trading: Similar to eToro, ZuluTrade allows users to copy the trades of successful traders via its “ZuluRank” system. This system provides transparency into performance history and risk management strategies of potential signal providers.

Broker Independence: ZuluTrade connects with numerous regulated brokers, allowing users to choose a platform they trust and maintain control over their accounts.

Risk Management Tools: The platform offers tools like customizable stop-loss and take-profit orders, helping users manage risk and protect their capital.

Performance Tracking: ZuluTrade tracks the performance of traders and provides detailed statistics, enabling users to make informed decisions about who to copy.

Community Features: Users can access a community forum to connect with other traders, ask questions, and discuss trading strategies.

Vested

Best for Indian investors interested in diversifying their portfolio with US stocks

Vested is a platform allowing Indian residents to invest in various alternative assets beyond traditional Indian stocks and fixed deposits. They offer access to:

US Stocks and ETFs: Invest in over 5,000 US stocks and ETFs to diversify your portfolio globally.

P2P Lending: Earn returns by lending to verified borrowers in India, with potential returns up to 11.5%.

INR Bonds: Invest in low-risk government and corporate bonds in India, offering fixed returns that beat inflation.

Solar: Participate in rooftop solar projects and earn returns from the electricity generated.

Key Features:

Easy to use: Sign up, complete the KYC process, and start investing with a user-friendly platform.

Diversification: Spread your investments across multiple asset classes to manage risk.

Tax benefits: Vested provides reports for filing income taxes easily.

Educational resources: Learn about different investment options through their Vested Academy.

Comparison of Best Trading Apps without Investment in India

| Feature | Tickertape | TradeIdeas | StockGro | eToro | ZuluTrade | Vested |

| Primary Focus | Indian Markets | US Markets | Indian Stock Simulation | Social & Copy Trading | Social & Copy Trading | Alternative Investments |

| Investment Options | Indian Stocks, ETFs, Mutual Funds | US Stocks, Options, Futures | Indian Stock Simulation | Stocks, ETFs, Forex, Crypto | Forex, Crypto, Stocks, Indices | US Stocks, P2P Lending, INR Bonds, Solar |

| Copy Trading | No | No | No | Yes | Yes | No |

| Social Features | Limited | Community forums | Yes | Yes | Yes | Limited |

| Educational Resources | Basic | Extensive | Yes | Yes | Limited | Yes |

| Minimum Investment | ₹10 | $100 | ₹0 | $10 | $100 | ₹1,000 |

| Commissions/Fees | Brokerage fees | Subscription fees | None | Brokerage fees | Performance fees | Platform fees |

| Available in India | Yes | Yes | Yes | Yes | Yes | Yes |

| Regulation | SEBI | FINRA/NFA | SEBI | FCA, CySEC, ASIC | ASIC, FCA | SEC, FINRA, SEBI |

How to Choose a Trading App in India?

Choosing the right trading app in India requires careful consideration due to the variety of options available and the inherent risks involved.

Define your needs and goals

What are your investment goals? (Short-term gains, long-term wealth accumulation, specific assets)

What is your risk tolerance? (Comfortable with higher potential returns and volatility, or prioritizing capital preservation)

What experience level do you have? (Beginner, intermediate, experienced)

What assets are you interested in? (Indian stocks, US stocks, mutual funds, options, etc.)

Research and compare available apps

Consider apps regulated by SEBI (Securities and Exchange Board of India) for added protection.

Compare features:

User interface and ease of use

Investment options and variety

Trading tools and charting capabilities

Educational resources and research materials

Customer support quality

Brokerage fees and charges

Minimum investment requirements

Read online reviews and user testimonials from trusted sources.

Prioritize safety and reliability

Check if the app is regulated by SEBI or other recognized authorities.

Review the app's security measures and data protection policies.

Look for clear and transparent information about fees, risks, and disclaimers.

Avoid apps with unrealistic promises of guaranteed returns or low risk.

Start small and learn first

Consider using paper trading features offered by some apps to simulate trading without real money.

Take advantage of educational resources and tutorials offered by the app or independent providers.

Start with small investments and gradually increase as you gain experience and confidence.

Consider seeking professional advice

If you are a beginner or unsure about specific platforms or strategies, consulting a SEBI-registered financial advisor can be helpful.

Trading Apps without Investment in India FAQs

What is SEBI?

SEBI stands for the Securities and Exchange Board of India. It is a statutory body established in 1992 under the Government of India's Ministry of Finance. Its primary function is to regulate the securities and commodities markets in India.

What are the benefits of using a trading app?

Convenience, accessibility, and lower fees compared to traditional brokers.

Do I need to be an experienced investor to use a trading app?

Not necessarily, but starting with paper trading and research is crucial, especially for beginners.

What features should I look for in a trading app?

User-friendliness, desired investment options, educational resources, security measures, and transparent fee structures.

Is it possible to make quick money through trading?

Responsible trading focuses on long-term goals and managing risk, not seeking quick gains.

Disclaimer

Investing comes with inherent risks, and this information isn't financial advice. While I've provided insights, it's important to do your own thorough research considering specific app features, regulations, and fees. Past performance doesn't guarantee future results, and even SEBI-regulated apps don't eliminate risk. Ultimately, your investment decisions and potential losses are your responsibility. If unsure, seek professional financial advice before putting your money at stake. Invest responsibly and prioritize long-term goals over quick gains.

You Also Like

7 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 7 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

10 Best Forex Trading YouTube Channels to Follow in 2024

Boost your Forex trading success with our top picks for 10 Best Forex Trading YouTube Channels including ForexSignals TV, Warrior Trading, and more.

Automated Forex Trading Software | How It Works | Pros and Cons

Unlock 24/5 trading potential, overcome human limitations and enhance your forex outcomes with Automated Forex Trading software!

Best Forex Traders to Follow on Instagram

Uncover the secrets of Forex trading on Instagram - dive into scam prevention, explore top traders, and boost your investment know-how!