Forex trading in Saudi Arabia is active and relatively popular, though operations remain smaller than global hubs. In Saudi Arabia,the forex market, is regulated by the Saudi Arabian Central Bank, which issues warnings about forex risks but otherwise takes a relatively hands-off regulatory approach compared to Western counterparts. Providing that multitude of local and international forex brokers operating within this country, traders often face a daunting task of finding truly reliable ones. Here we have compiled with the best forex broker list in Saudi Arabia for your reference to give you more confidence in trading.

8 Best Forex Brokers in Saudi Arabia

Over 9000 currency, stocks, ETFs, indices, and commodities are available.

Advanced trading tools allow you to analyze markets and execute trades with confidence.

Advanced platforms including MT4 and MT5, in addition to its proprietary app.

Rich educational resources are provided, with support available 24/7 in over 30 languages.

Offering negative balance protection to prevent consumers from losing more than they deposit .

Guaranteed stop loss orders, which protect the trader from market gap risk.

more

Comparison of the Best Forex Brokers in Saudi Arabia

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Brokers in Saudi Arabia Overall

| Brokers | Logo | Why are they the Best Forex Brokers in Saudi Arabia? |

| FOREX.com |  |

✅ Long established brokerage regulated by top-tier authorities, with good operation globally. ✅For Islamic investors they provide access to over 80 currency pairs and CFDs markets with swap-free compliance conforming to religious standards. ✅Support is available 24/5 in both Arabic and English via multiple contact channels. |

| XM |  |

✅Glovally regulated, including DFSA in UAE, knowing traders within this area better. ✅Offering Islamic swap-free accounts fully compliant with Sharia law, free from overnight interest rate charges. ✅Account managers fluent in Arabic guide clients on halal trading opportunities and applying ethical wealth management strategies. |

| Plus500 |  |

✅Heavily regulated, giving traders in Saudi Arabia a sense of safety. ✅Islamic account ensures no trades forbidden under Shariah, doesn't charge swaps on overnight positions. ✅Web/app platforms attract Shariah compliant investors with rich yet easy-to-use charting tools. |

| FXTM |  |

✅A respected and well-established broker with excellent operation worldwide. ✅Caters to Islamic investors with available swap-free account options fully compliant with Shariah principles. ✅Advantage accounts offers ultra competitive spreads from 0.0 pips on EUR/USD pair amid fast execution. |

| Capital.com |  |

✅Heavily and globally regulated, with good operation worldwide. ✅User-friendly proprietary app and web platforms make trading more intuitive. ✅Offering Islamic swap-free accounts that waive overnight swaps in adherence to Sharia laws. |

| OANDA |  |

✅Internationally regulated brokers are also authorized to serve clients in Saudi Arabia according to Shariah principles. ✅Swap-free Islamic accounts available across all major instruments. ✅ No requotes ensured for transparent halal trades. |

| XTB |  |

✅Officially authorized to operate in Saudi Arabia with local financial regulations. ✅For clients in Saudi Arabia, XTB supports convenient and secure funding in local currency. ✅xStation platform delivers advanced charting capabilities, over 150 technical indicators. |

| Moneta Markets |  |

✅Based regionally with Islamic account offerings conforming to religious customs. ✅Zero commission and market leading spreads from 0.0 pips amid Sharia compliant execution. ✅MT5 platform supports automated trading for those seeking Halal investment solutions only. |

FOREX.com

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, FCA, CYSEC, FSA

Best for active traders, low-cost trading

FOREX.com is a reputable online forex and CFD broker based in the United States. Established in 2001, it has built a strong reputation in the industry. This broker offers a diverse selection of trading instruments, such as forex, commodities, and indices, to meet the needs of both individual and institutional traders. One of the standout features of this platform is its user-friendly and versatile trading interface. Traders can choose between the popular MetaTrader 5 (MT4) platform, tradingview or the proprietary web-based platform. These options offer a robust and intuitive experience for executing trades and managing portfolios.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

XM

Overall: ⭐⭐⭐⭐⭐

Regulations: ASIC, CYSEC, FSC, DFSA

Best for fast order execution and no requote

XM was established in 2009 and is a CFD and forex broker operating online. With its headquarters in Cyprus and under the watchful eye of the Cyprus Securities and Exchange Commission (CySEC), this firm is a respected member of the brokerage community. XM provides trading services to customers all around the world and provides access to a wide variety of trading instruments, such as foreign exchange, commodities, equities, and indices.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

Plus500

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, CYSEC, FCA, FMA, MAS

Best for low-cost trading in currencies

Established in 2008, Plus500 is an online trading platform that offers retail investors a diverse selection of financial instruments. These include stocks, cryptocurrencies, commodities, forex, and more, all accessible through Contracts for Difference (CFDs). Operating in multiple countries and being regulated by various financial authorities, it offers users a sense of trust and security. Traders have the option to access the platform through web and mobile applications, providing convenience for individuals interested in participating in leveraged trading across global markets.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

FXTM

Overall: ⭐⭐⭐⭐⭐

Regulations: CYSEC, FCA

Best MetaTrader broker for copy trading and mobile trading.

FXTM, a notable global online brokerage regulated by multiple jurisdictions like the UK, Cyprus, South Africa, and Mauritius, was established in 2011 in Cyprus. Since its inception, FXTM has seen considerable expansion, serving over 2 million accounts across more than 180 countries. The broker offers access to a vast array of tradable assets exceeding 250 in count, encompassing forex, stocks, indices, commodities, cryptocurrencies, and ETFs. Traders can benefit from leverage up to 1:1000, competitive spreads, and swift execution on the widely adopted MetaTrader 4 and 5 platforms. FXTM is recognized for its commitment to trader education, multi-lingual customer support, and an extensive suite of trading resources that equip traders with necessary confidence.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

Capital.com

Overall: ⭐⭐⭐⭐⭐

Regulations: ASIC, CYSEC, FCA, NBRB, FSA

Best for CFDs trading and spread betting trading

Capital.com is a global online trading platform, registered and headquartered in Cyprus, and established in 2016. This broker is known for offering services in forex trading, spread betting, and Contracts for Difference (CFDs) on various financial instruments including stocks, indices, commodities, and cryptocurrencies. It offers access to advanced Metatrader 4 trading platform and tradingview, giving traders much confidence in trading.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

OANDA

Overall: ⭐⭐⭐⭐⭐

Regulations: ASIC, FCA, FSA, NFA, IIROC, MAS

Best for beginners and experienced traders alike

OANDA was started in 1996 and is now a reputable FX and CFD broker. An early leader in the field of foreign exchange trading online. Aanda is a global company with registrations in multiple jurisdictions, including the USA, Canada, Japan, the UK, Australia, and Singapore. It has a worldwide presence and provides a full spectrum of trading services to clients all over the globe. When it comes to cutting-edge technology and dedicated service, nobody does it better than OANDA.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

XTB

Overall: ⭐⭐⭐⭐

Regulations: CYSEC, FCA, CNMV

Best for stock trading with zero commissions

XTB stands as a global online trading and investment brokerage firm, specializing in the provision of contracts for difference (CFDs) across a wide spectrum – from forex, indices, commodities, stocks, ETFs, to cryptocurrencies. With a founding year of 2002, XTB boasts a rigorous regulatory standing, accredited by numerous financial authorities across the globe. These include the UK Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). For traders seeking diverse trading platforms, XTB extends an array of choices. Among them, the award-winning xStation 5 web and mobile platforms take the spotlight.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

Moneta Markets

Overall:⭐⭐⭐⭐

Regulations: ASIC (Appointed Representative license)

Best for MetaTrader trading experience and social trading

Founded in 2007, Moneta Markets is an Australian online Forex and CFD broker, giving its clients access to a bulk of trading assets, including forex, commodities, indices and more through both MT4 and PRO Trader platforms, flexible leverage up to 1:1000, initial deposit as low as $50.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

Forex Trading Knowledge Questions and Answers

Is forex trading legal in Saudi Arabia?

Yes, forex trading is legal in Saudi Arabia.The Saudi Central Bank, formerly known as the Saudi Arabian Monetary Authority or SAMA, has not imposed any bans or restrictions on forex trading. Consequently, numerous forex brokers, both licensed and unlicensed, operate within the country. However, the paramount consideration for retail traders is to identify a licensed broker, either domestically regulated within Saudi Arabia or internationally regulated, increasing a layer of security to their trading journey.

What is the most secure forex broker in Saudi Arabia?

XM ranks the most secure forex broker among so many competitors in Saudi Arabia.Let's see why:

| Registered Country | Regulated Entity | Regulator | Fund Protection Measures | Compensation Fund Amount |

|

TRADING POINT OF FINANCIAL INSTRUMENTS PTY LTD | ASIC | Segregated account with a licensed custodian | $250,000 |

|

Trading Point Of Financial Instruments Ltd | CYSEC | Segregation of client funds, Compliance monitoring | €20,000 |

|

XM GLOBAL LIMITED | FSC | Segregation of client funds, Compliance monitoring | No |

|

Trading Point MENA Limited | DFSA | Segregation of Client funds, Compliance monitoring | No |

Firstly, XM Group holds regulation in multiple global jurisdictions, including ASIC in Australia, CYSEC in Cyprus, FSC in Belize, and DFSA in the United Arab Emirates. This robust regulatory framework instills greater confidence among traders opting to trade with this broker.

XM provides negative balance protection, which means clients don't need to face extra margin calls even if losses exceed their equity due to market fluctuations or other reasons.

Moving on to XM's offerings: they charge no fees for deposits and withdrawals, a transparent fee structure, and free demo accounts for practice. When it comes to withdrawal speed, XM also receives mostly positive reviews, saying withdrawals on this platform were quickly processed.

What is an Islamic Forex account?

An Islamic Forex account, also known as a swap-free account, is designed for traders who abide by Islamic finance principles.According to Sharia law, interest accumulation is prohibited. Therefore, traders using Islamic accounts neither pay nor receive interest rates. Notably, transactions in accounts based on Islamic finance necessitate swift currency transfers from one account to another, ensuring promptness in execution. Simultaneously, transaction costs must be paid at the time of transfer.

Many reputable forex brokers, such as Exness, IC Markets, FP Markets, HFM, and others, provide Islamic accounts to entice more traders. Typically, Islamic accounts require higher minimum deposits, shorter time limits, and offer fewer discounts or promotions compared to regular forex accounts. Muslim customers seeking to open an Islamic Forex account need to register and open a trade, submitting the required documents for the registration of a halal trading account.

Do forex brokers need to provide Islamic accounts in Saudi Arabia?

There is no legal requirement for forex brokers to provide Islamic accounts specifically in Saudi Arabia.However, providing such account options could appeal to a larger Muslim client based interested in investing in a way that complies with Islamic finance principles. Therefore, major forex brokers operating globally and in the Middle East frequently choose to offer Islamic account options.

Is there any restriction on leverage in Saudi Arabia?

The Saudi Central Bank (SCB) does broadly regulate financial markets and aim to promote responsible investing and reduce speculative risks. But they have not set direct caps or limits on forex trading leverage. However, leverage restrictions are applied in many other regions. Some Middle East regulators have introduced leverage caps , for example 50:1, in the United Arab Emirates. Global forex brokers following regulatory standards in Europe, UK or Australia generally offer maximum leverage ranging from 30:1 to 500:1 depending on the account.

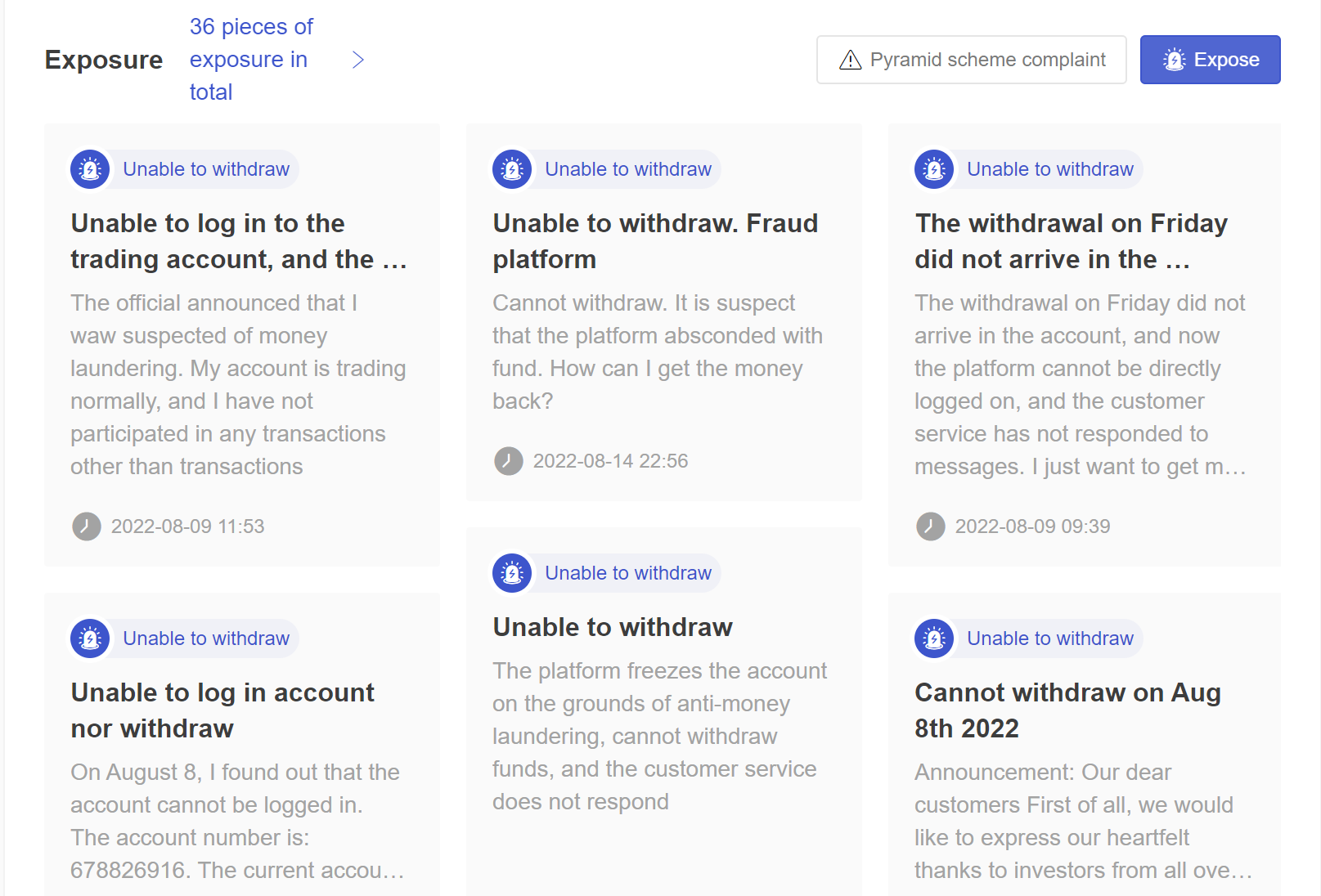

What are scam forex brokers that traders should avoid in Saudi Arabia?

| Broker | Logo | Registered Country | Regulation | Establishment of Years | Trading Platform | Customer Support | Additional Notes |

| ITGFX |  |

Australia |  |

2-5 years | MT5 | None | Revoked license & 123 scam exposures |

| Lilium |  |

United Kingdom |  |

2-5 years | Unknown | Phone & Email | 75 scam exposures |

| HDG MARKETS |  |

United Kingdom |  |

2-5 years | MT4 | Phone & Email | 36 scam exposures |

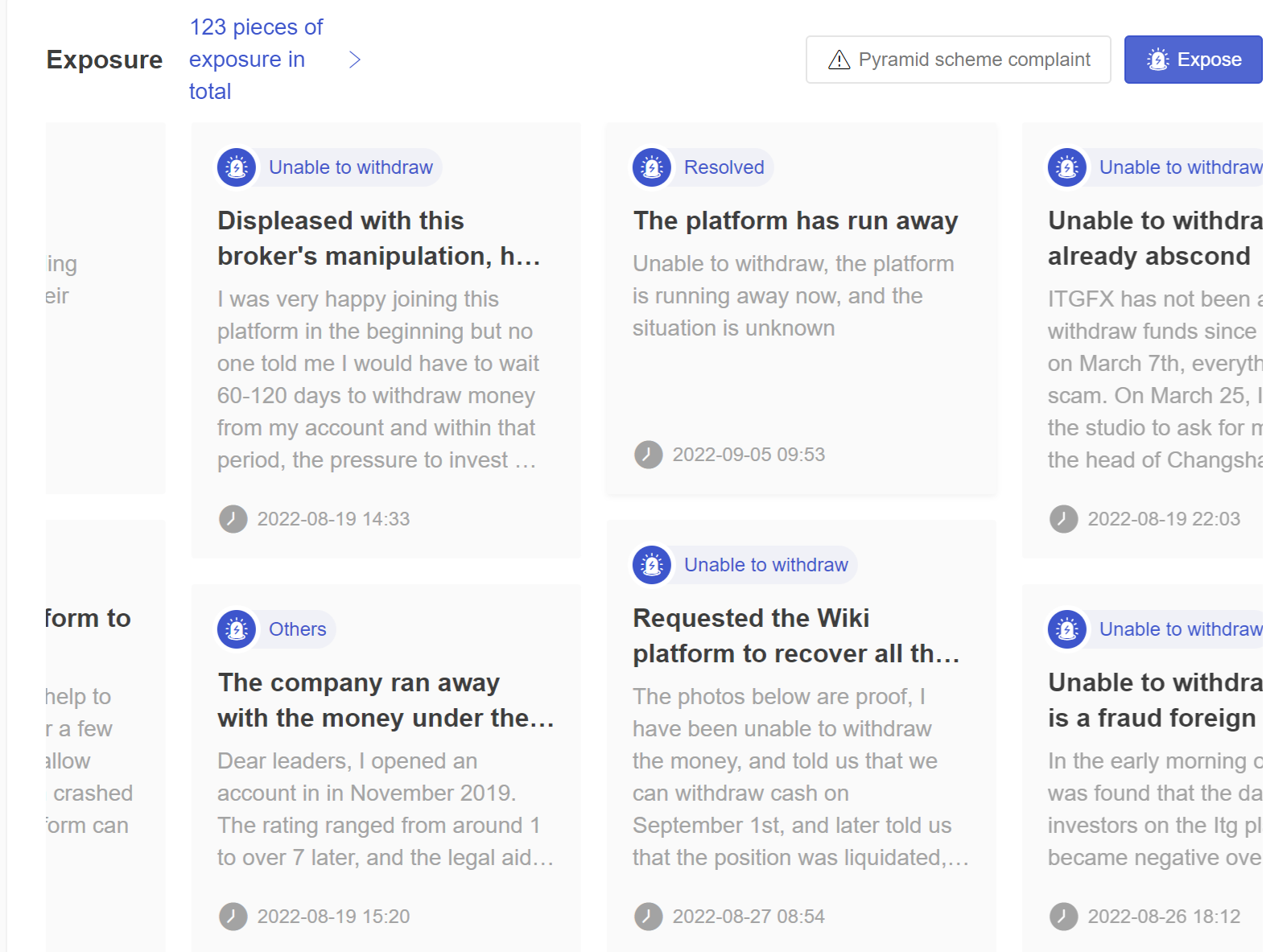

ITGFX, operated by a company called ITX GLOBAL PTY LTD, a broker without any regulation. Despite its brief operational history of 2-5 years, the broker has an alarming count of 123 scam exposures, a significantly concerning figure. Consequently, traders should steer clear of this scam broker.

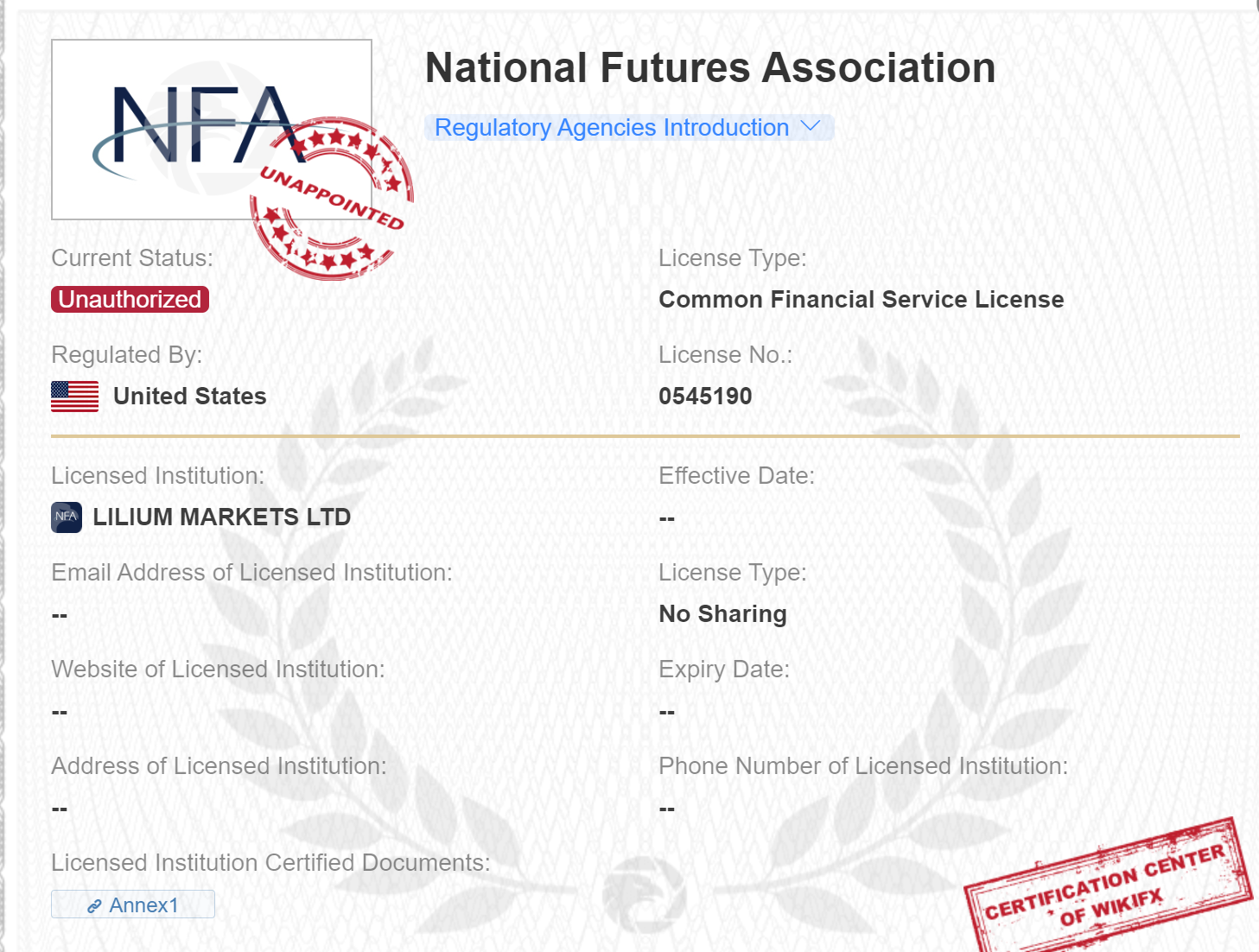

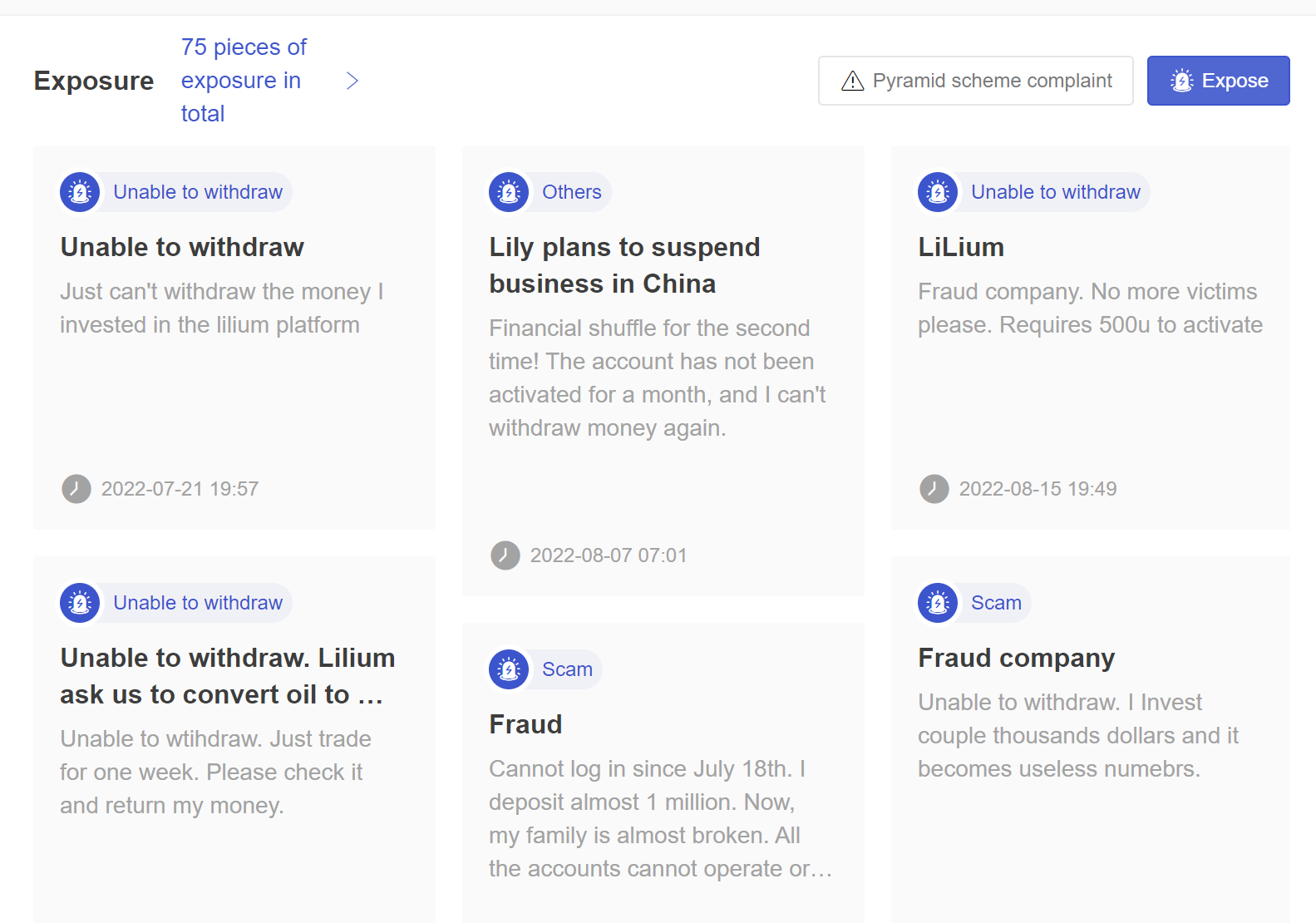

Lilium, operated by Lilium Market LTD, asserts regulation under the NFA. However, despite claims, we couldn't locate its name on the NFA website. A visit to its registered address proved futile. Adding to the concern, this broker has a distressing record of 75 reported scam exposures. Hence, traders should steer clear of this broker.

HDG Markets, operated by HDG Markets PTY Limited, operates as a scam broker. With a revoked license and a track record of 36 reported scam exposures, this raises serious concerns.

Do I have to pay taxes for forex trading in Saudi Arabia?

Unlike most countries, there is no personal income tax or capital gains tax regime currently applicable in Saudi Arabia.The tax-free trading environment offers traders a notable advantage, ensuring that their net returns remain untouched by any tax deductions. While in many other countries, like Italy, Russia, Ireland, income and investment profit taxes apply. This represents a big trading cost for traders who strive to gain profits in forex trading.

What are differences in forex trading in Saudi Arabia and other countries?

Saudi Arabia is a country with a Muslim population, and it does have some distinct differences in forex trading with other regions. Here let's explore more:

Regulatory Oversight- The Saudi Central Bank regulation on financial markets are relatively limited compared to strict regulators like ASIC, NFA, FCA etc. More leeway for brokers in terms of leverage, account types, and more, which means traders better to choose some internationally regulated broker to gain more confidence.

Trading Days- Saudi markets are closed on Fridays and Saturdays, unlike Western countries. So fewer trading days per week. Market hours are similar to global forex though.

Islamic Accounts - Trading accounts compliant with Shariah finance principles are very popular in Saudi compared to elsewhere. They have swap-free conditions and don't charge overnight interest. However, typically, these swap-free accounts often require higher thresholds, time limits, even higher trading costs. Traders should spend some time finding genuine ones.

Money Transfers- Wiring money in or out of Saudi accounts can be slower. Local bank transfers or Arab payment networks may be better options.

Advertising or Promotions - Nowdays, many brokers, even big ones in the industry, offer promotions or bonuses to attract more traders. However, SAMA has prohibited misleading ads and bonuses from brokers. Regulators elsewhere also frown on such practices.

Taxation - Profits from forex trading are considered as personal incomes in many countries, However, it is not subject to income tax in Saudi Arabia, which can be an advantage over tax regimes in some countries.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects.

We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

You Also Like

Best Forex Brokers for Beginners in Nigeria for 2024

Select the top forex brokers for beginners in Nigeria from many companies to ensure a safe trading environment.

Best Forex Trading Time in India 2024

Optimize your Forex trading in India by understanding prime trading times and exploring broker options.

What Time the Forex Market Opens in South Africa

Boost your Forex trading in South Africa with our guide on peak market hours for optimal trade activity!

6 Best No Deposit Bonus Forex Brokers in Malaysia in 2024

Start Forex trading risk-free in Malaysia! Discover the six top brokers, featuring attractive no-deposit bonuses.

7 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 7 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Top 10 Unregulated Forex Brokers 2024

Examine unregulated forex brokers, analyzing their distinguishing characteristics, inherent risks, and possible benefits for certain traders.

4 Best Forex Brokers Accepting US Traders in 2024

Discover top forex brokers accepting US traders, assessing their pros and cons to provide helpful guidance.

Best UK Forex Brokers for 2024

Review the top 10 forex brokers in UK, evaluating their trading pros and cons to provide traders with helpful guidance.