As part of the process of becoming a trader, choosing a right Forex broker is the top to give priority all the time. But what precisely is a Forex Trading broker? In order to comprehend this better, take look at the following. There are plenty of forex brokerage companies available for people in Nigeria, but note that you need to be more careful to settle for the best when it comes to choosing . Your broker plays an important role in your forex trading journey. Therefore, it is important to understand how Forex brokers work and to know the best options available at the very beginning.

Beginner Traders in Nigeria, should first know all of the scams associated with the industry. There are not much laws surrounding the industry, therefore there are many rooms for scams to take place. Traders should spend hours learning about scams for reputable sources, as well as, multiple sources. Once you have learnt about all the scams and risks involved, beginner traders need a broker with low expenses and high profitability. Traders also want a broker with fast and reliable withdrawals. If its possible to find a reputable broker which has a bonus, this will help beginner traders grow small accounts with less risk.

Best Forex Brokers for Beginners in Nigeria

A Stringently Regulated Broker, Reliable and Safe to Trade With, The Choice of Over 3500,000 Clients from Over 190 Countries.

Quick & Easy to Start Your Real Trading by Funding As Low As 5 USD, Lower & Friendlier Cost Structure Available, Advanced Trading Platforms & Tools Drive You Succeed into the Forex World.

Both ASIC & CYSEC Regulated Financial Providers offer You Excellent Security.

24/7 Professional and Multilingual Customer Support Easy to Reach.

Licensed & Regulated in Multiple Jurisdictions: ASIC, CYSEC, FCA, DFSA, SCB.

Super-Low 1 USD Initial Deposit Quite Friendly to Active Traders.

more

Comparison of the Best Forex Brokers for Beginners in Nigeria

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Forex Brokers for Beginners in Nigeria FAQs

What are forex brokers and what are their responsibilities?

A forex broker is a financial services firm that presents forex traders a platform for buying and selling foreign currencies. Foreign exchange is abbreviated as forex. In the forex market, transactions are always made between two separate currencies that are both international.

As a result, a forex broker will clearly give you with a pricing from the banks where they have lines of credit and currency liquidity. Several forex brokers employ many banks to price their products, and they'll provide you the greatest deal. Forex brokers make money by taking a piece of the pie every time you make a deal. A change in the relationship between two currencies in a pair is referred to as a pair change.

Before putting your deal on the market, your forex broker will charge you a few pips. When you enter your trade, the market may be trading at 1.3100 EUR/USD as a purchasing price, but the broker may put you in at 1.3102. When you immediately close a trade, the forex broker keeps the difference between the “market price” and the price you paid. This is called the spread.

There are two types of Forex brokers: retail and institutional.

• Dealing desk: For buying and selling currencies, dealing desk brokers, also known as market makers, set a fixed spread. Institutional investors often employ dealing desk brokers because they build their own market for their clients to trade in.

• No dealing desk: Brokers compare currency values from different financial institutions, e.g banks, and pass on the best to traders. Individual investors and retail traders choose no dealing desk brokers since it is more difficult for them to access the interbank and implements trades on their own.

What are the regulations around forex trading in Nigeria?

Forex trading in Nigeria is regulated by the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC). Regulation is primarily aimed at protecting traders and creating a stable and transparent trading environment.

Some key points in Nigerian forex regulations include:

All brokers must be registered and licensed by the CBN or the SEC.

Forex brokers must maintain a minimum capital adequacy ratio set by the regulator.

Brokers are obligated to keep client funds in segregated accounts, to prevent misuse of traders' funds.

Regular audits are performed on brokers to ensure adherence to regulations.

How much initial investment is recommended for beginners in forex trading?

There isn't a definitive answer to this as it depends on several factors like risk tolerance, trading strategy, and financial situation. Some platforms allow trading with as little as 100 to start but most professionals suggest starting with at least 1,000-$2,000. However, practicing with a demo account first is highly recommended before trading with real money. This helps to understand forex trading patterns and different trading strategies.

How can beginners practice forex trading without risking real money?

Beginners can practice forex trading without risking real money in several ways:

Demo Accounts: Almost all online trading platforms offer practice or demo accounts. These accounts offer the full functionality of a real trading account but use simulated money instead. This allows traders to practice their techniques and strategies without any risk.

Simulators: Forex simulators allow you to trade in real-time or sped-up time, providing a realistic trading environment. They usually provide historical data so you can backtest various strategies.

Forex Trading Games: There are several mobile apps and online games that simulate forex trading. While they might not be as comprehensive as a demo account, they can be a fun way to learn the basics.

Online Courses and Webinars: Many websites, platforms and educational institutes offer free or paid courses on forex trading where you can learn the theory before practicing.

Paper Trading: This is an old-school method where you make hypothetical trades on paper based on real-time market conditions, then monitor your performance as if the trades were real. Its a simple, but effective way to practice without risking real money.

While these methods can help you understand the mechanics of forex trading, be aware that they can't perfectly replicate the pressures and risks of real trading. Emotional control and risk management are significant aspects of successful trading that can only be fully understood through experience with real money at stake.

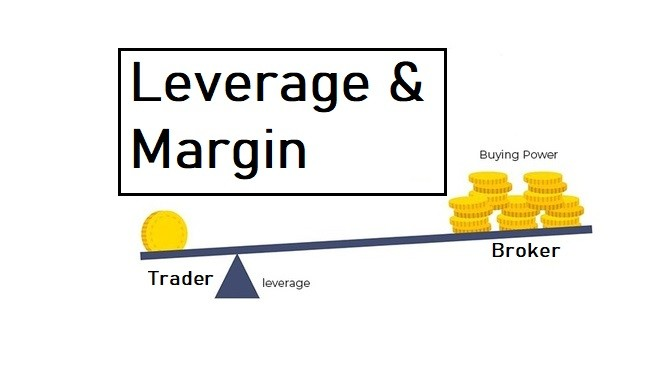

How does leverage work in forex trading?

Leverage in forex trading is a tool that allows traders to control a larger position than they would otherwise be able to with their own capital. It is essentially a loan from the broker.

For example, if a trader has a leverage ratio of 100:1, they can control a position worth $100,000 with only $1,000 in their account. This means that a small price movement in the currency pair they are trading can have a big impact on their profits or losses.

Leverage can be a powerful tool for forex traders, but it is important to use it carefully. Because leverage amplifies both profits and losses, it can also lead to large losses if the market moves against the trader.

Here is an example of how leverage works in forex trading:

A trader opens a long position on the EUR/USD currency pair with a leverage ratio of 100:1.

The trader deposits $1,000 into their account.

This gives the trader control over a position worth $100,000.

If the EUR/USD currency pair moves up 1%, the trader's profit will be $1,000.

However, if the EUR/USD currency pair moves down 1%, the trader's loss will also be $1,000.

It is important to note that forex brokers typically have margin requirements in place. This means that traders need to maintain a certain amount of equity in their account in order to keep their leveraged positions open. If the trader's equity falls below the margin requirement, the broker will close out their positions.

Leverage can be a useful tool for forex traders, but it is important to use it carefully and to understand the risks involved.

Here are some tips for using leverage safely:

Start with a low leverage ratio.

Use risk management techniques to limit your losses.

Don't risk more money than you can afford to lose.

Be patient and don't expect to get rich quick.

How to choose the most suitable broker?

Authorized by the FCA or other regulatory bodies

Companies that provide, advertise, or sell financial services or products in the United Kingdom are regulated by the Financial Conduct Authority (FCA). The Financial Services Compensation Scheme will protect your money if a forex broker is authorised by the FCA (FSCS).

The Financial Services Compensation Scheme (FSCS) protects up to £85,000 in assets if a company goes bankrupt or you received bad advice that resulted in you losing money.

Because unauthorised companies are not covered by the Financial Services Compensation Scheme (FSCS), it will be more difficult to recover your funds if something goes wrong with your investment. These businesses are more prone to be con artists.

Pairs of currencies

Major currency pairings are covered by most forex brokers, while minor and exotic currency pairs are not always available. Before choosing a forex broker, make sure you know which currencies you'll be able to trade.

Leverage

Before employing leverage, it's critical to understand what the broker presents in terms of leverage, the hazards involved, and how much you may lose, as it essentially subjects you to unlimited risk.

Spread

Spread, or the difference between the buying and selling price of a currency pair, is how most forex brokers generate money. As a result, look for a broker with fair spreads.

Fees

It's crucial to be aware of any additional fees or costs imposed by a forex broker, as these can cut into your profit.

Customer service is important

Due to the forex market is global and operates 24 hours a day, it's critical to find a broker that can provide you with quick customer service whenever you need it.

Nigeria has a number of regulated forex brokers with whom you can trade

AVATRADE

AvaTrade, which was founded in 2006, is regulated in three tier-1 and three tier-2 jurisdictions, making it a safe (low-risk) broker for trading CFDs and forex. AvaTrade also propose its own platforms AvaTrade WebTrader and AvaTradeGO, which include revolutionary features like AvaProtect, in addition to MetaTrader. AvaTrade has 44 FX options to choose from, and also over 1,200 CFDs.

FXTM

The FXTM or Forex Time company, which was founded in 2011 and has its headquarters in Cyprus (Limassol), has been well-known as one of the world's fastest growing and best forex brokers by the Financial Conduct Authority and other regulators. Because of its concentration on Africa and Asia, the company has seen tremendous and quick growth within Europe and beyond in a relatively short period of time.

250+ financial instruments, Forex products with over 50 currency pairs, and attractive FXTM CFDs on Cryptocurrencies such as Bitcoin, ETH, Litecoin, and Ripple are among the trading markets. You can also select from spot metal CFDs, share CFDs on over 170 major businesses, commodity CFDs, and indices CFDs.

IC Markets

IC Markets is a multinational forex broker based in Australia that was launched in 2007.

The Cyprus Securities and Exchange Commission (CySEC), the Seychelles Financial Supervisory Authority (FSA), and the Australian Securities and Investments Commission all regulate the corporation (ASIC).

Because it is governed by the top-tier ASIC, IC Markets is regarded safe. It is a safe broker (average-risk) for trading forex and CFDs because it is regulated in one tier-1 and one tier-2 jurisdiction. It presents low average spreads and affordable pricing across all account types.

Markets.Com

Markets.com was founded in 1999 and is a subsidiary of a publicly traded corporation in the United Kingdom (LSE: PTEC). Markets.com is a safe (low-risk) forex and CFDs broker because it is regulated in two tier-1 jurisdictions.

The MarketsX platform from Markets.com is well-designed, simple to use, and presents a solid set of services, including integrated research, market analysis, webinars, and educational videos. However, there is a lack of trading tool depth to compete with platform giants like IG and Saxo Bank. When compared to market giants such as CMC Markets and IG, forex spreads are wide (expensive).

Markets.com Provides access to the world's most popular CFDs, including shares, currencies, indices, bonds, ETFs, and commodities, for a total of more than 2,200 products.

Pepperstone

Pepperstone is a forex broker based in Australia that also offers CFDs. Company was founded in 2010, and in 2015, it opened a London office to better serve its European customers. Pepperstone's German and Cyprus businesses will assist new clients registering from the EU after Brexit.

Pepperstone is regarded safe since it is governed by three top-tier financial regulators: the Financial Conduct Authority (FCA) of the United Kingdom, the BaFin of Germany, and the Australian Securities and Investments Commission (ASIC).

The markets or instrument offering comprises 70+ currency pairs, cryptocurrencies (with access to trade Bitcoin, Bitcoin Cash, Ethereum, Dash, and Litecoin against the US Dollar with leverage of 5:1), metals, commodities, and a variety of important indices across several broker platforms.

FP Markets

FP Markets was founded in 2005 and is regulated in one tier-1 and one tier-2 jurisdiction, making it a safe (average-risk) broker for trading forex and CFDs.

FP Markets stands out as a low-cost FX and CFD broker – you can employ the MetaTrader platform as long as you use it. The Iress platform suite has over 8,000 tradeable symbols, but it's primarily a share trading platform - and it's a far more expensive option.

HotForex (HFM)

HotForex (HFM) is presently one of the best Forex brokers in Nigeria. They have a very low spread, are well controlled by many authorities, including the FCA and the FSCA, provide excellent customer service, offer local financing and withdrawal alternatives, and offer mobile trading. Read our complete HotForex review to see why you should (and shouldn't) trade with them.

HotForex presents over 1000 different securities, including 47 different forex pairs, metals, commodities, stock indexes, cryptocurrencies, and exchange-traded funds (ETFs). For this type of market-maker and pricing framework, this selection is above-average.

OANDA

OANDA, which was founded in 1996 and is regulated in six tier-1 jurisdictions, is a safe (low-risk) forex and CFDs broker. OANDA is a technology-driven financial services company based in the United States that was created in 1996 with the belief that the internet would open up the markets and provide everyone with equal access to data and trading. Due to its global presence and coverage of many jurisdictions, OANDA Corporation is rigorously regulated and authorized by several government bodies.

Alpari

Alpari is one of the largest Forex brokers, having gained experience over the years of operation. It was founded in 1998 by three Russian partners who started from the ground up, went through all the difficulties and crises, and eventually became a global trading company.

Alpari offers the Metatrader 4 and 5 platforms, as well as their own mobile trading app for Android and iOS. Investors and PAMM account holders can also use the Alpari invest app.

Alpari is a global corporation with multiple regulatory licenses, including licenses from the Financial Services Authority of Saint Vincent and the Grenadines and the International Financial Services Commission of Belize, allowing it to propose its services abroad.

Plus500

Plus500 was founded in 2008 and is part of the FTSE 250 Index. It is publicly traded on the London Stock Exchange (LSE: PLUS).

Plus500 is a safe (low-risk) broker for online trading because it is regulated in three tier-1 and four tier-2 jurisdictions.

Plus500 is a well-known global brand that provides online traders with an easy-to-use trading platform, as well as access to share trading and a wide range of CFDs.

Plus500's simple trading platform appeals to newbies looking for a user-friendly experience, but active traders will be disappointed by the lack of educational information and limited market research options.

How to trade forex for beginners?

Trading forex for new traders is not easy. Before you start, you should first learn some professional terms like basics (currency pairs), demo accounts, trading strategies, and more.

Then, you need to decide what trades (short or long) to make, how much it will cost you and how big the spread is (difference between ask and bid price). More importantly, you need to learn to read forex charts.

There are three different options available to traders using the MetaTrader platform: line chart, bar charts or candlestick charts. There are some suggestions for beginners to trade forex:

1. Know your markets

2. Stick to your plan

3. Practice with a demo account

4. Predict the market conditions

5. Know your limits

6. Know when to stop

7. Find a reliable forex broker

What are the common mistakes that beginners should avoid in forex trading?

There are several common mistakes beginners make when it comes to forex trading. Here are a few to keep in mind:

Trading Without a Plan

It's crucial to develop a strategy or plan before starting with forex trading. This plan should include your risk threshold, profit targets, and measures to manage losses.

Overtrading

Just because the forex market is open 24/5, it doesn't mean you need to be trading all the time. Overtrading can lead to poor decision-making and higher transaction costs.

Not Using Stop-Loss Orders

A stop-loss order is set to sell a security when it reaches a certain price and is used to limit an investors loss on a security position. Not using them could result in significant losses.

Using too Much Leverage

While leverage can amplify profits, it can also amplify losses. Especially for beginners, it's risky to use too much leverage.

Ignoring Market Trends

Even though currency values fluctuate quite frequently, there are still overall trends that one should pay attention to. Ignoring these can lead to losses.

Neglecting to Learn

The most successful forex traders are the ones who consistently learn and adapt their strategies based on market conditions and their own performance reviews. Take advantage of educational materials and keep up-to-date with market news.

You Also Like

Best Forex Brokers for Beginners in Nigeria for 2024

Select the top forex brokers for beginners in Nigeria from many companies to ensure a safe trading environment.

Best Forex Trading Time in India 2024

Optimize your Forex trading in India by understanding prime trading times and exploring broker options.

What Time the Forex Market Opens in South Africa

Boost your Forex trading in South Africa with our guide on peak market hours for optimal trade activity!

6 Best No Deposit Bonus Forex Brokers in Malaysia in 2024

Start Forex trading risk-free in Malaysia! Discover the six top brokers, featuring attractive no-deposit bonuses.

Best Forex Brokers for Beginners in Nigeria for 2024

Select the top forex brokers for beginners in Nigeria from many companies to ensure a safe trading environment.

Cheapest Brokers 2024 | We List the Best Brokers with low fees

Slash forex trading costs: find the cheapest brokers, avoid hidden fees, and boost your returns!

Best Zero Spread Forex Brokers in 2024

Dive into zero-spread forex trading: explore its perks, pitfalls, and discover top brokers to optimize your journey.

7 Best $10 Minimum Deposit Forex Brokers in 2024

Ultra-affordable Forex trading starts here! With only $10, join the Forex market with these seven champion brokers.