In the rapidly changing financial environment of 2024, enhancing the younger generation's knowledge of savings and investments is now more crucial than ever. Creating financial stability and fostering money-management aptitudes from an early age can pave the way for your child's prosperous financial future.

One method that is increasingly gaining popularity is the use of custodial accounts. These are designed to protect minors' assets until they come of age.

In this article, we will delve deep into the details of custodial accounts, explore their benefits and drawbacks, and offer a comparative analysis of top-tier best custodial brokers. Join us on this journey of equipping the next generation with the invaluable asset of financial literacy and independence.

List of the Best Brokers with Custodial Accounts

A tailored investment approach for your child's financial growth, under your guidance and control until they reach majority age.

more

Best Custodial Brokerage Account Overall

①Fidelity

Fidelity's custodial account lets you build wealth through stocks, ETFs, options, bonds, mutual funds, and much more. Plus, the account has no minimum opening requirements or fees, and any stocks, ETFs, or options the account holder invests in are commission-free.

Its custodial offerings are also supplemented with account perks like Fidelity Viewpoints, an online center with expert commentary on investing strategies, markets, and much more. In addition, Fidelity's Planning & Guidance Center offers tools to help you meet investing goals.

Fidelity Investments offers multiple other minor investment account options beyond UGMA/UTMA custodial accounts. These include its Roth IRA for Kids account, 529 plan, Fidelity Youth Account (which lets children between the ages of 13 and 17 invest independently), and trust accounts.

If you are a parent saving your own money for a child's education, a 529 account may make more sense than a custodial 529 or an UGMA/UTMA. That's because 529 accounts offer a greater degree of flexibility and control, as well as tax benefits.

| Fidelity |  |

| Investment Options | Stocks, ETFs, Options, Bonds, Mutual Funds, and more |

| Minimum Opening Requirements | No minimum opening requirements |

| Fees | No opening deposit, maintenance, or transfer fees |

| Commission on Investments | Commission-free for stocks, ETFs, and options |

| Additional Investment Options | Roth IRA for Kids, 529 Plan, Fidelity Youth Account, Trust Accounts |

| Education Resources | Yes |

| Open Fidelity Custodial Account | |

Pros:

No minimum opening requirements.

Commission-free investments in stocks, ETFs, and options.

Diverse range of investment options including stocks, ETFs, options, bonds, and mutual funds.

Access to Fidelity Viewpoints for expert commentary on investing strategies and markets.

Planning & Guidance Center tools to help meet investing goals.

Additional investment options beyond custodial accounts, including Roth IRA for Kids, 529 Plan, Fidelity Youth Account, and Trust Accounts.

Emphasis on financial education with lessons for life.

Cons:

Potential for simplicity over additional features catering to specific needs.

②Vanguard

Vanguard, a prominent player in retirement investing and mutual funds, extends its competitive features to custodial accounts. Vanguard's custodial accounts provide diverse investment options, including stocks, bonds, Vanguard mutual funds, non-Vanguard funds, and more. Vanguard's strength lies in its low-cost index fund products, making it our top choice for custodial accounts. The platform supports various account types, such as individual, joint, 529 savings plans, and UGMA/UTMA custodial accounts.

Notably, there are no opening deposit, maintenance, or account transfer fees. For investors seeking guidance, Vanguard Personal Advisor Services offers a robo-advice approach with ongoing financial advisor support, requiring a minimum investment of $50,000 and incurring a 0.30% annual fee.

| Vanguard |  |

| Investment Options | Diverse options including stocks, bonds, Vanguard mutual funds, and more. |

| Minimum Opening Requirements | No minimum opening requirements. |

| Fees | No opening deposit, maintenance, or transfer fees. Advisory fee for Personal Advisor Services (UGMA/UTMA). $25 fee for each brokerage account (waived with E-Delivery Service). |

| Commission on Investments | Commission-free purchases of Vanguard's low-cost mutual funds. Options contracts cost $1. |

| Additional Investment Options | Roth IRA for Kids, 529 Plan, Fidelity Youth Account, Trust Accounts. |

| Education Resources | Yes |

| Open Vanguard Custodial Account | |

Pros:

No minimum opening requirements.

Commission-free investments in Vanguard's low-cost mutual funds.

Diverse investment options, including stocks, bonds, and more.

Access to Vanguard Personal Advisor Services for personalized guidance.

No opening deposit, maintenance, or transfer fees.

Availability of 529 plans and trusts for education savings.

Custom scheduling for electronic fund transfers.

Industry-leading value with low-cost index fund products.

Cons:

Advisory fee for Personal Advisor Services (UGMA/UTMA).

$25 fee for each brokerage account, waived with E-Delivery Service.

Options contracts cost $1.

Potential tax implications for UGMA/UTMA transfers.

③Merrill Edge

Merrill Edge Custodial Accounts offer a comprehensive financial solution to invest and manage funds on behalf of your minor. Merrill Edge goes a step further by offering commission-free trades for stocks, ETFs, and options without minimum opening deposits, annual fees, or account maintenance fees.

If you ponder the robo-advisor route, Merrill Edge has two offerings: Merrill Guided Investing and Merrill Guided Investing with an Advisor, which is decided to simplify investing with guided, automated strategies. However, these come with annual fees of 0.45% and 0.85%, respectively, which are on the higher side.

If you're already a Bank of America client, the account can be funded by linking your existing Bank of America account. But even if you're not, you can easily fund the account via checks, wire transfers, or transfers or rollovers from existing accounts.

Beyond its custodial accounts, Merrill Edge offers a wide array of competitive financial products and tools. These include automated investing accounts (robo-advisors), individual retirement accounts (IRAs), 529 plans for education savings, retirement calculators, margin accounts, amongst others. Merrill Edge also provides round-the-clock phone support and live chat.

| Merrill Edge |  |

| Investment Options | Commission-free stocks, ETFs, and options. Robo-advisor options with Merrill Guided Investing. |

| Minimum Opening Requirements | No minimum opening deposits. |

| Fees | No annual fees or account maintenance fees for custodial accounts. Annual fees for Merrill Guided Investing and Merrill Guided Investing with an Advisor (0.45% and 0.85%, respectively). |

| Commission on Investments | Commission-free trading for stocks, ETFs, and options. |

| Additional Investment Options | Comprehensive range of financial products including automated investing accounts, IRAs, 529 plans, retirement calculators, margin accounts, and more. |

| Education Resources | Yes |

| Open Merrill Edge Custodial Account | |

Pros:

No minimum opening deposits, annual fees, or account maintenance fees for custodial accounts.

Commission-free trading for stocks, ETFs, and options.

Option for robo-advisor services with Merrill Guided Investing.

Seamless funding for Bank of America clients through linked accounts.

Multiple funding options including checks, wire transfers, and transfers from other accounts.

Comprehensive range of financial products beyond custodial accounts, including automated investing, IRAs, 529 plans, and more.

24/7 phone support and live chat for customer assistance.

Cons:

Annual fees for Merrill Edge's automated accounts are relatively high.

④E*TRADE

E*TRADE offers a suite of custodial products, making it a competitive choice for various types of investors. Their offerings include the standard UGMA/UTMA custodial account, IRA for Minors, and Coverdell ESA accounts. The standard custodial account allows for commission-free trades on stocks, ETFs, and options, while bond transactions incur a $1 fee with minimums ranging from $10 to $250. ETRADE boasts a vast selection of over 4,500 no-load, no-transaction-fee mutual funds.

For those who prefer robo-advice, E*TRADE's automated investing account, Core Portfolios, managed by experts, is available with a minimum setup requirement of $500. Custodial accounts come with no income or contribution limits and offer a free debit card, checking perks, and online bill pay. However, it's important to note that ETRADE does not support fractional share trading.

| E*TRADE |  |

| Investment Options | Commission-free stocks, ETFs, and options. No-fee mutual funds. Bond transactions at $1 per bond. |

| Minimum Opening Requirements | $500 for Core Portfolios automated investing account. |

| Fees | $1.00 per bond. No commission on stocks, ETFs, and options. |

| Commission on Investments | Commission-free trading for stocks, ETFs, and options. |

| Additional Investment Options | IRA for Minors, Coverdell ESA accounts. |

| Education Resources | Yes |

| Open E*TRADE Custodial Account | |

Pros:

Commission-free trading for stocks, ETFs, and options.

No-fee mutual funds with a vast selection.

Low minimum opening requirement for the automated investing account.

Free debit card, checking perks, and online bill pay.

Guidance on managing a child's portfolio until they come of age.

Additional investment options like IRA for Minors and Coverdell ESA accounts.

Cons:

No support for fractional share trading.

Higher fees for automated investing accounts (0.45% for Core Portfolios).

Bond transactions incur a $1.00 fee per bond with varying minimums.

⑤Charles Schwab

The Schwab One Custodial Account stands out as a versatile brokerage offering with notable advantages. This custodial account requires no minimum opening deposit, entails no account setup or maintenance fees, and facilitates commission-free trading for stocks and ETFs.

A distinctive feature, Schwab Stock Slices, permits the acquisition of fractional shares with a modest $5 minimum requirement. Importantly, custodial accounts impose no contribution limits, enhancing flexibility for investors. Beyond the Schwab One Custodial Account, Schwab extends its custodial offerings to include options like custodial IRAs (traditional or Roth), 529 college savings plans, and education savings accounts (ESA). The account is unique in its suitability for both self-directed and automated investing. Investors can choose automation through Charles Schwab Intelligent Portfolios or Schwab Intelligent Portfolios Premium robo-advisors, requiring a minimum investment of $5,000 and $25,000, respectively. The account also grants access to 24/7 service and support.

Important Notes:

Amounts exceeding the $2,600 threshold may be taxed at the parent's tax rate.

All assets are held in the child's name.

A custodial account is an irrevocable gift, requiring transfer to the child at the age of majority.

Funds used before the age of majority must be for the sole benefit of the minor.

| Charles Schwab |  |

| Investment Options | Commission-free stocks, ETFs, and options. Schwab Stock Slices for fractional shares ($5 minimum). |

| Minimum Opening Requirements | $0 minimum deposit. |

| Fees | No setup or maintenance fees. $1 per bond. |

| Commission on Investments | Commission-free trading for stocks and ETFs. |

| Additional Investment Options | Custodial IRAs, 529 plans, and ESAs. |

| Education Resources | Yes |

| Open Schwab One Custodial Account | |

Pros:

Commission-free trading for stocks, ETFs, and options.

$0 minimum opening deposit, making it accessible to all investors.

No account setup or maintenance fees.

Schwab Stock Slices allows fractional share investments with a low $5 minimum.

Access to a wide range of investment options, including mutual funds and other securities.

Automated investing options through Schwab Intelligent Portfolios.

24/7 service and support for account holders.

Cons:

$1 per bond fee for online secondary market trades.

Minimum requirements for automated investing: $5,000 for Schwab Intelligent Portfolios and $25,000 for Schwab Intelligent Portfolios Premium.

Custodial Account Knowledge Questions and Answers

What Is a Custodial Account?

A custodial account is a financial account that is created and managed by an adult, typically a parent, guardian, or legal representative, for a minor or an individual who is not able to manage their own finances. The person who manages the account is referred to as the “custodian”.

The funds in this account belong to the beneficiary (the minor or individual for whom the account is made), but control over the account will be in the hands of the custodian until the beneficiary reaches a certain age, typically 18 or 21 depending on the state law.

Custodial accounts can be used to save and invest for minors, and they can hold various investment types like stocks, bonds, ETFs, and cash.

How Does a Custodial Account Work?

A custodial account works by allowing an adult (the custodian) to open and manage a savings or investment account for a minor or an individual incapable of handling their finances.

In most cases, the custodian will make deposits, manage investments, and conduct other financial transactions on behalf of the beneficiary. This could involve investing in stocks, bonds, mutual funds, or other assets. However, the custodian must always act in the best interests of the beneficiary.

Furthermore, once a deposit is made into the account, it is irrevocable, meaning it cannot be taken back or moved to another account that doesn't benefit the beneficiary.

The beneficiary will gain control over the account once they reach the age of majority, typically 18 or 21 depending on state law. They can then use the funds in any way they see fit. The custodian is legally obligated to relinquish control over the account at that time.

What Are the Types of Custodial Accounts?

There are two primary types of custodial accounts:

Uniform Gift to Minors Act (UGMA)

This account permits minors to own securities, such as stocks, bonds, and mutual funds. However, real estate and other assets cannot be held in this account.

Uniform Transfers to Minors Act (UTMA)

This account allows minors to own other types of assets such as real estate, paintings, patents, and royalties, in addition to securities.

| UGMA (Uniform Gifts to Minors Act) | UTMA (Uniform Transfers to Minors Act) | |

| Purpose | To allow minors to own securities without requiring the need of a trust | To allow minors to own property without requiring the need of a trust |

| Age Limit | Age 18 or 21 | Up to 25 |

| Assets | Limited to securities, like stocks, bonds, and mutual funds | All property types, such as real estate, fine art, patents, and royalties, in addition to securities |

| Taxation | Subject to the “kiddie tax” | Subject to the “kiddie tax” |

| Control | Custodian maintains control until the minor reaches the age | Custodian maintains control until the minor reaches the age |

| Contribution Limits | No | No |

How to Choose a Custodial Account?

Now that you know the difference between UGMA/UTMA accounts and why going with a major broker is best, here are a few more factors to consider when picking a custodial account.

Account Type: Decide whether an UGMA or UTMA account suits your needs. If you're only planning to gift securities, an UGMA account may suffice. If you want to transfer more varied assets, consider an UTMA account.

Financial Institution: Different banks, brokerages and credit unions offer custodial accounts, but the terms of their offerings can vary. Consider the reputation, financial stability, and customer service of the financial institution.

Investment Options: Look for an account that offers a variety of investment options, such as stocks, bonds, and mutual funds. More investment choices give you more flexibility in how you grow the accounts assets.

Fees and Minimum Balances: Some custodial accounts might come with annual fees, minimum balance requirements, or transaction fees. It's important to understand the cost structure of each account you consider.

Ease of Use: Its worth considering how easy it is to deposit into and manage the account. Some accounts offer features such as automatic transfers or an easy-to-use app.

Educational Resources: Some providers offer helpful resources that can benefit both the custodian and the beneficiary, such as financial literacy materials and investing tutorials.

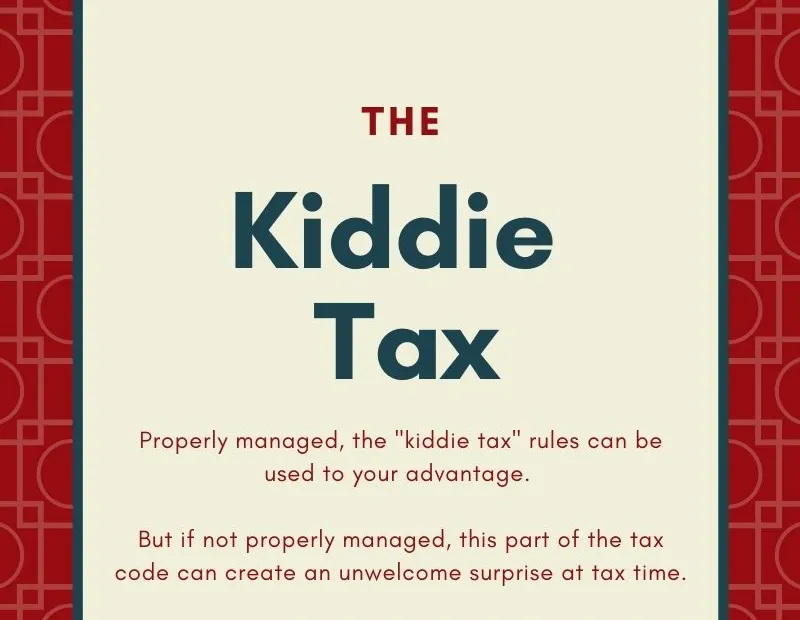

How Are Custodial Accounts Taxed?

Custodial accounts are subject to a specific set of tax rules. The investment gains, dividends, and interest that the account generates are considered the minors income and therefore are taxed at the minor's tax rate. This is often referred to as the “kiddie tax”.

The rules for 2021 are as follows:

The first $1,100 of unearned income is tax-free.

The next $1,100 is taxed at the minor's tax rate.

Any income over $2,200 is taxed at the parent's tax rate (or the rate of the minor's siblings, if higher).

Because tax laws and rules can change from year to year, it's wise to consult a tax advisor or conduct diligent research to understand the current tax liabilities for custodial accounts.

Comparison of Related Account Types

Roth IRA (Individual Retirement Account) is a type of retirement savings account in the United States, which allows investors to withdraw their investment without paying any taxes after reaching the prescribed retirement age.

529 Account, also known as a 529 Plan, is an education savings plan designed to help families set aside funds for future college costs in the United States. These plans are often tax-advantaged and sponsored by states, state agencies, or educational institutions.

Here is a comparison table of Roth IRA, Custodial Account, and 529 Account.

| Roth IRA | Custodial Account | 529 Account | |

| Purpose | As a retirement investment. | Hold and protect assets for minors until they reach adulthood. | For education savings |

| Tax Benefits | The income invested is post-tax, and returns are generally tax-free. | No specific tax benefits. | Contributions are not deductible, but earnings grow tax-free. |

| Income Limitations | Income limit for eligibility. | None | None |

| Access to Funds | Early withdrawals (before age 59.5) may incur taxes and penalties. | Minors can access the assets when they reach adulthood. | Funds must be used for qualified education expenses to get tax benefits. |

| Contribution Withdrawals | Cannot be withdrawn without penalties and taxes before the age of 59.5 | Cannot be withdrawn until the minor reaches adulthood. | No penalties as long as the money is used for educational purposes. |

| Investment Options | Broad range of investment options. | Broad range of investment options | Limited to the plan's offerings. |

What Are Some Other Options?

Unlike custodial accounts provided by brokers, there are also some savings applications specifically designed for families. The primary purpose of these applications is to enable parents to save for their children's future. The main advantages include simplicity, customization options, transparent fees, no additional costs, and a secure and reliable environment. Some of these popular options include:

Acorns Early is a user-friendly custodial investment account designed for children, offering a quick and simple registration process that takes just a few minutes. With minimal restrictions, it provides flexibility and ease of use. To set up an Acorns Early account, users only need to provide basic information such as the child's name, birthday, and SSN. This UTMA/UGMA custodial account stands out from other education-focused accounts like 529 plans, as funds can be utilized in various ways that directly benefit the child, such as for their first car or extracurricular activities.

The all-in-one finance and safety app for families that ties earnings to hard work, offering a 2% savings reward and up to 5% on savings goals. Invest together, earn 1% cash back for smart spending, and engage in financial literacy with fun games through Greenlight Level Up™ in the app.

Stockpile is an easy-to-use app that promotes active learning and participation by enabling parents and kids to invest together, fostering a hands-on approach to financial education. Stockpile offers a unique “Kid Chooses, Parent Approves” experience, allowing children to independently select stocks and other assets for investment, supervised by an adult custodian.

UNest is an app dedicated to simplifying family investments. Join the growing parent community, save, and invest with UNest. Download the UNest app on your phone and open an account in less than five minutes, making it the most intuitive and straightforward way to secure a bright future for your children. Set up a monthly contribution plan, receive gifts from friends and family to accelerate your fund growth, and easily track your savings anytime, anywhere.

These apps offer the advantage of streamlining the investment process. Acorns, for instance, rounds up spare change from purchases to investing in diverse portfolios, mirroring the approach of a robo-advisor. Similarly, UNest allows for monthly contributions as low as $25 to a portfolio of Vanguard funds for your child.

However, the drawback lies in the monthly fees associated with these simplified services. For instance, UNest charges $2.99 per month, and Acorns Early has a monthly fee of $5. While this may not seem burdensome, established brokers like Ally Invest and TD Ameritrade offer commission-free stock and ETF trading. Additionally, as your child matures, they may prefer a brokerage account with a comprehensive broker over managing their Stockpile account.

Main differences between Savings Apps and Custodial Brokerage Accounts

The main differences between custodial accounts in savings applications and free custodial accounts with brokerages often center around the types of service and cost.

Custodial accounts in savings applications

Free custodial accounts with brokerages

These custodial accounts are usually provided by brokers or other financial institutions and are designed for a broad range of investments, not limited to child savings. They might provide research and analysis tools in addition to basic trading and investment features. Such accounts are often free, but transaction fees, platform fees or other related costs may apply depending on the specific brokerage.

The common feature of these two types of custodial accounts is that under the management of the guardian, minors can own accounts, and when they become adults, these accounts will automatically be transferred to their own name.

These accounts are designed primarily for children's savings and investments. Parents or guardians manage these accounts until the children reach an appropriate age.

Savings apps may charge a fee for services, covering costs such as administration and account maintenance.

For instance, Stockpile Membership is priced at $4.95 per month. Additionally, such apps often provide user-friendly interfaces and educational resources to help parents and children understand investing and saving.

You Also Like

Best Forex Brokers for Beginners in Nigeria for 2024

Select the top forex brokers for beginners in Nigeria from many companies to ensure a safe trading environment.

Cheapest Brokers 2024 | We List the Best Brokers with low fees

Slash forex trading costs: find the cheapest brokers, avoid hidden fees, and boost your returns!

Best Zero Spread Forex Brokers in 2024

Dive into zero-spread forex trading: explore its perks, pitfalls, and discover top brokers to optimize your journey.

7 Best $10 Minimum Deposit Forex Brokers in 2024

Ultra-affordable Forex trading starts here! With only $10, join the Forex market with these seven champion brokers.