Company Summary

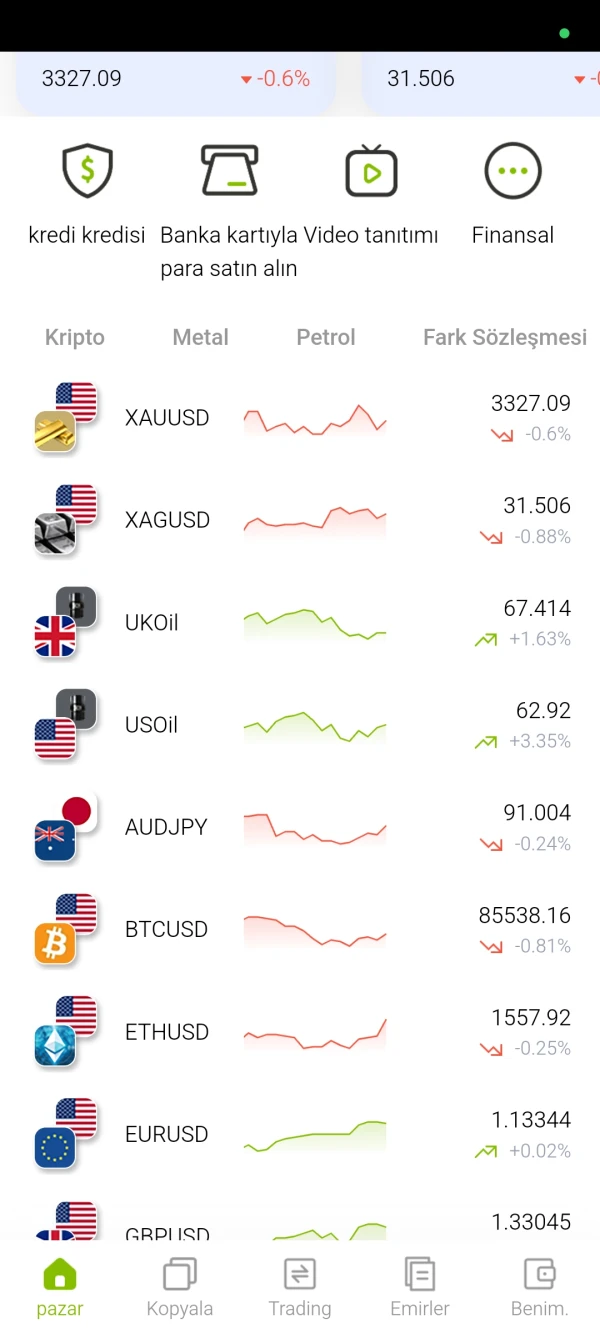

| NEWS Review Summary | |

| Founded | 2001 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Products and Services | Domestic Equities, Foreign Stocks, Foreign Currency-denominated Bonds, Mutual Funds |

| Customer Support | 0120-411-965 |

| info@news-sec.co.jp | |

NEWS Information

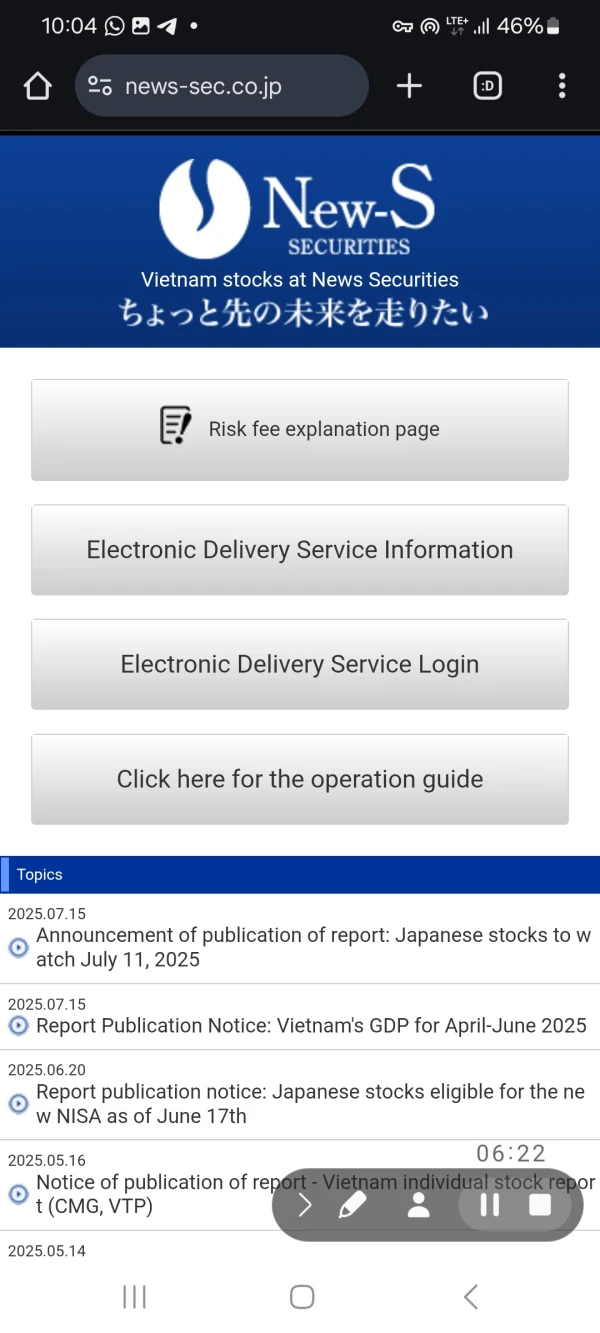

NEWS, based in Japan and regulated by the FSA, is an online trading platform that offers many investment products, including domestic equities (primarily in-person), foreign stocks (inquire for availability), foreign currency-denominated bonds, and mutual funds. While providing a diverse selection, their fee structure varies by product and transaction size, and information on deposits and withdrawals is not mentioned on their website.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

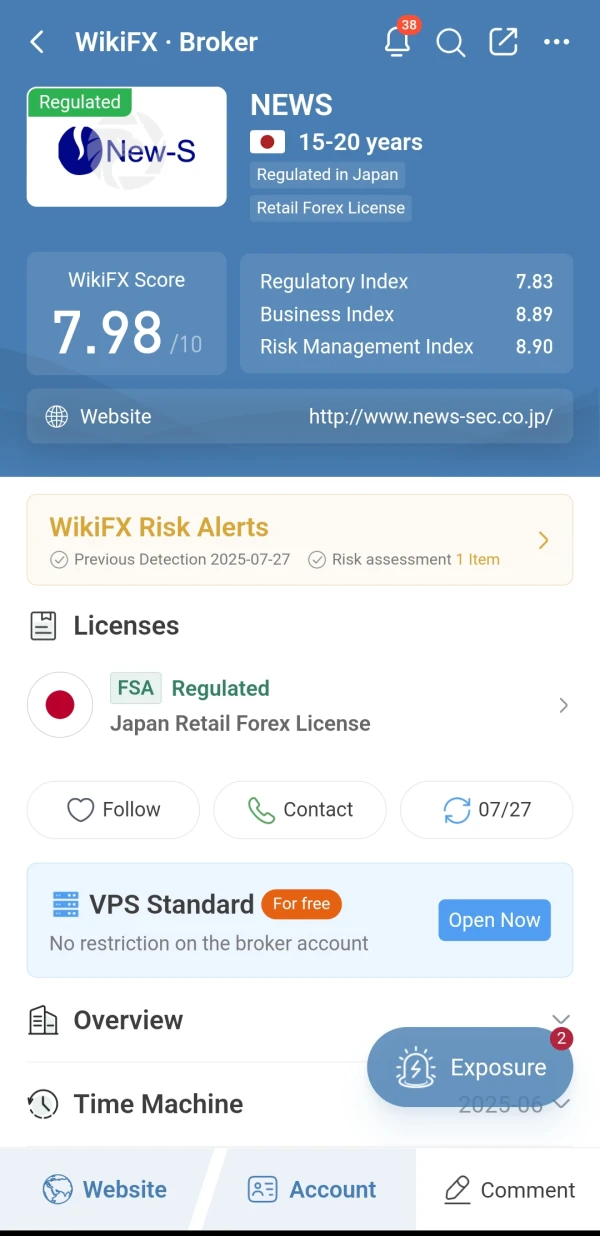

Is NEWS Legit?

NEWS has a Retail Forex License regulated by the Financial Services Agency (FSA) in Japan with a license number of 関東財務局長(金商)第138号.

Products and Services

NEWS provides different investment products and services. These offerings include:

1. Domestic Equities:

NEWS offers trading in domestic equities through in-person transactions, aiming to provide clients with optimal service. Services include spot trading, margin trading (system margin trading), futures trading, and options trading.

2. Foreign Stocks:

NEWS provides access to foreign stocks, with specific tradable instruments available upon inquiry. The brokerage covers equities from various countries, including Vietnam, Russia, Thailand, Dubai/Abu Dhabi, Brazil, the United States, Europe, China, Singapore, and more.

3. Foreign Currency-denominated Bonds: Clients can inquire about foreign currency-denominated bonds, and NEWS accommodates specific needs related to currency and redemption periods. NEWS offers bonds denominated in currencies like the Australian Dollar, New Zealand Dollar, Brazilian Real, South African Rand, Turkish Lira, Mexican Peso, among others.

4. Mutual Funds:

NEWS offers a selection of investment trusts; however, the specific products available can be obtained through inquiries. These investment trusts are managed by various investment trust companies, including Okasan Asset Management, Mitsubishi UFJ Kokusai Asset Management, Eastspring Investments, and others.

NEWS Fees

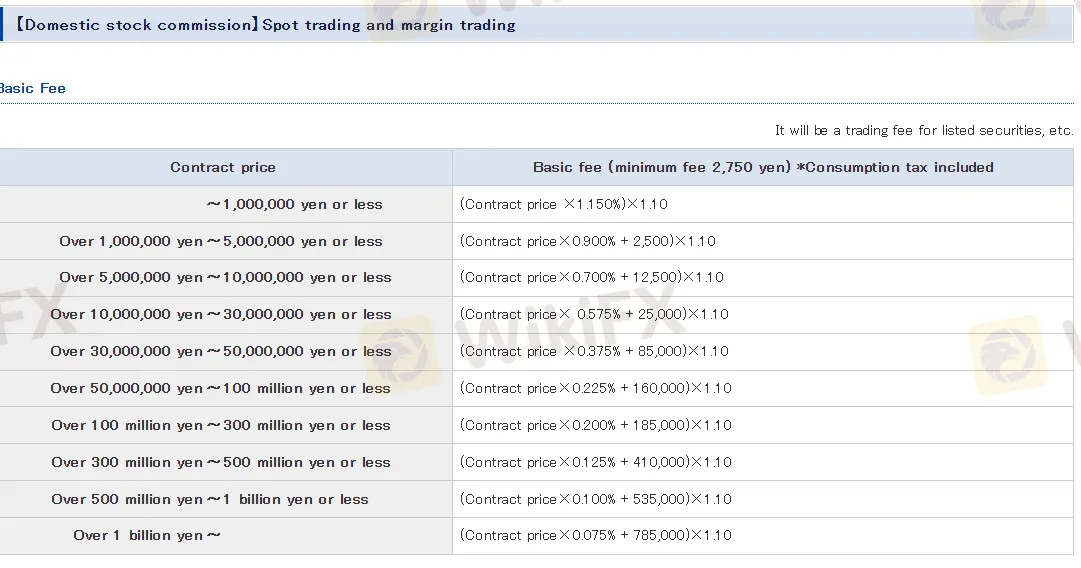

NEWS charges various fees for different types of transactions. Here's a breakdown of their fees:

- Domestic Stocks Fee: The basic commission fee is determined by the transaction amount. The commission fee starts at 1.15% for transactions up to ¥1 million and gradually decreases as the transaction amount increases.

| Contract Price | Basic Fee (Incl. Tax) |

| ~1,000,000 yen or less | (Contract price × 1.150%) × 1.10 |

| Over 1,000,000 yen ~ 5,000,000 yen or less | (Contract price × 0.900% + 2,500) × 1.10 |

| Over 5,000,000 yen ~ 10,000,000 yen or less | (Contract price × 0.700% + 12,500) × 1.10 |

| Over 10,000,000 yen ~ 30,000,000 yen or less | (Contract price × 0.575% + 25,000) × 1.10 |

| Over 30,000,000 yen ~ 50,000,000 yen or less | (Contract price × 0.375% + 85,000) × 1.10 |

| Over 50,000,000 yen ~ 100,000,000 yen or less | (Contract price × 0.225% + 160,000) × 1.10 |

| Over 100,000,000 yen ~ 300,000,000 yen or less | (Contract price × 0.200% + 185,000) × 1.10 |

| Over 300,000,000 yen ~ 500,000,000 yen or less | (Contract price × 0.125% + 410,000) × 1.10 |

| Over 500,000,000 yen ~ 1 billion yen or less | (Contract price × 0.100% + 535,000) × 1.10 |

| Over 1 billion yen ~ | (Contract price × 0.075% + 785,000) × 1.10 |

- Bond Fees: The fee is based on the transaction amount, starting at 1.0% for amounts up to ¥1 million.

| Contract Price | Basic Fee *Consumption tax included |

| ~1,000,000 yen or less | Contract price × 1.00% × 1.10 |

| Over 1M ~ 5M yen or less | (Contract price × 0.90% + 1,000) × 1.10 |

| Over 5M ~ 10M yen or less | (Contract price × 0.70% + 11,000) × 1.10 |

| Over 10M ~ 30M yen or less | (Contract price × 0.55% + 26,000) × 1.10 |

| Over 30M ~ 50M yen or less | (Contract price × 0.40% + 71,000) × 1.10 |

| Over 50M ~ 100M yen or less | (Contract price × 0.25% + 146,000) × 1.10 |

| Over 100M ~ 1B yen or less | (Contract price × 0.20% + 196,000) × 1.10 |

| Over 1 billion yen ~ | (Contract price × 0.15% + 696,000) × 1.10 |

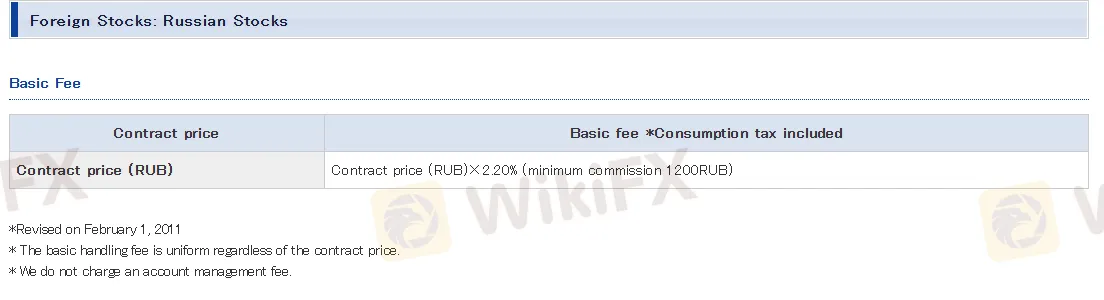

- Foreign Stock Fees: Fees for foreign stocks vary by country. For example, for Russian stocks, the fee is 2.2% of the transaction amount (minimum 1,200 RUB).

| Contract Price (RUB) | Basic Fee (Incl. Tax) |

| Any amount | Contract price (RUB) × 2.20% (minimum 1200 RUB) |

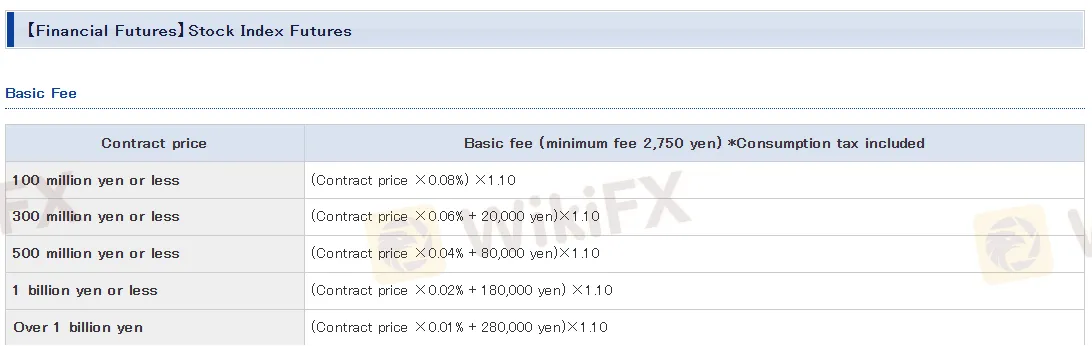

- Financial Futures Fees: For index futures, the fee starts at 0.08% for amounts up to ¥100 million.

| Contract Price | Basic Fee (Incl. Tax) |

| ≤ ¥100M | Price × 0.08% × 1.10 |

| ≤ ¥300M | (Price × 0.06% + ¥20,000) × 1.10 |

| ≤ ¥500M | (Price × 0.04% + ¥80,000) × 1.10 |

| ≤ ¥1B | (Price × 0.02% + ¥180,000) × 1.10 |

| > ¥1B | (Price × 0.01% + ¥280,000) × 1.10 |

hjcjfjc

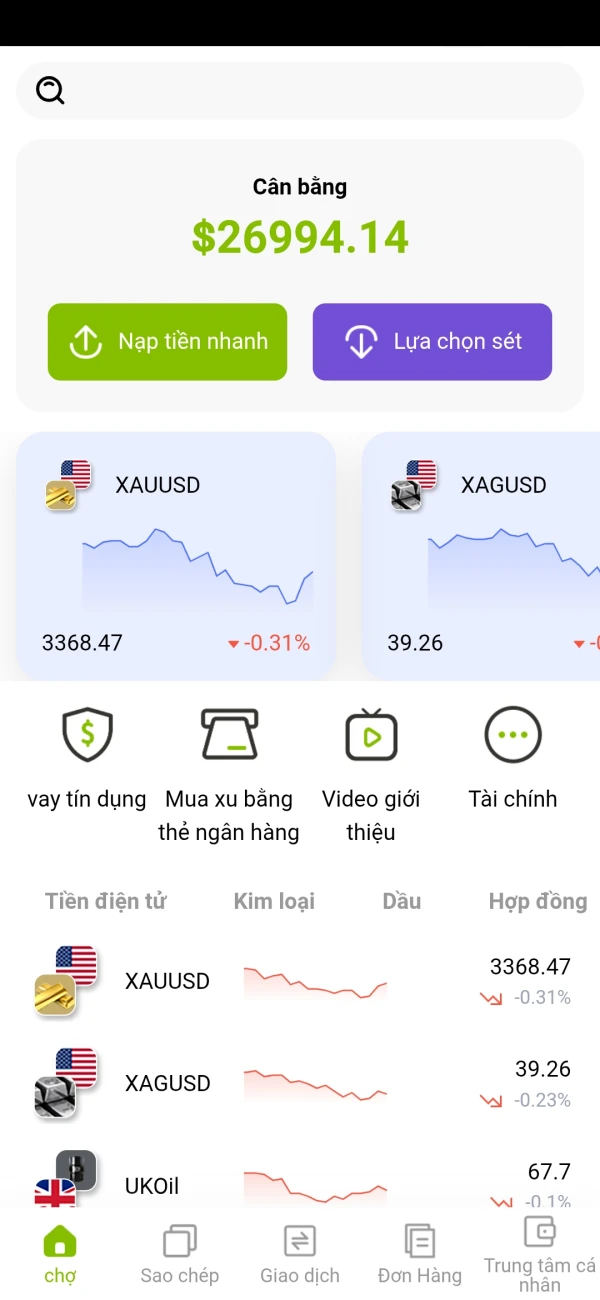

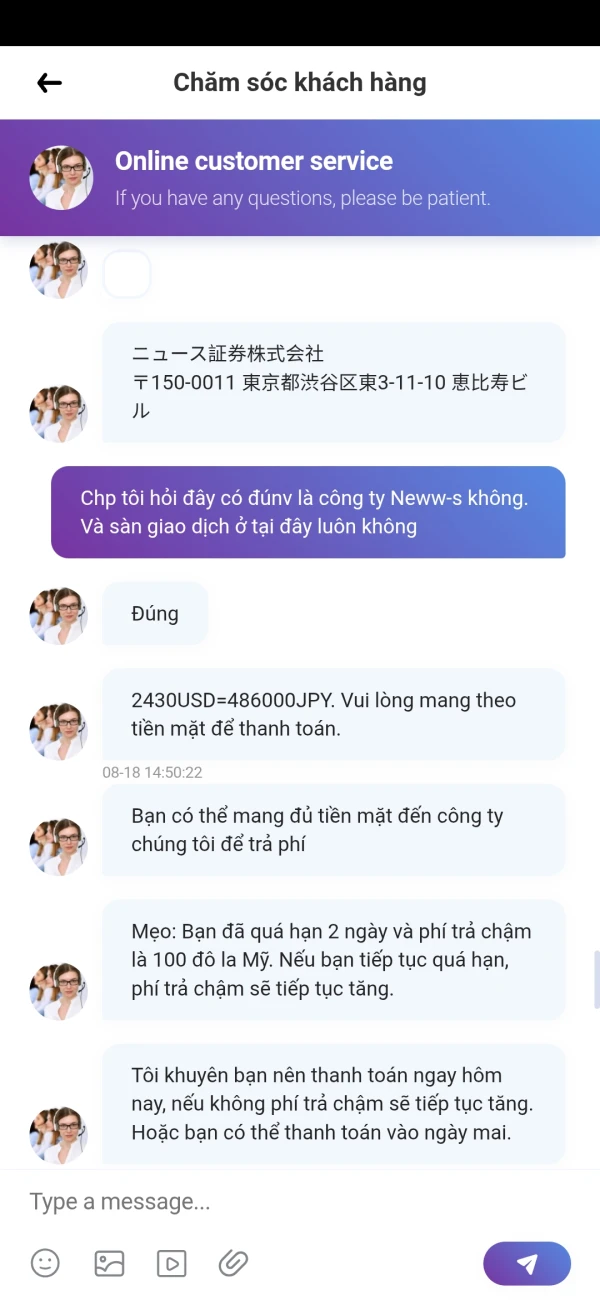

Vietnam

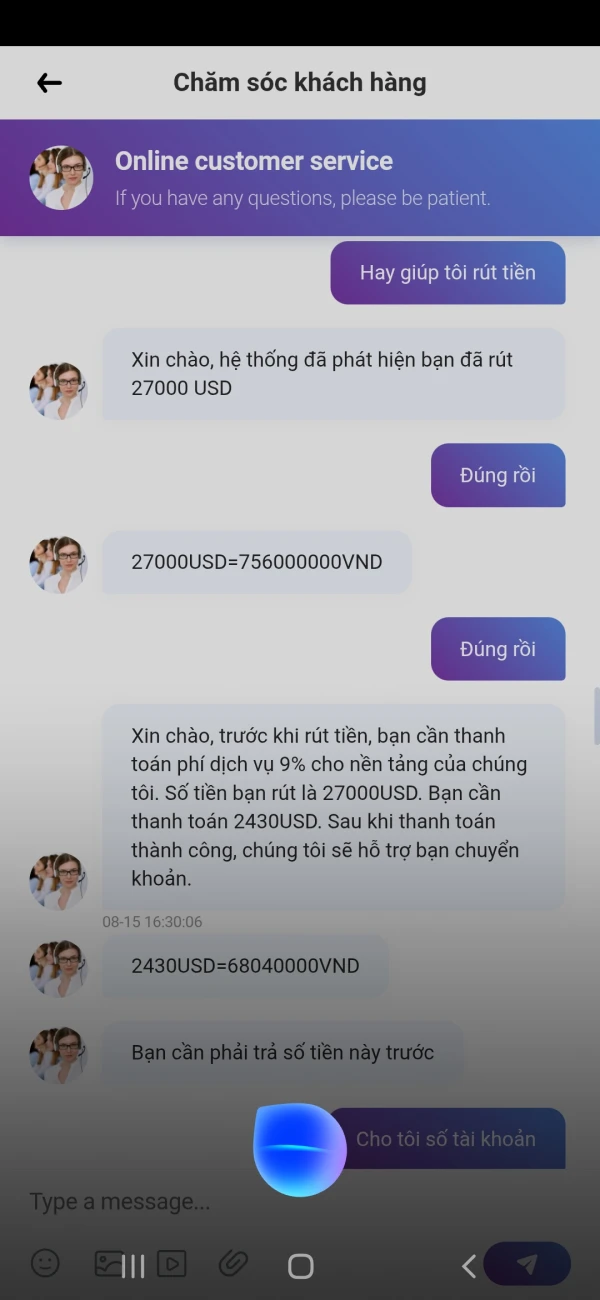

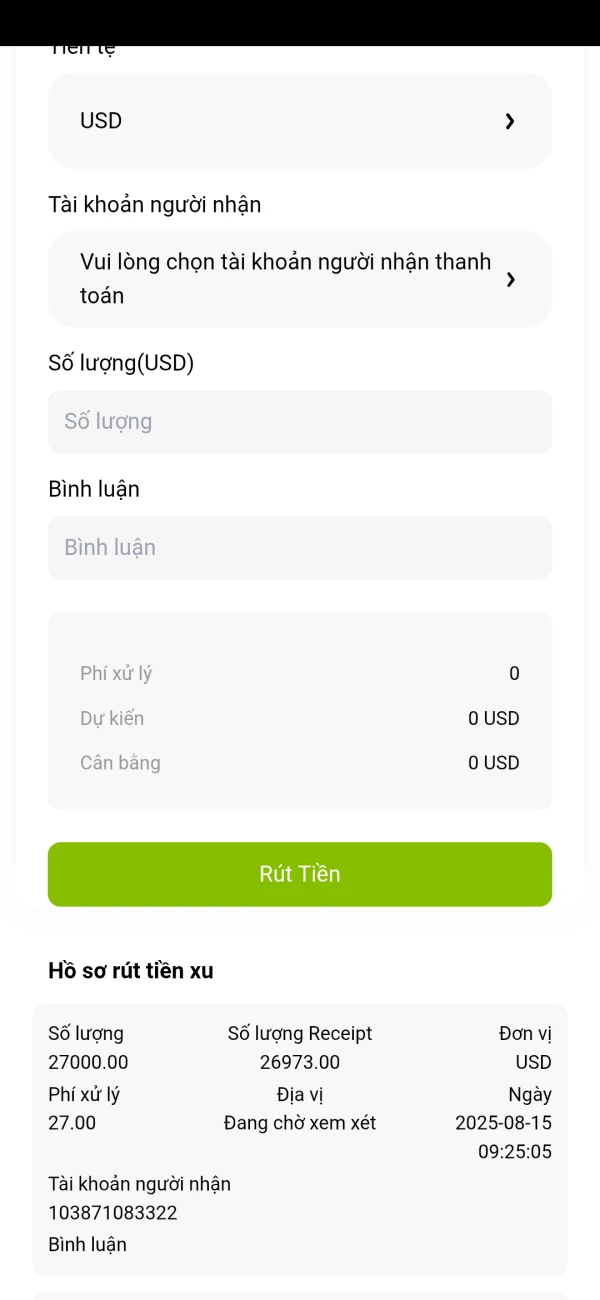

Previously, I participated in the NewS trading platform. I had deposited 200 USD, but when I traded, my balance increased to 226 USD. I attempted to withdraw funds, but the platform notified me that amounts less than 500 USD were not eligible for withdrawal and froze my funds. A few days later, I borrowed 1,000 USD in credit, and after multiple transactions, my balance increased to 27,000 USD. I placed a withdrawal request, but the platform notified me that I had to repay the 1,000 USD, so I deposited 28 million VND. The platform claimed there was a discrepancy (I had already paid off the 1,000 USD debt). After I completed the withdrawal request, the platform informed me that I had to pay an additional 2,430 USD as a 9% fee on the 27,000 USD I was withdrawing, and they insisted I transfer the payment before processing the transaction. I was very surprised by the platform's statement, and they also added that I must pay quickly, otherwise they would impose an additional penalty of 50 USD per day for delaying the payment of the 9% margin. I hope to receive assistance.

Exposure

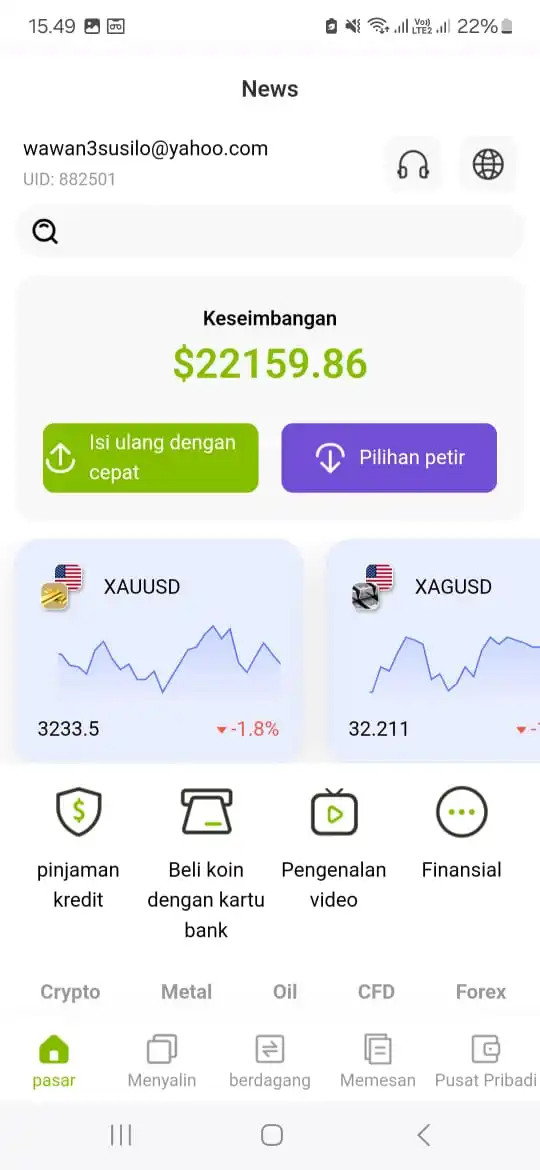

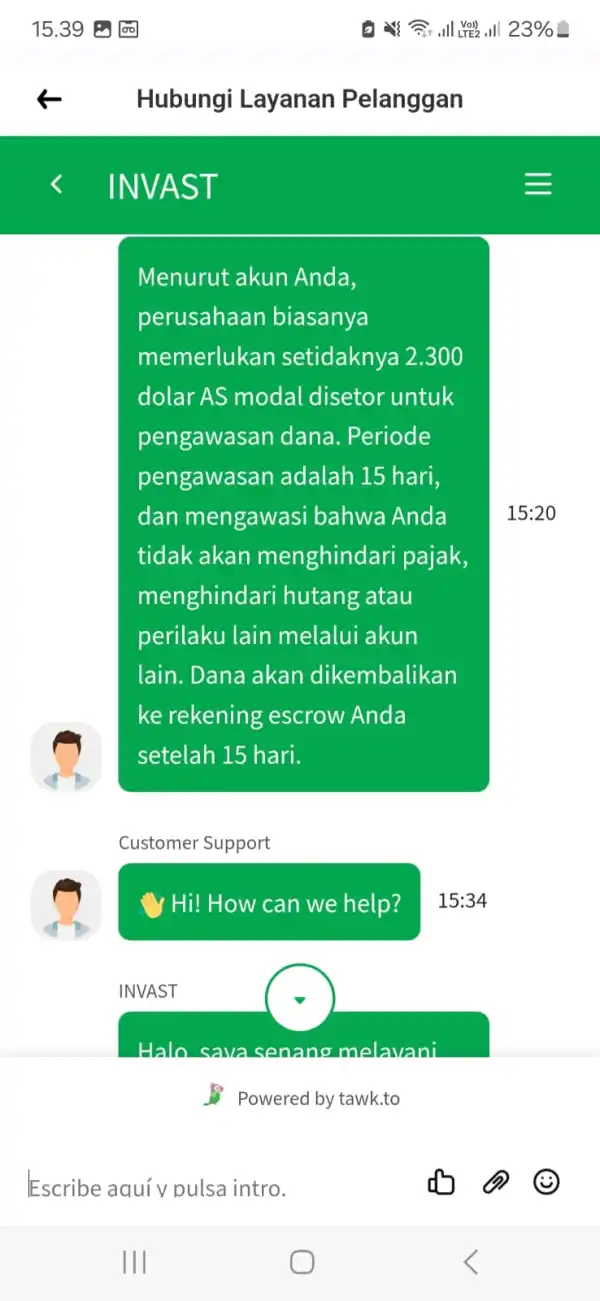

Wawan - IDR

Indonesia

Be careful not to become the next victim! Two months ago, around the 20th of February 2025, I met a woman on 'TikTok' who claimed to be from Japan and wanted to make friends with people from Indonesia. She claimed her name was Kagami Kishimoto (Lin Xue). After some time, she introduced me to Forex trading and sent me a link through WhatsApp to join a trading platform with the logo 'NEW-S'. In the first month, I was still able to withdraw the money I deposited, but when the amounts increased, they made it difficult for me to withdraw and demanded that I pay many fees, using made-up excuses to pressure me into paying. This awareness made me realize that I was scammed. This company is a fraud! Return my money, you bastards! If you don't return my money, I swear to God, your lives won't last long. Bastards... Scammers...!!!

Exposure

FX1467356491

Turkey

I believe they have been making me trade through a fake platform for about a month. They request money for verification when I ask for a withdrawal. It's a scam company.

Exposure

EMMANUEL JIDEOFOR

Netherlands

Despite being regulated, NEWS broker has a risk alert and exposure reports, raising concerns about its reliability. Proceed with caution.

Neutral

vikki6311

France

This broker, NEWS, seems shady. They're flagged for "Suspicious Scope of Business" and have a fresh risk alert. Even though they're regulated in Japan, those are big red flags for me. I'd stay away.

Neutral

TradeMax11

United States

A reliable platform for trading Vietnamese stocks. Clear info on fees and risks, as well as prompt customer support.

Positive