Company Summary

| Quick Vantage Review Summary | |

| Founded | 2009 |

| Headquarters | Sydney, Australia |

| Regulation | ASIC, FCA, CIMA/VFSC (Offshore), FSCA (General Registration) |

| Market Instruments | 1,000+ CFDs on forex, indices, precious metals, soft commodities, energy, ETFs, share CFDs, bonds |

| Demo Account | ✅($100,000 virtual fund) |

| Account Type | Pro ECN, Raw ECN, Standard, Cent, Premium, Swap free |

| Min Deposit | $50 |

| Leverage | Up to 500:1 |

| Spread | From 0.0 pips |

| Trading Platforms | Vantage App, MT4/5, TradingView, ProTrader |

| Copy Trading | ✅ |

| Payment Methods | Visa, MasterCard, Apple Pay, Google Pay, PayPal, Neteller, Skrill, Fasapay, Perfect Money, JCB, bitwallet, Sticpay, India UPI, Bank Transfer, International ETF, Domestic Fast Transfer (Australia Only), Astropay, Broker-to-Broker Transfer |

| Customer Support | 24/7 live chat, contact form, Help Center |

| Email: support@vantagemarkets.com | |

| Regional Restrictions | Canada, China, Romania, Singapore, the United States and jurisdictions on the FATF and EU/UN sanctions lists |

Vantage Information

Vantage is an online forex broker that offers trading services for individuals and institutions around the world. The company was founded in 2009 and is headquartered in Australia, with additional offices in the United Kingdom, Cayman Islands, and China. Vantage provides a variety of trading instruments, including forex, indices, precious metals, soft commodities, energy, ETFs, share CFDs, and bonds, and offers multiple trading platforms, such as MetaTrader4/5. Besides, the broker also provides rich and solid educational resources.

Pros & Cons

| Pros | Cons |

| • An extensive range of trading instruments | • Offshore CIMA and VFSC license |

| • Low minimum deposit requirement | • General registered FSCA license |

| • User-friendly trading platforms | • Regional restrictions |

| • Regulated by multiple top-tier authorities | |

| • Negative balance protection for clients | |

| • Demo accounts | |

| • Tight spreads | |

| • 24/7 customer support |

Is Vantage Legit?

Yes, Vantage operates under a strong regulatory frame and it has five entities regulated in different jurisdictions.

| Regulated in | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| ASIC | VANTAGE GLOBAL PRIME PTY LTD | Market Making (MM) | 428901 | Regulated |

| FCA | Vantage Global Prime LLP | Straight Through Processing (STP) | 590299 | Regulated |

| CIMA | Vantage International Group Limited | Straight Through Processing (STP) | 1383491 | Offshore Regulated |

| FSCA | VANTAGE MARKETS (PTY) LTD | Financial Service Corporate | 51268 | General Registration |

| VFSC | Vantage Global Limited | Retail Forex License | 700271 | Offshore Regulated |

Market Instruments

Vantage provides access to 1,000+ CFDs on forex, indices, precious metals, soft commodities, energy, ETFs, share CFDs, and bonds.

| Tradable Assets | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Precious Metals | ✔ |

| Soft Commodities | ✔ |

| Energy | ✔ |

| ETFs | ✔ |

| Share CFDs | ✔ |

| Bonds | ✔ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| Futures | ❌ |

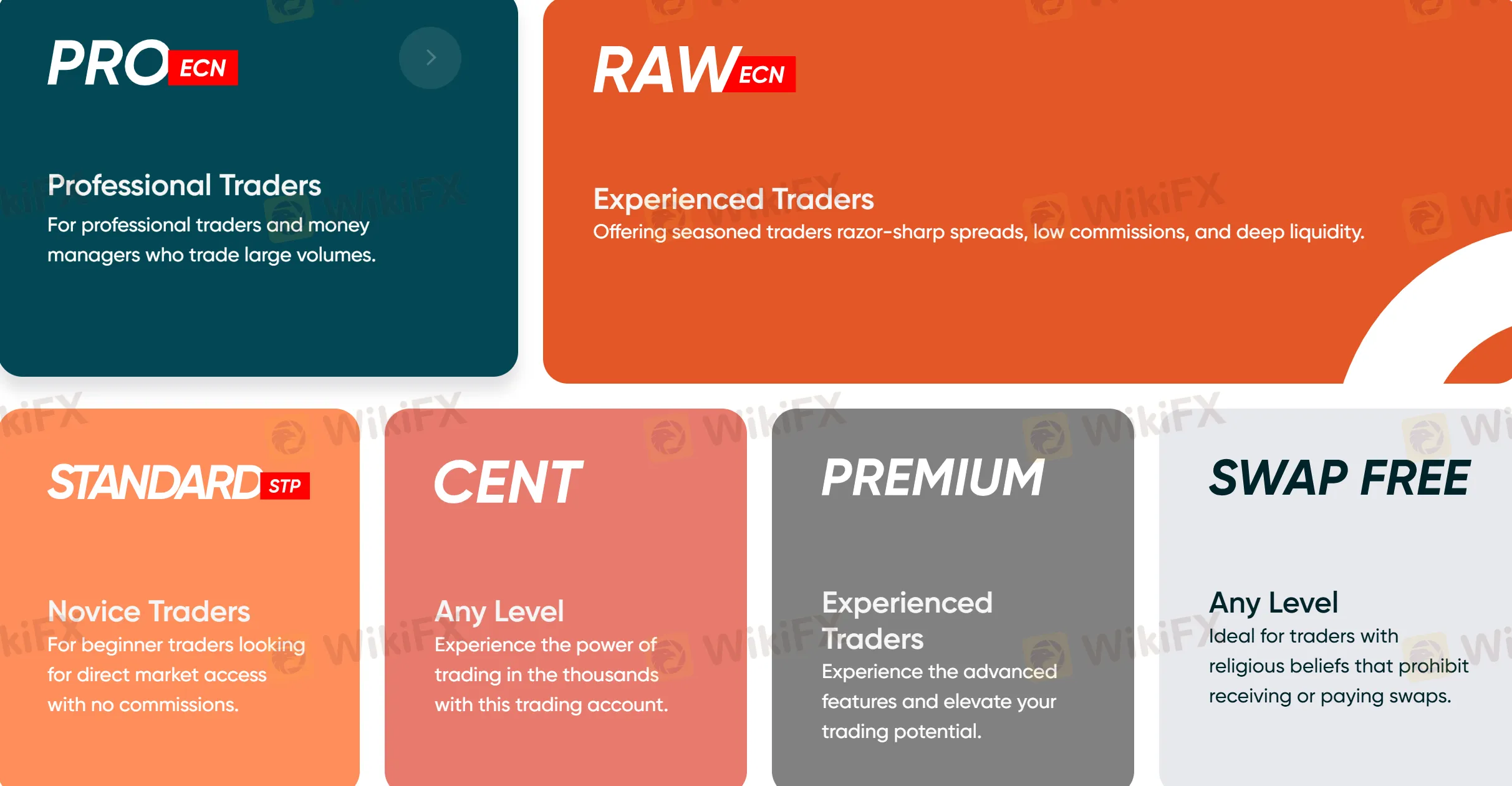

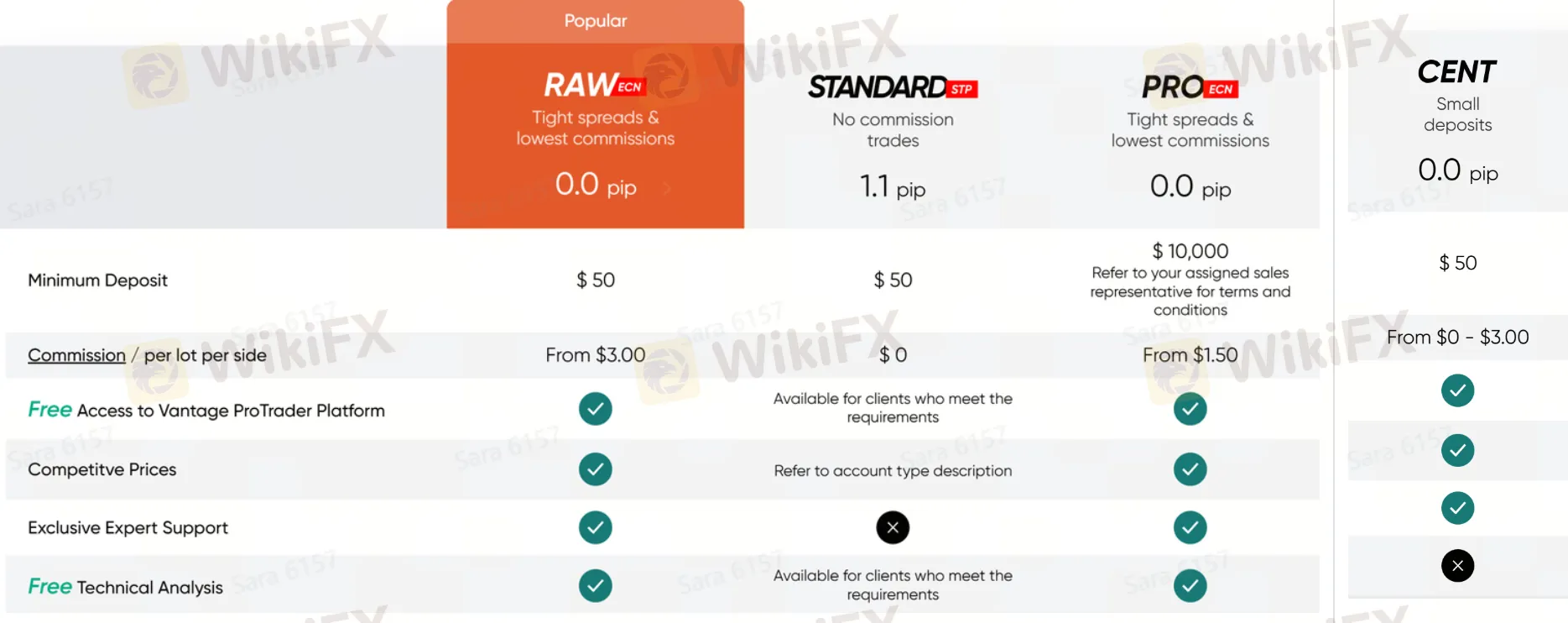

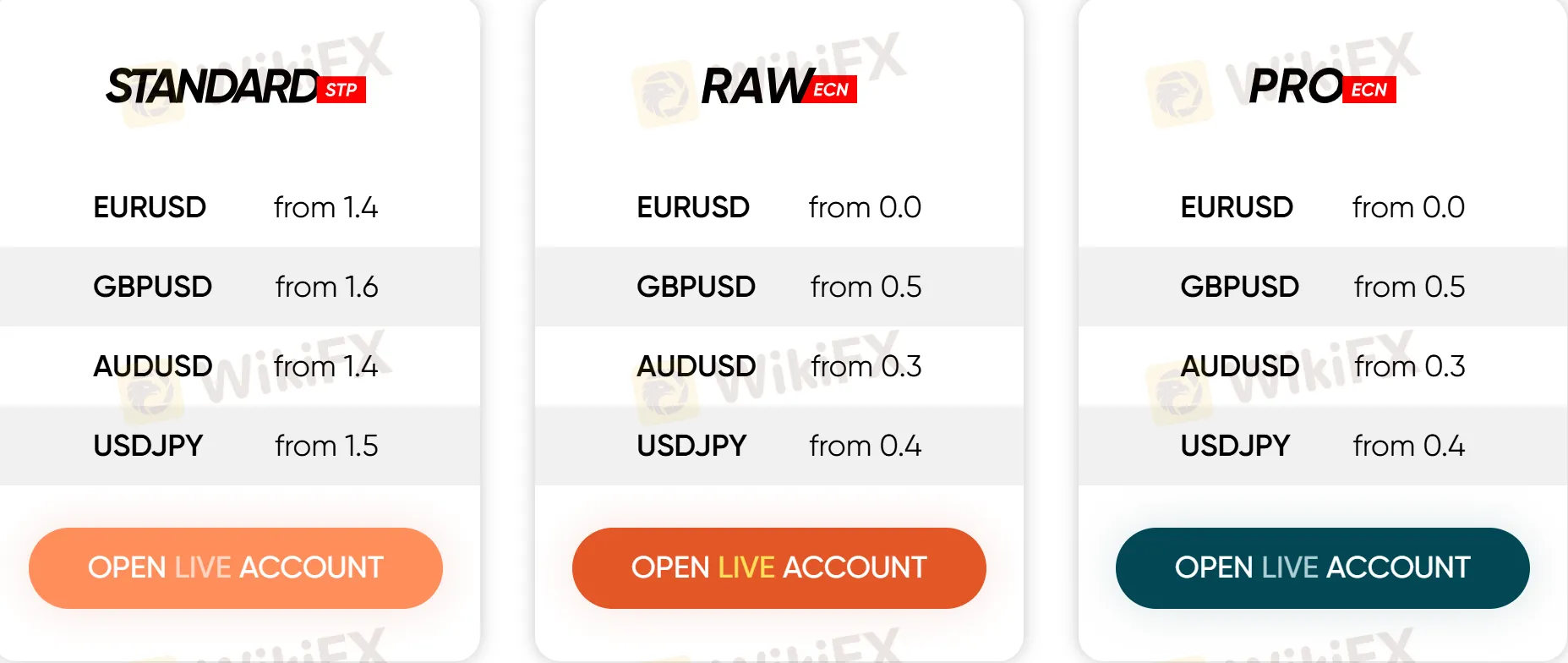

Account Type/Fees

Vantage has six different account options available tailored for various trading requirements: Pro ECN, Raw ECN, Standard, Cent, Premium, and Swap free.

| Account Type | Raw ECN | Standard | Pro ECN | Cent | Premium | Swap free |

| Min Deposit | $50 | $10,000 | $50 | / | ||

| Spread | From 0.0 pips | From 1.1 pips | From 0.0 pips | |||

| Commission | From $3 | From $0 | From $1.5 | From $0 - $3 | ||

| Suitable for | Experienced traders | Novide traders | Professional traders | Any level | Experienced traders | Any level |

Leverage

Vantage offers the maximum trading leverage of up to 500:1, a generous offering, ideal for professionals and scalpers. If you trade on the Premium account, you can even enjoy leverage up to 2000:1. However, inexperienced traders are advised not to use such a high leverage level in case of heavy fund losses.

Spreads & Commissions

When it comes to the core part of the forex trading spread, it varies depending on the account type.

| Account Type | Standard | Raw ECN | Pro ECN |

| EUR/USD Spread | From 1.4 pips | From 0.0 pips | |

| GBP/USD Spread | From 1.6 pips | From 0.5 pips | |

| AUD/USD Spread | From 1.4 pips | From 0.3 pips | |

| USD/JPY Spread | From 1.5 pips | From 0.4 pips | |

| Commissin | From $0 | From $3 | From $1.5 |

The EUR/USD spread on the Standard STP account starts from 1.4 pips with no additional commissions.

The EUR/USD spread on the Raw and Pro ECN accounts start from 0.0 pips, but with additional commissions required, from $3 per lot per side and from $1.5 per lot per side respectively.

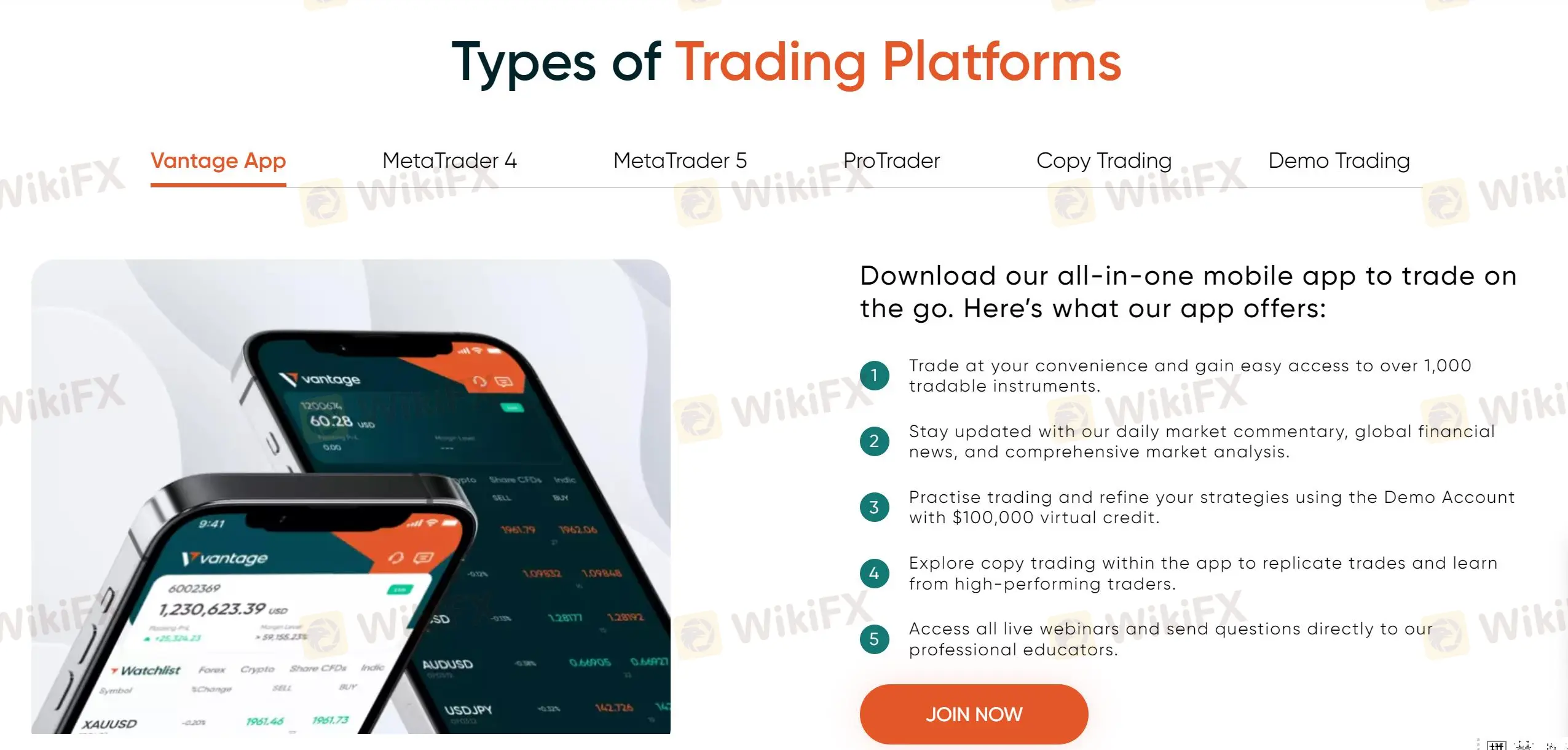

Trading Platforms

When it comes to trading platform, Vantage provides multiple flexible trading platform choices, including Vantage App, MT5, MT4, TradingView, and ProTrader. It also supports copy trading and demo trading.

| Trading Platform | Supported |

| Vantage App | ✔ |

| MetaTrader 4 | ✔ |

| MetaTrader 5 | ✔ |

| Tradingview | ✔ |

| ProTrader | ✔ |

| cTrader | ❌ |

| Copy Trading | ✔ |

| Demo Trading | ✔ |

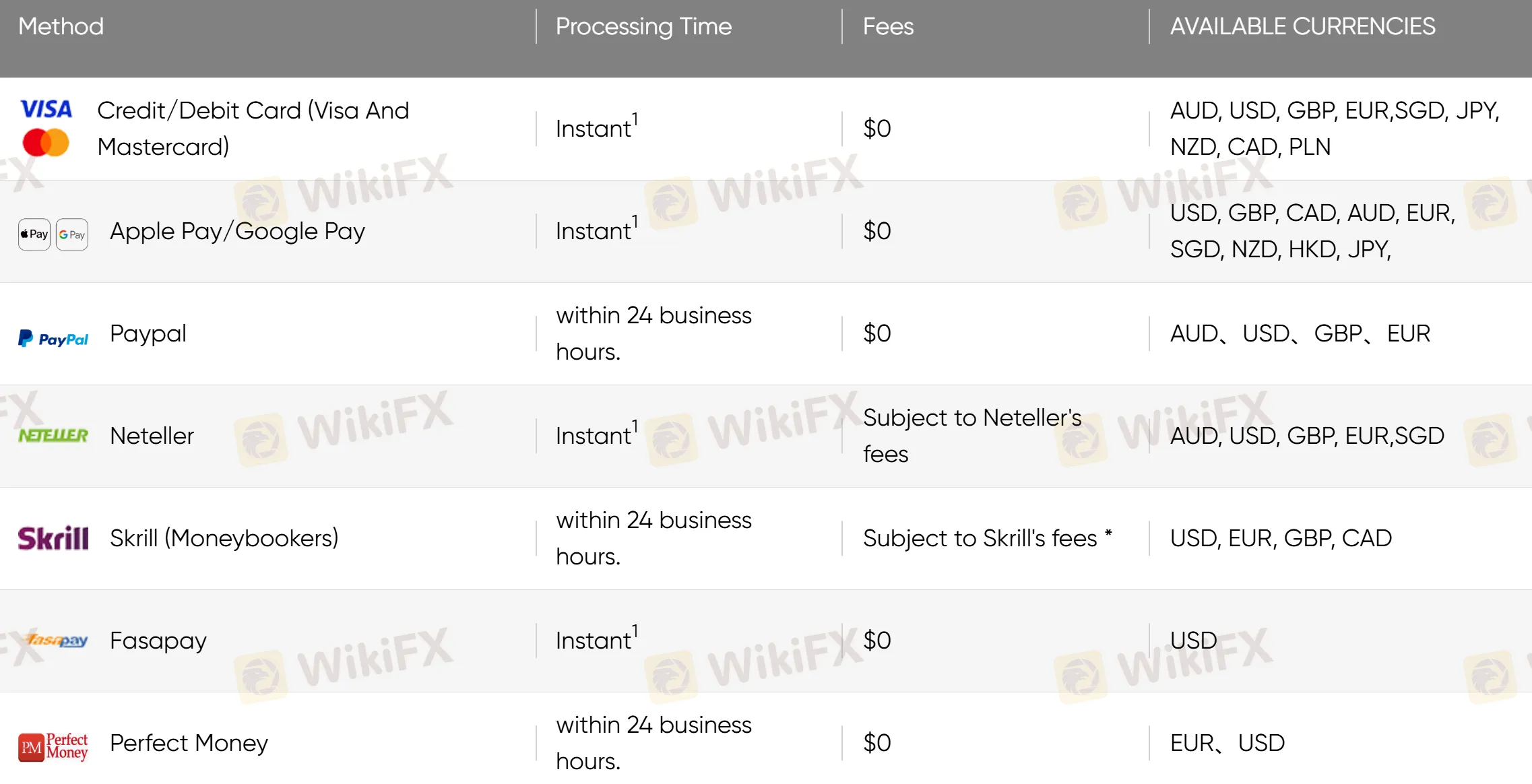

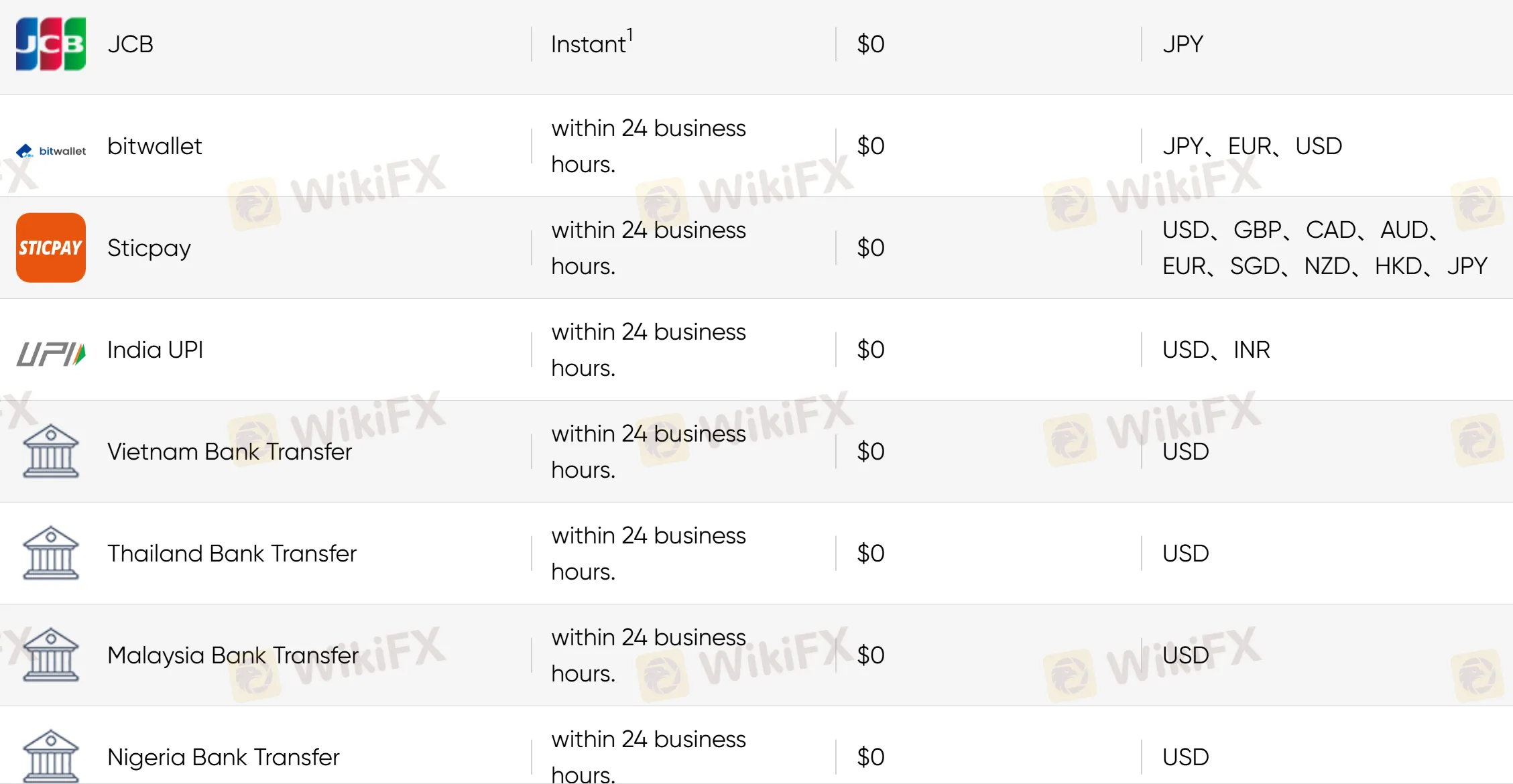

Deposits & Withdrawals

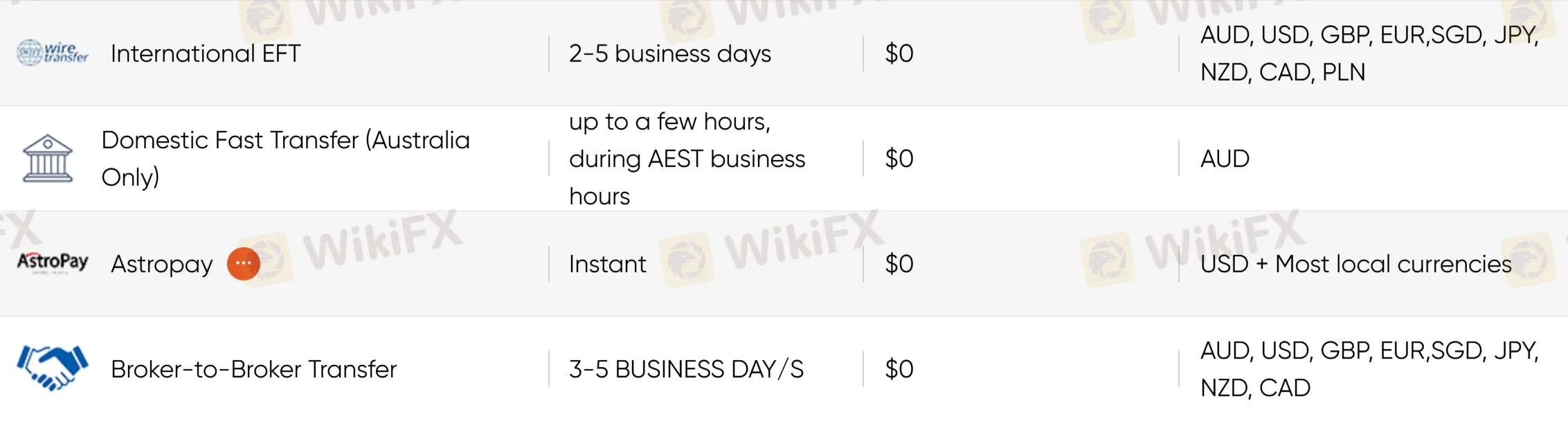

Vantage offers several flexible payment options, consisting of Visa, MasterCard, Apple Pay, Google Pay, PayPal, Neteller, Skrill, Fasapay, Perfect Money, JCB, bitwallet, Sticpay, India UPI, Bank Transfer, International ETF, Domestic Fast Transfer (Australia Only), Astropay, and Broker-to-Broker Transfer.

Find detailed info in the table below:

| Payment Method | Available Currencies | Deposit Fee | Deposit Time |

| Credit/Debit Card (Visa/MasterCard) | AUD, USD, GBP, EUR, SGD, JPY, NZD, CAD, PLN | ❌ | Instant |

| Apple Pay/Google Pay | USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, JPY | ||

| PayPal | AUD, USD, GBP, EUR | Within 24 business hours | |

| Neteller | AUD, USD, GBP, EUR, SGD | ✔ | Instant |

| Skrill | USD, EUR, GBP, CAD | Within 24 business hours | |

| Fasapay | USD | ❌❌ | Instant |

| Perfect Money | EUR, USD | Within 24 business hours | |

| JCB | JPY | Instant | |

| bitwallet | JPY, EUR, USD | Within 24 business hours | |

| Sticpay | USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, JPY | ||

| India UPI | USD, INR | ||

| Bank Transfer | USD | ||

| International ETF | AUD, USD, GBP, EUR, SGD, JPY, NZD, CAD, PLN | 2-5 business days | |

| Domestic Fast Transfer (Australia Only) | AUD | Up to a few hours, during AEST business hours | |

| Astropay | USD + most local currencies | Instant | |

| Broker-to-Broker Transfer | AUD, USD, GBP, EUR, SGD, JPY, NZD, CAD | 3-5 business days |

Education & Tools

The educational area is where vantage really shines. It offers a variety of analytical tools, including an economic calendar, market analysis, client sentiment, forex virtual private server, and trading signals, in addition to articles, courses, ebooks, terminology, live, and its distinctive The Vantage View, to aid its customers in becoming better traders.

| Educational Contents | Supported |

| Articles | ✔ |

| Courses | ✔ |

| ebooks | ✔ |

| Terminiology | ✔ |

| Live | ✔ |

| The Vantage View | ✔ |

| Economic Calendar | ✔ |

| Market Analysis | ✔ |

| Client Sentiment | ✔ |

| Forex VPS | ✔ |

| Trading Signals | ✔ |

Conclusion

To provide a summary, it would appear that Vantage is an excellent choice that works well for both seasoned pros and novices. Prominent features include an strong regulatory framework, high-quality eductaional content, and appealing promotional offers. However, there are traders who believe it has higher spreads on the Standard account when compared to other brokers. No matter which brokers you choose, remain vigilant because online trading is not without its risks.

Frequently Asked Questions (FAQs)

Is Vantage regulated?

Yes. It is regulated by ASIC, FCA, CIMA/VFSC (Offshore), and FSCA (General Registration).

At Vantage, are there any regional restrictions for traders?

Yes. It does not offer services to residents of certain jurisdictions such as Canada, China, Romania, Singapore, the United States and jurisdictions on the FATF and EU/UN sanctions lists.

Does Vantage offer industry-standard MT4 & MT5?

Yes. It supports MT4 and MT5, as well as Vantage App and ProTrader.

Is Vantage a good broker for beginners?

Yes. Vantage is a good choice for beginners. It is regulated well and offers risk-free demo accounts up to $100,000 virtual credit.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.