In today's trading landscape, it is evident that traders are experiencing a significant shift towards lower pricing models. These models, such as zero-spreads or zero-commissions, greatly benefit clients. On one hand, they reduce trading costs, while on the other hand, they streamline the complexities associated with trading costs. This alignment is ideal for traders. Brokers often offer zero-spread accounts specifically designed for high-frequency traders and scalpers. These traders engage in numerous trades on a daily basis and require more streamlined methods for managing trading costs, without the need for spreads. Many newcomers to zero-spreads trading may feel apprehensive about the high minimum deposit requirement. However, there is a simple solution to this. We have compiled a list of the best zero spread forex brokers for both beginners and seasoned traders. This will help you save time and energy when choosing a suitable broker in this regard.

9 Best Zero Spread Forex Brokers for 2024

Advanced range of trading products, CFD trading, MT4, MT5 and cTrader platforms offered.

Up to 1:500 leverage, extensive trading liquidity, and flawless order execution.

Over 9000 currency, stocks, ETFs, indices, and commodities are available.

Advanced trading tools allow you to analyze markets and execute trades with confidence.

Spreads that compete with the market reduce trading expenses while increasing returns.

Leading international regulators licence and regulate traders, ensuring financial security.

more

Comprison of Best Zero Spread Forex Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Zero Spread Forex Brokers Overall

| Broker | Logo | Why they are listed as the Best Zero Spread Brokers? |

| IC Markets |  |

✅ 25 top tier liquidity providers, allowing access to some of the best prices available. ✅Fast order execution, only around 10% of trades executed with delay. ✅ Offering raw spread from 0.0 pips, with commissions at $3.50 per lot per side. |

| FOREX.com |  |

✅ A substantial pool of top tier liquidity providers to offer real-time price. ✅ Raw pricing account offering 0.0 pips with low commissions. ✅99.73% of trades executed in less than 1 second. |

| Exness |  |

✅ Multi-tiered network of liquidity providers, including tier-1 banks and financial institutions. ✅ Executing orders in under 25 milliseconds, very little possibility of delay. ✅Raw Spread Account: spreads from 0.0 pips, commission at $3.5 per lot. |

| Eightcap |  |

✅ Multiple top-tier liquidity providers, offering best prices. ✅143 milliseconds for limit orders and 139 millisecondsfor market orders. ✅Raw Account: spreads from 0.0 pips, commissions at $3.5 per lot per side. |

| FP Markets |  |

✅ Many liquidity providers, some of them including UBS, Deutsche Bank, Barclays, HSBC, Citibank. ✅Average execution speed of 30 milliseconds. ✅ Raw Account: spreads from 0.0 pips, commissions at $3.5 per lot per side. |

| TMGM |  |

✅ Over 15 tier-1 liquidity providers, offering the most favorable prices. ✅Execute orders within 30 milliseconds. ✅Edge Account: spreads from 0.0 pips, commissions at $3.5 per lot per side. |

| Pepperstone |  |

✅A multi-tiered network of liquidity providers giving direct market access. ✅Execution as fast as 30ms (0.03 of second). ✅Razor Account: spreads from 0.0 pips, forex commissions at $3.5 per lot. |

| Vantage |  |

✅ 14 liquidity partners to offer the best prices on the market. ✅ A average order execution speed ranges between 100 milliseconds to 250 milliseconds. ✅Raw ECN Account: spreads from 0.0 pips, commissions at $3 per lot only. |

| BDSwiss |  |

✅ Over 20 liquidity providers, offering deep liquidity and competitive pricing. ✅Average order execution speed at 9 milliseconds for forex orders, extremely fast. ✅ Zero Spread Account: spreads from 0.0 pips, commissions at $6 per lot. |

IC Markets

Overall: ⭐⭐⭐⭐⭐

IC Markets operates as an online forex and CFD broker, based in Australia. The company was established in 2007 and has its main office in Sydney, Australia, renowned for its diverse selection of trading instruments and competitive spreads, serving both individual and institutional traders worldwide. IC Markets is regulated by the Australian Securities and Investments Commission (ASIC) and is well-known for its transparent and high-speed trading environment.

| ✅Pros | ❌Cons |

| • Over 2000 Trading Instruments | • Slow Live Chat support |

| • 30-day Demo Accounts for Practice | • No two-step login in trading • platforms |

| • 24/7 Customer Support | |

| • Low Forex Fees | |

| • No Inactivity fees | |

| • Quality Educational Contents |

FOREX.com

Overall: ⭐⭐⭐⭐⭐

Regulations: ASIC, FCA, FSA, NFA, IIROC, CIMA, MAS

FOREX.com is a reputable online forex and CFD broker based in the United States. Established in 2001, it has built a strong reputation in the industry. This broker offers a diverse selection of trading instruments, such as forex, commodities, and indices, to meet the needs of both individual and institutional traders. One of the standout features of this platform is its user-friendly and versatile trading interface. Traders can choose between the popular MetaTrader 4 (MT4) platform or the proprietary web-based platform. Both options offer a robust and intuitive experience for executing trades and managing portfolios.

| ✅Pros | ❌Cons |

| • Well established broker with a good reputation | • Robot online support |

| • A well-regulated broker | • Trading limitations on • MetaTrader accounts |

| • Competitive fee structure | • No Micro accounts |

| • Cryptos offered | |

| • Zeor-commission model | |

| • Demo accounts offered |

Exness

Overall: ⭐⭐⭐⭐⭐

Regulations: FCA, CYSEC, FSCA, FSA

Exness is an online forex and CFD broker that was established in 2008. Registered in Cyprus, this company has expanded its reach to become a well-known brokerage firm, providing trading services to clients around the world. Exness is renowned for its intuitive trading platforms and extensive selection of financial instruments, which have made it a favoured option for traders in the foreign exchange and financial markets.

| ✅Pros | ❌Cons |

| • Strigent regulation | • No welcome bonuses |

| • Tiny initial investment | |

| • Transparent and competitive fee structure | |

| • Unlimited leverage ratio | |

| • Dedicated customer support, 7/24 | |

| • Free demo accounts | |

| • Trading tools, VPS included | |

| • Social trading accounts offered |

Eightcap

Overall: ⭐⭐⭐⭐⭐

Regulations: ASIC, FCA, SCB

Eightcap is an online brokerage firm that was established in 2009. Headquartered in Melbourne, Australia, this company offers access to a wide range of financial markets, such as forex, stocks, indices, commodities, and cryptocurrencies. The company provides trading services to clients globally, with a particular emphasis on retail traders and investors.

| ✅Pros | ❌Cons |

| • Regulated by ASIC & FCA | • Limited leverage ratio in some areas |

| • A well-regulated broker | |

| • Competitive fee structure | |

| • Diversified range of trading assets |

FP Markets

Overall: ⭐⭐⭐⭐⭐

Regulations: ASIC, CYSEC

FP Markets, an Australian forex and CFD broker, was established in 2005. Based in Sydney, FP Markets is regulated by the Australian Securities and Investments Commision (ASIC) and holds an Australian Financial Services Licence. Throughout its extensive history of more than 15 years, FP Markets has established itself as a trusted name in the industry, known for its highly competitive pricing, lightning-fast execution speeds, and top-notch trading platforms such as MetaTrader 4, MetaTrader 5, and Iress. FP Markets provides a wide range of trading options, including forex trading on over 60 currency pairs and CFDs across various assets such as indices, commodities, shares, and cryptocurrencies. Traders have the option to select between raw spread accounts that offer access to deep liquidity or ECN accounts that provide tight variable spreads. FP Markets welcomes clients from around the world and is renowned for its round-the-clock customer support in multiple languages.

| ✅Pros | ❌Cons |

| • An established broker with a good reputation | • No micro accounts offered |

| • Competitive spreads | • Commissions charged on MT5 for equity CFD |

| • Demo accounts for practice | |

| • Advanced trading tools , VPS & Autochartist | |

| • Copy trading features | |

| • Access to 10,000+ markets |

TMGM

Overall: ⭐⭐⭐⭐⭐

TMGM (TradeMax Group) is a renowned global online forex and CFD broker established in 2017. The company is based in the Republic of Vanuatu, a small island nation in the South Pacific, and it provides trading services to clients all around the globe. TMGM offers a diverse selection of financial instruments, such as forex, commodities, indices, and cryptocurrencies, accessible through its user-friendly online trading platform. TMGM strives to provide a contemporary and intuitive trading experience for investors in the financial markets.

| ✅Pros | ❌Cons |

| • Heavily regulated by FCA | • products mainly including FX and CFDs |

| • Competitive Pricing | |

| • Advanced trading platforms | |

| • Low forex fees | |

| • 7/24 Customer Service |

Pepperstone

Overall: ⭐⭐⭐⭐⭐

Regulations: ASIC, CYSEC, FCA, SCB

Pepperstone, an online forex and CFD broker, was established in 2010 in Australia. The company is based in Melbourne, Australia, and has become a favoured option for traders around the globe. It provides access to a wide range of financial markets and trading instruments through its easy-to-use trading platforms. Pepperstone is renowned for its competitive pricing, tight spreads, and unwavering dedication to delivering a dependable trading environment for its clients.

| ✅Pros | ❌Cons |

| • Strong Regulation | • No Micro accounts |

| • Competitive Pricing | • Unfriendly Minimum Depoists |

| • Multiple Trading Platforms | |

| • Scalping & Hedging Allowed | |

| • 7/24 Customer Service |

Vantage

Overall: ⭐⭐⭐⭐

Regulations: ASIC, FCA, CIMA, VFSC

Vantage was established in 2009 as an online forex and CFD broker. The company is based in Australia and has established itself as a trusted financial services provider, offering a variety of trading instruments and platforms for both retail and institutional clients. Vantage, headquartered in Sydney, has gained a reputation as a global broker renowned for its competitive spreads and favourable trading conditions in the foreign exchange and CFD markets.

| ✅Pros | ❌Cons |

| • Operating unde two tier-1 regulators | • using trading central needs a $10,000 deposit |

| • Competitive Pricing | |

| • Multiple Trading Platforms | |

| • Social & copy trading feature | |

| • Low minimum deposits, only $50 |

BDSwiss

Overall: ⭐⭐⭐⭐

Regulations: CYSEC, FSA

BDSwiss is a prominent online brokerage that was established in 2012 and has its headquarters in Limassol, Cyprus. With a wide range of financial assets available, BDSwiss caters to over 1 million clients worldwide, offering access to forex, crypto, stocks, indices, and commodities. Traders have access to a range of trading platforms, including the popular MetaTrader 4 and MetaTrader 5, as well as the BDSwiss WebTrader, mobile apps, and advanced PowerTrader for desktop trading. BDSwiss is renowned for its competitive pricing, diverse account options, swift execution speeds, and round-the-clock multilingual customer support.

| ✅Pros | ❌Cons |

| • Strong Regulation | • No Micro accounts |

| • Competitive Pricing | • Unfriendly Minimum Depoists |

| • Multiple Trading Platforms | |

| • Scalping & Hedging Allowed | |

| • 7/24 Customer Service |

Forex Trading Knowledge Questions and Answers

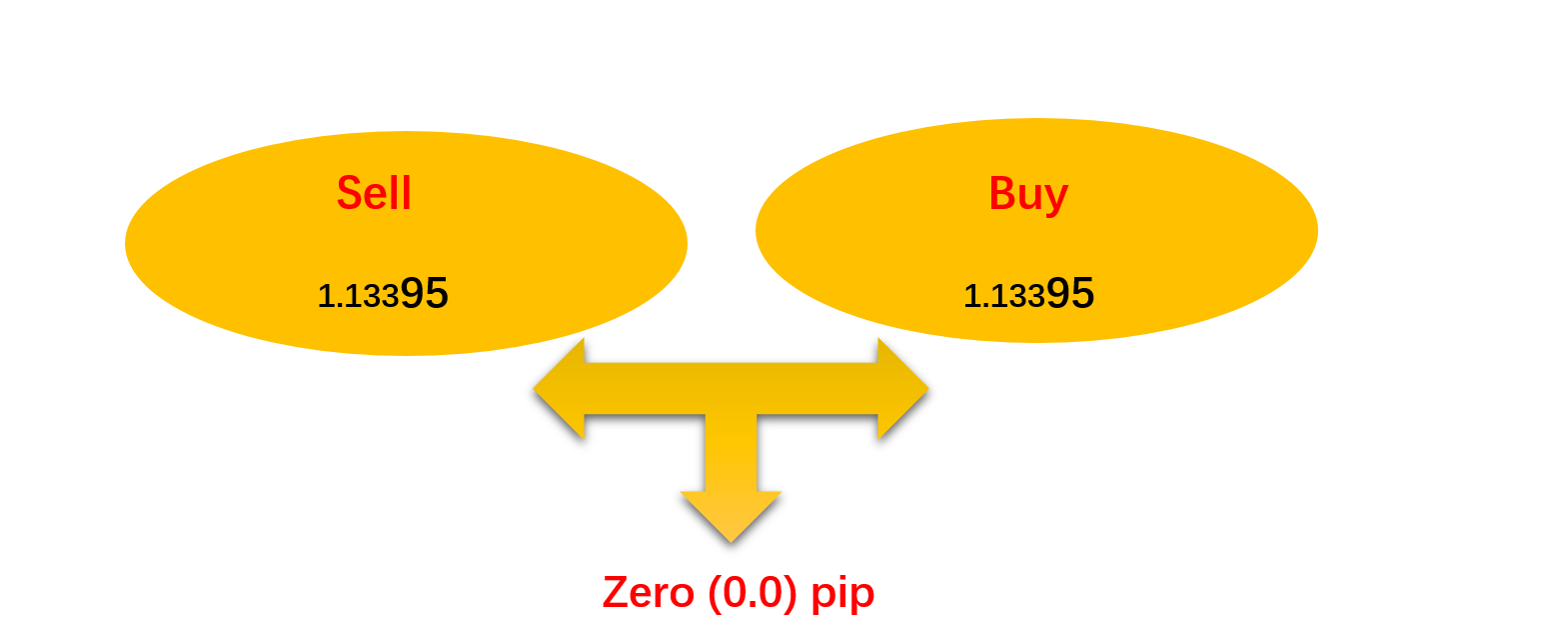

What is a zero spread account?

A “zero-spread” account will not incur any additional fees. If this is the case, then the price at which both buyers and sellers are willing to transact is equal. By eliminating the spread, zero-spread accounts save traders money. A spread decreases the potential gain from trade since it forces buyers to pay more than sellers receive. By removing this expense, trading becomes more productive and appealing to investors because to zero spreads. In most cases, a broker will want a commission fee even on a “zero” account.

Why do brokers offer zero spread accounts?

This answer is simple. Offering zero-spread accounts is only one of several enticing strategies used by brokers in the competitionto attract investors. Because of the time and money savings associated with a zero-spread account, it is becoming increasingly popular among traders. Furthermore, encouraging traders to trade more frequently by charging them cheap commissions instead of circulating spreads can boost trading volume.

What are pros and cons of a zero spread account?

Some pros of using a zero spread account:

Reduce Trading Costs:You can save money on trading expenses by using a commission-only, zero-spread account, as you won't have to worry about figuring out complex spreads.

Increase Trading Transparency:A zero spread account provides a straightforward cost structure for traders as there is no spread between the sell and buy price.

Increase Market Liquidity: Market Markers, who trade at rapid speeds, own most zero accounts, and their presence alone has the potential to significantly improve market liquidity.

Some cons of a zero spread account:

Increase Manipulation:Without spreads, market makers may have more room for price manipulation.

Increase Slippage:In the zero spread market, slippage is common since not all market makers can fulfil the orders that brokers are prepared to execute.

Spread Not Accurate:Many brokers advertise a “zero spread” account, but in reality, the spread is higher than zero on many major currency pairings. This is the case with well over 80% brokers.

|

|

|

|

|

|

|

|

Why are zero-spread accounts suitable for high frequency traders and scalpers?

Zero-spread accounts are ideal for high-frequency traders and scalpers because these traders operate on very thin profit margins and make numerous trades daily. In a zero-spread account, traders do not have to worry about the cost of the spread, which is the difference between the bid and the ask prices. Their huge volume of trades make this a viable strategy for reducing transaction costs. They can also make money off even little price changes because there is no spread.

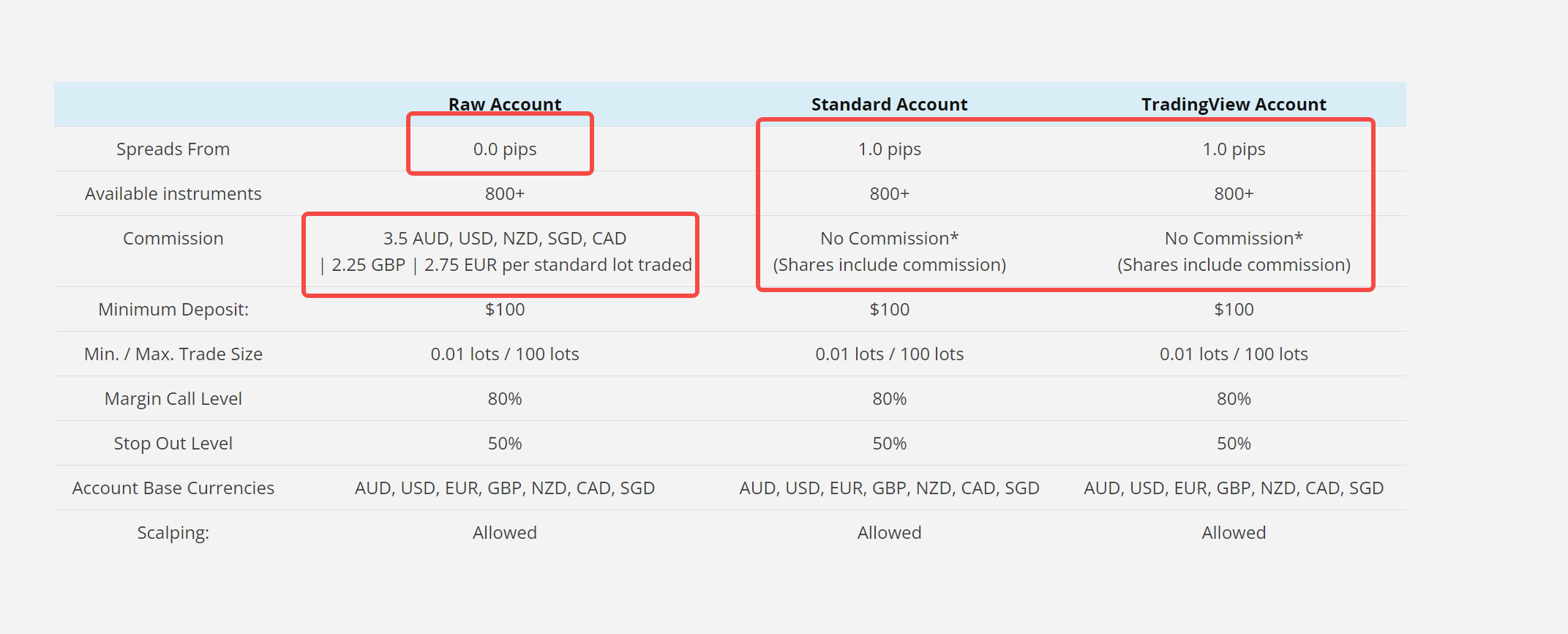

Zero spread or zero commissions, which one should I choose?

A trading account with no spread or a trading account with no commission, which should I choose? This is a question that many investors might have. To get to the bottom of this, let's first Let's look at the zero spread account and zero commission account offered by well-known broker Eightcap. Spreads on the raw account start at 0.0 pips, and commissions are $3.5 per standard lot. Trading costs are slightly less than a zero-commissions account offering spreads from 1.0 pips, after converting its commissions. However, since spreads can vary widely, many accounts advertising “0.0 pips” do not genuinely offer low spreads, for instance, average spread on the eur/usd pair starting at 0.9 pips among most brokers.

So, whatever one you choose depends on your trading style actually, as there is no big difference between a zero spread account and a zero commission account. High-frequency traders and scalpers who make numerous trades per day can more easily turn a profit on even little price fluctuations due to the absence of the spread. The lack of a commission can be especially appealing if you tend to trade infrequently but for greater sums, as this eliminates the need to budget for a consistent outlay of funds.Still, spreads are typically a part of these accounts, and their size might change the amount by which a trader stands to profit.

How can brokers offer a zero spread account without losing money?

For brokers to offer zero spread accounts without incurring losses, they can take one of several approaches. Obtaining money from other sources, including account management and maintenance charges, margin loan interest, swap rates, inactivity fees, or commissions for deposits and withdrawals, is one method. Alternatively, a broker can take on the role of both buyer and seller in a market making approach. That way, the broker can decide how much of a profit to take from the gap between the asking and bidding prices.

What are some ways to check a reputable zero-spread broker?

Finding a good zero-spread broker isn't always straightforward with so many options. As you start your search, here are some important things to keep in mind:

Check the broker's regulation-Regulation is one of the most crucial conditions for a broker who is functioning on the financial market. Strong regulation can ensure a fair transparent trading environment.

Test the broker's trading platforms-MetaTrader platforms, such as MT4 and MT5, are robust and dependable trading platforms that are often made available to traders by reputable brokers.

Read online reviews: Read user ratings and reviews posted on various websites. For example, you may simply key “ exness reviews” in google search box, various evaluations will come into your eyes. Authentic user feedback about a broker's services, dependability, and assistance is invaluable.

Practice demo account: Demo or trial accounts are available with many brokers. Use this occasion to examine their service quality and the trading environment is required.

Confirm minimum deposit: While many brokers do provide zero spread accounts, certain ones may impose significantly higher minimum deposits in order to initiate such accounts. For instance, the Bespoke account from ACY Security requires a minimum deposit of $10,000, which seems abhorrent; therefore, it is crucial to verify that the minimum deposit falls within a reasonable range.

Contact the broker's customer support: Contact the customer support team of the broker in an attempt to obtain prompt and effective responses to your inquiries. Should they have the ability to resolve your trading concerns promptly. That is critical for your real trades.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects.

We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

Best Forex Brokers for Beginners in Nigeria for 2024

Select the top forex brokers for beginners in Nigeria from many companies to ensure a safe trading environment.

Cheapest Brokers 2024 | We List the Best Brokers with low fees

Slash forex trading costs: find the cheapest brokers, avoid hidden fees, and boost your returns!

Best Zero Spread Forex Brokers in 2024

Dive into zero-spread forex trading: explore its perks, pitfalls, and discover top brokers to optimize your journey.

7 Best $10 Minimum Deposit Forex Brokers in 2024

Ultra-affordable Forex trading starts here! With only $10, join the Forex market with these seven champion brokers.

Forex Day Trading VS Forex Scalping: Which One to Choose?

Unravel the clash of Forex day trading and scalping - grasp their tactics, track differences, and tailor your trade.

How to Hedge Forex Positions? Some Relevant Strategies to Share.

Dive into Forex hedging strategies - reducing risk, seizing opportunities and securing robust trading profits.

Can I Trade Forex without Stop-Loss? Here Lets’ Discuss

Start Forex trading without stop-loss - understand how it works, explore other options and possible risks.

Forex Market Hours: What is the Best Time to Trade Forex?

Master the clock of Forex trading - optimize profits by knowing the best trading times globally!