We're happy to have you join us here on the WikiFX Forex Encyclopedia Channel as we explore the concept of “Drawdown” in forex trading. Here, we'll break down the concept of a “drawdown” in foreign exchange trading, why it's so crucial, and how to bring it under control.

WikiFX Forex Encyclopedia Channel is committed to bringing you the most comprehensive and reliable source of information about the forex market and forex trading possible. Hope you can gain a deeper comprehension of drawdowns in forex trading today.

This article shares 7 effective methods for controlling forex trading drawdowns, helping traders implement risk management, reduce losses, and increase profits.

What Is A Drawdown in Forex Trading?

When trading in the forex world, you may encounter the word “Drawdown” frequently. Here comes the question: What is A Drawdown in Forex?

Lets disclose it:

The drawdown of a trading account is the decline from its highest balance to its subsequent lowest balance. A “drawdown” occurs when an investor suffers a loss due to a bad trade.

For Instance, if you deposit $1,000 into your Forex account and then lose $500 on a bad trade, your account has seen a drawdown of $500.

Consider this: if a trader suffers a 50% loss, he or she must earn a 100% return on their reduced capital stake just to break even.

The drawdown measures a portfolio's ability to withstand losses before those losses begin to eat into gains.

It is also used as a measure of portfolio health, where the sum of all trades, both profitable and unprofitable, is totaled to find the longest losing streak.

In financial markets, three types of drawdown that are frequently discussed: Absolute Drawdown, Relative Drawdown, and Maximum Drawdown.

Three Types of Drawdown

✔Absolute Drawdow

✔Relative Drawdow

✔Maximum Drawdow

Absolute drawdownis the percentage drop from the initial deposit to the lowest position below the initial deposit during the test period.

In a Nutshell, this number indicates the maximum amount of money you can lose in relation to your initial deposit.

Formula: Absolute Drawdown=Initial Balance-Maximum Loss in the Initial Balance

Relative Drawdownis the highest Max-Drawdown in Percentage over the duration of the test. As opposed to the initial investment, the relative drawdown shows how much these traders can risk.

Example: You have a starting bankroll of $100. Equity is reduced to $1 after the initial trade. You just experienced a Maximum Drawdown of 99%, and Relative Drawdown will save that value as the all-time high for the percentage.

Formula: Relative Drawdown=Maximum Value of Equity - Minimum Value of Equity

Maximum Drawdownmeasures the largest decline from a portfolio's peak to its subsequent low point before a new peak is reached; it is a measure of downside risk over a certain time frame.

Formula: Max Drawdown Formula=All-Time Balance High-All-Time Balance

Why Are Drawdowns Important in Forex Trading?

Why drawdown is so important in forex trading?The very key answer lies in its direct guidance on calculating the degree of risk of a trading account.

The potential for a trading account to experience a drawdown is proportionate to its exposure to risk.

If your drawdown is big, you run a greater risk of losing your entire trading account, and if it's modest, then you run less risk.

Checking the portfolio's drawdown is always the first step before opening an account or making an investment. When trading, professionals don't chase more earnings but rather seek the minimum drawdown possible.

In this way, the absolute and relative drawdowns of a trader's account are the first thing to consider when evaluating his performance as a professional forex trader.

Then some traders may ask:

What percentage of drawdown is deemed acceptable?

I suppose it would rely on the size of your trading account. Large accounts typically have drawdowns between 5% to 6%, but this number should be kept below 6 % at all times. If your account is relatively small, however, a drawdown of 15% to 20% is regarded as acceptable, while a drawdown of more than 20% is high risk.

Drawdown has a significant effect on your trading career. So, be careful not to lose your footing. To avoid losing everything after making big gains, it is preferable to make modest gains and experience less drawdown.

How to Control Drawdown in Forex Trading?

Now that we have established that, lets go on to the meat and potatoes of this piece, which is the point: How to control drawdowns in forex trading?

Here we will go through a few strategies that can help to keep your drawdown in forex trading to a minimum:

Gradual Scaling in

Assuming the current EUR/USD rate is 1.1000, we buy 0.5 lots as our first trade, anticipating Euro strength. If the price rises to 1.1050, we consider adding 0.5 lots, and if it surpasses 1.1100, we add another 0.5 lots. This gradual approach controls individual loss risk but results in higher average entry prices and increased trading costs, requiring skilled timing for additional positions.

Set A Drawdown Limit

Set a weekly or monthly loss limit to avoid losses from accumulating while you're not playing well. Similar to how you can set your risk per transaction, you can also set a drawdown limit.

Here is an example:

Let's say you're willing to put up 1% of your money on the line with every trade. A monthly decline of 5% could be used as a stop-loss level to prevent further trading losses.

Consequently, if you suffer a loss of 5% or more of your account equity throughout the month, you must refrain from trading until the next month begins.

Don't risk further loss by attempting to trade today if youve already had a bad run, avoid trying to recoup all your losses in a single trade!

Naturally, you can tailor such a role to your trading preferences. As supposed to start on the first of the next month. You could make it by next week.

Trade with Small Sizes

It is always wise of you to keep your initial forex trades small and to a single currency pair. Take one deal at a time and limit your risk to 2% per trade, and even if things go horribly wrong, you'll still just be down 2%. You can limit your foreign exchange trading to just your preferred currency pair if you already know its relative value.

Place A Stop-Loss Order

Setting a stop-loss point before launching a trade is another prudent strategy for limiting drawdowns in your trading. Assuming the current EUR/USD quote is 1.1200/1.1202, and we decide to buy one lot of EUR/USD at 1.1200, anticipating a price increase, we implement a stop-loss to manage risk. We can set the stop-loss price at 1.1180, which is 20 pips away from the market price. This distance provides the stop-loss order with sufficient room to avoid being triggered by minor market fluctuations.

If the price breaches the support level at 1.1180, the stop-loss order will be activated, and we will exit the trade at the price of 1.1180. While there may be a minor loss, this approach effectively limits the risk of a significant drawdown.

In forex, there is no system that can guarantee 100% earnings, even though there are some professionals and robots who say they can do it.

If you've ever lost interest in trading forex after experiencing a temporary loss, you know how crucial it is to know how to manage drawdowns.

Select Proper Capital Management

For instance, a trader named Josh currently holds $200,000 in his account. He's considering two capital management methods:

Fixed Position: Trading 1 lot ($100,000), which is 50% of his total account balance.

Percentage Position: When his account balance is between $200,000 and $400,000, he'll use a 5% position size. Recently, with successful trades, his account has grown to $400,000.

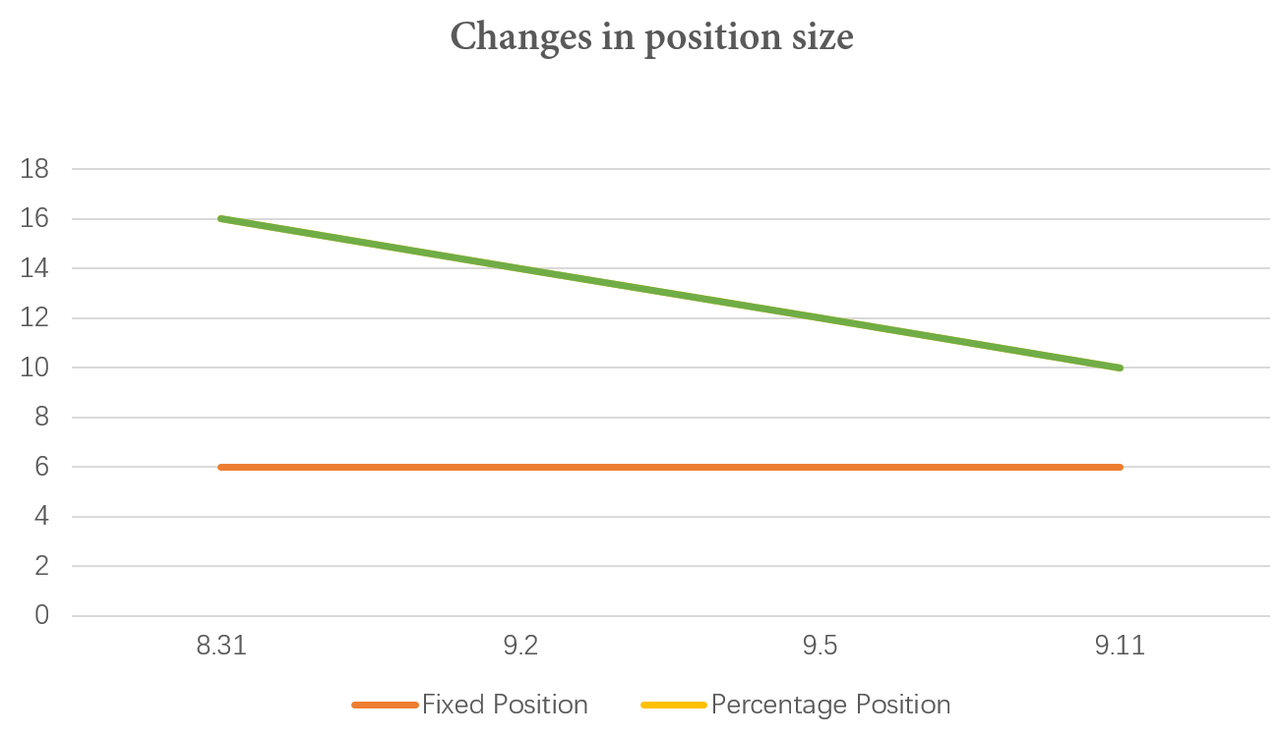

Here are the changes in position size for both methods:

From the above chart, it is evident that fixed position sizing, however, can not adjust position size according to changes in account capital. Conversely, percentage-based position management allows for the appropriate reduction of positions as account capital grows, aiding in controlling potential losses for individual trades.

Therefore, for Josh, adopting percentage-based position management is more suitable and helps mitigate trading drawdown risks.

Trade in Cross-Timeframe

Cross-timeframe trading involves two main strategies:

Intraday Trading: Opening and closing positions within the same day, typically holding for minutes to hours.

Long-Term Trading: Holding positions for several days to weeks.

These strategies can complement each other by optimizing capital use, hedging against losses, and recovering account equity during drawdowns.

Close Positions and Take a Break

If you're feeling emotionally and mentally drained, closing down open positions and taking some time off will do more than just stem the bleeding.

While the losses remain, this initial action will provide some much-needed comfort. Although it may be challenging at first, once you've done it, you'll be able to look back and see opportunities for earlier withdrawal.

A Real Example

A trader called Mohd Ali from Malaysia, bought 1 standard lot of EUR/USD at 1.2 in early June. Subsequently, the Euro weakened against the US Dollar in late June. The market had dropped to 1.1, and this led to Mohd Ali's floating losses reaching a considerable sum of $10,000.

At this point, Mohd took the following actions:

He placed a stop-loss order at 1.09, with a trigger to exit the trade if losses expanded to $20,000.

Recognizing potential support around 1.1 for EUR/USD, he added 0.5 standard lots at a price of 1.095.

He adjusted the leverage from 20x to 10x, reducing the per-point loss amount in the market.

In early July, the Euro rebounded to 1.15, and Mohd exited the additional 0.5 lot position, locking in some profits. Subsequently, the market continued to rise, and Mohd eventually took profit on the original 1 lot position at 1.2, reducing losses after the maximum drawdown.

To summarize this article

· Keep in mind that short-term losses are typical in forex trading. Don't think for a second that you can get it all back in one go.

· Always prepare for at least the maximum historical downturn, as it is inevitable. You should limit your exposure to loss by setting a maximum drawdown you're willing to experience.

· Trading success over the long term should be prioritized, as there is no such thing as a risk-free profit.

· The drawdown is a vital component of trading; embrace it as a necessity to your advantage to sharpen your trading skills.

Trading entails taking a hit sometimes; recognizing this as an up-front reality is essential. Even during prosperous stretches, a trader will spend significant time in a drawdown.

You need to develop a Zen-like acceptance of drawdowns as a natural and unavoidable element of trading. This is the point at which you can actually start to handle them.

If you want to become a skilled and mature trader, you must keep in mind the following factors to minimize drawdown trading:

·Set the maximum drawdown

· Reduce your trade size or leverage

· Increase your risk/reward ratio

WikiFX is a professional, global forex broker regulatory inquiry tool with extensive and easily accessible data on Forex Brokers (more than 38,000 brokers are now enlisted), the Forex Industry, News, Educational Resources, and more.

For more forex-related information and resources, please visit the WikiFX website or download WikiFX App now.

You Also Like

Forex Day Trading VS Forex Scalping: Which One to Choose?

Unravel the clash of Forex day trading and scalping - grasp their tactics, track differences, and tailor your trade.

How to Hedge Forex Positions? Some Relevant Strategies to Share.

Dive into Forex hedging strategies - reducing risk, seizing opportunities and securing robust trading profits.

Can I Trade Forex without Stop-Loss? Here Lets’ Discuss

Start Forex trading without stop-loss - understand how it works, explore other options and possible risks.

Forex Market Hours: What is the Best Time to Trade Forex?

Master the clock of Forex trading - optimize profits by knowing the best trading times globally!