According to my observations at the International Forex Forum, Philippine traders prefer strong regulated international brands that trade primarily on Metatrader 4 and primarily in US dollars and yen. Currency pairs can be traded. eToro appears to be the most preferred and licensed Forex broker in the Philippines, according to the comparison table on this page. There's a reason for this. Your broker is crucial in your forex trading journey. As a result, it is critical to understand how Filipino Forex brokers operate and to be aware of the best options available.

About Forex Broker Philippines: Forex trading is the most promising industry, with well-placed investments yielding excellent long-term returns. Forex brokers assist investors in trading forex through trading platforms and other means. Forex investment transactions are not restricted to a particular region or country but can be carried out from anywhere. Forex trading involves speculating on the value of a currency in order to profit. When a trader uses a Forex account to exchange one currency for another, they do so in pairs. Trade flows and geopolitical developments all have an impact on forex supply and demand, as well as the value of currency pairs. This causes daily fluctuations, which can present new opportunities for forex trading. Through an online trading platform provided by Forex brokers all over the world, you can buy and sell currencies from your mobile phone or laptop. It is best to find the best Forex broker to help you open a Forex trading account and make a profit, whether using your Forex trading account or a Forex trading platform.

The best forex brokers for beginners: Through an online trading platform provided by Forex brokers all over the world, you can buy and sell currencies from your mobile phone or laptop. It is best to find the best Forex broker to help you open a Forex trading account and make a profit, whether using your Forex trading account or a Forex trading platform. The ideal Forex broker is someone that is well regulated in their home country, accepts clients from their home country, has narrow trading spreads, and has a sufficient selection of currency pairs and other assets to meet trading needs. We reviewed the areas of online Forex brokers available before creating a shortlist of the best Forex brokers for beginners. You are now ready to trade your currency after you have chosen and opened a savings account.

Best Forex Broker for Beginners in the Philippines

Both ASIC & CYSEC Regulated Financial Providers offer You Excellent Security.

24/7 Professional and Multilingual Customer Support Easy to Reach.

A Stringently Regulated Broker, Reliable and Safe to Trade With, The Choice of Over 3500,000 Clients from Over 190 Countries.

Quick & Easy to Start Your Real Trading by Funding As Low As 5 USD, Lower & Friendlier Cost Structure Available, Advanced Trading Platforms & Tools Drive You Succeed into the Forex World.

Licensed & Regulated in Multiple Jurisdictions: ASIC, CYSEC, FCA, DFSA, SCB.

Super-Low 1 USD Initial Deposit Quite Friendly to Active Traders.

more

Comparison of the Best Forex Broker for Beginners in the Philippines

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Forex Broker for Beginners in the Philippines FAQs

Regulated Forex Brokers You Can Trade in the Philippines

AvaTrade

Avatrade provides financial company support and user-friendly technology in its trading operations. Bonds, cryptocurrencies, stocks, and ETFs are some of the CFDs available on the site. The retail market offered by AvaTrade depends on the global organization and trading platform of the selected company. You can also trade foreign currencies on mobile and learn about separated client funds and Filipino forex tools. However, check out Avatrade's honest reviews to learn more about the platform.

OctaFX

Founded in 2011, OctaFX is regulated in only one Tier 2 country (Cyprus), making it a high-risk Forex and CFD broker. The unregulated offshore operations of brokers in St. Vincent and the Grenadines also serve as a reason for professional traders to trade through the trading products available from this social trading platform and website. OctaFX is not a publicly-traded company and does not operate a bank.

OctaFX is regulated by Zero Tier 1 (High Trust), One Tier 2 (Medium Trust), and Zero Tier 3 (Low Trust) regulators. However, read all OctaFX reviews to learn more about trading platforms.

FXTM

FXTM, often known as ForexTime, was founded in 2011 and is the best Forex broker in the Philippines. Global regulators such as the Financial Conduct Authority of the United Kingdom, the Cyprus Securities and Exchange Commission (CYSEC FCA), the Financial Conduct Authority of South Africa, and the Financial Services Commission of the Republic of Mauritius have licensed and approved the FXTM brand.

Successful traders have access to over 250 financial CFDs, including currencies, commodities, and equities, through six different account types, divided into two categories: Standard and ECN. This site has tutorials to learn how to use the isolated client fund Forex ECN, create a demo account, and avoid the high risk of loss.

XTB

XTB is based in Warsaw, the capital of Poland, and was founded in 2002. As a social trading website, the XTB Group is endorsed by institutions such as the International Financial Services Commission of Belize, the Financial Conduct Authority of the United Kingdom, the Spanish Securities and Exchange Commission of Spain, the SEC of Cyprus, and Komisja Nadzorufinansowego of Poland. However, for more information on the platform, see the honest XTB review.

AxiTrader

Founded in 2007, AxiTrader is an Australian forex broker, a leading forex trading platform. The new brand “Axi” was launched in 2020. The Financial Conduct Authority (FCA), the Australian Securities and Investment Commission (ASIC), and the Financial Services Authority of Dubai are some of the financial regulators that oversee Axi (DFSA). As a result, AxiTrader is considered safe as it is managed by several leading agencies. It enables easy copy trading, financial instruments services, easy access to new traders, lower risk, and faster trading execution.

Dukascopy

Dukascopy Bank was founded in 2004 and is a Swiss-based financial institution. Dukascopy provides banking, copy trading, cryptocurrency trading, online brokers, and high-speed trading services to clients in Europe and Asia. We specialize in major currency pairs, CFDs, Forex, Binary Options, and Cryptocurrencies for a growing customer base.

This trading platform acts as a central bank and is considered secure as it is regulated by the Swiss Financial Markets Regulatory Authority (FINMA). We also hold a license to operate as a securities company in Japan and throughout Europe.

IC Markets

IC Markets is Australia's leading forex broker, founded in 2007. The Cyprus Securities and Exchange Commission (CySEC), the Seychelles Securities and Exchange Surveillance Authority (FSA), and the Australian Securities and Exchange Commission all regulate ASICs. With the support of ASIC CYSEC, we are a highly regulated company. Learn more about trading platforms.

Pepperstone

Pepperstone is one of Australia's leading Filipino Forex securities firms and also offers CFDs. Founded in 2010, the company opened an office in London in 2015 to better serve European customers and customers in other parts of the world. After Brexit, new EU customers will be serviced by companies in Germany and Cyprus.

Pepperstone is considered safe as it is regulated by three leading financial regulators: the Financial Conduct Authority (FCA) in the United Kingdom, BaFin in Germany, and the Australian Securities and Investment Commission (ASIC).

XM

Founded in 2009, XM Trading Point Holding, a global CFD and Forex broker, is the parent company of XM, an online broker. Three financial regulators regulate XM: the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investment Commission (ASIC), and the Belize International Financial Services Commission (IFSC).

What is Forex Trading?

Forex or Forex can be described as a network of buyers and sellers who transfer currencies to and from each other at agreed prices. This is a way for individuals, businesses, and central banks to exchange one currency for another. If you have traveled abroad, you may have traded forex. A lot of forexes are done for convenience, but most of the currency conversion is done to make a profit. The number of currencies that are converted daily can make price fluctuations in some currencies very volatile. It is this volatility that can make forex very attractive to traders. It offers greater opportunities for great profits while increasing risk.

Forex (currency) transactions in the Philippines are popular among residents. Although recommended, Forex brokers do not need to be approved by the Securities and Exchange Commission (SEC) to accept Filipino residents as clients.

What are Currency Pairs?

A currency pair is an estimate of two different currencies, where the value of one currency is estimated against the other. The first currency listed in the currency pair is called the base currency and the second currency is called the estimated currency.

Currency pairs compare the value of one currency with another. That is, compare the base (or first) currency with the second or estimated currency. It shows the amount of estimated currency needed to buy one unit of the base currency. Currencies are identified by the ISO currency code or the three-letter alphabet code associated with the international market. Therefore, for US dollars, the ISO code is US dollars.

The base currency and the estimated currency together form a currency pair. This term is used to evaluate currencies mutually. Traditionally, currency pairs were displayed as slash-separated abbreviations. EUR / USD refers to a currency pair where the euro is the base currency and the US dollar is the estimated currency.

What is a PIP?

What is a pip? Pip is an acronym for “Percentage in Point” or “Price Interest Point”. Pip is the smallest price fluctuation that the exchange rate can make based on the customs of the forex market. Most currency pairs are priced with 4 decimal places, and pip changes are at the 4th decimal place. Therefore, the pip is equal to 1/100 of 1% or 1 basis point.

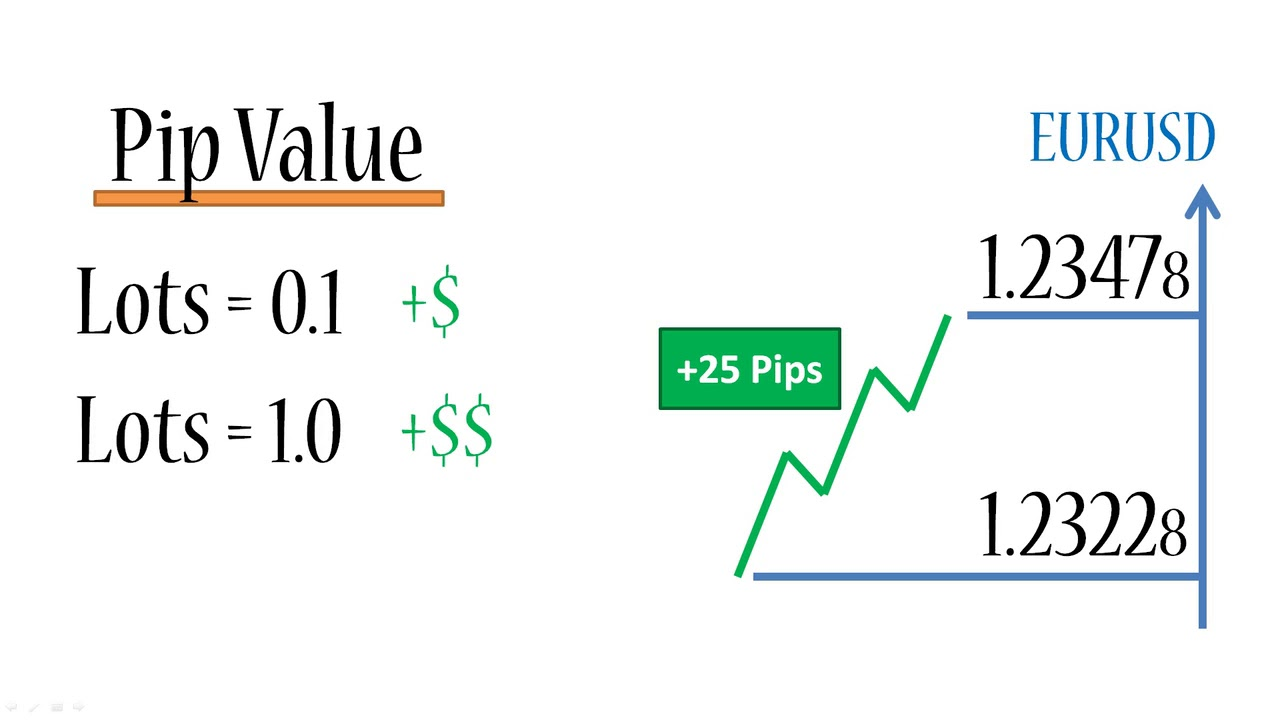

How Pip Works?

Pip is the basic concept of forex (forex) trading. Forex pairs are used to accurately propagate bid and ask prices to four decimal places. Simply put, forex traders buy and sell currencies that are valued compared to other currencies. Exchange rate movements are measured by pips. Most currency pairs are quoted to four decimal places, so the minimum change for these pairs is one pip. The value of a pip can be calculated by dividing 1/10,000 or 0.0001 by the exchange rate.

What is a ‘Lot’?

Most forex trading refers to the size of the transaction or the amount the trader is trading at any given time.

The lot size has a direct impact on risk and must first be fully understood before identifying an inlet or exit. Even the best trading strategies will fail if you don't have a clear idea of the lot size to use.

You will understand more as we go along.

4 Types of Lots Defined

A standard lot is equivalent to 100,000 units of the Base currency.

A mini lot is 10% of the standard lot or 10,000 units of the Base currency.

A micro lot is 1% of the standard lot of 1,000 units of the Base currency.

A nano lot is 0.1% of the standard lot of 1,000 units of the Base currency.

It is often the case now that the default is the standard lot. You can trade as small as a micro lot on Fullerton Markets MT4 platform.

Let's say you want to trade 1 lot or 100,000 units of AUD/USD, the size of the trade is equivalent to AUD 100,000.100,000 AUD / USD units, the transaction size will be equal to 100,000 AUD.

When is the Forex Market Open for Trading?

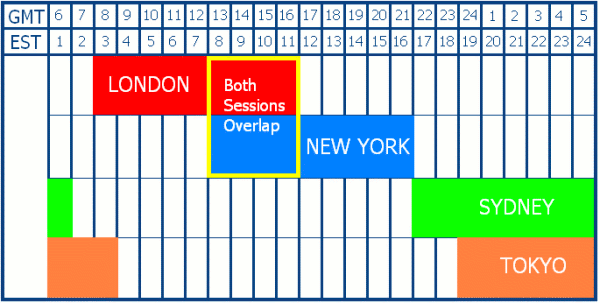

Forex is fully electronic and operates anywhere in the world from 5 pm to 6 pm. Sunday and Friday 5 pm Eastern Standard Time (EST). Each exchange has its trading hours from Monday to Friday. From the average trader's point of view, the four most important timeframes (all ESTs) are:

• London: 3 a.m. to 12 p.m. (noon)

• New York: 8 a.m. to 5 p.m.

• Sydney: 5 p.m. to 12 a.m. (midnight)

• Tokyo: 7 p.m. to 4 a.m

Each exchange works independently, but all trade the same currency 5. Therefore, if two exchanges are open, the number of traders who are willing to buy or sell a particular currency will increase exponentially. Bid and Ask on one Forex market exchange directly affects Bid and Ask on all other open exchanges. This will reduce market spreads and increase volatility, including in the next window.

• 8 a.m. to noon, with both the New York and London exchanges open

• 7 p.m. to 2 a.m., with both the Tokyo and Sydney exchanges open

• 3 a.m. to 4 a.m., with both the Tokyo and London exchanges open

The New York Stock Exchange is especially important for foreign investors. Their transactions include US dollars, which are involved in 90% of all forex transactions. The movement of the dollar can have a powerful spillover effect around the world.

There may be exceptions and the expected trading volume is based on the assumption that there is no significant news. Otherwise, political or military crises that occur during late trading hours can potentially increase volatility and trading volume.

Certain economic data that may drive the market has a fixed release schedule. This includes unemployment, the consumer price index (CPI), trade deficits, consumer confidence, and consumption. Knowing when to release this news will help you decide when to trade.

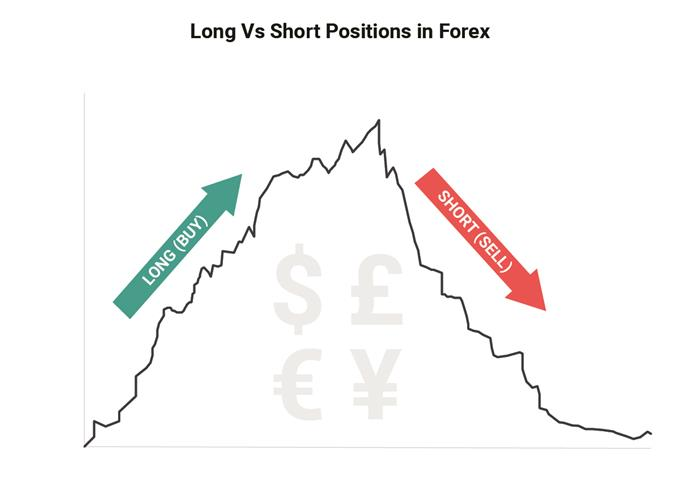

What does Long Position Denote?

Long or short in Forex means betting on either the value of the currency pair going up or down. Being long or short is the most basic aspect of entering the market. The longer the trader, the more positive the investment balance in the asset, in the hope that the value of the asset will increase. If he or she is in short supply, he or she will have a negative investment balance in the hope that the asset will be depreciated so that it can be repurchased at a lower price in the future.

A long position is a trade executed in which the trader expects the value of the underlying asset to increase. For example, when a trader places a buy order, they hold a long position on the underlying asset they have purchased. H. US dollar/yen. Here they expect the US dollar to rise against the Japanese yen.

For example, a trader who bought 2 lots of USD / JPY has a long position of 2 lots in USD / JPY. The underlying asset is USD / JPY, the direction is long and the size is 2 lots.

What does Short Position Denote?

The short position is essentially the opposite of the long position. When a trader enters a short position, we expect the price of the underlying currency to fall (fall). Selling back a currency means selling the underlying currency in the hope that its price will drop in the future, allowing traders to buy back the same currency at a lower price at a later date. The difference between a high selling price and a low buying price is profit. To give a real example, when a trader is shorting the USD / JPY, he sells the USD and buys the JPY.

Traders are looking for a sell signal to enter a short position. A common sell signal is when the price of the underlying currency reaches resistance levels. The resistance level is the price level at which the underlying asset is struggling to breakthrough. In the chart below, the USD / JPY has soared to 114.486 and is struggling to rise further. This level becomes a resistance level and provides a sell signal to traders when the price reaches 114.486.

Some traders prefer to trade only during major trading sessions, but if the opportunity arises, traders can virtually execute trades whenever the forex market is open.

What is a Forex Broker?

Forex brokers act as an intermediary between forex dealers and banks, or between banks' networks, allowing you to buy and sell foreign currencies. Forex brokers withdraw prices from banks and offer you the best prices available.

Forex brokers are also sometimes referred to as retail forex brokers or currency trading brokers. Once you have a broker, you can access the market and infer price increases or decreases in the hope of a big win for Solos-well, you don't have much money to put (yet). Maybe, but a big win nevertheless! Institutions and large corporations can also benefit from intermediary services.

What does a Forex Broker do?

Most retail forex brokers act as traders and often take the other side of the transaction to provide liquidity to the trader. Brokers make money from this activity by charging a small fee via Vidask Spread. Before the advent of retail forex brokers, single transaction volumes of less than $ 1 million discouraged entry into the market with high bidasque spreads. Unfortunately for everyone else, the opportunity to trade forex was not feasible.

Around 2000, retail brokers offered individual investors online accounts and began streaming prices from major banks and electronic brokerage services (EBS) systems. As a result, brokerage firms were able to provide retail services by bundling many small transactions and negotiating them in a bank-dominated inter-dealer market. Due to the much higher volume of transactions, participants in the inter-dealer market were prepared to provide liquidity to retail brokers' accessible prices.

In general, retail bidasque spreads are higher than in the inter-dealer market. However, as trading volumes increase, Vidask spreads narrow as the market depth increases. Therefore, if the queue has 1000 instead of one standard lot, the EUR / USD bidasque spread can be much smaller.

How to Choose a Forex Broker?

When choosing a forex broker, you first need to know what type of investor you are and what your goal is to invest in currencies.

Each broker offering Forex investment has its strengths and weaknesses. Some of the most important things to consider are regulations, the level of security these companies have, and transaction fees. Security features vary from broker to broker. Some brokers have built-in security features such as two-factor authentication that protect your account from hackers.

Many Forex brokers are regulated. US brokers are regulated by the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC), and France, Germany, Switzerland, Austria, Canada, and the United Kingdom also regulate forex brokers. However, not all brokers are regulated, and traders need to be aware of unregulated companies.

Brokers also differ in that the minimum account and transaction fees required for the platform are different. Before jumping to the trading platform, it is advisable to create a budget for your investment life. Find out how much you want to invest, how much you are willing to pay, and what your goals are. There are many factors to consider when choosing the right platform. Try to consider as much as possible before committing.

You Also Like

Best Forex Brokers for Beginners in Nigeria for 2024

Select the top forex brokers for beginners in Nigeria from many companies to ensure a safe trading environment.

Best Forex Trading Time in India 2024

Optimize your Forex trading in India by understanding prime trading times and exploring broker options.

What Time the Forex Market Opens in South Africa

Boost your Forex trading in South Africa with our guide on peak market hours for optimal trade activity!

6 Best No Deposit Bonus Forex Brokers in Malaysia in 2024

Start Forex trading risk-free in Malaysia! Discover the six top brokers, featuring attractive no-deposit bonuses.

7 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 7 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Top 10 Unregulated Forex Brokers 2024

Examine unregulated forex brokers, analyzing their distinguishing characteristics, inherent risks, and possible benefits for certain traders.

4 Best Forex Brokers Accepting US Traders in 2024

Discover top forex brokers accepting US traders, assessing their pros and cons to provide helpful guidance.

Best UK Forex Brokers for 2024

Review the top 10 forex brokers in UK, evaluating their trading pros and cons to provide traders with helpful guidance.