Beginners come to the forex trading world often worry about the initial investment. Naturally, they tend to seek out cost-free trading platforms that strike a balance between ease of use, a friendly interface, and simplified features. Yet, it is commonly to know that while brokers offer these trading platforms for free at the start, charges may emerge during actual trading. Fortunately, there are some free trading platforms options tailored for novices, indeed. They provide a great starting point without immediate financial obligations. Let's spotlight some of these ideal free platforms that cater well to beginners' needs:

User-Friendly Interface and Simplicity

The trading software must feature a user interface that is not only intuitive and easy for navigation, but also simple enough that beginners can easily understand and operate without getting overwhelmed by complexity. Novices can swiftly adapt to these platforms.

Cost Structure Awareness

Though accessible at no upfront cost, beginners must remain aware of potential costs inherent in the trading process, such as spreads, commissions, and other fees incurred during active trading.

Trading Features

More useful trading features, especially automated and copy trading, prove instrumental for novice traders, making trading more accessible. For beginners, automated trading offers preset strategies, sparing them from constant market monitoring. This eases pressure, ensuring a steadier trading experience. Meanwhile, copy trading lets novices mirror seasoned traders, learning from their wise strategies.

Order Execution Speed

Efficient order execution speed becomes a lifeline for novice traders, allowing rapid entry or exit from positions amid market fluctuations. It is key, ensuring trades occur at desired prices, enhancing their trading profitability.

Device Compatibility

An exceptional trading platform can easily work across multiple devices like PCs and smartphones, ensuring users can conveniently trade anytime, anywhere.

Best Free Forex Trading Platform Overall

| Trading Software | Logos | Why are they listed as the Best Free Forex Trading Platform for Beginners? |

| MetaTrader 4 |  |

✅ MT4's simple and intuitive layout helps beginners become quickly acclimated to the trading process, compatible for various devices. ✅ Widely offered by numerous brokers for free, increasing the chance for a beginner to find a broker with favorable terms. ✅ Equipped with uniqueExpert Advisors (EAs)simplify trading and can be great learning tools for beginners. |

| MetaTrader 5 |  |

✅ Expanded 21 timeframes, compared to MT4s 9, and supports more market types, such as shares and commodities. ✅ MT5 boasts a built-in economic calendar displaying news events, data releases and forecasts directly on the platform, making it easier to respond quickly to market changes and perform superior fundamental analysis. ✅ Inclusion of community dialogue and copy trading, both features allow novices to learn from successful traders. |

| cTrader |  |

✅ cTrader's interface can be tailored which helps beginners design a comfortable trading environment. ✅ Rich feature set including market depth display, market depth information can provide beginners greater insights into market conditions. ✅ Automated trading through cBots along with copy trading allows beginners to replicate successful trader strategies. |

| TradingView |  |

✅ Thriving community of traders can be a valuable resource for a beginner looking for varied perspectives. ✅ Extensive charting tools with multiple indicators, muiltiple features can assist beginners to carry out comprehensive market analysis. ✅ Allowingaccess to numerous educational materials as well as demo accounts available, which offer substantial learning for beginners. |

| Thinkorswim |  |

✅Thinkorswim offers a 'paperMoney' feature, where new traders can practice with virtual money, honing their skills before moving onto real trading. ✅ Thinkorswim provides powerful analytical tools, including charts, technical studies, and economic data sets, helping beginners carry out in-depth market evaluations. ✅TD Ameritrade, the provider of Thinkorswim, grants free access to webcasts, articles, and courses on a vast range of trading-related topics, a great benefit for beginners. |

| Robinhood |  |

✅ Highly intuitive interface, simple navigation design of Robinhood makes it an easy start for beginners. ✅ Zero commissions for trades, Robinhood breaks down cost barriers, making it a compelling choice for beginners. ✅ User-friendly mobile app for flexible trading, the mobile app caters to modern on-the-go traders, particularly beginners. |

Overview of the Best Free Forex Trading Platform for Beginners

MetaTrader 4

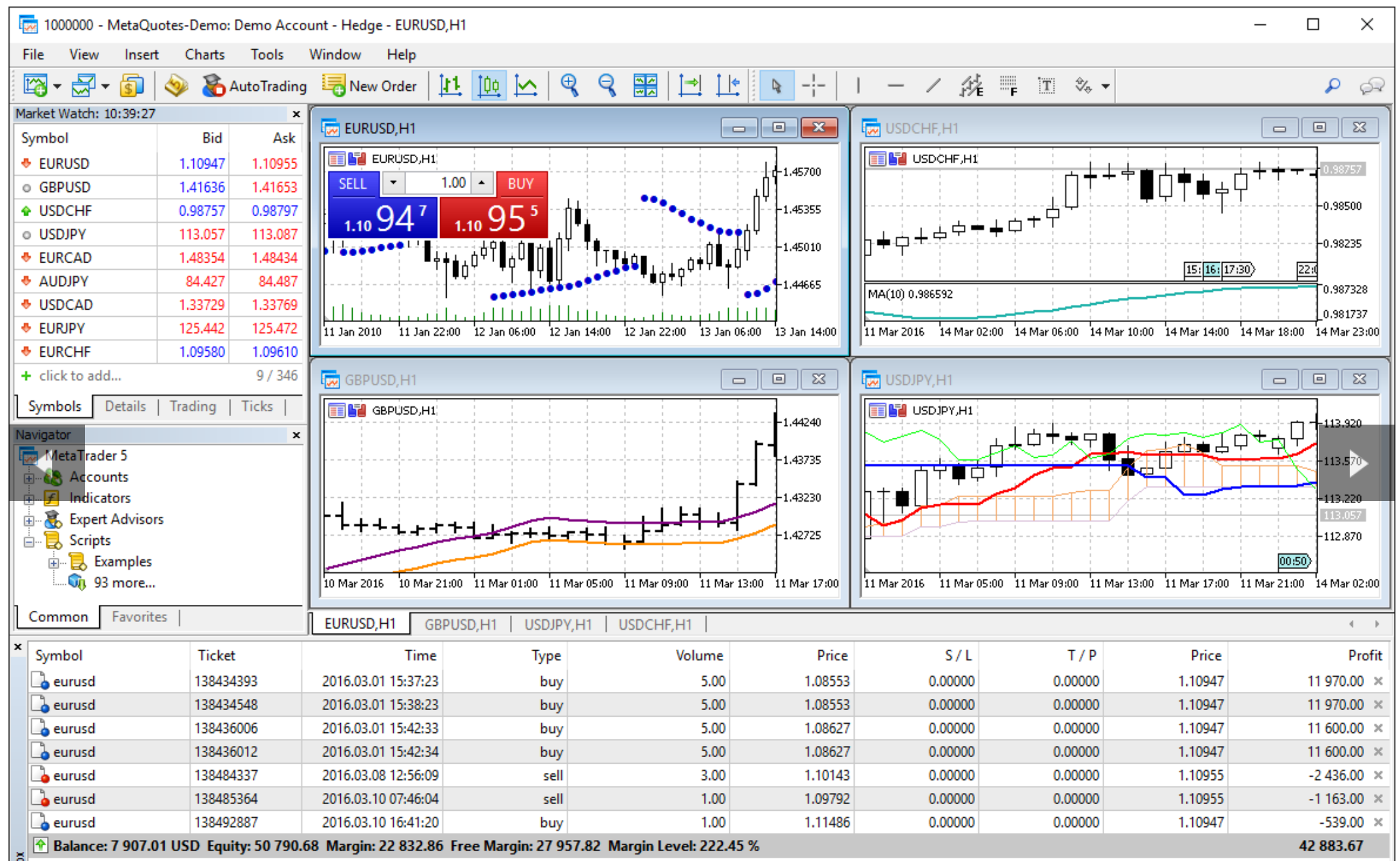

MetaTrader 4, commonly known as MT4, is a widely used electronic forex trading platform. Launched in 2005 by MetaQuotes Software, the platform has stood the test of time to maintain its status as a go-to resource for retailers and traders alike. Throughout its history, MT4 has continuously evolved to improve its performance, facilitating exponential growth in forex trading. This has been further bolstered by the platform's reputation for reliability and enhanced security features. On the compatibility front, MT4 extends its reach by being compatible with multiple devices, including computer desktops, smartphones, and tablets. This way, users can engage in real-time trading, regardless of their location.

With an intuitive interface that appeals to beginners as well as seasoned traders, MT4 prioritizes user-friendliness. Its interface presents an assortment of analytical tools, trading functions, charts, and indicators that aim to simplify trading. Distinctively, MetaTrader 4 is known for irrefutably low trading fees, hence making it a suitable choice, especially for beginners who are careful about minimizing their trading costs.

One of the unique features MT4 is renowned for is its Expert Advisors (EAs) function. This automated trading feature allows users to develop, simulate, and deploy trades in various financial markets around the clock.

✅Where MetaTrader 4 shines:

• Mature and stable, MT4 has been around since 2005 and has proven its reliability and stability, crucial for traders who rely on their platform to execute trades flawlessly.

• MT4 offers a high degree of customization, allowing traders to personalize your workspace, indicators, and even create your own Expert Advisors (EAs) using MQL4 programming language.

• MT4 boasts a massive community of users and developers who create and share a wealth of custom indicators, EAs, and trading strategies, making it easy to find resources and support for your trading needs.\

• MT4 allows you to backtest your trading strategies on historical data to assess their effectiveness before risking real money.

• Mobile Trading Available, trading on the go with the MT4 mobile app for iOS and Android.

❌Where MetaTrader 4 shorts:

• Outdated interface, compared to newer platforms, MT4's interface might feel outdated and clunky.

• MT4 lacks some advanced order types available in newer platforms, thus limiting for complex trading strategies.

• MetaQuotes, the developer of MT4, doesn't offer direct customer support. You'll need to rely on the community or your broker for assistance.

MetaTrader 5

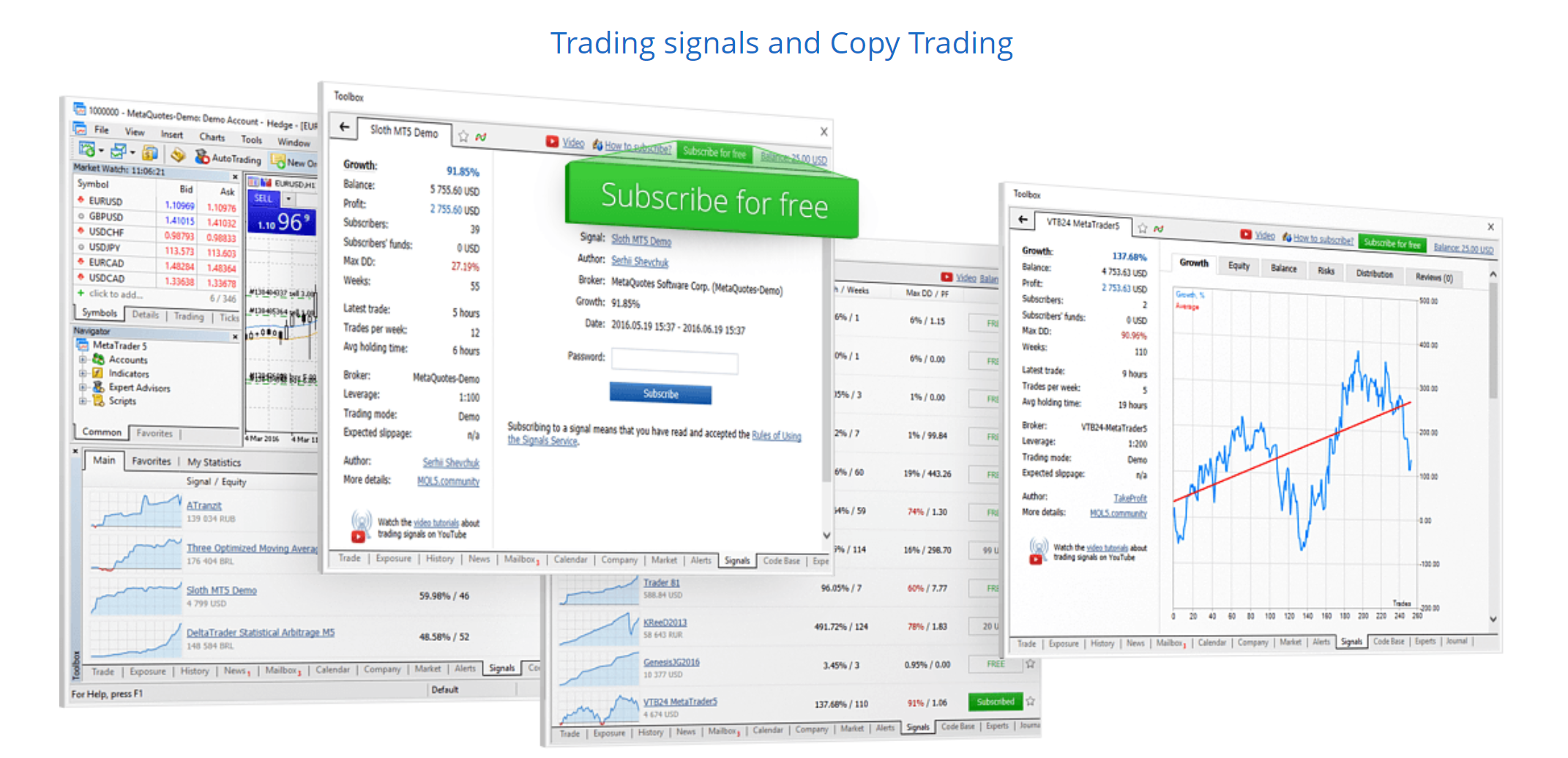

MetaTrader 5, often referred to as MT5, is a significant upgrade in the line of forex trading platforms developed by MetaQuotes Software. Launched in 2010, it aimed to offer traders a more comprehensive selection of instruments and an improved trading experience. Since its founding, MT5 has advanced increasingly, keeping up with the changing needs of the trading community. Compatibility is vital in todays fast-paced trading world, and MT5 does not disappoint. The platform works smoothly on various devices, including desktops, smartphones, and tablets, thus facilitating trades on the go.

The interface of MT5 is designed with user-friendliness in mind, extending professional-level analytics for thorough market analysis. It also provides a wider array of timeframes, chart types, and indicators than its predecessor, making it a more versatile choice for traders.

On the fee front, MT5, like MT4, is renowned for its minimal trading costs, making it an economical choice for traders of all levels. Indicative trading fees should, however, be confirmed with individual brokers since they may vary.

One standout feature of MT5 is its ability to provide access to not just forex, but also stocks, futures, and commodities. Moreover, the platform also includes a built-in Economic Calendar and a more advanced Strategy Tester for EAs, making it a more comprehensive trading solution.

✅Where MetaTrader 5 shines:

• Compared to MT4's dated interface, MT5 boasts a modern and user-friendly interface with improved charting capabilities and customizable workspaces.

• MT5 supports wider asset classes beyond forex, spaning stocks, futures, and CFDs, making it a more versatile platform for diverse trading strategies.

• More advanced order types like trailing stops and take profit orders, providing greater flexibility for managing your trades.

• Built-in Economic Calendar, helping traders plan your trades strategically.

• MT5 uses the MQL5 programming language, more powerful and object-oriented than MQL4, allowing for more sophisticated EAs and trading tools to be developed.

❌Where MetaTrader 5 shorts:

• While growing, the MT5 community and resources are still not as vast as MT4's, especially for custom indicators and EAs.

• Not all brokers offer MT5 yet, especially smaller ones, which might limit your platform choice depending on your broker preference.

• Some users report occasional performance issues with MT5, particularly on older computers or with resource-intensive EAs.

• Certain advanced features in MT5, like real-time market data feeds for specific asset classes, might require paid subscriptions.

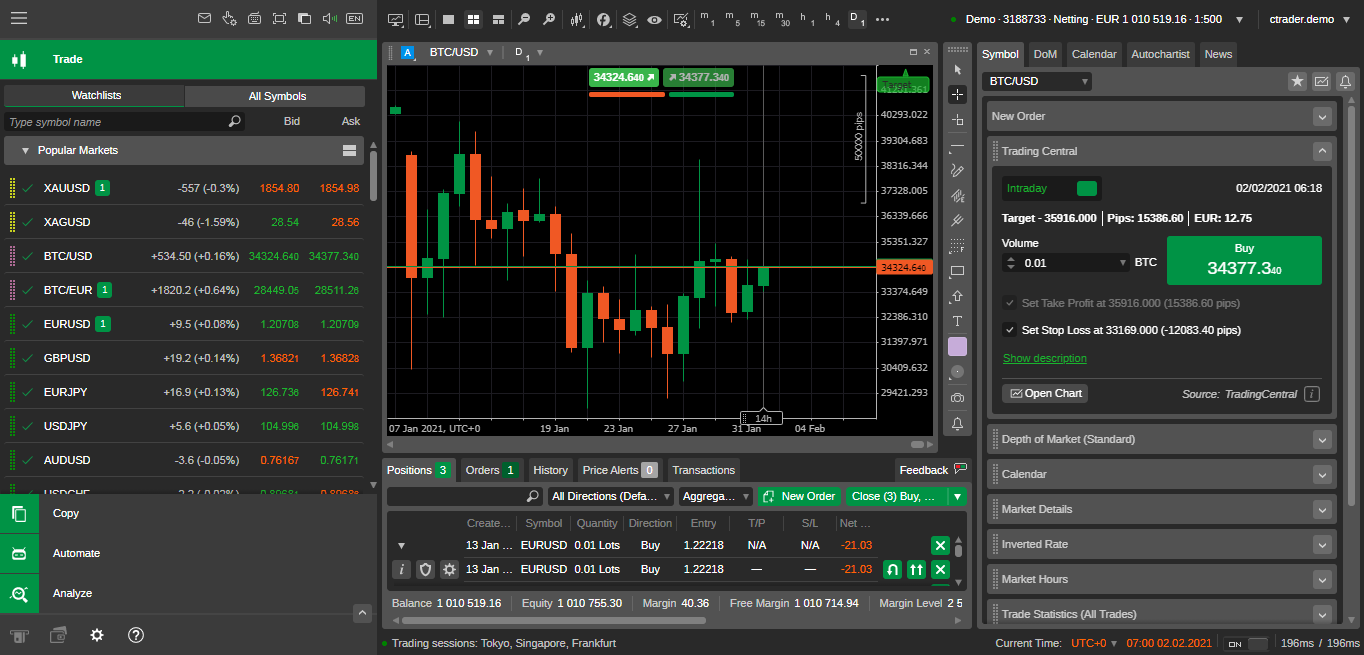

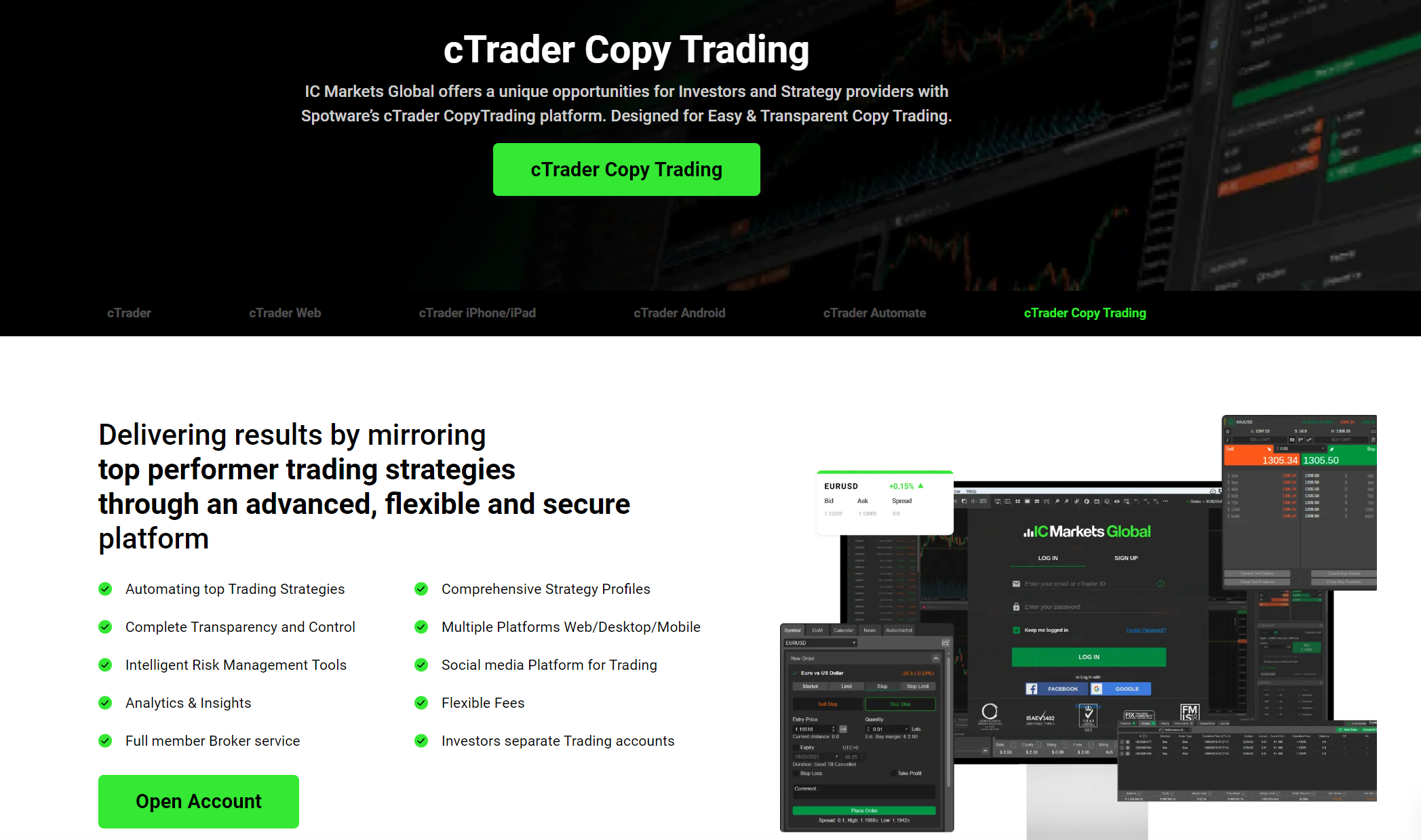

cTrader

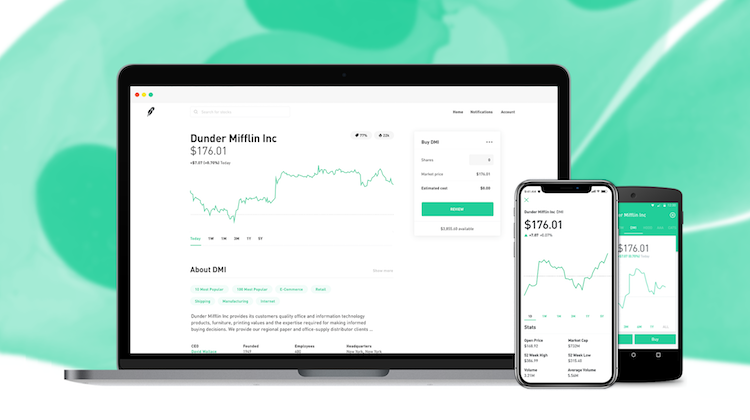

cTrader, established in 2010 by Spotware, is an innovative online trading platform committed to providing an effective trading interface for forex and CFD traders. Since its launch, cTrader has gained a reputable market position with its forward-thinking approach and dedication towards the evolution of the trading industry. One such progression was the launch of cTrader Automate Suite, enhancing automated and algorithmic trading. It provides a consistent trading experience across web, desktop, and native mobile apps for IOS and Android, enabling traders to operate anywhere, anytime.

The interface is lauded for its clean design, streamlined layout, and high level of customization. This sophistication doesnt compromise its user-friendly nature, allowing traders of all skill levels to navigate with ease.

While trading fees depend on the broker, cTrader itself doesnt charge users any additional fees. This transparency aligns with its philosophy of creating a fair trading environment.

A signature feature of cTrader is its depth of market and price ladder trading, which allows traders more control and precision over their order placements. This couples with extensive resources for back-testing and algorithmic trading, making it a holistic and robust platform.

✅Where cTrader shines:

• cTrader offers unparalleled market depth and order book visibility, allowing traders to see the full liquidity picture and act wisely in real-time market dynamics.

• cTrader utilizes a server-side order matching system, ensuring fast and reliable execution of trades directly with liquidity providers, minimizing slippage and delays.

• cTrader boasts a clean and user-friendly interface with customizable workspaces and advanced charting tools,offering a pleasant and efficient trading experience.

• cTrader supports cAlgo, a robust scripting language similar to C#, allowing you to develop and deploy sophisticated trading robots and strategies.

• cTrader operates with an agency model, meaning no internal dealing desk intervenes in your trades, providing a fair and transparent trading environment.

❌Where cTrader shorts:

• Compared to MT4 and MT5, cTrader is offered by a smaller pool of brokers.

• Compared to platforms with integrated news feeds and fundamental data tools, cTrader primarily focuses on technical analysis, lacking features for research-driven trading.

• While cTrader caters well to forex and CFDs, its support for other asset classes like stocks and options might be limited depending on your broker.

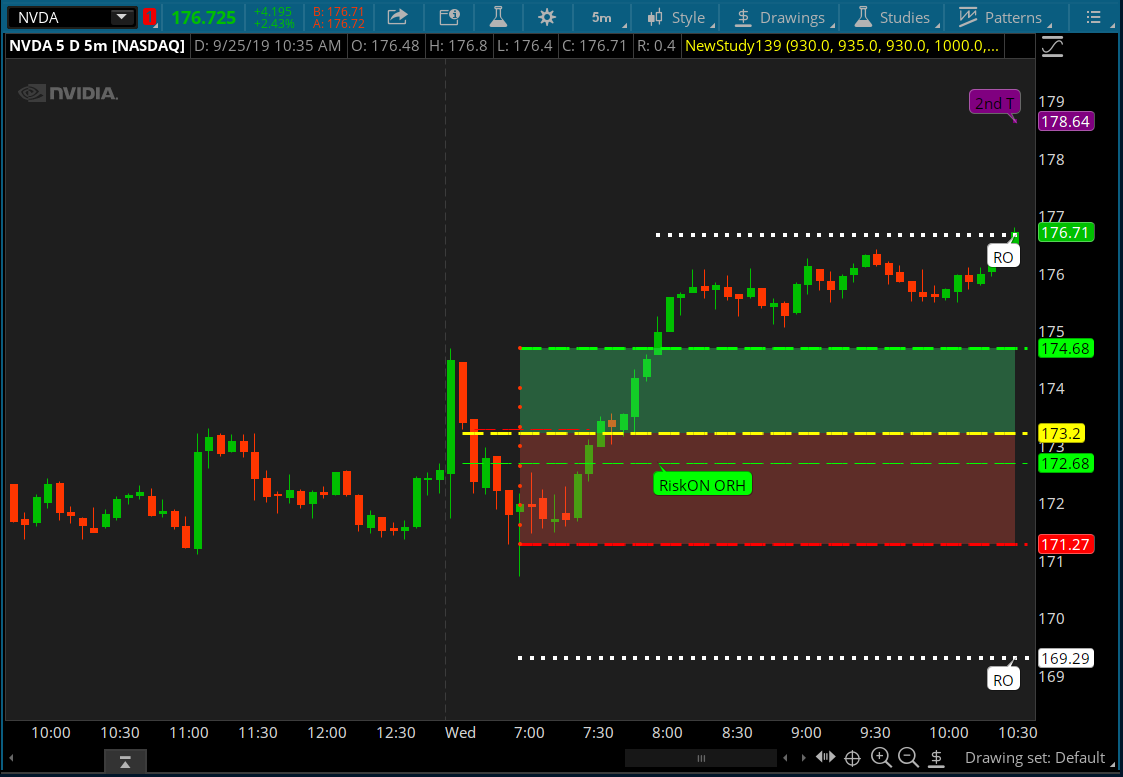

Tradingview

TradingView, established in 2011, is a cloud-based charting and social networking platform. It is known for providing powerful analytics tools to traders and investors. Since its foundation, TradingView has shown a steady evolution in its services, striving to provide better and broader solutions for traders. Its creation came as a disruptive shift in the market, offering a comprehensive yet user-friendly tool for financial enthusiasts. In terms of compatibility, TradingView outclasses many others. As a cloud-based platform, it supports web browsers on multiple devices, from desktop computers to smartphones, allowing traders to stay connected round the clock.

The interface of TradingView is well-commended for its clean, intuitive design. Overloaded with visual aids, it allows users to view, share, and learn from professional-grade charts, indicators, and strategies.

TradingView operates on a 'freemium' model, offering free accounts with limited access and premium accounts for wider access and additional features. Despite this, bare minimum trading fees are attached ensuring all users have a fair trading experience. One unique feature of TradingView is its emphasis on community-based inputs. It allows its users to share and exchange strategies, charts, and ideas within its network, encouraging collaborative learning among traders.

✅Where TradingView shines:

• With Tradingview, traders can access over 100 chart types, 400+ built-in indicators, and an endless library of community-created indicators, customizing everything from candlesticks to line styles.

• Backtesting playground, refining your strategies with advanced backtesting capabilities, testing on historical data, optimize parameters, and gain confidence before risking real money.

• Community-built indicators, exploring over 100,000 user-created indicators for diverse charting and analysis options.

❌Where TradingView shorts:

• TradingView primarily serves as a charting and analysis platform. While some brokers offer direct integration, execution capabilities might be limited compared to dedicated trading platforms.

• The free tier offers basic features, but unlocking the full potential of TradingView requires paid subscriptions, which can be costly for high-frequency traders.

• TradingView primarily serves as a charting and analysis platform. While some brokers offer direct integration, execution capabilities might be limited compared to dedicated trading platforms.

Thinkorswim

Thinkorswim, widely acclaimed as a top-tier trading platform, was launched in 1999. It was developed by TD Ameritrade to cater to experienced traders seeking extensive trading tools. Since its launch, Thinkorswim has underlined its dominance with numerous enhancements to its technology, providing its users with a top-tier, adaptable trading experience. It fully integrated with TD Ameritrade in 2009, leveraging its established market presence and extensive resources. Thinkorswim offers a desktop platform, a web-based platform, and a mobile app, ensuring traders have 24/7 access to the financial markets.

The user interface of Thinkorswim is its biggest selling point. Complete with professional-level tools and features, it offers an advanced and customizable trading experience, yet maintaining a clear, user-friendly navigation.

As for trading costs, Thinkorswim prides itself on competitive pricing. Though trading fees can vary, the platform offers a $0 commission on online exchange-listed US stocks, ETFs, and options trades, making it an appealing choice for many traders.

Thinkorswim stands out for its extensive suite of tools and resources that include backtesting capabilities, strategy roller, advanced charting tools, and CNBC TV. Particularly, its robust desktop platform allows traders to execute advanced trades and manage their orders with precision.

✅Where Thinkorswim shines:

• Designed to be intuitive and customizable, even for newcomers.

• Thinkorswim provides paper trading, allowing traders to practice strategies and fine-tune their execution without risking real money.

• Access additional features and resources offered by TD Ameritrade, the brokerage that hosts Thinkorswim.

❌Where Thinkorswim shorts:

• Heavy on Resources, the platform can be resource-intensive, requiring a powerful computer for smooth operation.

• While competitive for options trading, higher fees compared to some discount brokers can eat into profits.

• Platform features cater more towards short-term trading strategies, requiring adaptation for long-term options plays.

• The mobile app lacks some key features like the Probability Density Calculator, limiting on-the-go options analysis.

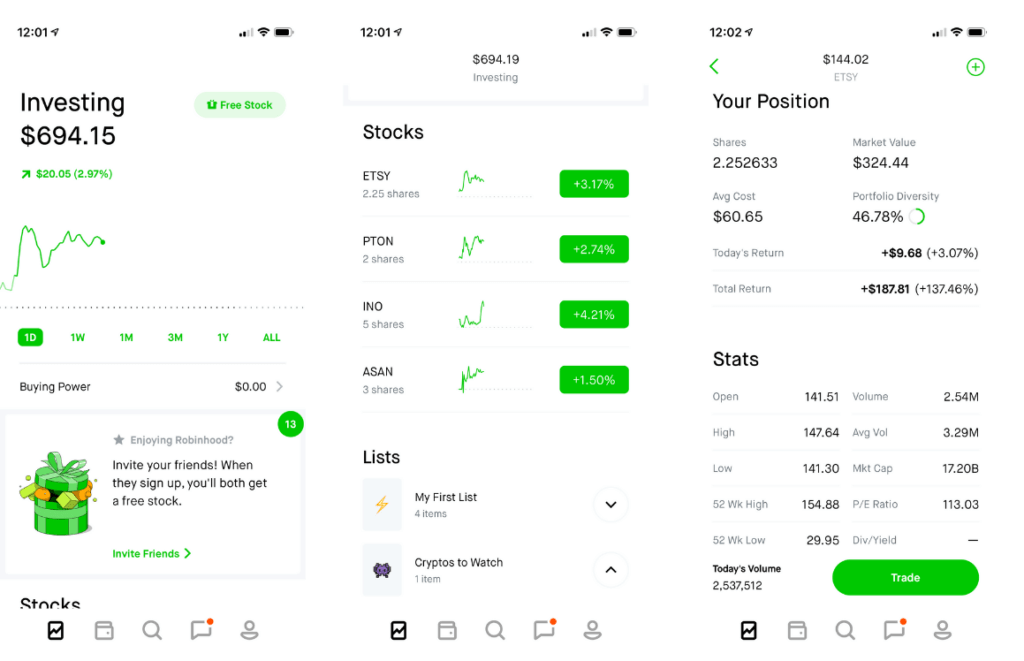

Robinhood

Robinhood is a mobile-first trading platform founded in 2013, with the aim of democratizing finance for all by offering commission-free trades. Throughout its short development course, Robinhood gained immense popularity by capturing significant user growth, particularly among younger, tech-savvy investors. In terms of platform compatibility, Robinhood is primarily a mobile trading platform and caters to both Android and iOS users. However, it also supports web-based trading to ensure users can engage with the markets from any device.

As far as the user interface is concerned, Robinhood provides a simple, no-frills design that caters especially to novice investors. However, it also offers real-time market data, customized investment news, and an earnings calendar, making it a multifaceted platform.

Robinhood operates on a zero-dollar commission structure. It does not charge any trading fees, making trading accessible to investors, irrespective of their portfolio size. A standout feature of Robinhood is its fractional shares trading. This empowers users to invest in their favorite companies, regardless of share price, aligning with its mission to democratize financial markets.

✅Where Robinhood shines:

• Robinhood's biggest draw is its commission-free stock, ETF, and crypto trades, making it ideal for active traders who want to avoid eating on their returns with fees.

• Robinhood's user interface is clean and intuitive, designed for seamless mobile trading. This makes it convenient for managing your investments on the go.

• Earn 4.65% APY on uninvested cash (Robinhood Gold offers even higher). This beats most traditional savings accounts and allows your idle cash to work for you.

❌Where Robinhood shorts:

• Robinhood lacks advanced features like mutual funds, fixed income, and complex options strategies.

• Robinhood has faced criticism for its customer service, which can be slow and unreliable at times.

• Robinhood routes some orders to market makers who pay them for the execution, which can potentially impact your execution price, though Robinhood claims it aims for best execution.

Forex Trading Knowledge Questions and Answers

What is free trading software?

Free trading software is a digital application used for online trading in the financial markets. It offers a suite of tools for executing trades, managing portfolios, and analyzing market trends. While initial access to these platforms may be free, additional features or upgrades may come with costs. The reliability and performance of trading software can vary significantly, therefore, it is key to choose a platform that fits their trading needs and skill level.

How do free trading platforms make money?

Free trading software typically make money through several ways. Firstly, many offer premium features or paid subscriptions, where users pay a fee to access advanced tools and resources. Secondly, they often earn interest in the uninvested cash held in users' accounts. Additionally, certain free trading platforms may earn from payments for order flow, a practice where they receive compensation for directing orders to different parties for trade execution.

Can free trading software be used for professional trading?

Yes, free trading software can indeed be used for professional trading. Many of these platforms offer a range of tools and features that cater to the needs of professional traders including advanced charting, algorithmic trading, and backtesting capabilities. However, some advanced functionality might only be available through 'premium' versions or paid upgrades.

Can I practice trading with a demo account in trading software?

Yes. you can. Typically, most trading software platforms offer demo accounts for free, which allow beginners to test strategies without risking real money. Notably, most demo accounts come with no expiry period, but this can vary from platform to platform.

Can I use multiple forex trading software at the same time?

Yes, you can use multiple forex trading platforms at the same time, and actually, brokers do allow traders to use multiple trading software platforms. Yet, policies can vary depending on different brokers. Using multiple trading platforms can offer the advantage of accessing various tools and features, but it also requires handling multiple interfaces, which might impact trading efficiency.

Which broker offers the best trading software for beginners?

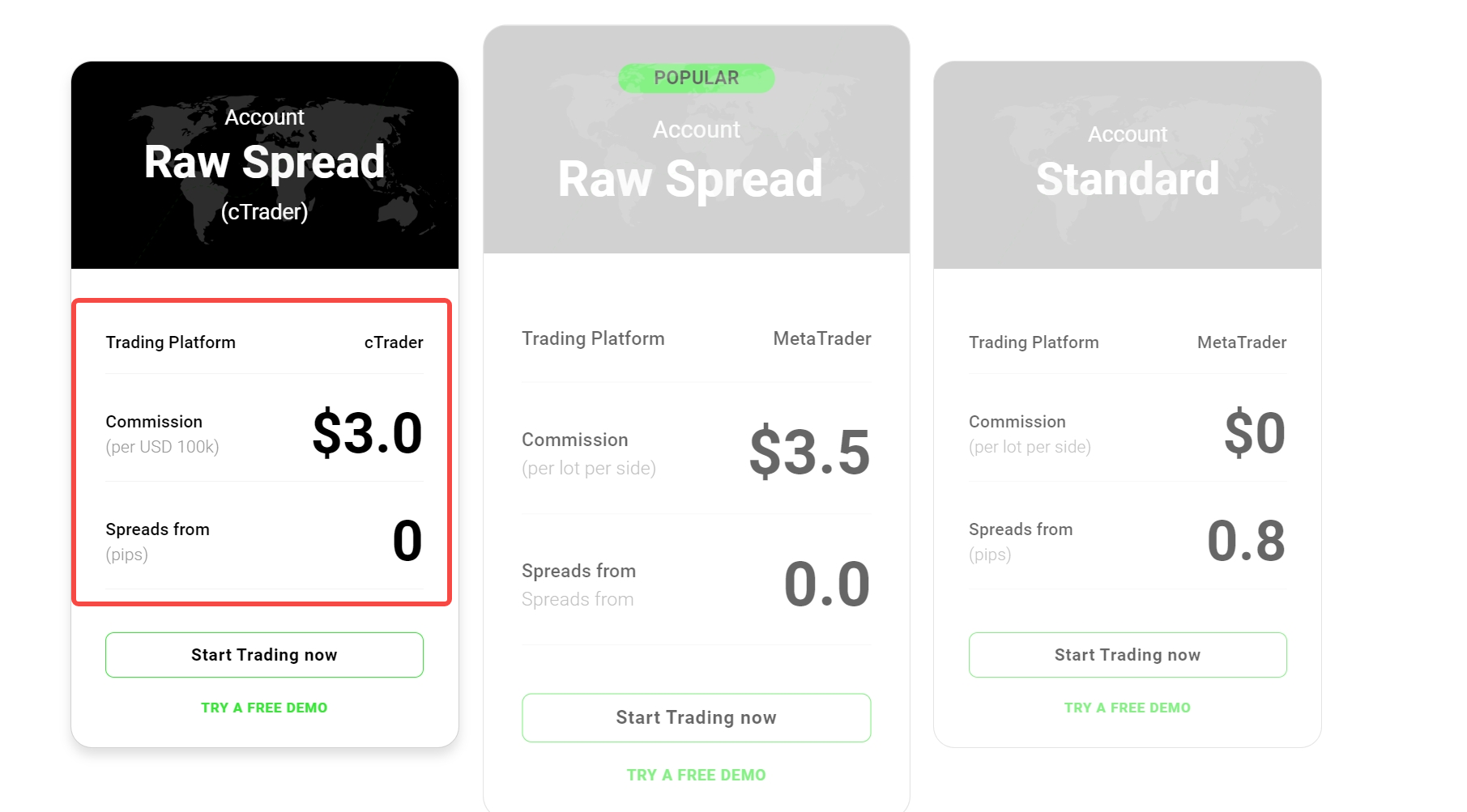

Clearly, IC Markets stands tall when it comes to offering the best trading software for beginners - cTrader. IC Markets cTrader platform is accessible across multiple devices, including web, iPhone/iPad, and android, giving traders great trading flexbility to trade anytime, anywhere.

Another exceptional feature of IC Markets' cTrader is its support for automated and copy trading solutions,particularly usefulto novice traders, allowing them to replicate and learn from successful trading strategies employed by seasoned professionals.

With cTrader server located in the LD5 IBX Equinix Data Centre in London, IC Markets thus features fast order execution, average under 40 milliseconds, ranking top in in the industry. Notably, the platform imposes no restrictions on trading strategies, welcoming both hedging and scalping, particularly advantageous for beginners exploring diverse approaches.

Lastly, when it comes to trading fees, IC Markets obviously is the winner again. Within the IC Markets' Raw Spreads cTrader account, spreads start from an impressively low 0.0 pips, accompanied by commissions starting at $3 per lot, which is much lower than trading through many other trading software.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like

7 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 7 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

10 Best Forex Trading YouTube Channels to Follow in 2024

Boost your Forex trading success with our top picks for 10 Best Forex Trading YouTube Channels including ForexSignals TV, Warrior Trading, and more.

Automated Forex Trading Software | How It Works | Pros and Cons

Unlock 24/5 trading potential, overcome human limitations and enhance your forex outcomes with Automated Forex Trading software!

Best Forex Traders to Follow on Instagram

Uncover the secrets of Forex trading on Instagram - dive into scam prevention, explore top traders, and boost your investment know-how!