Long-term trading refers to a trading strategy in which a trader holds onto a trade for an extended period, typically over several months to years. This strategy is based on fundamental analysis that focuses on financial and economic factors such as a company's earnings reports, overall economic indicators, and related industry trends. Unlike short-term trading which prioritizes quick profits from market volatility, long-term trading plays on the intrinsic value of assets, relying on gradual price changes over time. There, indeed, exist many forex brokers that suit long-term investing, thus, picking a broker for your long-term investment goals can be a tough task. The choice of the broker plays a key role. To help with this, here we've selected top 6 forex brokers, which are particularly apt for carrying out long-term investment plans.

In the upcoming section, we'll dive into an in-depth analysis of each broker's strengths. Let's now discover the 6 top-rated brokers for long-term investing.

Best Brokers for Long-Term Investing Overall

Access to a wide array of investment products from equities, options, and futures to forex, bonds, ETFs, and more.

Powerful trading tools and platforms suitable for experienced traders, enabling complex analysis and strategy building.

Comprehensive research resources, ranging from stock analysis tools to timely market news.

24/7 assistance, dedicated live chat features, and knowledgeable support representatives available.

Offering a wealth of educational content, including tutorials, webcasts, articles, helping traders to expand their trading knowledge.

Its proprietary trading platform, Thinkorswim, widely regarded as one of the best trading platforms available.

more

Comparison of the Best Brokers for Long-Term Investing

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Overview of the Best Brokers for Long-Term Investing

InteractiveBrokers

|

|

Broker |

|

Founded in |

1977 |

Regulated by |

|

Min. Deposit |

$250 |

Products |

global stocks, options, futures, currencies, cryptocurrencies, and more |

Trading Platforms |

IBKR Trader Workstation (TWS) IBKR Desktop IBKR Mobile IBKR GlobalTrader IBKR Client Portal |

Payment Methods |

ACH, Bank Wire, Bill Pay, Check, Transfer from Wise Balance |

Customer Support |

5/24 |

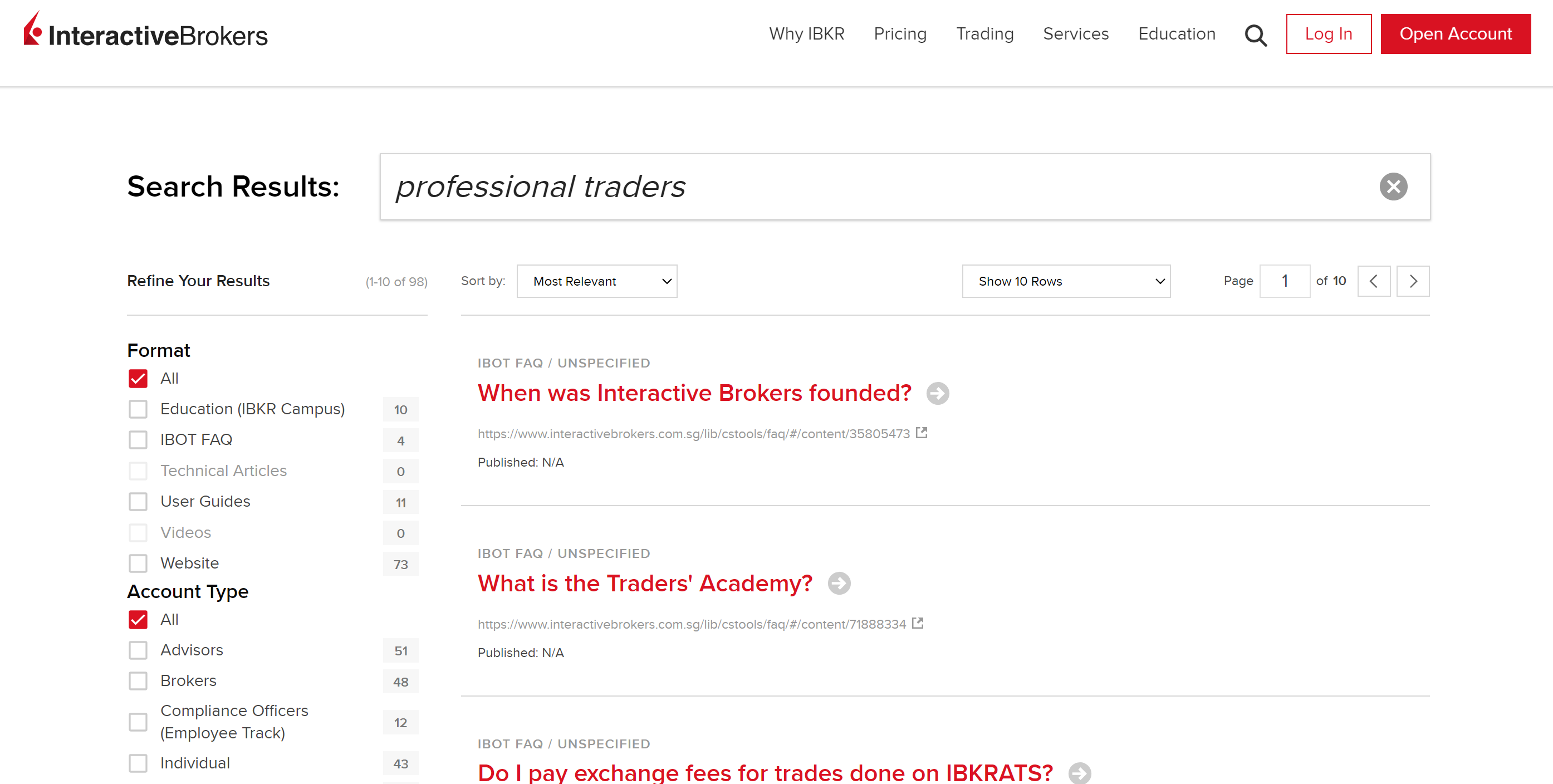

Interactive Brokers LLC, founded in 1977, is a U.S.-based brokerage firm registered in Greenwich, Connecticut. It's a leading platform that offers a vast range of tradable instruments including stocks, options, futures, forex, bonds, ETFs and mutual funds, across over 135 markets in 33 countries. The broker provides powerful trading platforms like Trader Workstation (TWS), IBKR Mobile, and Client Portal, featuring sophisticated tools, charts, and analytics for advanced trading. Customer support involves numerous channels including chat, email, phone, and an extensive library of FAQs and educational resources. Interactive Brokers is widely recognized for its competitive fees, broad product range, and robust trading technology, making it a preferred choice for many seasoned investors and traders worldwide.

InteractiveBrokers's standing as one of the best long-term brokers can be attributed to several factors. Its access to international markets enables diversification for long-term growth. The advanced trading tools coupled with comprehensive research offerings support informed, strategic long-term investment decisions. Moreover, its transparent, volume-tiered pricing is cost-effective for long-term investment owing to potential savings on recurring trades. Lastly, features like PortfolioAnalyst allow investors to monitor and manage their long-term portfolios effectively. Therefore, Interactive Brokers' robust infrastructure, diverse offerings, and supportive tools make it an excellent choice for long-term investing.

✅ Where InteractiveBrokers shines:

• Heavily regulated by ASIC, FCA, operating in a transparent way, adding extra layer of security.

• Features advanced trading platforms with powerful tools, efficient order routing, and high-speed execution.

• Its tiered pricing structure is favourable for frequent traders, featuring low commissions and margin rates.

• Interactive Brokers affords investing in different currencies and in international markets, which allows more opportunities for diversification over the long term.

❌ Where InteractiveBrokers Shorts:

• Charges monthly inactivity fees if certain commission thresholds aren't met, negatively impacting infrequent traders or beginners with smaller portfolios.

• Despite multiple channels, customer support has been reported to be slow at times, possibly impacting traders who require immediate assistance.

• While direct margin rates are relatively low, tiered rates can be higher for some balances compared to competitors.

Fidelity

|

|

Broker |

|

Founded in |

1969 |

Regulated by |

SFC |

Min. Deposit |

$0 |

Products |

Individual Bonds. Bond Funds. Bond ETFs. CDs. Fractional CDs. CD Ladders. Money Market Funds. Fixed Annuities. |

Services |

Retirement Plans, Investing, Brokerage, Wealth Management, Financial Planning and Advice, Online Trading |

Trading Platform |

Active trading software |

Payment Methods |

Apple Pay, Venmo, PayPal and other apps |

Customer Support |

24/7 |

Fidelity, officially Fidelity International, is an investment firm founded in 1969. It's an independent company headquartered in Bermuda, which provides investment solutions to clients in over 25 countries worldwide. The firm offers diverse tradable instruments such as mutual funds, ETFs, term deposits, and bonds. In relation to trading platforms, Fidelity facilitates investments through its user-friendly web platform and mobile app. Its customer support system involves phone, email, and live chat services. The firm has a strong reputation in the industry, mainly due to its emphasis on research, variety of investment products, and excellent customer service.

What makes Fidelity stand out as one of the best long-term brokers is its comprehensive research and insights, making it a valuable resource for long-term investors. Its diverse range of low-cost mutual funds and ETFs are ideal for long-term strategies such as retirement planning. Moreover, its absence of trading fees for online trades encourages long-term investment approach. The firm's commitment to educational content also helps investors understand the market and refine their investment strategies. Thus, Fidelitys approach to catering to long-term investors' needs, through resource provision and encouraging client's investment management growth, significantly contributes to its standing as an excellent choice for long-term investing.

✅ Where Fidelity Shines:

• Fidelity provides comprehensive research resources, including professional reports, original articles, and planning tools, ideal for informed decision-making.

• Fidelity offers a wide range of highly rated mutual funds and ETFs, providing long-term investors with diverse options for their portfolios.

• Their savings accounts have competitive rates which can maximize your passive income over the long-term.

• With phone, email, or chat options, Fidelity consistently ranks highly for its proficient and responsive customer service team.

❌ Where Fidelity Shorts:

• Unlike some brokers, Fidelity does not offer direct market access, which could be a downside for more advanced traders.

• Active Trader Pro, its advanced trading platform, is available only to users making 36 or more trades in a rolling 12-month period.

• Fidelity does not offer forex trading, which can be a disadvantage for investors seeking opportunities in the currency markets.

TD Ameritrade

|

|

Broker |

TD Ameritrade |

Founded in |

1971 |

Regulated by |

SFC |

Min. Deposit |

$0 |

Products |

Mutual FundsETFsIndex FundsStocksOptionsBonds, CDs & Fixed IncomeMoney Market Funds |

Services |

Banking and Borrowing |

Trading Platforms |

Thinkorswim |

Payment Methods |

ACH, Wire Transfer, Check |

Customer Support |

24/7 |

TD Ameritrade, founded in 1971, is a leading U.S.-based brokerage firm headquartered in Omaha, Nebraska, offering a wide variety of tradable instruments such as stocks, futures, forex, options, mutual funds, and ETFs. TD Ameritrade offers robust trading platforms including the popular thinkorswim platform, suitable for both beginners and advanced traders, and a well-designed mobile app for trading on the go. The firm boasts reliable customer support through phone, email, live chat, as well as physical branches nationwide. TD Ameritrade is highly recognized and respected in the industry for its user-friendly platforms, extensive investment offerings, free research and data, excellent customer service, and commission-free online stock, ETF, and options trades.

TD Ameritrade stands out as one of the best brokers for long-term investments for several reasons. Its extensive range of investment offerings provides the necessary diversity for long-term portfolio growth. The company offers a wealth of free, high-quality research, critical for making informed long-term investment decisions. Besides, its user-friendly, technologically advanced platforms allow investors to efficiently manage their long-term investments, make strategic decisions, and remain smart about market trends. Retirement planning and managed portfolio options also entertain the needs of long-term investors. Lastly, the firm's commitment to investor education, with free webcasts, articles, and online courses, proves tremendously helpful in steering long-term investment strategies. Therefore, in view of the extensive offerings and supportive resources, TD Ameritrade is a highly suitable platform for long-term investing.

✅ Where TD Ameritrade Shines:

• Its user-friendly thinkorswim platform, and the corresponding mobile app, offer advanced tools and resources, suitable for both novices and experienced traders.

• TD Ameritrade provides comprehensive, high-quality research resources at no cost, an excellent asset for informed decision-making.

• The platform offers rich educational content, which comes in handy for both beginner and experienced investors.

❌ Where TD Ameritrade Shorts:

• While certain trades are commission-free, fees for other trades, including broker-assisted trades, are • relatively high compared to some competitors.

• The thinkorswim platform, albeit powerful and comprehensive, may be overwhelming for beginners due to its complexity.

• Traders do not have the option to direct orders to a particular exchange for execution, which some advanced traders may find limiting.

Robinhood

|

|

Broker |

Robinhood |

Founded in |

2013 |

Min. Deposit |

$0 |

Products |

stocks, ETFs, cryptocurrency, and options |

Trading Platform |

Robinhood Platform |

Payment Methods |

Visa, Mastercard, Robinhood Cash Card |

Customer Support |

7/24 |

Robinhood, established in 2013, is a known broker firm based in the U.S. It was set up with a unique goal to make finance available to all by offering commission-free trading. Users can trade Stocks, ETFs, Options, ADRs, and Cryptocurrencies through its easy-to-use mobile app and web-based platform. Regarding customer support, Robinhood mainly provides support via email and has an extensive FAQ section.

Users appreciate Robinhood's easy-to-use interface, free trading policy which attracts budget-conscious traders, and its handy mobile app for trading on the move. However, it has received criticism for its limited customer service and lack of comprehensive investment research tools.

With respect to being one of the best long-term investment brokers, its key advantage is the absence of trading commissions. This means that long-term investors can grow their returns without regular costs eating into their profits. Also, Robinhood's new fractional shares feature lets long-term investors spread their money across a variety of high-value stocks. With a simple user interface, it's a good choice for those seeking a straightforward long-term investment experience. But investors should balance these perks against their need for robust research tools and extensive customer support when considering Robinhood for long-term investments.

✅ Where Robinhood Shines:

• Robinhood's zero-commission trading policy for stocks, options, ETFs, and cryptocurrencies appeals to cost-conscious users.

• Its user-friendly mobile platform is appreciated by the new generation of tech-savvy traders.

• Robinhood offers extended trading hours, giving users more flexibility to trade according to their schedule.

❌ Where Robinhood Shorts:

• Unlike more traditional brokers, Robinhood lacks comprehensive advanced charts, research tools, and detailed market analysis.

• Robinhood only offers individual taxable accounts and lacks individual retirement account (IRA) options.

• Robinhoods customer support, primarily provided through email, can be slow to respond, leading to user dissatisfaction.

Webull

|

|

Broker |

Webull |

Founded in |

2017 |

Regulated by |

FSA |

Min. Deposit |

$0 |

Products |

US-listed stocks, ETFs, Over-the-counter (OTC) securities, and options |

Trading Platform |

online trading platform |

Payment Methods |

Wire transfer, ACH, |

Customer Support |

7/24 |

Webull, founded in 2017, is a digital brokerage firm based in New York, USA. The platform provides diverse tradable instruments such as stocks, options, ETFs, and cryptocurrencies. their proprietary trading platform is known for its detailed analytics, intuitive design and powerful trading tools, accessible via desktop, web, and mobile. Customer support includes 24/7 help center via email and live chat. Webull has a strong reputation amongst tech-savvy traders and investors due to its commission-free trades and comprehensive trading platform.

Webull's standing as a top long-term broker stems from several features. It offers a broad array of securities, especially equity securities, allowing for ample diversification, a critical aspect of long-term investing. The platform's advanced data analytics and real-time market data contribute significantly towards informed, strategic investment decisions. There are no fees for trades made on the platform, which is convenient for buy-and-hold investors who intend to build up positions over time. The inclusion of retirement accounts such as traditional, Roth, and rollover IRA accounts makes it a strong candidate for long-term retirement savings strategies. Moreover, Webulls in-depth educational resources and market analysis tools prove beneficial for users to understand market trends and optimize their long-term investment strategies.

✅ Where Webull Shines:

• Webull offers zero-commission trades which are highly appealing to all types of investors.

• Its proprietary trading platform offers detailed analytics and market data, especially beneficial for investors who want to deeply analyze their investments.

• The platform offers trading in several cryptocurrencies, particularly appealing to tech-savvy, modern investors.

• Webull offers 24/7 customer support, which is always a plus point in brokerage services.

❌ Where Webull Shorts:

• Webull primarily deals with stocks, options, ETFs, and cryptocurrencies. The lack of more diverse investment classes like futures, bonds, and forex can be a drawback for some investors.

• Despite having 24/7 customer support, the support is primarily via email and live chat; there's no direct phone support, which is often preferred by many users.

TradeStation

|

|

Broker |

TradeStation |

Founded in |

1982 |

Regulated by |

FCA |

Min. Deposit |

$0 |

Products |

stocks, bonds, funds and options, futures and cryptocurrency |

Trading Platform |

TradeStation Platform |

Payment Methods |

Smart Transfer, Wire Transfer, Check Deposit, or Electronic Transfer (ACAT) |

Customer Support |

5/24 |

TradeStation, established in 1982, is a US-based brokerage firm located in Florida. The platform presents a range of tradable instruments, such as stocks, options, futures, ETFs, bonds, and cryptocurrencies. TradeStation is renowned for its advanced trading platform, designed to cater to the needs of experienced traders and featuring a wide array of technical analysis tools. Furthermore, TradeStation offers mobile and web-based platforms for on-the-go trading. Customer support is provided via phone, email, live chat, and at branch locations. The firm is generally recognized for its innovative trading tools, diverse offerings, and in-depth research.

TradeStation's repute as an excellent long-term broker results from several key factors. The wide array of investment options it provides allows for comprehensive portfolio diversification, crucial for long-term investment success. Furthermore, the access to quality and extensive market research data that TradeStation provides is invaluable for making informed, strategic long-term investment decisions. Its advanced trading technology appeals to investors who enjoy being hands-on and continually up-to-date with their long-term investments. Additionally, TradeStation offers Individual Retirement Accounts (IRAs), which are particularly suited to long-term, retirement-focused investing. Lastly, the company's strong emphasis on education helps investors better comprehend the market and long-term investing strategies.

✅ Where TradeStation Shines:

• TradeStation offers Direct Market Access (DMA), which is a crucial advantage for professional traders as it usually results in faster trade execution and better prices.

• Professional traders can tailor charts, screens and watch lists according to their preference, which increases efficiency of analysis and trading.

• TradeStation has its own proprietary trading technology which is recognized for its reliability and speed, important factors for professional traders.

❌ WhereTradeStation Shorts:

• There are platform fees for less active traders, and though the commissions on stocks and ETFs are competitive, options and futures traders might face relatively high costs compared to other brokers.

• Despite its availability via various channels, some users have reported slower response times.

Forex Trading Knowledge Questions and Answers

What is long-term investing?

Long-term investing is a strategy that involves purchasing financial instruments, such as stocks, bonds, mutual funds, or real estate, with the expectation that they will appreciate in value over a period of several years. While short-term market fluctuations are less important to long-term investors, they nevertheless focus on the fundamental value of their investments, taking into account economic indicators, industry trends, and company performance data. Basically, it is about commitment and patience as it banks on the principle of compounding returns and overall market trends delivering profitability over time. Typically, less risk and less hands-on management than short-term trading involves.

Long-term investing VS Short-term Investing: Which suits Beginners More?

The choice between long-term and short-term investing depends on a beginner's financial goals, risk tolerance, time commitment, and understanding of the market. More often, long-term investing is suggested for beginners, as it tends to be less risky, requiring less time for management, and allows more room for market recovery in case of a downturn. Besides, it also benefits from compound returns over time. In contrast, short-term investing or trading, while potentially lucrative, involves higher risks, requires intense market knowledge, constant monitoring of trends, and has little room for error, hard for beginners to handle.

Can I make profits through long-term investing?

Yes, long-term investing can lead to profits. The long-term approach aims to capture the overall upward trend of the market or a specific investment over time. It relies on the principle of compound interest where your existing profits generate additional gains. While profits aren't guaranteed in investing, a well-researched and diversified long-term portfolio typically has potential for substantial growth over several years. Patience and staying the course despite market fluctuation are vital in long-term investing.

How can I diversify with little money?

Even with a small budget, diversification is still achievable. Here are some strategies:

• ETFs and Mutual Funds: You can buy these funds that have a variety of stocks or bonds. They provide diversification without the need to invest a lot in individual securities.

• Fractional Shares: Some platforms allow you to buy parts of a share. This way, you can invest in larger, more expensive companies within your budget.

• A Diverse Bond Portfolio: Investing in bond funds rather than individual bonds allows for diversification. The bond funds comprise a myriad of bonds, mitigating risk.

• Peer-to-Peer Lending: Through P2P platforms, your investment is spread over several loans. This diversifies your portfolio while providing potential returns.

• Robo-Advisors: These platforms automate investment and diversification based on your financial goals and risk tolerance.

What are tips for long-term investing?

Maintain Confidence: As a long-term investor, your conviction in your chosen portfolio is important. Since the focus is on long term, short-term downswings, while concerning, shouldn't trigger panic selling. Instead, view these moments as tests of your investment hypotheses and adjust as necessary.

Prioritize Research: Resist the allure of 'secret strategies' from reputed traders. Every investment requires in-depth research. Delve into company fundamentals, industry position, financial health, and long-term growth prospects before making an investment.

Aim for Long-Term Profits: High rates of returns may seem attractive, but they also bring significant risk. In long-term investing, it's safer to lean towards lower-risk investments that offer steady, compounded returns over time.

Follow a Consistent Trading Strategy: Rather than swinging from one investing strategy to another, consistency is key. Choose a strategy that aligns with your financial goals and risk tolerance, and stick to it. This allows for tracking the effectiveness of your strategy and making necessary refinements along the way.

Maintain an Open Mind: Financial markets are dynamic, and strategies might need to be reassessed or tweaked as conditions change. Hence, being receptive to inevitable change, and agile enough to capitalise upon these shifts, will ultimately sustain successful investing.

Be Future-Oriented: Look beyond current profitability and focus on future potentials. Consider the long-term growth prospects of your investments, evaluating potential future earnings and dividends over current gains.

What are pros and cons of long-term investing?

Pros of Long-Term Investing:

• Higher Potential Returns: Over time, stocks have historically outperformed other asset classes like cash or bonds. The magic of compounding interest allows gains to snowball throughout the years, leading to significantly higher returns compared to short-term investments.

• Reduced Risk: While no investment is guaranteed, long-term investing allows you to ride out market volatility. Short-term fluctuations become less important as you focus on the long-term trend of underlying businesses.

• Less Stress: Constant monitoring and trading can be stressful. Long-term investing lets you take a “set it and forget it” approach, freeing up mental energy and avoiding emotional decisions based on temporary market swings.

• Lower Costs: Frequent buying and selling incur transaction fees and taxes. Long-term investing minimizes these costs, increasing your overall profit.

• Tax Advantages: Many countries offer lower capital gains tax rates for investments held for a specific period (e.g., 5 years). This further boosts your returns.

Cons of Long-Term Investing:

• Limited Access to Funds: Your money is tied up for the long term, making it less readily available for emergencies or unexpected expenses.

• Missed Opportunities: While market timing is notoriously difficult, there may be instances where short-term opportunities for high returns exist. Long-term investing might miss out on these.

• Knowledge and Research: Selecting suitable long-term investments requires research and understanding of different asset classes and market dynamics.

• Unforeseen Events: Black swan events or unforeseen circumstances can significantly impact markets and potentially disrupt your long-term plans.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

Forex Day Trading VS Forex Scalping: Which One to Choose?

Unravel the clash of Forex day trading and scalping - grasp their tactics, track differences, and tailor your trade.

How to Hedge Forex Positions? Some Relevant Strategies to Share.

Dive into Forex hedging strategies - reducing risk, seizing opportunities and securing robust trading profits.

Can I Trade Forex without Stop-Loss? Here Lets’ Discuss

Start Forex trading without stop-loss - understand how it works, explore other options and possible risks.

Forex Market Hours: What is the Best Time to Trade Forex?

Master the clock of Forex trading - optimize profits by knowing the best trading times globally!