When new to the trading industry, figuring out how to get started can be a daunting task. Luckily, there are automated trading platforms that help beginners dive into the world of trading, offering user-friendly interfaces, integrated educational resources, and even socially interactive trading communities. In this article, we on WikiFX will look at the best automated trading platforms geared towards beginners for the year 2024.

Best Automated Trading for Beginners

| Rank | Best Automated Trading for Beginners | Why We Chose? | |

| ① |  |

MetaTrader 4/5 | User-friendly with educational resources and trading bots community |

|

|||

| ② |  |

eToro | Offers automated trading and allows following experienced traders |

| ③ |  |

ZuluTrade | Simple platform for beginners to follow expert trades |

| ④ |  |

NinjaTrader | Allows automation without programming knowledge, and offers a free demo account |

| ⑤ |  |

Interactive Brokers (IB) | Provides an advanced platform with tools for automating trading strategies |

Best Automated Trading for Beginners Compared

| Platform | Fees | Trading Assets | Demo Account | Key Feature | Learn & Practice Tools |

| MetaTrader 4/5 | Free | Forex, CFDs, futures, indices, commodities | Yes | Automated trading (Expert Advisors); User community for trading bots | Comprehensive guides and educational resources |

| eToro | Free | Stocks, Cryptocurrencies, Currencies, Commodities, ETFs | Yes | Social trading (CopyTrading) | Live webinars, courses, dedicated blog |

| ZuluTrade | Free | Mostly forex, others vary by broker | Yes | Copy-Trading | Guides, a blog, FAQ section, and 24/7 customer support |

| NinjaTrader | Yes | Futures, forex, and equities | Yes | Automates strategies without programming knowledge | Extensive learning resources, free demo account, and 24/7 email support |

| Interactive Brokers (IB) | Free | Stocks, options, futures, currencies, bonds and funds | Yes | Advanced interactive traders' platform (TWS); Robust API for automating strategies | Comprehensive educational resources Traders' Academy, platform training, market analysis |

Best Automated Trading for Beginners Reviewed

① MetaTrader 4/5

User-friendly with educational resources and trading bots community

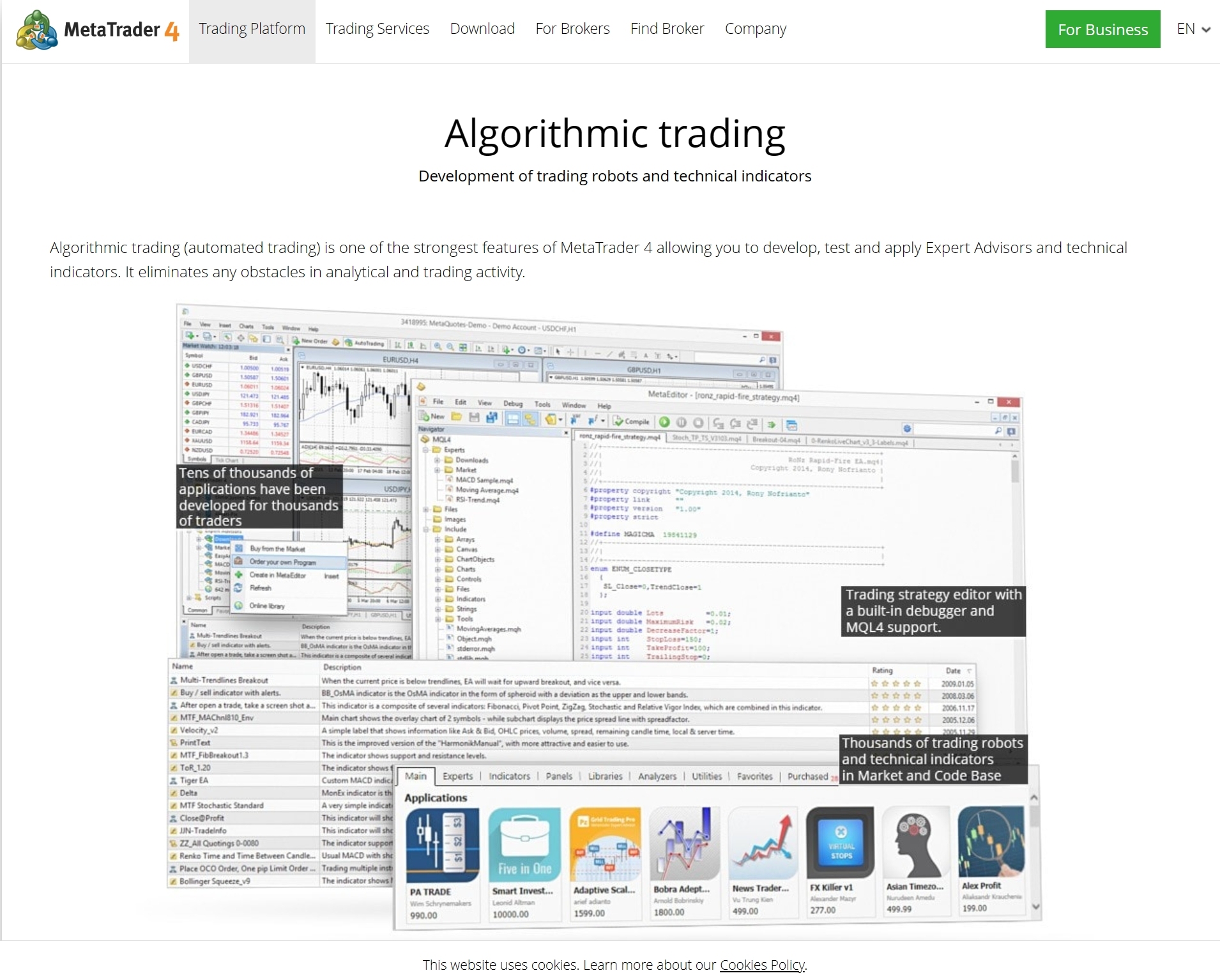

MetaTrader 4 and MetaTrader 5 are two of the most popular trading platforms used by millions of traders around the world. Both platforms are developed by MetaQuotes Software Corp and offer users the ability to automate their trading strategies.

MetaTrader 4 (MT4)

Launched in 2005, MetaTrader 4 is renowned for its simplicity, security, and capability for enabling automated trading.

User Experience: MT4 features real-time quotes, one-click trading, multiple order types, and 30 pre-packaged technical indicators. Users can also customize these features to their preferences.

Automated Trading: MT4 offers capabilities for automated trading through its MQL4 Program which allows users to create custom trading algorithms, called Expert Advisors (EAs), that automate trading strategies.

Charting Tools: MT4 has interactive charts with 9 timeframes for each symbol. This allows traders to identify trends and forecast price dynamics.

MetaTrader Market: This is essentially an online shop where users can buy or sell additional EAs or algorithmic strategies.

MetaTrader 5 (MT5)

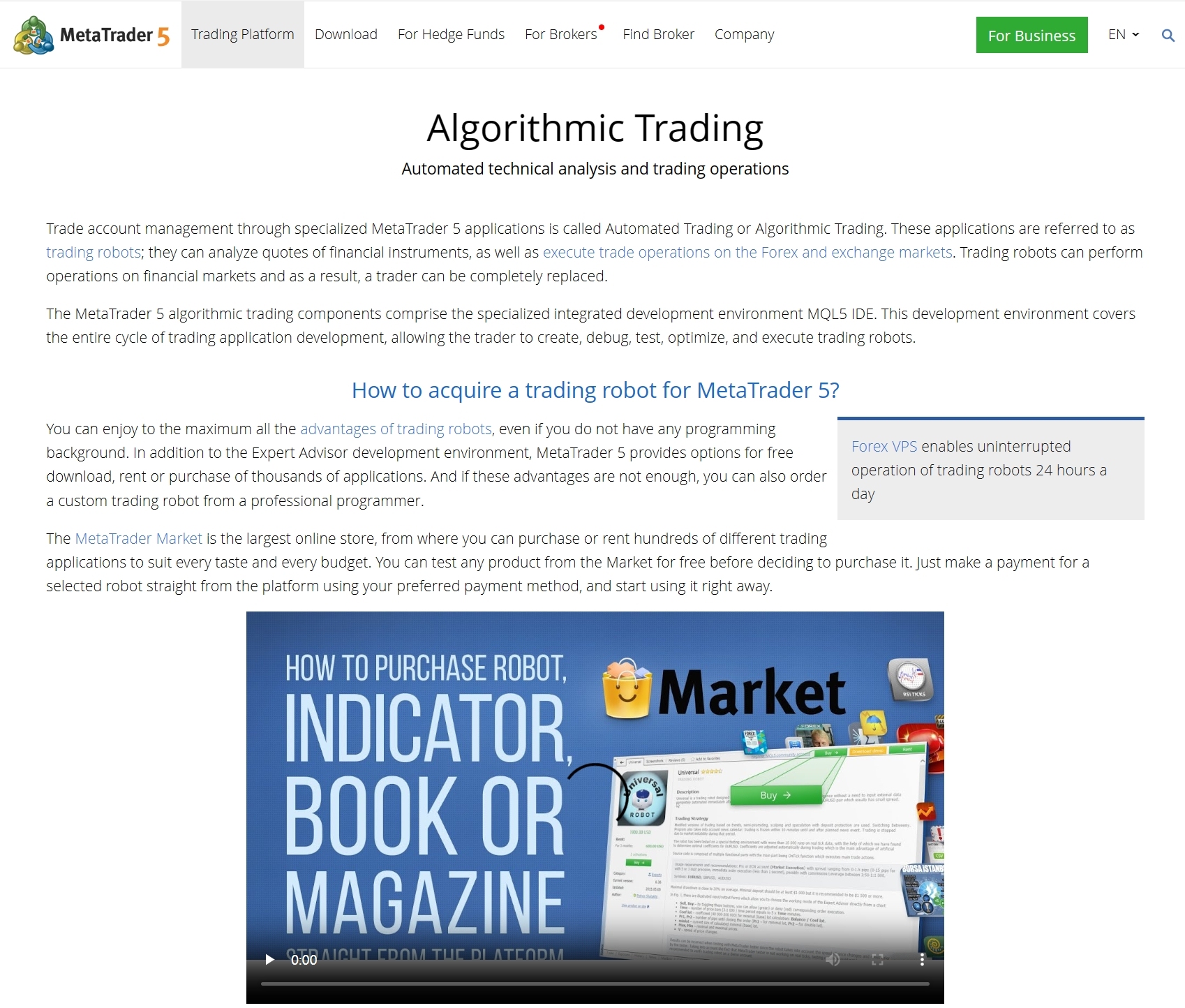

Launched in 2010, MetaTrader 5 is a more powerful and efficient version of MT4. It caters to not only forex but also stocks and futures markets.

More Markets, More Indicators: In addition to forex, traders can also trade stocks and futures. It offers 38 pre-packaged technical indicators, 44 analytical objects, and unlimited number of charts.

Depth of Market (DOM): This feature shows market depth in real time, displaying bids and offers at different prices directly from market participants.

Economic Calendar: This tool provides news events and indicators that can affect financial markets. It could be used to forecast potential price movement and make informed trading decisions.

Integrated MQL5 Community: Users can interact with each other, discuss trading strategies, and share free or commercial EAs or indicators.

While both MT4 and MT5 are comprehensive, user-friendly platforms that offer executions at speed, MT5's extended features provide a bit more depth, making it more suitable for advanced traders. Beginners usually start with MT4 due to its simplicity and ease of use.

MetaTrader 4/5 Pros & Cons

| Pros √ | Cons × |

|

|

|

|

|

|

|

Why we chose MetaTrader 4/5?

Known for their user-friendly interface, these platforms provide beginners with ample educational resources and comprehensive guides which are crucial for understanding automated trading. They have a vast community where users can share or purchase trading bots (called Expert Advisors).

② eToro

Offers automated trading and allows following experienced traders

eToro, founded in 2007, is a social trading and investment platform that allows users to trade in various assets, including Forex, stocks, cryptocurrencies, and commodities.

User Experience: eToro has a user-friendly interface and provides a variety of tools to manage portfolios. It offers real-time data, technical analysis tools, and other resources for trading and market analysis.

Social Trading: eToro is well-known for its 'CopyTrading' feature. It allows users to view, follow and copy the network's top traders automatically. This feature is particularly favorable for beginners as they can learn from experienced traders' strategies.

Ease of Use: eToro offers a simple and intuitive platform which appeals to beginners. Its trading processes are straightforward, making it easy for users to understand and execute trades.

Versatile Assets: Users can trade numerous financial instruments on the platform, including Forex pairs, cryptocurrencies, stocks, and commodities.

Education and Resources: eToro offers various educational resources, including live webinars, courses, and a dedicated blog. These help users stay updated with market news and learn more about trading strategies.

Safety and Regulation: eToro is regulated in different regions by the Cyprus Securities and Exchange Commission (CySEC), the UK's Financial Conduct Authority (FCA), and the Australian Securities and Investments Commission (ASIC), providing a significant degree of security to its users.

Overall, eToro's platform is recognized for the transparency it provides in market trading and for inspiring a social and collaborative trading community. Its simplicity and comprehensive features make it suitable for both beginner and advanced traders.

eToro Pros & Cons

| Pros √ | Cons × |

|

|

|

|

|

Why we chose eToro?

eToro not only offers automated trading features but also allows you to imitate the operations of other successful traders. This social trading aspect is beneficial for beginners looking to learn from experienced individuals.

③ ZuluTrade

Simple platform for beginners to follow expert trades

ZuluTrade, founded in 2007, is an online social and copy trading platform. Essentially, it enables you to mimic the strategies of successful traders to follow their trading strategies in real-time.

Copy Trading: ZuluTrade's key feature is the ability for users to follow other traders' strategies and to copy them. This concept allows beginners to profit from the experience of successful Forex traders.

Range of Traders: The platform offers a wide array of traders (Also known as “Signal providers”) from which users can follow and copy trades. The performance of each trader is displayed transparently, allowing users to make informed decisions.

ZuluGuard: This is a protective feature offered by ZuluTrade that monitors the behavior of followed traders and steps in, blocking any malicious trades and securing the user's capital.

ZuluScripts: This feature allows traders to create scripts that drive automatic operations when certain market conditions are met.

Automator: An added tool that lets you create and execute your own automated rules, without the need of any coding or programming skills.

Social Aspects: ZuluTrade's community users can share their experiences, strategies, and recommendations on the network's forum. This encourages an environment where advancements in strategies can be made.

Support and Resources: ZuluTrade offers 24/7 customer support and a variety of resources such as guides, a blog, and a FAQ section to help users understand the platforms functionalities better.

This platform is a good option for beginners and experienced traders alike. Beginners can profit from the knowledge of experienced traders, whereas experienced traders can earn extra income when their strategies are copied. ZuluTrade is regulated in the EU and Japan, adding an extra layer of security for their users.

ZuluTrade Pros & Cons

| Pros √ | Cons × |

|

|

|

|

|

Why we chose ZuluTrade?

This platform is ideal for beginners as it provides a straightforward way to follow expert traders' trades. This copy-trading feature allows beginners to understand how and when experts trade, enhancing their trading skills.

④ NinjaTrader

Allows automation without programming knowledge, and offers a free demo account

NinjaTrader, founded in 2003, is an online trading platform catered towards advanced forex, futures, and stock traders. Its recognized for its advanced technical analysis and algorithmic trading features.

Advanced Charting: NinjaTrader offers advanced charting capabilities including customizable indicators and chart trading functionality.

Strategy Builder: The platform comes with a strategy builder application that does not require coding skills. It allows users to design, backtest and run their own automated trading strategies.

Trade Simulation: NinjaTrader offers a simulator for strategy back-testing as well as for practicing trading. This allows beginners to learn without risking real capital.

Market Analyser: The powerful market scanning tool lets traders quickly scan and filter markets based on their preferred criteria.

Order Types: With a wide range of order types for standard and automated trading, traders have plenty of flexibility for executing their trades.

Ecosystem: NinjaTrader features a vast ecosystem of third-party developers, resulting in a large library of trading indicators, applications and strategies available for purchase.

Support and Training: NinjaTrader offers many educational resources including a trading blog, webinars, video library, and a community forum. It also offers round the clock support via email.

Though it has a steep learning curve, NinjaTrader is an excellent platform for seasoned traders seeking advanced trading tools. And with the availability of a free trial version, beginners interested in learning can use the platform to develop their skills before commencing with live trading.

NinjaTrader Pros & Cons

| Pros √ | Cons × |

|

|

|

|

|

Why we chose NinjaTrader?

Beginner traders often choose NinjaTrader since it allows them to automate their strategies without any programming knowledge. Moreover, it provides extensive learning resources and a free demo account for practicing.

⑤ Interactive Brokers (IB)

Provides an advanced platform with tools for automating trading strategies

Founded in 1978, Interactive Brokers (IB) is an established brokerage firm that offers trading in a wide array of financial instruments including forex, stocks, futures, options and more across global markets.

Trade execution and technology: Interactive Brokers is known for its superior trade execution, low cost, and advanced trading technology. Their platform provides real-time monitoring, risk management tools, and sophisticated order routing capabilities.

API Access: The platform provides access to their Application Programming Interface (API), which allows traders to automate their trading strategies. Traders can build, test and deploy their own automated trading systems using their favorite programming language.

Trader Workstation (TWS): TWS is Interactive Brokers' flagship trading platform loaded with trading tools, features and modules. It is customizable and can support several different trading styles.

Range of Investments: You can not only trade Forex but also stocks, options futures, funds, and bonds. This diversity allows traders to branch out and diversify their investment portfolio.

Education and Training Resources: Interactive Brokers has a comprehensive educational platform, Traders' Academy, which offers free online courses on various trading topics. They also host webinars, provide web-based and mobile trading platform training, and market analysis.

Global Accessibility: Traders from over 200 countries can trade with Interactive Brokers, enjoying its extensive reach and access to multiple exchanges and markets worldwide.

Regulation: Interactive Brokers is registered with multiple regulatory bodies worldwide, including Australia Securities & Investment Commission, UK's Financial Conduct Authority, Japan's Financial Services Agency, Securities and Futures Commission of Hong Kong, and Investment Industry Regulatory Organization of Canada.

Overall, Interactive Brokers' trading platform is geared towards experienced traders due to its vast professional-grade tools and capabilities. However, the extensive educational resources make possible for a beginner to learn and grow in the platform, making it suitable for traders of all skill levels.

Interactive Brokers (IB) Pros & Cons

| Pros √ | Cons × |

|

|

|

|

|

Why we chose Interactive Brokers (IB)?

Interactive Brokers offer a robust API that enables traders to automate their strategies. Beginners benefit from IB's Trader Workstation (TWS) platform, which provides advanced tools and features in an understandable format.

What is Automated Trading?

Automated trading, also known as algorithmic trading, is a method of executing trades on a trading platform through a computer program or algorithm. These algorithms are based on pre-determined specifications such as timing, price, volume of order and other market factors. This allows for trades to be executed at a speed and frequency that is much faster than what a human trader could do manually. Automated trading can eliminate emotional and human errors in trading, provide market efficiency and can work continuously without the need for rest.

How does Automated Trading Work?

Automated trading works by using a pre-determined strategy, coded into a program or algorithm which automatically executes trades on a trading platform.

Here's a step-by-step rundown of how it typically works:

Develop a Trading Strategy

The process begins with the trader developing a specific trading strategy. This strategy is based on technical analysis indicators or patterns, financial data, and/or statistical analysis.

Coding the Strategy

The trader then encodes this strategy into a computer program. The code includes instructions on what trades to make, when to make them, and at what levels, based on the strategy the trader has created.

Backtesting the Strategy

Before employing the program in live markets, the algorithm is backtested using historical data. This helps determine the viability of the strategy by simulating how the algorithm would have acted if it had been used in past market conditions.

Set Up the Algorithm on a Trading Platform

If the strategy proves successful in backtesting, the program is set up on a trading platform. Most online trading platforms today support automated trading and provide APIs (Application Programming Interfaces) for this purpose.

Execution of Trades

The program constantly monitors the market for specific conditions defined by the strategy. Once these conditions are met, the algorithm automatically executes the trade without the need for human intervention.

Evaluation and Adjustment

Traders monitor the performance of the trading algorithm over time. They may adjust the coded strategy based on market changes, the algorithms performance, or changes in their trading goals.

Automated trading can often be an attractive option as it aims to eliminate emotion and reduce the need for intensive screen time. However, always keep in mind that markets are highly dynamic and even the most well-crafted algorithms may need adjustments over time.

How to Choose the Right Automated Trading Platform?

Choosing the right automated trading platform is crucial and depends on your specific needs and goals. Here are some key factors to consider:

Usability and Interface: The platform should have a user-friendly interface, especially for beginners. It should have an intuitive design that's easy to navigate and use.

Trading Strategies Support: Make sure the platform supports the type of trading strategies you want to implement. Whether it is price action, trend following or scalping, the platform should be able to handle it.

Automation Capability: The platform should allow automation of trading strategies without needing intricate coding skills. Check if they offer 'drag-and-drop' strategy builders or simple coding languages for strategy construction.

Backtesting Facility: Look for platforms that provide backtesting tools. Backtesting allows you to test your trading strategy using historical data before risking real money.

Security Measures: Security is paramount when you're dealing with financial transactions. Check the security measures the platform implements to protect your data and your funds.

Asset Classes: Different platforms may support different asset classes (stocks, futures, forex, etc.). You should choose one that supports trading in the asset classes you're interested in.

Integration with broker: Some platforms are standalone while others are only available when linked with specific brokers. You need to check if the platform can be integrated with your preferred broker.

Costs: There might be costs associated with using certain platforms. Factor in any subscription fees, transaction fees, or other costs.

Customer Support: Good customer support can make your trading journey much smoother. They should be able to provide timely and significant help when you encounter issues.

Community and Educational Resources: Some platforms have large user communities and provide learning resources, which might be beneficial, especially for beginners.

Remember, what works best for someone else might not work best for you. Evaluate your needs and research extensively before deciding on a platform.

Benefits and Risks of Automated Trading

Benefits

√ Speed and Efficiency: Algorithms can process vast amounts of data and execute trades faster than a human ever could. This can potentially lead to improved entry and exit prices.

√ Elimination of Emotional Decisions: Automated trading takes emotions out of the equation, which can lead to more disciplined and consistent trading.

√ 24/7 Trading: Algorithms can operate round the clock, taking advantage of opportunities that may occur at any time, even when you're asleep or away from your computer.

√ Backtesting Capability: Automated trading allows for backtesting on historical data, which can be useful for optimizing strategies before they go live.

√ Consistency: Once a profitable trading strategy has been established, the algorithm can implement it consistently, eliminating the potential from human error or bias.

| Benefits √ | Risks × |

| · Speed and Efficiency | · Lack of Human Discretion |

| · Elimination of Emotional Decisions | · Over-Optimization |

| · 24/7 Trading | · Dependence on Technology |

| · Backtesting Capability | · Risk of “Black Box” Trading |

| · Consistency | · Patience and Monitoring |

Risks

× Lack of Human Discretion: Unlike human traders, an algorithm cannot comprehend changes in market conditions or unexpected geopolitical events that might impact the markets.

× Over-Optimization: While backtesting is beneficial, there's a risk called 'over-optimization,' where a trading strategy is adjusted too much to align with historical data, causing it to perform poorly in live trading.

× Dependence on Technology: Automated trading relies heavily on technology. System failures, internet disconnections, or software glitches can lead to missed trades or unexpected losses.

× Risk of “Black Box” Trading: If a trader is using a pre-built algorithm, they may not fully understand how it operates, thus taking trades on faith without understanding the logic behind them.

× Patience and Monitoring: Automated trading still requires patience (for the system to generate results) and supervision (to ensure the system is functioning correctly).

While automated trading has distinct advantages, it's not a surefire way to success and involves risk like any trading activity. Automated systems should be tested and monitored, and understanding the strategy the algorithm is using is vital to managing its risks.

Future of Automated Trading

The future of automated trading looks promising and is likely to be shaped by several emerging developments:

Artificial Intelligence and Machine Learning: AI and ML are set to revolutionize automated trading. ML algorithms can learn and adapt to new patterns in the market, potentially yield better results than static algorithms. AI can handle vast amounts of data and make complex trading decisions in real time.

Blockchain Technology: Blockchains decentralization, immutability, and transparency can potentially increase the security and efficiency of trading transactions.

Quantum Computing: With its ability to process complex calculations at incredible speed, quantum computing could take algorithmic trading to a new level, allowing for even more efficient and accurate predictions.

Increased Regulation: As technology advances, we might see more regulatory bodies stepping in to protect consumers, which will lead to more transparency and trust in automated trading.

Personalized Trading Bots: The next generation of trading bots could be personalized based on each trader's risk tolerance, trading objectives, and other personal preferences.

Cloud-Based Trading Systems: Cloud technology is likely to play a larger role in hosting trading platforms, providing benefits in terms of cost, scalability, and accessibility.

Increased Accessibility: As technology becomes cheaper and more available, automated trading will likely become more accessible to the general public, not just to institutions and professional traders.

Despite these exciting developments, the main challenges for the future will be the necessity to ensure responsible, ethical use of technology, maintain transparency, safeguard against potential security risks, and manage the risk of financial loss.

Final Thoughts

Choosing an appropriate trading platform is a significant step for a beginner trader. Through automated trading platforms such as MetaTrader 4 and 5, eToro, ZuluTrade, NinjaTrader, and Interactive Brokers (IB), beginners in 2024 can step into the trading world with confidence, armed with user-friendly interfaces, learning resources, and supportive trading communities. Choose wisely according to personal preferences and needs, and remember, every professional trader started as a beginner.

Best Automated Trading FAQs

Is automated trading good for beginners?

Automated trading can be beneficial for beginners as it provides discipline and removes emotion-based decisions from trading. However, beginners should also have a basic understanding of how the financial markets and trading work.

Are there risks involved in automated trading?

Yes, like all trading, automated trading also poses risks. These include market volatility, software or platform malfunctions, and information delays. It is essential to monitor performance regularly.

Can I make money with automated trading?

Yes, you can make money with automated trading, but it depends on various factors, like the effectiveness of your trading strategy, risk management practices, and continuous monitoring of the market and your algorithm's performance. It's vital to remember that while automated trading can be useful, it is not a guaranteed way to make money and involves risk.

Can I test automated trading strategies before using them?

Yes, many platforms offer demo or backtesting facilities where you can test your strategies using past data or virtual money.

Do all trading platforms support automated trading?

No, not all trading platforms support automated trading. Each platform has different features and functionalities. Therefore, it's important to choose one that aligns with your trading needs and skill level.

Disclaimer

Trading Forex (foreign exchange) carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, risk appetite, and the possibility of incurring losses. There is a possibility that you may sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

You Also Like

7 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 7 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

10 Best Forex Trading YouTube Channels to Follow in 2024

Boost your Forex trading success with our top picks for 10 Best Forex Trading YouTube Channels including ForexSignals TV, Warrior Trading, and more.

Automated Forex Trading Software | How It Works | Pros and Cons

Unlock 24/5 trading potential, overcome human limitations and enhance your forex outcomes with Automated Forex Trading software!

Best Forex Traders to Follow on Instagram

Uncover the secrets of Forex trading on Instagram - dive into scam prevention, explore top traders, and boost your investment know-how!

Forex Day Trading VS Forex Scalping: Which One to Choose?

Unravel the clash of Forex day trading and scalping - grasp their tactics, track differences, and tailor your trade.

How to Hedge Forex Positions? Some Relevant Strategies to Share.

Dive into Forex hedging strategies - reducing risk, seizing opportunities and securing robust trading profits.

Can I Trade Forex without Stop-Loss? Here Lets’ Discuss

Start Forex trading without stop-loss - understand how it works, explore other options and possible risks.

Forex Market Hours: What is the Best Time to Trade Forex?

Master the clock of Forex trading - optimize profits by knowing the best trading times globally!