For newcomers to the forex market, trading forex can be quite challenging, and there is certainly a certain amount of risk involved. For this reason, most new users are advised to start by using a forex demo account before committing to buying any real money. The demo account serves this purpose, although they can also be used for many other purposes. Demo accounts do not use real money and so there is virtually no risk associated with them. In this way, they provide you with the opportunity to test different trading strategies and get a feel for the market. Without investing anything, you can test entering and exiting positions, see how the price changes, and even earn some money. Your earnings, however, will also be fictitious.

Additionally, through them, you can gain an understanding of some basic, yet still essential concepts related to forex trading. Having the basics such as entering and exiting positions, taking long and short positions, and pip calculation is all something that can be picked up and implemented using the demo account. However, even though demo accounts are always free, there are some that offer more value than others. Traders who have a demo account are more likely to open a live account with the same broker. The following list is based on the top brokers that provide a demo account as well as offering the best trading conditions.

Best Forex Demo Account Brokers

A long-established Broker, Strictly Regulated by Multiple Regulatory Bodies in Various Jurisdictions, Offering Sufficient Reliability.

Over 80 Currency Tradable, Competitive Pricing Structure with Tight Spreads from 0 Pips.

A Multi-Regulated Big Player that renders you adequate Safety.

Enjoy the Ease of Withdrawal without any Additional Charges.

Globally Licensed and Regulated by FAC & CYSEC, Offering Great Reliability.

Advanced Trading Platforms Offering of Ultra-Low Spreads, Starting from 0 pips.

more

Best Forex Demo Account Brokers Video

Comparison of the Best Forex Demo Account Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Forex Demo Account Brokers FAQs

What is a Demo Account?

Demo accounts allow new investors test their strategies and learn how to use trading technology without putting themselves at risk. With the demo account, users can trade using fake money and simulate what the returns would be if they traded with real money. Schools and colleges commonly use demo accounts to teach investing and compete in trading competitions.

Stock traders, currency exchange traders, and commodities traders generally use demo accounts, but not long-term investors. It is less useful to use a demo account as the longer it takes to earn profits from an investment, the more time it takes away from compounding real money.

How does a Demo Account Work?

With demo accounts, investors can practice trading on a platform without risking their own capital. With live trading, you will not be exposed to the risks associated with live trading platforms on a demo account. Consequently, you can learn how platforms work without having to risk your money.

Having a demo account means that you won't lose cash, although you can't gain cash, either. In order to minimize risk when trading on the real market, traders need to learn discipline and develop strategies.

How to Open a Demo Account?

Generally speaking, setting up a demo trading account is quite simple. Select a Broker - Most brokers offer demo trading platforms to help you get familiar with the features and to develop strategies. Decide which broker you will use first.

Registration is required - you will need to enter your specific information. Details such as name, address, and banking details will be required. Your identification will likely also have to be verified.

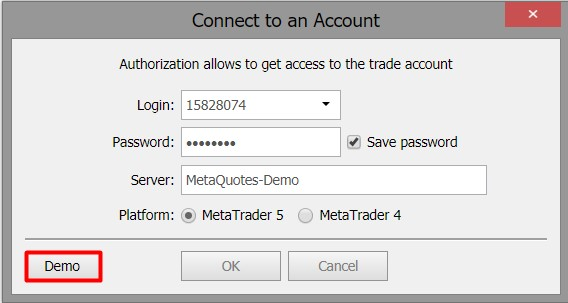

MetaTrader4 can be installed once you have chosen a broker. You will need the platform that allows you to trade once you have chosen a broker. The most commonly used trading platforms are MetaTrader 4 and MetaTrader 5.

After registering with a trading program, you receive login information. You will be able to open an account after logging in. This is where you will be able to select a 'demo account' and select your preferred trading server.

As soon as you are set up, you can begin trading.

How Long do Demo Accounts Last?

In a demo account, traders can test out a program for up to 3 months before deciding whether to proceed with purchasing the full version. Basically, the three-month period is given to ensure that the prospective buyer will have enough information to make them want to buy.

Why is It Necessary to Open a Demo Account?

Even after studying a lot, there is no substitute for experience when trading Foreign Exchange. Therefore, new traders have to experience a few losses before making a profit. New traders are now able to try out trading with a demo account, which has increased the stakes for novice traders, letting them take a shot at trading without risking their capital. Demo account usage is also greatly appreciated by experienced traders. A typical use of this account type is testing out theories and finding out if a new Forex robot will be worth buying before investing in it.

What are Advantages of Demo Accounts?

Demo accounts are a great way to learn different trading strategies and softwares. If you are a new investor, paper trading is a much safer way to make technical errors than real trading. Investors can make good use of the proprietary trading software that each brokerage offers.

Whether you are a beginner or an experienced trader, a demo account allows you to test strategies without risking any money. Trading with a demo account offers the trader the opportunity to test the strategy before trading with real money.

Commodities and Forex can also be lucrative, even though many traders start with stocks. However, the same techniques may not apply in all three asset classes. A demo account allows experienced traders to test out other asset classes to determine which works and which does not.

The Differences between Demo & Live Accounts

A forex demo account differs from a real account in that it is used as a training account for traders to practice trading without risking any real money. Real accounts, on the other hand, use real money, and traders risk their own cash. A demo account allows users to trade with fake money and simulate the profits they would receive if they were trading with real money. Colleges and schools commonly use demo accounts to teach investing and participate in trading competitions.

However, studies have shown that even in the case of a person who has gained ample trading experience after trading with these demo accounts, things might turn out to be different when real money is involved. Since you don't need to risk anything when trading with virtual money, it's more accessible than trading with real money.

Can I Have Multiple Forex Demo Accounts?

Depending on the broker, you may be able to open up to five demo accounts. However, some offer up to 19 demo accounts. Generally, there is no way to tell how many demo accounts are possible at any given time. Demo account numbers are not capped by all brokers.

If your broker has a limit on demo accounts, you can contact their customer support by email or live chat to request additional demo accounts.

You can find brokers who will allow you to open only one account of each type per email address. Thus, unless you provide them with another email address or open a new account, you are not permitted to create any more accounts. Traders do not benefit from this practice since they need to spend their resources on opening new accounts instead of allowing them to open as many accounts as they want.

In most cases, you won't need more than five accounts, or maybe one will be enough depending on your strategy.

Anyway, you should practice on a demo account until you are very good at it.

Is a Demo Trading Account Free?

In most cases, demo platforms are free. As you will not be trading with real money, there is no risk of losing money in the process. Consequently, there are no deposits, withdrawals, or training fees associated with this.

How to Choose Forex Accounts?

Different accounts with different. Before opening up a trading account, you should figure out the following questions:

How much do you want to deposit? You should keep in mind that it is not wise to trade with money you cannot afford to lose.

What is your risk tolerance? If you are a conservative trader, you may choose a micro account you can trade micro-lots. But if you want to trade more aggressively, you may better choose a standard account.

Do you need any advanced tools? Many forex brokers offer their best trading tools to their professional clients, which may include innovative news analysis or access to an extensive range of indicators.

Once you can define what kind of trader you are, your trading goals, and your risk tolerance, you can know what account suits you most.

Can I Withdraw Money from a Demo Account?

Sadly, the answer is no. Demo accounts are intended for practice only. The account is not funded with real money, so you don't deposit anything.

Because of this, any profits you would have made would not be able to be withdrawn.

You Also Like

Best Forex Brokers for Beginners in Nigeria for 2024

Select the top forex brokers for beginners in Nigeria from many companies to ensure a safe trading environment.

Cheapest Brokers 2024 | We List the Best Brokers with low fees

Slash forex trading costs: find the cheapest brokers, avoid hidden fees, and boost your returns!

Best Zero Spread Forex Brokers in 2024

Dive into zero-spread forex trading: explore its perks, pitfalls, and discover top brokers to optimize your journey.

7 Best $10 Minimum Deposit Forex Brokers in 2024

Ultra-affordable Forex trading starts here! With only $10, join the Forex market with these seven champion brokers.