In order to become a Forex trader in South Africa, you would need a Forex broker. This is a characteristic that not many stock trading superstars provide. Because the market is so diversified, you must evaluate Forex brokers differently than stockbrokers. Trading with a reputable Forex broker is essential for success in the global Forex market. You may have special demands linked to your platform, trading tools, or research requirements as a Contract for Difference (CFD) trader or Forex investor.

You can choose which Forex broker is suitable for you by knowing more about your investing style requirements. Unlike stock markets and investment trusts, forex trading is not yet well-known in the Philippines, but it is a terrific way to diversify your portfolio. Domestic Forex trading may not be as popular as it once was, but it is gaining traction on many of today's Forex trading platforms.

Best Forex Brokers in South Africa

A Multi-Regulated Big Player that renders you adequate Safety.

Enjoy the Ease of Withdrawal without any Additional Charges.

Both ASIC & CYSEC Regulated Financial Provider offers You Excellent Security.

24/7 Professional and Multilingual Customer Support Easy to Reach.

A Multi-regulated Broker for you to Start Real Trading with a $1 Initial Deposit.

Incredibly Unlimited Leverage Offering for Asia, Rare Among Brokers.

more

Comparison of the Best Forex Brokers in South Africa

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Forex Brokers in South Africa FAQs

South African Financial Regulatory Authorities

Forex brokers are not obliged to get regulated by the Financial Sector Conduct Authority (FSCA) to accept South African citizens as customers, despite the fact that it is encouraged. South Africa's financial regulating authority is the Financial Sector Conduct Authority.

Foreign Exchange Market in the South Africa

In South Africa, the Foreign Exchange market is not new, however Forex has become a booming sensation all around the country. This new lucrative market has become a source of income to many people in the country, in more ways than one. Many people make money, trading, staring brokers and selling education. The FSCA is the market conduct regulator for financial institutions that provide financial products and services, as well as market infrastructures.

The FSCA regulates financial institutions that are licensed under a financial sector law, such as banks, insurers, retirement funds, and administrators. Market conduct regulation and oversight are the responsibility of the Financial Sector Conduct Authority (FSCA). FSCA strives to improve and promote the efficiency and integrity of financial markets, as well as to safeguard financial customers by encouraging financial firms to treat them fairly and offering financial education. The FSCA will help preserve financial stability even more.

Unfortunately, for retail traders, there is only one regulatory system in the country. The FSCA is the only organisation regulating Forex activities in the country. This is because it is still a new concept in the country, meaning there are not many laws or regulatory bodies governing this industry. This leaves rooms for many scams and corruption throughout the industry. It is important that the traders understand the level scams in this industry before entering into it. There are many scams and techniques that are legal, however unfair or unethical.

Is It Legal to Trade Forex in South Africa?

Yes, Forex trading is allowed and regulated in South Africa by the Financial Services Commission of South Africa (FSCA). The FSCA regulates all South African brokers, however foreign brokers situated abroad are not required to be licensed. Individuals can lawfully join up with any Forex broker, regardless of their regulatory status, located anywhere in the world.

In South Africa, How do I Trade Forex?

Anyone with an internet connection may participate in forex trading. However, just because everyone can do something doesn't mean they should. Serious Forex traders understand that a profitable trading career requires education, dedication, and strategy. You may benefit from a few transactions if you begin trading Forex without these abilities, but you will eventually lose.

Forex trading may be a terrific method to make a consistent income if you prepare correctly and are willing to learn. But, before we get into the more complicated components of trading, let's have a look at what you'll need:

A Reliable and Speedy Internet Connection

The Forex markets move at a breakneck pace, and if your connection slows or goes down, you'll lose money. In the blink of an eye, winning deals may turn into losing trades. Many South Africans trade on their phones, although this should only be used as a backup (or to check on open deals while on the go) rather than as the primary trading platform.

A Forex Dealer

The importance of finding a good Forex broker cannot be overstated. For educational reasons only, we keep an updated list of the top Forex brokers in South Africa, as well as a full Forex broker directory that includes all brokers, even those we do not trust or recommend. The directory is a fantastic place to start if you've heard of a broker and want to know if you can trust them. Only the top Forex brokers in South Africa are recommended by TradeForexSA, which uses a transparent evaluation approach.

A Trading Platform for Forex

This is the software that your Forex broker will give for you to utilize in order to trade. Although some brokers have their own platforms, the majority of them accept third-party programs such as MetaTrader 4, MetaTrader 5, and cTrader. The finest Forex trading platform is the one that makes you feel most at ease. Many brokers will provide more than one sort of platform, therefore a demo account may be used to test out the various platforms offered by various brokers.

A Demo Account

Beginners should practice trading on a demo account before putting money into a live account, so they can learn how the market and trading platform function without risking their own money. They're also a safer option to experiment with alternative techniques or trade multiple currencies without putting your money in danger.

We provide a beginners guide to Forex trading in South Africa to help you started, as well as information on how to place your first transaction. Learning how to trade Forex successfully will take some time, as traders must comprehend the different components and methods in order to be lucrative.

What is the Minimum Investment to Begin Trading Forex in South Africa?

Although trading accounts may be started for as low as $5 (70 ZAR), most brokers need a minimum deposit of $100 to $200. But how much should you invest to begin trading? The answer is contingent on how much money you have available and how much risk you are ready to accept.

Beginner traders should start with a balance of 200–500 USD in their account. This allows traders to generate little returns while maintaining a prudent risk management strategy.

When is the Ideal Time to Trade Currency Pairs?

Monday through Friday, the Forex market is open 24 hours a day, however the optimum time to trade Forex is when the world's main stock markets are the most active. The more traders that participate in the market, the more volatile it becomes — and the more volatile it becomes, the simpler it is to profit.

Because New York and London have the world's two major financial markets, the optimal time for South Africans to trade Forex is during the crossover period, when both the London and New York financial markets are open.

The Sydney and Tokyo markets are the other two main markets, and trading while they are open is a solid strategy, albeit you will have to stay up very late or get up extremely early.

What is the Best Forex Trading Strategy?

There is no one-size-fits-all method that will ensure your success. Profitable traders will employ a variety of methods, and they will know when to employ each one. Fundamental analysis (analyzing economic patterns and news events) or technical analysis will be used in forex trading methods (analysing historical price action on charts). It's also a good idea to practice the approach without risking any actual money until you're confident you understand how it works and how to put it into action.

The following are the most prevalent trading strategies:

Price Action Trading is the study of previous fluctuations in currency prices in order to forecast which direction the price will go next. Price action trading is for you if you enjoy examining charts and looking for patterns. It is nearly entirely based on technical analysis, and there are several price action trading systems.

Range Trading: Range trading is based on predicting when other traders will buy or sell a currency. Range trading, like price action trading, is based on technical analysis, but it also necessitates a thorough grasp of the currency pair being traded.

Scalping is when a trader starts and closes a large number of deals in a single day. The objective is to make a large number of tiny profits. With scalping, technical analysis is vital, but the key issue is the time commitment necessary. Scalpers might lose track of time by staring at their trading monitor all day.

Positional Trading: When a trader holds a position, or numerous positions, for an extended length of time – weeks, months, or even years – this is known as positional trading. Fundamental analysis is a big part of positional trading, but technical analysis is also vital.

The time of day (which impacts how many other people are trading and the volatility of the market), order types (such as stop loss and take profit orders), and automated trading software/bots are all things to consider when creating a Forex strategy (which can see movements in the market that you may miss).

Is It Lucrative to Trade Forex in South Africa?

South Africans can lawfully trade in the foreign exchange market through any FSCA-regulated forex broker that is permitted to provide derivative products to South African customers. In 2017, the daily forex trading volume in South Africa was expected to be approximately $19.1 billion USD.

Pros Of Forex Trading

Accessibility

Leverage

Potential For Fast Returns

Easy Short Selling

Liquidity

Technical Strategy

Less Potential For Insider Price Manipulation

Fewer Fees And Commissions

Simple Tax Rules

Automation

Cons Of Forex Trading

Volatility

Small Traders May Face Some Disadvantages

Lighter Regulatory Protection

Fewer Residual Returns

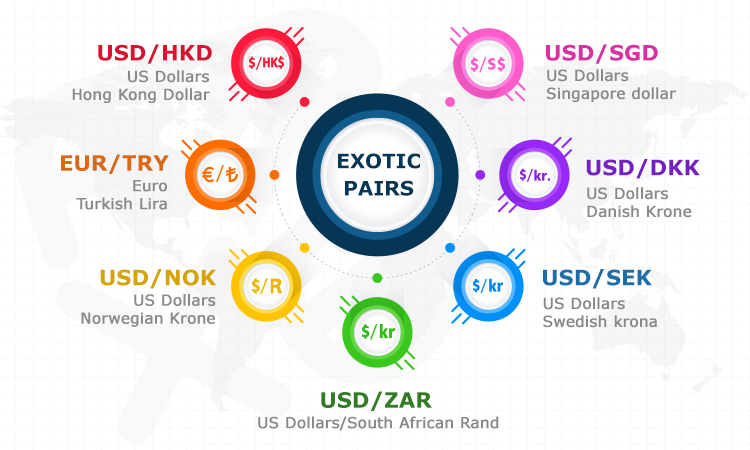

What are Currency Pairs and How do They Work?

The quotation of one currency in relation to another is referred to as a currency pair. All currencies are traded against each other in the Forex market, which is why they are referred to as 'currency pairings.' When you trade in the forex market, you're essentially trading two currencies at the same time.

How to Choose Forex Accounts?

Different accounts with different. Before opening up a trading account, you should figure out the following questions:

How much do you want to deposit? You should keep in mind that it is not wise to trade with money you cannot afford to lose.

What is your risk tolerance? If you are a conservative trader, you may choose a micro account you can trade micro-lots. But if you want to trade more aggressively, you may better choose a standard account.

Do you need any advanced tools? Many forex brokers offer their best trading tools to their professional clients, which may include innovative news analysis or access to an extensive range of indicators.

Once you can define what kind of trader you are, your trading goals, and your risk tolerance, you can know what account suits you most.

You Also Like

Best Forex Brokers for Beginners in Nigeria for 2024

Select the top forex brokers for beginners in Nigeria from many companies to ensure a safe trading environment.

Best Forex Trading Time in India 2024

Optimize your Forex trading in India by understanding prime trading times and exploring broker options.

What Time the Forex Market Opens in South Africa

Boost your Forex trading in South Africa with our guide on peak market hours for optimal trade activity!

6 Best No Deposit Bonus Forex Brokers in Malaysia in 2024

Start Forex trading risk-free in Malaysia! Discover the six top brokers, featuring attractive no-deposit bonuses.

7 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 7 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Top 10 Unregulated Forex Brokers 2024

Examine unregulated forex brokers, analyzing their distinguishing characteristics, inherent risks, and possible benefits for certain traders.

4 Best Forex Brokers Accepting US Traders in 2024

Discover top forex brokers accepting US traders, assessing their pros and cons to provide helpful guidance.

Best UK Forex Brokers for 2024

Review the top 10 forex brokers in UK, evaluating their trading pros and cons to provide traders with helpful guidance.