In this article, we explore the '10 Best ECN Forex Brokers in 2026', a comprehensive ranking compiled by our team on WikiFX. Our methodology considers multiple factors including broker regulation, trading conditions, platform options, and customer service, among others. Each broker is rigorously tested and evaluated, our rankings thereby providing relevant, trustworthy information for all kinds of traders.

This guide is an extension of our commitment to provide well-researched, invaluable insights to our audiences, similar to the numerous other rankings we've put together over time. These diverse rankings aim to provide clear, concise information to help traders navigate the complex world of forex trading.

Best ECN Forex Brokers

more

Comparion of Best ECN Forex Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best ECN Forex Brokers Reviewed

① Exness

Best for beginner-friendly operations

Exness is an eminent player in the realm of ECN Forex brokers, acclaimed for its advanced technology, vast range of tradable assets, and transparent operations. Launched in 2008, it has steadily grown into a global entity, catering to the trading requirements of both retail and institutional traders.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Broker Type | ECN |

| Execution Speed | 99.5% of orders are executed within 0.4 seconds |

| Min. Deposit | $10 |

| Regulation | CySEC, FCA, FSCA, FSA (Offshore) |

| Financial Instruments | CFDs on forex, commodities, stocks, indices, cryptos |

| Demo Account | ✅($10,000 virtual funds) |

| Max. Leverage | 1: Unlimited |

| Trading Cost | From 0.2 pips & commission-free (Standard account) |

| Trading Platforms | MT4/5, Exness Terminal, Exness Trade app |

| Social Trading | ✅ |

| Customer Support | 24/7 live chat |

Pros

√ Regulated by well-known regulatory bodies - CySEC, FCA, FSCA, FSA (Offshore)

√ Wide range of trading instruments

√ Low minimum deposit of only $10

√ Fast execution speed and minimal latency

√ Access to advanced platforms MetaTrader 4

√ 24/7 Customer support in multiple languages

Cons

× Clients from the USA, Canada, Iran, North Korea, Europe, the United Kingdom, Russia, Belarus and others are not allowed

② BlackBull Markets

Best for low spreads and forex education

BlackBull Markets, an ECN forex broker based in New Zealand, is a preferred choice for many traders. Launched in 2014, the company has quickly gained a strong foothold in the market because of its advantageous offerings for traders.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Broker Type | ECN, STP |

| Execution Speed | <100ms |

| Min. Deposit | $0 |

| Regulation | FMA, FSA (Offshore) |

| Financial Instruments | 26,000, forex, commodities, equities, indices, metals, futures, cryptos |

| Demo Account | ✅ |

| Max. Leverage | 1:500 |

| Trading Cost | From 0.8 pips & commission-free (ECN Standard account) |

| Trading Platforms | TradingView, MT4/5, cTrader, BlackBull CopyTrader, BlackBull Invest |

| Copy Trading | ✅ |

| Customer Support | 24/7 live chat, contact form, phone, email, WhatsApp |

Pros

√ Regulated by FMA and FSA (Offshore)

√ Offers an extensive selection of 26,000 trading instruments

√ No minimum deposit requirement

√ Follows ECN model with tight spreads and fast execution speeds

√ Does not charge commission on ECN standard account

√ Provides access to MetaTrader4 and MetaTrader5 - advanced and user-friendly trading platforms

√ Excellent 24/7 customer support

Cons

× Clients from the European Union, the United Kingdom and any non-resident of New Zealand are not allowed

③ RoboForex

Best at offering low ECN fees

RoboForex is a prominent ECN broker, acclaimed for its extensive range of assets, robust platforms, and customer-centric approach. Founded in 2009, the broker has made significant strides in the forex arena by providing quality services to its clientele.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Broker Type | ECN |

| Execution Speed | Over 90% of orders executed within 60 milliseconds |

| Min. Deposit | $10 |

| Regulation | CySEC, NBRB, FSC (Offshore) |

| Financial Instruments | Stocks, indices, futures, ETFs, soft commodities, energies, metals, currencies |

| Demo Account | ✅ |

| Max. Leverage | 1:2000 |

| Trading Cost | Floating from 0 pips & commission-free (ECN account) |

| Trading Platforms | MT4/5, WebTrader, MobileTrader, StocksTrader |

| Copy Trading | ✅ |

| Customer Support | 24/7 live chat, contact form, phone, WhatsApp |

Pros

√ Regulated by CySEC, NBRB, and FSC (Offshore), ensuring a safe trading environment

√ Low minimum deposit of only $10

√ Offers ECN trading conditions with tight spreads starting from 0 pips and a high leverage up to 1:2000

√ Provides access to both MetaTrader 4 and MetaTrader 5 platforms

√ Provides 24/7 customer support in multiple languages

Cons

× Withdrawal fee charged, free withdrawal only twice a month

× Clients from the USA, Canada, Japan, Australia, Bonaire, Brazil, Curaçao, East Timor, Indonesia, Iran, Liberia, Saipan, Russia, Sint Eustatius, Tahiti, Turkey, Guinea-Bissau, Micronesia, Northern Mariana Islands, Svalbard and Jan Mayen, South Sudan, Ukraine, and Belarus are not allowed

④ FXTM

Best for true ECN and trading platform

FXTM, also known as ForexTime, is a dominant force in the ECN Forex brokerage landscape. With its establishment in 2011, the company has consistently demonstrated its commitment to providing top-tier trading services.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Broker Type | ECN |

| Execution Speed | Not publicly specified |

| Min. Deposit | $/€/£/₦200 |

| Regulation | FCA, FSC (Offshore) |

| Financial Instruments | Forex, metals, commodities, stocks, indices, cryptos, future CFDs |

| Demo Account | ✅ |

| Max. Leverage | 1:3000 |

| Trading Cost | From 0.0 pips & $3.50 per lot traded on FX (Advantage account) |

| Trading Platforms | MT4/5, mobile trading |

| Customer Support | 24/5 live chat, contact form, phone |

Pros

√ Offers access to a broad range of financial instruments including forex, metals, commodities, stocks, indices, cryptos, and future CFDs

√ Provides ECN trading conditions with spreads from 0.0 pips on the Advantage account, and up to 1:3000 leverage

√ Offers advanced trading platforms, MetaTrader 4 and MetaTrader 5

Cons

× High minimum deposit requirement

× Clients from the USA, Mauritius, Japan, Canada, Haiti, Iran, Suriname, the Democratic People's Republic of Korea, Puerto Rico, the Occupied Area of Cyprus, Quebec, Iraq, Syria, Cuba, Belarus, Myanmar, Russia and India are not allowed

⑤ IC Markets

Best for low forex fees and free transactions

IC Markets Global is a renowned ECN forex broker based in Australia. Established in 2007, IC Markets has been a favored choice for many traders due to their advanced technology, wide variety of assets, and transparent business model.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Broker Type | ECN, STP |

| Execution Speed | 99% of their orders are executed in less than 40 milliseconds |

| Min. Deposit | $200 |

| Regulation | ASIC, CySEC |

| Financial Instruments | 2,250+, CFDs on 61 currency pairs, 24 commodities, 2,100+ stocks, 25 indexes, 9 bonds, 21 cryptocurrencies, 4 futures |

| Demo Account | ✅ (30 days) |

| Islamic Account | ✅ |

| Max. Leverage | 1:1000 |

| Trading Cost | From 0.8 pips & commission-free (Standard account) |

| Trading Platforms | MT4/5, cTrader, TradingView (Windows, Web, Android, Mac, iOS) |

| Social Trading | ✅ |

| Customer Support | 24/7 live chat, contact form, phone, email |

Pros

√ Offers a wide range of over 2,250 financial instruments including CFDs on 61 currency pairs, 24 commodities, 2,100+ stocks, 25 indexes, 9 bonds, 21 cryptocurrencies, and 4 futures

√ Features low spreads starting from 0.8 pips on the Standard account and ultra-fast execution speed, making it suitable for various strategies including scalping and algorithmic trading

√ Provides advanced trading platforms including MetaTrader 4, MetaTrader 5, cTrader, and TradingView

√

√ Provides customer support 24/7 in multiple languagesNo fees for deposits and withdrawals

Cons

× Clients from the United States of America, Canada, Brazil, Israel, New Zealand, Iran and North Korea (Democratic People's Republic of Korea) are not allowed

× The minimum deposit of $200 is relatively high for beginner traders

⑥ XM

Best for low trading fees

XM, operated by the XM Group, is a distinguished ECN broker globally acclaimed for its responsive customer service, user-friendly trading platforms, and extensive educational resources. Established in 2009, XM prides itself on a robust technological infrastructure that bolsters efficient forex trading.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| Broker Type | ECN |

| Execution Speed | 99.35% of trades are executed in less than a second |

| Min. Deposit | $5 |

| Regulation | ASIC, CySEC, DFSA, FSC (Offshore) |

| Financial Instruments | 1,400+, forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, thematic indices |

| Demo Account | ✅ (30 days) |

| Islamic Account | ✅ |

| Max. Leverage | 1:1000 |

| Trading Cost | From 1.0 pips & commission-free (Standard account) |

| Trading Platforms | MT4/5, XM App |

| Copy Trading | ✅ |

| Customer Support | 24/7 live chat, phone |

Pros

√ Regulated by multiple high-standing entities like ASIC, CySEC, DFSA, and FSC (Offshore), ensuring a secure trading environment

√ Offers an impressively wide range of over 1,400 financial instruments for trading

√ Low minimum deposit of only $5

√ Adheres to the ECN model with tight spreads from 1.0 pips and swift order execution

√ Provides access to advanced platforms MetaTrader 4 and MetaTrader 5

√ Offers 24/7 available customer support in various languages

√ Wide range of educational resources available for traders

Cons

× Although spreads are tight under the ECN model, the trading costs are relatively high for some traders, especially beginners

× Clients from the United States of America, Canada, Argentina, Israel and the Islamic Republic of Iran are not allowed

⑦ MultiBank

Best for adherence to regulations

MultiBank is a global forex and CFD broker that has been operating since 2005. The broker is known for its strong regulatory compliance and wide range of trading options.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| Broker Type | ECN |

| Execution Speed | Not publicly specified |

| Min. Deposit | $50 |

| Regulation | ASIC, CySEC, SCA, MAS |

| Financial Instruments | Forex, metals, shares, indices, commodities, cryptocurrencies |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Max. Leverage | 1:500 |

| Trading Cost | From 1.5 pips (Standard account) |

| Trading Platforms | MT4/5, Web Trader, MultiBank-Plus |

| Social Trading | ✅ |

| Customer Support | 24/7 live chat, contact form, phone, WhatsApp |

Pros

√ Highly regulated by ASIC, CySEC, SCA, MAS, providing a secure trading environment

√ Offers a wide range of trading instruments, including forex, metals, shares, indices, commodities, and cryptocurrencies

√ Provides access to the advanced platform MetaTrader 4/5

Cons

× Unclear fee structure

⑧ Pepperstone

Best for fast digital account opening and free transactions

Pepperstone, an Australian-based forex broker, has had a significant impact since its inception in 2010. With a reputation for low cost trading and customer satisfaction, Pepperstone consistently ranks high on lists of top-tier ECN brokers.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| Broker Type | ECN |

| Execution Speed | 98% of trades are executed within 30 milliseconds |

| Min. Deposit | $0 |

| Regulation | ASIC, CySEC, FCA, DFSA, SCB (Offshore) |

| Financial Instruments | Forex, shares, ETFs, indices, commodities, currency indices, cryptocurrencies, CFD forwards |

| Demo Account | ✅(30 days, $50,000 virtual funds) |

| Max. Leverage | 1:500 |

| Trading Cost | Average 1.1 pips (EUR/USD) & commission-free (Standard account) |

| Trading Platforms | TradingView, MT4/5, Pepperstone platform, cTrader |

| Copy/Social Trading | ✅ |

| Customer Support | 24/7 - phone, email |

Pros

√ Well-regulated by notable organizations like ASIC and FCA, ensuring high client fund security and transparency

√ Offers a wide variety of over 1,200 trading instruments ranging from forex to commodities

√ Provides competitive trading conditions with an average spread of 1.1 pips and fast execution speeds

√ Follows an ECN pricing model, providing transparent and competitive pricing, with commission-free trading available on the Standard account

√ Provides access to versatile and advanced trading platforms including TradingView, MT4/5, Pepperstone platform, and cTrader

Cons

× High minimum deposit for swap-free accounts

× No clear info on deposits and withdrawals

⑨ FP Markets

Best for educational tools and low forex fees

FP Markets is an Australian-based forex broker that has been around since 2005. Praised for their direct market access and ideal trading conditions, they are a favorite among many traders.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| Broker Type | ECN |

| Execution Speed | Most of the orders filled in less than 40 milliseconds |

| Min. Deposit | $100 AUD or equivalent |

| Regulation | ASIC, CYSEC |

| Financial Instruments | 70+ forex currency pairs, 10,000+ stocks, 19 indices, commodities, bonds, metals, digital currencies |

| Demo Account | ✅ (30 days) |

| Max. Leverage | 1:500 |

| Trading Cost | From 1.0 pips & commission-free (Standard account) |

| Trading Platforms | MT4/5, TradingView, cTrader, FP Markets Trading App |

| Copy/Social Trading | ✅ |

| Customer Support | 24/7 live chat, phone, email |

Pros

√ Regulated by well-respected regulatory bodies such as ASIC and CySEC, providing a secure trading environment

√ Offers a wide variety of trading instruments including 70+ forex currency pairs, 10,000+ stocks, 19 indices, commodities, bonds, metals, digital currencies

√ Provides tight spreads starting from 1.0 pips on the Standard account and rapid execution speed, accommodating all varieties of trading strategies

√ Provides access to advanced trading platforms MetaTrader 4 and MetaTrader 5

√ Offers robust 24/7 customer support accessible via live chat, phone, and email

Cons

× A minimum deposit requirement of $100 AUD is relatively high, while most brokers have no minimum deposit requirement

× Clients from the Afghanistan, Cuba, Islamic Republic of Iran, Iraq, Liberia, Libya, Myanmar, Palestine, Russian Federation, Somalia, Syrian Arab Republic, Sudan, Yemen, and United States are not allowed

× Withdrawal fee charged

⑩ FXOpen

Best MT4 ECN Broker

FXOpen is a well-established forex broker known for providing trader-friendly conditions and sophisticated technology. Founded in 2005, it has grown from an educational center to a respected ECN broker with global recognition.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| Broker Type | ECN, STP |

| Execution Speed | Not publicly specified |

| Min. Deposit | $/€300 |

| Regulation | CySEC |

| Financial Instruments | 700+, indices, commodities, forex, shares, cryptos, ETFs |

| Demo Account | ✅ |

| Max. Leverage | 1:30 |

| Trading Cost | Floating from 0 pips & commission from $1.50 per lot |

| Trading Platforms | MT4/5, TickTrader, TradingView |

| Customer Support | 9 am-8 pm (Eastern European Time) - live chat, phone, email |

Pros

√ Regulated by the Cyprus Securities and Exchange Commission (CySEC), ensuring a secure trading environment

√ Provides 700+ trading instruments including indices, commodities, forex, shares, cryptos, and ETFs

√ Offers tight spreads from 0 pips, low commissions, and swift execution as an ECN broker

√ Provides access to advanced trading platforms MetaTrader 4 and MetaTrader 5

Cons

× Relatively high minimum deposit requirement of $/€300

× Absence of 24/7 customer support

× US clients are not allowed

× Withdrawal fees charged for Bank Transfer

ECN Forex Brokers FAQs

What is an ECN forex broker?

ECN stands for Electronic Communication Network. An ECN Forex broker operates by providing a platform where traders can buy and sell currency pairs directly to one another, bypassing intermediaries. This allows traders to get a direct connection with the market and trade within real market conditions - the prices are set by market participants.

ECN brokers typically offer tighter bid/ask spreads, which can reduce trading costs. However, they usually charge a commission on trades, as market spreads keep fluctuating and can even turn to zero. Note that quotes from ECN brokers represent the best possible market conditions, but the final spread could widen depending on the order's size and market volatility.

One characteristic of an ECN broker is that they allow for more market transparency. Traders can usually see where the liquidity is and execute trades accordingly. This type of broker is particularly popular among experienced traders and those dealing in large volumes.

How does an ECN forex broker work?

An ECN Forex broker essentially serves as a bridge that links smaller market participants with tier-1 liquidity providers through an ECN. The ECN aggregates forex rates from these liquidity providers and shows the best bid/best ask rateson its trading platform.

The ECN forex broker works by five steps:

Step 1: Traders place a buy or sell order on their forex trading platform.

Step 2: The ECN broker transfers the order to the Electronic Communication Network.

Step 3: The Electronic Communication Network matches the trader's order with the best available opposite order from liquidity providers, which encompass banks, financial institutions, and even other traders in some cases.

Step 4: The matching of the order happens in real-time.

Step 5: After both parties agree to the terms of the trade (order size, price, etc.), the transaction completes.

Pros & cons of ECN forex brokers

| Pros √ | Cons × |

| · Direct Market Access | · Commission Fees |

| · High Levels of Price Transparency | · Higher Minimum Deposits Requirement |

| · Anonymity in Trading | · Increased Market Volatility |

| · No Dealing Desk Interference | · Complexity of Trading Platforms |

| · Lower Spreads | · Variable Spreads during Low Liquidity |

Pros

Direct Market Access: ECN brokers provide direct access to the interbank market, which can result in better prices and faster execution of orders.

Transparency: ECN brokers offer high levels of price transparency. You're able to see the real-time prices and quantities in the market, which allows you to see the depth of the market.

Anonymity: Trade orders are executed anonymously, providing privacy to traders as other market participants cannot see the orders.

No Dealing Desk Interference: Since ECN brokers simply match trades between market participants, they do not trade against their clients, reducing potential conflicts of interest.

Lower Spreads: Throughout periods of high liquidity, ECN brokers usually offer tighter spreads.

Cons

Commission Fees: ECN brokers usually charge a fixed commission on every transaction, which may increase trading costs.

Higher Capital Required: ECN brokers often require higher minimum deposits, which might not be suitable for all traders, especially beginners.

High Market Volatility: ECN brokers offer direct access to market prices, so traders may experience large price swings. This increased volatility can amplify both profits and losses.

Complexity: The trading platform and data provided by some ECN brokers may be complex and require a learning curve for less experienced traders.

Variable Spreads: While at times spreads can be tighter, during periods of low liquidity they can significantly widen, affecting trade execution.

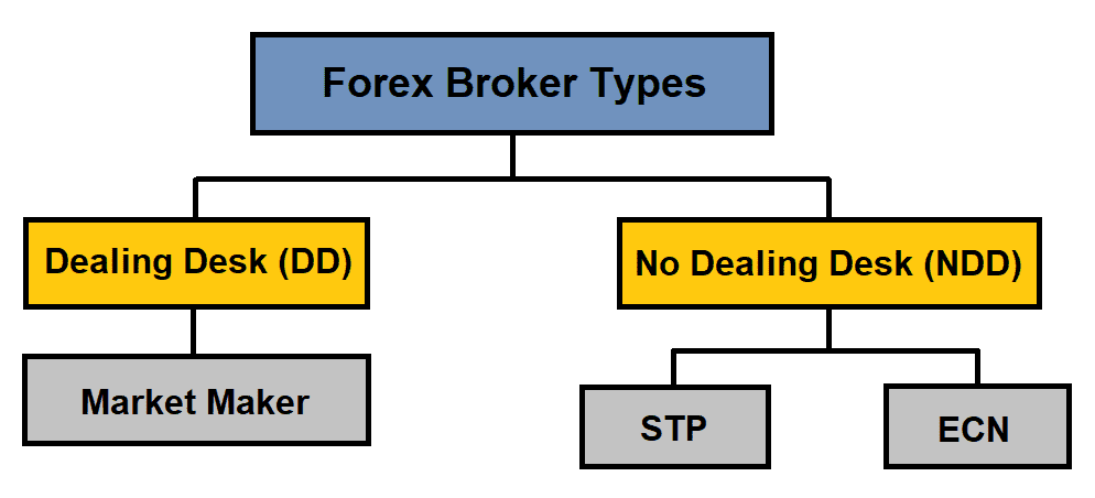

Compare ECN forex brokers with other types of brokers

Dealing Desk (DD) Brokers

Market Maker

Market makers create an in-house market by taking the other side of a client's order. They can control the prices at which they fill the orders and often provide fixed spreads. However, there can be a potential conflict of interest as these brokers can profit from the client's losses.

No Dealing Desk (NDD) Brokers

NDD brokers act as a bridge between the client and the liquidity providers and include Straight Through Processing (STP) and ECN+STP. NDD brokers do not take the opposite side of their clients' trades and instead pass orders directly to liquidity providers.

ECN Brokers

ECN (Electronic Communication Network) brokers provide a transparent trading environment where traders have direct access to interbank prices from multiple liquidity providers. They offer tight spread but charge a commission for the service. The orders are automatically executed, providing fast order execution speed and anonymity.

STP Brokers

STP (Straight Through Processing) brokers send orders directly from clients to the liquidity providers (banks or larger brokers). They usually offer variable spreads.

| Broker Type | Order Execution | Trading Cost | Spreads | Anonymity | Risk of Conflict |

| Market Maker | In-house, may delay execution | Earns from spreads, no commission | Fixed, typically wider | Low | High, as broker can trade against clients |

| ECN | Direct market access, auto execution | Charges a commission | Variable, can be very tight | High | Low, no dealing desk |

| STP | Direct to liquidity providers, auto execution | Earns from spreads, usually no commission | Variable | Moderate | Moderate, no dealing desk but spread markup is possible |

How to choose the best ECN forex brokers?

Choosing the best ECN Forex broker involves several factors to consider:

Regulation

Ensure the broker is regulated by a reputable financial authority. This adds a layer of protection for your funds and ensures the broker adheres to standard industry practices.

On WikiFX, we strive to deliver the most relevant and up-to-date regulatory information about forex brokers. We understand how vital it is to know your broker's regulatory status before investing your hard-earned money. Our team conducts an extensive background check on forex brokers from around the globe to provide you with their regulatory data and other critical aspects.

By using WikiFX, you can easily verify a broker's regulatory status and steer clear of potential frauds or unregulated platforms. Knowledge is power - stay informed, stay safe and always check a broker's regulatory status on WikiFX before investing. It's easy, fast, and can save you from unnecessary losses.

Financial Instruments

Consider which pairs or other CFDs (Contracts for Difference) are available. You may want to trade a wide range of Forex pairs, or have certain favourite pairs you wish to focus on.

Market Depth

Another advantage of ECN brokers is a view into market depth, with details on where buy and sell orders are. However, not all ECNs provide full market depth, so make sure your chosen broker does.

Margin and Leverage

Different brokers offer different leverage ratios. While a high ratio means larger potential profit, it also brings higher risk. Choose a leverage level that matches your risk tolerance.

Spread

While the nature of ECN means that the spread is variable, it's still vital to take note of a broker's average spreads. Some brokers may also offer zero spread for certain currency pairs.

Commission and Fees

Given ECN brokers charge a commission on trades, you should compare the fee structures of different brokers. Lower commission rates can save significant trading costs over time.

Trading Platform

Assess the features of the broker's trading platform, ensuring it's easy to use, has a secure and stable connection, and provides necessary tools for executing your trading strategies.

Execution Speed

With ECN, execution speed should be faster. Check if this is the case with your chosen broker.

Customer Support

Good customer support is important for resolving potential issues quickly. Look for brokers who offer quality 24/7 customer service.

Positive Reviews

Look for positive reviews and comments from other users about their experience with the brokers you are considering.

Can beginners use ECN forex brokers?

Yes, beginners can use ECN forex brokers, but it's important to understand that ECN trading can be more complex and challenging than using a standard retail forex broker. ECN brokers offer a type of trading environment that is considered more transparent and efficient, but it also comes with its own set of challenges. So while beginners can use ECN brokers, it's recommended that they have a firm grasp of how forex trading works, a good understanding of their risk tolerance, and, ideally, some practice on a demo account before diving in.

Forex Risk Disclaimer

Trading Forex (foreign exchange) carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, risk appetite, and the possibility of incurring losses. There is a possibility that you may sustain a loss of some or all of your initial investment and therefore you should not invest money that you can not afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

You Also Like

8 Best Forex Brokers With Segregated Accounts in 2026

Review the 8 Best Forex Brokers With Segregated Accounts. Analyze regulation, fund management practices, and compensation schemes for each.

4 Best $5 Minimum Deposit Forex Brokers in 2026

Explore forex trading with just $5 through the top four brokers, offering optimum services with minimal capital.

Best DMA Forex Brokers (Direct Market Access) for 2026

Delve into the world of DMA Forex Brokers with our guide. Discover top picks and know how DMA brokers operate, their pros and cons.

7 Best $10 Minimum Deposit Forex Brokers in 2026

Ultra-affordable Forex trading starts here! With only $10, join the Forex market with these seven champion brokers.