Cent Accounts stand as a unique proposition in the Forex world, offering traders the ability to trade with minimal capital, thus lowering financial risks while still gaining practical experience. This ranking is the result of a well-analyzed methodology, honing in on several important factors including regulation and security, account flexibility, trading conditions, trading platforms, among others to assure an authentic and unbiased assessment. We have poured many hours into this research, a testament to our commitment to provide in-depth and reliable information to simplify your trading journey and decision-making process.

Best Cent Account Forex Brokers

more

Comparion of Best Cent Account Forex Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Cent Account Forex Brokers Reviewed

① Exness

Best overall, excelling in all aspects

Exness is a global online trading broker established in 2008, regulated by the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). They offer trading services across various financial instruments, including CFDs on forex, commodities, stocks, indices, and cryptos. To cater to diverse client needs, Exness offers multiple account types, including Standard, Standard Cent, Pro, Zero, and Raw Spread, with advantages such as flexible leverage, tight spreads, and fast order execution. Additionally, they provide educational resources to equip traders.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Min. Deposit | $10 |

| Regulation | CySEC, FCA, FSCA, FSA (Offshore) |

| Trading Instruments | CFDs on forex, commodities, stocks, indices, cryptos |

| Demo Account | ✅($10,000 virtual funds) |

| Max. Leverage | 1: Unlimited |

| Trading Platforms | MT4/5, Exness Terminal, Exness Trade app |

| Customer Support | 24/7 live chat |

| Regional Restrictions | The USA, Canada, Iran, North Korea, Europe, the UK, Russia, Belarus and others |

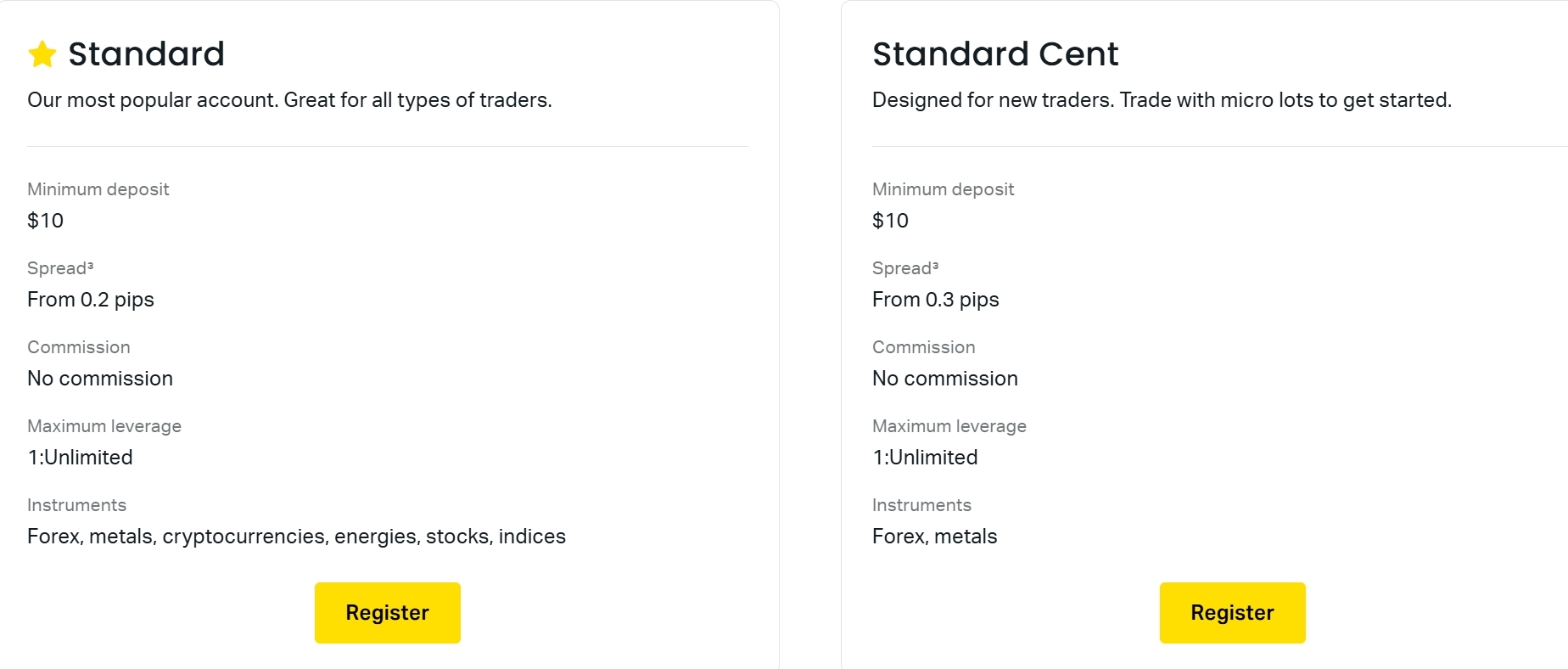

Exness Standard Cent Account

Exness Standard Cent Account is an excellent choice for traders who want to experience live market conditions with lower risk. The account allows trading in currency pairs and metals with spreads starting from 0.3 pips. It provides unlimited leverage and is compatible with the MT4 trading platform. The minimum deposit requirement is just $10, and it offers the benefits of a swap-free account.

| Exness Standard Cent Account Features | |

| Min. Deposit | $10 |

| Trading Instruments | Forex, metals |

| Max. Leverage | 1: Unlimited |

| Spread | From 0.3 pips |

| Commission | ❌ |

| Trading Platforms | MT4 |

| Min. Order Volume | 0.01 lots |

| Margin Calls | 60% |

| Stop Out | / |

| Order Execution | Market execution |

| Swap Free | ✅ |

Exness Standard Cent Account Pros & Cons

| Pros | Cons |

| √ Low spread starting from 0.3 pips | × Limited to forex and metals |

| √ Gives access to market execution | × Regional restrictions apply |

| √ Unlimited leverage, providing more trading opportunities | |

| √ Swap-free |

② RoboForex

Best for the lowest minimum order volume on MT5

RoboForex is a regulated global online broker that was established in 2009. Providing services to clients all over the world, they offer trading in multiple assets like stocks, indices, futures, ETFs, soft commodities, energies, metals, and currencies. RoboForex is known for its diverse range of account types, advanced trading platforms including MT4, MT5, MobileTrader, StocksTrader, WebTrader, and attractive offers like cashback and bonuses. Educational resources and round-the-clock customer support are also available.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Min. Deposit | $10 |

| Regulation | CySEC, NBRB, FSC (Offshore) |

| Trading Instruments | Stocks, indices, futures, ETFs, soft commodities, energies, metals, currencies |

| Demo Account | ✅ |

| Max. Leverage | 1:2000 |

| Trading Platforms | MT4/5, WebTrader, MobileTrader, StocksTrader |

| Customer Support | 24/7 live chat, contact form, phone, WhatsApp |

| Regional Restrictions | The USA, Canada, Japan, Australia, Bonaire, Brazil, Curaçao, East Timor, Indonesia, Iran, Liberia, Saipan, Russia, Sint Eustatius, Tahiti, Turkey, Guinea-Bissau, Micronesia, Northern Mariana Islands, Svalbard and Jan Mayen, South Sudan, Ukraine, Belarus |

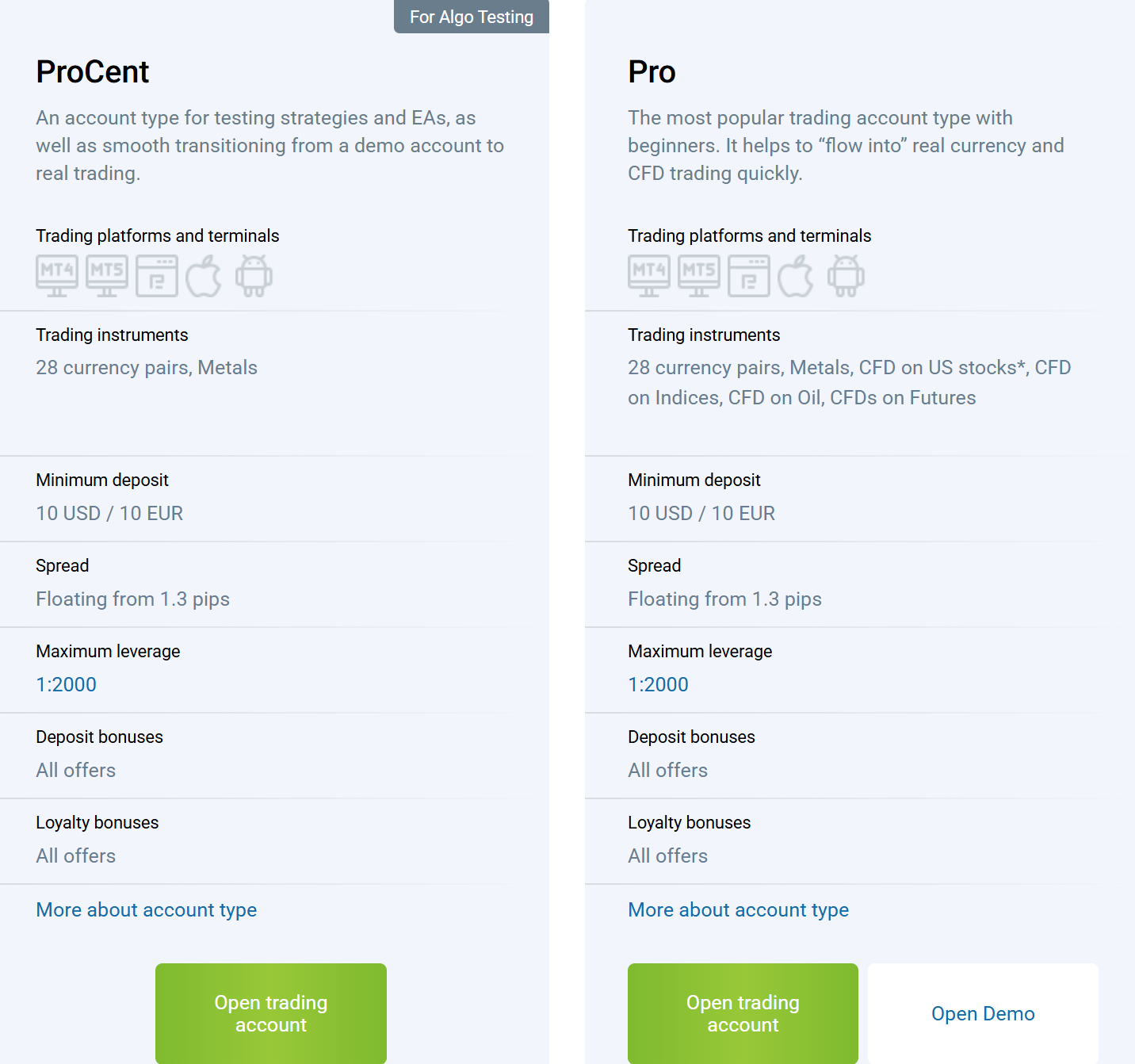

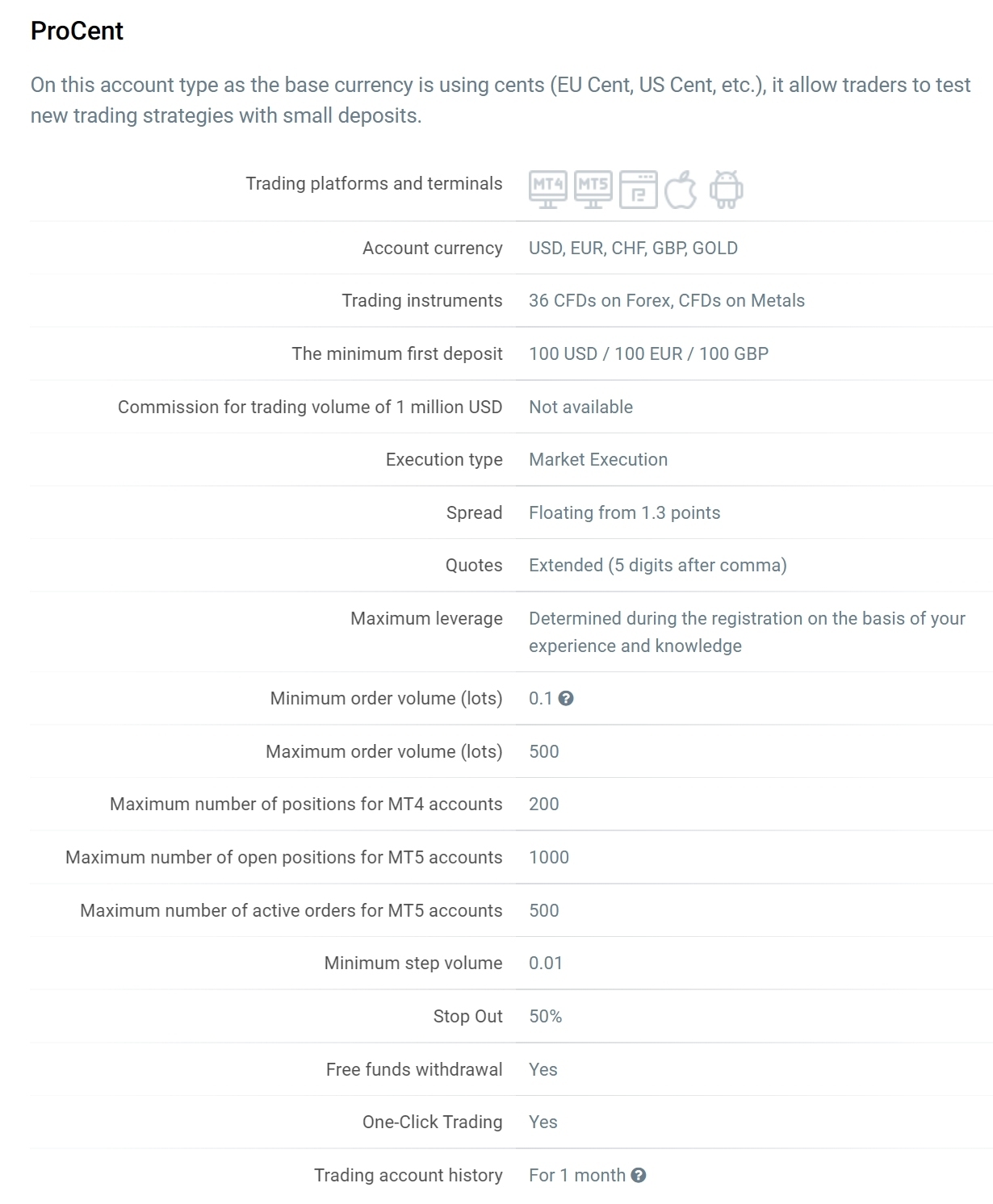

RoboForex Pro Cent Account

RoboForex offers a Pro Cent Account that is designed to provide traders access to real market conditions with lower risk due to smaller trading volumes. The account allows trading on 28 currency pairs and metals with floating spreads starting from 1.3 pips. It offers high leverage of up to 1:2000 and compatibility with multiple platforms including MT4, MT5, WebTrader, and MobileTrader. The minimum deposit requirement of this account is $/€10, and it also features a swap-free option.

| RoboForex Pro Cent Account Features | |

| Min. Deposit | $/€10 |

| Trading Instruments | 28 currency pairs, metals |

| Max. Leverage | 1:2000 |

| Spreads | Floating from 1.3 pips |

| Commission | / |

| Trading Platforms | MT4, MT5, WebTrader, MobileTrader |

| Min. Order Volume | 0.1 lots (MT4); 0.01 lots (MT5) |

| Margin Calls | / |

| Stop Out | 30% |

| Order Execution | Market execution |

| Swap Free | ✅ |

RoboForex Pro Cent Account Pros & Cons

| Pros | Cons |

| √ Low minimum deposit of $/€10 | × Spreads starting from 1.3 pips is higher compared to some other brokers |

| √ High leverage of up to 1:2000 | × Limited to 28 currency pairs and metals |

| √ Compatibility with multiple trading platforms | × Stop out at 30% |

| √ Swap-free option available | × Regional restrictions apply |

| √ Market execution allows instant trade execution |

③ HFM

Best for offering the highest leverage

HFM is a well-established global financial trading platform that allows its clients to trade in a diverse range of financial instruments. It is recognized for its robust infrastructure, state-of-the-art trading platforms, and user-friendly interface. HFM offers an array of investment opportunities, including 500+ CFDs on Forex, Commodities, Metals, Bonds, Energies, ETFs, Indices, Cryptos, and Stocks. It prides itself on its favourable trading conditions, comprehensive educational resources, and dedicated customer support.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Min. Deposit | $0 |

| Regulation | CySEC, FCA, DFSA, FSA (Offshore) |

| Trading Instruments | 500+ CFDs on Forex, Commodities, Metals, Bonds, Energies, ETFs, Indices, Cryptos, Stocks |

| Demo Account | ✅ |

| Max. Leverage | 1:2000 |

| Trading Platforms | MT4/5, HFM Trading App |

| Customer Support | 00:00 Monday to 23:59 Friday (Server Time) - live chat, contact form, phone, fax, email |

| Regional Restrictions | The USA, Canada, Sudan, Syria, Iran, North Korea |

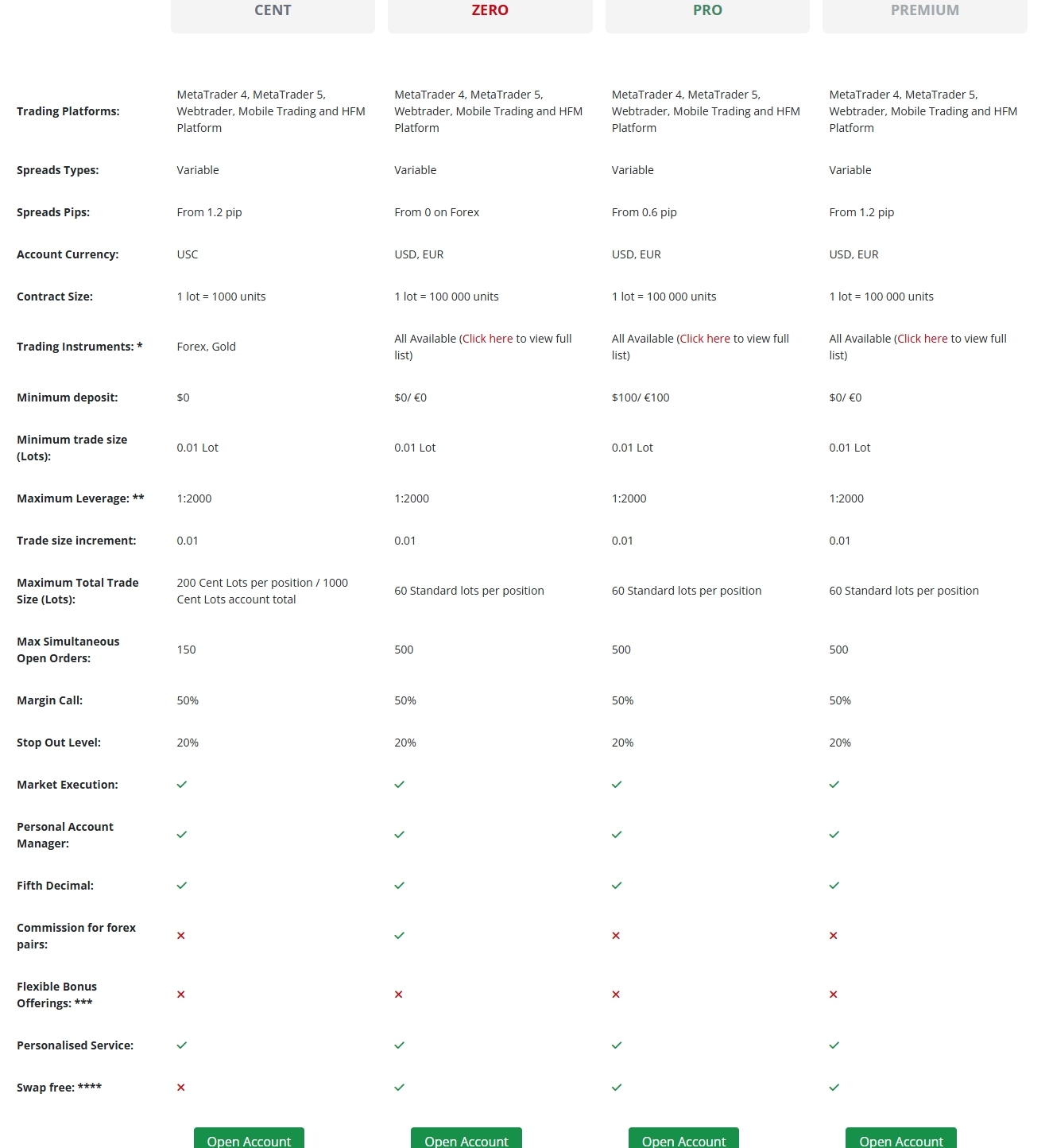

HFM Cent Account

HFM provides a Cent Account that is appropriate for those wanting to experience trading with less financial risk. It comes with a high leverage of 1:2000 and offers variable spreads beginning from 1.2 pips. Significantly, it has no minimum deposit requirement, making it even more accessible for beginners or traders with limited capital.

| HFM Cent Account Features | |

| Min. Deposit | $0 |

| Trading Instruments | Forex, Gold |

| Max. Leverage | 1:2000 |

| Spreads | From 1.2 pips |

| Commission | ❌ |

| Trading Platforms | MT4/5, Webtrader, Mobile trading, HFM Platform |

| Min. Order Volume | / |

| Margin Calls | 50% |

| Stop Out | 20% |

| Order Execution | / |

| Swap Free | ❌ |

HFM Cent Account Pros & Cons

| Pros | Cons |

| √ No minimum deposit requirement | × Limited tradable assets (Forex, Gold) |

| √ High leverage of up to 1:2000 | × No swap free |

| √ No commission | × Regional restrictions apply |

④ BDSwiss

Best for the range of instruments on Cent accounts

BDSwiss is an established online trading brokerage founded in 2012 and regulated by FSA (Offshore). Offering 250+ CFDs on Forex, Shares, Indices, Commodities, and Cryptos, it caters to more than a million registered accounts globally. Available on multiple trading platforms such as Desktop, Mobile, Web, BDSwiss is flexible for varying trading needs. Renowned for its excellence in diverse trading conditions, comprehensive educational resources, and excellent customer support, BDSwiss maintains high standards of transparency and security.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Min. Deposit | $10 |

| Regulation | FSA (Offshore) |

| Trading Instruments | 250+ CFDs on Forex, Shares, Indices, Commodities & Cryptos |

| Demo Account | ✅ |

| Max. Leverage | 1:2000 |

| Trading Platforms | Desktop, Mobile, Web |

| Customer Support | 24/5 live chat |

| Regional Restrictions | Algeria, Bahrain, Democratic Peoples Republic of Korea, Democratic Republic of Congo, Egypt, Eritrea, Iran, Iraq, Israel, Japan, Jordan, Kuwait, Lebanon, Libya, Mauritius, Morocco, Myanmar, Oman, Palestine, Qatar, Saudi Arabia, Seychelles, Somalia, Sudan, Syria, Tunisia, United Arab Emirates, United Kingdom, United States (and US reportable persons), Yemen and the EU |

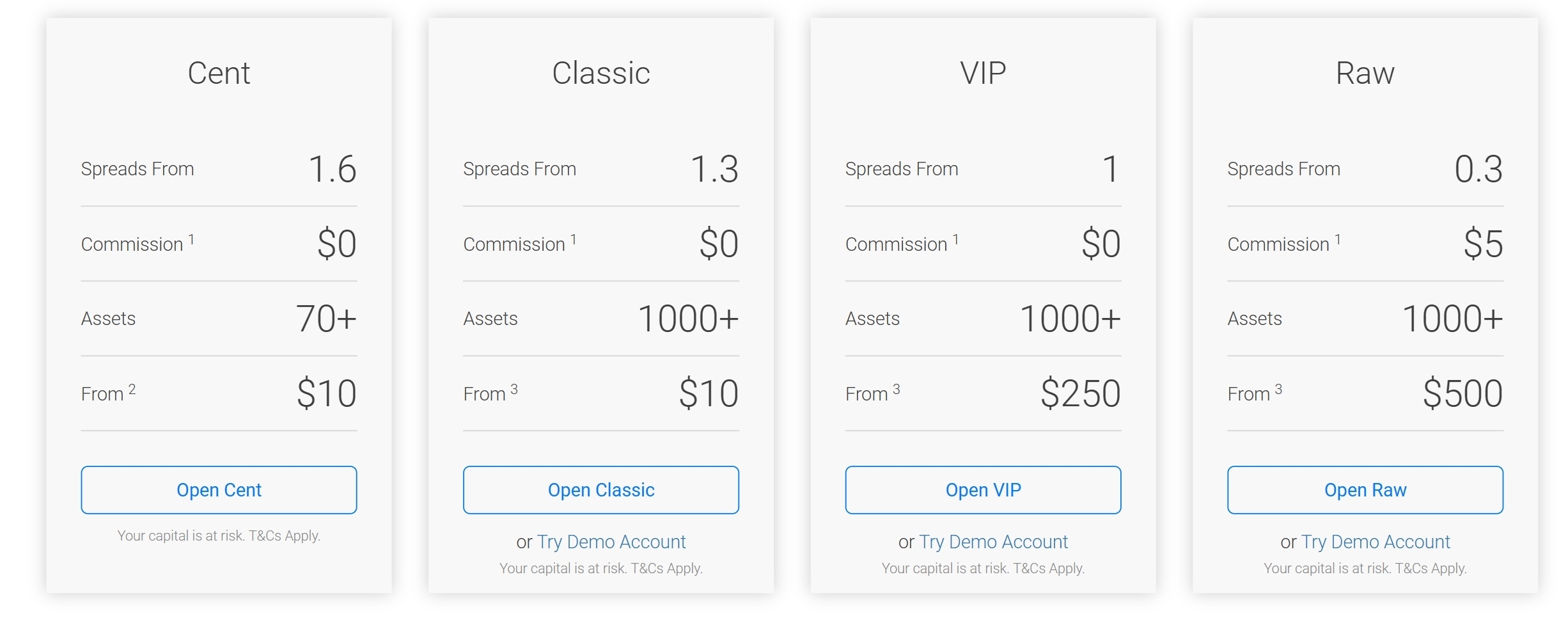

BDSwiss Cent Account

BDSwiss' Cent Account is suitable for traders who wish to trade with reduced financial risk. The account requires a minimum deposit of 10 and provides access to over 70 trading instruments. It promotes transparency with 0 commission and spreads starting from 1.6 pips.

| BDSwiss Cent Account Features | |

| Min. Deposit | $10 |

| Trading Instruments | 70+ |

| Max. Leverage | / |

| Spreads | From 1.6 pips |

| Commission | $0 |

| Trading Platforms | / |

| Min. Order Volume | / |

| Margin Calls | / |

| Stop Out | / |

| Order Execution | / |

| Swap Free | / |

BDSwiss Cent Account Pros & Cons

| Pros | Cons |

| √ Minimum deposit of $10 | × Wide spreads starting from 1.6 pips |

| √ Access to over 70 trading instruments | × Lack of information on maximum leverage |

| √ Zero commission trading | × Non-disclosure of trading platforms |

| × Insufficient details on execution type, margin calls, and stop-out levels | |

| × Unclear whether a swap-free option is available |

⑤ Markets4you

Best for Cent account with 24/7 live chat support

Markets4you is an international online trading broker that has been offering services to traders since 2007. Regulated by the FSC, it provides 150+ trading instruments, including forex, commodities, stocks, and indices. The broker is known for its user-friendly trading platforms, multiple account types designed to suit different traders, and a competitive leverage of up to 1:4000. Forex4you also offers comprehensive educational resources and round-the-clock customer support.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| Min. Deposit | $0 |

| Regulation | FSC |

| Trading Instruments | 150+, forex, commodities, stocks, indices |

| Demo Account | ✅ |

| Max. Leverage | 1:4000 |

| Trading Platforms | Markets4you, MT4/5 |

| Customer Support | 24/7 live chat, phone, email, WhatsApp, Messenger, Telegram |

| Regional Restrictions | / |

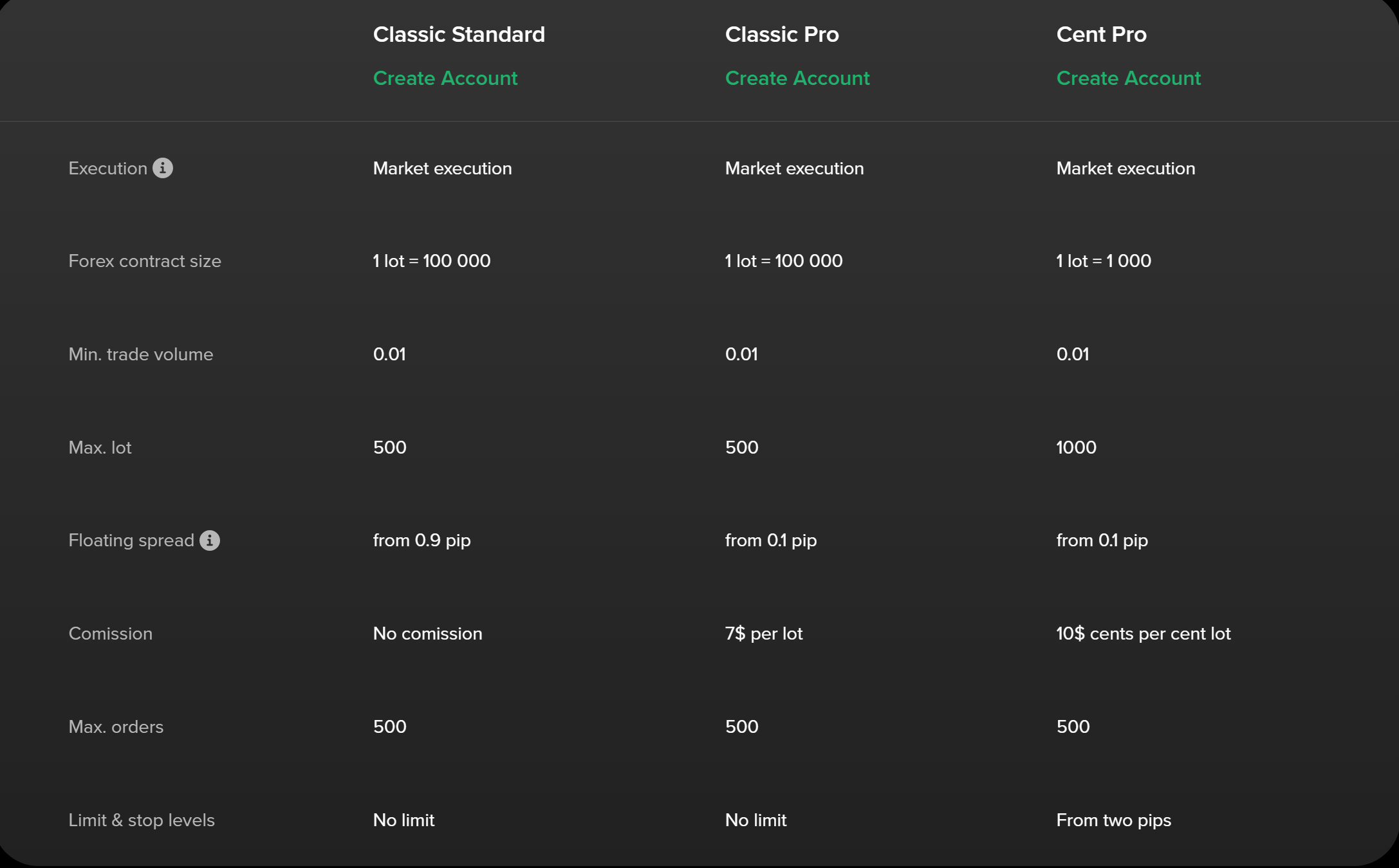

Forex4you Cent Pro Account

Forex4you offers two types of Cent Accounts: Cent Fixed Account and Cent Pro Account.

Forex4you Cent Pro Account

Forex4you Cent Pro Account does not require a minimum deposit and offer leverage ranging from 1:10 to 1:4000. It has floating spreads from 0.1 pips but charges $10 cents per cent lot as commission. It supports instant and market execution, and offer the benefit of a swap-free account.

| Forex4you Cent Pro Account Features | |

| Min. Deposit | $0 |

| Trading Instruments | / |

| Max. Leverage | 1:10-1:4000 |

| Spreads | Floating from 0.1 pips |

| Commission | $10 cents per cent lot |

| Trading Platforms | / |

| Min. Order Volume | 0.01 lot |

| Margin Calls | / |

| Stop Out | / |

| Order Execution | Market execution |

| Swap Free | ✅ |

Forex4you Cent Pro Account Pros & Cons

| Pros | Cons |

| √ No minimum deposit | × Commission of $10 cents per cent lot could reduce profits |

| √ High leverage up to 1:4000 | × Full range of trading instruments not stated |

| √ Low floating spreads starting from 0.1 pips, ideal for scalping | × Market execution may involve slippage |

| √ Swap-free | |

| √ More exposure to real market conditions due to floating spreads and commission charges |

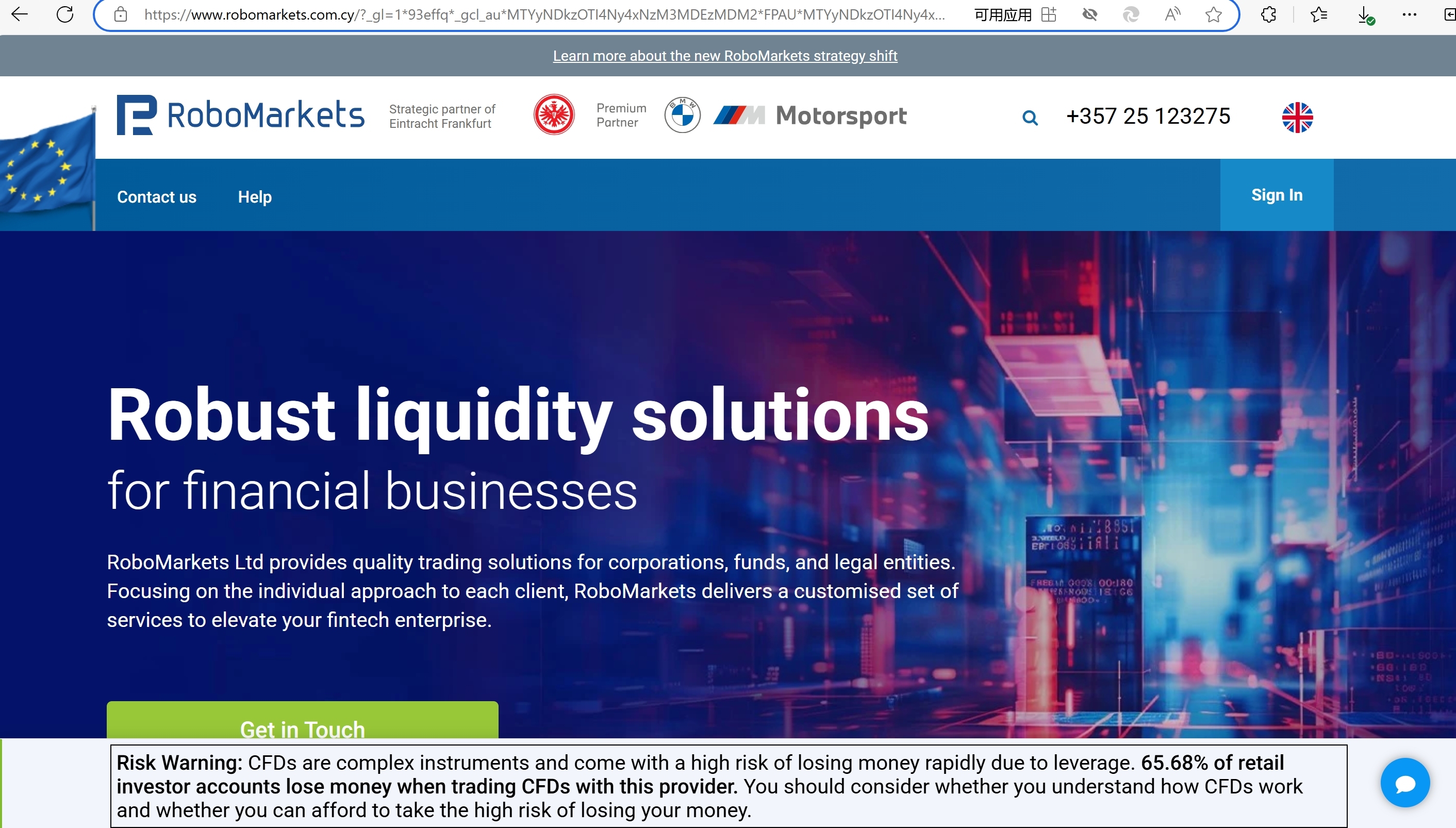

⑥ RoboMarkets

Best for maintaining high stop outs

RoboMarkets is a multi-asset online broker that was established in 2012. It's regulated by the Cyprus Securities and Exchange Commission (CySEC), thus providing traders with a high level of security and transparency. The broker offers trading on a variety of asset classes, including forex, stocks, indices, ETFs, commodities, and cryptocurrencies. Available on multiple platforms such as MT4, MT5, and TradingView, RoboMarkets caters to different trading needs, providing a selection of account types and competitive spreads. The company places a strong emphasis on education and customer support.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| Min. Deposit | $/€/£100 |

| Regulation | CySEC |

| Trading Instruments | 3,000+, stocks, indices, forex, cryptocurrencies, ETFs, commodities, precious metals, energy |

| Demo Account | / |

| Max. Leverage | / |

| Trading Platforms | WebTrader, MobileTrader, TradingView, MT4, MT5 |

| Customer Support | 24/7 live chat, contact form, phone, WhatsApp |

| Regional Restrictions | Only available to the residents of the EU/EEA countries |

RoboMarkets ProCent Account

RoboMarkets offers a ProCent Account that caters to different classes of traders, including beginners and those interested in minimizing their trading risks. With a required minimum deposit of $/€/£100 and offering 36 CFDs on forex and metals, it provides relatively diverse trading possibilities. It offers floating spreads starting from 1.3 points, commission-free trading, and market execution.

| RoboMarkets ProCent Account Features | |

| Min. Deposit | $/€/£100 |

| Trading Instruments | 36 CFDs on forex, CFDs on metals |

| Max. Leverage | Determined during registration on the basis of your experience and knowledge |

| Spreads | Floating from 1.3 points |

| Commission | ❌ |

| Trading Platforms | MT4, MT5, WebTrader, MobileTrader |

| Min. Order Volume | 0.1 lots |

| Margin Calls | / |

| Stop Out | 50% |

| Order Execution | Market Execution |

| Swap Free | / |

RoboMarkets ProCent Account Pros & Cons

| Pros | Cons |

| √ Access to 36 CFDs on forex and metals | × Leverage is not pre-determined and is set during registration based on the trader's experience and knowledge |

| √ Floating spreads starting from 1.3 points | × Stop out level is relatively high at 50% |

| √ Commission-free trading | × Limitations on trading instruments compared to its other account types |

| √ Market execution for instant and accurate orders | × Only available for residents of EU/EEA countries |

| √ Compatibility with multiple trading platforms |

⑦ FIBO Group

Best for having no minimum deposit requirements

FIBO Group is a reputable online trading broker that has been in the industry since 1998. It's offshore regulated by the FSC, providing a reliable and transparent trading environment. FIBO Group offers a wide variety of financial instruments, encompassing forex, spot metals, cryptocurrencies, CFDs, US and stocks. The broker provides accessibility across various platforms including MT4, MT5, and cTrader, and caters to different trading styles with various account types, competitive spreads, and leverage up to 1:1000. Alongside trading services, FIBO Group also offers educational resources and dedicated customer support.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| Min. Deposit | $0 |

| Regulation | FSC (Offshore) |

| Trading Instruments | Forex, spot metals, cryptocurrencies, CFDs, US stocks |

| Demo Account | ✅ |

| Max. Leverage | 1:1000 |

| Trading Platforms | MT4, MT5, cTrader |

| Customer Support | Live chat, phone |

| Regional Restrictions | The United Kingdom, North Korea, and the United States |

FIBO Group MT4 Cent Account

FIBO Group's MT4 Cent Account offers a unique proposition for traders looking for minimal financial risk in forex trading. The attractive aspect is the non-existence of a minimum deposit requirement, coupled with an impressive maximum leverage of 1:3000. The account also offers a swap-free option which can attract traders of Islamic faith.

| FIBO Group MT4 Cent Account Features | |

| Min. Deposit | $0 cents |

| Trading Instruments | / |

| Max. Leverage | 1:3000 |

| Spreads | / |

| Commission | / |

| Trading Platforms | / |

| Min. Order Volume | / |

| Margin Calls | / |

| Stop Out | / |

| Order Execution | / |

| Swap Free | ✅ |

FIBO Group MT4 Cent Account Pros & Cons

| Pros | Cons |

| √ No minimum deposit requirement | × Specific account features and limitations aren't fully disclosed |

| √ High maximum leverage of 1:3000 | × Regional restrictions apply |

| √ Swap-free account |

⑧ JustMarkets

Best for completing commission-free transactions

JustMarkets is a prominent online trading broker that provides quick and secure access to a broad spectrum of financial markets. Regulated by recognized authorities, JustMarkets offers 100+ trading instruments including currency pairs, precious metals, energies, indices, and shares. Available on user-friendly platforms, it provides traders with a selection of accounts to match their trading needs, competitive spreads, and leverage. In addition to its trading services, JustMarkets emphasizes educating its users via comprehensive educational resources and provides responsive customer assistance.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| Min. Deposit | $10 |

| Regulation | CySEC, FSA (Offshore) |

| Trading Instruments | 100+, currency pairs, precious metals, energies, indices, and shares |

| Demo Account | ✅ |

| Max. Leverage | 1:30 (retail)/1:300 (professional) |

| Trading Platforms | MT4/5 (PC, Android, iPhone, WebTrader), JustMarkets trading app |

| Customer Support | 24/7 live chat, request a callback, phone, email |

| Regional Restrictions | The USA, France, Belgium, Non-EU |

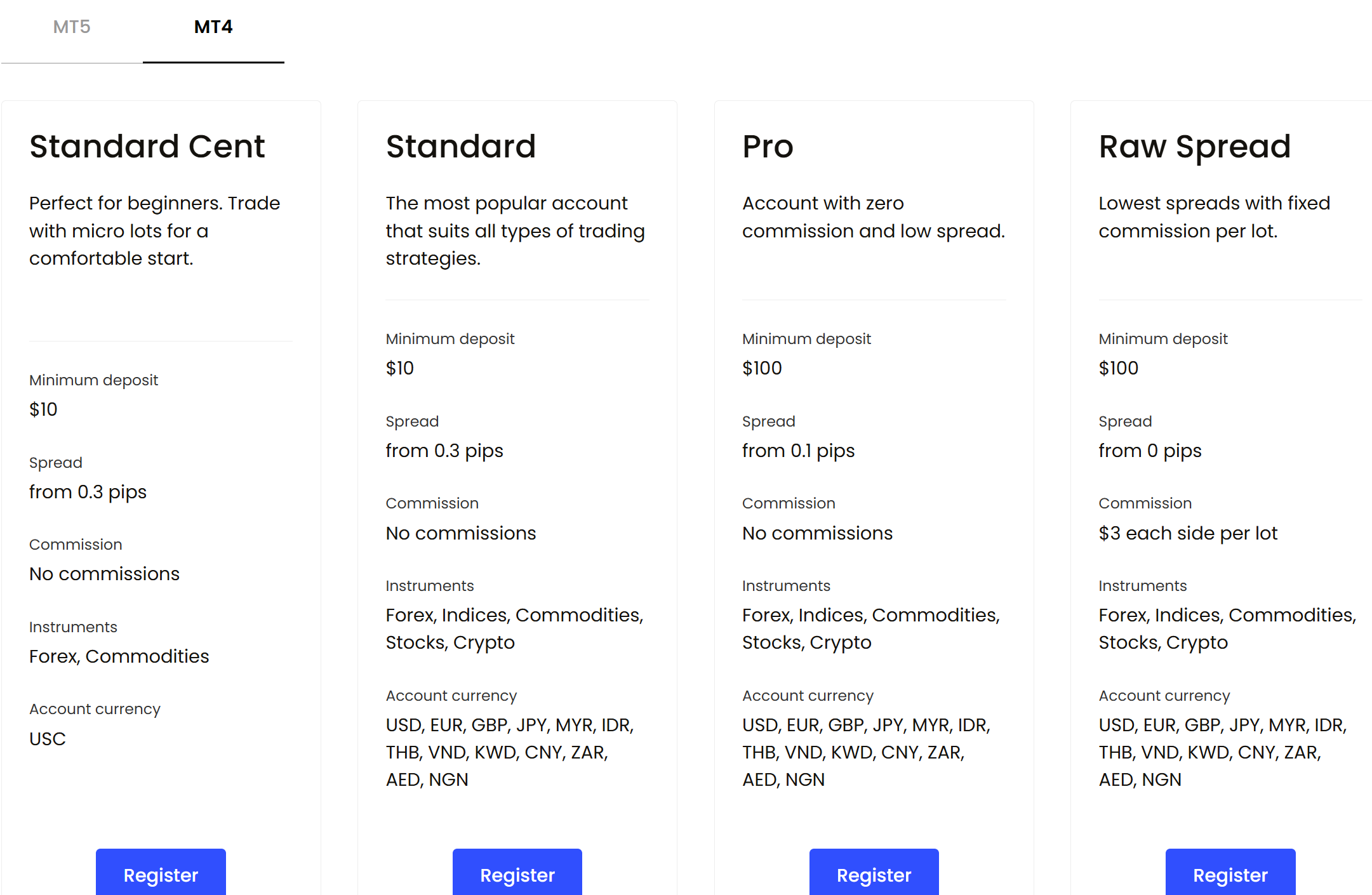

JustMarkets MT4 Standard Cent Account

JustMarkets' MT4 Standard Cent Account provides an enticing choice for traders seeking to limit financial risks. With a negligible minimum deposit of $10 and a high max leverage of 1:300, it offers significant financial flexibility. The account is advantageous in terms of its low starting spreads from 0.3 pips and absence of commission. Moreover, it provides a swap-free option.

| JustMarkets MT4 Standard Cent Account Features | |

| Min. Deposit | $10 |

| Trading Instruments | Forex, commodities |

| Max. Leverage | 1:30 (retail)/1:300 (professional) |

| Spreads | From 0.3 pips |

| Commission | ❌ |

| Trading Platforms | MT4 |

| Min. Order Volume | / |

| Margin Calls | / |

| Stop Out | / |

| Order Execution | / |

| Swap Free | ✅ |

JustMarkets MT4 Standard Cent Account Pros & Cons

| Pros | Cons |

| √ Low required minimum deposit of $10 | × Unspecified information on minimum order volume, margin calls, stop outs, and order execution |

| √ High max leverage of 1:300 | × Regional restrictions apply |

| √ Attractive spreads starting from 0.3 pips | |

| √ Commission-free trading | |

| √ Swap-free account |

Cent Account Forex Brokers FAQs

What is a Cent Account?

A Cent Account is a type of forex trading account that denominates the amount deposited into cents. In this type of account, if you deposit $10, it will appear as 1000 cents in your account. This allows you to trade in smaller increments and with lower risk, which is particularly beneficial for beginners or those with smaller amounts to invest. It allows you to better manage risk and execute strategy effectively without requiring high capital.

How does a Cent Account Work in Forex?

A Cent Account in Forex works by denoting the deposited amount and all trading transactions in cents instead of standard currency units, like the Dollar or Euro. The goal is to allow traders to gain experience in a live trading environment with lower financial risk.

e.g.

If you deposit $10 into a Cent Account, instead of reading as $10.00, your account balance will show 1000 cents. All your trades would then be conducted in terms of cents rather than dollars.

A significant advantage this presents is the ability to trade with reduced size lots.

e.g.

If a broker offers a minimum lot size of 0.01 in a standard account (equivalent to 1000 units of base currency), the same 0.01 lot in a Cent Account equates to just 10 units. Consequently, this reduces the cost per pip, thereby decreasing the total risk per trade.

In essence, a Cent Account allows you, especially beginners or those with limited capital, to participate in the nearly identical trading environment as those with larger accounts but at a much diminished financial risk.

However, while the benefits may be reduced, so are the potential profits. The profits, similar to the investments, are also calculated in cents. Hence, a potential trade win that could seem large when calculated in cents might be quite small when converted back to standard currency.

Comparison Table: Cent Account vs Micro, Standard and Demo Account

Each type of account has its own advantages and is meant to cater to different levels of traders.

| Account Type | Cent | Micro | Standard | Demo |

| Suitable for | Beginners and those testing new strategies | Beginners with a bit more experience and capital | Experienced traders, those with more capital | Beginners, those learning the platform, or trying out new strategies |

| Real Money Trading | ✔ | ✔ | ✔ | ❌ |

| Currency Denomination | Cents | Primary Currency (e.g., dollars) | Virtual Currency | |

| Minimum Deposit | Low | Low | Medium to High | ❌ |

| Trading Size | Smallest | Smaller than standard, greater than cent | Large | Depends on the virtual balance granted by the broker |

| Leverage | Depends on the broker, usually lower | Depends on the broker | Higher | Depends on the broker, typically mirrors live account conditions |

| Profit Potential | Low | Medium | High | ❌ |

| Risk Level | Low | Medium | High | ❌ |

Cent Account

The strength of a Cent Account lies in its lower risk level and lower minimum deposit requirement, making it ideal for beginners and those who want to experiment with new strategies without putting much capital at risk. However, the potential profit is also lower since all transactions are denominated in cents not standard currency units.

Micro Account

This is something of a middle ground between Cent and Standard accounts. It allows trading in smaller currency units than a standard account, which reduces risk and minimum deposit requirements. It's suitable for those with a bit more trading experience and capital.

Standard Account

These accounts are typically for well-funded and good-experienced traders. They offer the potential for larger profits but at the expense of higher risk. Transactions in a standard account are done in standard currency units.

Demo Account

As the name implies, a demo account isfor demonstration or practice purposes. It uses virtual currency, so theres no risk of losing real money, and no real profit can be earned. It's ideal for beginners learning the ropes, or experienced traders wanting to test new strategies.

Pros & Cons of Cent Accounts

Cent Accounts come with their own set of advantages and disadvantages.

| Pros √ | Cons × |

| · Lower Risk | · Limited brokers offer Cent accounts |

| · Ideal for beginners | · Possible lower leverage |

| · Low investment requirement | · Limited Earning Potential |

| · Allows for more precise risk management | · May promote less mindful trading |

Pros

Lower Risk: Since the trading balance and profits/losses are calculated in cents instead of dollars, the risk associated with trading is significantly reduced.

Ideal for beginners: Cent Accounts are perfect for those who are new to forex trading, as they allow trading in smaller lot sizes. This allows you to learn and experiment without incurring heavy losses.

Low investment requirement: Cent Accounts often have lower minimum deposit requirements.

Allows for more precise risk management: Because you can be made in smaller increments, cent accounts can offer more precise risk management.

Cons

Limited brokers offer Cent accounts: Not all Forex brokers offer the option of a Cent Account.

Possible lower leverage: Sometimes, brokers may offer lower leverage on Cent Accounts than on standard accounts.

Limited Earning Potential: Income potential may be limited because profits are also counted in cents rather than dollars. A gain that looks large in terms of cents may not be very significant in actual Dollar terms.

May promote less mindful trading: The small stakes can sometimes lead to careless trading, as losses are less painful in cent amounts. This could develop bad habits for when you transition to a standard account.

What is Lot Size in Cent Accounts?

In Cent Accounts, a lot size refers to the total number of currency units that you're trading. Because the currency value is denoted in cents, the lot size is also quantified differently than a standard account. Namely, one standard lot in a Cent Account differs and is significantly smaller than in a standard account. Therefore, the lot size in Cent Accounts allows traders to trade at diminished risk levels, making it more suitable for new traders or those with smaller capital balances.

For example, in some Cent Accounts, 1 standard lot equals 100,000 cents, not dollars. Plus, this type of account often allows a lower minimum trading volume, such as micro or even nano lots.

Are Cent Accounts Good for Beginners?

Yes, Cent Accounts can be a perfect fit for beginners in Forex trading.

Since all balances, profits, and losses are calculated in cents rather than standard currency, beginners can experiment without the fear of significant financial losses. These accounts are also more accessible because they typically have lower deposit requirements. They provide a practical learning experience for beginners as they are like trading on a live account but without risking a large amount of money. Lastly, Cent Accounts also allow precise risk management as trades can be made in smaller increments.

How to Choose the Best Cent Account Forex Broker?

Choosing the best Cent Account Forex broker requires careful consideration. You should consider the following aspects:

Regulation and Security

The broker should be regulated by reputable financial authorities. This indicates the broker's legitimacy and provides you with certain protections.

On WikiFX, we strive to deliver the most relevant and up-to-date regulatory information about forex brokers. We understand how vital it is to know your broker's regulatory status before investing your hard-earned money. Our team conducts an extensive background check on forex brokers from around the globe to provide you with their regulatory data and other critical aspects.

By using WikiFX, you can easily verify a broker's regulatory status and steer clear of potential frauds or unregulated platforms. Knowledge is power - stay informed, stay safe and always check a broker's regulatory status on WikiFX before investing. It's easy, fast, and can save you from unnecessary losses.

Account Flexibility

Your broker should offer the flexibility to adjust lot sizes and provide options suitable for your trading strategy.

Low Spreads and Commissions

Ideally, the broker should offer low spreads and commissions. This factors into your trading costs, especially if you're trading frequently.

Trading Platform

Ensure the trading platform is reliable and user-friendly. Popular platforms like MetaTrader 4 or MetaTrader 5 are usually a safe bet.

Educational Resources

Useful for beginners. These resources can help you better understand Forex trading.

Customer Support

Responsive and professional customer support can be very important, especially when you experience issues or have queries.

Take your time to research, read reviews, and test out a broker (many offer demo accounts) before deciding.

Forex Risk Disclaimer

Trading Forex (foreign exchange) carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, risk appetite, and the possibility of incurring losses. There is a possibility that you may sustain a loss of some or all of your initial investment and therefore you should not invest money that you can not afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

You Also Like

8 Best Forex Brokers With Segregated Accounts in 2026

Review the 8 Best Forex Brokers With Segregated Accounts. Analyze regulation, fund management practices, and compensation schemes for each.

4 Best $5 Minimum Deposit Forex Brokers in 2026

Explore forex trading with just $5 through the top four brokers, offering optimum services with minimal capital.

Best DMA Forex Brokers (Direct Market Access) for 2026

Delve into the world of DMA Forex Brokers with our guide. Discover top picks and know how DMA brokers operate, their pros and cons.

7 Best $10 Minimum Deposit Forex Brokers in 2026

Ultra-affordable Forex trading starts here! With only $10, join the Forex market with these seven champion brokers.