General Information & Regulation

IG is a trading name of IG Markets Ltd (a company registered in England and Wales under number 04008957) and IG Index Ltd (a company registered in England and Wales under number 01190902). IG was founded in 1974 in London, U.K. is the world's first broker to actually built the concept of financial spread betting that introduced online dealing as early as in 1998. IG headquartered in London (UK) and including operations in the USA, Australia, Japan, New Zealand, registered among European countries and Singapore.

Regulatory Information

IG Markets have 9 entities under stringent regulation in their own jurisdictions:

IG MARKETS LIMITED, authorized and regulated by the Australia Securities and Investment Commission (ASIC), with Regulatory License No. 220440

IG AUSTRALIA PTY LTD, authorized and regulated by the Australia Securities and Investment Commission (ASIC), with Regulatory License No.515106

IG Markets Limited, authorized and regulated by the Financial Conduct Authority (FCA), with Regulatory License No.195355

IG証券株式会社, authorized and regulated by the Financial Services Agency (FSA) in Japan, with Regulatory License No. 9010401051715

IG US LLC, authorized and regulated by the National Futures Association (NFA), with Regulatory License No. 0509630

IG MARKETS LIMITED, authorized and regulated by the Financial Markets Authority (FMA), with Regulatory License No. 18923

IG ASIA PTE LTD, authorized and regulated by the Monetary Authority of Singapore (MAS), with Regulatory License Number Unreleased.

IG Limited, authorized and regulated by the Dubai Financial Services Authority (DFSA), with Regulatory License No. F001780

Pros & Cons of IG

To ensure greater openness and compliance with strict regulations, IG is publicly traded on the Stock Exchange. Low Forex trading fees, a comprehensive teaching center, a wide variety of powerful trading tools, and solid research are just some of IG's many positives as a trading partner.

However, the selection of products available for trade is somewhat restricted, with Forex and CFDs being the primary vehicles for doing so.

some advanatges and disadvantages of IG are listed below:

Market Instruments

IG claims that it offers a wide range of tradable financial instruments for global investors, over 18,000 instruments, including Forex, indices, CFDs on stocks, digital cryptocurrencies, options trading for investors to choose from.

Account Types

IG seems only offer a basic account, and this broker requires no minimum initial deposit, which means investors can fund their IG account any money to start trading with this broker. Most other brokers would, in most cases, ask a minimum depsit of $100 ~$200 to open a standard account.

IG Leverage

In accordance with the new ESMA regulation, which tightened the restrictions on trading in Europe, European citizens and residents can now only use a certain multiplier in their transactions. Depending on the specifics of the local regulations, IG trading accounts may be subject to additional ratio restrictions.

So, while European traders are restricted to a maximum leverage of 1:30 on Forex instruments, Australian authorities permit a much higher 1:200 leverage. Check out the table below for a full look at the leverages available for cryptocurrency, commodity, share, and index instruments.

IG Spreads & Commissions

The minimum spread is around 0.6 pips on the EURUSD pair, 0.6 pips for AUDUSD, 0.9 pips for GBPUSD, 0.9 pips for EURGBP, 0.3 pips for spot gold, 2 pips for spot silver, 0.5 pips for emerging market indices, 2.8 pips for Brent crude oil and 2.8 pips for US light crude oil. Stock CFDs commissions: The minimum commission for US stocks is 2 cents per share per side(minimum $15), 0.18% for Hong Kong stocks (minimum HKD15), 0.10% for UK stocks (minimum £10), and 0.08% for Australian stocks (minimum AUD$7).

IG Trading Platform

IG offers traders an award-winning trading platform that makes trading faster and smarter, featuring an online trading platform, a trading app, a tablet app, an MT4 trading platform, and ProRealTime advanced charting. The web-based platform allows traders to open, close, and adjust positions more quickly in just a few seconds, split charts to view the same market in multiple time frames simultaneously, and upgraded smart mode to automatically save trade sizes and stop-loss levels. ProRealTime's advanced charts cover price, volatility, and more than 100 other indicators, allowing you to trade directly from the charts, including setting buy and sell orders.

Trading Tools

Additionally, all IGs platforms are enhanced with 18 free add-ons and indicators, Autochartist, technical analysis tools, and a free VPS for an expert advisor, and a range of small detailed settings that enhances trader deal.

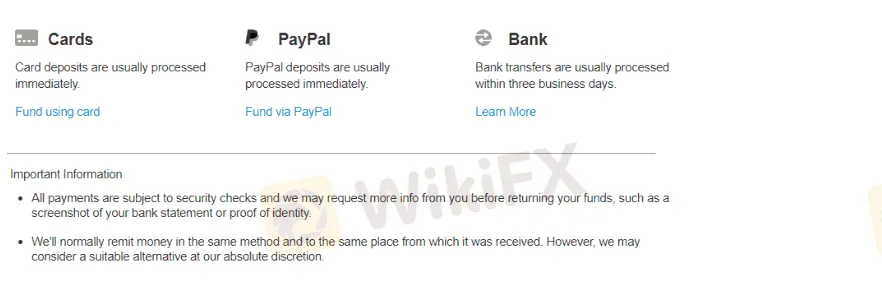

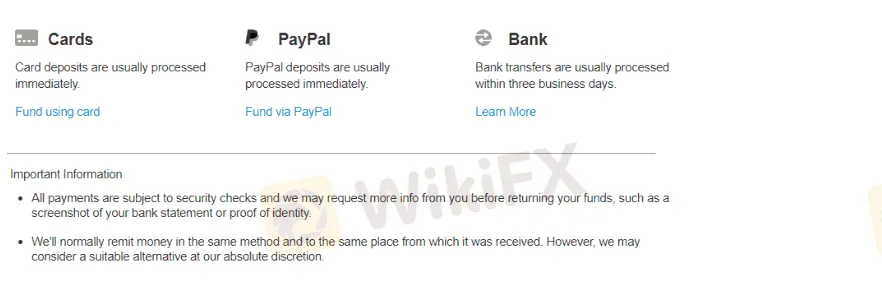

Deposit & Withdrawal

You won't have to worry about meeting any sort of minimum deposit or paying any sort of transfer charge. However, before you start trading, you should check the deposit requirements and margin for the instruments you plan to use.

Since there are a variety of deposit options, a trader may select the one that works best for them in terms of initial trading fees and get started trading practically immediately. In addition, double-check the availability of this and any other feasible alternatives in your area.

Customer Support

IG customer support services can be reached through several methods, including live chats, social media, available on Phone 24h . Traders absolutely covered by responses to queries in different languages, since the variety of offices truly represents all variety of nationalities and countries.

Educational Resources

In addition to its many other benefits, IG's dedication to its clients' success shines through in the form of IG Academy's free trading classes, webinars, and other resources. You'll discover everything you need to get started trading with IG, thanks to the company's extensive educational resources that boost trading potential, allow you to improve your abilities if you already have them, and provide you with help at the beginning.

Being one of the largest firms in the world, IG makes substantial investments in the training of traders and other interested parties through its IG Academy, which is an integral part of its global offering. To ensure that its traders are well-educated, IG often hosts Live Seminars with prominent figures in the industry.

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX