cTrader has grown popular as a capable platform for new and experienced traders alike due to its robust trading features including intuitive drag-and-drop workspace personalization coupled with adaptable, pro-level visual analysis through feature-packed charts and market depth tools, risk management, signal copying and automated strategizing. With so many brokers providing cTrader to attracting traders out there, identifying a singular 'best' cTrader broker is no simple task given the many to evaluate. Still, by comparing trading cost, spreads and commissions, execution pace, platform reach, minimum deposit, and more, we highlight those consistently surpassing in areas necessary to traders. The following 5 forex brokers consistently shine based on priorities like pricing, performance, accessibility and onboarding costs. While not recommending, we hope these insights provide useful reference for your cTrader trading.

5 Best cTrader Forex Brokers

Competitive spreads from 0 pips with Raw Spread account that gives you true institutional pricing.

Commissions starting at $3 per lot on cTrader, some of the lowest in the industry.

FxPro's razor-thin margins let traders keep more of their profits.

Trade like a pro on MT4, MT5, or cTrader - your choice, your style.

Leader in low-latency trading environments with an average execution speed of just 30 milliseconds.

Extensive MT4 and MT5 plugins, cTrader and tools for advanced analysis.

more

5 Best cTrader Forex Brokers

Competitive spreads from 0 pips with Raw Spread account that gives you true institutional pricing.

Commissions starting at $3 per lot on cTrader, some of the lowest in the industry.

FxPro's razor-thin margins let traders keep more of their profits.

Trade like a pro on MT4, MT5, or cTrader - your choice, your style.

Leader in low-latency trading environments with an average execution speed of just 30 milliseconds.

Extensive MT4 and MT5 plugins, cTrader and tools for advanced analysis.

more

Comparison of the Best cTrader Forex Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best cTrader Forex Brokers Overall

Broker |

Logo |

Why are they listed as the Best cTradder Forex Brokers? |

|

✅Raw spreads, commissions at $3 per lot on cTrader, much lower than MT4. ✅cTrader server located in LD5 IBX Equinix Data Centre in London, ensuring low latency, fast execution. ✅cTrader has no restriction on trading, high-frequency trading, scalping, copy trading all allowed. |

|

|

✅Only $100 to open a cTrader account, more easily accessible. ✅Low spreads on FX and metals, with commissions on cTrader at $3.5 per lot traded. ✅FxPro cTrader features 6 chart types, 28 timeframes, 22 languages supported. |

|

|

✅Pepperstone cTrader accounts involve two types of offerings, giving traders more choices. ✅Powerful risk management tools, also giving access to automated trading. ✅Pepperstone is a trusted broker, favored by millions of traders all over the world. |

|

|

✅€100 to open a cTrader account, easily accessible both for beginners and experienced traders. ✅Order fills averaging less than 0.05 seconds, ensure high-efficiency trading. ✅Raw spreads on cTrader, with commissions at $3.5 per lot. |

|

|

✅$50 to open a cTrader account, easily accessible for beginners. ✅Spreads from 0.0 pips, with competitve commissions charged. ✅FIBO Group cTrader provides advanced automation support and FIX API integration. |

Overview of Best cTrader Forex Brokers

IC Markets Global-Best cTrader Broker for Low Trading Costs

Broker |

|

Regulated by |

ASIC (Australia) , CYSEC (Cyprus) |

Min.Deposit |

$200 |

Tradable Instruments |

Forex CFDs,Commodities CFDs, Indices CFDs, Bonds CFDsDigital currencies, Stocks CFDs, Futures CFDs |

Trading Platform(s) |

MT4, MT5, cTrader |

Leverage |

1:1000 |

Trading Fees |

Spreads as low as 0.0 pips, commissions at $3.5 per lot per side |

Payment Methods |

bank / wire transfer, Paypal, credit card, Skrill, Neteller, UnionPay, Bpay, FasaPay and Poli. |

Copy Trading |

✅ |

Bonus |

❌ |

Customer Support |

7/24 |

Pros |

✅Lower commissions on cTrader compared to MT4 ✅cTrader copy trading available ✅Multiple payment options, available in multiple currencies ✅Generous Leverage up to 1:1000 |

Cons |

❌ Slightly high stock fees ❌ Lacks a proprietary trading app |

Founded in 2007, IC Markets is an Australian online broker offering trading across over 2,250 financial instruments. Traders can access various CFD products on forex, commodities, indices, bonds, cryptocurrencies and more on IC Markets platforms which include the widely-used MetaTrader 4 and MetaTrader 5 as well as their advanced cTrader platform designed for technical traders.

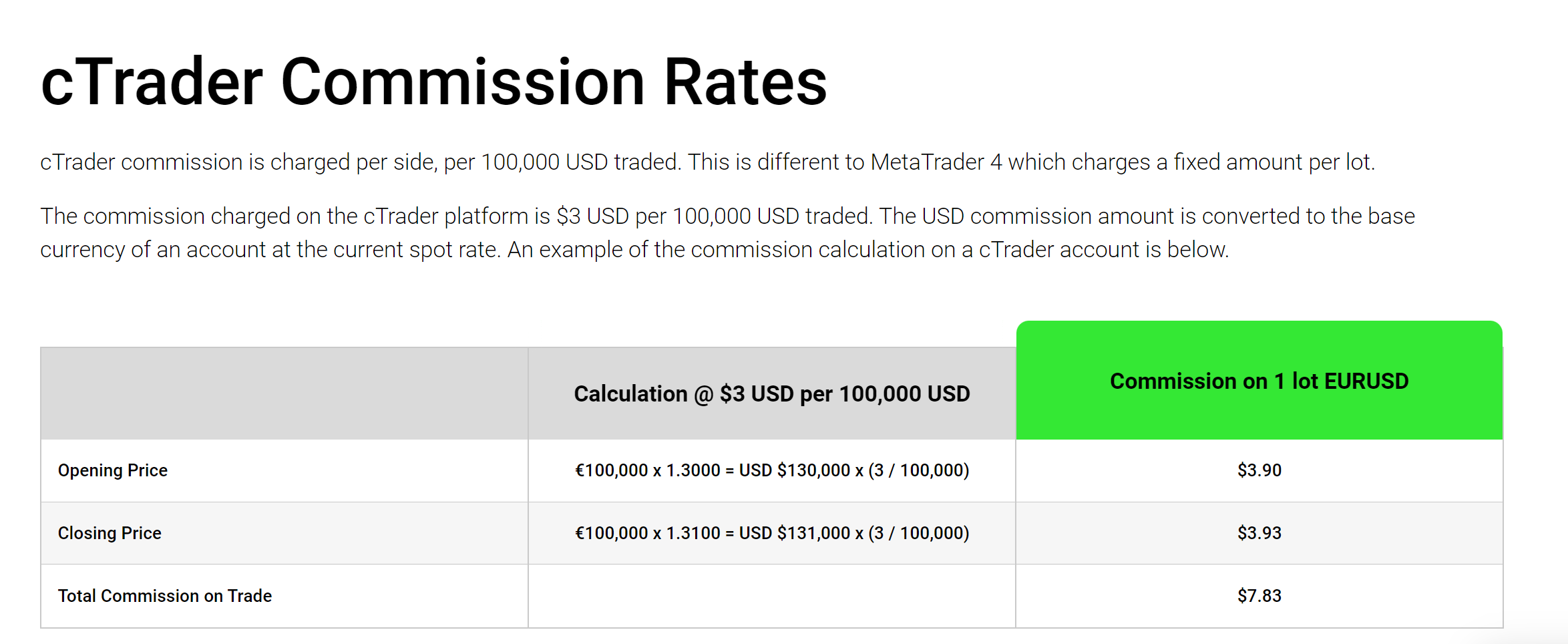

The minimum deposit to open a cTrader account with IC Markets Global is $200. The cTrader platform features low trading costs with raw spreads from 0.0 pips plus a commission charge of $3 per standard lot traded, lower than the $3.5 commission on their MetaTrader 4 accounts.

Traders can take advantage of generous leverage up to 1:1000. IC Markets Global cTrader provides fast order execution, no restrictions on trading strategies, and depth of market pricing direct from their aggregators.Moreover, IC Markets also offers a cTrader Copy Trading platform which provides unique opportunities for investors to follow and copy profitable trading strategies from vetted Strategy Providers.

Lastly, IC Markets Global cTrader supports multiple devices, including Web, iPhone, iPad, Android, 16 languages available on cTrader.

FXPro-Best cTrader Broker for Proprietary Trading App

Broker |

|

Regulated by |

CYSEC (Cyprus), FCA (UK) |

Min.Deposit |

$100 ( FXPro cTrader account) |

Tradable Instruments |

Forex, Futures, Indices, Shares, Metals, Energy, Cryptocurrencies |

Trading Platform(s) |

FXPro trading platform, MT4, MT5, cTrader, FXPro Trading App |

Leverage |

1:500 |

Trading Fees |

Spreads from 0.0 pips, with commission at $3.5 per lot |

Payment Methods |

UK Entity: Bank Transfer, Broker to Broker, VISA, MasterCard, Maestro Cyprus Entity: Bank Transfer, Broker to Broker, VISA, MasterCard, PayPal, Skrill, Neteller Bahamas Entity: Bank Transfer, Broker to Broker, VISA, MasterCard, PayPal, Skrill |

Copy Trading |

✅ |

Bonus |

❌ |

Customer Support |

7/24 |

Pros |

✅Multiple trading platforms choices ✅Friendly minimum deposit to open a cTrader account ✅No deposit fees |

Cons |

❌Limited payment options for its UK entity |

Founded in 2006, FXPro is based in the UK, with multiple global entities regulated across Europe, South Africa, Australia and The Bahamas. Being an online broker, it offers trading across forex, indices, commodities, shares, crypto and more. Traders at FXPro can access over 2,100 instruments including over 70 forex currency pairs and CFDs on leading global indices, commodities, equities and cryptocurrencies. Some more shining areas of FxPro include tight spreads from just 0.1 pips, fast execution speeds leveraging cutting edge technology, and a focus on trust with segregated client funds and FXPros own backstop Financial Services Compensation Scheme protecting accounts up to €1 million. With its reputation, regulation, platform choice, tight spreads and 7/24 multilingual customer service, FXPro delivers an appealing solution for active trading everywhere.

FxPro's cTrader platform caters well to active traders with its robust tools and competitive pricing. The minimum deposit to open a cTrader account is friendly $100. With an FxPro cTrader account, low spreads on FX and Metals, commissions are reduced to $3.5 per lot per side. Some robust features of FxPro cTrader include 6 chart types and 28 timeframes, Level 2 DoM (Depth of Market), no restrictions on stop/limit levels, detachable charts and linked charts. Besides, FxPro cTrader offers automated trading via Virtual Private Servers allowing complex algorithms to run smoothly. And mobility is no problem either. FxPro cTrader is readily available across devices including mobile, tablets and web platforms. Their Trading Central platform also neatly integrates trading signals and research into the cTrader experience.

Pepperstone-Best cTrader Broker for All-Around Offerings

Broker |

|

Regulated by |

ASIC (Australia), CYSEC (Cyprus), FCA (UK), DFSA (UAE) |

Min.Deposit |

AUD$200 |

Tradable Instruments |

Forex, Indices, Currency Indices, Cryptocurrency, Shares, ETFs |

Trading Platform(s) |

MT4, MT5, cTrader, Tradingview |

Leverage |

1:500 |

Trading Fees |

Spreads from 0.6 pips on major FX, and commissions at $3 per lot |

Payment Methods |

Visa, MasterCard, Bank Transfer, PayPal, Neteller, Skrill, Union Pay |

Copy Trading |

✅ |

Bonus |

❌ |

Customer Support |

7/24 |

Pros |

✅Solid educational resources ✅Multiple trading platform choices, including Tradingview and cTrader ✅Multlingual customer support for cTrader platform |

Cons |

❌No micro accounts ❌ No bonus |

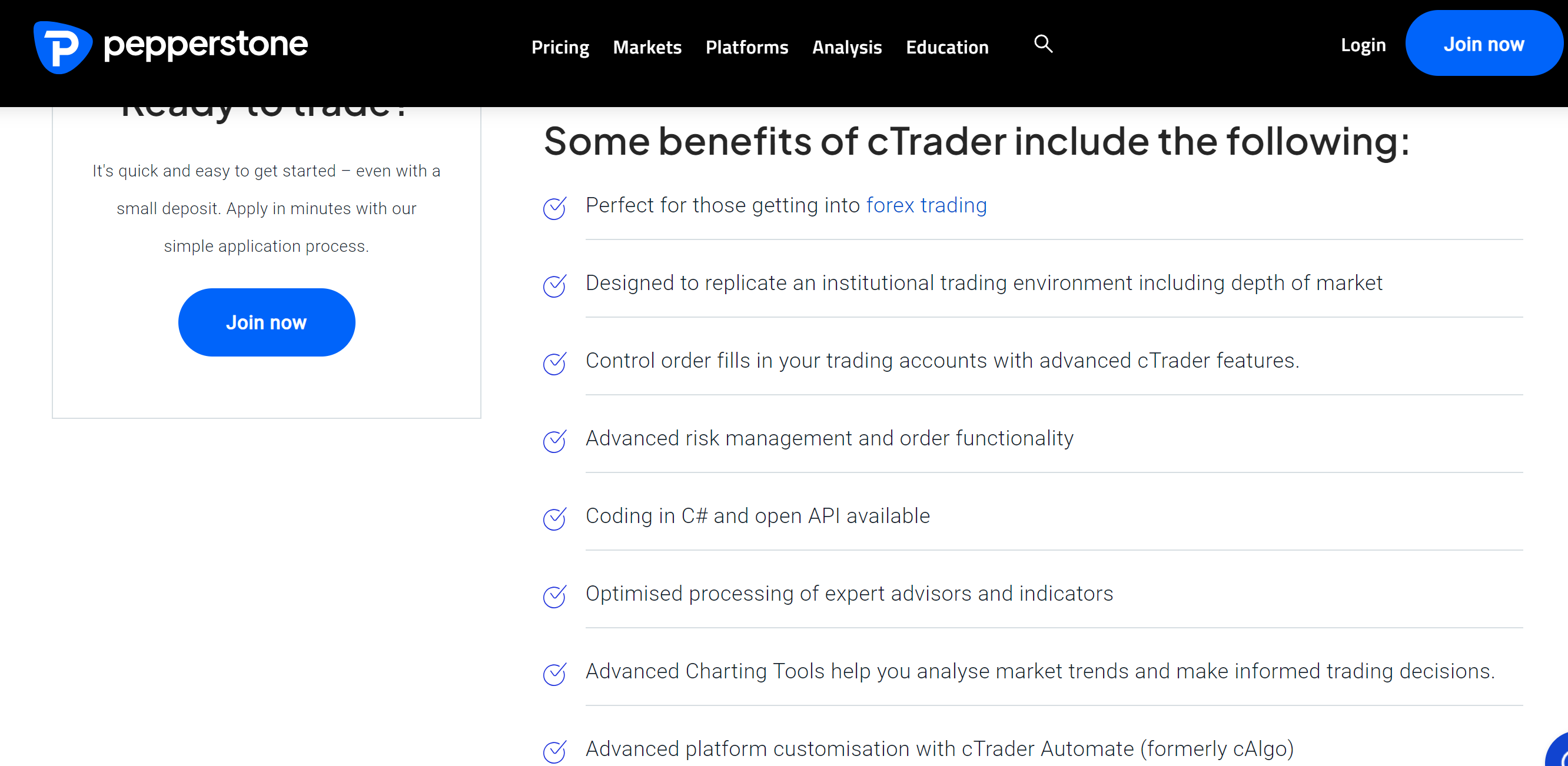

Founded in 2010, Pepperstone has grown to become one of the world's leading online forex and CFD brokers, offering trading access across thousands of instruments and assets. At Pepperstone, traders can access over 75 currency pairs as well as CFDs on indices, shares, commodities and cryptocurrencies, with over 10,000 trading instruments in total. Pepperstone offers choice for traders through their suite of trading platform options including the ever-popular MetaTrader 4 & 5 platforms as well as their Pepperstone cTrader equipped with robust trading features. When it comes to customer service Pepperstone delivers, with dedicated 24/7 support teams offering guidance in English, Spanish, Arabic, Italian and more via chat, email, phone and their extensive knowledge base.

Peppertstone cTrader is friendly to both new and experienced CFD and forex traders. To open a cTrader account requires an initial deposit of AUD$200. Traders can then choose between two core account offerings: the Standard account or the Razor account. The Standard Account has variable but often wider average spreads, with no commissions. This makes it well-suited to newer traders. The Razor Account offers raw institutional spreads from 0.0 pips, with a competitive commission of $3.5 per lot per side. This account focuses on high volume traders seeking tight spreads.

The cTrader platform itself delivers a stable, customisable interface compatible across devices like iOS, Android, Windows and web trading. Key features include advanced order types and risk management tools, optimised processing for expert advisors and indicators, sophisticated charting, and automation capabilities via cTrader Automate. Besides, Pepperstone also focuses on localisation across languages including English, Russian, French, Spanish, Portuguese, Polish, Japanese, Korean, Chinese, Italian, Greek, Turkish, Hungarian and German.

Skilling-Best cTrader Brokers for Copy Trading

Broker |

|

Regulated by |

CYSEC (Cyprus), FSA (Seychelles) |

Min.Deposit |

€100 |

Tradable Instruments |

Forex,Shares,Indices,Commodities, Cryptocurrencies, Soft Commodities |

Trading Platform(s) |

Skilling Trader, Skilling cTrader, MetaTrader 4, Skilling Copy |

Leverage |

1:200 |

Trading Fees |

Spreads as low as 0.1 pips, commissions at $3.5 per lot per side |

Payment Methods |

VISA, MasterCard, VOLT, GooglePlay, Skrill, Neteller, Trustly, PayPal, Bank Trransfer, Klarna |

Copy Trading |

✅ |

Bonus |

❌ |

Customer Support |

7/24 |

Pros |

✅Competitive spreads from 0.1 pips ✅Multiple trading platform choices ✅Skilling Copy for copy trading ✅Rated 4.3 out of 5 based on 175 reviews |

Cons |

❌ Deposits via Skrill & Neteller subject to a fee of 0%-2.9% ❌Limited leverage ratio on cryptos ❌Fees for copy trading may apply |

Founded in 2016, Skilling is an online CFD broker offering access to over 1,200 tradable instruments across 70+ currency pairs, shares,indices, commodities, cryptocurrencies, soft commodities. Traders can access multiple platforms including the popular MetaTrader4 & 5 alongside Skillings featured cTrader. For customer support, Skilling offers multilingual assistance 24/7 through live chat, email and phone support. Additionally, Skilling provides a copy trading platform called SkillingCopy, enabling clients to automatically copy positions opened by experienced and profitable traders.

Skilling offers its robust cTrader platform alongside the popular MetaTrader suite. cTrader accounts come in two tiers - Standard requiring €100 minimum deposit and Premium with a €5,000 minimum. The core difference in pricing is that Standard has no commissions but slightly wider average spreads from 0.7 pips, while Premium pricing is more competitive overall with tight spreads from 0.7 pips coupled with a $3.5 commission per lot traded. Both account types provide access to over 1,200 instruments on the full-featured cTrader platform from a web or mobile cTrader interface. More importantly, order execution is rapid, with order fills averaging less than 0.05 seconds thanks to Skillings integration of top tier liquidity providers.

FIBOGroup-Best cTrader Broker for Multiple Trading Platform Choices

Broker |

|

Regulated by |

CYSEC (Cyprus), BaFin (Germany), FSC (The Virgin Islands) |

Min.Deposit |

$50 (cTrader account) |

Tradable Instruments |

Forex, Spot metals, Cryptocurrency, CFDs |

Trading Platform(s) |

MetaTrader 4, MetaTrader 5, cTrader, WebTerminal MT4, WebTerminal MT5cTrader Copy, FIBO Forex Drive mobile app |

Leverage |

1:1000 |

Trading Fees |

Raw spreas with commissions at 0.003% from the amount of a transaction |

Payment Methods |

SWIFT, Visa, MasterCard, Neteller, Skrill, WebMoney, FasaPay, Perfect Money, Cryptocurrency |

Copy Trading |

✅ |

Bonus |

20% deposit bonus |

Customer Support |

7/24 |

Pros |

✅ Low minimum deposit for cTrader account ✅20% deposit bonus ✅Multiple trading platform choices ✅Copy trading solutions offered |

Cons |

❌Not regulated by ASIC and FCA |

Founded in 1998, FIBO Group is an international broker providing access to over 1000 financial instruments including forex, metals, indices, shares, bonds and cryptocurrencies. Traders can access these markets through FIBO Groups suite of platforms - MetaTrader 4, MetaTrader 5, cTrader. FIBO Group does not charge any commissions, rather keeping costs low and incorporating them into tight dealing spreads starting from 0 pips. The cTrader platform provides advanced trading tools, integrated trading strategies and customization preferred by active traders. So for over 20 years, FIBO Group has delivered trading access, tight spreads and responsive services , making them a reliable choice for active forex and CFD traders.

FIBO Group provides traders access to the advanced cTrader platform alongside its MetaTrader offering. cTrader accounts come in two forms. The cTrader NDD has slightly wider average spreads but lower commissions at just 0.003% per trade value. The cTrader Zero Spread account offers raw spreads from 0 pips coupled with a commission of 0.012% (minimum $1).

Both account types have a relatively low minimum deposit of $50 to cater to traders large and small. And clients enjoy access to 50+ indicators and overlays to analyze the markets across 26 different time frames and 4 chart types. The cTrader platform provides advanced automation support and FIX API integration for traders seeking more sophisticated tools. And mobility is no obstacle, with full versions available across the web and mobile.

Forex Trading Knowledge Questions and Answers

Do I have to pay for cTrader?

No, brokers offering cTrader access allow clients to use it free of charge. Many forex and CFD brokers now provide cTrader either alongside, or as an alternative to the popular MetaTrader platform suites. Traders simply open an account with a broker that supports cTrader, like IC Markets, Pepperstone, FxPro or FIBO Group and can then access the cTrader web and desktop platforms to begin trading.

So while brokers may have minimum deposits to open an account, the cTrader platforms are provided free of charge once you have funded your account. The only costs for using cTrader would be any spreads, commissions or financing charges as detailed in your chosen broker's pricing structure - the same costs you would incur regardless of platform.

What is the Minimum Deposit for cTrader?

Typically, the minimum deposit to open a cTrader account varies depending on brokers, but is often quite acesssible for new traders. For example, IC Markets requires a $200 minimum initial deposit for its cTrader offering, and Pepperstone has its cTrader accounts available from an $200 AUD deposit. FxPro allows cTrader access from just a $100 initial deposit. And currently holding the title for lowest cTrader threshold is FIBO Group, which enables cTrader access for traders ready to deposit just $50 to start.

Is MetaTrader 4 better than cTrader?

Judging that is challenging. While MetaTrader 4 maintains wider popularity and a vast ecosystem of automated tools, cTrader excels in delivering ultra-fast execution and advanced analytics better suited to discretionary trading. MT4 supports an enormous community of users, signals, and expert advisors. In contrast, cTrader affords sub 100 millisecond execution through direct access bridges along with customizable charts, Level II depth data, and a commissioned pricing model catering specifically to short-term professional traders. Therefore, MT4 and cTrader platforms align better to differing priorities.

Is cTrader Suitable for Scalping?

Scalpers seek to capture small gains on an intraday basis through high volume, rapid-execution trades before market movements reverse. With its sub-100 millisecond execution times through direct liquidity access, cTrader provides the raw speed that scalping demands. Advanced interactive charts, technical indicators, and order hotkeys further empower reacting to fast price movements. Scalpers must however factor cTrader's per trade commissions into their profit calculations and refine risk management to account for higher costs.

Which is the best cTrader forex broker?

IC Markets. Based on criteria important to traders like minimum deposits, instrument access, spreads and commissions, compatibility, and execution speeds - an evaluation across some of the top cTrader brokers shows IC Markets to be a standout. In terms of tradable assets, IC Markets offers access to a deep pool of over 230 instruments on its cTrader platform including forex, commodities, bonds, indices and crypto. Pricing analysis also reveals that costs from spreads and commissions tend to be lower at IC Markets versus other alternatives with similar regulatory standing. And execution speed tests display consistently rapid order fulfillment through IC Market‘s optimized connectivity to liquidity providers. Add to these a slate of resources, tools, and automated strategies available through copy trading or expert advisors, and IC Market’s cTrader platform presents an industry leading solution for many traders.

| Broker | IC Markets | FxPro | Pepperstone | Skilling | FIBO Group |

| Minimum Deposit | $200 | $100 | AUD$200 | €100 | $50 |

| Accessible Markets | 2250+ | 2100+ | 1200+ | 1200+ | 1000+ |

| Spreads | 0.0 pips | Low spreads | 0.0 pips | 0.1 pips | 0 pips |

| Commissions | $3 per lot per side | $3.5 per lot per side | 3.5 USD (per lot, per side) | $3.5 per lot traded | 0.012% from the transactionamount |

| Order Execution | Averagely under 40 milliseconds | Averagely under 30 milliseconds | Averagely around 30 milliseconds | Averagely around 35 milliseconds | Averagely under 40 milliseconds |

| Available Devices | Web, iPhone, iPad, Android | Macs, Windows, iOS, and Android | IOS, Android, and Windows | Mobile, Web | Mobile, Web |

| Language Supported | 16 | 22 | 14 | 18 | 14 |

Should a beginner use cTrader?

Basically, cTrader is very beginner-friendly, as evidenced by the low minimum deposit requirements many brokers have set for cTrader accounts, allowing easier access. Additionally, some of cTrader's standout trading features make it well-suited for new traders.

Ease of Customizing: The intuitive, visually-oriented interface of cTrader allows quick and simple organization. Users can drag-and-drop to rearrange components like charts or windows.

Automated Trading: cTrader provides copy trading tools enabling new traders to automatically emulate the successful strategies of more experienced investors selected from the public community.

Integrated Learning: Tutorials and trading guides embedded directly into the cTrader platform allow new users to understand concepts without leaving their workspace. Tips explain how to mark up a chart for analysis, for instance.

Multilingual Support: Many brokers offering cTrader provide 24/5 customer service with representatives ready to assist beginners in languages like English, Chinese, Arabic and beyond as users orient themselves.

To Wrap Up

The article makes the case that cTrader is an advanced platform with unique capabilities to enhance forex trading, and that top brokers provide robust trading conditions to match. While technology and conditions matter, finding alignment with a broker on trading philosophy levels the playing field more than any one platform alone. In a word, the decision comes down to your personal trading preferences and goals in selecting the broker that is the best fit.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects.

We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

7 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 7 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

10 Best Forex Trading YouTube Channels to Follow in 2024

Boost your Forex trading success with our top picks for 10 Best Forex Trading YouTube Channels including ForexSignals TV, Warrior Trading, and more.

Automated Forex Trading Software | How It Works | Pros and Cons

Unlock 24/5 trading potential, overcome human limitations and enhance your forex outcomes with Automated Forex Trading software!

Best Forex Traders to Follow on Instagram

Uncover the secrets of Forex trading on Instagram - dive into scam prevention, explore top traders, and boost your investment know-how!