HFM Information

HFM, founded in 2010, HFM is a multiregulated online trading broker that provides both individual and institutional clients with online trading services. HFM has been headquartered in Cyprus but serves several global offices in Dubai, South Africa, and offshore entities in St Vincent and the Grenadines.

It regulated by multiple regulators, and offers more than 500 trading instruments. In addition, it sets up 4 types of accounts for traders with different trading needs and experience, all of which can use the 3 trading platforms it provides.

Pros & Cons

Pros:

- HFM is a well-regulated company by various reputable authorities, CySEC, FCA, DFSA, and FSA (Offshore), providing a high level of security to traders' funds and personal information.

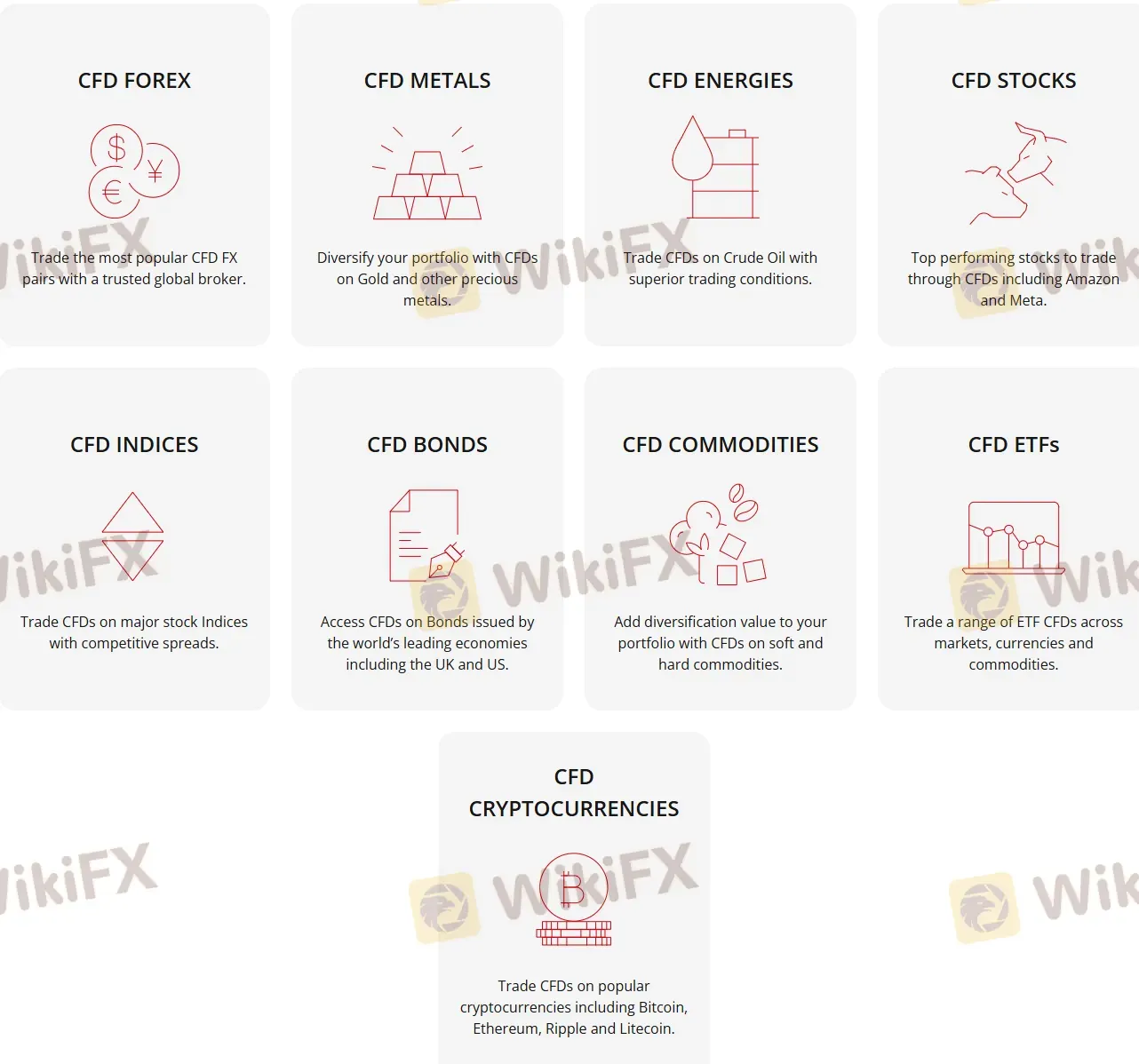

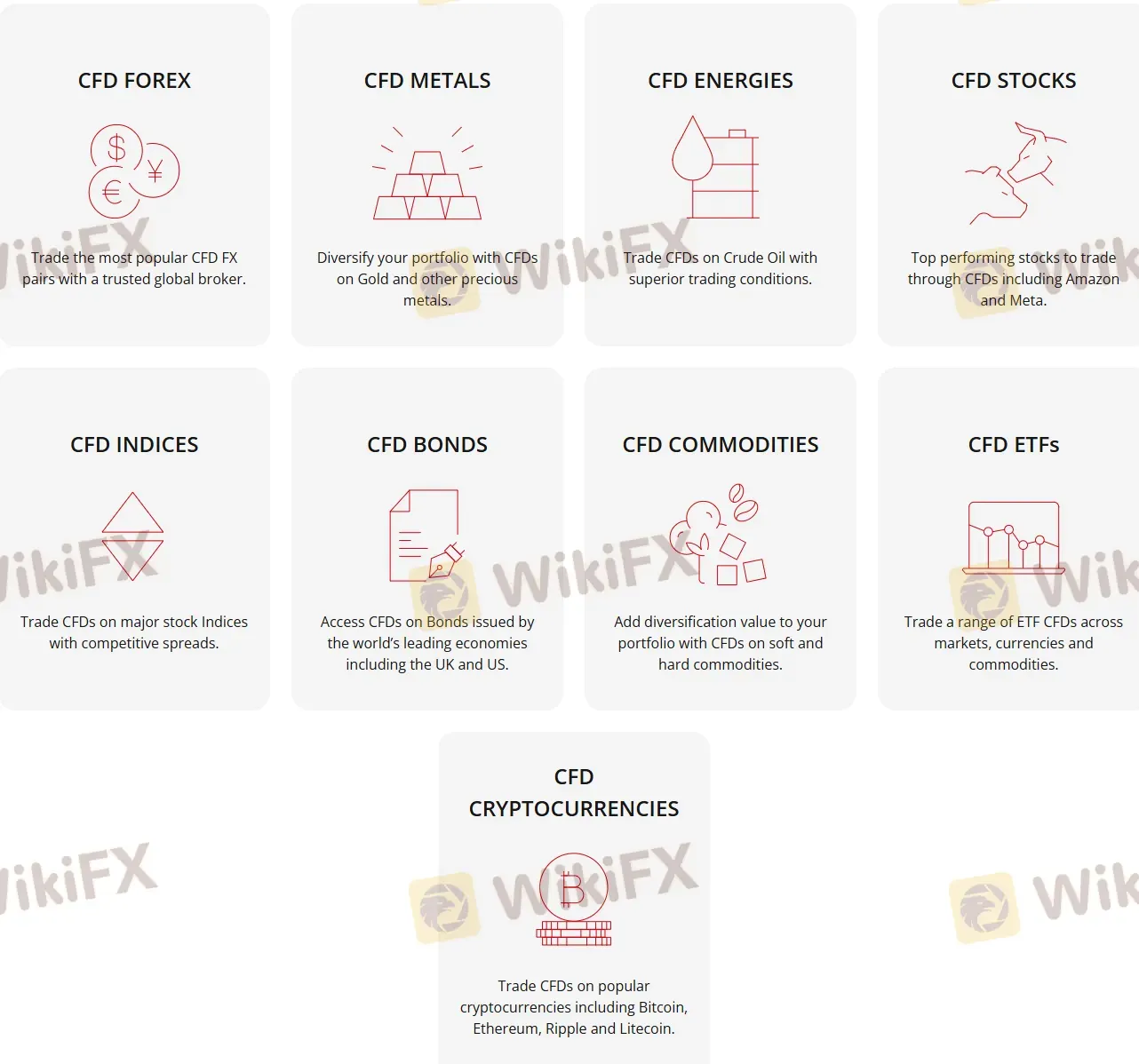

- The company offers 500+ CFDs on Forex, Commodities, Metals, Bonds, Energies, ETFs, Indices, Cryptos, and Stocks.

- There are multiple account types available, including Premium, Pro, Zero, and Cent, catering to the different needs of traders.

- HFM offers rich educational resources such as webinars, video tutorials, and daily analysis, providing valuable insights for traders.

- The company provides multiple trading platforms including MetaTrader4, MetaTrader5, and their proprietary HFM Trading App, giving traders a wide range of options to choose from.

- HFM offers various customer channels, through multiple channels including email, phone, and live chat.

Cons:

- HFM does not provide services to residents of the USA, Canada, Sudan, Syria, Iran, and North Korea.

- Customer support is only available from 00:00 Monday to 23:59 Friday (Server Time).

Yes. HFM is regulated by multiple regulatory authorities, including FCA in UK, DFSA in UAE, and FSA in Seychelles.

• HF Markets (UK) Limited, its UK entity, under the regulation of the Financial Conduct Authority - FCA in the UK (license number 801701)

• HF Markets (DIFC) Limited, the Dubai entity under regulation of Dubai Financial Services Authority - DFSA (license number F004885)

• HF Markets (Seychelles) Ltd, authorized and offshore regulated by the Seychelles Financial Services Authority (FSA), with Regulatory License No. SD015

HFM appears to be a serious player when it comes to offering protection measures for its clients. They provide market leading insurance, positioning themselves as an industry leader in financial safety.

In addition to this, they maintain their accounts with major banks and ensure the segregation of client funds for added security. They also provide protection against negative balances, helping traders avoid owing more than they've invested.

Along with these measures, HFM implements robust risk management strategies to further safeguard their clients' assets.

Market Instruments

HFM offers a diverse range of 500+ CFDs on Forex, Commodities, Metals, Bonds, Energies, ETFs, Indices, Cryptos, and Stocks. This extensive offering provides traders with a wide range of investment opportunities and the ability to diversify their portfolio.

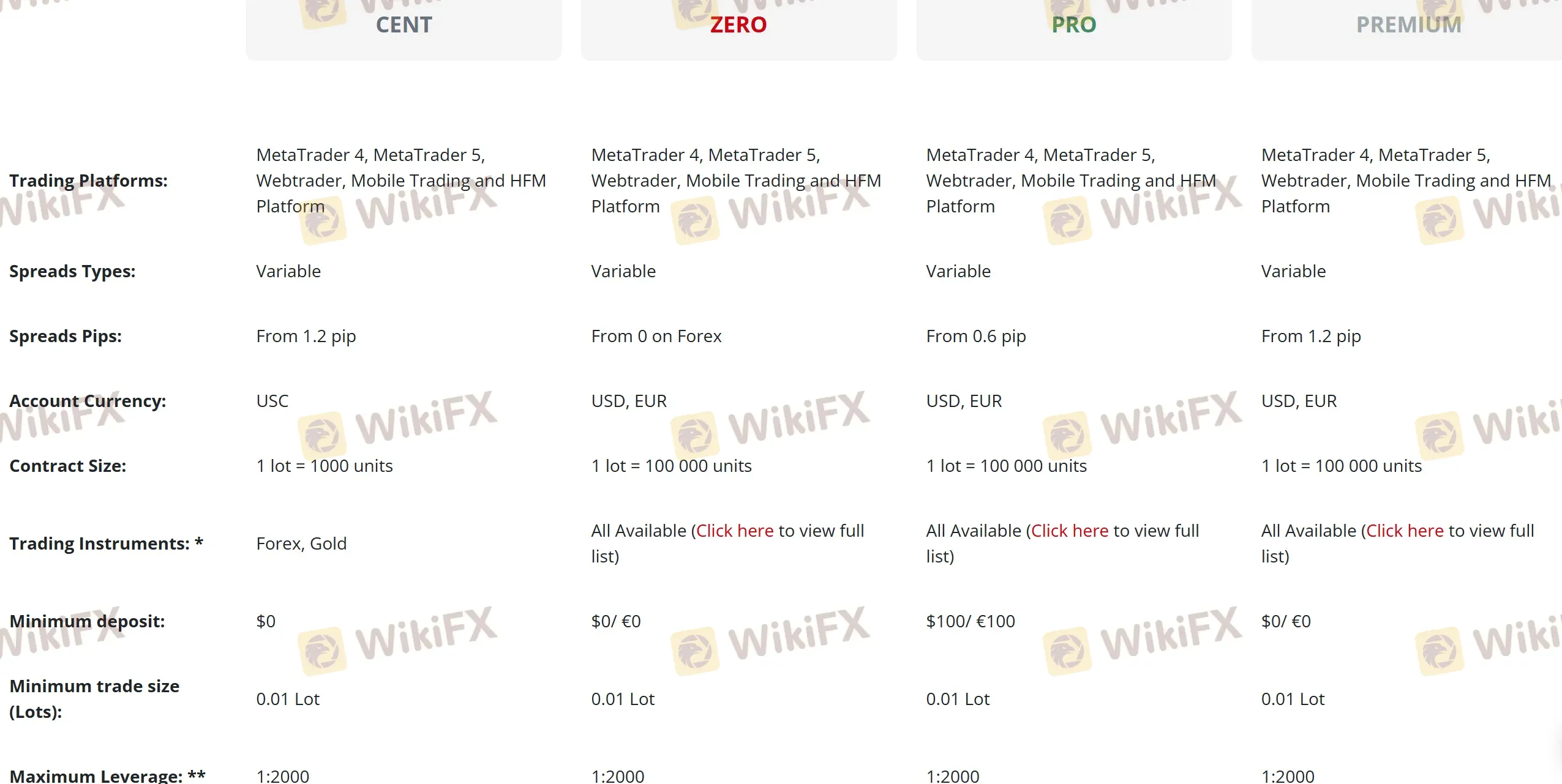

Account Types

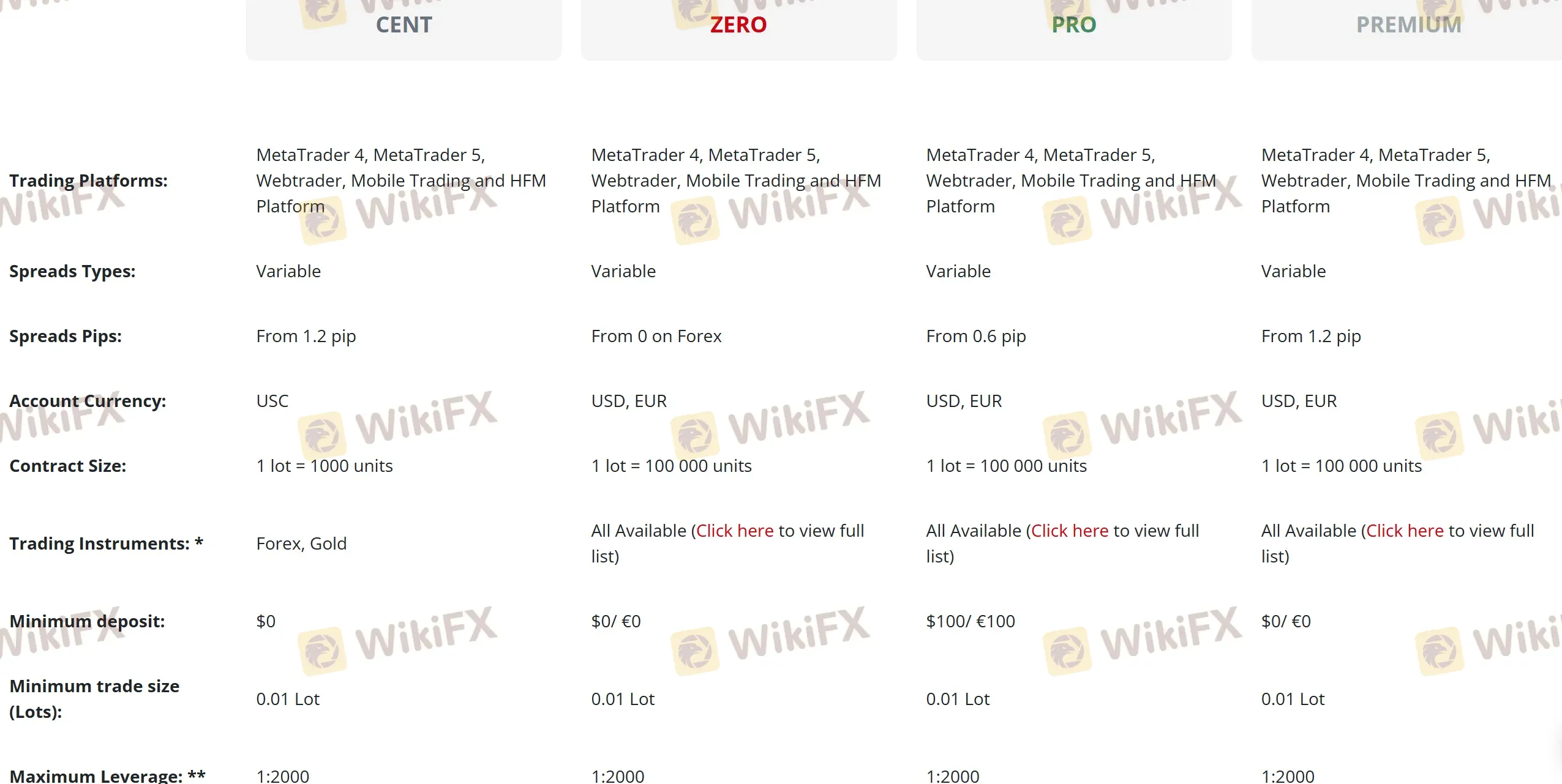

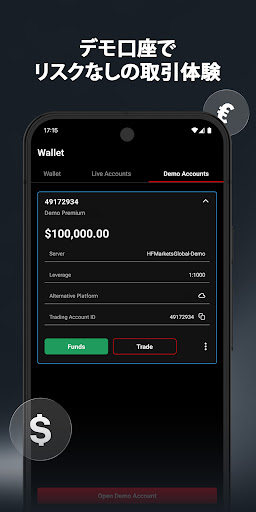

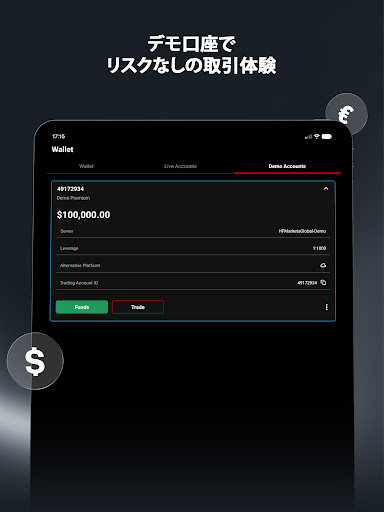

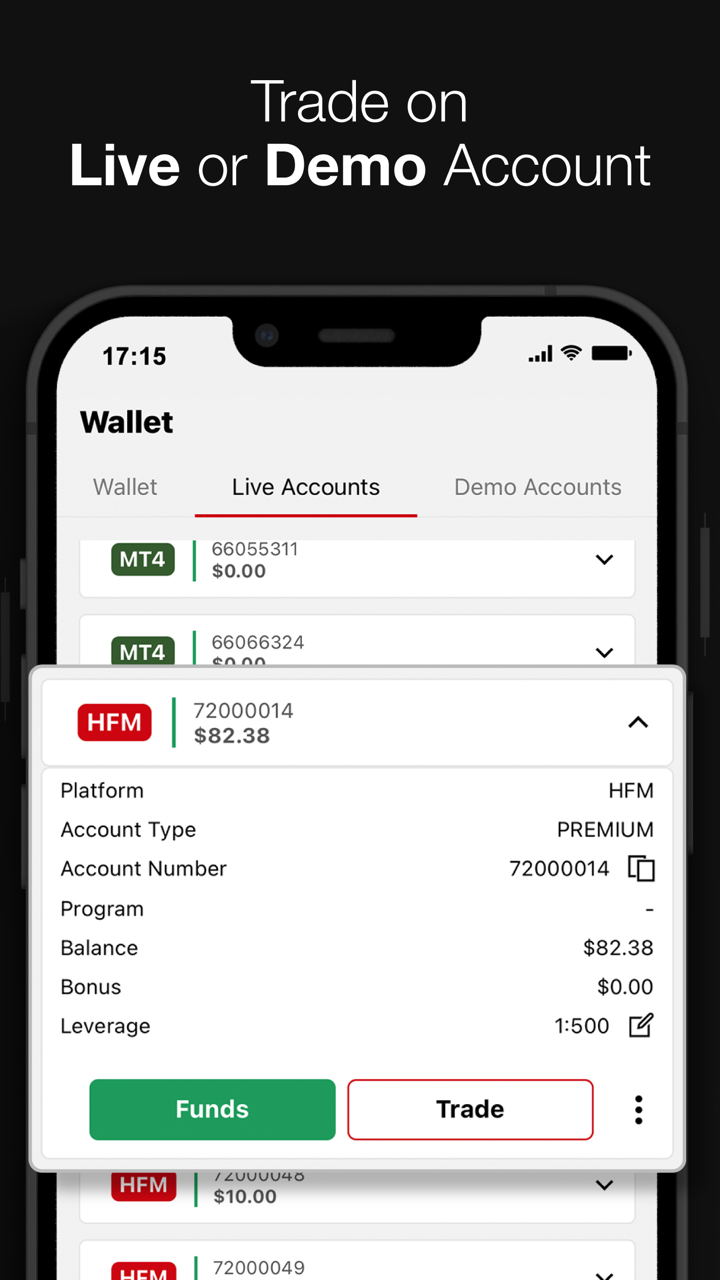

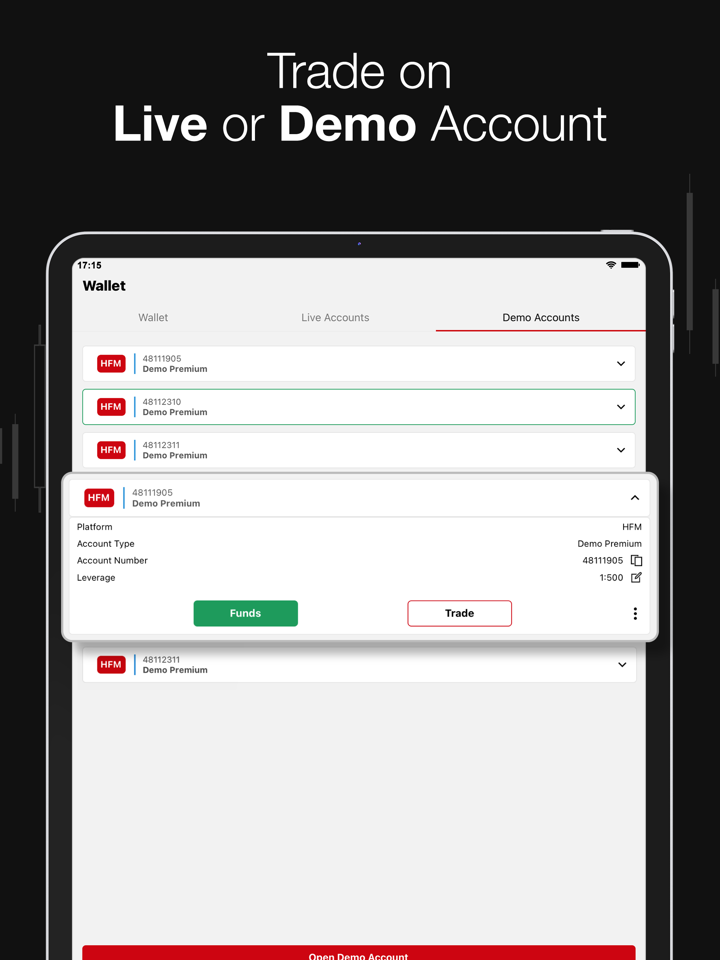

HFM indeed offers a range of accounts to suit various trading styles and levels. They provide the option of Cent, Zero, Pro, and Premium accounts, catering to both novice and experienced traders.

The Pro account requires an initial deposit of $/€100 to get started. Interestingly, HFM does not impose a minimum deposit requirement for the Cent, Zero, and Premium accounts.

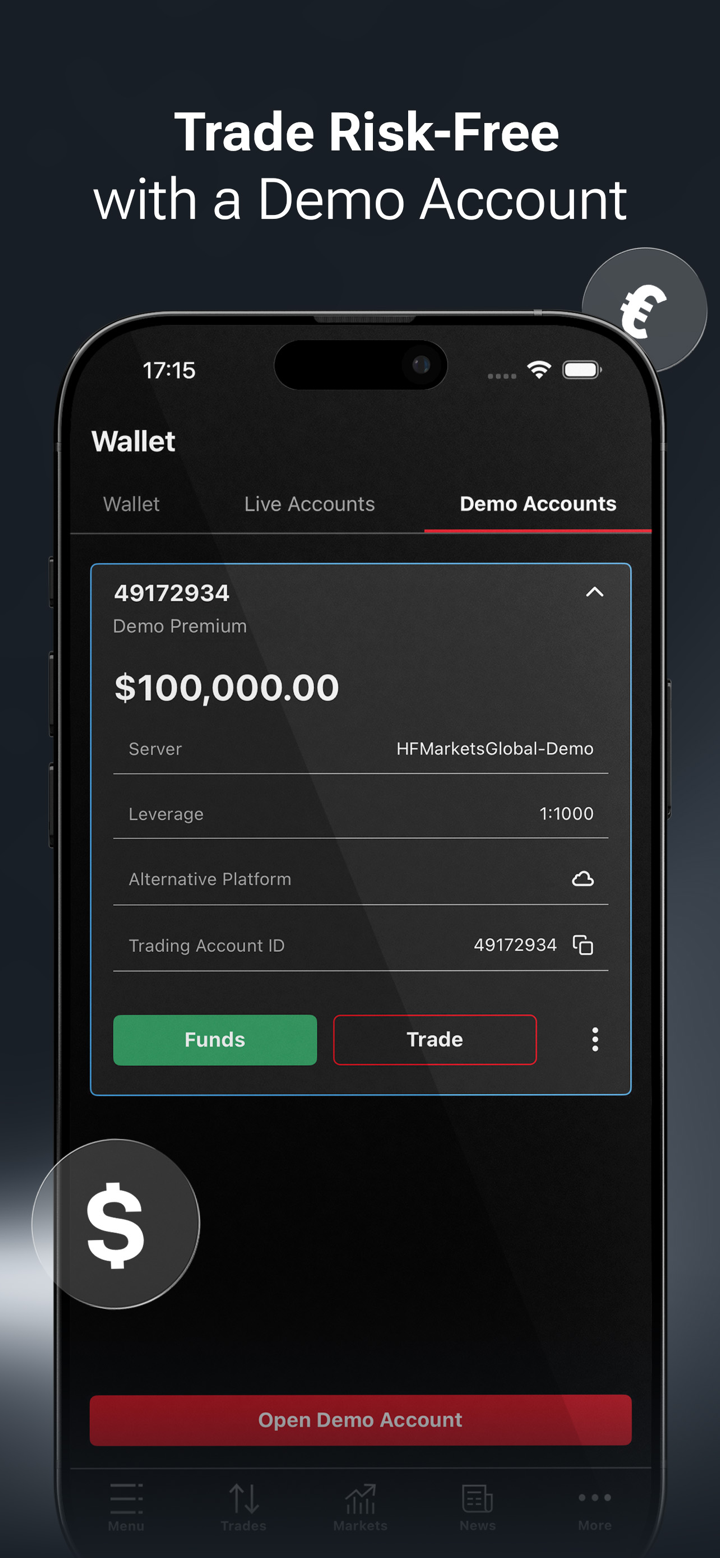

Alongside these, they also offer free demo accounts, allowing potential traders to test out their platform and develop their trading strategies before committing real money.

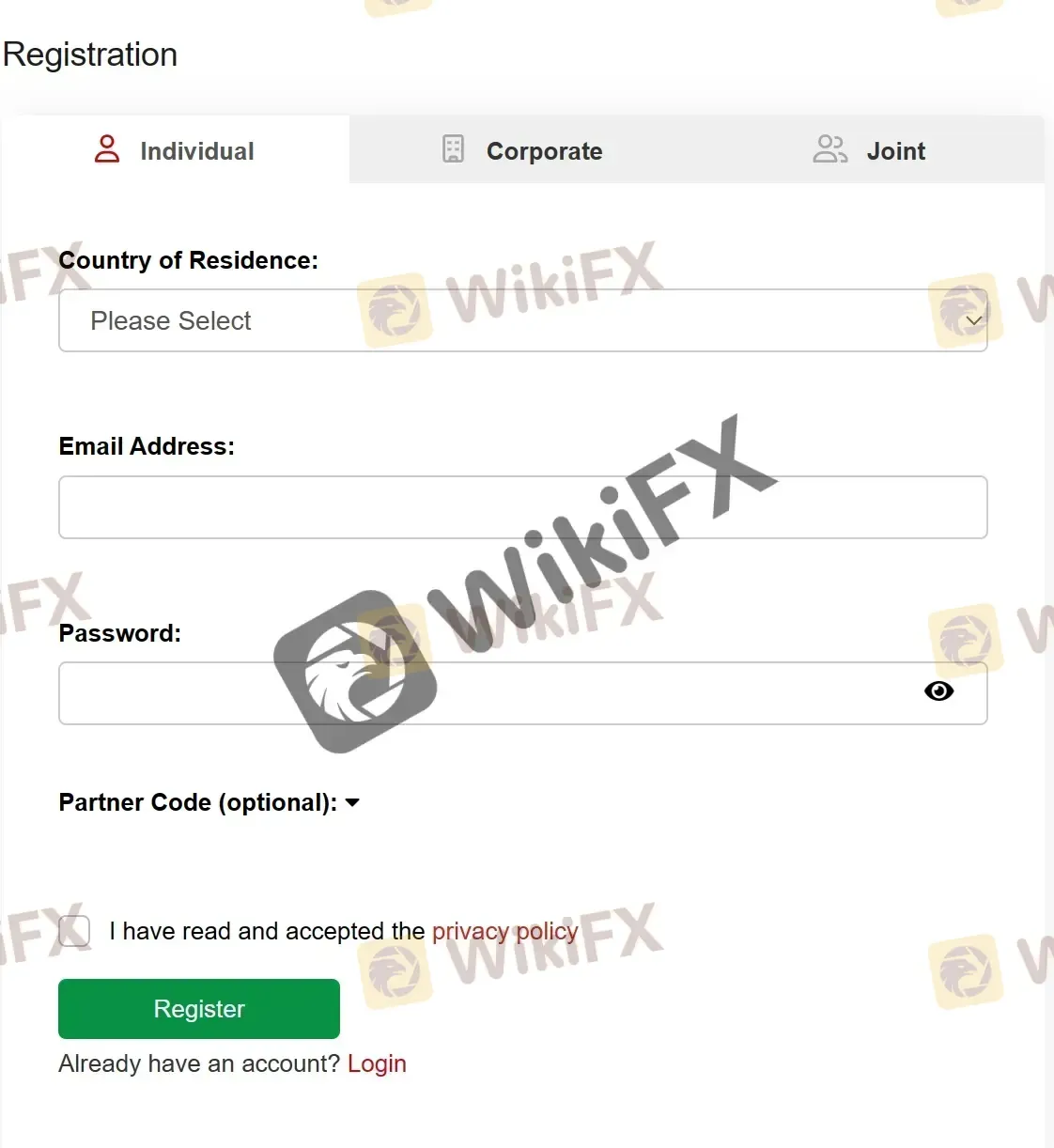

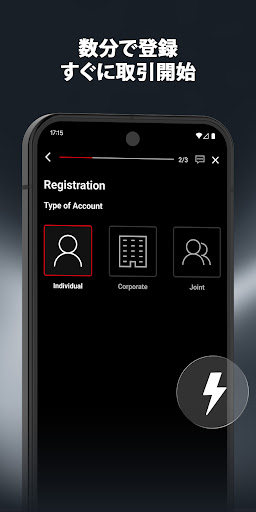

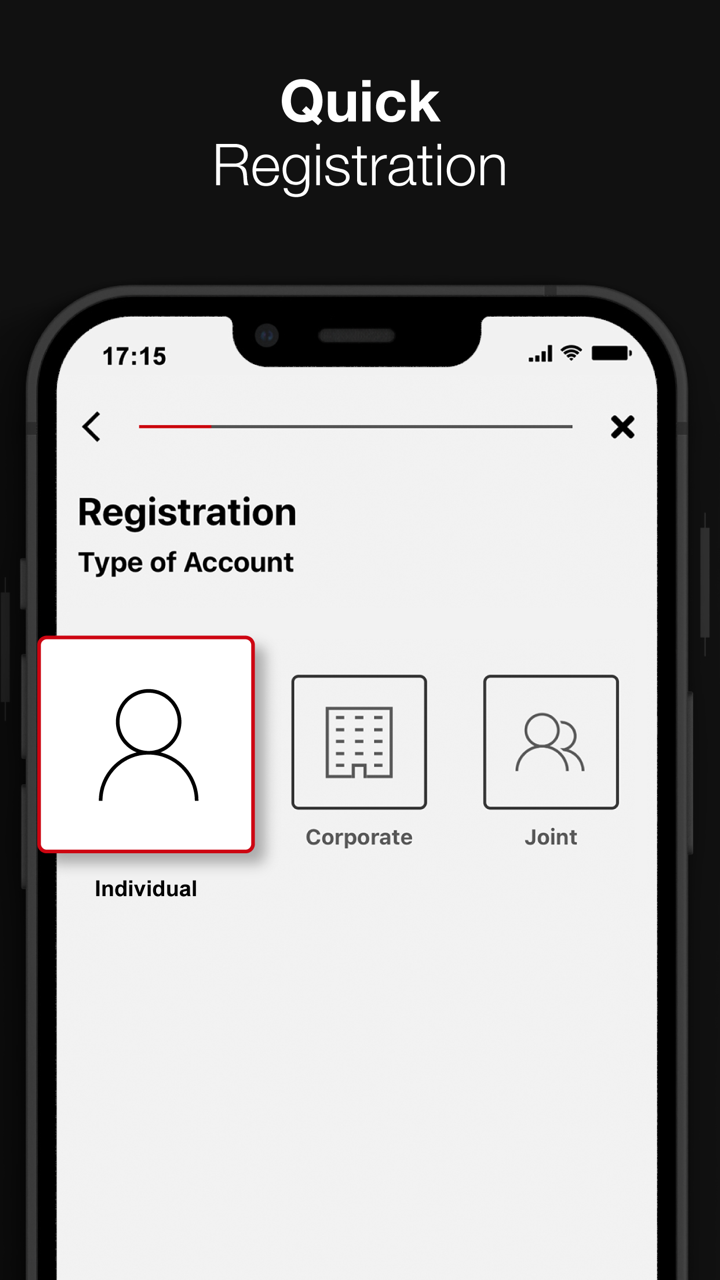

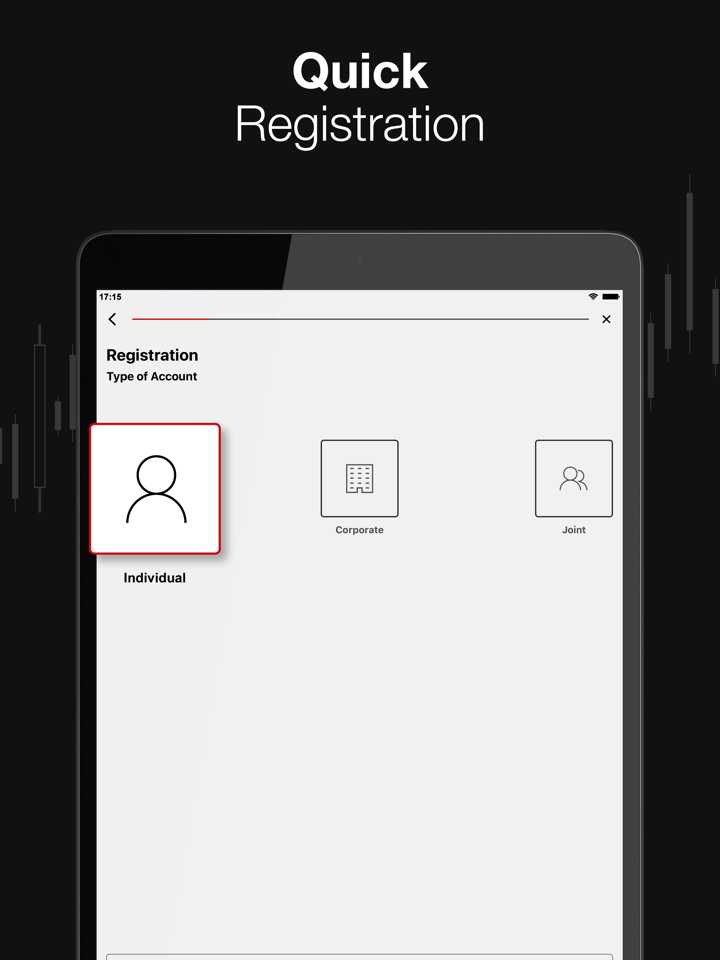

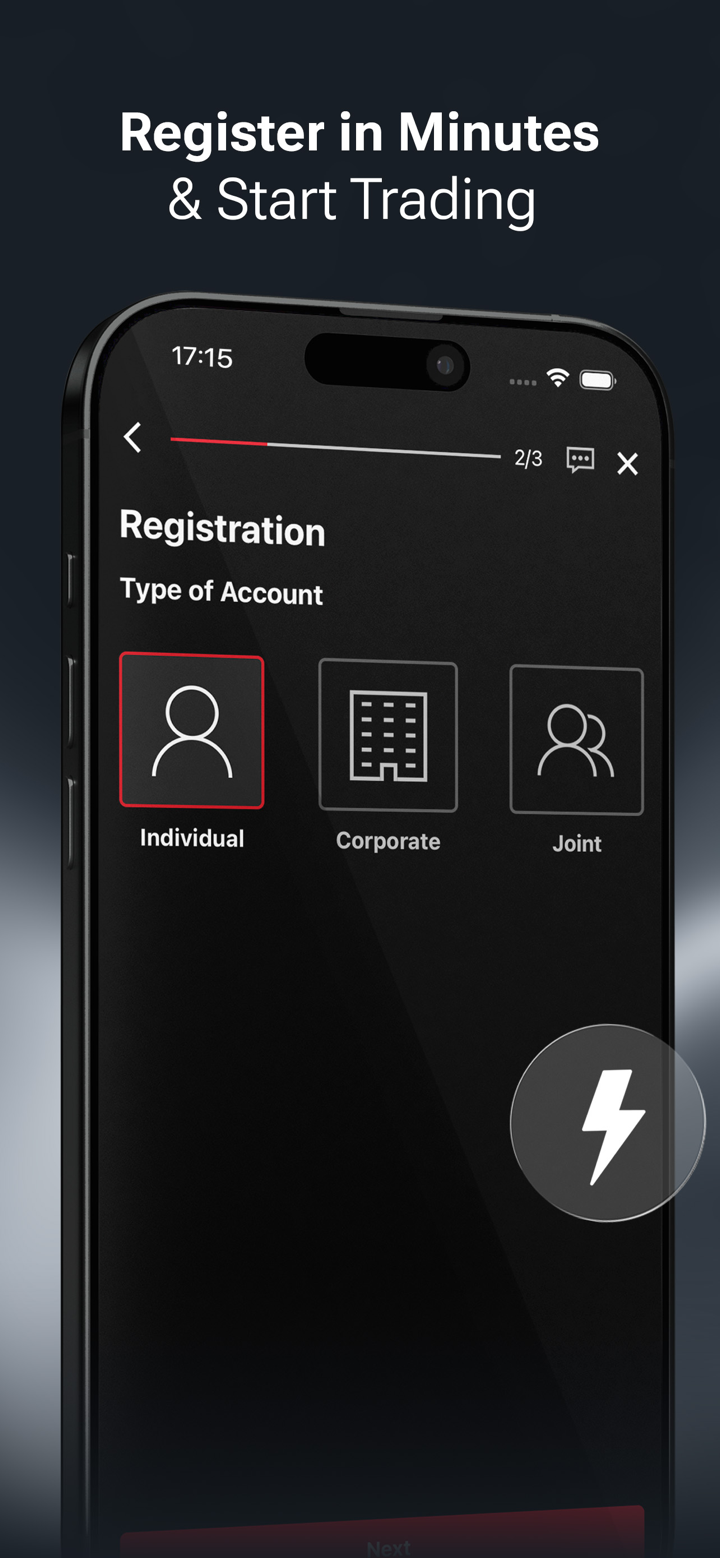

How to Open an Account?

Opening an account with HFM typically involves a few standard steps:

Step 1: Visit the HFM website and click on the “Register” button.

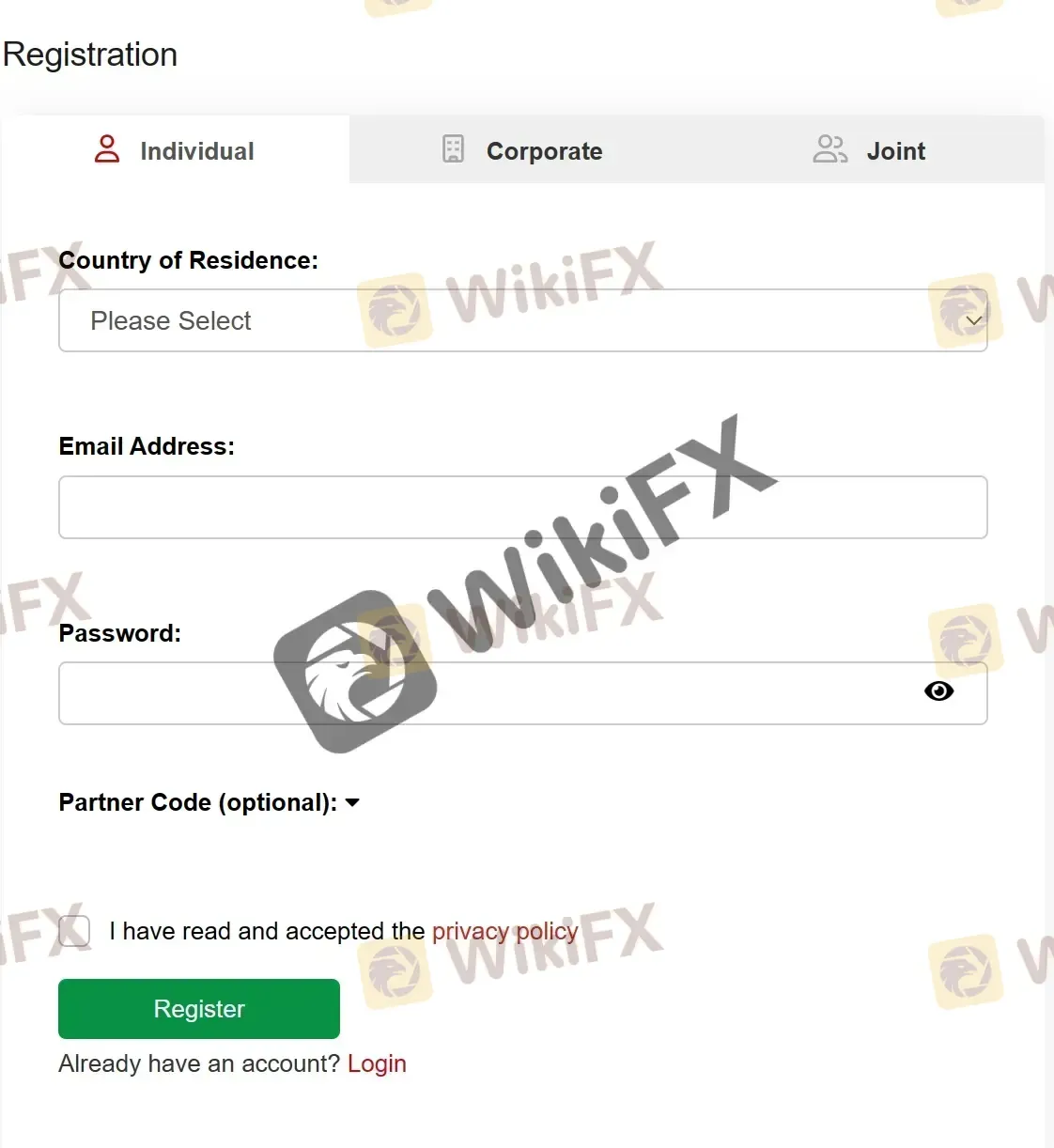

Step 2: Fill out the registration form with your personal information such as country of residence, email address, and password.

Step 3: Once you've completed the registration form, you'll need to submit some documents to verify your identity and address. This generally involves uploading a copy of your passport or national ID for identification and a utility bill or bank statement for proof of address.

Step 4: After identity verification, you can choose your account type. HFM offers Cent, Zero, Pro and Premium accounts. The Pro account requires a minimum initial deposit of $/€100/₦50,000/¥13,000, while the other three types do not have a minimum deposit requirement.

Step 5: Once you've selected your account type, you can make the necessary deposit using your preferred method of payment.

Step 6: After your deposit is confirmed, your account should be set up and ready for trading.

Leverage

HFM offers a maximum leverage of up to 1:2000, which can be an attractive feature for traders looking to maximize their potential profits with a smaller investment. This high leverage also provides greater market exposure and trading opportunities, allowing traders to take advantage of price movements in various markets.

However, it is important to note that high leverage also comes with high risk and potential losses. Traders must exercise proper risk management and discipline to avoid margin calls and account liquidation. While this feature may attract experienced traders, it may not be suitable for all, especially beginners or those with limited capital.

Spreads & Commissions

HFM caters to different trading preferences with variable spreads across its account types.

Trading Platforms

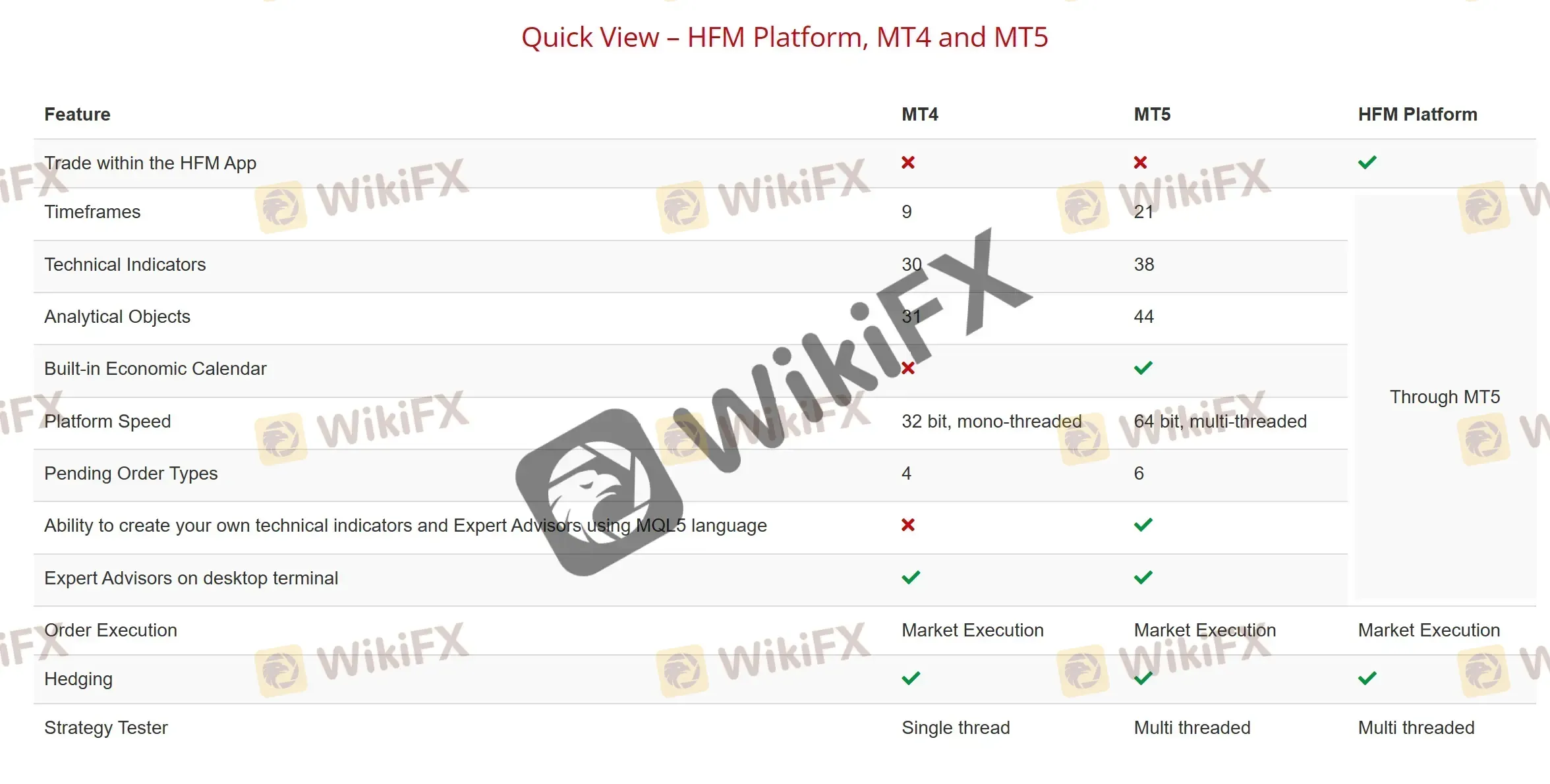

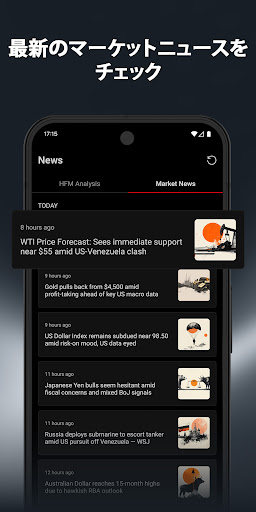

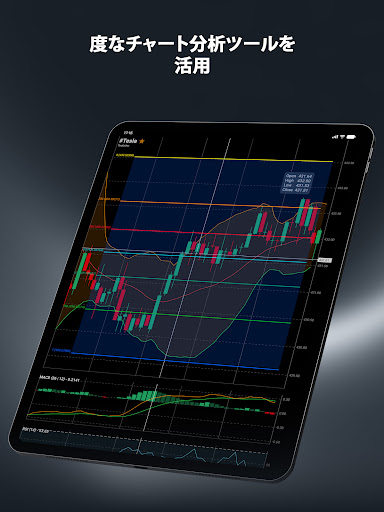

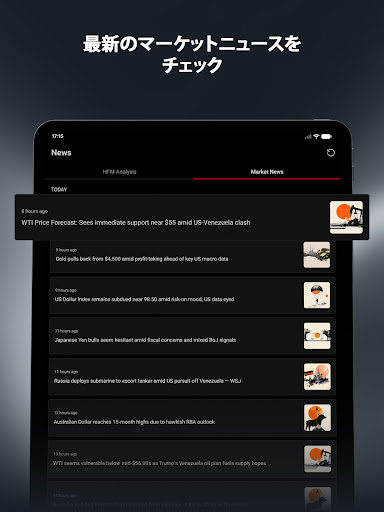

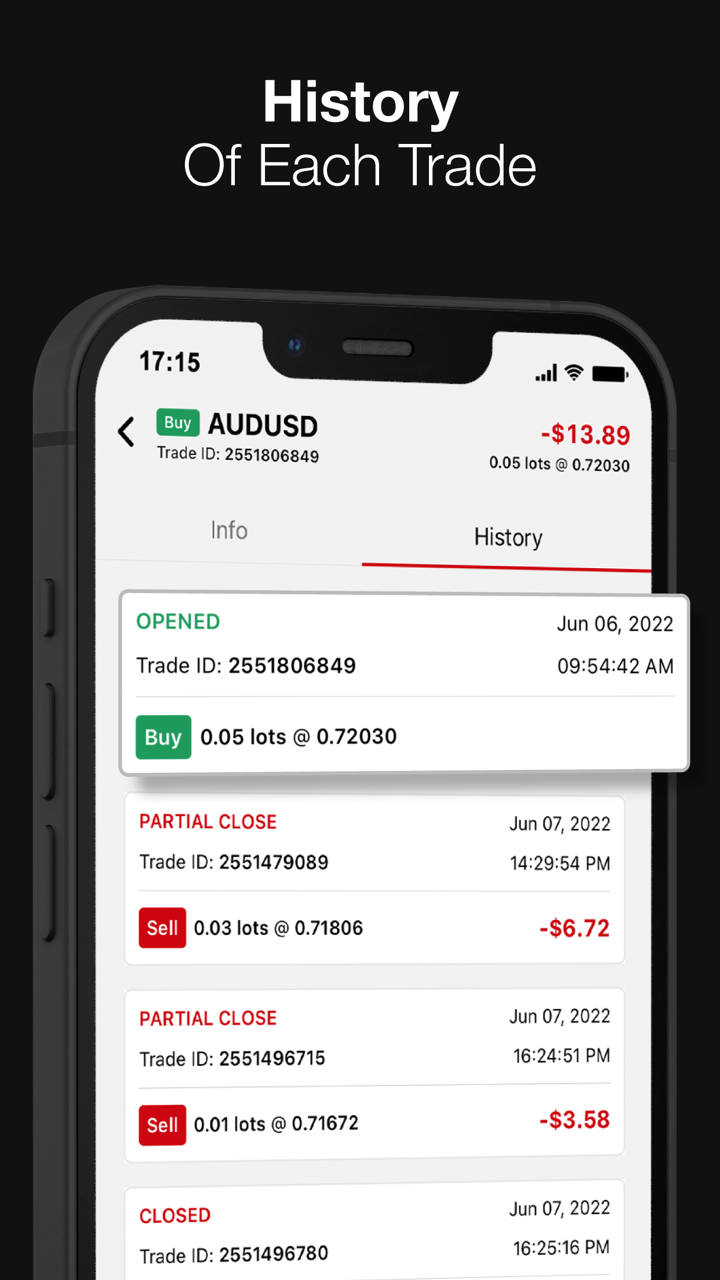

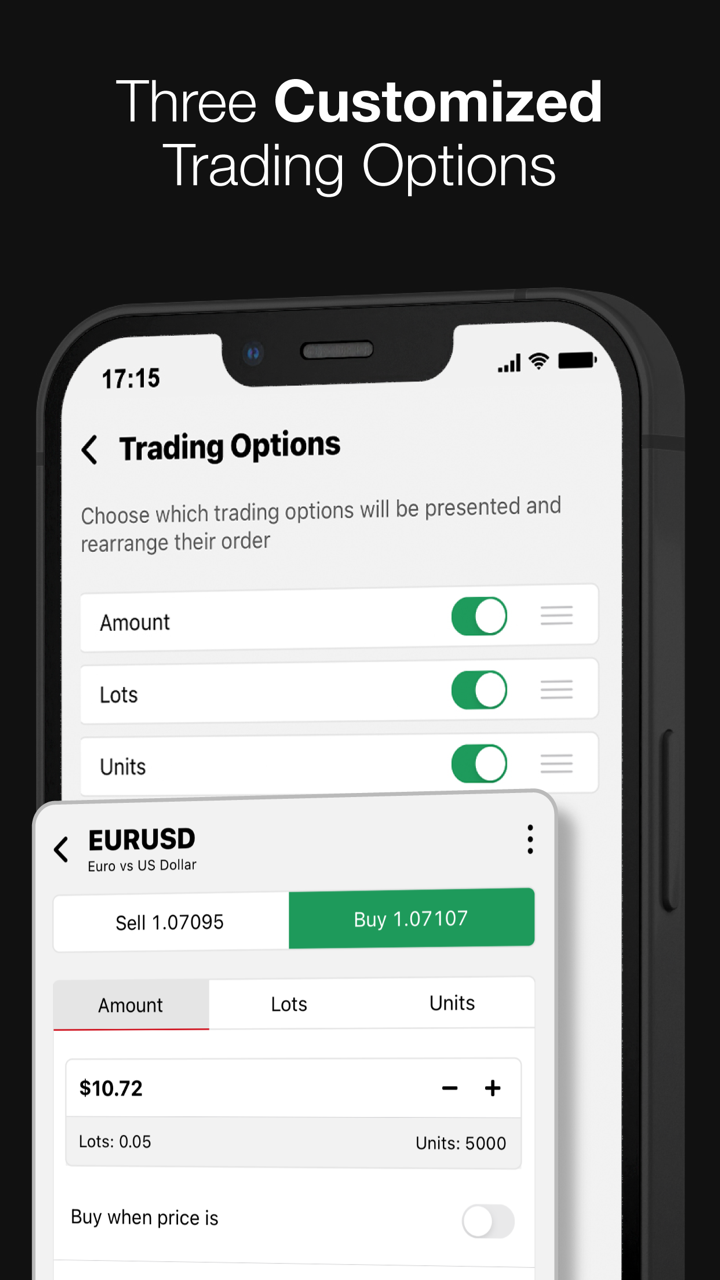

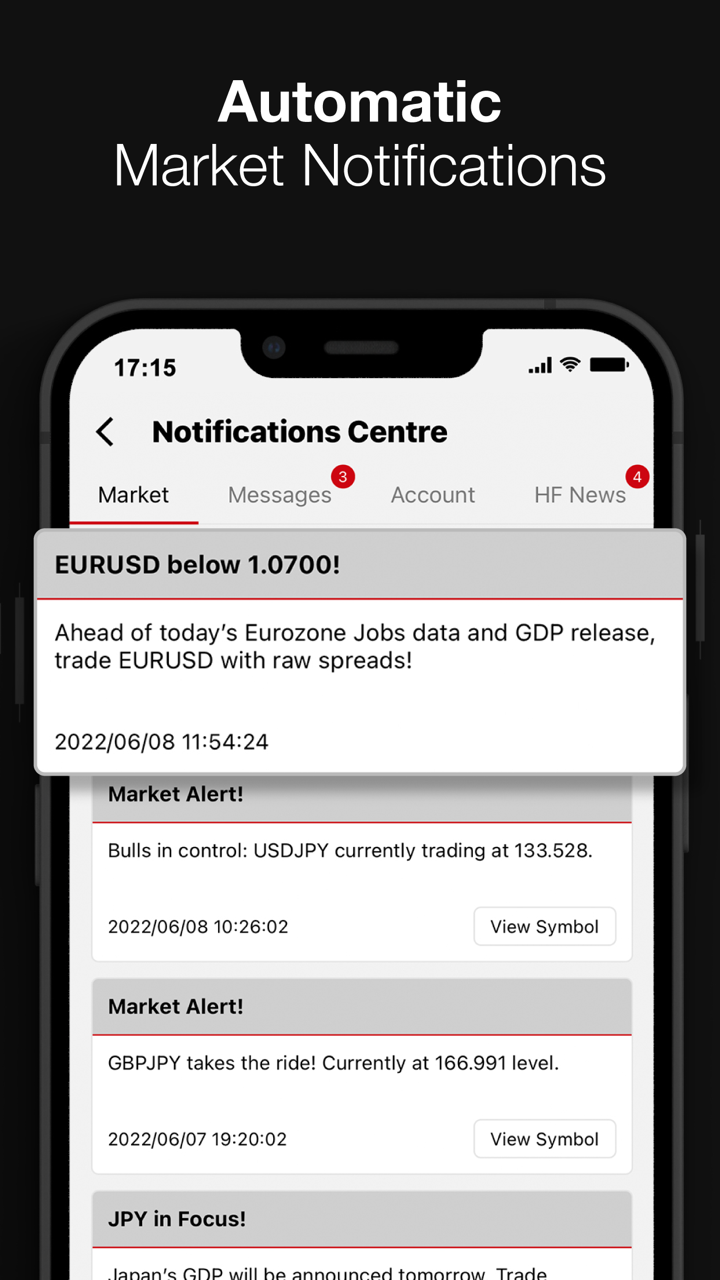

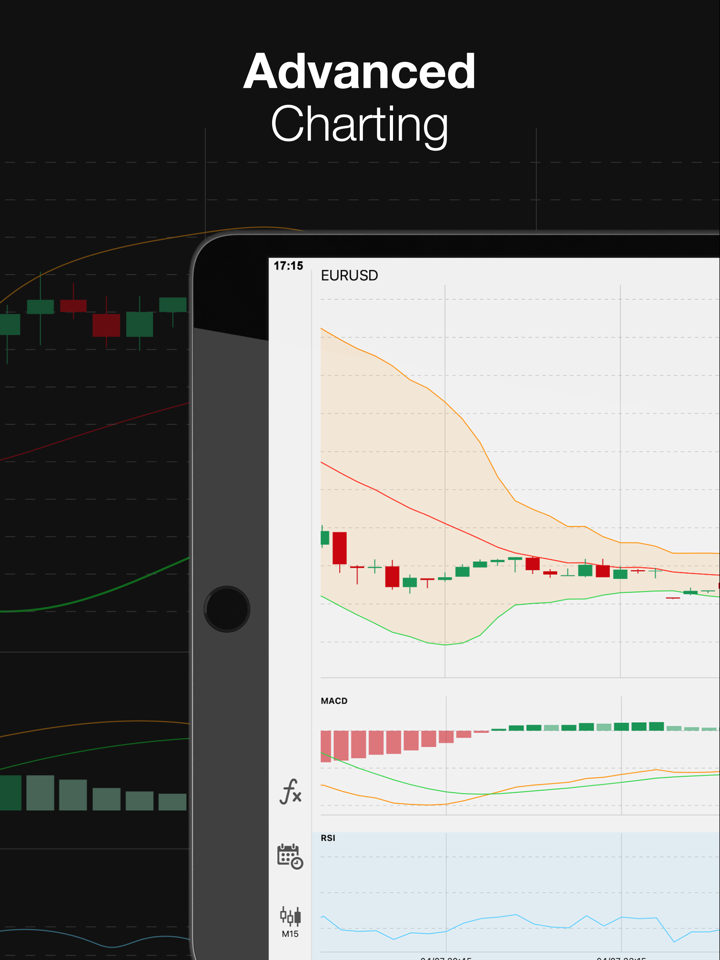

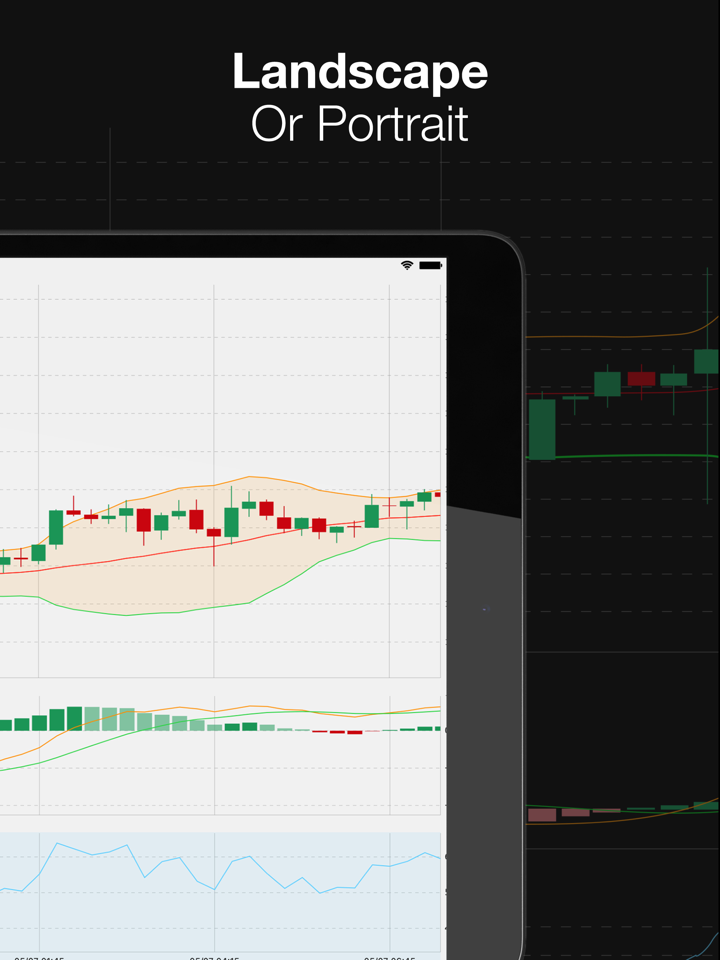

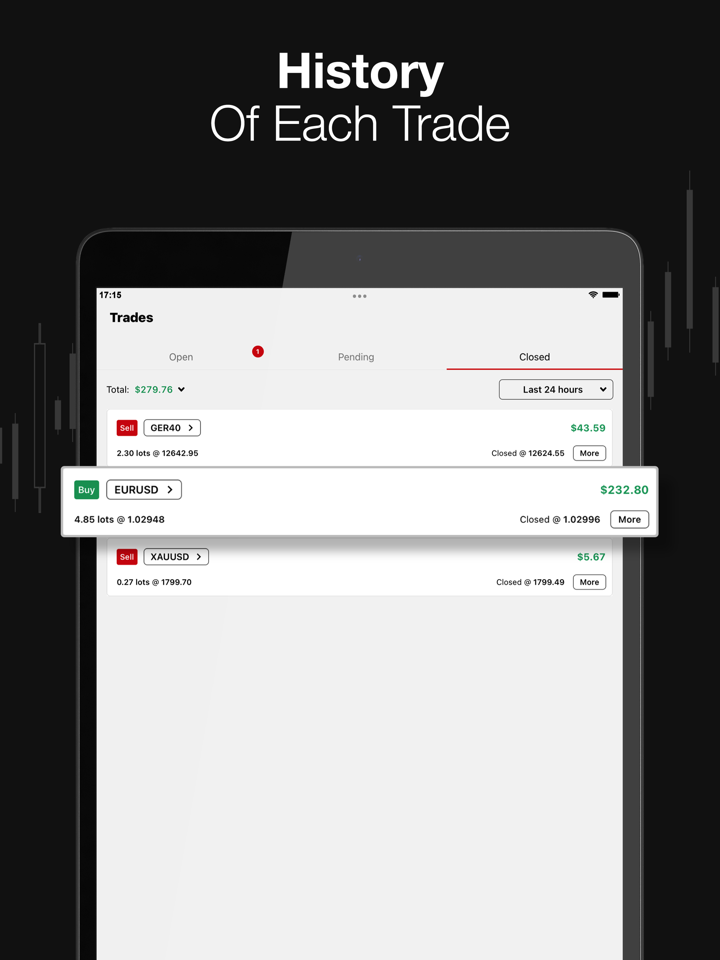

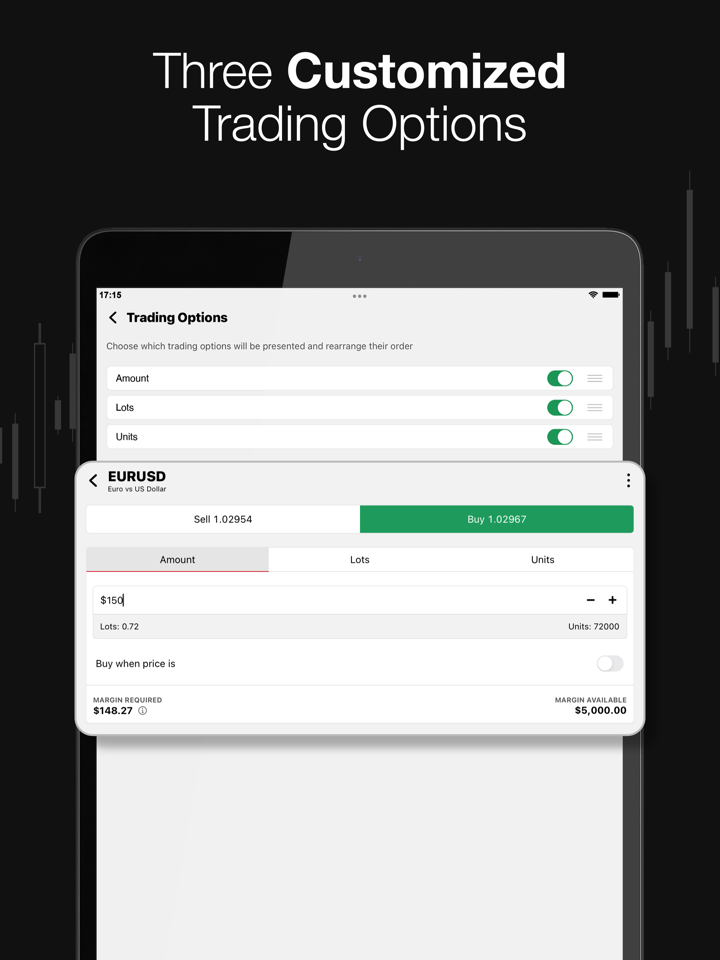

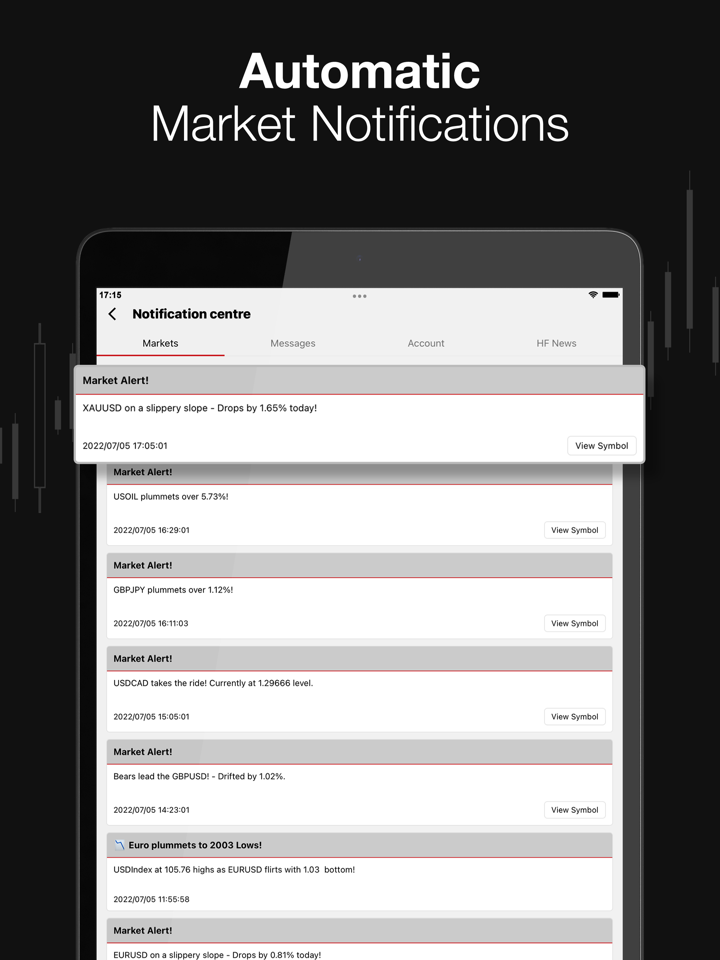

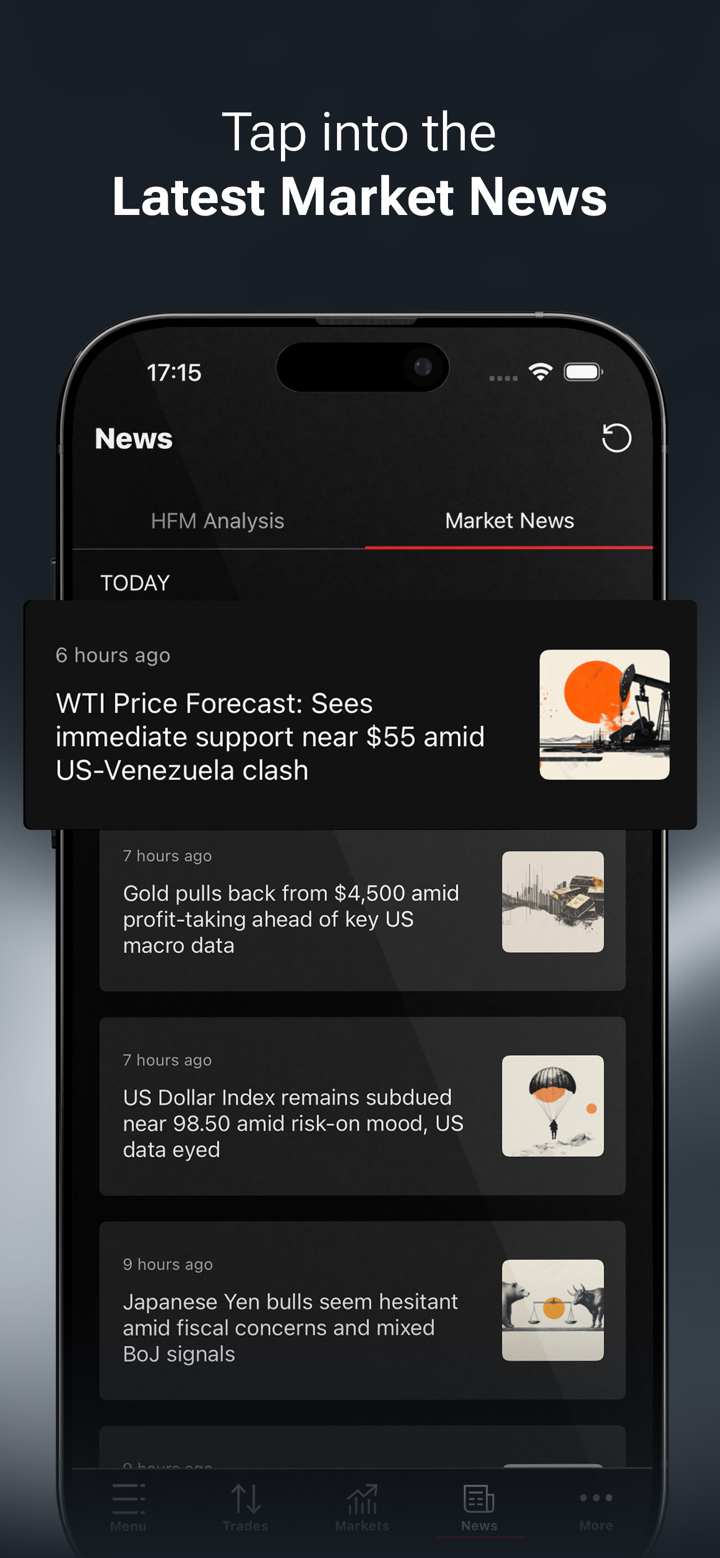

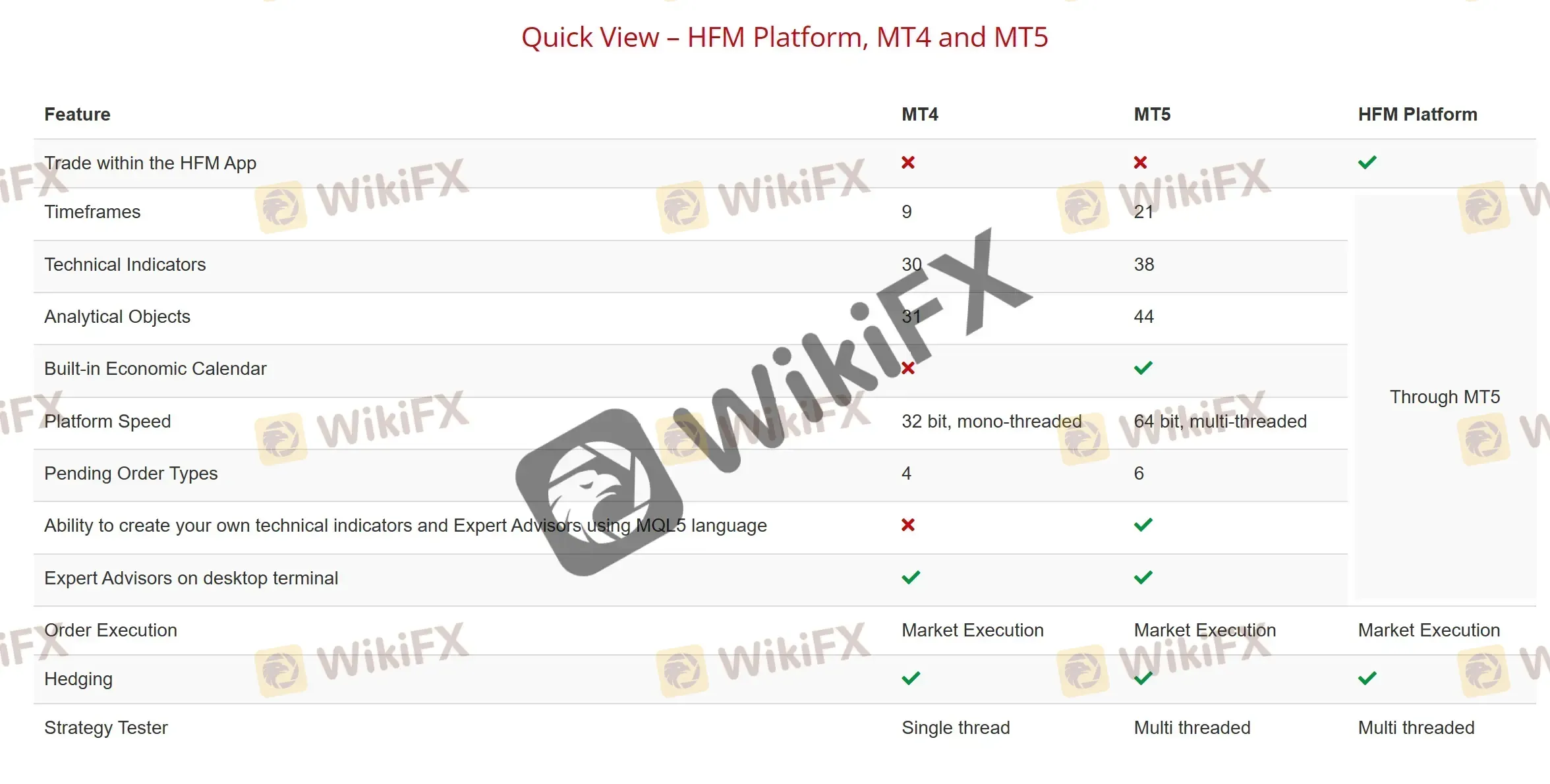

HFM offers multiple trading platforms including the popular MetaTrader4 and MetaTrader5 platforms as well as their proprietary HFM Trading App.

The MetaTrader4 and MetaTrader5 platforms are widely used in the industry and provide traders with access to a wide range of trading tools and indicators.

The HFM mobile app is relatively new but has an intuitive user interface and advanced charting features. However, it may have limited customization options and a limited selection of third-party plugins and add-ons.

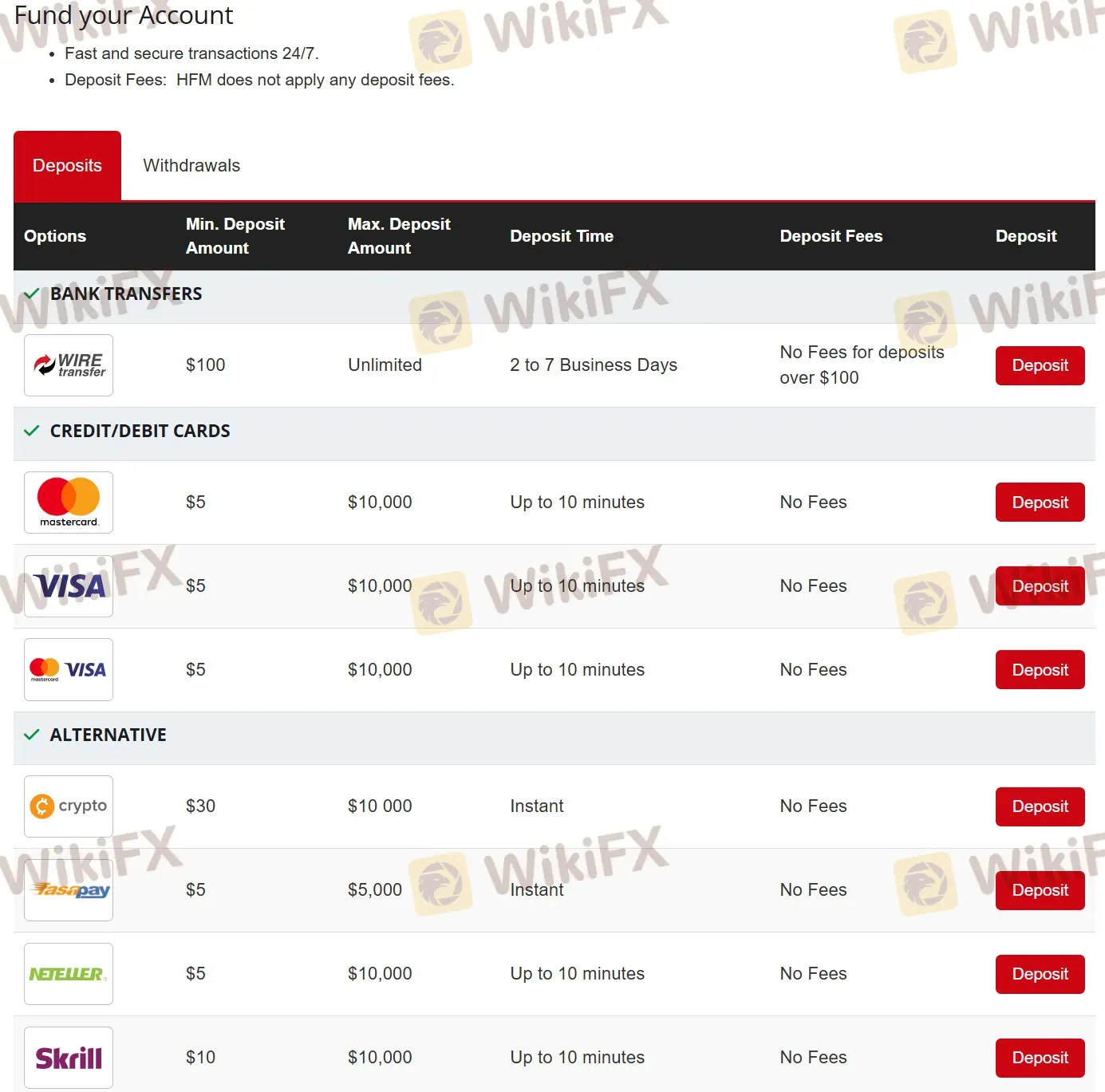

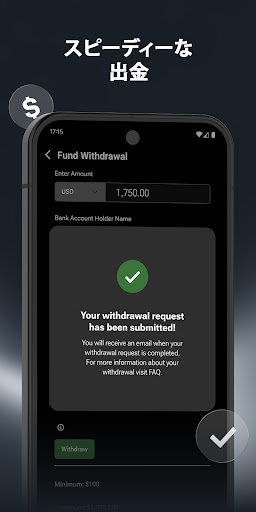

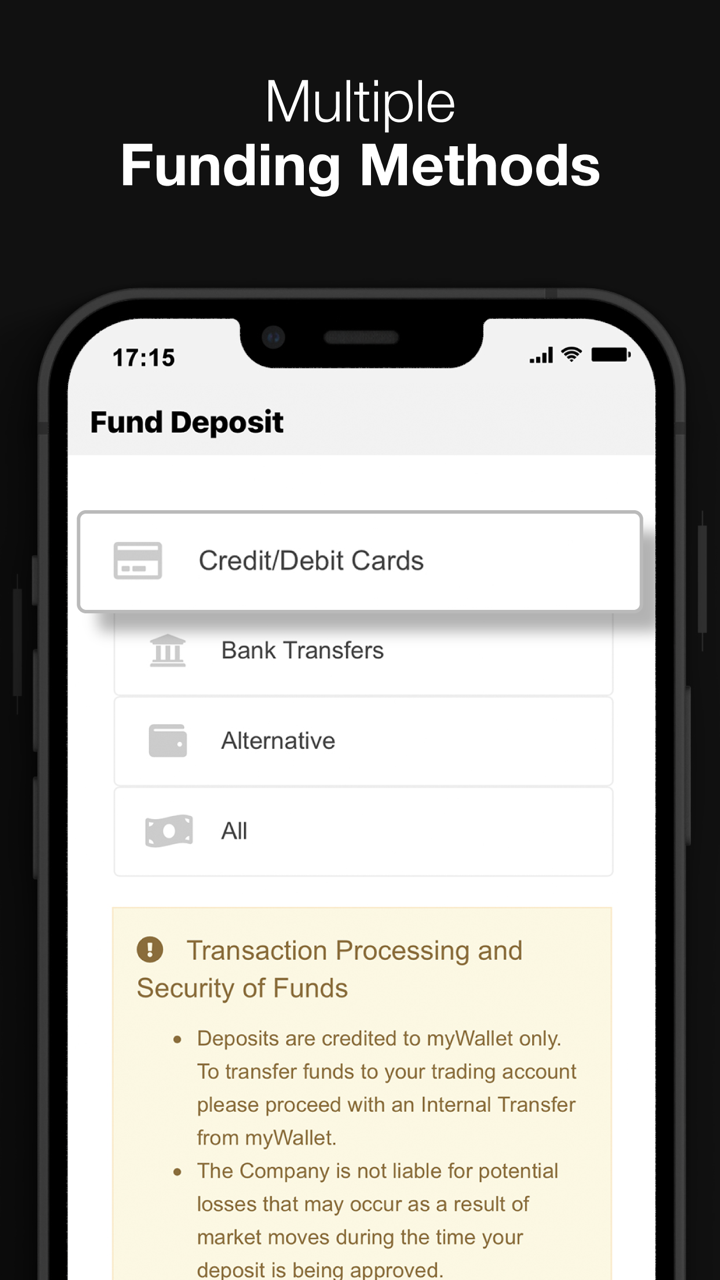

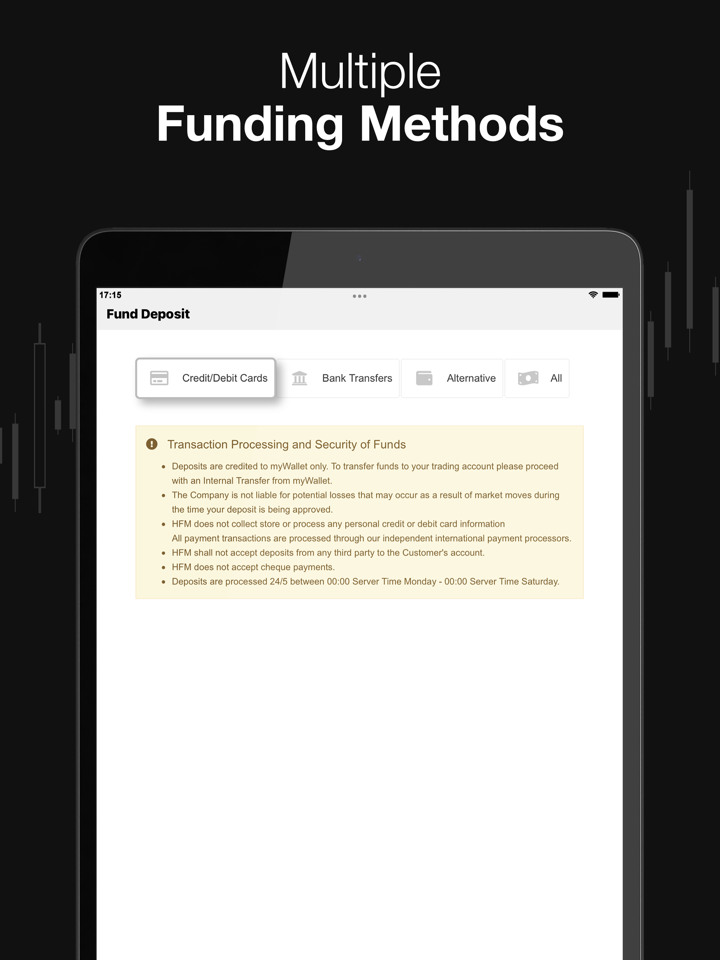

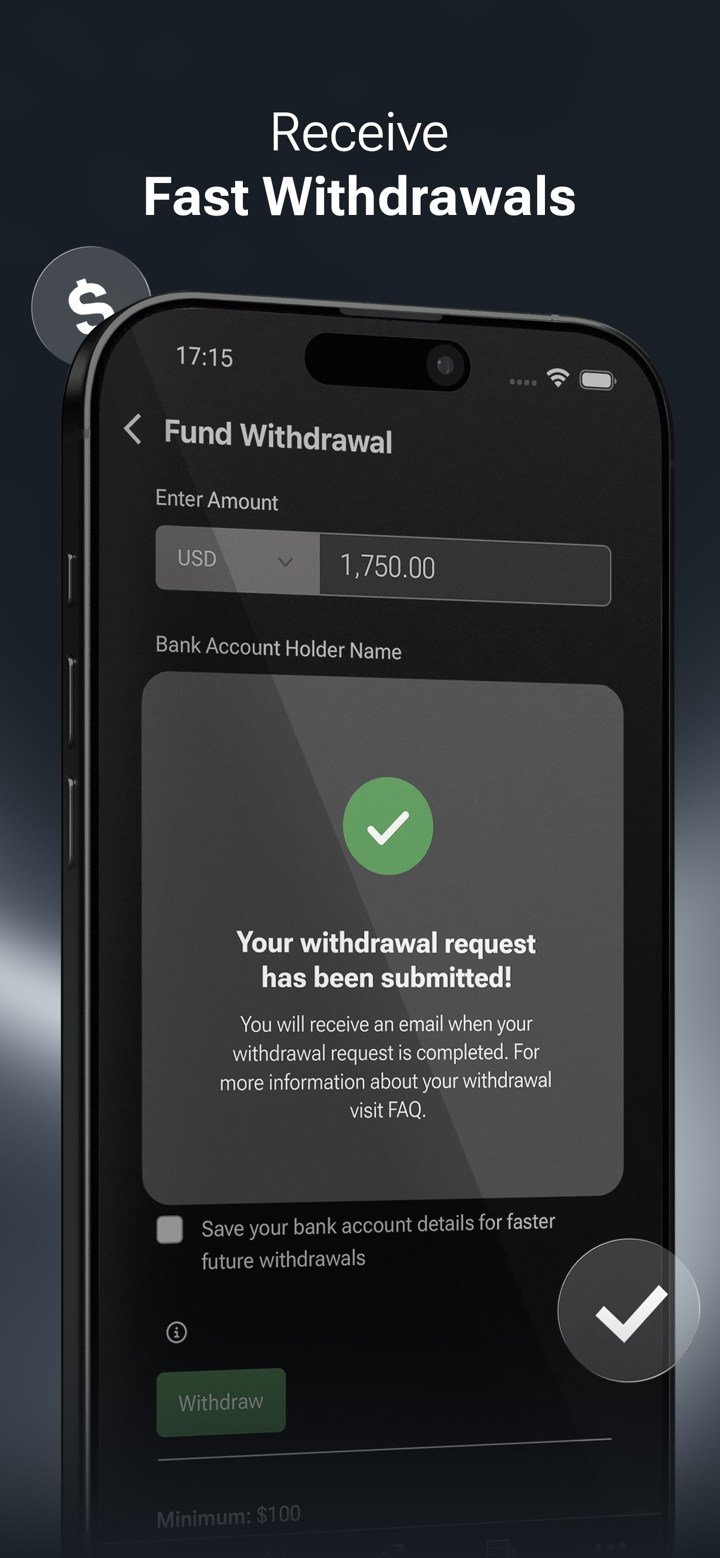

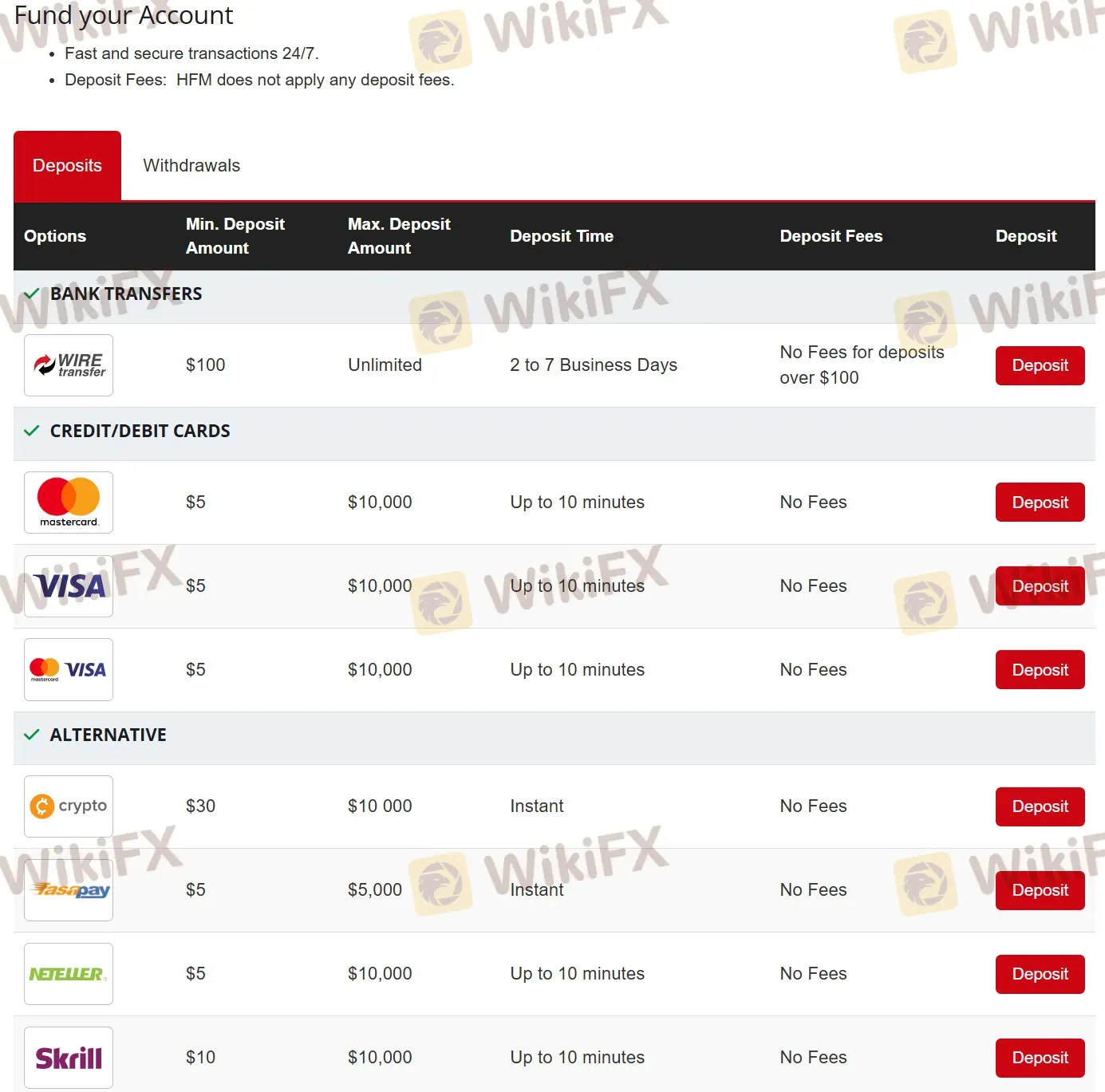

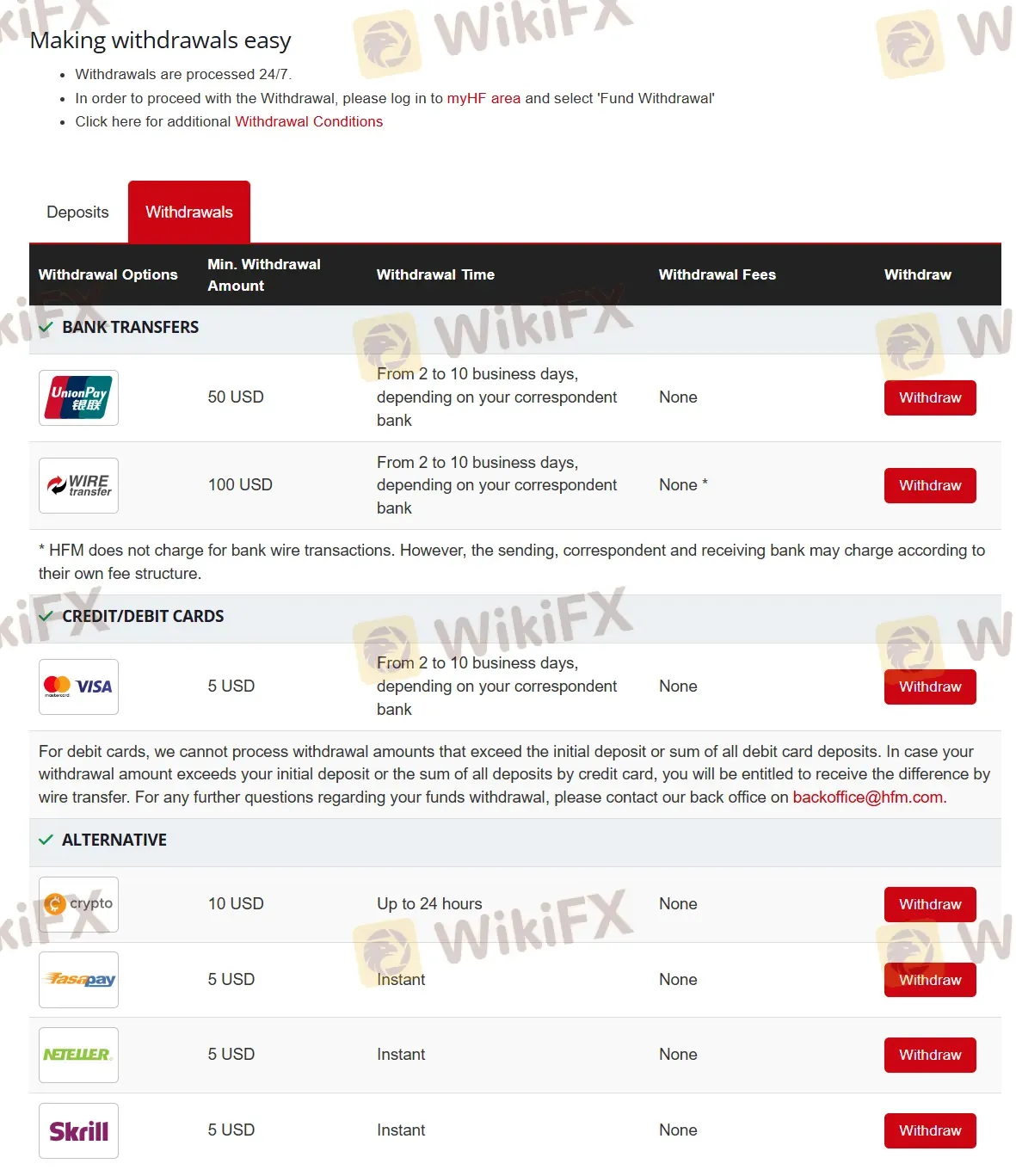

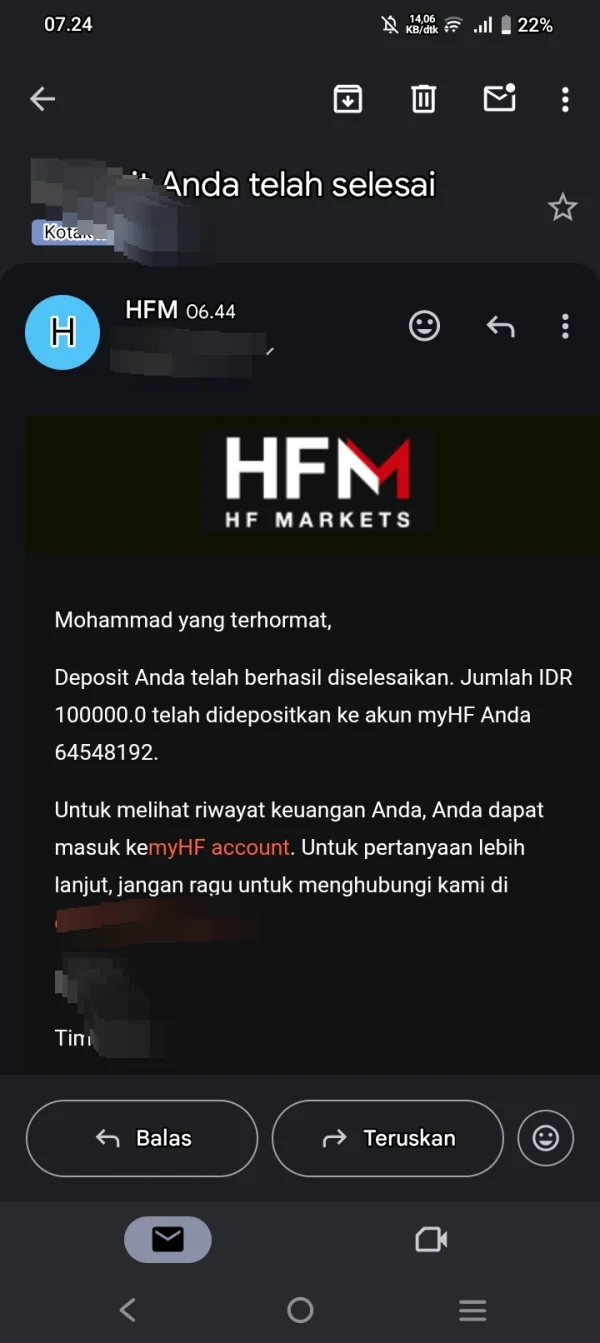

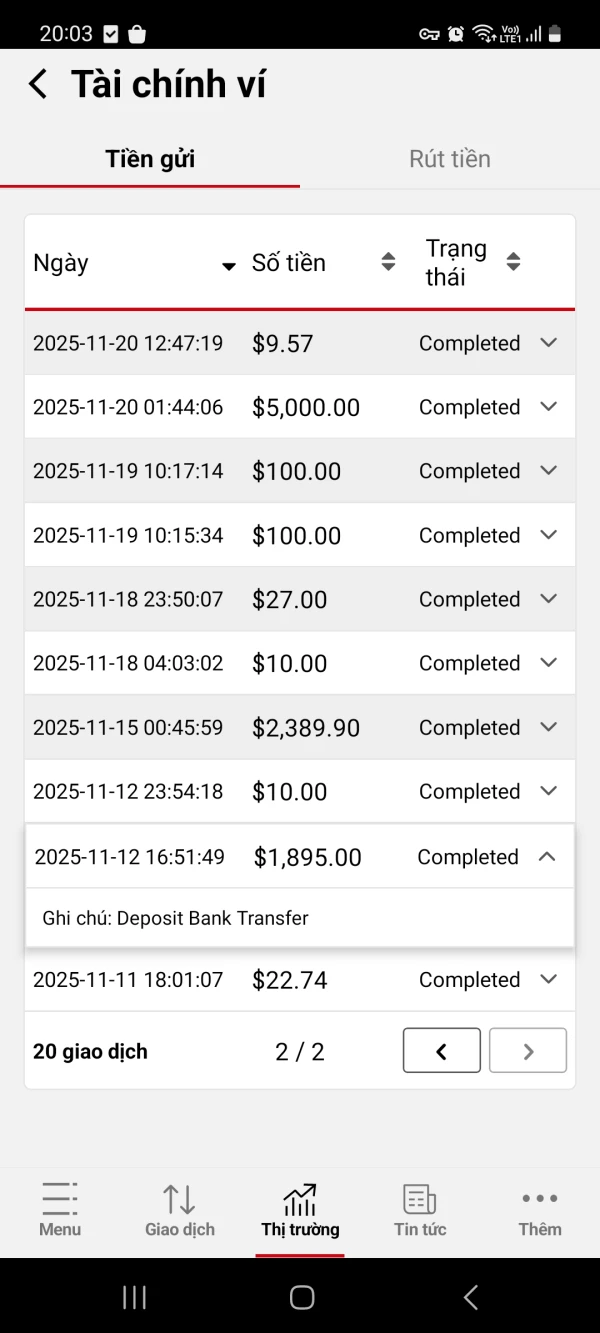

Deposits & Withdrawals

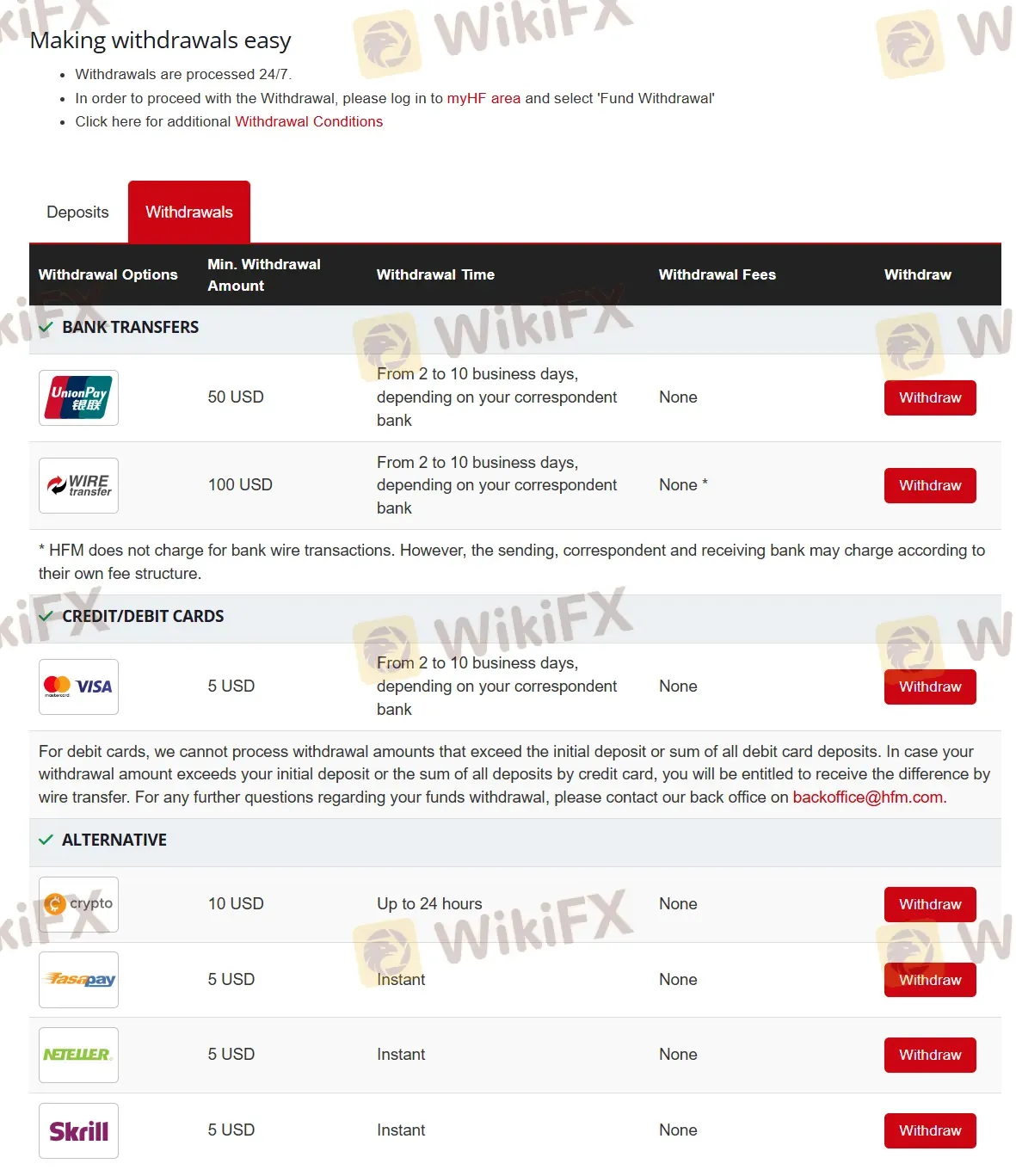

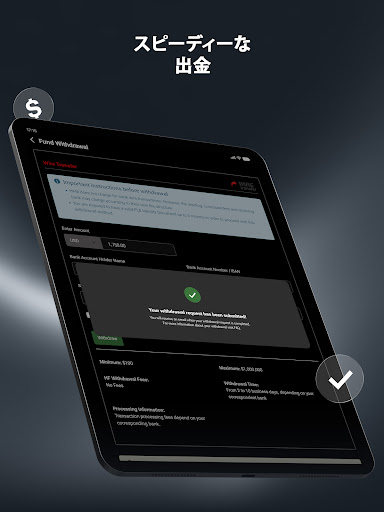

HFM indeed provides a variety of options to make deposit and withdrawal processes simple and flexible for its customers. They accept UnionPay (only withdrawal), Wire Transfer, MasterCard, Visa, Crypto, Fasapay, Neteller, Skrill.

The minimum deposit or withdrawal limit is quite low, set at $5 for most payment methods, which makes it convenient for traders of all sizes. They also ensure cost-effectiveness by not charging for most deposits and withdrawals.

More details can be found in the below screenshots:

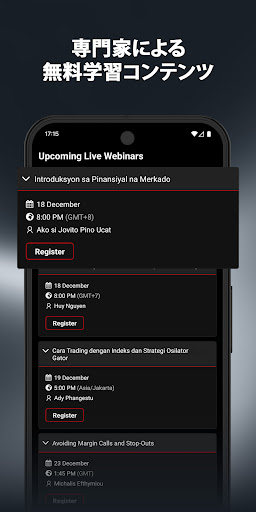

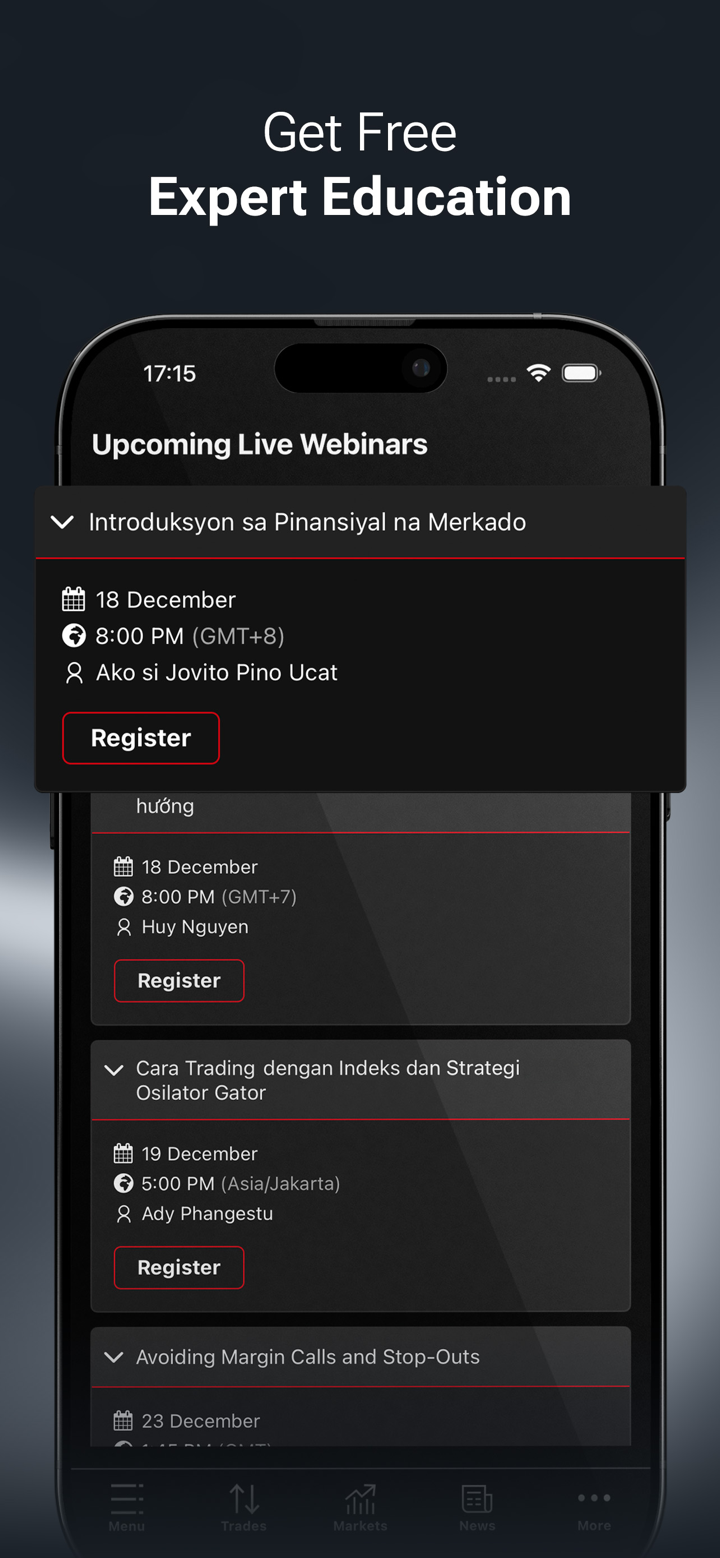

Education Resources

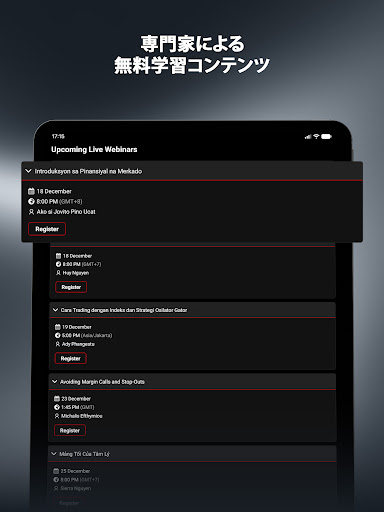

HFM is deeply committed to trader education and offers a comprehensive suite of educational resources for traders at all levels. They provide in-depth trading courses that cover a wide range of topics.

Their portfolio of educational resources also includes engaging videos that explain intricate trading concepts in an easy-to-understand format.

They hold webinars and seminars (upcoming), giving both novice and experienced traders the opportunity to learn first-hand from industry experts.

Additionally, HFM provides insightful podcasts featuring discussions on various trading topics.

In addition, HFM offers How To Videos for traders to learn about using HFM App, MT4 and MT5 platforms.

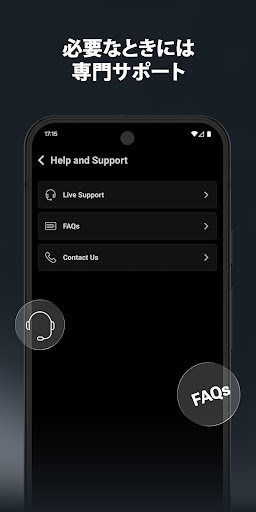

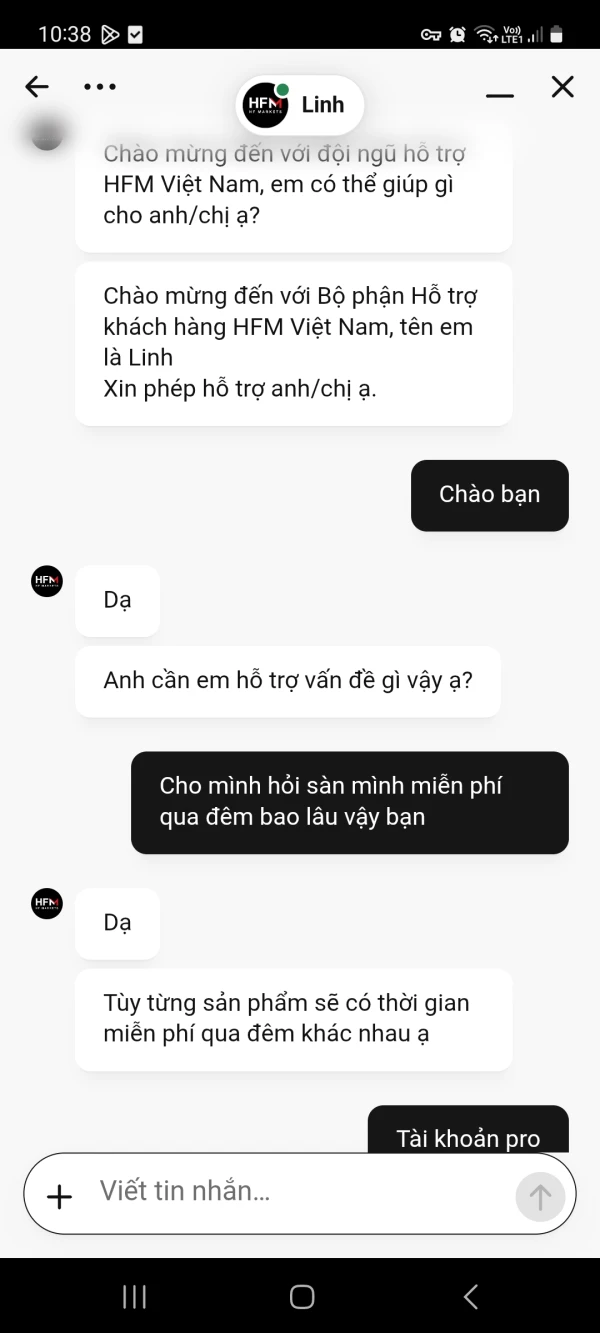

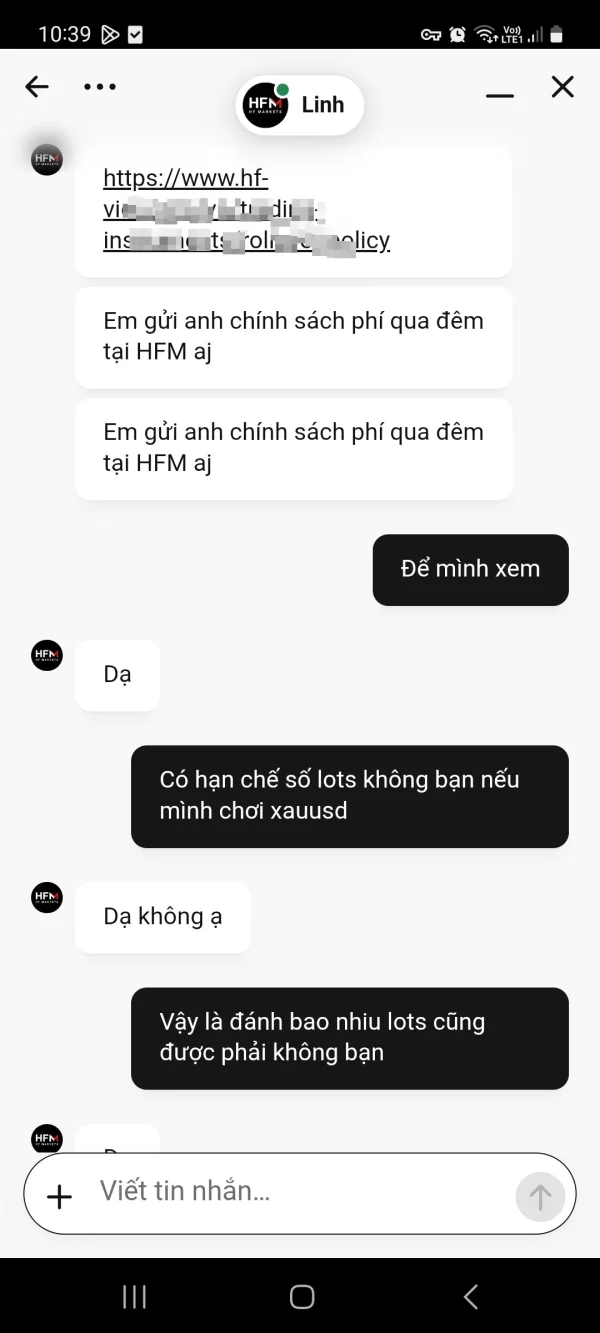

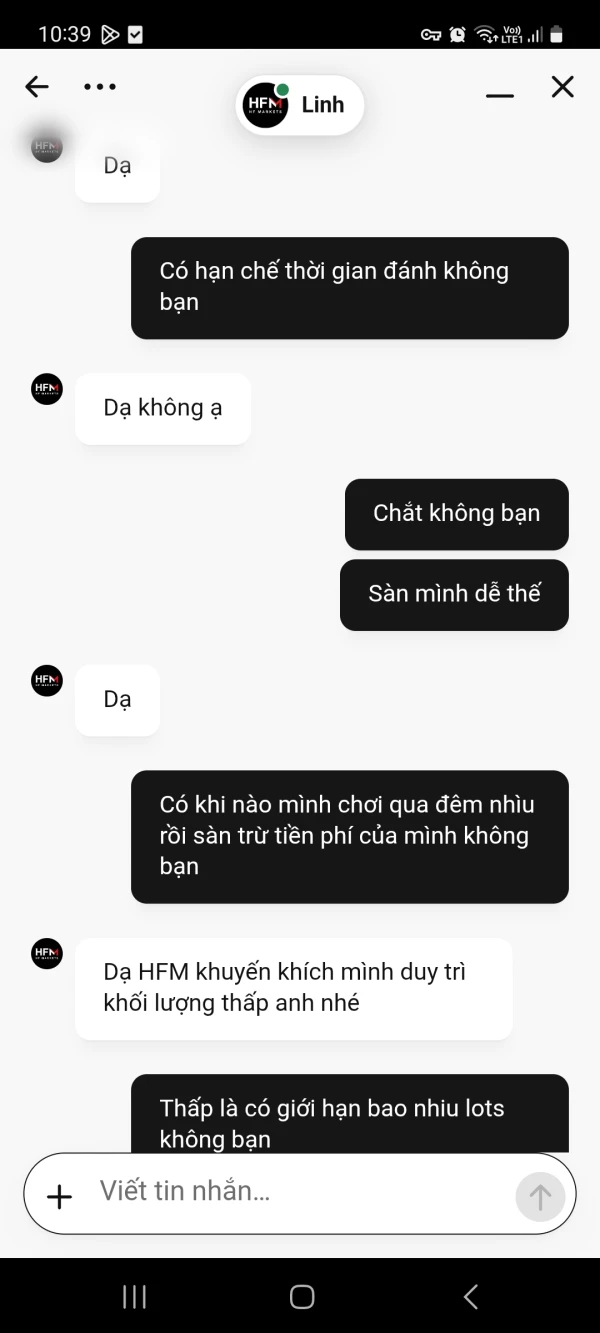

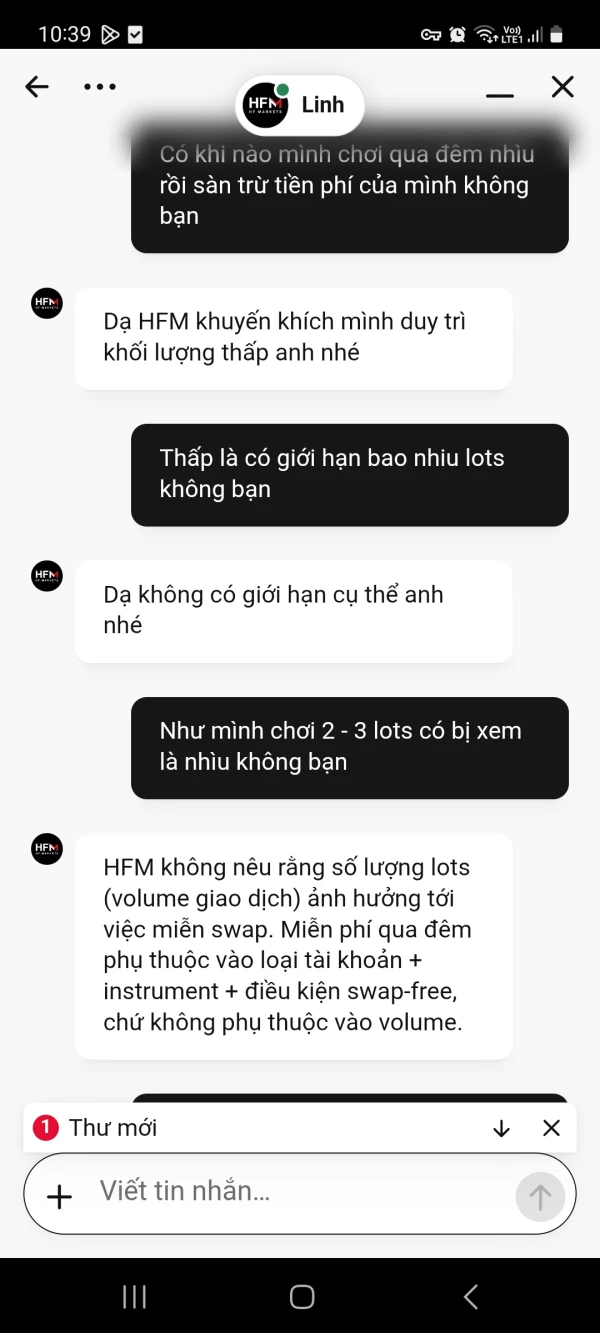

Customer Service

HFM offers multiple avenues of customer support to ensure all client queries and concerns are attended to. The live chat feature on their platform allows for real-time assistance, alongside a contact form for more comprehensive inquiries.

They can also be reached through their phone number: +44-2030978571 or via email at support@hfm.com.

For those who prefer social media interactions, they have an active presence on Facebook, Twitter, Telegram, Instagram, YouTube, and LinkedIn where they post regular updates and users can interact with them.

Lastly, for common questions, their FAQ section could be of help as it covers a range of general queries.

2025 SkyLine Malaysia

2025 SkyLine Malaysia  2025 SkyLine Thailand

2025 SkyLine Thailand

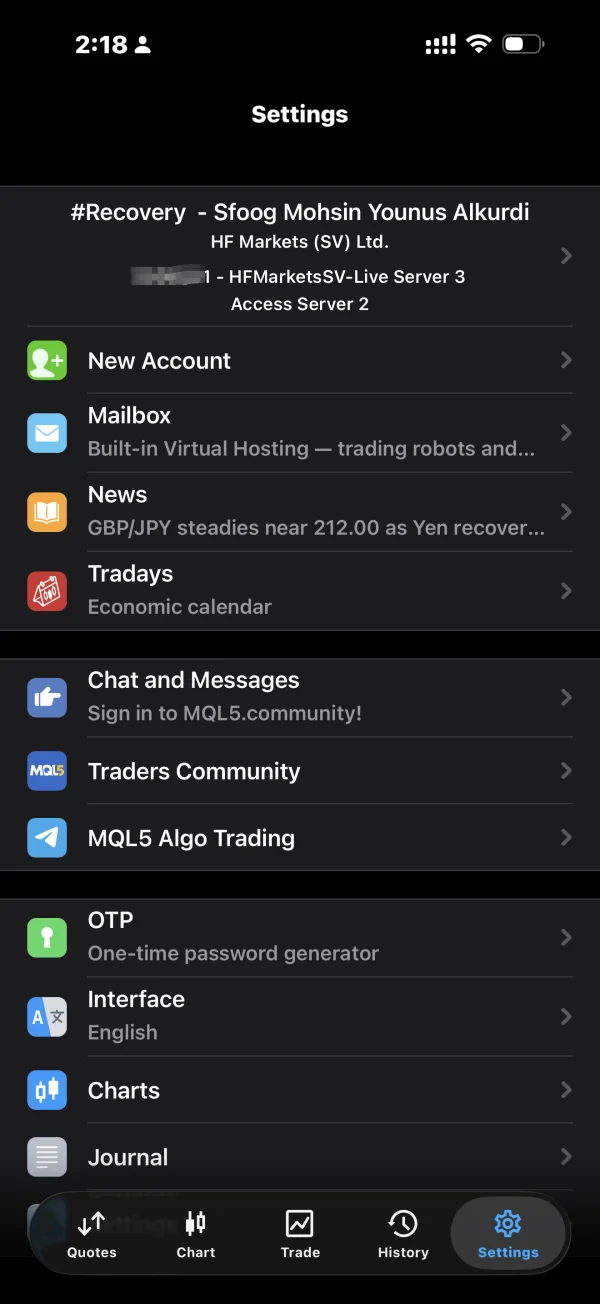

Falconiraqi

Iraq

i make my deposit today and open positions depending on bonus supercharge 100% and price go up in profit and hfm closed my position and say bonus can’t loss or make any help with account and close my position with loss

Exposure

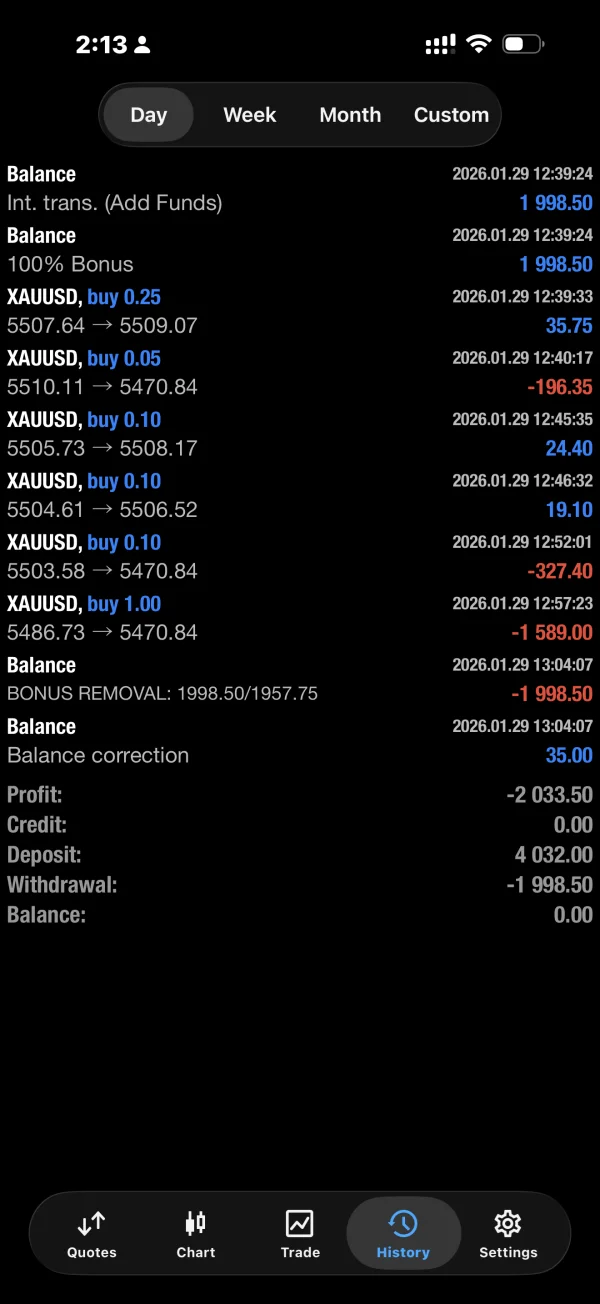

Mohammad Khoirul Fikri

Indonesia

This trader is a fraud. I wanted to open a position on MT5 but couldn't. Then I opened a position on the HFM app. I had a floating profit, but suddenly an error occurred when I wanted to take profits. Suddenly, I lost a lot of money on January 27.

Exposure

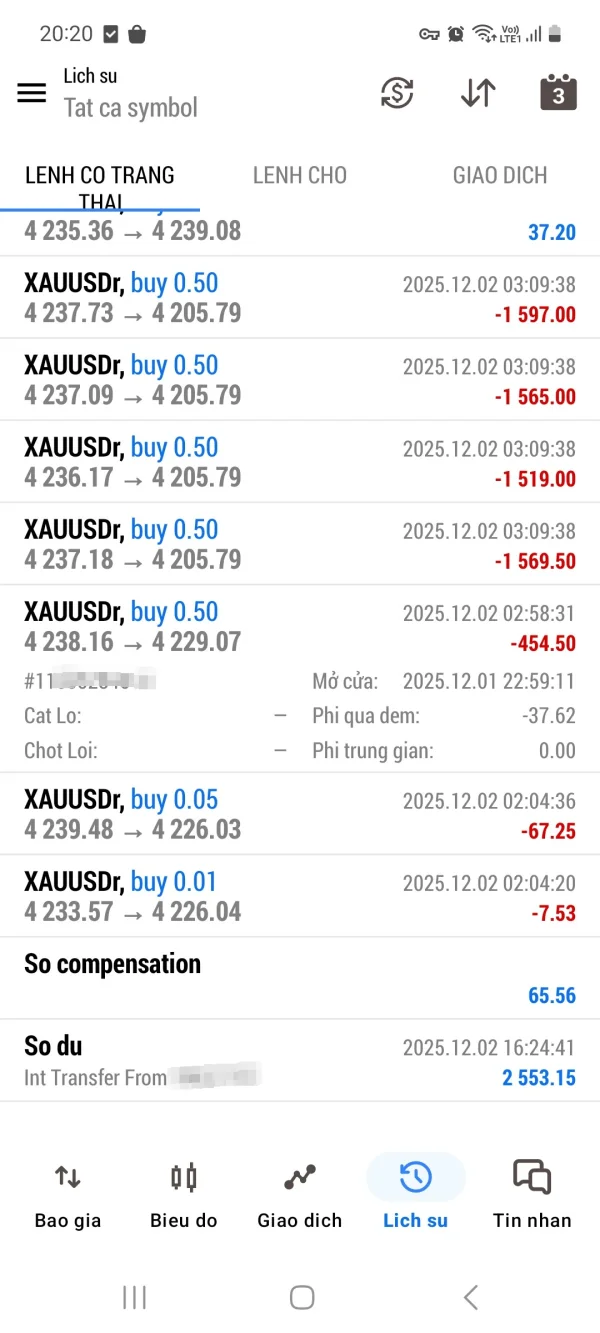

FX2284056203

Vietnam

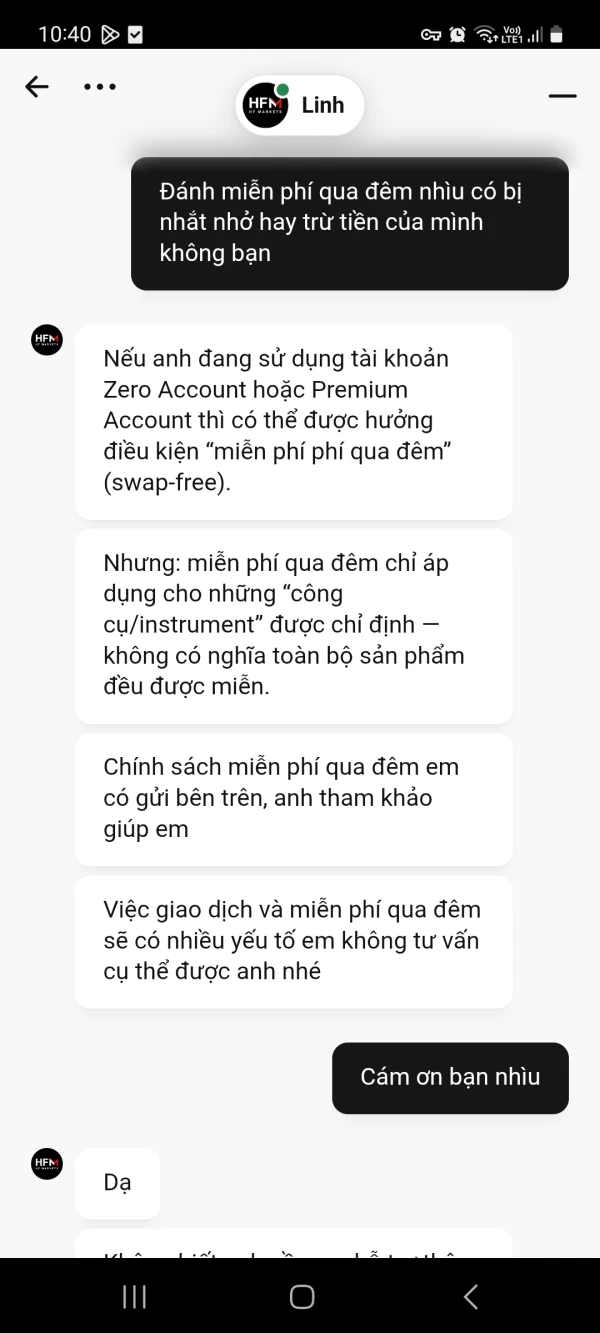

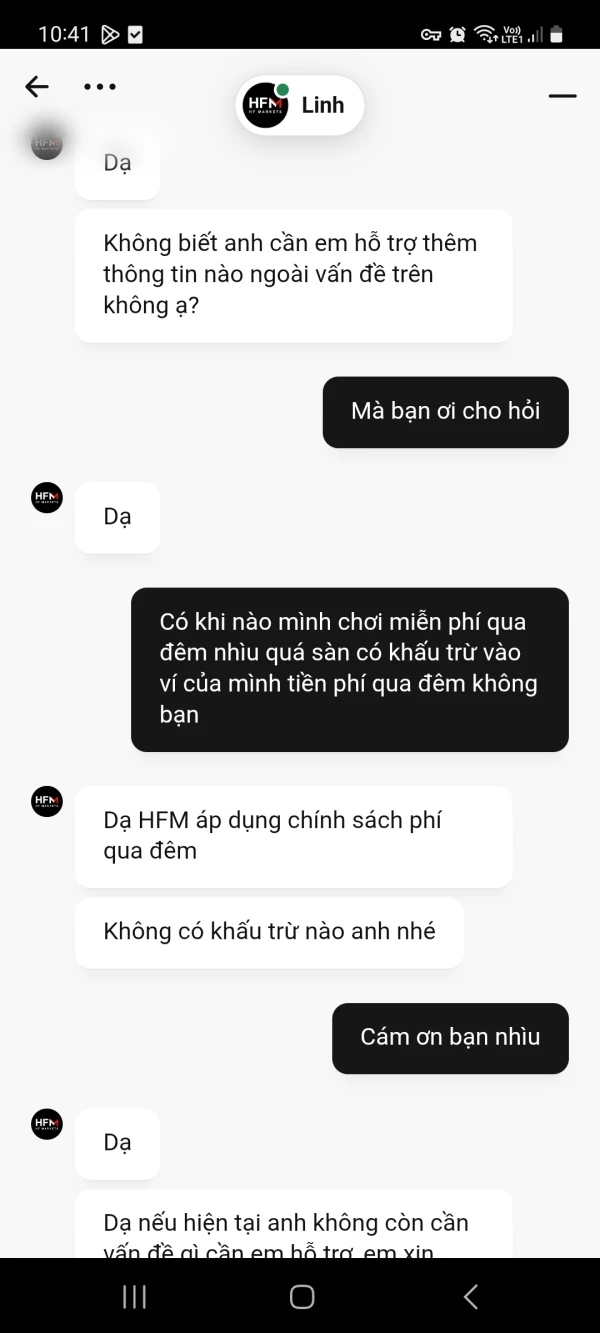

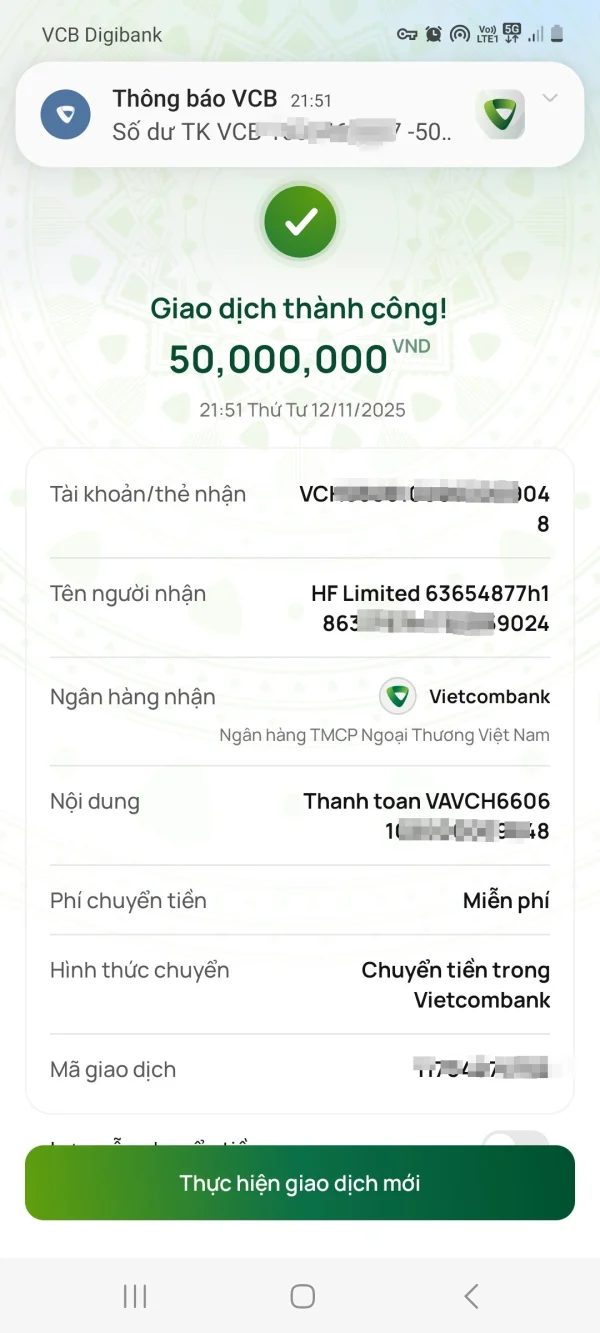

HFM has fraudulently charged me $2,553 in overnight fees. The platform offers a 45-day free overnight fee policy, but my account has not reached that period yet, and the platform has deducted $2,553 in overnight fees from my account (from the time I created the account until now) for an unjustifiable reason. The platform claims I abused the overnight fees without providing any concrete evidence. I traded normally, and I had previously asked HFM platform staff that my account was eligible for 45 days of free overnight fees and that the platform would not deduct any fees from my account. I request that HFM platform return the 2553 USD to me.

Exposure

FX3201977242

Hong Kong

It's quite good, and the slippage is also within my acceptable range.

Neutral

FX1700663048

Indonesia

I just started using it so I don't know much about this Broker, but the Spread is too big in my opinion

Neutral

黄富城

Hong Kong

New accounts can only trade with accounts that have large spreads; accounts with small spreads are not available.

Neutral

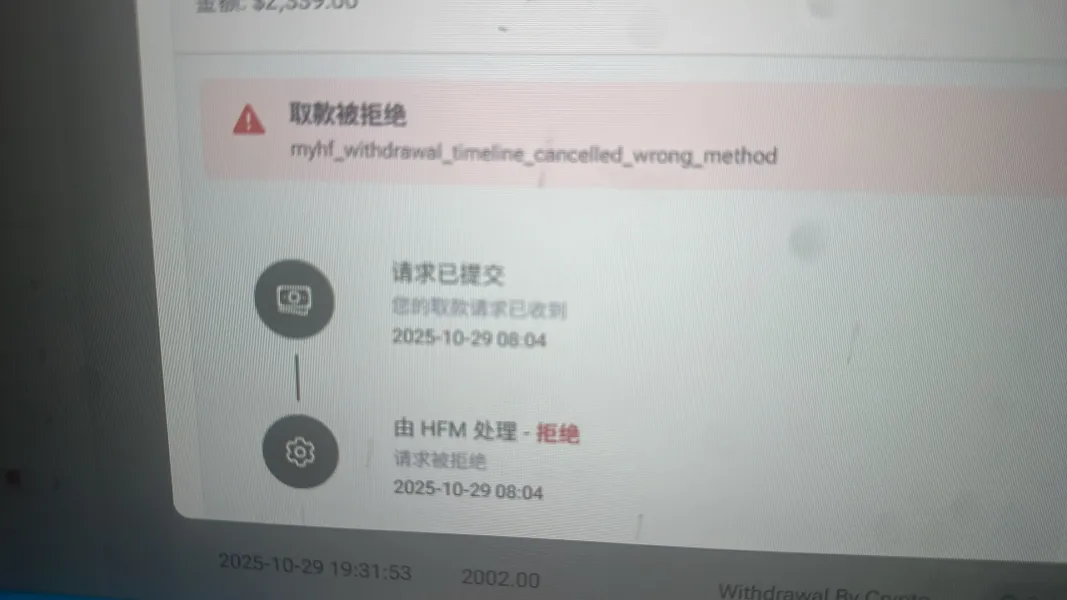

年少无知

Hong Kong

The black platform directly rejected my withdrawal request, and I can't get my money out. I'm so anxious. The evidence is shown in the picture below.

Exposure

hai tran

Vietnam

The platform offers high leverage, fast order execution. Deposits and withdrawals are quick. High security, low deposit/withdrawal spread. Support is enthusiastic. However, leverage is reduced during news events.

Positive

Elgi Efriyan

Indonesia

I can't log in at all. What about the balance that's still in my account? The link is broken.

Exposure

LAM SAU FONG

Malaysia

I was trading gold futures at a financial investment center in Malaysia called HFMARKET under the name of a company regulated by the UK Financial Conduct Authority (FCA). The incident occurred on July 17th (trading platform time: 7:36 AM), when the HFM MT5 trading platform forcibly liquidated my position. The liquidation price did not match the actual market price, and the liquidation order recorded in the trading platform log did not correspond with the liquidation time. The company failed to explain the discrepancy between the liquidation price and actual market data. For simultaneously liquidated trades, the liquidation prices differed by 100 pips: - Buy order: Price 3400, but liquidated at 3249 - Sell order: Price 3254, but liquidated at 3427 The day's market high was 3352.86, and the low was 3309.45. I provided evidence and demanded the company properly resolve this matter, but they failed to offer a satisfactory explanation. An unreasonable 100-point discrepancy appeared in the trading spread. Furthermore, the photos I submitted also show significant discrepancies: At 4:36, I performed no actions, yet the spread and price differed by 100 points, with the platform's forced liquidation occurring at this exact time of 4:36. At 7:36, the spread and price records do not match. Backend records show no orders at 7:36, yet the forced liquidation time is recorded as 7:36 in the photo. I immediately emailed HFMARKETS to lodge a complaint. The company requested all supporting evidence and photos, which I have consistently provided. However, the company has yet to offer any reasonable response and remains silent.

Exposure

FX3985520517

Chile

HF Markets approved a withdrawal of USD 22,000 and confirmed it by email. Later, before any blockchain transaction was completed, the withdrawal was reversed and the funds were internally removed after an internal review. All trades were manual on MT5, the profits were credited to the account, and no trades were invalidated at the time of execution.

Exposure

FX1565983808

Thailand

Deposits and withdrawals are convenient and fast. There are bonuses, 100% and 20% deposit bonuses. I've been playing for many years and haven't encountered any problems. A minor issue is with crypto deposits—you have to take a photo, send it, and request permission for crypto deposits and withdrawals before you can proceed. Everything else is great. The spreads are acceptable, and there are multiple account options to choose from, depending on your trading preferences and goals.

Positive

FX3094007385

Indonesia

A deposit via Dana on August 28, 2025, at 6:03 p.m. did not enter the hfm e-wallet even though the transfer was successful. I have contacted hfm support many times, but there has been no confirmation as to when the deposit will enter the e-wallet.

Exposure

movinon

Tajikistan

Unable to Withdraw, I was able to a portion but the amount isn't in my bank account! It's been 6 hours. This was my second attempt! The first one didn't process because I had to withdraw the amount of I deposited through Bank Card had to be withdrawn the same way! I did right away as they responded to my email like 5 hours after. Now the money I withdrawn is not being deposited to my ban account even though it says, transaction processed by payment provider. In the email it says: refunded by EcommPay. I don't even know what EcommPay is! How can I contact them and understand what's the withdrawal status! HFM isn't responding and I need this money asap! This is making me stuck in a bad situation! :(

Exposure

zeynap006

Turkey

I deposited $3,000 and opened small trades on GBP/USD and EUR/USD. As soon as I was over $220 in profit, the manipulation started: Massive slippage near key levels Fake spikes on MT4 not seen on TradingView Delayed execution and sudden spread widening Lag only when in profit – highly suspicious News candles were rigged (see screenshots) Support gave copy-paste responses, denied everything

Exposure

きのこまん

Japan

The spreads are tight, deposits and withdrawals are stable, making it a reliable broker. I also enjoy participating in their occasional trading competitions. Their customer support is excellent as well.

Positive

FX5137562772

Japan

The appeal of micro accounts, which can be used for practice, lies in the fact that they allow you to operate with small amounts of real money rather than virtual funds like demo accounts. They are particularly convenient for the verification stage before committing larger funds or when you want to practice trading while minimizing risk. Since you can experience the actual market dynamics with small amounts, they are helpful for getting a feel for trading. However, the trading environment tends to have slightly wider spreads, making them somewhat unsuitable for short-term trading. On the other hand, execution is stable with minimal slippage, which is a significant advantage as it allows for worry-free trading.

Neutral

sndbb

India

I have noticed chart descripanses when compared to trading view, most time charts in HFM expecially in gold, price moves more faster as if deliberately manipulated.Causing me financial losses

Exposure

bsbsb227

India

Honestly never thought i will face issue to withdraw my funds and they will block my wallet they keep rejecting it even i have talked to them with customer support the and they keep the same words i even wrote emails to them many time with providing all the proofs and still honestly very disappointing response

Exposure

pakxbbs

India

My $100 withdrawal from HF Markets (HFM) was a disaster. Despite their website claiming "no fees," I received only $52 via wire transfer. This is outright robbery. The hidden charges, combined with their notoriously high spreads, make trading with them a financially draining experience, leaving traders with far less than they are owed.

Exposure

hdbdb3124

India

Once you profit with HF Markets (HFM), they'll scam you. They close your MT4 account, reject all withdrawal requests, and lock you out of your client portal. They'll stop at nothing to prevent you from getting your money, making it impossible to withdraw any funds.

Exposure

hdjdb

India

if you deposited even one dollar through a different payment method and then win thousands, and decide to withdraw everything, they will reject the payment just because that one dollar came from a different deposit method, even if all the account details match the account holder’s name. This is not to mention the long delays in approving or rejecting a withdrawal.

Exposure

gajsvs

India

Don't use UPI to deposit money with this broker. They take the payment through a merchant's UPI ID, then deny receiving the funds, even when you provide proof. I've been in contact with their deposit team for a week, and despite providing all the necessary documents and bank statements, they keep asking for the same information.

Exposure