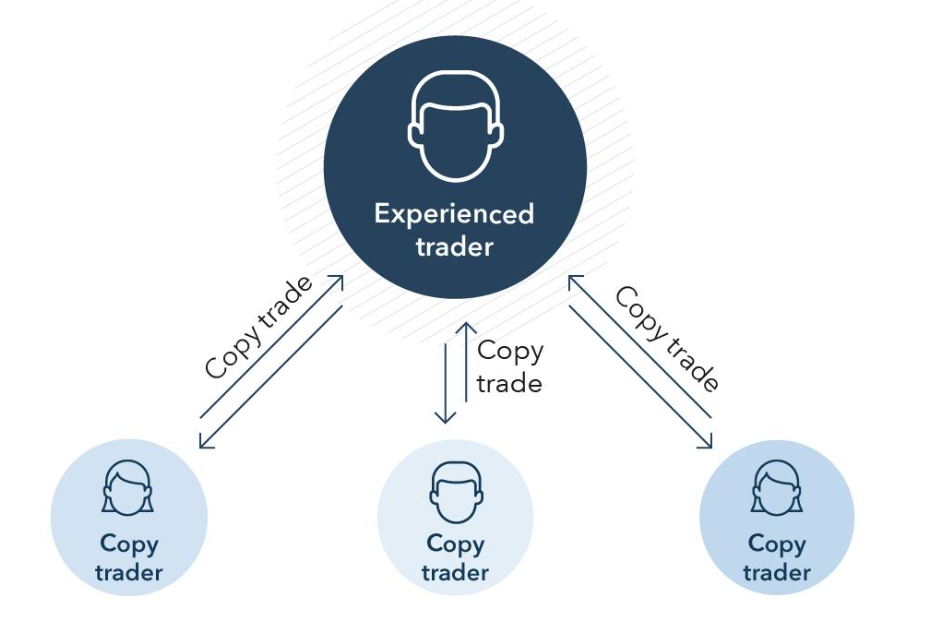

For more than a decade, the popularity of forex copy trading (also known as social trading, mirror trading, or auto trading) has been steadily rising. When you duplicate trading, you employ technology to copy the real-time forex trades of other live traders who you want to follow. Your brokerage account will automatically duplicate their trades every whenever they trade.

New investors are enjoying a more confident start to their trading adventure because to copy trading. A fantastic method to learn from successful traders is to copy their trades. With copy trading systems, you may simply follow in the footsteps of the pros. Some debates will take happening simultaneously on social media, so you may understand more about the reasoning behind each decision. Many significant lessons can be gained from experienced traders, such as the significance of diversification and the ability to think logically rather than emotionally.

When compared to mirror trading, copy trading allows you to learn from observing the trades of others without having any knowledge of the technique itself (i.e. you only see the actual transactions).

For those who value their time above all else, copy trading is an excellent investment option. Even if you have no prior trading experience, copy traders may get started right away because they don't have to do any of the heavy lifting. Copy trading has evolved from a niche strategy to a mainstream one over the course of the last several years. As a result of the numerous advantages that copy trading offers new investors, it is becoming increasingly popular among them. Here we present you the list of Best Copy Trading Software for your reference.

Top 7 Best Copy Trading Forex Brokers

Globally Licensed and Regulated by FCA & CYSEC, Offering Great Reliability.

Advanced Trading Platforms Offering of Ultra-Low Spreads, Starting from 0 pips.

A Multi-Regulated Big Player that renders you adequate Safety.

Enjoy the Ease of Withdrawal without any Additional Charges.

FCA-reguated broker with thousands of assets to choose from;

Offering a professional trading platform on both web and mobile devices.

more

Comparison of the Best Copy Trading Forex Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Forex Trading Knowledge Questions and Answers

What is copy trading?

Copy trading is a form of automated investment strategy where individuals replicate the trading actions of experienced investors in real-time.

Copy trading, originated with early pioneers in social trading technology who initially served as third-party platform developers. Prominent among these pioneers were companies like Tradency, ZuluTrade, and eToro. While some of these entities continue to function as independent service providers (ISPs), others evolved in a different direction. For instance, eToro transitioned into a brokerage service.

What is popular copy trading platforms?

AvaTrade

AvaTrade is one of the top forex copy trading platforms located in Ireland and regulated in multiple jurisdictions. This is one of the greatest copy trading tools for duplicating trading operations from one trading account to another in real time.

AvaTrade has a good selection of the most popular copy trading services. In addition, this broker works with signal providers to deliver market alerts and trade notifications to its clients' smartphones.

• What AvaTrader has to offer is as follows:

• ZuluTrade – With a large variety of signal providers to choose from

• Duplitrade – Easily and conveniently copy trades from multiple signal provider

• AvaSocial – Connect with your peers and automate your trades. Perfect for both beginners and advanced.

eToro

Copy trading software provider eTtoro was founded in 2006 and now serves nearly 120000 traders. For stock and commodity trading as well as foreign exchange and commodities, this copy trading platform has it all: CFDs, Social Trading, Indices, Cryptocurrency, Index Funds, ETFs (ETF).

To begin with, it's the best social and copy trading platform for beginners that desire a more user-friendly experience.

Vantage Markets

As of today, Vantage clients can begin to diversify their portfolio by copying the moves of proprietary traders and trading their own accounts with real money! With the DupliTrade-Vantage connection, you get access to a portfolio of prop traders that have been handpicked for their expertise. You may then select the traders you want to clone based on their performance, strategy, and trading style, and their trades will be replicated on your Vantage MT4 or MT5 account.

Does copy trading really work?

The short answer is yes, copy trading really does work. However, to fully grasp how and why it works, you must first grasp the concept of copy trade.

Copy trading is a trading strategy that involves copying the trades of a successful trader in real-time. For example, if the trader buys X shares of Y stock, you will do the same. If they sell a cryptocurrency when the price is high, you will do the same. If they buy a cryptocurrency when the price is low, during the dip, you will do the same, trusting that the trader expects the price to go up in the future.

It works because you don‘t have to have any experience to do it. You don’t have to go through years of trial and error to learn what works and what doesn‘t. You don’t have to take courses or read books that explain how the stock market works. You don‘t need to learn various forex and stock trading strategies or how to use indicators. You don’t need to lose money while learning how the market works.

Everyone, not just beginners, can benefit from copy trading. When it comes to copy trading, beginners are frequently the ones that reap the greatest rewards, since they are the ones who are most likely to lose money if they were to go it alone.

How do you copy trade?

Copy trading is a straightforward process that involves the following steps:

Choose a Copy Trading Platform: Select a copy trading platform that allows you to automatically replicate the trades of experienced traders.

Select a Signal Provider: Pick a signal provider, an experienced trader, whose trading style and risk level align with your investment goals and preferences.

Allocate Capital: Decide how much of your trading account balance you want to allocate for copying the signal provider's trades.

Fine-Tune Settings: Customize your risk management settings and determine whether you want to copy the provider's existing open positions or only new trades.

Initiate Copy Trading: Once you're satisfied with your settings, initiate copy trading to replicate the chosen trader's actions.

Monitor Performance: Keep an eye on your trading account's performance, adjusting your strategy as needed based on trade frequency and results.

Adapt to Changes: Modify your parameters and subscriptions when necessary, such as in response to the signal provider's performance or your market expectations. Set risk management thresholds before copying trades, considering both past and potential returns.

How do you copy the best traders?

When selecting a trader to follow, consider factors beyond absolute returns. Analyze various performance indicators, including average profit and loss, trade volume, and trade duration, to make an informed decision. Top traders often attract more followers, but finding a diverse mix of traders aligning with your goals is crucial.

Set any risk management limitations and thresholds for the traders whose trades you wish to duplicate before deciding whether to copy their current transactions or only their new trades going ahead.

With a proven track record of success (i.e., monthly trading results) and consistent risk-adjusted returns and above-average overall results, the top traders often have the most followers. You must also discover a good mix of diversity based on your own goals.

Look at more than just the absolute returns when comparing the top traders to copy, such as by analyzing various performance indicators — average profit and loss, the number of trades placed, and average transaction duration — while making your pick.

Can I make money through copy trading?

Like any other investment, copy trading has the potential for both profit and loss. Both the traders you follow and when you mimic their trades have an impact on how much money you make or lose in the market.

As a rule of thumb, don't merely replicate a trader because he or she is making money at the moment; that doesn't necessarily mean it's the optimum time to do so.

Past performance does not guarantee future results, as the market adage goes. Only invest what you can afford to lose in copy trading, as it is a risky endeavor. Before settling on a course of action, gather as much information as possible and work backwards from there.

Is copy trading a good idea?

Although automating your trading approach may sound like a smart idea, active account management is still required when using copy trading. There are pros and cons to copy trading, but the finest copy-trade brokers will give you the tools you need to keep track of your portfolio and diversify it appropriately.

Whether copy trading suits you depends on your tastes, overall goals, risk-tolerances, and how much of your portfolio you intend to allocate to copy trading. While the risk/reward parameters and maximum drawdown thresholds can be set, you'll still need to select the copying providers that you want to use. Copy trading still requires you to work when setting it up because it's considered a self-directed account in most countries, Rather than relying on an investment fund or other passive investments where someone else makes the investment decisions for you, you can take control of your own investing selections.

What are the risks of copy trading?

Copy trading entails some dangers, just like any other sort of investment. Most of your money will be at stake if you choose the wrong trader to emulate. It is possible to lose money if you choose a trader based solely on the fact that they appear to be performing well at the moment, but it turns out that they lack a long-term strategy.

The stock market could also see a downturn. Unexpected political events can have a significant impact on the direction of a currency pair in forex trading. Even so, a seasoned forex trader would keep abreast of such developments and make purchases or sales of currency pairs in accordance. After a bull run, a sudden bear market in the crypto market can come, but a competent crypto trader will be able to forecast this.

Investing in a duplicate trading platform with high transaction costs carries additional risk. They can eat away at the profits you've made. A lousy spread trading platform is the same as a copy trading platform. When copy trading, you should be on the alert for hidden costs and poor spread rates.

Even the most experienced forex traders can suffer losses. Do your research and look for a trader that has been successful year after year for many years; this increases your chances of making money over time. This trader is well-versed in the market's intricacies and has the ability to adapt quickly.

Frequently Asked Questions (FAQs) about Copy Trading:

Q: What are signal providers in copy trading?

A: Signal providers are experienced traders who make their trades available for others to copy. They serve as the source of trading signals for followers.

Q: Do I need trading experience to use copy trading?

A: No, copy trading is designed to be user-friendly and accessible to all levels of traders, including beginners. You can start copy trading without extensive trading knowledge.

Q: Are there fees associated with copy trading?

A: Yes, there may be fees associated with copy trading, such as platform fees or performance-based fees for signal providers. Be sure to review the fee structure of your chosen platform.

Q: Is copy trading available for different financial markets besides forex?

A: Yes, while copy trading is commonly associated with forex, it is also available for other financial markets like stocks, cryptocurrencies, and commodities. The availability may vary by platform.

Q: How can I monitor my copy trading performance?

A: Most platforms provide tools and dashboards to track your copy trading performance in real-time. You can monitor your account's progress and make adjustments as needed.

Q: Can I stop copy trading at any time?

A: Yes, you have the flexibility to stop copy trading at any time. You can close your copied trades or discontinue copying a particular signal provider.

Q: Is copy trading suitable for long-term investments?

A: Copy trading can be used for both short-term and long-term strategies. It depends on your investment goals and the signal providers you choose to follow.

You Also Like

Forex Day Trading VS Forex Scalping: Which One to Choose?

Unravel the clash of Forex day trading and scalping - grasp their tactics, track differences, and tailor your trade.

How to Hedge Forex Positions? Some Relevant Strategies to Share.

Dive into Forex hedging strategies - reducing risk, seizing opportunities and securing robust trading profits.

Can I Trade Forex without Stop-Loss? Here Lets’ Discuss

Start Forex trading without stop-loss - understand how it works, explore other options and possible risks.

Forex Market Hours: What is the Best Time to Trade Forex?

Master the clock of Forex trading - optimize profits by knowing the best trading times globally!