Since currency values were constantly changing, traders were frequently required to keep an eye on these fluctuations in order to pinpoint a lucrative trade. That is where automated forex trading software came into play. Despite the fact that major institutional investors were the first to implement and carry out algorithmic trading, the popularity of automated forex trading software designed for personal forex traders has grown rapidly over the last few years. Concerning forex trading software, For the most part, forex brokerages offer mobile applications, desktop applications, and web-based trading platforms for their clients. Depending on your trading style, the best trading platforms will offer live data, flexible charts, custom views, and the facility to execute trades rapidly to ensure that your profits are locked in when they are needed. With the right CFD and Forex trading software, your chances of getting a successful trading experience will increase considerably. As you can see from the list below, we have prepared a comprehensive list of the Best Forex Trading Software out there. Numerous forex brokers claim to offer stable and high-performance trading platforms, but these platforms may be among the best because they can potentially be a good match for your experience and risk tolerance.

Best Forex Trading Software for 2026

Both ASIC & CYSEC Regulated Financial Providers offer You Excellent Security.

24/7 Professional and Multilingual Customer Support Easy to Reach.

A Stringently Regulated Broker, Reliable and Safe to Trade With.

Quick & Easy to Start Real Trading by Funding As Low As 5 USD.

Strictly Regulated by ASIC and CYSEC, a Safe Broker to Trade With.

MT4 & MT5 Available, Plus Two Copy Platforms: Social Trading & Myfxbooks.

A Multi-regulated Broker for you to Start Real Trading with a $10 Initial Deposit.

Incredibly Unlimited Leverage Offering for Asia, Rare Among Brokers.

Licensed & Regulated in Multiple Jurisdictions: ASIC, CYSEC, and FCA.

Super-Low 10 USD Initial Deposit Quite Friendly to Active Traders.

more

Comparison of the Best Forex Trading Software

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Forex Trading Software FAQs

What is Trading Software?

Trade software is a computer program that gives traders access to financial products such as currencies, stocks, bonds, and other derivatives over the internet without the need for a financial middleman such as a broker, a market maker, or an exchange. Trading software allows investors to place trades regardless of their location. In contrast to the traditional floor trading method, where orders are placed through an open outcry system, trading software employs a computerized system to place orders.

Brokerages usually offer their clients either free or discounted online trading platforms if they keep funds in their accounts. Clients can manage their accounts via the trading software from anywhere and can access it via desktop, mobile, and web-based platforms.

What Trading Software do Most Reputable Forex Brokers Offer?

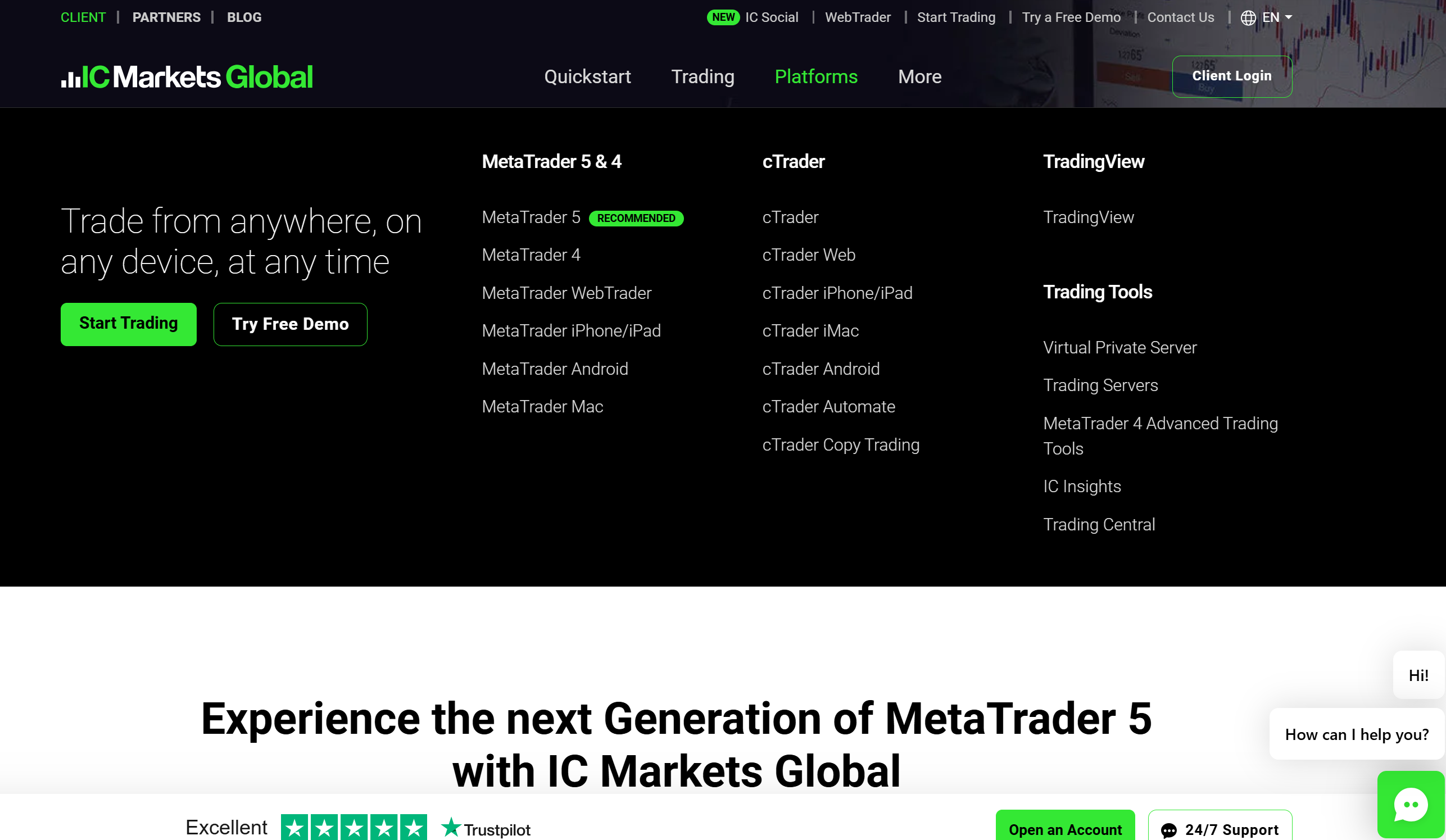

IC Markets Global

Trading software offered by IC Markets Global includes the full suite of MT4/MT5, cTrader, and TradingView. Additionally, it offers MT4 Advanced Trading Tools. There are 20 unique trading tools that give traders an edge over their competition. The MAM/PAMM packages manage retail accounts and the VPS hosting supports algorithmic trading. IC Markets' copy trading platform includes Myfxbook Autotrade and ZuluTrade, and MT4/MT5 features copy trading as well.

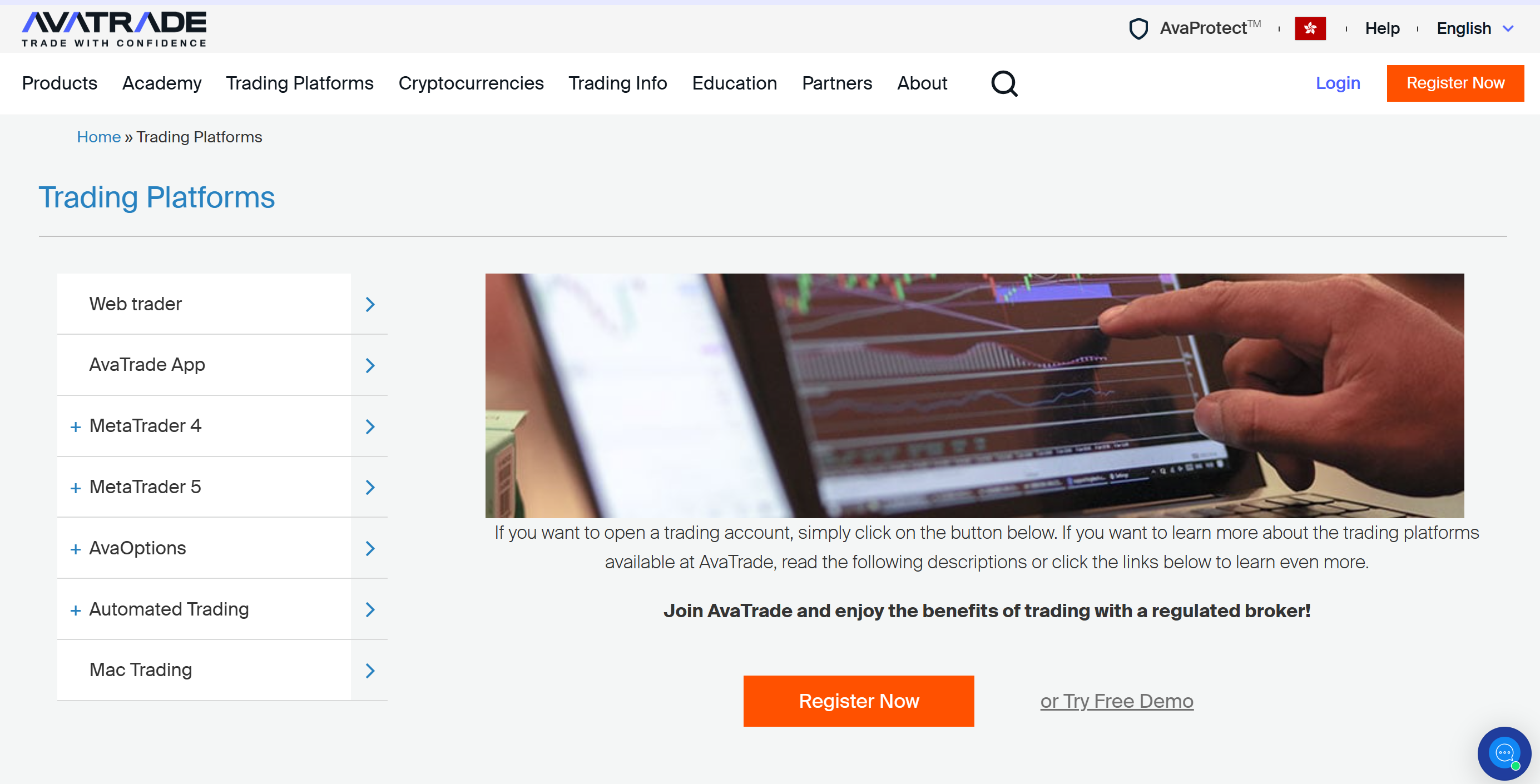

AvaTrade

Trading with AvaTrade is a familiar experience for those with MT4/MT5, and it is a leader in algorithmic trading, offering a copy trading platform as well. In addition, it supports other trading platforms, such as WebTrader and its mobile apps, AvaSocial, AvaOptions, and DupliTrade.

Exness

In terms of Exness' trading platforms, customers have a choice between industry leader - MT4/5, as well as Exness Terminal, and Exness Trade app.

FXTM

Aside from offering traders the MT4 and MT5 platforms, FXTM also has a proprietary mobile app. It upgrades MT4 with six plugins plus its Pivot Points Strategy, featuring live updates and commentary from the FXTM Head of Education, and the mobile app is user-friendly and easy to use.

Pepperstone

Pepperstone's trading technology and software emphasize the importance of performance together with an additional parameter. Pepperstone trading platforms including MT4 or its new version MT5, TradingView, and cTrader on various versions (iPhone, Android, tablet, dekstop, web).

IG

Aside from IG's proprietary web-based trading platform, traders can use ProRealTime, one of the best trading platforms for serious traders. Additionally, IG Markets US continues to develop MT4 and adds 18 add-ons to it, as well as AutoChartist.

Eightcap

Through Eightcap, traders can use MetaTrader 4/5 and TradingView platforms, which have many advanced features and tools.

TMGM

There is a wide range of products available across the TMGM group's subsidiaries to meet traders' needs. Over 12,000 trading instruments such as forex, indices, metals, energies, shares, and cryptos can be accessible through the trading platform, the most popular MT4/5 available through PC, Web, and Mobile versions.

What is Popular Trading Software?

You will find a number of different automatic Forex trading software options out there, each with its own set of benefits and disadvantages. While many commercial companies have built their own platforms, many others choose to use, and in fact, White Label, the solutions that are generally known in the existing business world. There is no way to determine which platforms are best since that depends on the individual user's opinion. However, there has been a noticeable trend in terms of popular platforms that seem to be used by both beginners and veterans. A few of the most popular and reputable platforms are Metatrader 4, Metatrader 5, cTrader, and NinjaTrader, and more.

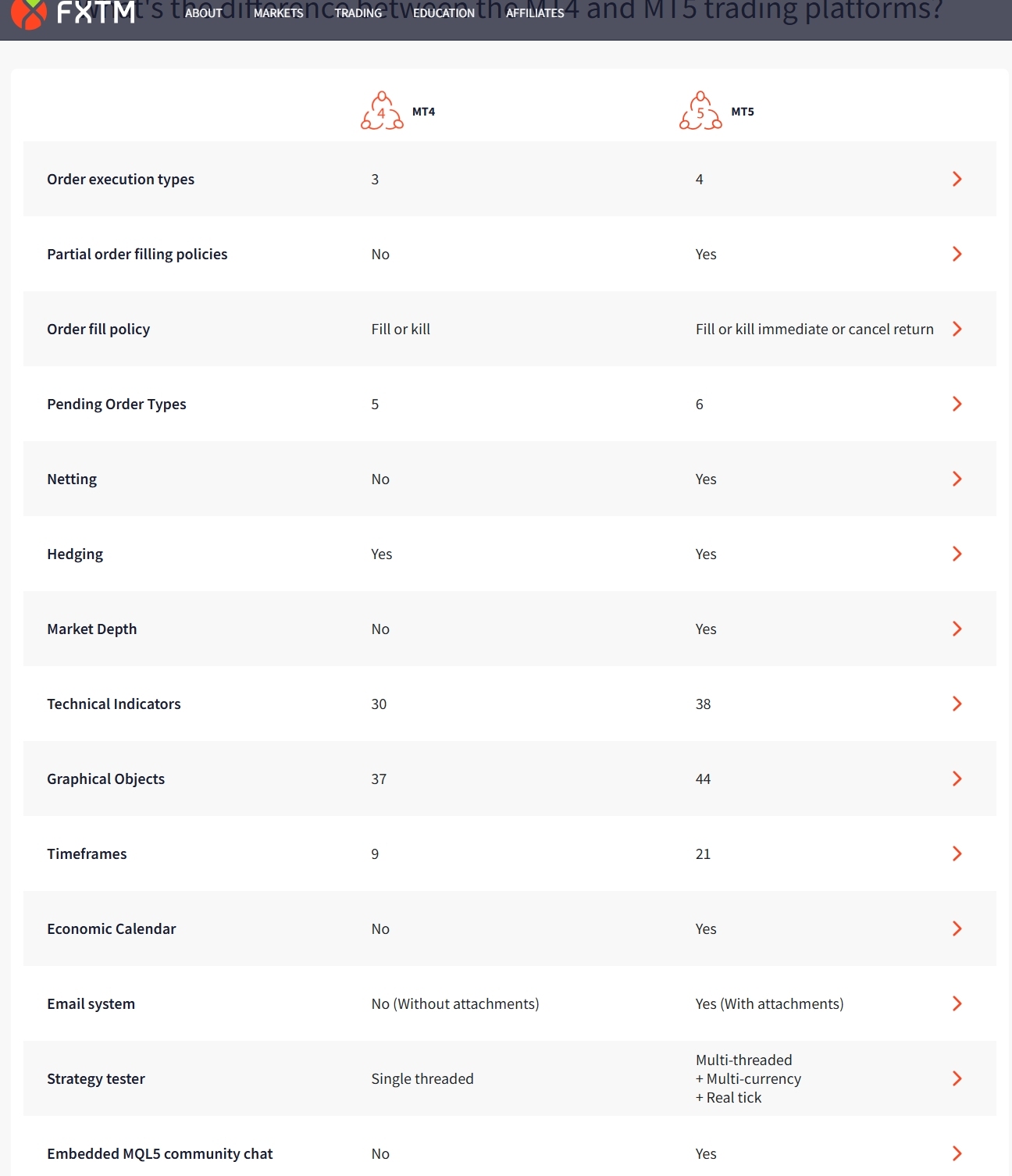

MetaTrader 4 Trading Software

The MetaTrader 4 platform allows traders to trade Forex, analyze financial markets, and build Expert Advisors. Market, Trading Signals, and Mobile Trading are three of the core features of MetaTrader 4.

Traders of all skill levels have ample access to the platform: advanced technical analysis, an automated trading system, Expert Advisors, algorithmic trading, and mobile trading. MetaTrader 4 Signals and Markets feature additional trading services. As for Signals, you can copy other traders' trades, and in the market you can purchase Expert Advisors and Technical indicators.

MetaTrader 5 Trading Software

The MetaTrader 5 platform allows Forex, stocks, and futures trading. With it, you can perform comprehensive price analysis, use algorithmic trading applications (trading robots, expert advisors), as well as copy trading.

With MetaTrader 5, you can open multiple positions on the same financial instrument in opposite or identical directions with the hedging method. Quite often, it is used for Forex trading.

cTrader

cTrader is a top-level platform offering multi-asset trading, advanced charting tools, level II pricing, and fast entry and execution. Featuring an eye-catching user interface, it is supported by the most advanced backend technology, and is accessible across multiple platforms. The package includes cTrader Copy, cTrader Automate, cTrader Open API, and cTrader FIX API.

NinjaTrader

NinjaTrader provides software and brokerage services targeted at active traders. The NinjaTrader software gives you access to charting, market analysis, and live trading if you have a funded account (the SIM version is free no matter if you have a funded account).

For traders who want plenty of technical analysis tools, NinjaTrader is a great choice. The trading software package includes excellent charting, real-time analysis, highly customizable technical indicators, and various third-party apps.

Thinkorswim

Thinkorswim is a trading software owned by TD Ameritrade that targets experienced stock, options, and futures traders seeking advanced tools, screeners, and charts. TD Ameritrade offers free use of thinkorswim when you open an account. You can install it on your desktop and use it for real-time quotes, chart analysis, and options risk graphs, among other things.

What are the Pros and Cons of Different Types of Forex Trading Software?

| Trading Platform | Pros | Cons |

| MetaTrader 4 (MT4) |

|

|

| MetaTrader 5 (MT5) |

|

|

| cTrader |

|

|

| NinjaTrader |

|

|

| Thinkorswim |

|

|

Ultimately, the best type of Forex trading software for you will depend on your individual needs and preferences. Consider the features and tools that are important to you, your budget, and your trading style when choosing a software platform.

Here are some additional things to consider when choosing Forex trading software:

Ease of use: How easy is the software to learn and use? If you are new to Forex trading, it is important to choose software that is user-friendly.

Features and tools: What features and tools are important to you? Consider things like charting tools, technical indicators, news and research, and more.

Supported markets: What markets do you want to trade? Make sure to choose software that supports the markets you are interested in.

Cost: How much does the software cost? Consider your budget when choosing a software platform.

Customer support: Does the software provider offer good customer support? This is important in case you have any problems with the software.

It is also important to demo or try out different trading software platforms before you choose one. This will give you a chance to see how they work and decide which one is right for you.

Are There Free Trials Available for Forex Trading Software?

Yes, there are free trials available for Forex trading software. Most popular Forex trading software platforms offer free trials, typically ranging from 7 to 30 days. This allows you to try out the software and see if it's right for you before you commit to a paid subscription.

Here are some examples of popular Forex trading software platforms that offer free trials:

MetaTrader 5

NinjaTrader

To take advantage of a free trial, simply visit the website of the Forex trading software platform you're interested in and sign up for an account. You'll then be able to download and install the software and start using it immediately.

Keep in mind that some free trials may have limited features or functionality. For example, you may not be able to trade with real money or access all of the platform's features. However, free trials are a great way to get a feel for the software and see if it's right for you before you commit to a paid subscription.

How to Choose Trading Software?

Traders should take into consideration the features available to them and the fee that is associated with the software they select. A trading platform that offers Level 2 quotes in real-time is more attractive to day traders for selecting stocks to trade. Trading software that let buyers visualize their strategies are more attractive to options traders, on the other hand.

The fee structure is another consideration traders make when selecting a trading platform. Trading platforms with low fees are preferred by traders who get access to essential features such as responsive charts, news feeds, technical analysis tools, etc., depending on their strategies. Traders who use scalping, for instance, prefer less expensive platforms that do not eat away at their profits.

What is the Best Forex Trading Software for Beginners?

The best Forex trading software for beginners is one that is easy to use and provides all the essential features needed to trade effectively.

Some popular Forex trading software for beginners includes:

MetaTrader 4 (MT4): MT4 is a widely used Forex trading platform that is known for its user-friendly interface and powerful charting tools. It is also available for free download from most Forex brokers.

MetaTrader 5 (MT5): MT5 is an updated version of MT4 that offers a number of new features, such as built-in hedging capabilities and more advanced charting tools.

cTrader: cTrader is a popular Forex trading platform that is known for its fast execution and low spreads. It also offers a number of educational resources for beginners.

ZuluTrade: ZuluTrade is a Forex trading platform that allows traders to copy the trades of other successful traders. This can be a great way for beginners to learn from more experienced traders and to generate profits without having to do their own research and analysis.

Some Forex brokers offer their own proprietary trading platforms. These platforms may be a good option for beginners, as they are designed to be easy to use and integrated with the broker's trading platform.

What is the Best Forex Trading Software for Experienced Traders?

The best Forex trading software for experienced traders is one that offers a wide range of features and flexibility to meet the specific needs of the trader. Some popular Forex trading software for experienced traders includes:

NinjaTrader: NinjaTrader is a powerful and versatile Forex trading platform that offers a wide range of features, including advanced charting tools, technical indicators, and order management tools. It also allows traders to develop and automate their own trading strategies.

FXCM Trading Station II: FXCM Trading Station II is another popular Forex trading platform that offers a wide range of features, including advanced charting tools, technical indicators, and order management tools. It also allows traders to trade directly from the charts and to use multiple monitors.

eSignal: eSignal is a professional Forex trading platform that offers a wide range of features, including advanced charting tools, technical indicators, and order management tools. It also offers access to real-time market data and news.

Some Forex brokers offer their own proprietary trading platforms. These platforms may be a good option for experienced traders, as they may offer additional features and functionality that are not available in other platforms.

Why is Forex Trading Software So Important?

Here are some of the features that make foreign exchange software a must-have for every trader:

Stop Loss-With this feature, you can have your currency sold automatically once they reach a specific price. This is the best way to prevent the cascading losses that traders face when they attempt to gain some value.

History-A trader must have access to the history of the transactions he has made in the past few months. Planning future purchases and sales of currencies is made much easier with this tool.

Buy & Sell-You will need to buy and sell more currencies if you are doing forex trading. With this feature, you can not only prepare for the most extreme grappling situations but also see how to handle them.

Deposits & Withdrawals- This feature allows you to build up your investment portfolio. You can put more money into the account so you are prepared for more frequent trade sessions. Gaining profits also means you would have to be able to access them whenever you want. It is very important to ensure that as many of your earnings as possible are in a liquid state, which can easily be accomplished with this feature.

How Much does Trading Software Cost?

How much does the software cost? Does it come as part of the standard brokerage account or is it an additional fee? You should carry out a cost-benefit analysis based on your particular trading activity. It would be a good idea to compare all the options and versions available to you based on what you do. Many trading software packages include a brokerage account by default, however it may not contain all the necessary features. Make sure to check the costs of the higher versions, which may be significantly more than the standard one. Trading returns and decisions should only be evaluated based on realistic gains that have been discounted after taking into account such costs.

What are Some Tips for Using Forex Trading Software Effectively?

Choose the right software for your needs. There are many different types of Forex trading software available, each with its own strengths and weaknesses. Consider your trading style, budget, and experience level when choosing a software platform.

Demo the software before you use it with real money. Most Forex trading software platforms offer free demos. This is a great way to learn how to use the software and make sure it's right for you before you start trading with real money.

Customize the software to fit your needs. Most Forex trading software platforms allow you to customize the interface and settings to fit your needs. This can help you to work more efficiently and effectively.

Use the software's features to your advantage. Most Forex trading software platforms offer a wide range of features, such as charting tools, technical indicators, and news and research. Make sure to take advantage of these features to make informed trading decisions.

Backtest your trading strategies before you use them in the live market. Backtesting allows you to test your trading strategies on historical data to see how they would have performed. This can help you to identify which strategies are most profitable and which ones are most likely to lose money.

Risk management is key. Forex trading is a risky activity, so it's important to have a risk management plan in place. This will help you to limit your losses and protect your capital.

Please note that Forex trading is a risky activity and there is no guarantee of profit. It is important to do your research and understand the risks involved before you start trading Forex.

You Also Like

7 Best Platforms for Copy Trading in India 2026

India's leading copy trading platforms allows you to automatically copy the trades of top performers, enhancing profitbility.

Best Forex Brokers in Denmark for 2026

Discover top regulated forex brokers, trading platforms and broker reviews for reliable trading in Denmark.

Best Forex Brokers Ireland in 2026

Compare top forex brokers in Ireland with robust regulation, excellent platforms and broker reviews for secure trading.

Best Forex Brokers with Trading APIs for 2026

Dive into top Forex Brokers with exceptional trading APIs, offering benefits, security, and a variety of platforms.