Company Summary

| BCR Review Summary | |

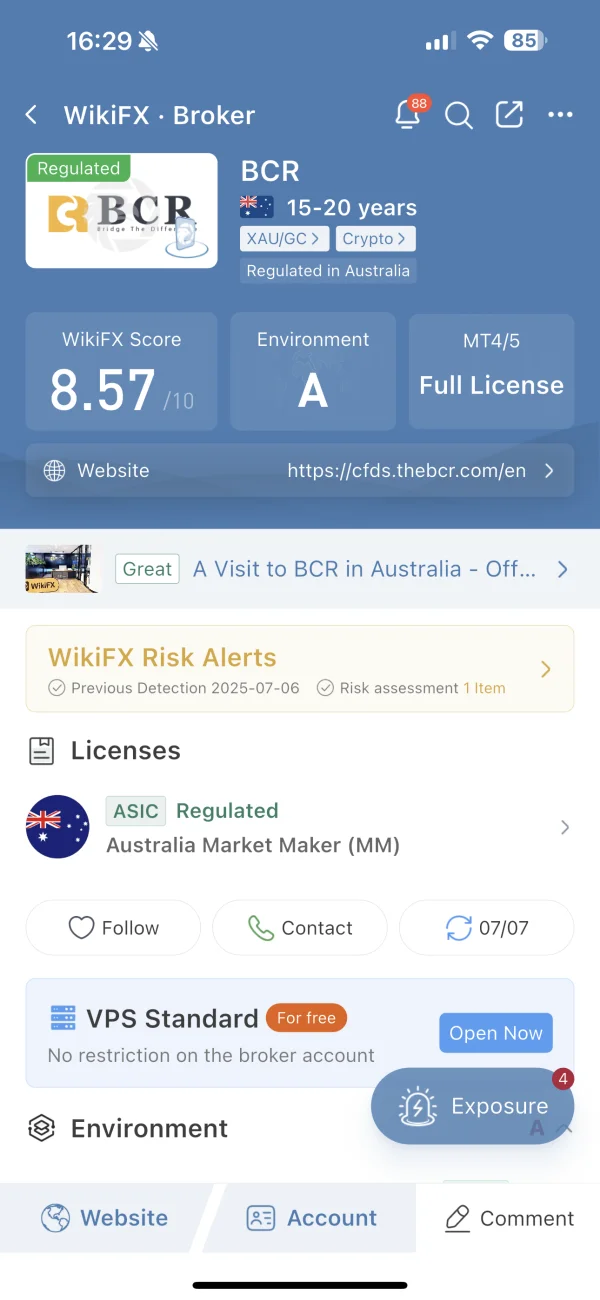

| Founded | 2008 |

| Registered Country/Region | Australia |

| Regulation | ASIC |

| Market Instruments | Forex, Share CFDs, Metal CFDs, Commodity CFDs, Index CFDs |

| Demo Account | ✅ |

| Leverage | Up to 1:400 |

| Spread | From 1.7 pips (Standard account) |

| Trading Platform | MetaTrader 4, MetaTrader 5 |

| Minimum Deposit | $300 |

| Customer Support | Live chat |

| Phone: +1 284 346 2897 | |

| Email: info@thebcr.com | |

BCR Information

BCR, formed in 2008 and registered by ASIC in Australia, provides leveraged CFD trading on forex, equities, metals, commodities, and indices via popular platforms such as MT4, MT5, and MAM. It offers a variety of account types for both novices and advanced traders, including demo accounts, and no deposit or withdrawal fees. However, it currently makes no mention of offering Islamic (swap-free) accounts or cryptocurrency trading.

Pros and Cons

| Pros | Cons |

| Regulated by ASIC | No swap-free (Islamic) accounts mentioned |

| Access to 300+ instruments including forex & CFDs | High minimum deposit of $300 |

| Multiple account types | |

| MT4 and MT5 platforms | |

| Live chat support |

Is BCR Legit?

Yes, BCR is a regulated broker that works for BACERA CO PTY LTD, which is a licensed business. The Australia Securities & Investment Commission (ASIC) keeps an eye on it. It holds a Market Maker (MM) license with license number 000328794, effective since December 19, 2008.

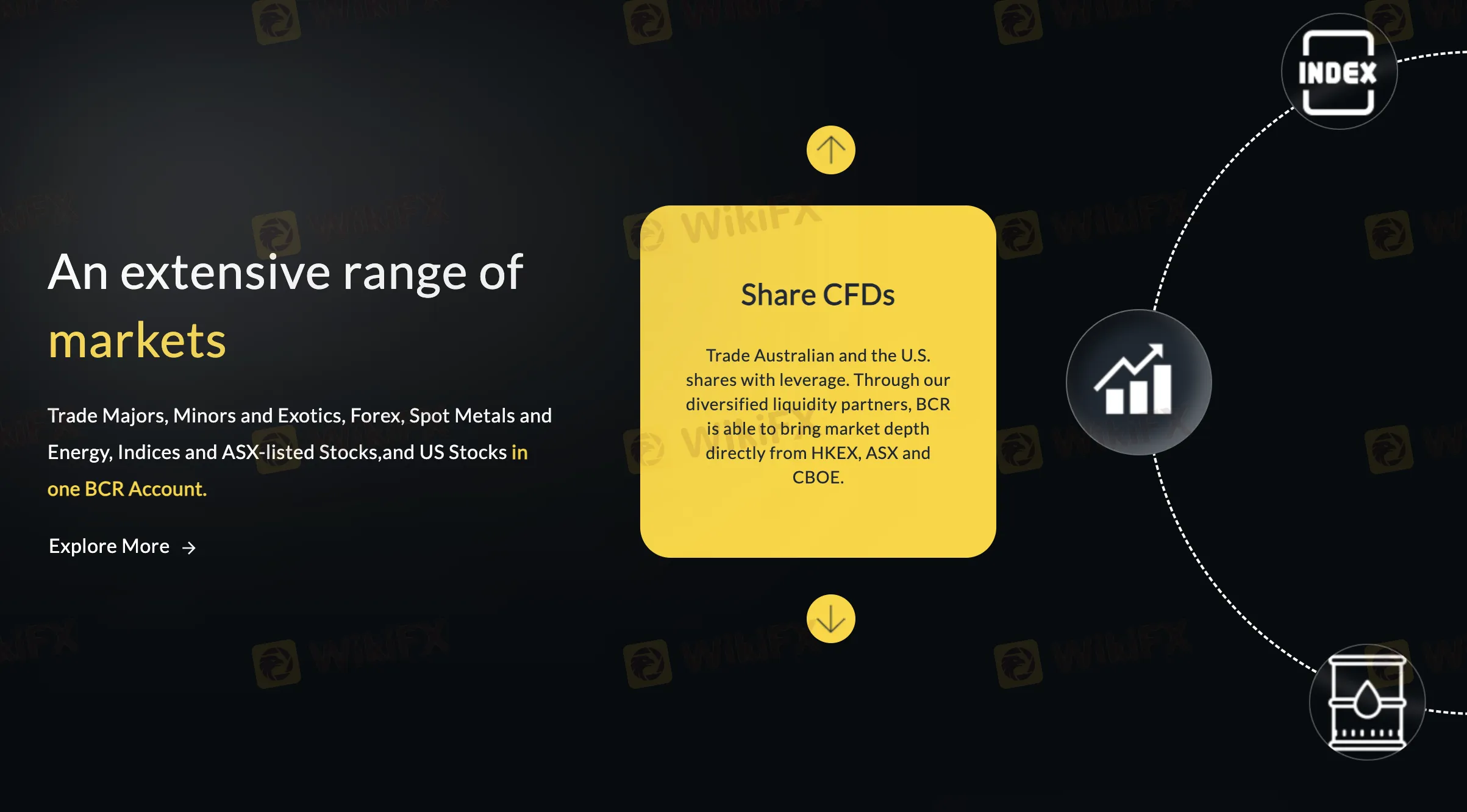

What Can I Trade on BCR?

BCR gives you access to more than 300 financial products, including as 40+ forex currency pairs, global share CFDs, metals, commodities, and index CFDs. It gives both new and seasoned traders a flexible, leveraged trading environment across several asset types.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Share CFDs | ✔ |

| Metal CFDs | ✔ |

| Commodity CFDs | ✔ |

| Index CFDs | ✔ |

| Cryptocurrencies | ✘ |

| Bonds | ✘ |

| Options | ✘ |

| ETFs | ✘ |

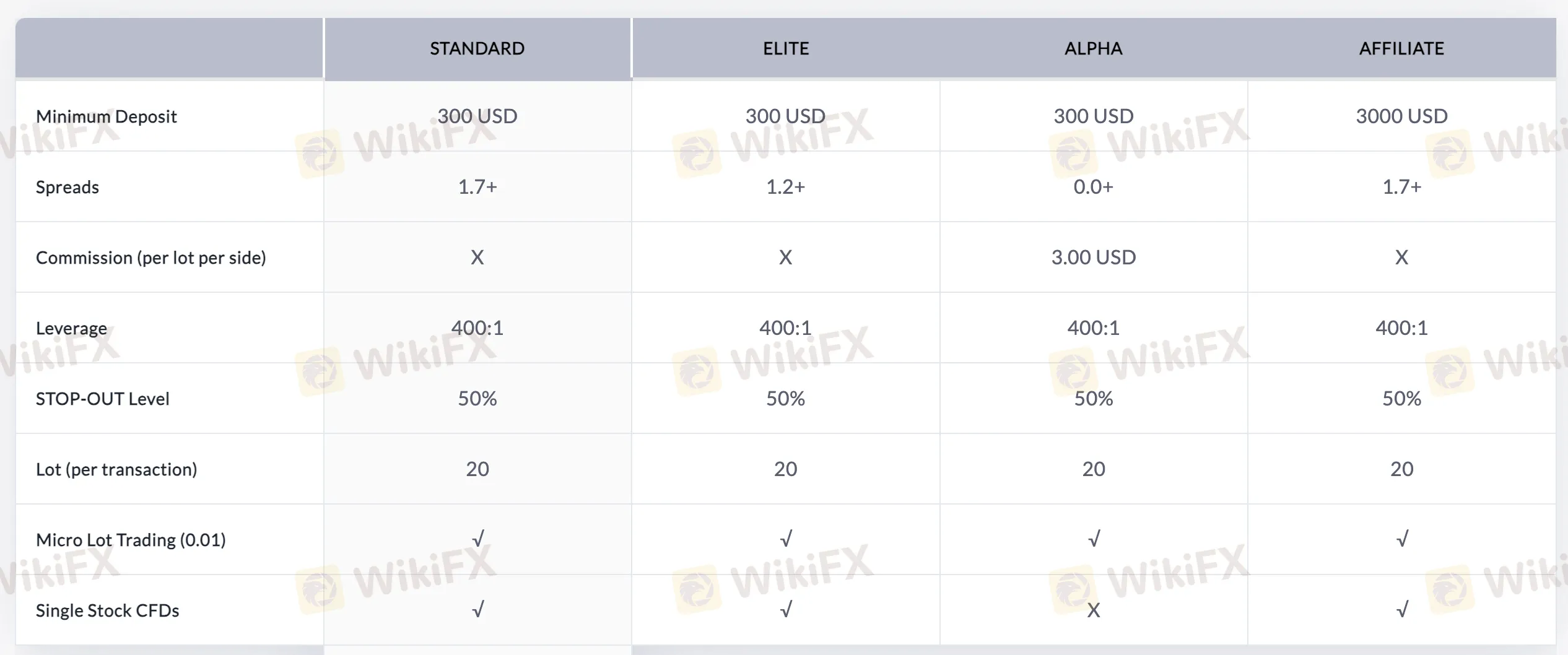

Account Type

BCR has four categories of live accounts: Standard, Elite, Alpha, and Affiliate. All of these accounts use the MetaTrader platform. There are demo accounts, however, there is no mention of Islamic (swap-free) accounts.

| Account Type | Minimum Deposit | Maximum Leverage | Spread | Commission | Suitable for |

| Standard | $300 | 400:1 | From 1.7 pips | 0 | Beginners, general traders |

| Elite | From 1.2 pips | 0 | Active traders wanting lower spreads | ||

| Alpha | From 0.0 pips | $3 per lot per side | Serious/professional traders | ||

| Affiliate | $3,000 | From 1.7 pips | 0 | Partners, affiliate traders |

Leverage

BCR gives traders up to 400:1 leverage, which lets them control big bets with a modest deposit. High leverage can make profits bigger, but it can also make losses bigger.

BCR Fees

BCR's prices are affordable and in line with what other companies charge. They have tight spreads, fair commissions (on Alpha accounts), and no hidden fees for deposits or withdrawals.

| Account Type | Spreads from | Commission |

| Standard | 1.7 pips | 0 |

| Elite | 1.2 pips | 0 |

| Alpha | 0.0 pips | $3 USD per lot per side |

| Affiliate | 1.7 pips | 0 |

Non-Trading Fees

| Non-Trading Fees | Amount |

| Deposit Fee | 0 |

| Withdrawal Fee | 0 |

| Inactivity Fee | Not mentioned |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 4 | ✔ | Windows, macOS, Web, iOS, Android | Beginners |

| MetaTrader 5 | ✔ | Windows, macOS, Web, iOS, Android | Experienced traders |

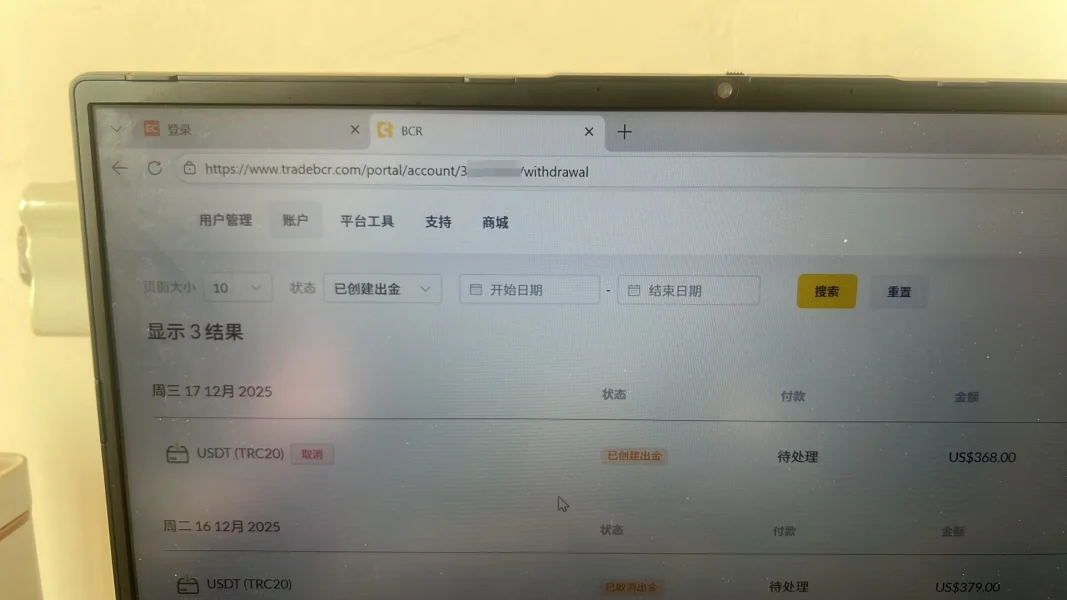

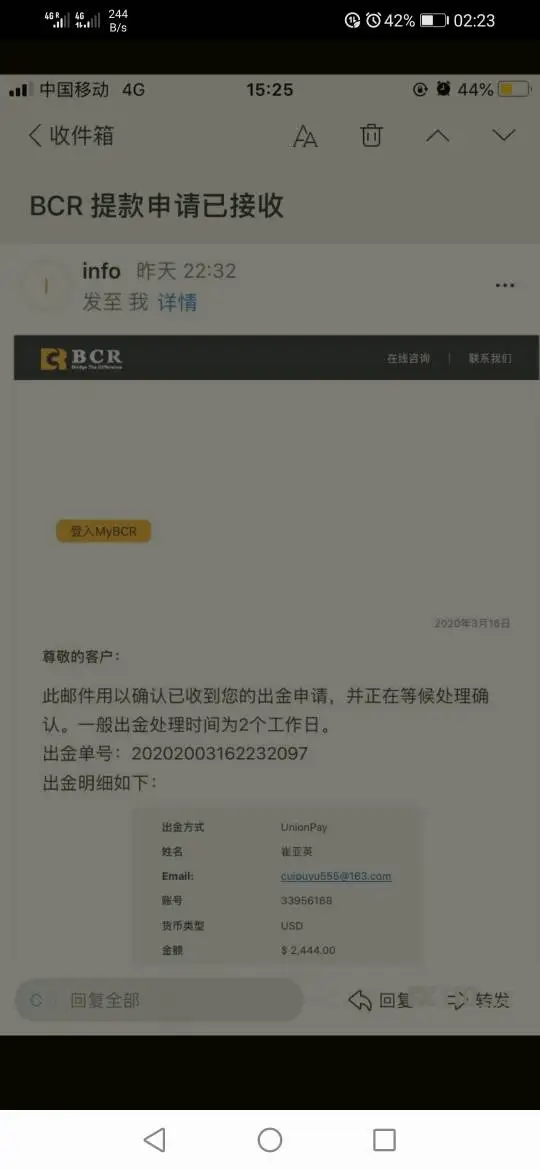

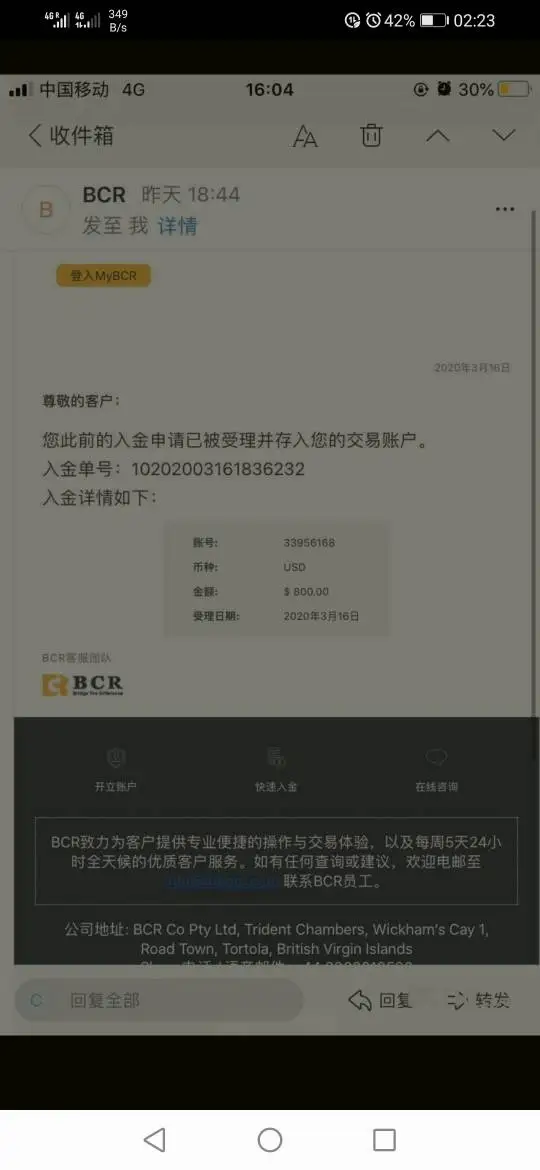

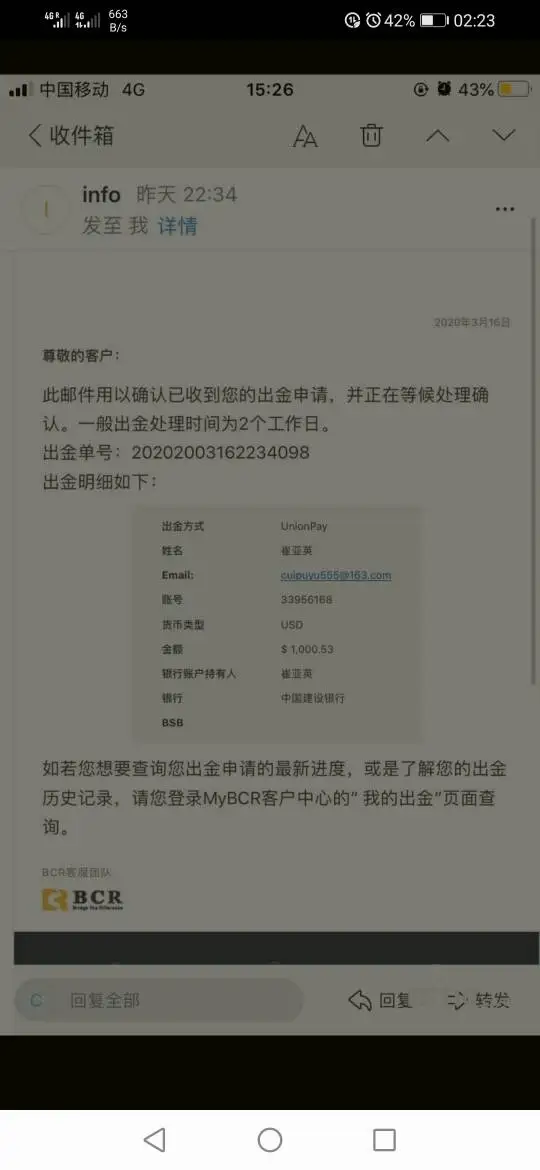

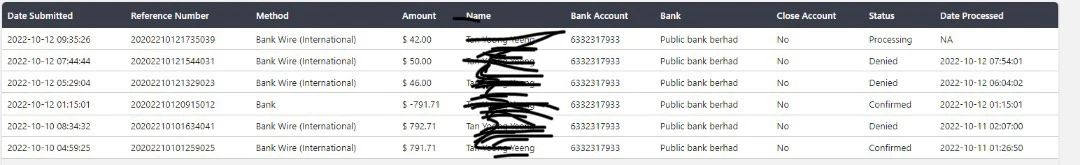

Deposit and Withdrawal

BCR does not charge any extra fees for deposits or withdrawals (though intermediary or international bank fees may apply). The minimum deposit at BCR is 300 USD.

| Payment Method | Minimum Deposit | Fees | Deposit Processing Time | Withdrawal Processing Time |

| Bank Transfer | 300 USD | 0 | 1–2 days | Same-day (if before cutoff) |

| UnionPay | ~30 min | |||

| MasterCard | Instant | |||

| Direct Debit | ||||

| Visa | ||||

| Fasapay | ||||

| Help2Pay | ||||

| BPay | ||||

| Skrill | ||||

| Neteller | ||||

| POLi | ||||

| USDT |

2025 SkyLine Malaysia

2025 SkyLine Malaysia

FX1618013620

Germany

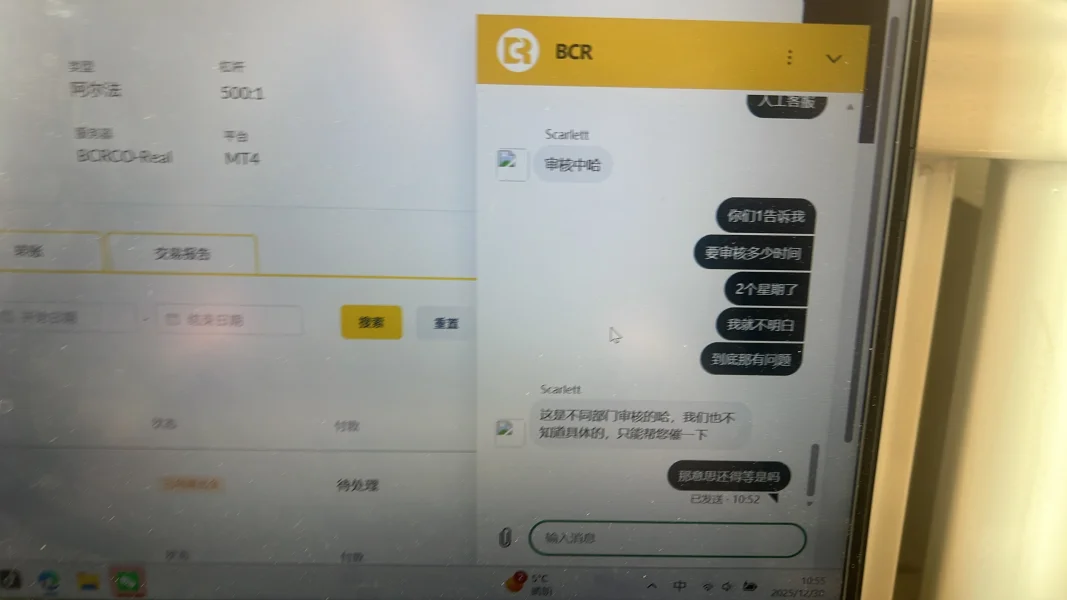

It's been two weeks without any payouts, just stuck in review. They keep stalling—from December 17th all the way to now.

Exposure

不存在

Philippines

It is simply a fraud. My friend deposited $300 on it. But his account was banned after he profited $3400.

Exposure

shaB

Malaysia

A super trash platform. A big brand ASIC, a 14 years experienced security company cannot withdraw 40 dollars. And ask us to deposit 100k to withdraw. Fraud platform. It is the person. Everyone takes a look.

Exposure

BCR总部招销售

Taiwan

The service attitude is very good, and the deposit and withdrawal are very fast 🌼😀

Positive

ishool

Philippines

BCR is one of the 3 forex brokers I use, I love them especially because of their speed in executing trades and their very low slippage orders. Big ups to them 👍

Positive

澳洲交易小天才

Malaysia

You can also exchange points for Labubu, love it!!

Positive

羊羊EDGEMKT

Singapore

After using BCR for two years, I am completely hooked! The loyalty points exchange is super conscience, with a wide range of products from daily essentials to trendy blind boxes available. This time, I even managed to redeem the hidden Labubu edition for free using points, and the moment I opened the box, I was overwhelmed with happiness! The customer service response is incredibly fast, issues are resolved in seconds, and the benefits from various activities are endless. Every time I open the app, there are new surprises waiting for me. Not only have I saved money, but my happiness has also doubled! BCR is definitely a treasure trove platform. I highly recommend it to my friends around me. Let's enjoy accumulating points, enjoying the benefits, and having a great time together!

Positive

FX4084630533

Taiwan

Very smooth, with customer service available 24 hours online.

Positive

taufan2056

Indonesia

I am trading under the guidance of analyst Alvin Yap from the USA. From December 5th to 23rd, I joined the EFH-1004 BTC EXCLUSIVE INVESTMENT TIPS trading group on WhatsApp with admin Jessica Chan. The company's address is in Singapore: https://equitiesfirst.com After trading for 7 days, this morning on December 24th, last night, and also a few days ago, I made 3 withdrawals: 1. The first withdrawal on December 19th, 2024, amounted to USD 124. 2. The second withdrawal on December 23rd, 2024, amounted to USD 1010. 3. The third withdrawal on December 24th, 2024, amounted to USD 612.45. 4. The fourth withdrawal on December 24th, 2024, amounted to USD 511. Total withdrawal is USD 2,257.45. The withdrawals are currently pending review and I have not received any email response. I contacted admin Jessica and was asked to transfer a commission from Indodax. After transferring a commission of 7 million, I still cannot make a withdrawal. I contacted Jessica again and she said I have to pay crypto taxes. From this scenario, it is clear that they are scammers. Until now, the funds in my BCR account cannot be withdrawn.

Exposure

ĐĐặng TThương

United States

Fast deposits and withdrawals, smooth transactions

Positive

FX1113810591

Taiwan

Recently, I also opened an agent, the commission is fast, and it is quite convenient to use. There are also many deposit methods.

Positive

FX1113810591

Taiwan

I really like this platform, I have been using it for a long time. It has a large Australian license and the experience of depositing and withdrawing funds is very good.

Positive

FX1113810591

Taiwan

I just learned about the platform, there are many activities, I am ready to give it a try. Some friends have been trading well in it, so I am ready to switch and give it a try.

Positive

FX1113810591

Taiwan

A friend recommended a new platform to me. The current experience is very good, with low spreads. I am ready to experience the withdrawal speed.

Positive

FX7332350672

Taiwan

The agent's backend is really convenient. I'm so used to using it...

Positive

FX7332350672

Taiwan

A friend recommended trading on this platform, and it's been great. It's an old platform, so I feel more at ease using it.

Positive

FX1113810591

Taiwan

I am a real trader and have switched to many platforms. Currently, I am trading on this platform and the experience so far is good. Whether it's the withdrawal speed or the trading experience, it's better than before. Will continue to observe...

Positive

FX1113810591

Taiwan

Just switched to this company for trading, tested for over a month, it's pretty good. By the way, I also opened an agency, and the commission is also credited quickly.

Positive

MDM

Taiwan

Opened an agent for this company, the commission is also good, I also trade, it's great. Will continue to use.

Positive

币圈小能手007

India

I have been trading with this company for half a year, and the experience is very good and smooth. The rebate is also given well.。

Positive

币圈小能手007

Thailand

BCR Forex Broker provides an excellent trading experience. Their platform is stable and user-friendly, suitable for traders of all levels. Customer service is responsive and provides detailed answers, ensuring that every user receives timely assistance. The wide range of market choices and transparent fee structure make BCR a trusted choice. I am very satisfied with their service and highly recommend it to other traders.

Positive

币圈小能手007

Thailand

I have been trading on this platform for many years. It has always been stable. I have also tried other platforms, but this one has the best experience. 😎

Positive

币圈小能手007

Singapore

This year I just switched to BCR Trading, and the experience was very good. Especially the backend design is very good, and the trading experience is also very good. For us old traders, it's still very good.

Positive