Company Summary

| CPT Markets | Basic Information |

| Founded | 2016 |

| Registered Country | Belize |

| Regulation | FCA (UK), Offshore FSC (Belize), FSCA (South Africa) |

| Minimum Deposit | $20 |

| Demo Account | ✅ |

| Tradable Assets | Forex, Indices, Commodities, Stocks, Cryptocurrencies |

| Trading Platform | MetaTrader 4, MetaTrader 5, cTrader |

| Spread | From 1.4 pips (Classic account) |

| Leverage | Up to 1:1000 |

| Customer Support | Online Chat: 5/24 |

| Email: support.za@cptmarkets.com, info@cptmarkets.co.uk, cs@cinda.com.hk | |

| Region Restrictions | The United States, United Kingdom, Canada, Israel, Iran, Cyprus, and North Korea... |

CPT Markets Basic Information

Founded in 2016, CPT Markets is a global financial brokerage firm that offers trading on Forex, Metals, Energy, Indices, Cryptocurrencies through MT4, MT5 or cTrader. However, CPT Markets does not offer its services to residents of the United States, Canada, and some other jurisdictions.

Is CPT Markets legit?

CPT Markets is a legit broker and it has three entities regulated in their own jurisdictions:

CPT Markets UK is the trading name used by CPT Markets UK Limited. The company's registered office is located in Wales, England, with registration number 6707165, authorized and managed by the UK Financial Conduct Authority (FCA), number 606110. CPT Markets UK Limited is an associated company of CPT Markets Limited.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Status |

| Financial Conduct Authority (FCA) | CPT Markets UK Limited | Market Making (MM) | 606110 | Regulated |

CPT Markets is the trading name used by CPT Markets Limited, registered in Belize, offshore regulated by the Belize International Financial Services Commission (FSC), license number: No. IFSC000314/351.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Status |

| Financial Services Commission (FSC) | CPT Markets Limited | Retail Forex | 000314/126 | Offshore Regulated |

Another entity, CPT MARKETS (PTY) LTD, is regulated in South Africa, authorized by the Financial Sector Conduct Authority (FSCA) under license no. 45954.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Status |

| Financial Sector Conduct Authority (FSCA) | CPT MARKETS (PTY) LTD | Financial Service | 45954 | Regulated |

Pros & Cons

| Pros | Cons |

|

|

|

|

| |

| |

| |

| |

|

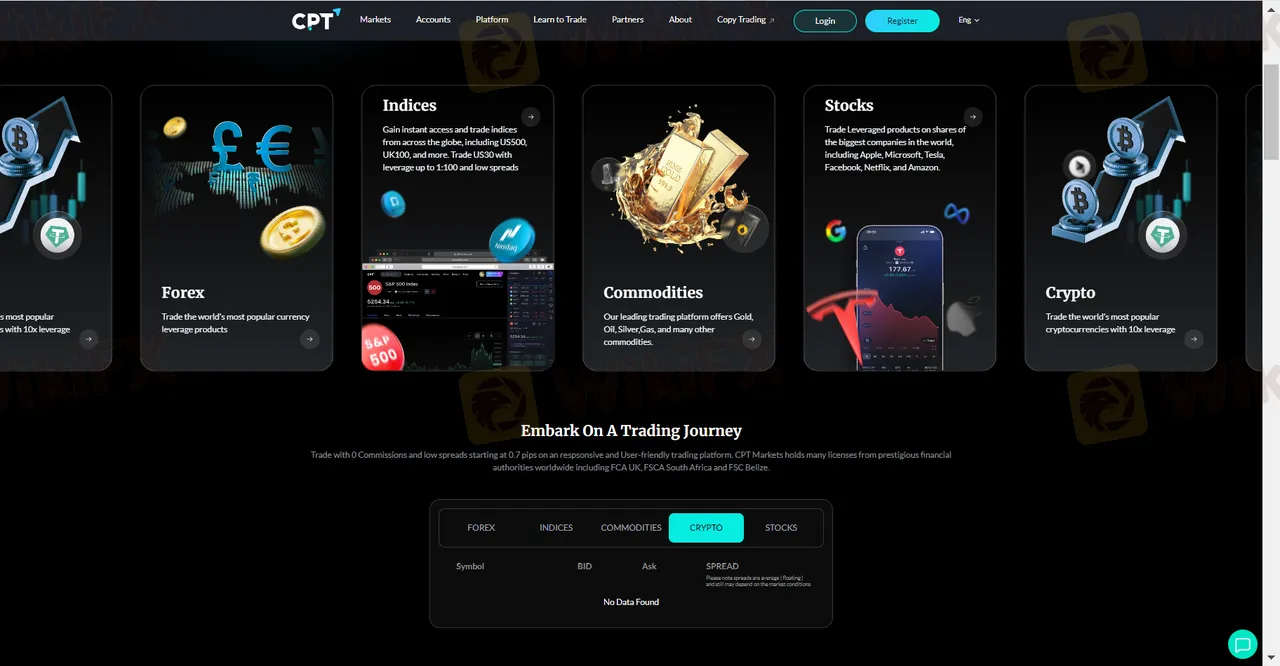

Market Instruments

CPT Markets offers access to five classes of tradable instruments across different markets, including forex, indices, commodities, stocks, and cryptocurrencies. With over 60 currency pairs, major indices such as the S&P 500 and Nasdaq 100, popular commodities like gold, silver, and crude oil, as well as cryptocurrencies like Bitcoin and Ethereum, traders can choose their preferred investment options based on their trading style.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Types

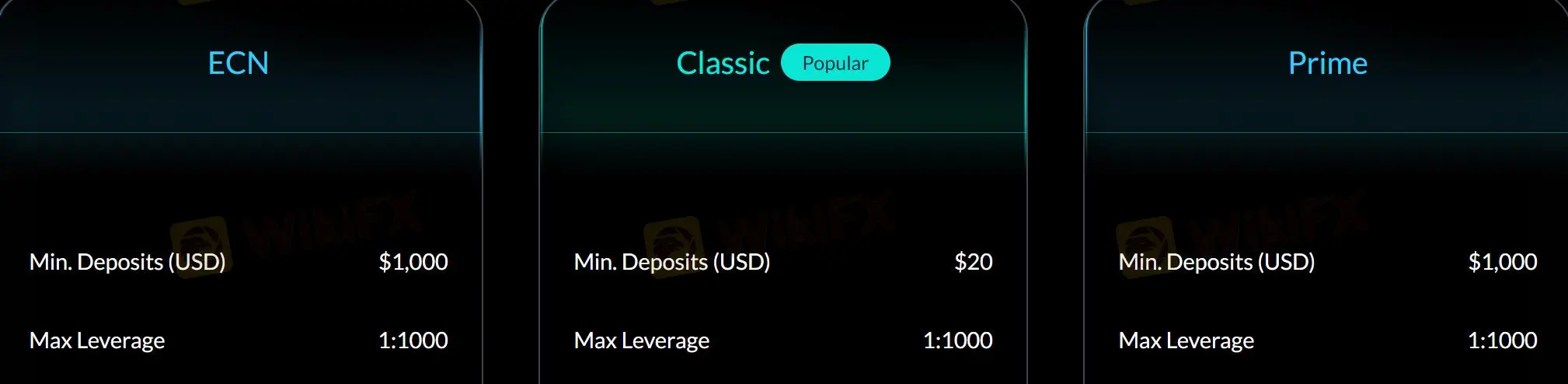

Three account options are on offer with CPT Markets, namely Classic, ECN and Prime, classified by account-opening deposits.

For those looking for a more accessible entry point, the Classic account is the most popular choice. It requires a minimal deposit of just $20, making it ideal for beginners or those preferring to start with smaller capital. While it maintains the high leverage of 1:1000, it offers slightly wider spreads of 1.4 pips but without any commission charges.

The ECN account, with a minimum deposit of $1,000, is tailored for experienced traders seeking tight spreads and direct market access. It offers spreads as low as 0.1 pips and operates on a commission-based model. This account type provides maximum leverage of 1:1000, with a 50% margin call and a 30% stop out level.

The Prime account strikes a balance between the ECN and Classic offerings. It requires the same $1,000 minimum deposit as the ECN account but provides a commission-free trading environment with spreads from 0.7 pips. This account maintains the same leverage, margin call, and stop out levels as the other account types.

| Account Type | Min Deposit | Max Leverage | Spread | Commission |

| ECN | $1,000 | 1:1000 | From 0.1 pips | ✔ |

| Classic | $20 | From 1.4 pips | ❌ | |

| Prime | $1,000 | From 0.7 pips | ❌ |

Aside from the three types of trading accounts above, CPT Markets also offers MAM accounts and Corporate accounts.

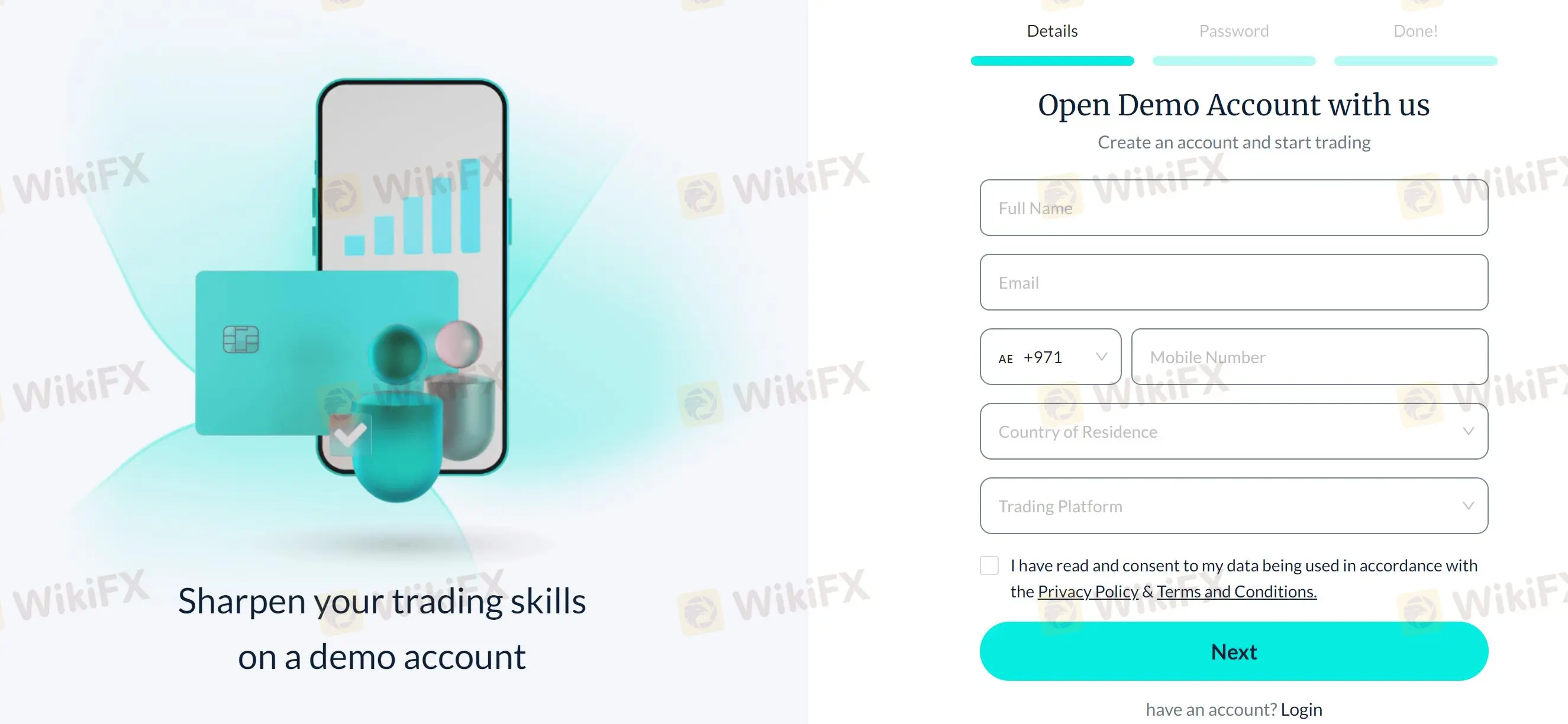

Demo Accounts

CPT Markets offers demo accounts to its clients, which can be used to practice trading without risking real money. The validity period of the CPT Markets demo account is 30 days, after which the account will expire. It's not possible to extend the demo account's validity period, but clients can open a new demo account once the previous one expires. Each client is allowed to have multiple demo accounts to test different trading strategies or to use them for educational purposes.

Leverage

CPT Markets (Belize) offers a maximum leverage of up to 1:1000, which is considered to be high.

While CPT Markets (UK) offers trading leverage up to 1:30 in accordance with the regulations set by the Financial Conduct Authority (FCA). One of the regulations set by the FCA is the maximum allowable leverage that can be offered to retail clients, which is currently set at 1:30 for forex trading. This is intended to protect retail clients from incurring large losses due to excessive leverage.

Spreads & Commissions

CPT Markets offers variable spreads, which means that the spread can widen or narrow based on market conditions. The broker also charges commissions on some of its account types.

The spreads on CPT Markets' forex pairs start from 0.0 pips, with an average spread of 0.2 pips on the EUR/USD pair. The broker also offers competitive spreads on other major currency pairs, such as GBP/USD, USD/JPY, and AUD/USD.

For indices, the spread on the UK 100 index starts from 0.8 points, while the spread on the US 500 index starts from 0.5 points. For commodities, the spread on gold starts from 0.3 pips, while the spread on silver starts from 0.02 pips.

In terms of commissions, CPT Markets charges $4 per lot for its ECN account, while the Standard and Platinum accounts have no commission charges.

Non-Trading Fees

In addition to trading costs, CPT Markets also charges non-trading fees that clients should be aware of. These fees include fees for deposits, withdrawals, account inactivity, and other administrative fees that may apply.

CPT Markets does not charge fees for deposits and withdrawals, and clients can make unlimited free-of-charge withdrawals per month. However, it should be noted that some payment providers may charge their own fees for transactions, which is beyond the control of the broker.

Inactivity fees may be charged to clients who have not made any trades or account activity for a period of 90 days or more. The fee for this inactivity is $50 per month, which will be deducted from the client's account balance. However, if there is no available balance in the account, no fee will be charged.

Other administrative fees that may apply include fees for account closure, wire transfers, and chargebacks. These fees vary depending on the specific circumstances and are listed in the broker's terms and conditions

Besides, CPT Markets also charge swap fees. Swap fees are charges incurred for holding a position overnight, also known as an overnight financing fee. The amount of the swap fee depends on the instrument being traded and the direction of the position (long or short).

Trading Platforms

CPT Markets gives its clients access to three excellent choices of trading platforms, the advanced MT4 and MT5 as well as cTrader.

MetaTrader 4 (MT4)

CPT Markets offers the popular MetaTrader 4 (MT4) trading platform, which is available for download on desktop and mobile devices. MT4 is a well-established platform in the industry, offering advanced charting tools, technical analysis indicators, and the ability to execute trades directly from the platform. Additionally, CPT Markets also provides a web-based platform, which can be accessed through a web browser without the need for any downloads. The web platform offers similar features to the desktop platform, including charting tools and order execution.

MetaTrader 5 (MT5)

Besides, CPT Markets also offers the MetaTrader 5 (MT5) trading platform to its clients. With MT5, traders can access a range of order types, including market orders, limit orders, stop orders, and trailing stops. The platform also supports hedging, allowing traders to open multiple positions in the same market in different directions. In addition to the desktop version, CPT Markets also offers a mobile version of the MT5 platform, allowing traders to access the markets from anywhere with an internet connection. The mobile app is available for both iOS and Android devices and offers many of the same features as the desktop version.

cTrader

CPT Markets also offers cTrader, an intuitive and easy-to-use trading platform for new and advanced traders. With cTrader, you can customize your on-the-go trading experience with a variety of order types, technical analysis tools, price alerts, and trade statistics. CPT Markets cTrader is available on PC, desktop and mobile devices.

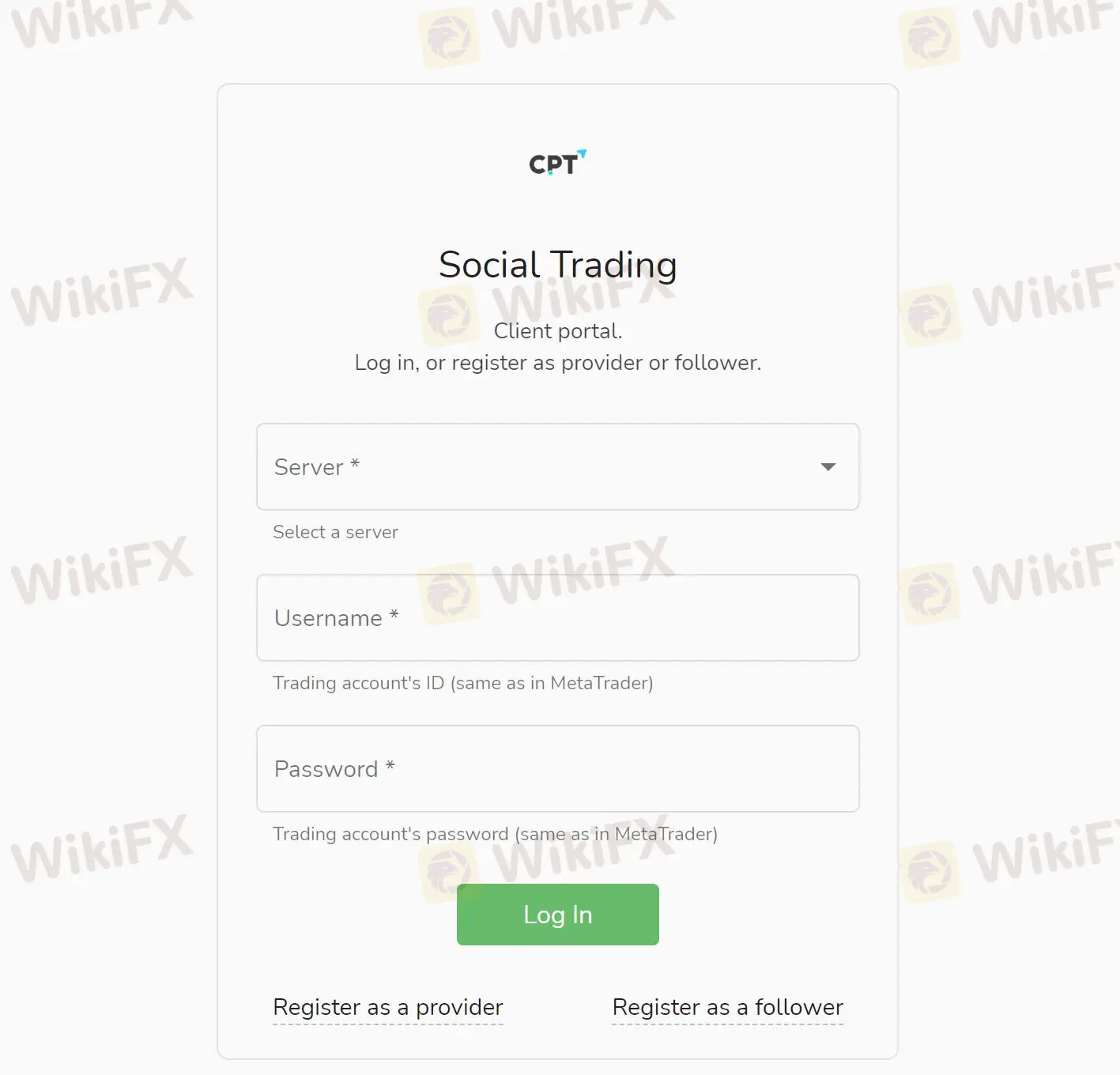

Copy Trading

CPT Markets offers a copy trading feature that allows less experienced traders to replicate the strategies of successful investors. You can choose to be a social trading provider or follower by filling out the following form.

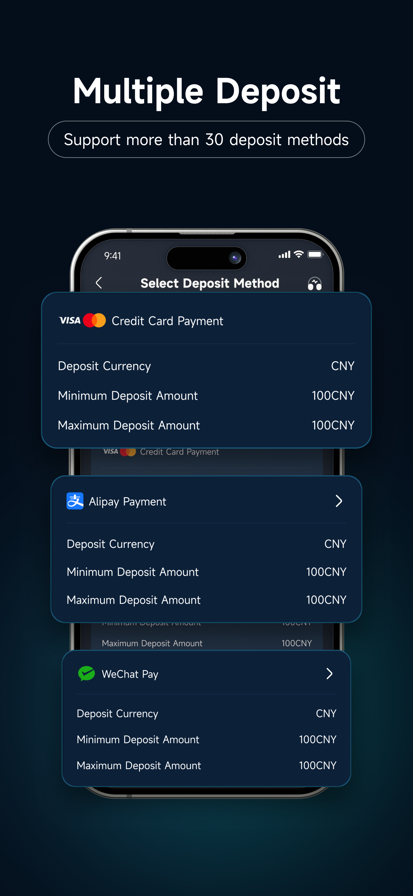

Deposit & Withdrawal

CPT Markets offers 14 payment methods for its clients, including bank transfer, credit/debit card, and Skrill, Neteller, and other online payment systems. The broker does not charge any fees for deposits, but third-party fees may apply depending on the payment method used. Withdrawals are generally processed within one business day, but it may take up to five business days for funds to appear in the client's account, depending on the withdrawal method.

Clients can make deposits and withdrawals in multiple currencies, including USD, EUR, GBP, AUD, and CAD. However, it's worth noting that there may be some currency conversion fees charged by the payment provider. In terms of minimum deposit requirements, CPT Markets requires a minimum deposit of $500 for all account types, which is higher than the industry standard.

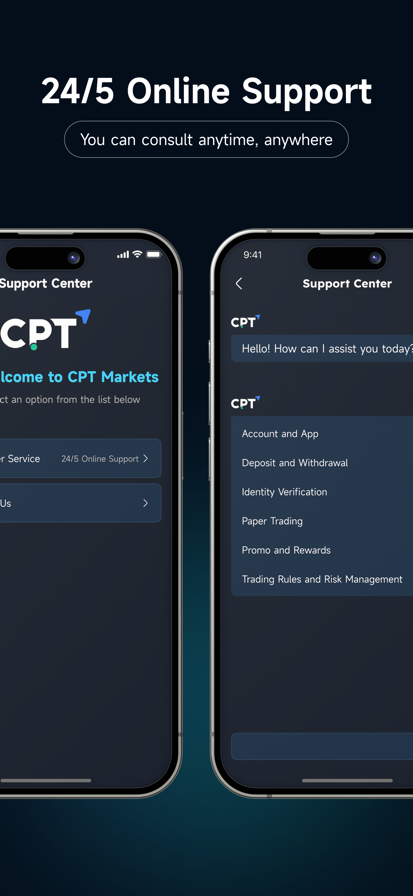

Customer Support

Clients can reach out to the broker's customer service team through phone, email, live chat, and social media platforms such as Facebook and Twitter. CPT Markets' customer service team is available 24/5 to assist clients with any questions or issues they may have.

The broker has a multilingual support team that can assist clients in different languages, including English, Chinese, Spanish, and Arabic.

| Region | Office Address | Additional Info | |

|---|---|---|---|

| United Kingdom | Level 7, One Canada Square, Canary Wharf, London, E14 5AA, UK - CPT UK | info@cptmarkets.co.uk | Support available 24/5 |

| South Africa | 6 Kikuyu Road, Sunninghill, Johannesburg Gauteng, 2191, South Africa | support.za@cptmarkets.com | Support available 24/5 |

| Media Collaboration | N/A | marketing.za@cptmarkets.com | For media-related inquiries |

| Complaints | N/A | complaints@cptmarkets.com | For complaints |

| Career | N/A | career@cptmarkets.com | For job applications (send CV) |

Educational Resources

In comparison to industry peers such as FP Markets and XM, CPT Markets offers a more limited range of educational resources. The broker's educational offerings are focused primarily on essential tools, including the CPT Academy, an Economic Calendar, and occasional webinars. While these resources provide basic support for traders, the scope and depth of educational content are not as extensive as those offered by some of its competitors in the forex and CFD trading space.

FAQs

Is CPT Markets legit?

CPT Markets operates legally, and it is regulated by FCA in the UK, FSC in Belize, and FSCA in South Africa.

What account types are available at CPT Markets?

CPT Markets offers several account types, including Classic, ECN, Prime, MAM and Corporate accounts.

Is CPT Markets a good broker for beginners?

Yes, CPT Markets is a good broker for beginners. CPT Markets offers robust platforms for traders, operating under stringent regulatory oversight and providing solid educational resources along with demo accounts. More importantly, it allows small-budget trading from $20 only.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital.