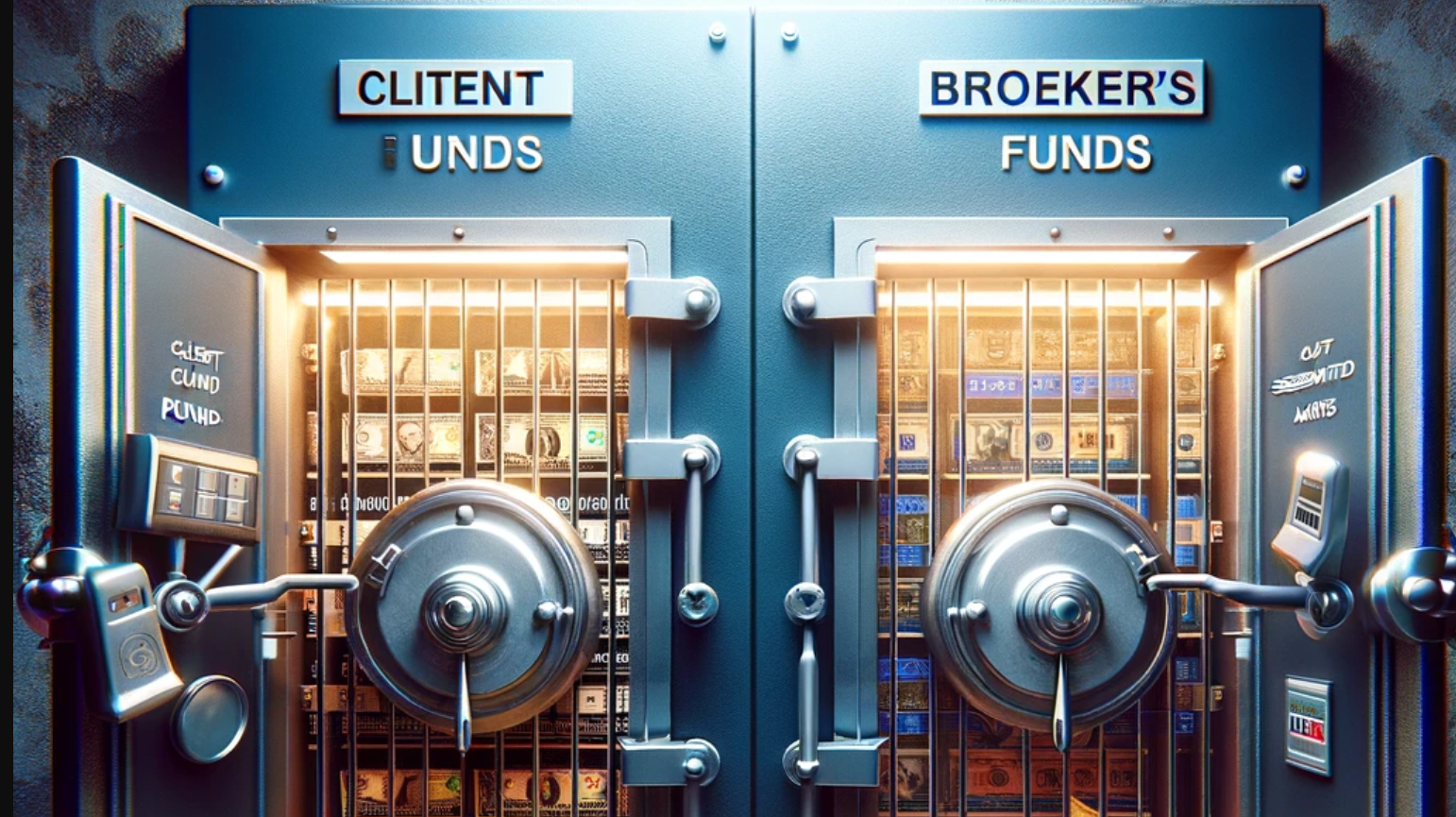

When trading forex, keeping your deposited funds safe should be a top priority. Trading with brokers that hold client money in segregated accounts offers protection by isolating your capital from the broker‘s finances. This article reviews leading forex brokers like IG, XM, AvaTrade, FP Markets, IC Markets, Forex.com, InteractiveBrokers, and HYCM that provide the benefits of segregated client accounts. We will analyze key factors like regulation status, capital adequacy, fund management practices, and compensation schemes for each broker. Understanding a broker’s segregated account policies and protections could make the difference in recovering your money should issues arise. If you prioritize the safety of your trading capital, this list shows reputable brokers to consider implementing proper segregated account controls and procedures.

Comparison of the Best Forex Brokers with Segregated Accounts

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Brokers With Segregated Accounts Overall

| Brokers | Logos | Why are they listed as the best Forex Brokers with Segregated Accounts? |

| IG |  |

✅Globally regulated by top-tier agencies like FCA and ASIC, a well-established broker with a solid reputation. ✅IG maintained segregated accounts for decades, with client funds held at tier-1 banks. ✅Their $1 billion+ in capital demonstrates financial strength. |

| XM |  |

✅Regulated in multiple jurisdictions such as Cyprus, Australia and South Africa. ✅XM is transparent about segregated accounts held at reputable institutions to secure client funds. |

| AvaTrade |  |

✅Heavily and globally regulated, a well-trusted broker that has a solid reputation. ✅AvaTrade provides assurances that client money is kept in segregated bank accounts for added protection. |

| FP Markets |  |

✅A well-regulated forex broker that has excellent operation and high recognition. ✅FP Markets explicitly states all client funds are held in segregated accounts at National Australia Bank for security. |

| IC Markets |  |

✅Operates segregated client accounts in compliance with Australian regulatory directives. ✅IC Markets won so many traders' recognition, operating in a transparent and secure way. |

| Forex.com |  |

✅A publicly traded broker regulated in several major centers. ✅ Forex.com clearly outlines protections provided by holding client deposits in segregated bank accounts. |

| InteractiveBrokers |  |

✅Fully regulated global broker with decades of secure operations. ✅Client account protection through asset segregation is a cornerstone of their business. |

| HYCM |  |

✅A well-established broker that has operated for over 50 years, with a large client base. ✅UK-regulated pioneer that touts segregated accounts at global banking leaders as key to financial security assurance. |

Overview of the Best Forex Brokers With Segregated Accounts

IG

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$250 |

Tradable Instruments |

Forex,Shares,Indices, Commodities, Thematic and basket,Options trading, Futures trading, Spot trading |

Trading Platforms |

Online, Mobile, Tablet & Apps |

Trading Costs |

Forex: Spreads on major FX from 0.6 pips CFD shares: Spreads on UK and US shares start from £3 or $3 per trade |

Segregated Accounts |

✅ |

Max. Leverage |

40:1 |

Demo accounts |

✅ |

Copy Trading |

❌ |

❌ |

|

Payment Methods |

Debit Card, Wire Transfer, Bank Transfer (Automated Clearing House (ACH)) |

Customer Support |

7/24 |

IG Group, founded in 1974, is a UK-based company providing trading in financial derivatives such as contracts for difference and financial spread betting, and stockbroking to retail traders. It is recognized and regulated in multiple countries, thereby ensuring a smooth global operation. IG's customers can trade vast instruments including currencies, indices, commodities, stocks, ETFs, and more on its proprietary platform. This user-friendly platform is technologically superior, offering fast and reliable execution, real-time market updates, and advanced charting tools, all accessible on mobile and desktop. IG Group's 24/7 customer support is commendable, with a highly responsive team providing assistance via phone, email, or live chat. Moreover, IG is known for its educational offerings, providing a vast array of financial webinars and detailed market outlook articles.

Operating segregated client accounts to Tier 1 standards in compliance with FCA rules, IG publicly confirms it does not use client money for any purpose besides margin and settlements.

✅Where IG shines:

• Globally and heavily regulated, a well-established forex broker, giving its traders an extra layer of security.

• Comprehensive trading platform which is feature-packed with advanced charting tools.

• Offering global market access allowing traders to engage in spread-betting on various markets from international stock indices to commodities.

• Providing robust customer support available 24/7, addressing traders' trading problems any time.

❌Where IG shorts:

• Features and tools on the trading platform can seem overwhelming for beginners.

• IG's trading costs may be higher in certain markets compared to many forex brokers.

• IG does not support the MetaTrader platforms, a pity for many MetaTrader lover.

XM

|

|

Broker |

XM |

Regulated by |

|

Min. Deposit |

$5 |

Tradable Instruments |

forex, commodities, equity indices, precious metals, and energies |

Trading Platforms |

MT4, MT5, XM WebTrader |

Trading Costs |

XM Ultra Low Micro Account: spreads from 0.6 pips, no commission charged. XM Ultra Low Standard Account: spreads on all majors from 0.6 pips, no commission charged. XM Zero Account: spreads on all majors from 0 pips, commissions charged |

Segregated Accounts |

✅ |

Max. Leverage |

1000:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Deposit bonus up to $5,000 |

|

Payment Methods |

Credit and Debit Cards, Bank Transfers, e-Wallets |

Customer Support |

7/24 |

Established in 2009, XM is a well-regarded broker headquartered in Cyprus. The platform provides an extensive tradable instruments, over 1000, covering forex, commodities, equity indices, precious metals, and energies. Operating on the MetaTrader 4, MetaTrader 5 trading platforms, and XM WebTrader, XM ensures a reliable and user-friendly trading experience. With dedicated 24/5 customer support, the broker emphasizes timely and effective assistance. Recognized for its client-centric approach, XM has earned several recognitions, highlighting its commitment to excellence. Unique features include a loyalty program that provides cash rewards and bonuses, showcasing XM's focus on enhancing the overall trading experience for its users.

XM states client funds are held in segregated accounts separate from company funds for added security. Accounts segregated by client classification are maintained at regulated investment grade banks. XM publishes frequent financial statements to validate its robust capital reserves.

✅ Where XM Shines:

• Regulated by several reputable authorities, including CySEC (Cyprus), FCA (UK), and ASIC (Australia).

• Starting with as little as $5 allows beginner traders to test the platform.

• Offers over 1,400 CFDs, including forex, stocks, indices, and commodities.

• Solid educational resources, like unlimited access to Video Tutorials, free daily technical Analysis, and Daily Forex Market Outlook.

• Known for swift order execution with minimal slippage.

❌Where XM Shorts:

• Primarily focuses on CFDs, lacking options like futures or real stocks (except in the Shares account).

• Protection against negative balances isn't guaranteed outside the EU.

• No US clients accepted, unavailable for traders in the United States.

AvaTrade

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

Stocks, indices, commodities, currencies (Forex), ETFs, and cryptocurrencies |

Trading Platforms |

MT4, MT5, AvaOptions, ZuluTrade and more |

Trading Costs |

Spreads from 0.9 pips, Equity CFDs with 0.13% markup over market spreads, cryptocurrencies ranging between 0.20% and 2.00% |

Segregated Account |

✅ |

Max. Leverage |

400:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

✅ |

|

Payment Methods |

Credit/Debit Cards and Wire Transfers, Skrill, Neteller, and WebMoney |

Customer Support |

5/24 |

AvaTrade, founded in 2006, is a renowned online trading broker based in Dublin, Ireland. Registered and regulated in several jurisdictions worldwide, they offer an extensive range of tradable instruments, covering forex, commodities, indices, stocks, bonds, ETFs, and cryptocurrencies, among others. AvaTrade offers its clients access to a variety of reliable trading platforms, including MetaTrader 4 and 5 and their proprietary AvaTradeGo and AvaOptions platforms. Their spreads are competitive, and they offer leverage up to 1:400. Unique features, such as DupliTrade for copy trading and AvaProtect for risk management, give AvaTrade an edge over many brokers. User recognition is high for their excellent customer service and extensive educational resources, contributing to their reputable standing in the trading world.

Maintaining segregated client accounts held in trust at regulated banking institutions, AvaTrade is transparent that client funds are not used for any operational activities or business expenses. Account balances are reported directly from segregated bank records.

✅Where AvaTrade shines:

• Robust regulatory compliance with multiple international entities, providing an added level of trust and security to clients.

• Specialized trading platforms, including DupliTrade and ZuluTrade, which support social and copy trading.

• Providing access to options trading for cryptocurrencies, which is a plus for traders looking to diversify their trading strategy with alternative derivatives on digital currencies.

• Supporting various order types such as Limit Orders, Market Orders, Stop Loss Orders, Entry Orders and more for risk management.

❌Where AvaTrade shorts:

• Relatively longer processing times for certain types of withdrawals, which might lead to delays in accessing funds.

• While AvaTrade is available in several countries worldwide, it does not accept clients from certain jurisdictions.

• Inactivity fees of $50 are levied on accounts that remain inactive for a specified period, typically three consecutive months.

FP Markets

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

forex, shares, commodities, stock market indices and digital currencies |

Trading Platforms |

MetaTrader 4, MetaTrader 5, WebTrader, Iress |

Trading Costs |

Forex Standard account: spreads from 0.1 pips, with zero commissions charged Forex Raw account: spreads from 0.0 pips, with commissions at $3 per lot per side |

Segregated Accounts |

✅ |

Max. Leverage |

500:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

Bank Transfer, PayPal, Debit/Credit Card |

Customer Support |

7/24 |

Established in 2005, FP Markets is an Australian regulated broker that has had an excellent operation for nearly 20 years, providing over 10,000 trading instruments across Forex, Shares, Metals, Commodities, Indices, Bonds, ETFs. Notably, FP Markets provide institutional grade liquidity and pricing by leveraging a Straight Through Processing (STP) model to route all client orders directly to tier-1 liquidity providers. Traders can access interbank spreads from 0 pips and fast ECN execution speeds on MetaTrader 4 and MetaTrader 5. With segregated client funds, dedicated account managers and 24/7 multilingual support, FP Markets combines the ideal blend of trading infrastructure, trust and service.

FP Markets confirms all client fund is held in segregated accounts at National Australia Bank, completely separate from FP Markets funds. Daily reconciliations ensure balances match client liabilities at all times.

✅ Where FP Marrkets shines:

• A geniune STP broker, offering truly competitive spreads in the industry;

• Well-established, has operated for nearly 20 years;

• Social trading solutions introduced for easier forex trading;

• Robust Educational contents, covering Trading Courses Videos, Webinars, Podcasts, and more;

• Both MT4 & MT5, and Iress trading platforms on offer, a strong suite;

• Fast order execution, with average speed under 40 milliseconds;

• 7/24 customer service, Monday to Sunday

❌Where FP Markets Shorts :

• No free sign-up bonus offered;

• Demo accounts incur a limited duration;

IC Markets

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

Forex, Commodities CFDs,Indices, Bonds, Digital Currency.Stock, Futures |

Trading Platforms |

MetaTrader 4, MetaTrader 5, MetaTrader WebTrader, MetaTrader iPhone/iPad.MetaTrader Android, MetaTrader Mac |

Trading Costs |

Raw Spread ( cTrader): spreads from 0.0 pips, commissions at $3 Raw Spread ( MetaTrader): spreads from 0.0 pips, commissions at $3.5 Standard ( MetaTrader): spreads from 0.8 pips, no commissions charged. |

Segregated Account |

✅ |

Max. Leverage |

500:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

Bank/Wire transfer, Paypal, Credit Card, Skrill, Neteller, UnionPay, Bpay, FasaPay and Poli |

Customer Support |

7/24 |

IC Markets, founded in Sydney, Australia, in 2007, is a highly commended broker recognized globally for its superior trading services. Registered with the Australian Securities and Investments Commission (ASIC), it also enforces strict regulatory compliance, assuring reliability and security. IC Markets, renowned for its wide assortment of tradable instruments, gives traders access to forex pairs, commodities, indices, bonds, and cryptocurrencies, among others. By offering both the MetaTrader and cTrader platforms, the broker cares about more traders, facilitating sophisticated charting, algorithmic trading, and more. IC Markets is celebrated for its competitive trading costs, notably for its low spreads and affordable commissions. With customer service held in high regard, you can expect prompt, multilingual assistance 24/7 via live chat, email, and phone. The recognition IC Markets boasts is solidified by its global reputation, network of international clients, and high recognization from professional traders.

IC Markets implements mandatory segregated client accounts under its Australian regulation, clearly stating that client fund cannot be used to meet company obligations. Banking partners are selectively chosen for account security.

✅ Where IC Markets shines:

• Heavily regulated by ASIC, and CYSEC, operating in a transparent and secure way.

• IC Markets worldwide presence, supported by a diverse global client base, solidifying its reliable reputation.

• Grantingaccess to a broad range of tradable instruments from forex, commodities, to indices, giving traders more trading fexiblity.

• Recognized for offering some of the lowest spreads in the industry, starting from 0.0 pips on major Forex pairs.

• For oil traders, IC Markets' competitive edge lies in the low fees for oil trading supported by their raw spread accounts.

• With MetaTrader and cTrader on offer, traders can benefit from the detailed charting and algorithmic trading capabilities.

❌Where IC Markets Shorts :

• IC Markets primarily focuses on forex and CFDs, and may not be suitable for traders seeking to invest in other financial instruments such as stocks and ETFs.

• For certain CFD trades, IC Markets require a higher margin which might be intimidating to novice traders or those with limited capital.

Forex.com

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

forex, stock CFDs, indices or commodities, |

Trading Platforms |

MT4, MT5, Mobile App, Webtrader |

Trading Costs |

Standard account: No commissions are charged on any instruments. RAW account: $$7 per $$100,000 USD traded on all instruments. |

Segregated Accounts |

✅ |

Max. Leverage |

50:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

credit card, debit card, Skrill and Neteller e-wallets and wire transfer |

Customer Support |

5/24 |

Forex.com, founded in 1999, is a US-based online broker that operates globally. The broker offers trading in over 80 currency pairs, along with numerous other instruments including indices, commodities, and stock CFDs. Forex.com provides a proprietary platform called “Advanced Trading”, and supports MetaTrader 4 platform, both accessible from web, desktop and mobile devices. Their customer support team is available 24/5 via phone, email, and live chat. The broker is recognized for its performance and reliability, comprehensive research tools, and a well-rounded service in general.

Fund segregation mandated by regulations provides assurance client deposits are not exposed to company finances. Forex.com reports segregated funds held at major banks are monitored in real-time for integrity.

✅ Where Forex.com Shines:

• Forex.coms robust regulatory infrastructure across multiple jurisdictions assures professional traders of a safe and secure trading environment.

• The average-to-competitive spreads coupled with an active trader program that cuts costs for high-volume traders is an advantageous offer.

• U.S. based clients cannot trade cryptocurrencies, restricting the options for traders based in the United States.

• Forex.com supports advanced order types such as trailing stops, stop loss, and limit orders, allowing professionals to implement complex strategies.

• Regular provision of market insights and technical analysis helps professional traders plan their strategy more accurately and stay informed about market trends.

❌ Where Forex.com Shorts:

• Although the broker offers over 80 currency pairs, it has a relatively limited range of other assets, which might deter traders seeking a diverse asset selection.

• Forex.com charges inactivity fees of $15 for accounts that have been dormant for a year, which can increase the costs for occasional trader.

InteractiveBrokers

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$250 |

Tradable Instruments |

global stocks, options, futures, currencies, cryptocurrencies, and more |

Trading Platforms |

IBKR Trader Workstation (TWS)IBKR DesktopIBKR MobileIBKR GlobalTraderIBKR Client Portal |

Trading Costs |

Tiered fee structure |

Segregated Accounts |

✅ |

Max. Leverage |

40:1 |

Demo accounts |

✅ |

Copy Trading |

❌ |

❌ |

|

Payment Methods |

ACH, Bank Wire, Bill Pay, Check, Transfer from Wise Balance |

Customer Support |

5/24 |

Interactive Brokers LLC, founded in 1978, is a U.S.-based brokerage firm registered in Greenwich, Connecticut. It's a leading platform that offers a vast range of tradable instruments including stocks, options, futures, forex, bonds, ETFs and mutual funds, across over 135 markets in 33 countries. The broker provides powerful trading platforms like Trader Workstation (TWS), IBKR Mobile, and Client Portal, featuring sophisticated tools, charts, and analytics for advanced trading. Customer support involves numerous channels including chat, email, phone, and an extensive library of FAQs and educational resources. Interactive Brokers is widely recognized for its competitive fees, broad product range, and robust trading technology, making it a preferred choice for many seasoned investors and traders worldwide.

InteractiveBrokers places a strong emphasis on holding client assets in segregated accounts completely separate from company funds. They consider asset segregation a key fiduciary responsibility to clients under their regulations. Interactive Brokers states that all client cash deposits are maintained in segregated bank accounts that are not exposed to company finances in any way. Furthermore, they provide clients with real-time transparency into cash balances and securities holdings across their individual segregated accounts.

✅ Where InteractiveBrokers Shines:

• Heavily regulated by ASIC, FCA, SFC, FSA, IIROC, operating in a transparent way, adding an extra layer of security.

• Features advanced trading platforms with powerful tools, efficient order routing, and high-speed execution.

• Its tiered pricing structure is favourable for frequent traders, featuring low commissions and margin rates.

• Interactive Brokers affords investing in different currencies and in international markets, which allows more opportunities for diversification over the long term.

❌ Where InteractiveBrokers Shorts:

• Charges monthly inactivity fees if certain commission thresholds aren't met, negatively impacting infrequent traders or beginners with smaller portfolios.

• Despite multiple channels, customer support has been reported to be slow at times, possibly impacting traders who require immediate assistance.

• While direct margin rates are relatively low, tiered rates can be higher for some balances compared to competitors.

HYCM

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$20 |

Tradable Instruments |

Forex, commodities, indices, cryptocurrencies and stocks |

Trading Platforms |

MetaTrader 4, MetaTrader 5, WebTrader, HYCM Trader |

Trading Costs |

Fixed spreads from 1.5 ipsVariable spreads from 1.2 pipsRaw Spreads from 0.1 pips |

Segregated Accounts |

✅ |

Max. Leverage |

500:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Payment Methods |

Debit/Credit Card (Visa or Mastercard), Skrill, Neteller, China Union Pay, Interac or Wire Transfer |

Customer Support |

5/24 |

Established in 1977, HYCM is a renowned Forex broker based in London, United Kingdom. It comes under the regulation of several regulators, including FCA in the UK and CySEC in Cyprus, and more. This multi-asset broker offers extensive tradable instruments including Forex, commodities, indices, cryptocurrencies and stocks. To start real trading, only $20 is enought to open an account on the HYCM platform. HYCM supports both the MetaTrader 4 and MetaTrader 5 platforms, as well as its proprietary HYCM Trader. It prides itself in offering top-notch customer service that's accessible five days a week. Positive user recognition has been achieved by HYCM over the years for its low spreads, fast order execution, and distinctive features like its multiple account types designed for various trading styles.

HYCM offers segregated accounts, ensuring an extra layer of protection for your deposited funds. These accounts comply with regulations set by financial authorities like the FCA, CySEC. Client fund is held separately from HYCM's own funds in special bank accounts, acting as a safeguard in case of company insolvency.

✅Where HYCM Shines:

• Operating under the regulations of multiple financial authorities, including the FCA, CySEC, and CIMA.

• Offering a wide selection of popular trading platforms, including MetaTrader 4, MetaTrader 5, and WebTrader, HYCM Trader.

• $20 to enter the real markets, making trading easily accessible for beginners.

• No deposit bonus offered, giving new traders more courage to start real trading.

❌Where HYCM Shorts:

• No 7/24 customer support, which could lead to some inconvenience for traders who have problems during weekends.

• Order execution speed can be low sometimes.

Frequently Asked Questions (FAQs)

What is a "seggerated account" in forex trading?

In forex trading, a “segregated account” refers to a type of account where a client's funds are kept separate from the broker's own operating funds. This separation ensures that client assets are exclusively used for their intended trading purposes and cannot be accessed by the broker for any other financial activities, such as running day-to-day business operations or settling the brokers own debts. Segregated accounts offer an added layer of security and protection for traders, reducing the risk of misuse of funds and increasing trust in the brokerage's operations.

Why are forex brokers offering segregated accounts important?

Segregated accounts provide an important safeguard for traders' funds by keeping client money separate from the broker's operational accounts. Under this structure, client deposits are held in trust at top-tier banking institutions and cannot be used by the broker for daily expenses or liabilities. Regulated forex brokers are mandated to maintain segregated accounts in compliance with financial policies. For traders, verifying that a broker offers segregated accounts helps mitigate misuse risks and ensures account balances remain accessible if the firm closes.

How to check if a forex broker offers segregated accounts?

The easiest way to confirm segregated accounts is to look for direct confirmation on the broker's website or documentation. Reputable brokers promote this to reassure traders. Alternatively, traders can also contact customer support and request written verification that client funds are kept in segregated accounts. On regulated brokers, account segregation is mandatory, so traders should check if the broker is overseen by authorities like ASIC, FCA or CySEC who enforce segregation rules. Confirming the broker keeps client deposits at top-tier banks also provides assurance.

Are there additional fees for maintaining a segregated account?

No, reputable forex brokers do not charge extra fees specifically for maintaining segregated accounts. Keeping client deposits in secure, separate accounts is a standard requirement enforced by regulators. Responsible brokers will absorb the costs of meeting this obligation as part of providing a safe trading environment.

What happens to my funds in a segregated account if the broker goes bankrupt?

The segregated structure ensures client funds are completely separate from the broker's own accounts. So in the event of bankruptcy, segregated accounts cannot be frozen or seized as assets of the brokerage. While delays in withdrawal may occur during the bankruptcy proceedings, the trustee is obligated to prioritize returning segregated account funds back to clients based on individual account records. Traders may need to complete paperwork to reclaim their deposit. But the segregated status provides strong legal protections that client money remains entirely unconnected to the broker's financial situation.

What are pros and cons of brokers with segregated accounts?

Pros of brokers with segregated accounts

• Enhanced security: The most significant advantage is increased protection for your deposited funds. Client money is held separately from the broker's own funds in dedicated bank accounts. This reduces the risk of losing your funds if the broker faces financial difficulties or insolvency.

• Regulatory compliance: Segregated accounts often align with regulations set by financial authorities, fostering greater transparency and accountability from the broker.

• Peace of mind: Knowing your funds are segregated can provide increased confidence and peace of mind while you trade, allowing you to focus on your investment decisions.

Cons of brokers with segregated accounts

• Potential fees: Some brokers may charge additional fees for maintaining segregated accounts, impacting your overall trading costs.

• Limited availability: Not all brokers offer segregated accounts, which can narrow traders' options when choosing a brokerage platform.

• Investment risks remain: While segregated accounts protect your funds from the broker's financial issues, they do not eliminate inherent investment risks. You are still responsible for managing your portfolio and making wise investment decisions.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

Best Forex Brokers for Beginners in Nigeria for 2024

Select the top forex brokers for beginners in Nigeria from many companies to ensure a safe trading environment.

Cheapest Brokers 2024 | We List the Best Brokers with low fees

Slash forex trading costs: find the cheapest brokers, avoid hidden fees, and boost your returns!

Best Zero Spread Forex Brokers in 2024

Dive into zero-spread forex trading: explore its perks, pitfalls, and discover top brokers to optimize your journey.

7 Best $10 Minimum Deposit Forex Brokers in 2024

Ultra-affordable Forex trading starts here! With only $10, join the Forex market with these seven champion brokers.