In forex trading, every second counts. The forex market operates around the clock on working days, but this doesn't, necessairly, mean that every moment is opportune for tradable assets. To make the most profit, traders have to know when to trade, as prices fluctuate significantly at different times of the day.

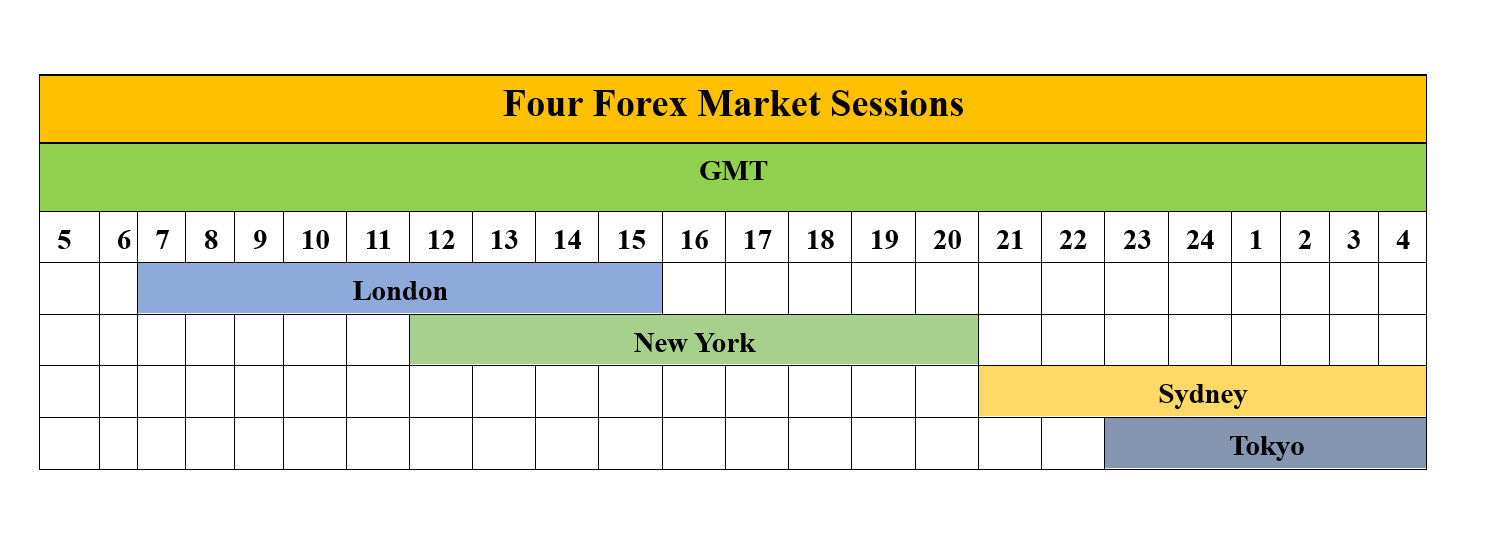

There are typically four major trading sessions: Sydney, Tokyo, London, and New York. Both Sydney and Tokyo sessions form what is commonly known as the Asian sessions. Hence, Forex is often alluded to as the 3-session market, comprising the Asian, London, and New York sessions.

Asian Session: 22:00 – 08:00 GMT

The Asian forex sessions, comprising principally of the Sydney and Tokyo trading hours, play a vital role in the currency markets. These sessions contribute to the earliest wave of currency trading in the global forex market. Within these hours, market activity and liquidity could be lower compared to the other sessions, but crucial financial data from Australia, New Zealand, and Japan is announced, which can lead to significant price movements and present trading opportunities. During the Asian forex sessions, the spread of major currency pairs can vary. As a benchmark, the EUR/USD pair might be around 1.2 pips, the GBP/USD pair might be roughly 0.9 pips, and the USD/JPY pair might be about 1.1 pips.

London Session: 08:00 - 16:00 GMT

The London forex session is another major part of the global currency trading timing, featured by high liquidity yet greater volatility. This session overlaps with both the Asian and New York sessions, indirectly increasing trading volume and boosting significant price movements. Zeroing in on the Asian sessions, the typical spreads could be around 1.2 pips for the EUR/USD, 0.9 pips for the GBP/USD, and 1.1 pips for the USD/JPY. However, these are estimations and actual spreads may vary based on the market conditions.

New York Session: 13:00 - 21:00 GMT

The New York forex session is a crucial time slot in the daily routine of forex trading. This session, marked by high trading volumes and potential for price swings, overlaps with the London session, which amplifies the impact it has on global forex trends. Now, if we turn our attention to the New York session, the spreads for popular pairs can be norrower, EUR/USD, GBP/USD, and USD/JPY are commonly in the range of 1.0 pips, 0.9 pips, and 1.0 pips respectively. Please note, these are rough averages and actual spreads can shift depending on the market's rhythm and liquidity at any given time.

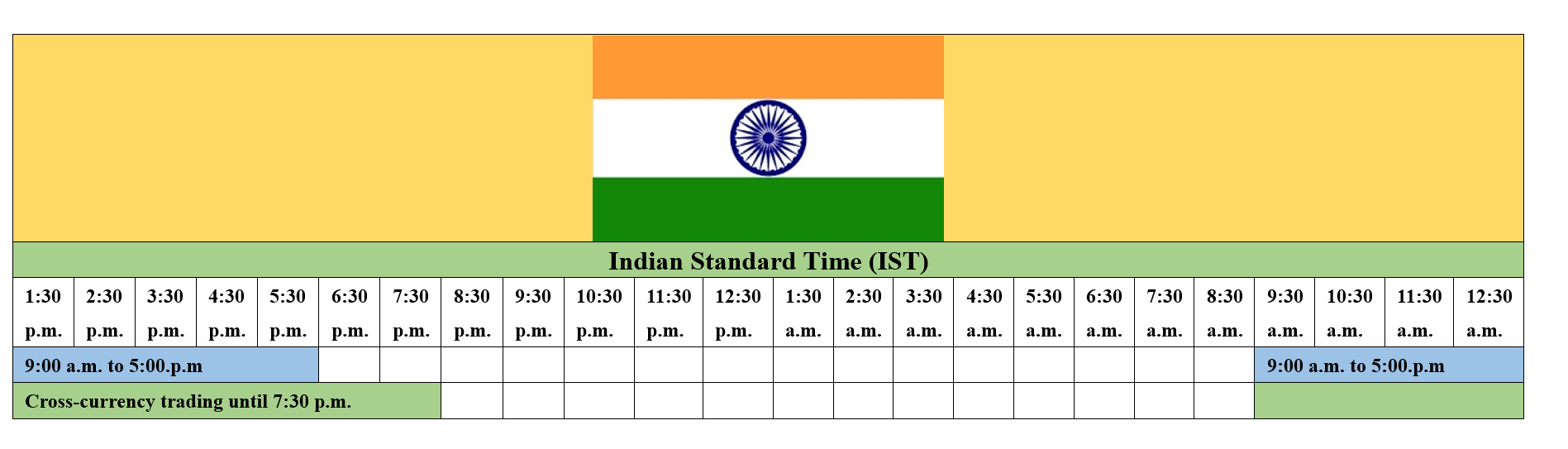

Let's explore forex trading time in India then

India's forex trading hours intersect with the Asian session, and this session is when financial markets in Tokyo, Hong Kong, Singapore, and also India are most active. Typically, forex trading in India begins at 9:00 a.m. Indian Standard Time (IST) and wraps up at 5:00 p.m.IST, running parallel to standard business hours. India's forex trading activity overlap with both the tail end of the Asian session and the beginning of the European session, which is a period known for heightened volatility and trading volume across global forex markets.

There are some key features about fotex trading hours in India:

• Overlapping Sessions: India's forex trading hours uniquely overlap with both the end of the Asian session and the start of the European session. This overlap often leads to periods of enhanced market volatility and trading volume across global forex markets.

• Time Zone Considerations: India's unique IST timezone, being 5.5 hours ahead of GMT, means its forex trading hours can provide early opportunities or indicators for traders in the Western countries before their local markets open.

• Interplay with Global Trading Trends: While forex trading can trade 7/24, global forex trading activity tends to peak during the New York and London sessions. Therefore, trading during Indian forex hours may not always experience the same degree of liquidity and volatility as observable during these key global trading times.

• After-Hours Trading: After-hours trading, which means investors can place stock buy or sell orders after regular trading hours, is possible in India due to the global nature of forex trading. Liquidity, however, might be lower and spreads can be wider than during standard business hours.

What is the best forex trading time in India?

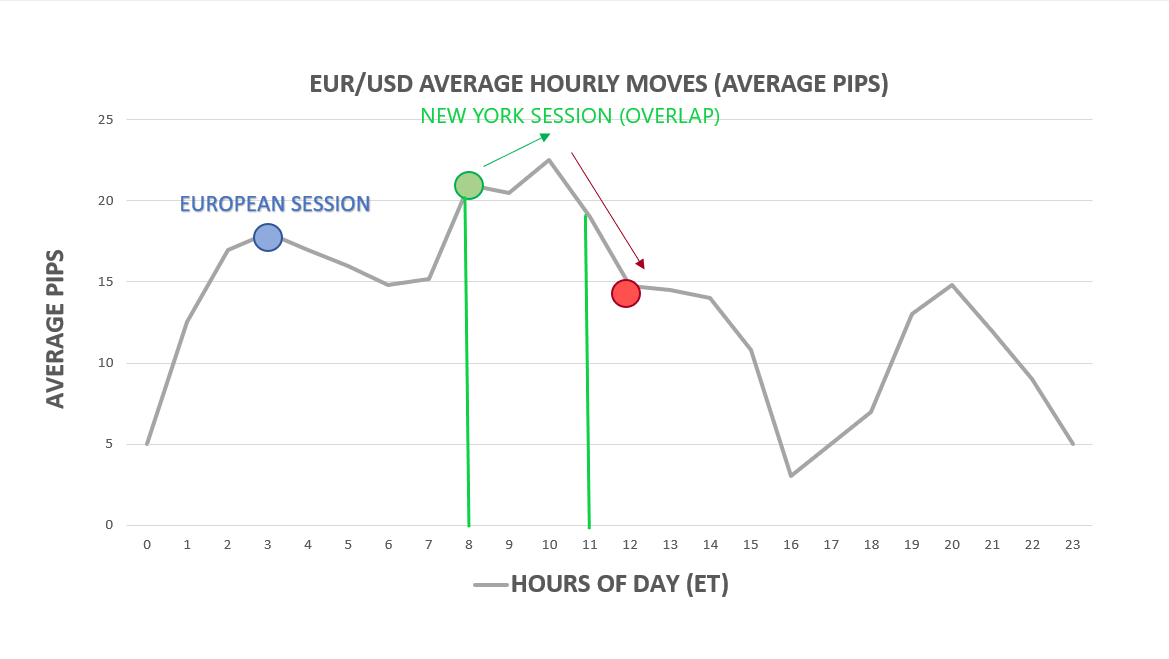

The best forex trading time in Indin is typically between 11:30 a.m. to 5:30 a.m. IST(6:00 to 12:00 GMT)and 11:30p.m. to 5:30 a.m. IST(18:00 to 0:00 GMT ). Indeed, there are some reasons to explain why.

The first time slot, 11:30 a.m. to 5:30 a.m. IST, coincides with the opening hours of the European market. Here, you'd observe a surge in trading volume since multiple global financial markets overlap. For instance, this is the time when traders would observe the European investors reacting to news events that happened during the Asian session. And it's also the time when the U.S. market wakes up and starts pushing new data into the markets. Consequently, this cross-continental exchange of data gives rise to trends and faster price movements, proving beneficial for day traders.

The second slot, 11:30p.m. to 5:30 a.m. IST, corresponds to the window of overlap between the North American and the Asian trading session. While it's late in the U.S, Asia is just starting its day, and hence, trading interest picks up. Similarly, it capitalizes on the inter-market dynamics, often creating tradable fluctuations in forex prices.

For instance, if you're focusing on EUR/USD, this pair, being liquid throughout the day, is likely to exhibit tighter spreads during the European session (6:00 to 12:00 GMT or 11:30 AM to 5:30 PM IST) when both the European and U.S. markets operate simultaneously. As a result, trades will get executed at your desired price more often, with less worry about slippage. However, monitoring economic news releases during these periods is also vital, as they can lead to sudden jumps in volatility.

Some forex brokers who cater to India forex trading hours

XM

|

|

Broker |

|

Registered in |

Cyprus |

Regulated by |

|

Min. Deposit |

$0 |

Products |

Forex, CFDs on stocks, Indices, Commodities, and Precious Metals |

Trading Costs |

XM Ultra Low Micro Account: spreads from 0.6 pipsXM Ultra Low Standard Account: spreads from 0.6 pipsXM Zero Account: spreads from 0 pips |

Cater to India Trading Time |

✅ |

Max. Leverage |

2000:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Depoit bonus up to $5,000 |

|

Trading Platform |

MT4, MT5, XM WebTrader |

Payment Methods |

Bank Transfer, Credit Card/Debit Card and Skrill |

Customer Support |

7/24 |

XM, founded in 2009, is a well-established online broker registered in Cyprus, offering access to extensive tradable instruments including Forex, Stocks CFDs, Commodities CFDs, Equity Indices CFDs, Precious Metals CFDs, and Energies CFDs. XM's noteworthy trading platforms include MetaTrader 4 and MetaTrader 5, both available on PC, Mac, Tablets, and Mobile. These platforms are equipped with advanced charting tools, automated trading capabilities, and user-friendly interface integral for both novice and experienced traders alike. Notably, XM provides traders with rich and free materials including webinars, video tutorials, and market analyses to enrich their trading experience. Over these years, XM has gained a reputable standing and high recognizaton for its speedy and reliable execution of trades, transparent pricing, and strong regulatory compliance.

XM, as a global forex broker, adapts its services to the local trading environments. In India, XM operates round the clock for five days a week, paralleling the global forex market hours. This setup provides Indian traders the opportunity to engage in trading during peak market activities, particularly during the late evening when the US and European markets overlap.

IG

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$250 |

Tradable Instruments |

Forex,Shares,Indices, Commodities, Thematic and basket,Options trading, Futures trading, Spot trading |

Trading Platforms |

Online, Mobile, Tablet & Apps |

Trading Costs |

Forex: Spreads on major FX from 0.6 pipsCFD shares: Spreads on UK and US shares start from £3 or $3 per trade |

Cater to Indian forex trading hours |

✅ |

Max. Leverage |

50:1 |

Demo accounts |

✅ |

Copy Trading |

❌ |

❌ |

|

Payment Methods |

Debit Card, Wire Transfer, Bank Transfer (Automated Clearing House (ACH)) |

Customer Support |

7/24 |

IG Group, founded in 1974, is a UK-based company providing trading in financial derivatives such as contracts for difference and financial spread betting, and stockbroking to retail traders. It is recognized and regulated in multiple countries, thereby ensuring a smooth global operation. IG's customers can trade vast instruments including currencies, indices, commodities, stocks, ETFs, and more on its proprietary platform. This user-friendly platform is technologically superior, offering fast and reliable execution, real-time market updates, and advanced charting tools, all accessible on mobile and desktop. IG Group's 24/7 customer support is commendable, with a highly responsive team providing assistance via phone, email, or live chat. Moreover, IG is known for its educational offerings, providing a vast array of financial webinars and detailed market outlook articles.

IG, being a well-known forex broker globally, sets up its services in line with Indian trading hours. They understand that being flexible is key in forex, so IG provides 24/5 access to its platform, fitting nicely with the worldwide forex market timings. This allows traders from India to capture opportunities during the peak market action when European and US trading hours overlap.

FXTM

|

|

Broker |

|

Registered in |

United Kingdom |

Regulated by |

|

Min. Deposit |

$0 |

Products |

Currencies, Stocks, Indices, Commodities, and more |

Trading Costs |

Advantage Plus: spreads from 0.0 pips, zero commissions |

Cater to India Trading Time |

✅ |

Trading Platform |

MT4, MT5, Mobile Trading |

Max. Leverage |

2000:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

Credit and debit cards, e-Wallets, crypto, Bank Wire transfers and local payment options |

Customer Support |

7/24 |

Founded in 2011, FXTM, short for ForexTime, is a global forex broker registered in the United Kingdom. FXTM offers an extensive range of tradable instruments including more than 60 currency pairs, CFDs on commodities, indices, spot metals, and stocks. Besides, FXTM offers robust and popular trading platforms, including the universally popular MetaTrader 4 and MetaTrader 5, as well as their own proprietary app, FXTM Trader app. FXTM is well recognized by its users for its fast execution speeds, tight spreads, and extensive educational resources. In terms of unique features, FXTM stands out with its innovative investment program, FXTM Invest, allowing traders to follow suitable strategy managers. This reputable trading broker has also obtained various prestigious awards in the global forex industry, further proving its credibility and the high level of services it offers.

Catering specifically to Indian tradders, FXTM provides exceptional features tailored to the Indian forex trading hours. Knowing the significance of flexibility in forex trading, FXTM ensures its trading services are available 24/5, aligning perfectly with the world forex market operating hours. Indian traders can take full advantage of the European and US market overlaps during late evening IST when liquidity and volatility often peak.

Frequently Asked Questions (FAQs)

Can I trade forex 7/24 in India?

Yes, theoretically, traders can trade forex 24/7 in India since the forex market operates around the clock, from Monday to Friday. However, there are peak hours where market activity is high due to the overlap of major global trading sessions. While the possibility exists to trade anytime, it may not always be beneficial depending on the currency pair you're trading and the market liquidity during off-peak hours.

What time is the New York session in India?

Can I trade all currency pairs during India trading session?

Yes, you can trade all currency pairs during the Indian trading session. For instance, pairs like USD/INR, EUR/INR, GBP/INR, and JPY/INR can be actively traded. However, not all currency pairs may have high liquidity or volatility at all times. Some currency pairs could be more active and have tighter spreads when their respective markets are open. For example, USD/JPY might show more activity during the overlap of the India and Japan sessions.

What are the factors influencing the best times for forex trading in India?

• Global Market Sessions: The overlap of major forex trading sessions like New York, London, Sydney, and Tokyo sessions often offer higher volatility and liquidity, which can be beneficial.

• Economic Announcements: Monetary policy updates from Reserve Bank of India, GDP data releases and other crucial economic data have an impact on volatility and hence, the trading opportunity.

• Currency Pairs: The best time to trade often depends on the currency pairs one is trading. Pairs involving INR, USD, EUR, GBP tend to exhibit high activity during overlapping market sessions of countries involved in the pairs.

• Domestic Market Movements: Share Index variations like Sensex and Nifty, commodities trading, political events, and even weather conditions might impact the Foreign Exchange market.

• Global News: International events or news that impact major economies such as changes in oil prices, political unrest, international trade policies, and job reports also sway the forex market.

How to manage volatility during India's forex peak hours?

• Control Leverage: Reducing your leverage, such as from a 1:100 ratio to 1:10, can minimize losses in times of volatility. For instance, let's say you put up $1000 on a trade using 1:100 leverage, a market shift of $100,000. By reducing your leverage to 1:10, your loss on the same shift is just $100.

• Apply Stop-Loss Orders: You can set stop-loss orders to automatically close out a trading position once the market moves a certain degree against you. Example: If you open a long position on the USD/INR pair at 75.00, setting a stop-loss order at 74.50 ensures your position is closed before incurring more losses.

• Trade at Optimal Times: Increased volatility often coincides with the period of overlap between two market sessions. In the Indian context, enhanced market activity during the European/US sessions (late evening in India) might present abundant trading opportunities.

• Stay Updated with News Events: Major financial news can drive sudden market swings. As an example, if the US announces a significant change in interest rates, it can cause the USD to rise or fall sharply. Being alert to such news enables you to respond quickly to market-moving events.

• Diversify Trades: Trading a range of different currency pairs helps spread risk. Rather than focusing solely on USD/EUR, consider trading other pairs such as GBP/JPY or AUD/CAD to balance potential losses against gains elsewhere.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers. We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

Best Forex Brokers for Beginners in Nigeria for 2024

Select the top forex brokers for beginners in Nigeria from many companies to ensure a safe trading environment.

Best Forex Trading Time in India 2024

Optimize your Forex trading in India by understanding prime trading times and exploring broker options.

What Time the Forex Market Opens in South Africa

Boost your Forex trading in South Africa with our guide on peak market hours for optimal trade activity!

6 Best No Deposit Bonus Forex Brokers in Malaysia in 2024

Start Forex trading risk-free in Malaysia! Discover the six top brokers, featuring attractive no-deposit bonuses.