Score

EFX

Bulgaria|2-5 years|

Bulgaria|2-5 years| https://efxcpi.com/

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

White Label

Finland

FinlandContact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+31 970 1028 0923

Other ways of contact

Broker Information

More

EFX CPI LLC

EFX

Bulgaria

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 5 for this broker in the past 3 months. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:400 |

| Minimum Deposit | $50000 |

| Minimum Spread | 1.2 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:200 |

| Minimum Deposit | $5000 |

| Minimum Spread | 1.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:200 |

| Minimum Deposit | $50 |

| Minimum Spread | 1.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:200 |

| Minimum Deposit | -- |

| Minimum Spread | 1.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed EFX also viewed..

XM

AUS GLOBAL

HFM

GTC

EFX · Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| EFX Review Summary in 10 Points | |

| Founded | N/A |

| Registered Country/Region | Bulgaria |

| Regulation | No license |

| Market Instruments | forex, index, commodities, stock and cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:400 |

| EUR/USD Spread | 1.5 pips (Std) |

| Trading Platforms | MT4 |

| Minimum deposit | $50 |

| Customer Support | 24/5 phone, email, online messaging |

What is EFX?

EFX, a trading name of EFX CPI LLC, is an unregulated forex and CFD broker registered in Bulgaria that claims to provide its clients with various tradable financial instruments including currencies, commodities, indices, and cryptocurrencies, with flexible leverage up to 1:400 and floating spreads from 1.2 pips on the MT4 trading platform via 3 different live account types, as well as 24/5 customer support service.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

EFX offers a wide range of trading instruments and multiple account types, providing flexibility to traders. The accessibility of MT4 on various devices, enhances convenience for different devices. The availability of diverse deposit and withdrawal options adds convenience for clients.

However, the lack of regulation raises concerns about the safety and security of funds. Additionally, higher spreads compared to industry standards and reports of withdrawal issues raise potential red flags. Mixed reviews and complaints suggest a need for caution and further research when considering EFX as a trading option.

| Pros | Cons |

| • Wide Range of Trading Instruments | • Lack of Regulation |

| • Multiple Account Types | • Limited Information on Commissions |

| • Demo accounts available | • Reports of Withdrawal Issues |

| • MT4 supported | |

| • Popular payment methods offered | |

| • Low minimum deposit ($50) |

It's important for individuals to carefully assess these pros and cons, along with conducting thorough research, to make an informed decision about whether EFX aligns with their trading needs and preferences.

EFX Alternative Brokers

UFX - offers a user-friendly trading experience and a wide range of educational resources, making it a suitable choice for beginner traders.

ActivTrades - a reputable broker with strong regulatory oversight and a diverse range of trading instruments, making it a reliable option for experienced traders.

ForexChief - provides competitive trading conditions, including low spreads and fast execution, making it a favorable choice for active traders seeking cost-effective trading solutions.

There are many alternative brokers to EFX depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is EFX Safe or Scam?

Due to the lack of valid regulation and reports of withdrawal issues, it is important to exercise caution when dealing with EFX. The absence of regulatory oversight raises concerns about the safety and security of funds. While it may be premature to label EFX as a scam, the combination of unregulated operations and reports of withdrawal difficulties suggests potential risks.

Traders should carefully assess the available information and consider the potential consequences before engaging with an unregulated platform. It is advisable to opt for brokers that are regulated by reputable financial authorities, as they provide a higher level of investor protection and transparency.

Market Instruments

EFX provides a diverse range of trading instruments across various asset classes, allowing traders to access multiple markets. With over 108+ products available, EFX offers opportunities to trade in forex currency pairs, enabling investors to engage in the dynamic foreign exchange market. Additionally, EFX provides access to a variety of indices, allowing traders to speculate on the performance of different stock market indexes around the world.

Furthermore, EFX facilitates trading in commodities, including precious metals, energies, and agricultural products, enabling investors to participate in the commodities market and diversify their portfolios. Moreover, EFX offers the opportunity to trade individual stocks, allowing traders to speculate on the performance of specific companies. Lastly, EFX includes cryptocurrencies in its product offering, enabling traders to engage in the digital currency market and potentially benefit from price fluctuations in popular cryptocurrencies.

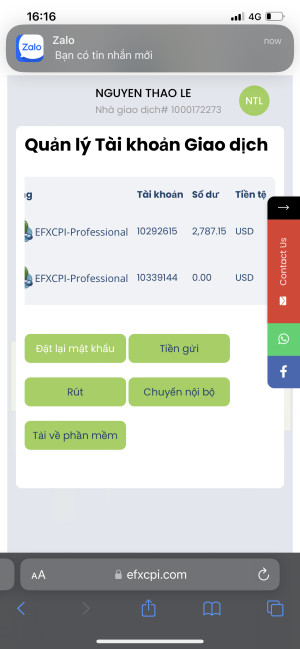

Accounts

EFX provides traders with a comprehensive range of account options, including both demo and live trading accounts. The demo accounts offer a risk-free environment for traders to practice and familiarize themselves with the platform and its features before committing real funds. These accounts are particularly beneficial for beginners who are new to trading or for experienced traders who wish to test new strategies.

In addition to demo accounts, EFX offers three types of live trading accounts: Standard, Islamic, and Professional. The Standard account is suitable for traders with smaller capital, as it has a minimum initial deposit requirement of $50. The Islamic account is designed for Muslim traders and adheres to Shariah principles, providing swap-free trading options. It requires a higher minimum initial deposit of $5,000. For experienced and professional traders, EFX offers the Professional account, which provides advanced features, competitive trading conditions, and access to additional services. With these diverse account options, EFX aims to cater to the needs of traders with different levels of experience, trading strategies, and capital sizes.

Leverage

EFX offers competitive leverage options for traders across its different account types. The leverage provided allows traders to amplify their trading positions and potentially increase their potential profits. For the demo, Standard, and Islamic accounts, EFX offers a leverage of 1:200.

This level of leverage provides traders with the opportunity to control larger positions in the market with a relatively smaller amount of capital. It is important for traders to understand the risks associated with higher leverage and use it judiciously to manage their trading strategies effectively.

For those seeking even higher leverage, EFX offers a leverage of 1:400 for its Professional account. This higher leverage can be particularly attractive for experienced traders who are comfortable with the associated risks and have a well-defined trading strategy in place.

Spreads & Commissions

EFX offers competitive spreads on its trading accounts, allowing traders to access the financial markets with favorable trading conditions. The spreads are of the floating type, meaning they may vary based on market conditions and liquidity. For the demo, Standard, and Islamic accounts, EFX provides spreads starting from 1.5 pips. This ensures that traders have access to relatively tight spreads, enhancing their trading efficiency. On the other hand, the Professional account offers even tighter spreads, starting from 1.2 pips. This premium account option caters to experienced and high-volume traders who require enhanced trading conditions.

Regarding commissions, EFX adopts a different approach depending on the account type. The demo account does not incur any commission charges, allowing traders to practice and familiarize themselves with the trading platform without additional costs. The Professional account, aimed at high-net-worth individuals and professional traders, also operates on a commission-free basis. However, for the Standard and Islamic accounts, specific commission details are not provided, and it is recommended to consult with EFX directly for more accurate information. Traders utilizing these accounts should consider the potential impact of commissions on their trading costs.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| EFX | 1.5 (Std) | Unspecified (Std) |

| UFX | 3.0 (Std) | $6 |

| ActivTrades | 0.6 (Variable) | $3.50 |

| ForexChief | 0.1 (Variable) | $7 |

Please note that these values are based on the information provided and may be subject to change. It's always recommended to verify the latest information directly from the broker's official website or contact their customer support for the most accurate and up-to-date details.

Trading Platforms

EFX provides traders with a comprehensive range of trading platforms, including the widely acclaimed MetaTrader 4 (MT4) platform. MT4 is available for various devices, including PC, Mac, Android, iPhone, iPad, and WebTrader, ensuring seamless accessibility for traders across different operating systems and devices.

MT4 is renowned for its advanced charting capabilities, a wide range of technical indicators, and a user-friendly interface, making it a popular choice among both beginner and experienced traders. With MT4, traders can execute trades, access real-time market data, analyze charts, and implement automated trading strategies through Expert Advisors (EAs).

The availability of MT4 on multiple platforms allows traders to stay connected and trade on the go, providing flexibility and convenience in managing their trading activities. Additionally, the inclusion of WebTrader ensures that traders can access their accounts and trade directly through web browsers without the need for software downloads.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| EFX | MT4 |

| UFX | ParagonEX Trader, MT5 |

| ActivTrades | MT4, MT5, ActivTrader |

| ForexChief | MT4 |

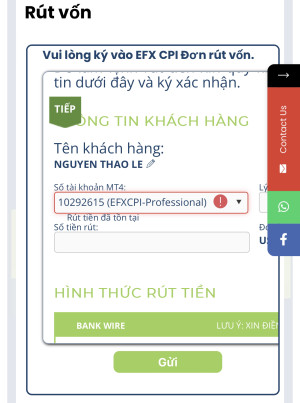

Deposits & Withdrawals

EFX offers a wide range of deposit and withdrawal options, allowing traders to conveniently fund their accounts and withdraw their profits. Some of the accepted payment methods include Visa, Skrill, MasterCard, and Neteller, providing flexibility for traders to choose the option that suits them best. The minimum initial deposit requirement of $50 makes it accessible for traders with different budget sizes to get started with their trading journey.

EFX minimum deposit vs other brokers

| EFX | Most other | |

| Minimum Deposit | $50 | $100 |

Bonuses

EFX provides a 20% deposit bonus for live accounts, offering traders an additional incentive to boost their trading capital. This bonus can be beneficial for traders as it allows them to potentially increase their trading positions and potentially enhance their trading opportunities. However, it's important for traders to thoroughly review the terms and conditions associated with the bonus offer, as there may be certain requirements or restrictions that need to be met before the bonus can be fully utilized or withdrawn.

Additionally, while EFX offers a deposit bonus, it is important to note that there may be certain fees or charges associated with specific account activities or services. Traders should carefully review the fee structure provided by EFX to understand any potential costs or charges that may apply to their trading activities. Being aware of the bonuses and fees associated with EFX can help traders make informed decisions and effectively manage their trading accounts.

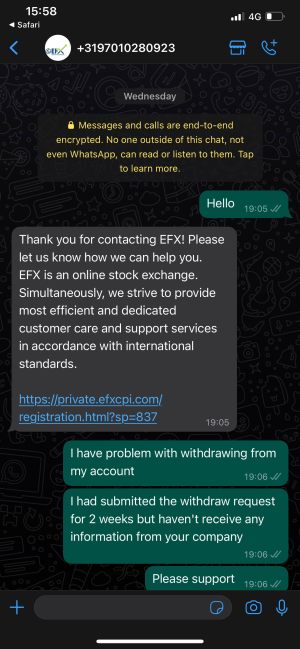

Customer Service

EFX provides 24/5 multiple channels for customer support, including telephone (+31 970 1028 0923) and email (SUPPORT@EFXCPI.COM) for direct communication. They also offer online messaging options to reach out to their support team. In addition, EFX maintains a presence on popular social media platforms such as Twitter, Facebook, Instagram, and WhatsApp, enabling traders to stay updated with the latest news and announcements.

Office address:

DUBAI REPRESENTATIVE OFFICE: OFFICE 805 METROPOLIS BURJ KHALIFA BOULEVARD DUBAI;

OFFICE BULGARIA: SOLUNSKA STR., SOFLA 1000, BULGARIA;

QATAR OFFICE: THE E18TEEEN TOWER MARINA DISTRICT, LUSAIL CITY QATAR;

GERMANY OFFICE: KAISERDAM 14057, BERLIN, DEUTSCHLAND.

| Pros | Cons |

| • Multiple contact options | • No 24/7 customer support |

| • Presence on social media platforms for easy communication | |

| • Various office locations for localized support |

Note: These pros and cons are subjective and may vary depending on the individual's experience with EFX's customer service.

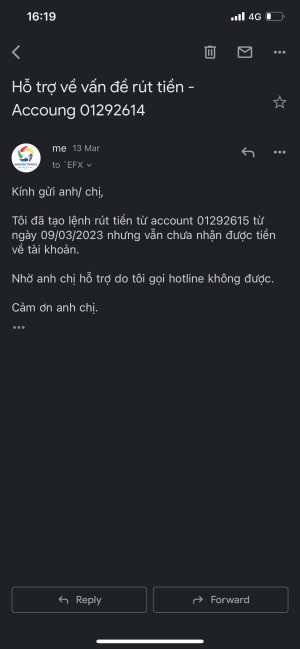

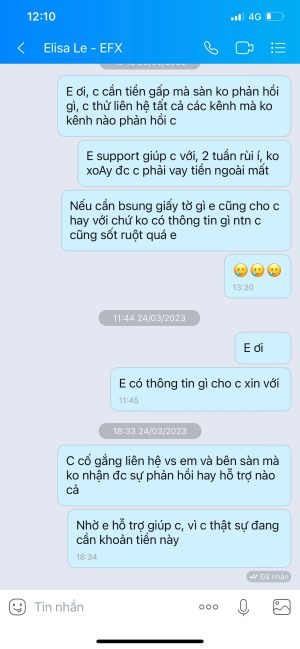

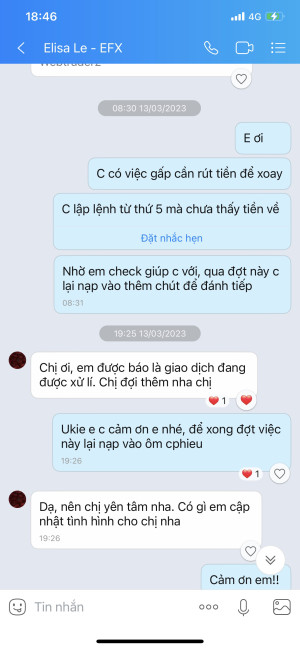

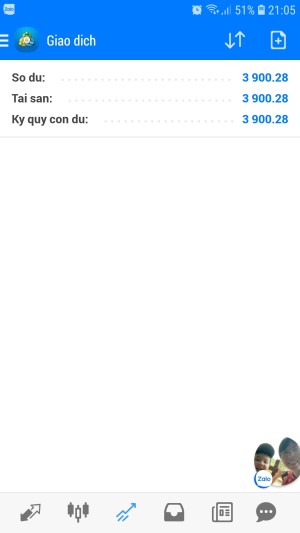

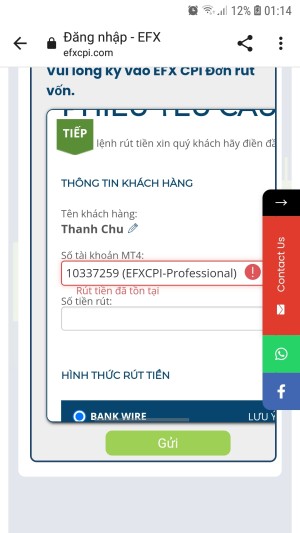

User Exposure on WikiFX

On our website, you can see that some reports of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

Generally, EFX is an online brokerage that offers a variety of trading instruments, multiple account types, and access to popular MT4 trading platform. The availability of diverse deposit and withdrawal options adds convenience for clients.

However, it is crucial to note that EFX operates without valid regulation, which raises concerns about the safety and security of funds. Additionally, the higher spreads compared to industry standards and reports of withdrawal issues are potential red flags that traders should consider. While EFX may offer some benefits, individuals should approach this broker with caution and conduct thorough research before making any investment decisions. It is essential to weigh the potential advantages against the risks associated with an unregulated platform. Traders are encouraged to consider alternative regulated brokers that offer stronger investor protections.

Frequently Asked Questions (FAQs)

| Q 1: | Is EFX regulated? |

| A 1: | No. It has been verified that EFX currently has no valid regulation. |

| Q 2: | Does EFX offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does EFX offer the industry leading MT4 & MT5? |

| A 3: | Yes. It supports MT4. |

| Q 4: | What is the minimum deposit for EFX? |

| A 4: | The minimum initial deposit to open an account is $50. |

| Q 5: | Is EFX a good broker for beginners? |

| A 5: | No. EFX is not a good choice for beginners. Although it offers demo accounts on the industry-standard MT4, it lacks legal regulation and fees are non-transparent. |

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now