Global Broker governance & inquiry App!

Tracks

Indian authorities accuse OctaFX, broker denies said said the allegations are baseless.

OctaFX, a well-known brokerage firm, has recently come under charges of money laundering and chart manipulation by Indian authorities. The company denied the accusations and said the allegations were baseless.

Are Prop Firms Worth the Hype? Let's Delve Into This Topic!

Proprietary trading firms, commonly known as prop firms, have been gaining attention in the forex and cryptocurrency industry. These firms recruit traders to trade with their capital, offering potentially lucrative opportunities. However, the question arises: Are prop firms truly worth the hype?

WikiFX Global Supervisors Gathering! Participate to win cash prizes!

A major event is coming! The "WikiFX Global Supervisors Gathering" event has officially launched, and participants will have the chance to win USDT rewards!

FXCM

XM

GO MARKETS

IC Markets

FP Markets

FBS

FXTRADING.com

Trade Nation

HYCM

VT Markets

Hantec

BCR

MultiBank Group

STARTRADER

IG

easyMarkets

VPS Standard

1*CPU/1G*RAM/40G*HDD/1M*ADSL

VPS Pro

2*CPU/2G*RAM/60G*HDD/1M*ADSL

VPS cTrader

2*CPU/4G*RAM/100G*HDD/2M*ADSL

XM

2*CPU/2G*RAM/60G*HDD/2M*ADSL

OEXN

2*CPU/2G*RAM/60G*HDD/2M*ADSL

GTC

2*CPU/2G*RAM/60G*HDD/2M*ADSL

Latest

CAPPMOREFX AGAIN IN NEWS !!

This fraudulent entity later changed its name and became Returnfx.

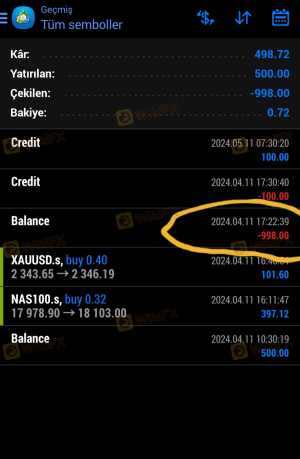

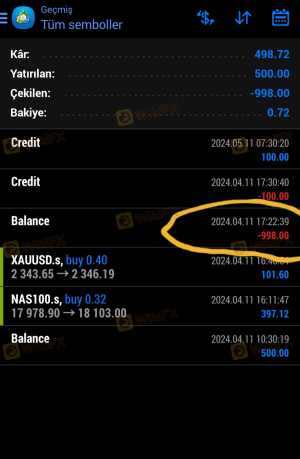

Unable to Withdraw

Unable to Withdraw My $998 money is not paid and they blocked my acco

I made a profit in 2 transactions and when I wanted to withdraw my money, they unfairly confiscated my money and banned access to my account. They don't pay my 998 dollars. Everything is expected from such a company that does not even pay 998 dollars. I want my money paid urgently

Yaman1903

Yaman1903

Interactive Brokers Now Allows 22-Hour Treasury Bond Trading

Interactive Brokers has expanded trading hours for US Treasury bonds, now allowing trading for 22 hours daily.

Are Prop Firms Worth the Hype?

Proprietary trading firms, commonly known as prop firms, have been gaining attention in the forex and cryptocurrency industry. These firms recruit traders to trade with their capital, offering potentially lucrative opportunities. However, the question arises: Are prop firms truly worth the hype?

FCAA warns Investors against Fintech Market

The Financial and Consumer Affairs Authority of Saskatchewan (FCAA) is warning investors about the online entity Fintech Market.

Rights Protection Center

XeOne

XeOne

XeOne

XeOneUnable to withdraw funds

please be careful I was humiliated and defrauded here, profile aided.

JustMarkets

JustMarkets

JustMarkets

JustMarketsThey rob my money

I deposited to trading account for 4 days ago and they ignored every contact which me send by email, otherwise they rejected my withdrawal too.

FXGT.com

FXGT.com

FXGT.com

FXGT.comfxgt does not pay my money

When I tried to withdraw around 800 USD from my account number 897769 with my e-mail address, they closed my account. I cannot log in to the panel. When I log in to the meta page, it says authorization failed. I funded 2000 USD. It's still on the account. I have around 2800 receivables. They defrauded me. Please help me. I am in a difficult situation.

Monaxa

Monaxa

Monaxa

MonaxaA BIG SCAM BROKER

Suddenly said i break their Rules that im multiple log in with same vps and directly deducted all my credit around 22k USD!!!! i ask for live chat service to asist me and they ask me via email to contact them but everytime i contact them they doesnt wan to answer my email and directly deducted all my credit. since i start trade from so many month.BTW i have too much transaction tht i been trade in this broker so i just roughly took some photo.

247Tradelifestyle

247Tradelifestyle

247Tradelifestyle

247TradelifestyleUnable to withdraw

i invested 10 usd which i gained 1200 usd and i cant withdraw my profit of 1200usd.

OctaFX

OctaFX

OctaFX

OctaFXCannot withdrawal a year

I Don't know why the official company didnt know about this ...after I transfer on Crypto into this Platforms...after consulting from them they Don't know about this Paltforms...really hate the scammer liked this if you can trusted on deals...

Super Profit 8

Super Profit 8

Super Profit 8

Super Profit 8 I have 32616$ and declined withdrawal

This company is managed by Chris Mayo. I have invested £6044.43 and gained profits of 32616$ but Mr Mayo has restricted funds not to be withdrawn. I search Mr Chris Mayo on LinkedIn, I found him but he declined any involved with WhatsApp group and claimed this Chris Mayo using is name abusively. it is not him that this is a scam. I have evidence of everything.

SQUAREDFINANCIAL

SQUAREDFINANCIAL

SQUAREDFINANCIAL

SQUAREDFINANCIALI can't withdraw my money

The company called Squared has seized my money and is not paying me. I started trading on Tuesday-Wednesday and I was at a loss on the gold chart and I was making a loss, then there was no problem, then I was always at a loss until Friday, and on Friday at 15:30 or 16:30 there was US data, I was not aware of it, and suddenly there was a profit on the screen, so I closed the transactions, and then they accused me of situations that I did not understand nonsense, cut off communication and confiscated my money. They do not help in any way, they are officially scammers! If this situation continues, my complaints to the relevant licenses and meta system will continue non-stop

QmmFx

QmmFx

QmmFx

QmmFxWithdrawal not possible

The broker refuses the payout every time. No chance. No reason. Maybe someone has an idea.

Super Profit 8

Super Profit 8

Super Profit 8

Super Profit 8 Not able to withdraw money

They made me invest £20,000 in the name of JP Morgan, Chris Mayo and Super Profit 8 as the institutional account managed by JP Morgan, Chris Mayo. They are now denying withdrawals from the platform. All my deposit money is locked and I lost all my money.

EPFX

EPFX

EPFX

EPFXProfits Stolen

This broker isn't a healthy environment for traders. They disabled my profile when I was asking them to resolve their technical issues regarding me being able to withdraw my $45 profits imagine what kind of a regulated broker runs away with $45 of a traders that's pure desperation and unethical business practices. I would never recommend anyone to this unethical money laundering scheme platform.

Quotex

Quotex

Quotex

QuotexDeposit not come to account

My funds have been debited from my wallet account, but not credited to my Quotex trading balance account Deposit #51630131 / 2024-03-27 07:13:36 / 100.00$ Successfully transferred at 14:14 on 27/3/2024 On 27 March I deposited 100$ to my account on Quotex website. The recipient was Ho Van Minh from Quotex system. But until now my account amount is 0$. Where is my money in Quotex system? Quotex must be fully responsible for it. Quotex said they will contact me once there is an update from the financial provider, tell me do not interfere!? But until today 20 April they did not contact me. This is the third time Quotex cheated me. Last year I deposited 2 times 50$ each to my Quotex account but the same situation, my account was 0$.

XeOne

XeOne

XeOne

XeOneThey are proper using B Book never give withdrawal

His one manager himanshu is very big fraud person he stolen my 3000 doller and denay to send withdrawal

Doo Prime

Doo Prime

Doo Prime

Doo PrimeMy $998 money is not paid and they blocked my acco

I made a profit in 2 transactions and when I wanted to withdraw my money, they unfairly confiscated my money and banned access to my account. They don't pay my 998 dollars. Everything is expected from such a company that does not even pay 998 dollars. I want my money paid urgently

Spring FX Signals

Spring FX Signals

Spring FX Signals

Spring FX Signalsscam

100% scam.This is just a scam company. I was invested in this by a lady who goes by Nappy Terry on Instagram.. We can't withdraw our profits. They will tell you to deposit money again to withdraw.. This is a scam company. They have targeted Indians more. Nappy Terri She also has a son Thiago...no American friends on her insta id all are Indians. Be careful with it. I am giving her photo below.

CXM Trading

CXM Trading

CXM Trading

CXM TradingAlchemy prine limited

Hello Team, This is to inform you that i have been scammed by the trading App 'CXM trading” assessed through “In-CARLYLES” app. When i put up my car for sale on car selling app, I was approached by someone who called her name 'Kelly' having the cell # +852 6558 5997 ahowing interest to buy. She initially showed herself a business owner and an investor and declared that she made lot of profits from the trading app by sending screenshots of her balance growing by leaps and insisted me to try as well. She trapped me through by giving a simulation account and guided how to use it. then asked me to start investment with $300 on 16.04.2024 and took me to $2350 investment on 17-07-2024. She said she will provide investment strategies by their analytics and if i grow/top up my balance to 5000 USD then 10,000 USD and so on for more lucrative strategies. I only traded 0.3 lots and they showed a dummy profit on UKOIl while on that day UKOiL price dis not touch that limit hence it was all scam and artificial. When i got the doubted i asked her she showed me a linkthat their firm is registered. Out of my Balance 2337 $. Later, I came up with a need to partially withdraw my amount $18,00/- and asked her for withdrawal. She connected me to a customer services email 'internationalforeignexchange01@gmail.com' which she has given me to verify my identity and ensure deposits in my account through Binance. Upon withdrawal request, she asked me to pay the Liquidated damages 20% '$500' first in Wallet Account “TMBoEdmddFgan5JkP1fWjYSr4xY1GLNGiH”before we proceed your withdrawal. When I completed the transaction then she asked to pay the Income tax of 15% to get the payment. I didn’t pay and told them to either debit taxes and charges from my balance but they are saying i need to pay first and still waiting for the withdrawal. I processed the withdrawal through the app later on 18-03-2024 and its showing 'Pending Review' since dat day

Discover

,电报飞机C2C36

NISA ACCOUNT MANAGER

Chrisclipx

清风.Telegram:@V1686

NISA ACCOUNT MANAGER

EA

Tools Immortality

Income in last year +120.00%

This tool is an indicator that can display the net value change graph of the account in historical time and the opening and closing positions and connection graphs of all historical orders.

USD 0.99 USD 980.00PurchaseMartin ForexWorld

Income in last year +115.90%

Martin's strategy is mainly used in symbol market, mainly used in small period and shock market, keep trading back and forth, adding up.

USD 0.99 USD 980.00PurchaseComprehensive type Godness

Income in last year +261.86%

Expect to enlarge the market;Even if the direction is wrong, you can set a stop loss.and you can solve the problem of inaccurate opening positions by adding several positions before the stop loss is reached.

USD 0.99 USD 980.00PurchaseTrend type Aberration

Income in last year +173.36%

This is a classic CTA strategy, similar to the band line strategy, which makes a trend market and breaks through the shock range to buy. If the market continues to go, it will hold it until it goes long, falls below the midline of the band line, or closes short and rises above the middle rail of the band line.

USD 0.99 USD 280.00Purchase

Ranking List

- Total Margin

- Active Trading Ranking

- Total lots

- Stop Out

- Profit Order

- Brokers' Profitability

- New User

- Spread Cost

- Rollover Cost

- Net Deposit Ranking

- Net Withdrawal Ranking

- Active Funds Ranking

Total Margin

- 30 days

- 90 days

- 6 months

- Brokerage

- Total Asset%

- Ranking

- 1

Exness

- 34.90

- --

- 2

XM

- 14.77

- --

- 3

FBS

- 6.51

- 1

- 4

FXTM

- 5.79

- 1

- 5

GMI

- 5.41

- --

- 6

Doo Prime

- 4.41

- --

- 7

TMGM

- 2.27

- 1

- 8

IC Markets

- 2.15

- 1

- 9

Vantage

- 1.52

- --

- 10

ZFX

- 0.93

- --

Active Trading Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Activation rate%

- Ranking

- 1

Exness

- 59.26

- --

- 2

XM

- 49.44

- --

- 3

GMI

- 12.74

- --

- 4

FBS

- 12.39

- --

- 5

TMGM

- 9.06

- 2

- 6

IC Markets

- 6.95

- --

- 7

Doo Prime

- 6.08

- 1

- 8

FXTM

- 5.79

- 3

- 9

Vantage

- 2.75

- 2

- 10

ZFX

- 2.10

- 3

Total lots

- 30 days

- 90 days

- 6 months

- Brokerage

- Trading Volume%

- Ranking

- 1

FBS

- 66.67

- --

- 2

Exness

- 21.48

- 1

- 3

IC Markets

- 18.00

- 1

- 4

FXTM

- 16.11

- 2

- 5

USGFX

- 15.77

- 3

- 6

Tickmill

- 9.92

- 1

- 7

GMI

- 5.06

- 11

- 8

TMGM

- 3.25

- 2

- 9

ZFX

- 1.37

- 3

- 10

XM

- 1.16

- 1

Stop Out

- 30 days

- 90 days

- 6 months

- Brokerage

- Stop Out%

- Ranking

- 1

Alpari International

- 5.95

- 23

- 2

Forex Club

- 5.94

- 30

- 3

NCE

- 4.84

- 3

- 4

GKFX Prime

- 4.65

- 32

- 5

WeTrade

- 3.12

- 16

- 6

CPT Markets

- 2.98

- 1

- 7

ThinkMarkets

- 2.88

- 5

- 8

USGFX

- 2.08

- 5

- 9

GMI

- 1.96

- 2

- 10

Valutrades

- 1.59

- 13

Profit Order

- 30 days

- 90 days

- 6 months

- Brokerage

- Win rate%

- Ranking

- 1

FBS

- 12.38

- 4

- 2

TMGM

- 4.64

- 1

- 3

IC Markets

- 1.56

- 3

- 4

Pepperstone

- 1.25

- 15

- 5

ZFX

- 0.95

- 4

- 6

AvaTrade

- 0.28

- 5

- 7

CWG Markets

- 0.27

- 3

- 8

EightCap

- 0.23

- 34

- 9

Vantage

- 0.18

- 29

- 10

RockGlobal

- 0.15

- 3

Brokers' Profitability

- 30 days

- 90 days

- 6 months

- Brokerage

- Total Profit%

- Ranking

- 1

XM

- 33.27

- 47

- 2

GMI

- 8.70

- --

- 3

Doo Prime

- 5.35

- 3

- 4

Axitrader

- 4.14

- 42

- 5

VT Markets

- 2.54

- 2

- 6

CXM Trading

- 1.59

- 1

- 7

FXTM

- 1.22

- 6

- 8

CPT Markets

- 0.30

- 25

- 9

ACY Securities

- 0.12

- 2

- 10

Tickmill

- 0.08

- 2

New User

- 30 days

- 90 days

- 6 months

- Brokerage

- Growth value%

- Ranking

- 1

Exness

- 17.92

- --

- 2

XM

- 17.76

- --

- 3

FXTM

- 4.49

- --

- 4

FBS

- 4.47

- 2

- 5

GMI

- 4.07

- --

- 6

IC Markets

- 3.93

- 2

- 7

TMGM

- 3.16

- --

- 8

Doo Prime

- 2.47

- --

- 9

FXTRADING.com

- 1.22

- --

- 10

Vantage

- 1.12

- --

Spread Cost

- 30 days

- 90 days

- 6 months

- Brokerage

- Average Spread

- Ranking

- 1

XM

- 19.64

- 1

- 2

Exness

- 17.17

- 1

- 3

FBS

- 5.60

- 1

- 4

GMI

- 4.93

- 1

- 5

TMGM

- 3.70

- 2

- 6

IC Markets

- 2.82

- 1

- 7

FXTM

- 2.18

- 1

- 8

Doo Prime

- 2.06

- --

- 9

FXTRADING.com

- 1.23

- --

- 10

Vantage

- 0.95

- --

Rollover Cost

- 30 days

- 90 days

- 6 months

- Brokerage

- Average rollover

- Ranking

- 1

Exness

- 435.35

- --

- 2

XM

- 72.86

- --

- 3

FBS

- 33.42

- 39

- 4

FXDD

- 21.59

- 32

- 5

RockGlobal

- 9.45

- 29

- 6

ZFX

- 3.17

- 2

- 7

Pepperstone

- 3.02

- 13

- 8

Swissquote

- 2.34

- 5

- 9

Doo Prime

- 2.17

- 21

- 10

USGFX

- 1.50

- 7

Net Deposit Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Net Deposit%

- Ranking

- 1

MultiBank Group

- 94.26

- 40

- 2

AvaTrade

- 76.97

- 2

- 3

VT Markets

- 76.71

- 14

- 4

Vantage

- 74.64

- 1

- 5

EightCap

- 72.29

- 2

- 6

FxPro

- 71.98

- 2

- 7

TMGM

- 71.92

- 22

- 8

CWG Markets

- 71.60

- 3

- 9

Alpari International

- 71.43

- 3

- 10

CXM Trading

- 71.28

- 13

Net Withdrawal Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Net Withdraw%

- Ranking

- 1

Exness

- 7.00

- --

- 2

Doo Prime

- 7.00

- 3

- 3

GO MARKETS

- 7.00

- --

- 4

Valutrades

- 8.00

- --

- 5

FBS

- 10.00

- 2

- 6

ThinkMarkets

- 11.00

- 4

- 7

Axitrader

- 12.00

- 9

- 8

ACY Securities

- 12.00

- 16

- 9

AvaTrade

- 13.00

- 1

- 10

IC Markets

- 13.00

- --

Active Funds Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Activation rate%

- Ranking

- 1

FXDD

- -0.60

- --

- 2

FXCM

- -0.80

- 4

- 3

AUS GLOBAL

- -0.86

- 1

- 4

GMI

- -0.95

- --

- 5

Doo Prime

- -1.36

- 2

- 6

FXPRIMUS

- -1.50

- --

- 7

FOREX.com

- -1.50

- 1

- 8

AvaTrade

- -2.56

- --

- 9

HYCM

- -2.60

- 2

- 10

Just2Trade

- -2.90

- --

Real-time spread comparison EURUSD

- Brokers

- Accounts

- Buy

- Sell

- Spread

- Average spread/day

- Long Position Swap USD/Lot

- Short Position Swap USD/Lot

To view more

Please download WikiFX APP

Know More and Enjoy More