*Please note that the information in this table is subject to change and you should always refer to the broker's official website for the most up-to-date information.

Overview of STARTRADER

STARTRADER is a forex broker that offers trading services for 200+ financial instruments, including forex currency pairs, commodities such as gold and oil, indices such as the S&P 500, and more.

The broker offers two different types of trading accounts, that is Standard and ECN accounts, each with its own unique features and benefits, a minimum deposit of $50 is required to start trading on the platform.

STARTRADER offers multiple trading platforms, including MT4, MT5, as well as COPY TRADE as well as WEB TRADER. These platforms include advanced charting tools, real-time quotes, and a range of technical analysis indicators to help traders make informed decisions. The platform also offers one-click trading, hedging capabilities, and the ability to set stop-loss and take-profit orders.

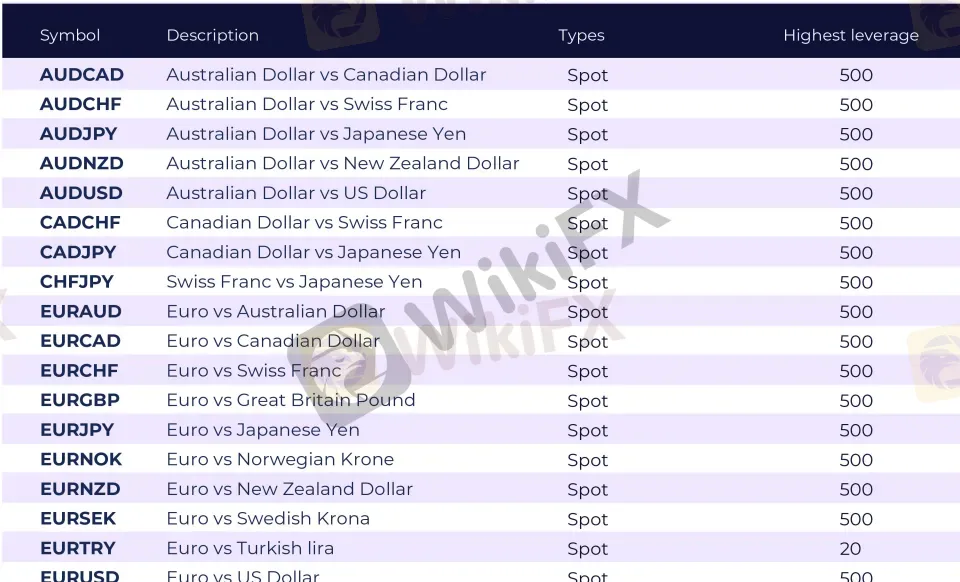

The broker offers leverage up to 1:500 and competitive spreads starting from 0.1 pips. STARTRADER also provides traders with educational resources, market analysis, and a customer support team that is available 24/5 to assist with any queries or issues.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. We will also briefly summarize the main advantages and disadvantages so that you can understand the broker's characteristics at a glance.

Is STARTRADER Legit or a Scam?

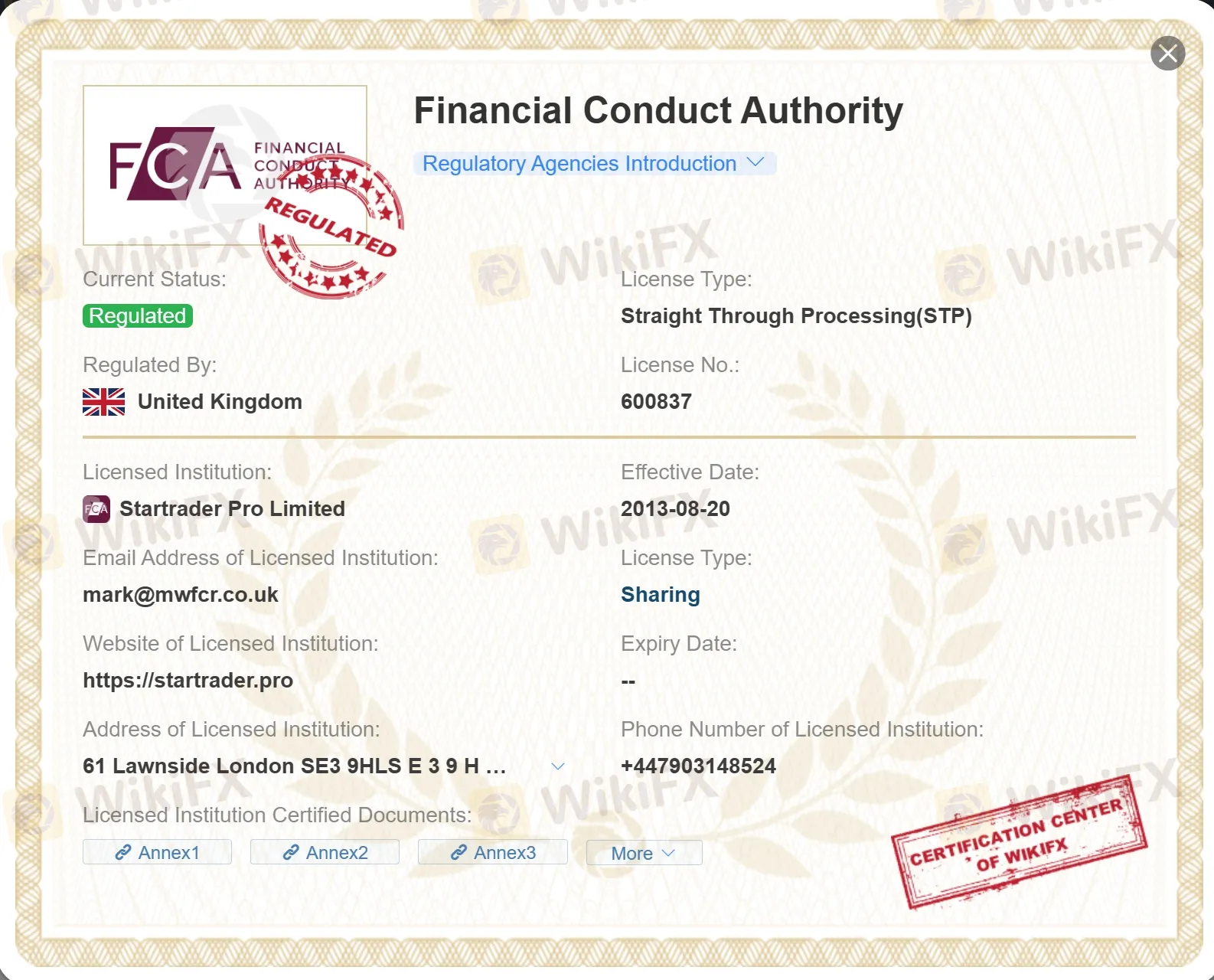

STARTRADER has three entities under regulation:

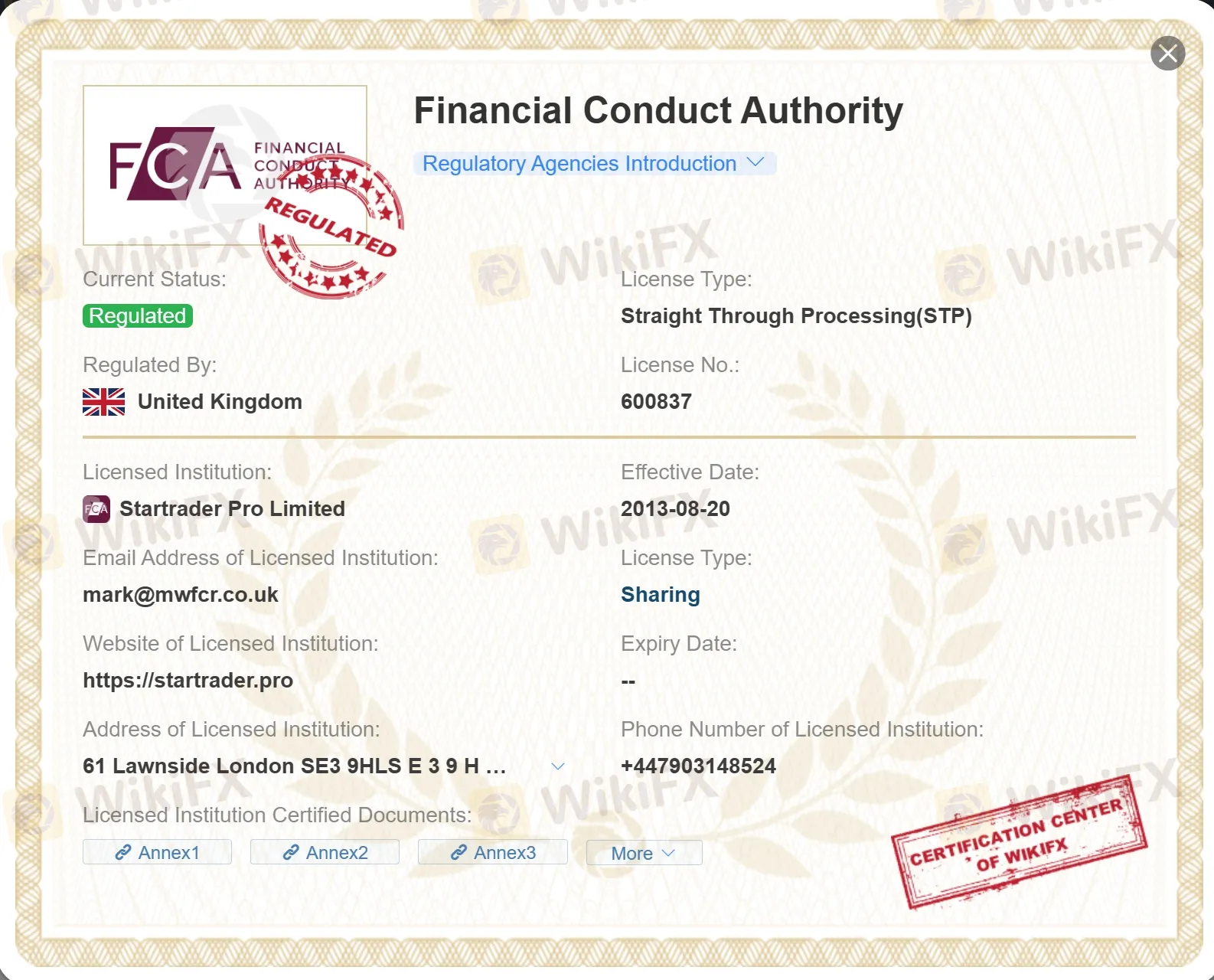

Startrader Pro Limited is regulated by the Financial Conduct Authority (FCA) under regulatory license number: 600837.

STARTRADER Limited is offshore regulated by the Seychelles Financial Services Authority (FSA) under regulatory license number SD049.

STARTRADER INTERNATIONAL PTY LTD is generally registered by the Financial Sector Conduct Authority (FSCA) under regulatory license number 52464.

These regulatory bodies typically require brokers to follow strict operational guidelines intended to protect traders.

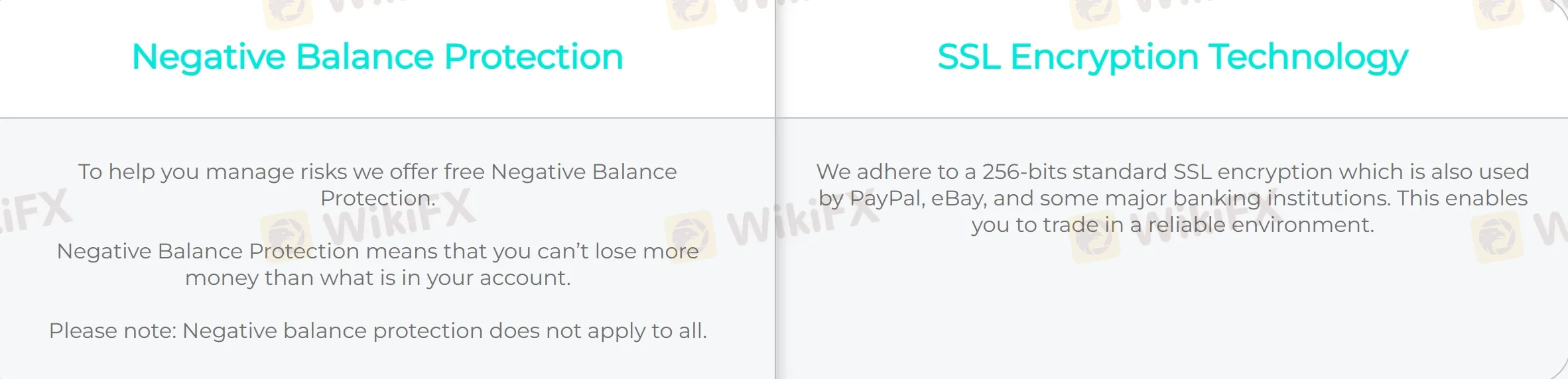

Further adding to the broker's credibility is its employment of security measures like segregated client accounts, which refers to the practice of keeping client funds separate from the company's operating funds. It also guarantees negative balance protection, preventing clients from losing more than their account balance. The use of SSL encryption technology ensures secure data transfer.

All these factors suggest that STARTRADER is not a scam and can be considered a legit broker.

However, it's crucial for traders to conduct their due diligence. This includes understanding the broker's terms and conditions and researching online reviews to gain a comprehensive understanding of other traders' experiences with the broker.

Pros & Cons

STARTRADER is a Seychelles-based forex broker that offers a wide range of tradable instruments, and generous leverage up to 1:500. The broker also provides multiple trading platforms with advanced charting tools and technical analysis indicators, as well as educational resources for traders.

However, there are some potential downsides, such as regional restrictions and limited account types offered.

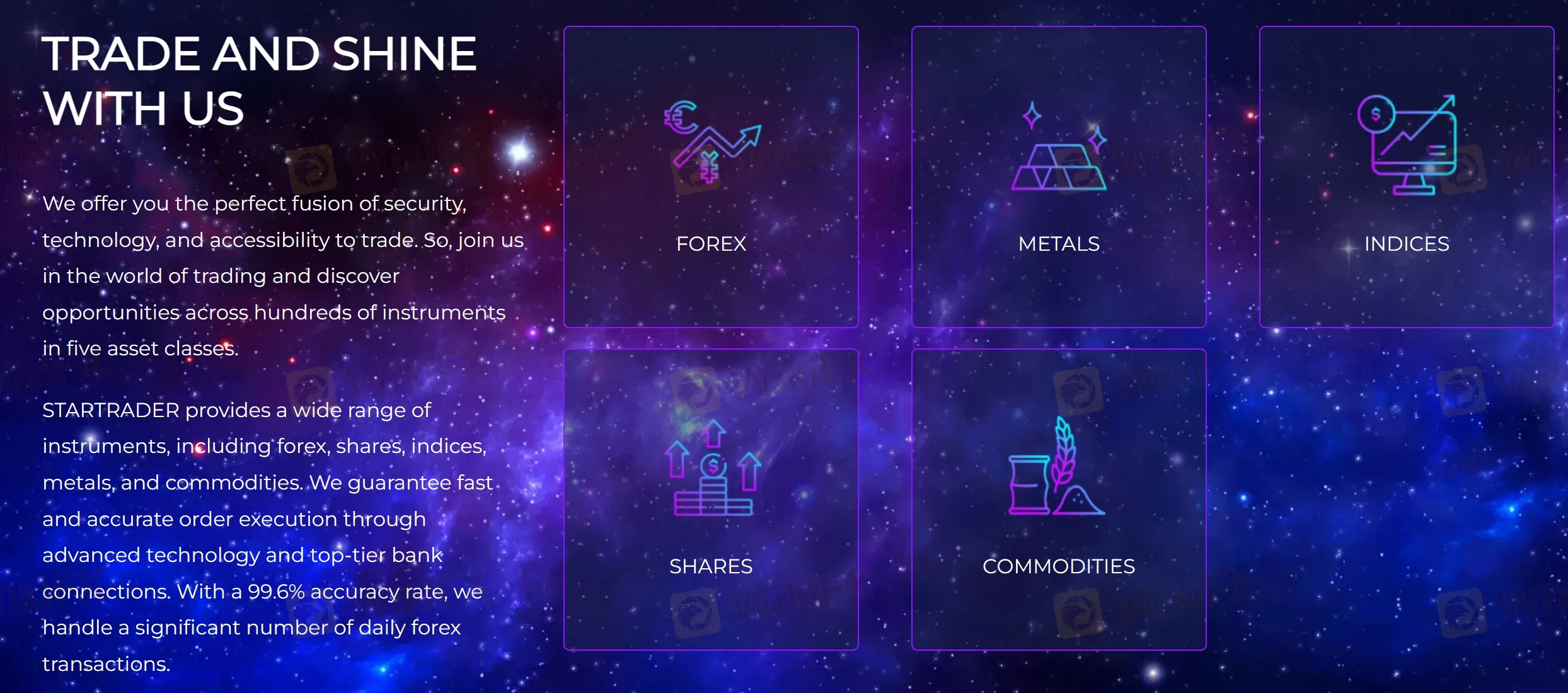

Market Intruments

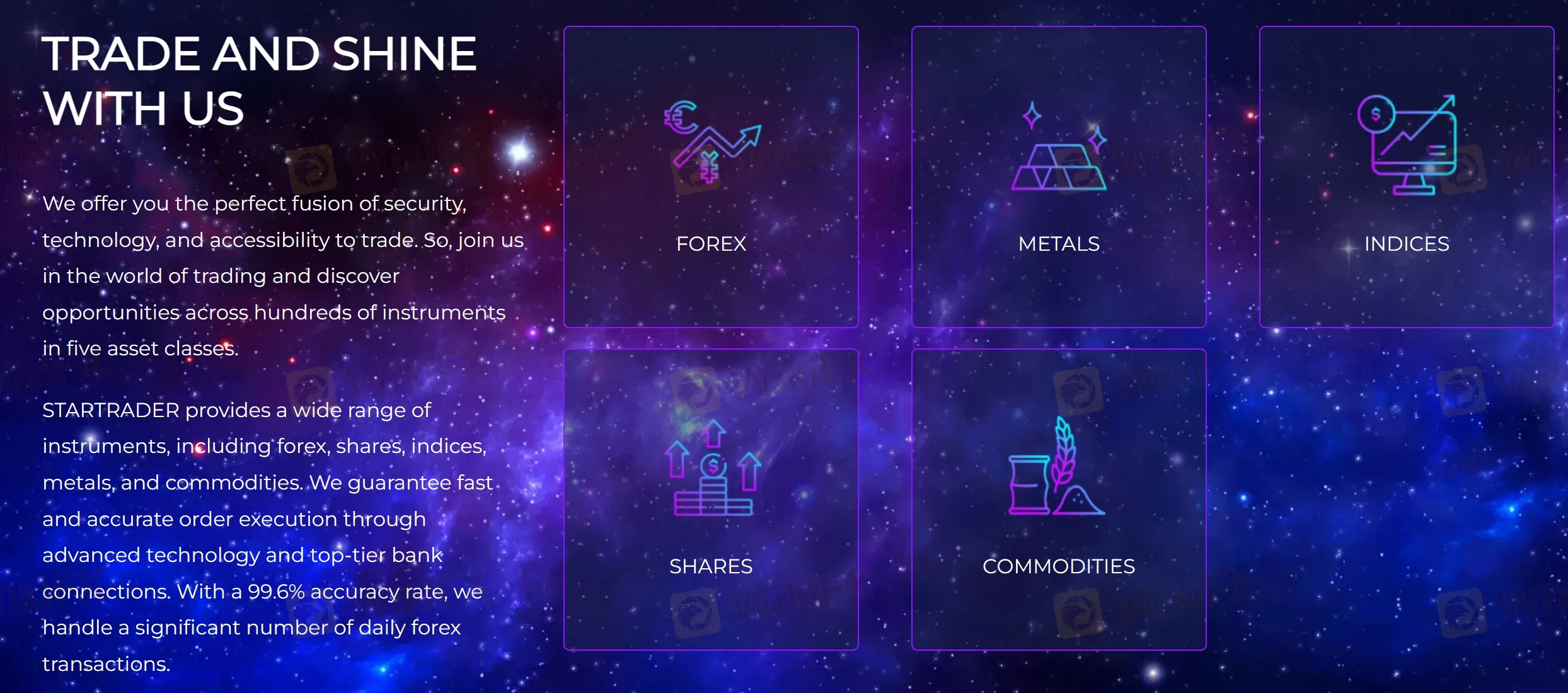

STARTRADER offers 200+ market instruments for traders to choose from, providing ample opportunities for traders to invest and diversify their portfolios.

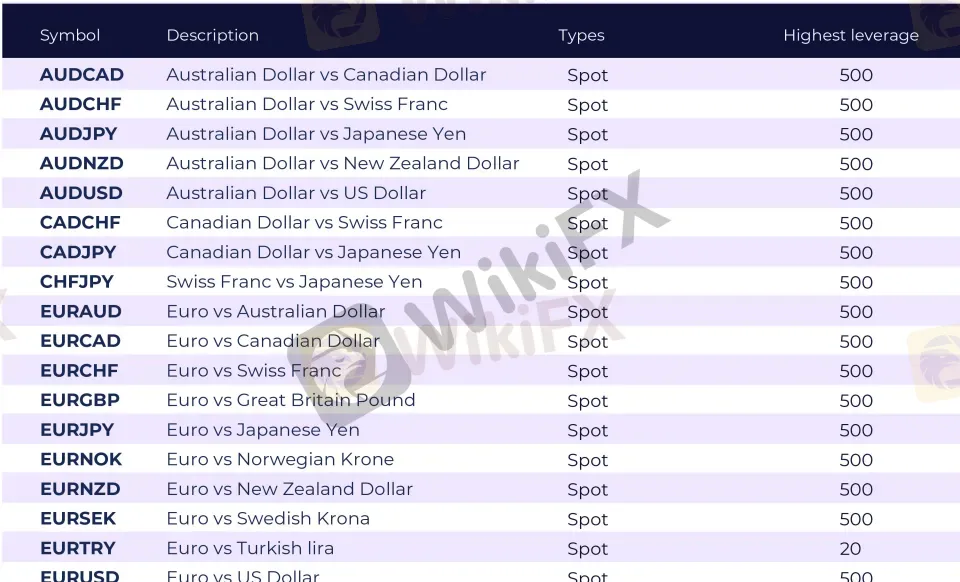

Forex: STARTRADER offers over 35 currency pairs, including major, minor, and exotic currency pairs for forex trading, including EUR/USD, GBP/USD, USD/JPY, and AUD/CAD, among others.

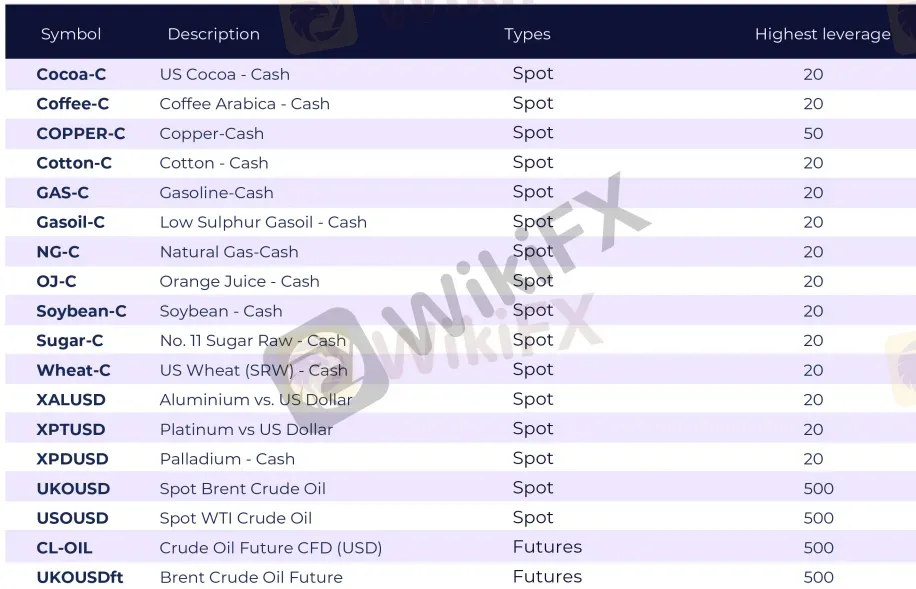

Metals: This typically includes trading in commodities like gold, silver, platinum, and palladium.

Indices: They also provide more than 20 indices, tracking various segments of the financial markets, both globally and regionally.

Shares: The broker also provides access to over 70 different stocks, allowing traders to take a position on a wide range of companies across various sectors.

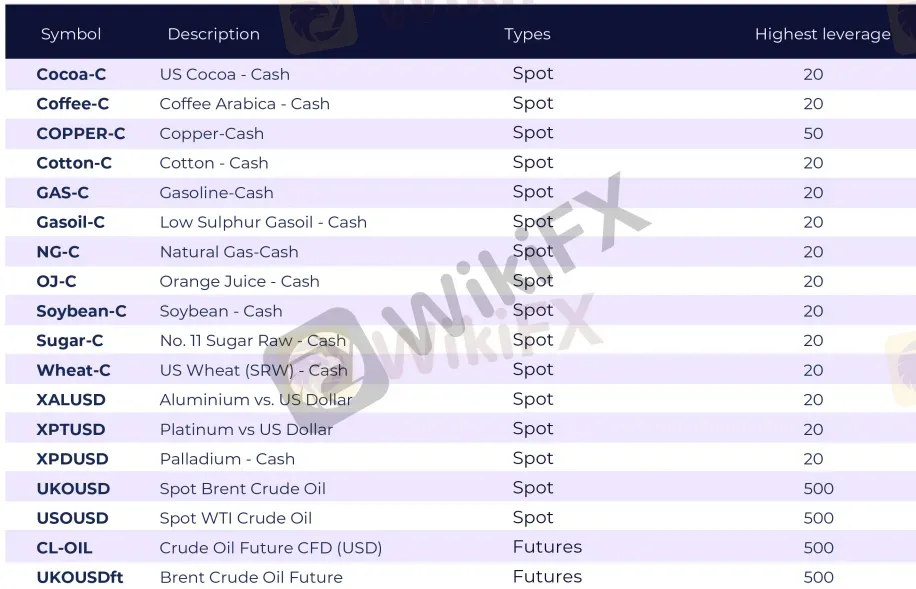

Commodities: STARTRADER offers more than 20 commodities, providing an opportunity for traders to engage in the trading of both soft (like wheat, cocoa, or coffee) and hard commodities (like gold, oil, or natural gas).

This mix of offerings gives traders ample choices for diversifying their portfolios and opportunities to take advantage of different market conditions. However, it's essential to fully understand each instrument's characteristics and risks and to develop a suitable strategy based on one's trading objectives and risk tolerance.

Account Types

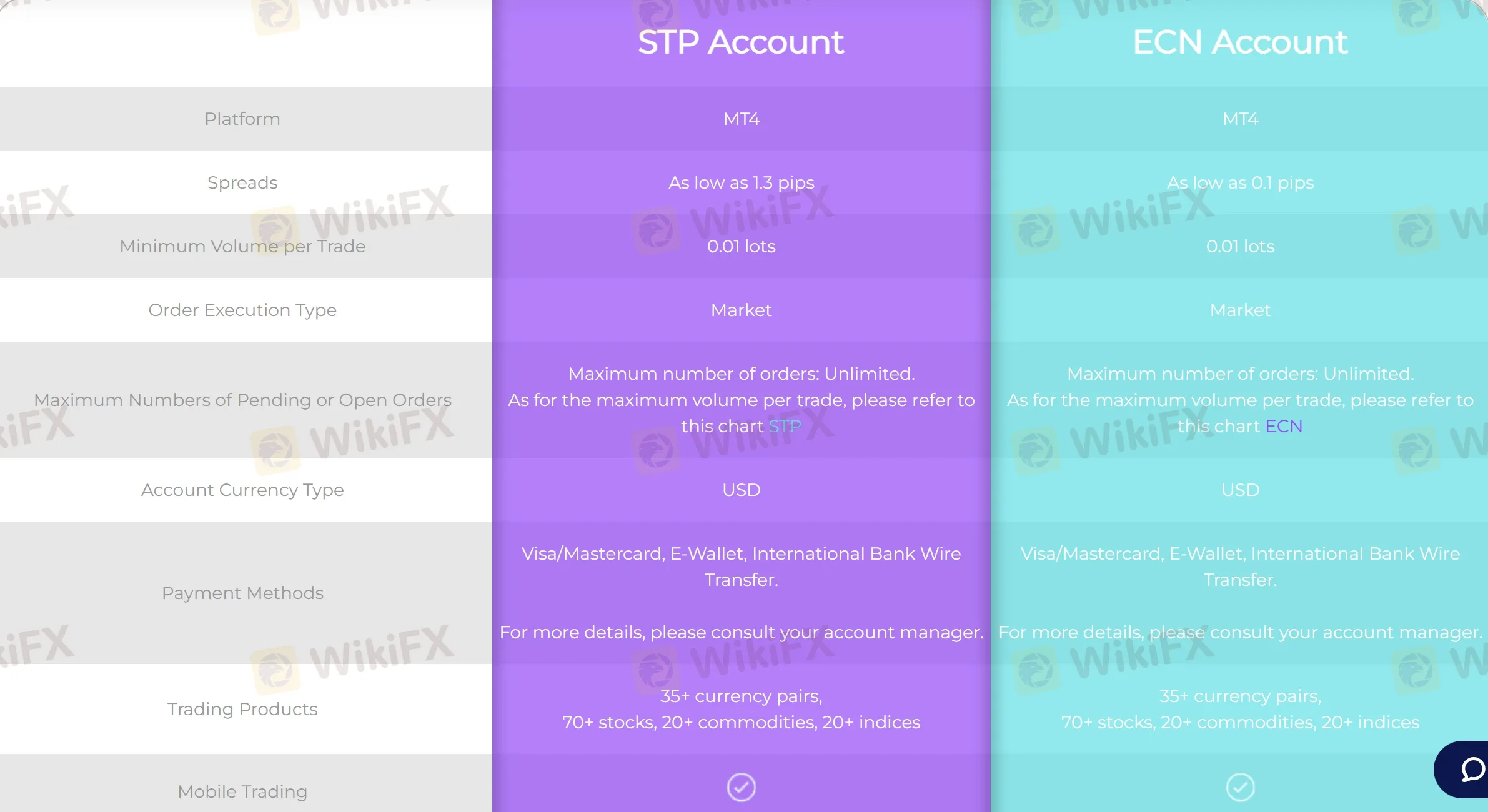

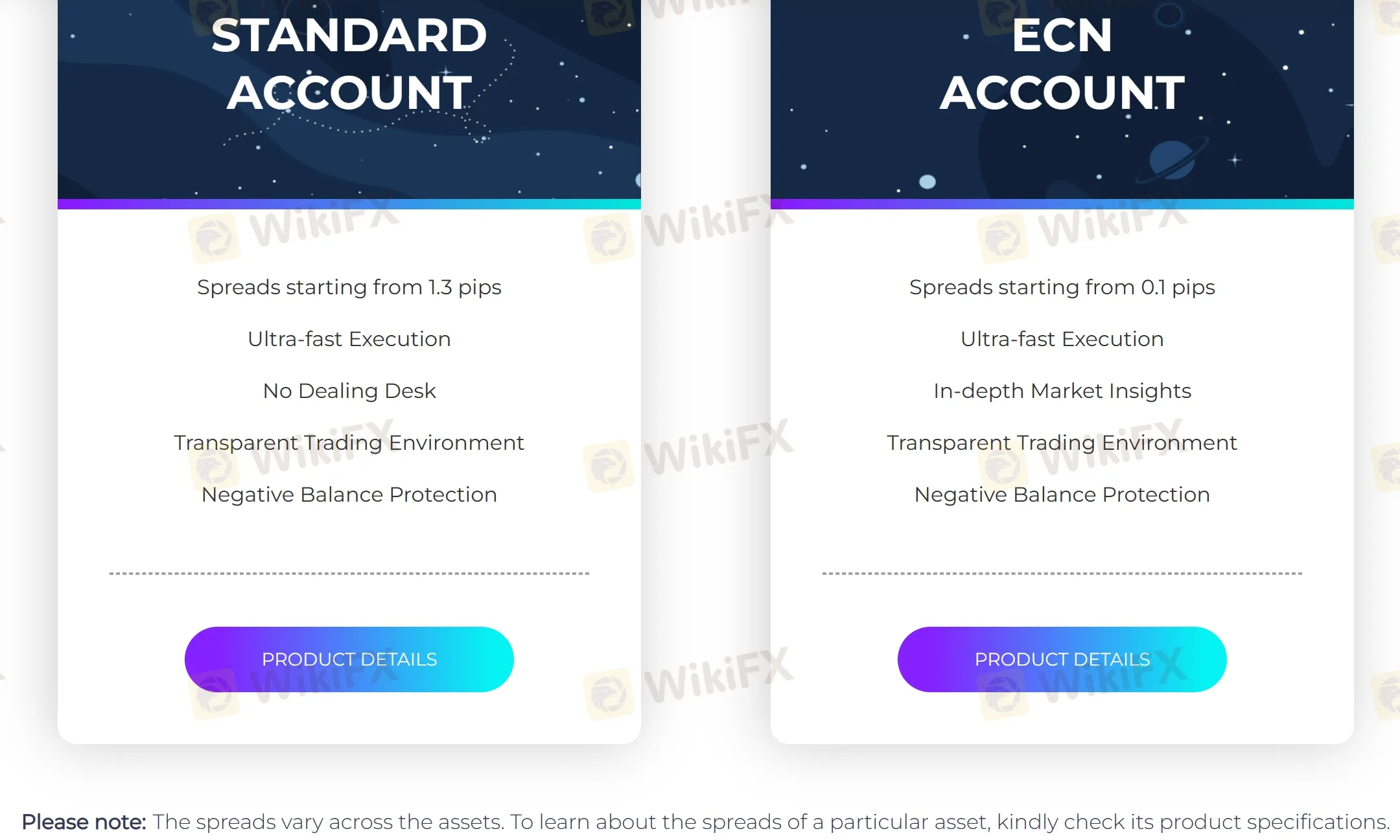

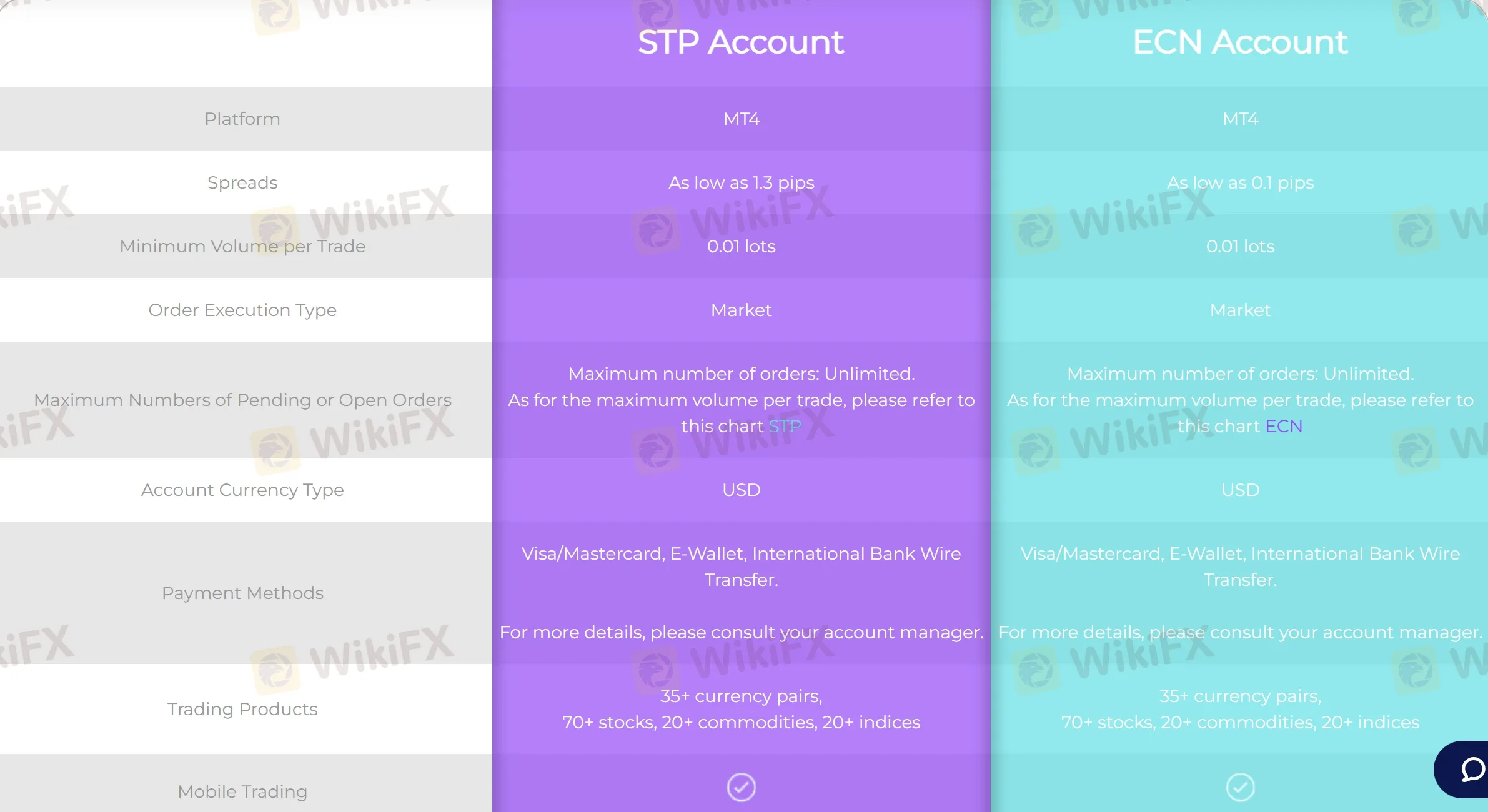

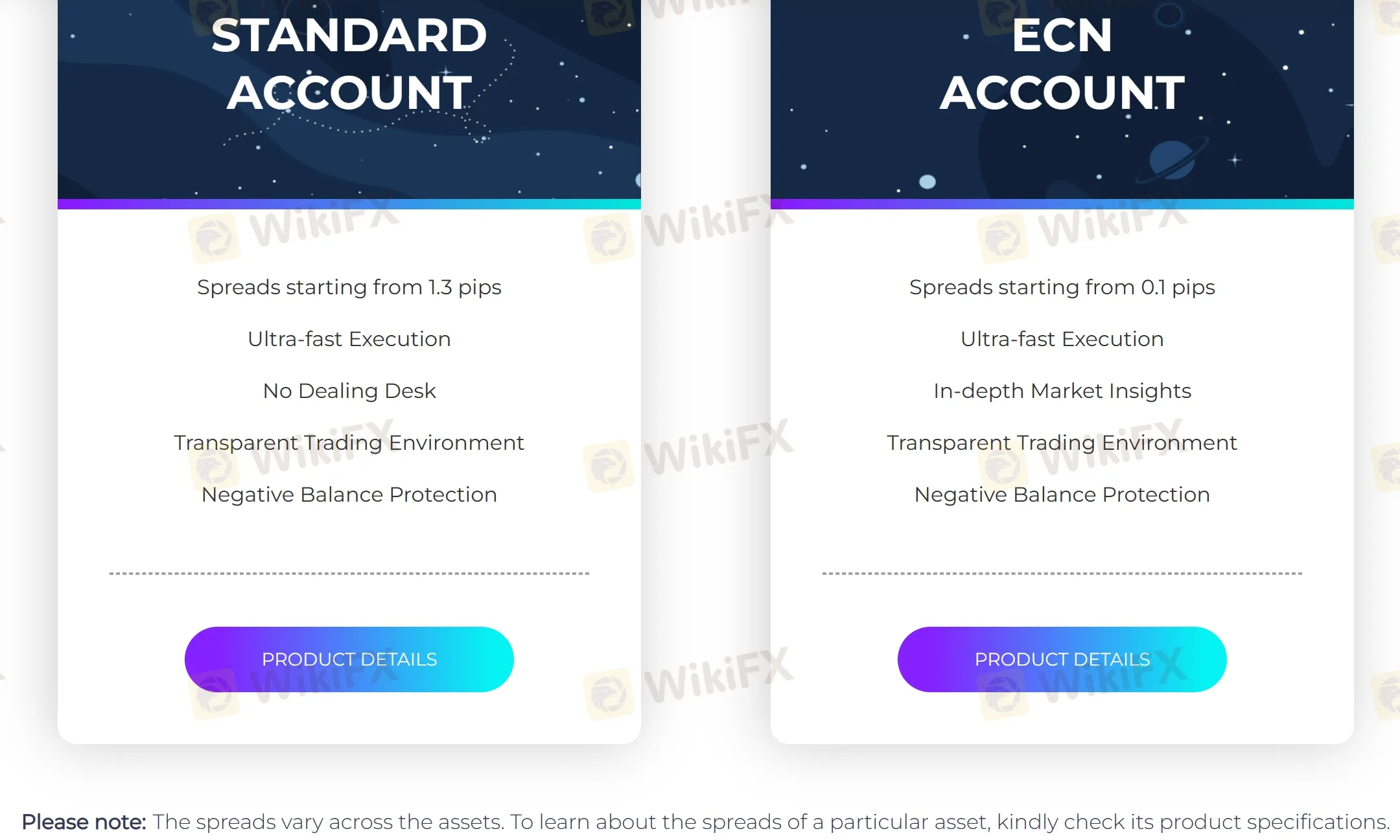

Apart from demo accounts, STARTRADER offers two primary live account types, catering to traders with different levels of experience and trading strategies.

The Standard account is designed for traders who prefer fixed spreads, and is well-suited for beginners or traders who prefer a simpler trading experience. This account type offers spreads from 1.3 pips and leverage up to 1:500, with no minimum deposit disclosed. Additionally, traders can access a wide range of tradable instruments, including forex, commodities, indices, cryptocurrencies, and shares.

The ECN account, on the other hand, is tailored to more experienced traders who require a more sophisticated trading experience. This account type offers variable spreads and allows traders to access the interbank market, which can provide greater liquidity and potentially tighter spreads. Traders can also take advantage of the advanced trading platform provided by STARTRADER, which features advanced charting tools, technical analysis indicators, and more. The ECN account also offers competitive leverage up to 1:500, with no minimum deposit disclosed.

When choosing an account type, traders should carefully consider their trading objectives, risk tolerance, and overall experience in the markets.

How to Open an Account?

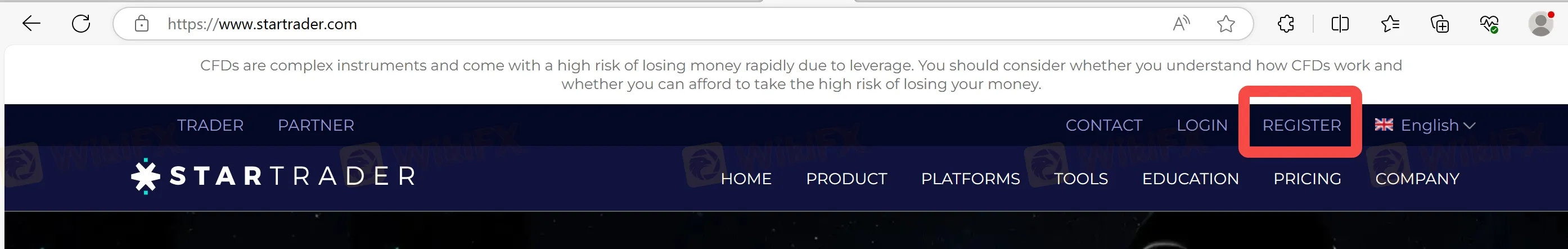

Opening an account with STARTRADER is a straightforward and easy process that can be completed in just a few simple steps.

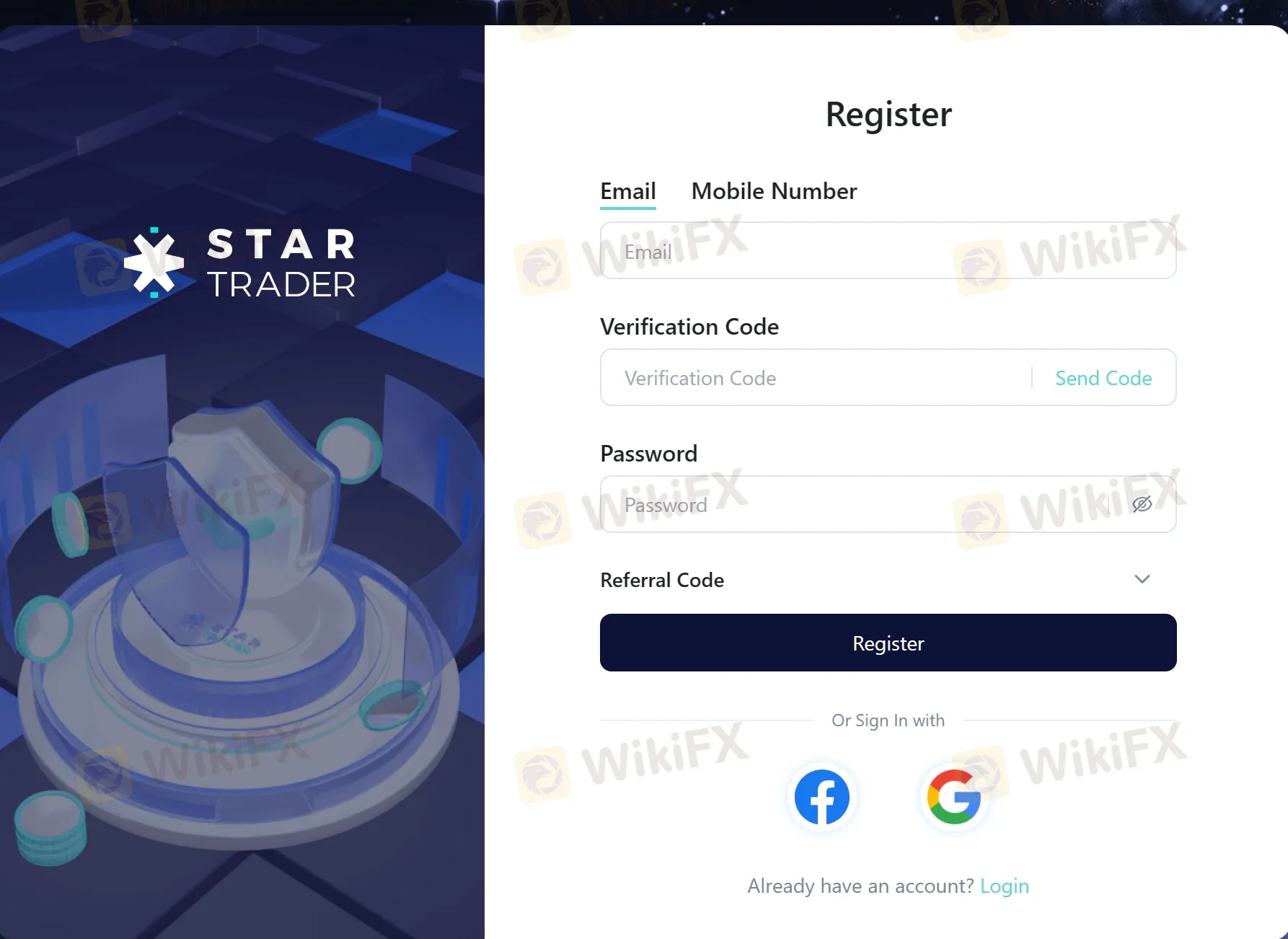

Step 1: First, visit the STARTRADER website and click on the “REGISTER” button. You will be prompted to fill out a registration form, which requires you to provide some personal information, such as email address and password.

Step 2: Next, you will need to provide some additional information, such as your preferred account type (Standard or ECN), currency preference, and trading platform preference.

Step 3: After completing the registration form, you will be asked to verify your email address by clicking on a link sent to your email inbox. You will then need to provide proof of identity and address by uploading a copy of your government-issued ID and a recent utility bill or bank statement.

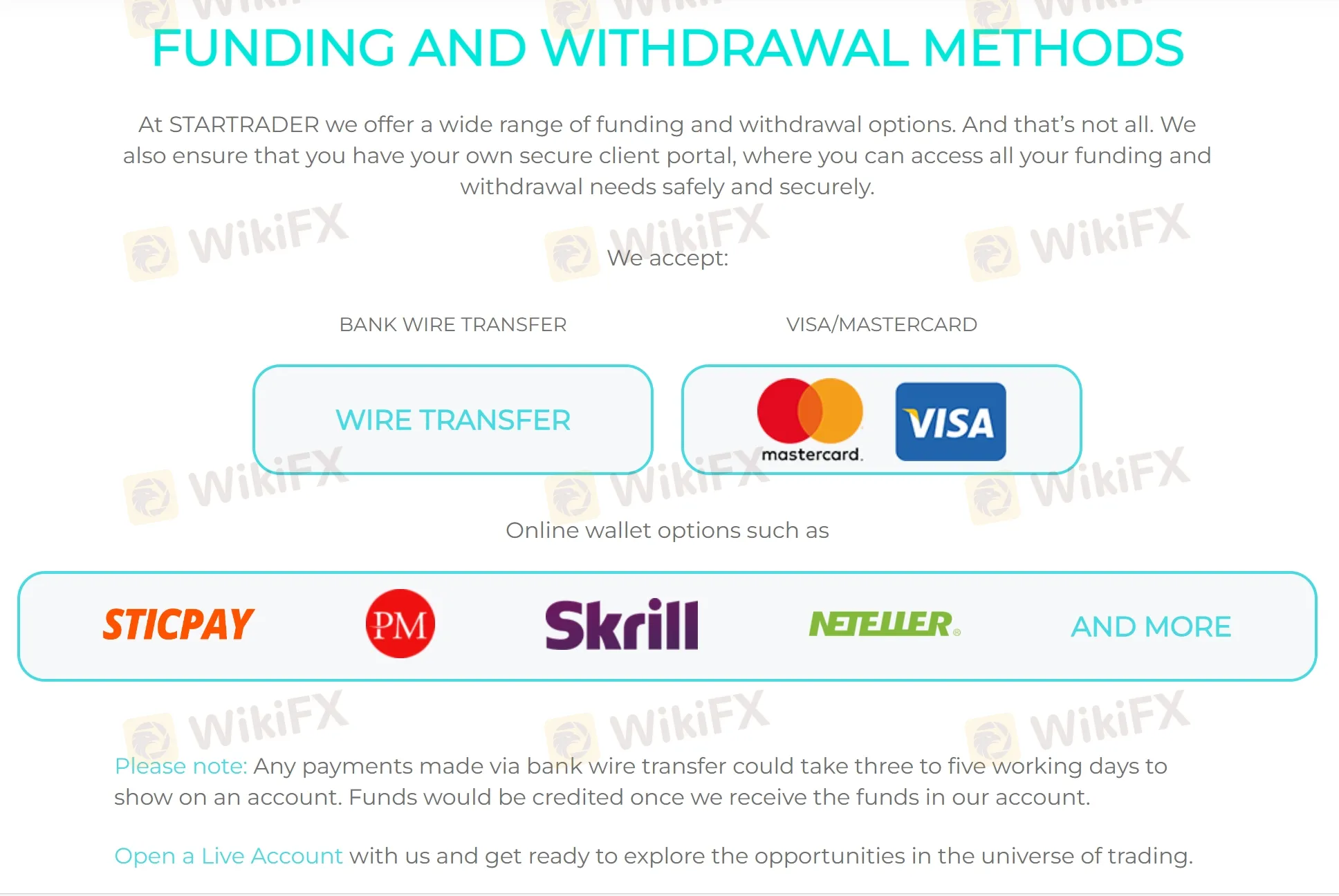

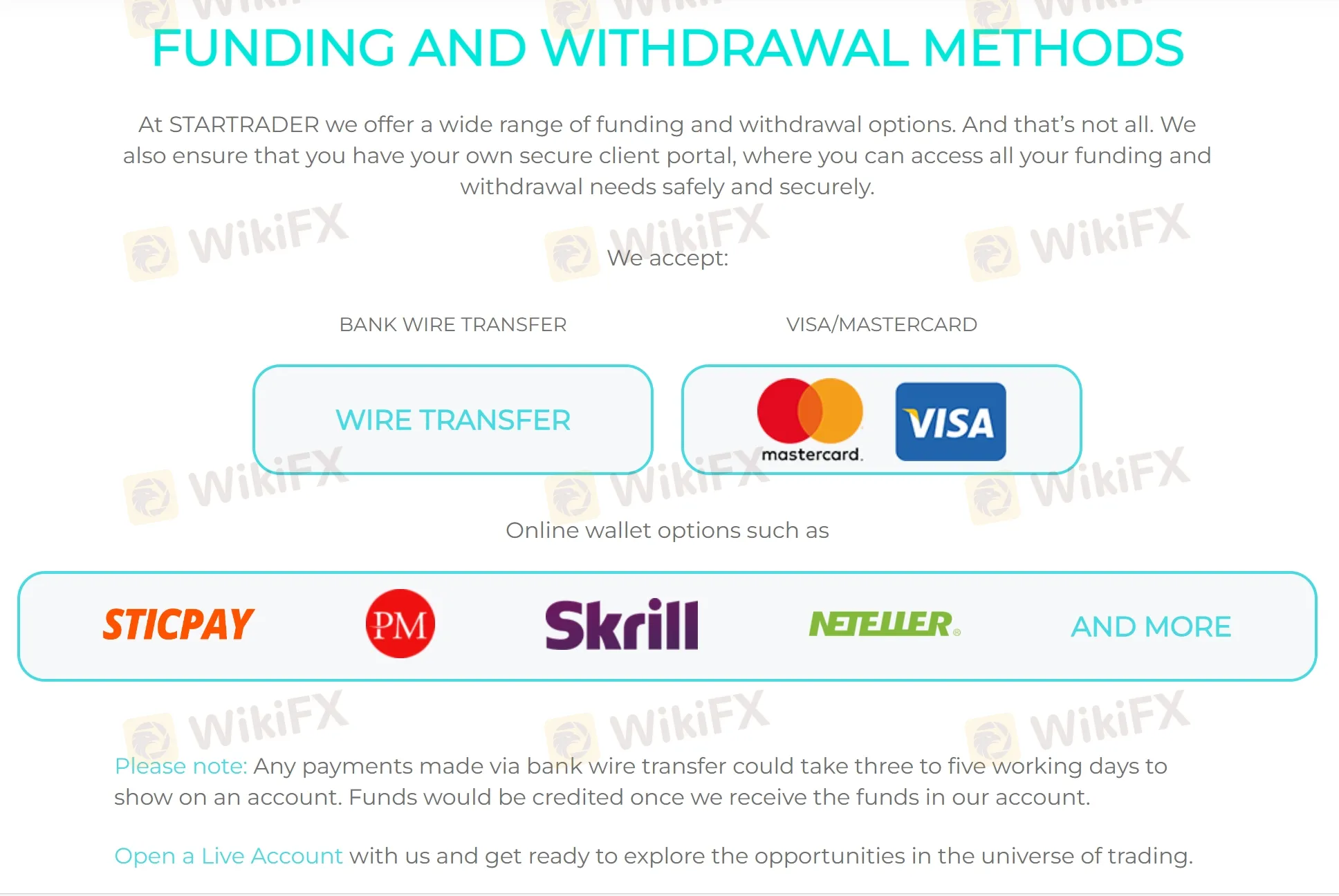

Step 4: Once your account is approved, you can fund your account and start trading immediately. STARTRADER supports a range of payment methods, including Bank Wire Transfer, Visa/MasterCard, Sticpay, PerfectMoney, Skrill, Neteller, and more.

Leverage

TARTRADER offers a maximum trading leverage of up to 1:500, depending on the account type and the instrument being traded. For Standard account holders, the maximum leverage available is 1:500, which is still relatively high compared to other brokers in the industry. For ECN account holders, the maximum leverage available is also 1:500.

While leverage can magnify potential profits, it can also increase the risks associated with trading. Traders should always use leverage responsibly and consider their risk tolerance and trading strategy before choosing a leverage level.

Spreads & Commissions (Trading Fees)

While STARTRADER does offer transparent trading fees, the exact commission charges for ECN accounts may vary depending on the instrument being traded and other factors such as account activity.

For Standard accounts, there are no commissions charged on trades made through the account. Instead, the broker makes money through the spread, which is the difference between the bid and ask price of a financial instrument. The spreads offered by this broker are 1.3 pips.

For ECN accounts, the spreads offered by the broker are typically lower, starting from as low as 0.1 pips. However, traders are charged a commission on each trade.

While the commission charges are not specifically outlined on the broker's website, STARTRADER does offer a transparent fee structure and provides traders with real-time information on the spreads and commissions applicable to their trades. Traders can also access detailed trading reports that provide a breakdown of their trading costs and fees.

Non-Trading Fees

In addition to trading fees, STARTRADER also charges non-trading fees, which traders should be aware of when considering trading with the broker.

One of the non-trading fees charged by STARTRADER is an inactivity fee. If an account remains inactive for a period of 90 days, a fee of $10 will be charged each month until the account becomes active again.

Another non-trading fee charged by the broker is a withdrawal fee. For each withdrawal made, STARTRADER charges a fee of 1% of the withdrawal amount, with a minimum fee of $30 and a maximum fee of $500.

STARTRADER also charges a fee for currency conversion. If a trader deposits funds in a currency other than the base currency of their account, the broker will convert the funds to the base currency at the current exchange rate and charge a fee of 2% of the converted amount.

Trading Platforms

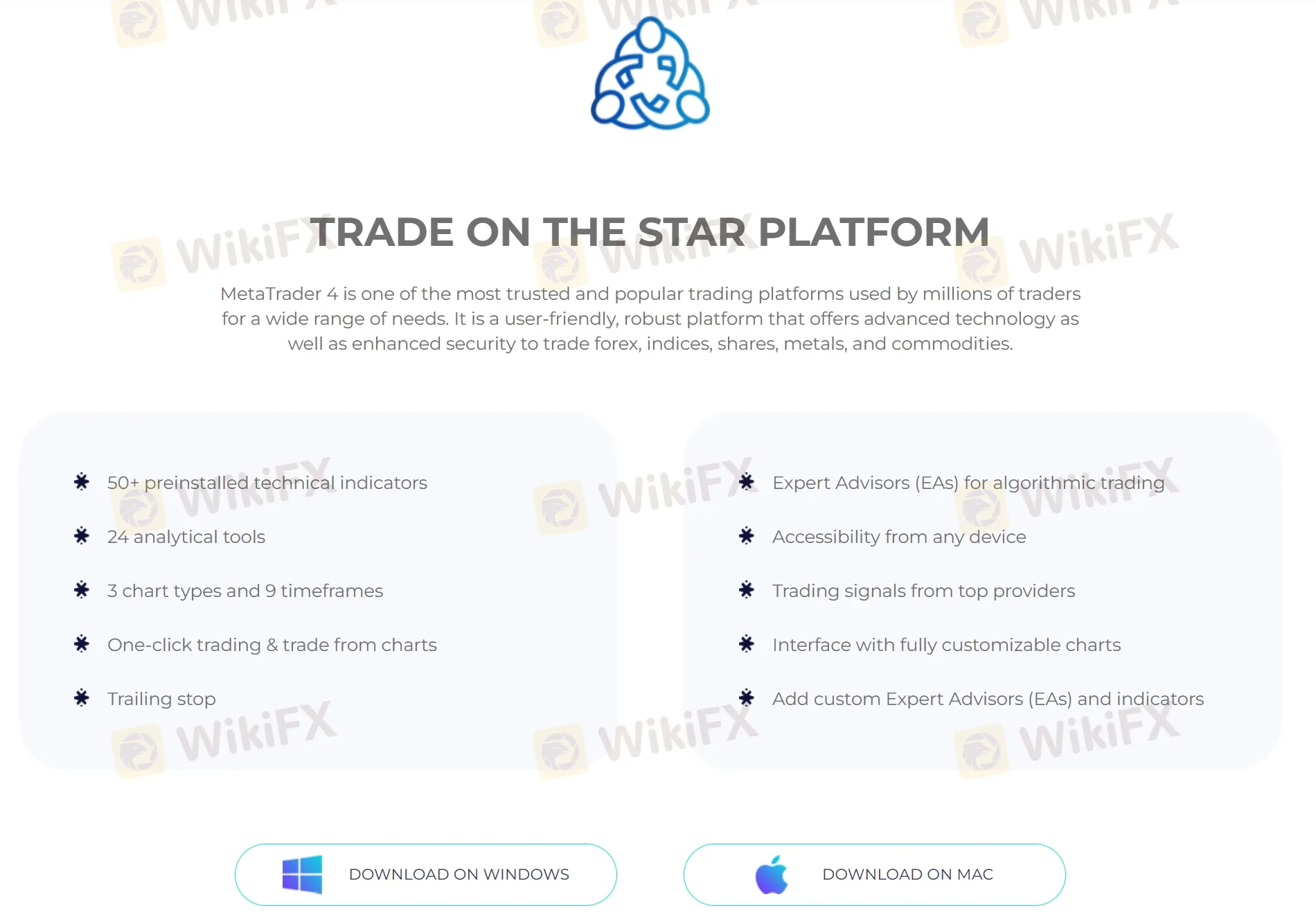

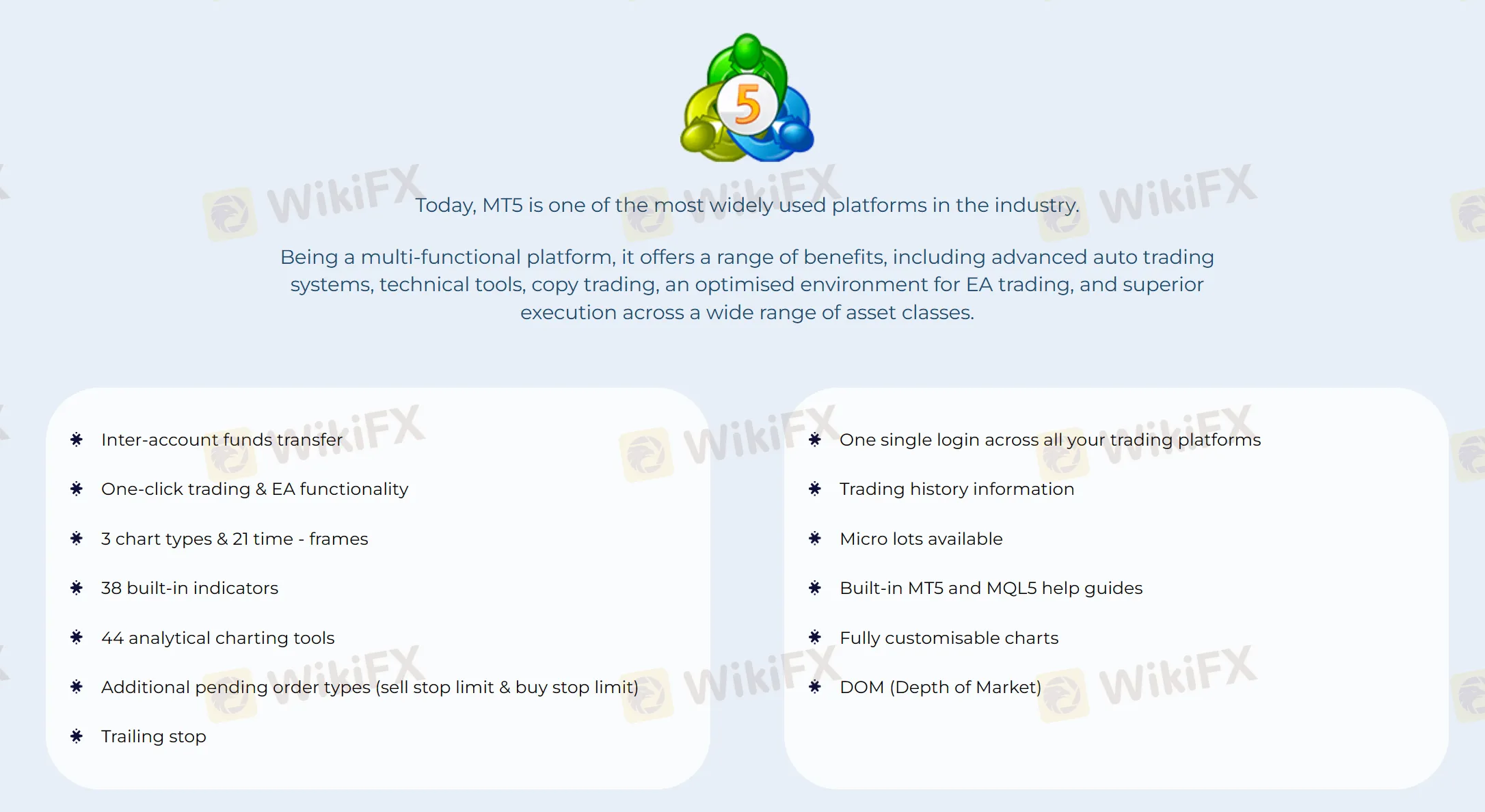

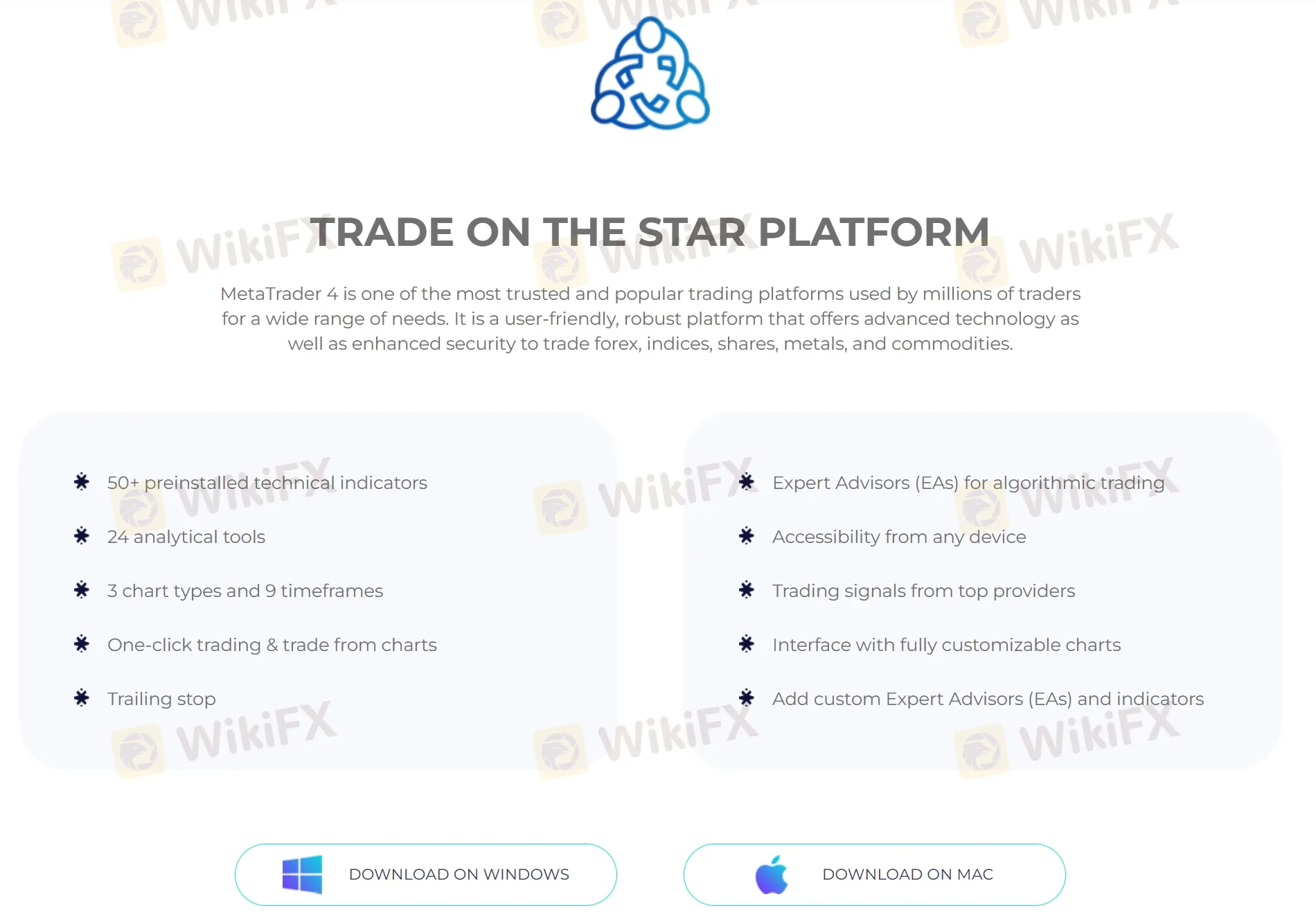

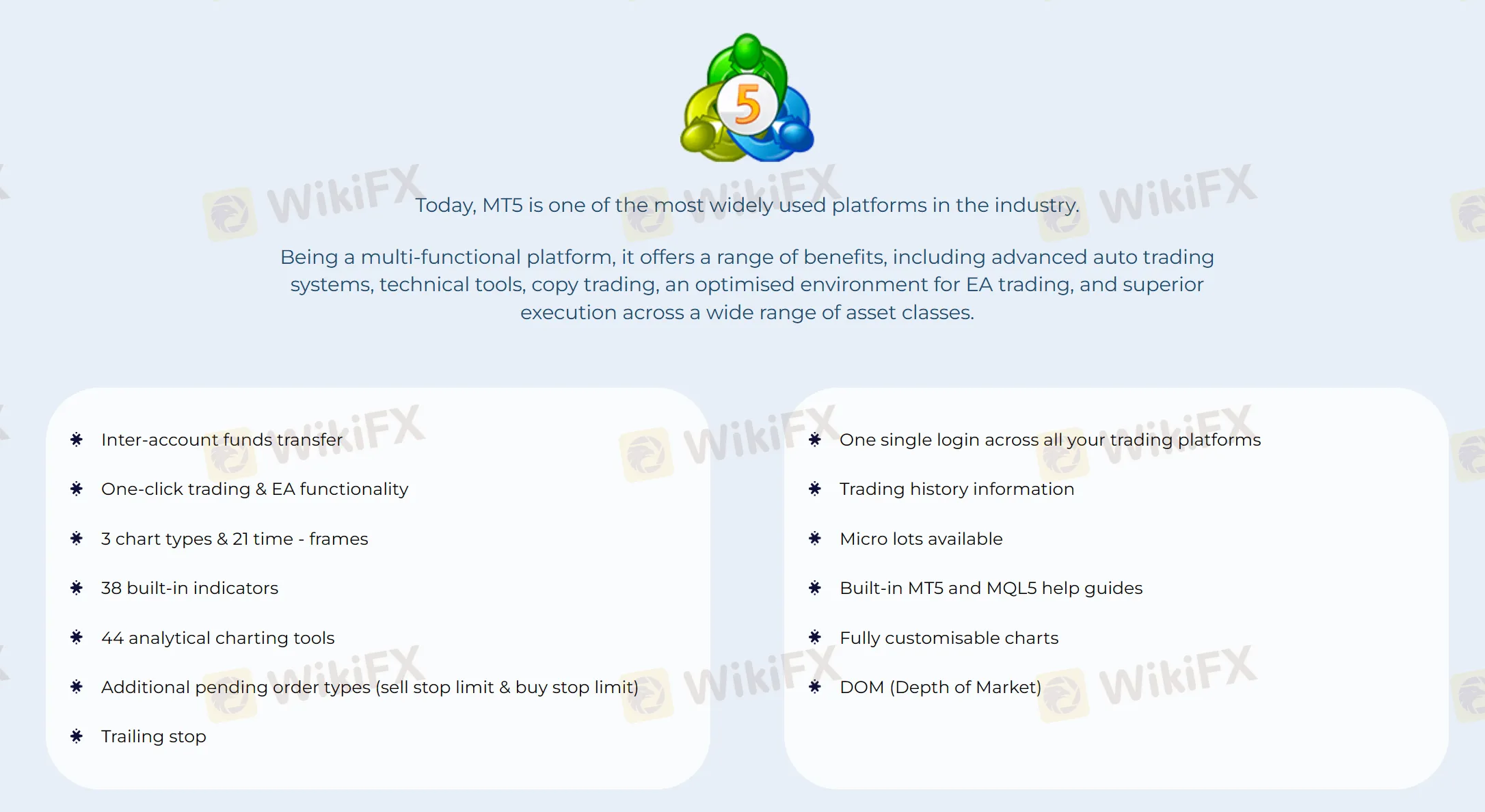

STARTRADER caters to the diverse trading needs of its clients by offering them access to three distinct trading platforms: the widely popular and extensively-used MetaTrader 4 (MT4), its newer and more sophisticated version, MetaTrader 5 (MT5), and its proprietary WebTrader platform, which is a browser-based trading platform designed to provide traders with easy access to the financial markets from any device with an internet connection.

MT4 is renowned for its advanced technical analysis tools, algorithmic trading capabilities, and high-speed trade execution, making it a favored platform amongst traders of all experience levels. It offers traders an array of features, such as customizable charting, real-time quotes, and a vast selection of technical indicators.

MT5, on the other hand, is the latest version of the MetaTrader platform, offering even more advanced features and capabilities, including enhanced charting and analytical tools, multi-currency support, and a more extensive selection of timeframes. It is also designed to support additional types of assets such as stocks and futures, providing traders with greater market diversity.

STARTRADER's proprietary WebTrader platform, meanwhile, is a web-based trading platform that allows traders to access their trading accounts from anywhere in the world, providing them with the flexibility and convenience of trading on-the-go. It offers traders a wide range of tools, including real-time quotes, charting tools, and technical analysis indicators, while also providing a user-friendly interface that is easy to navigate.

The following is a comparison table prepared, highlighting the trading platforms offered by STARTRADER, INFINOX, CPT Markets, and Eightcap:

Copy Trade

STARTRADER's offering of a copy trading feature is great for traders who prefer to capitalize on the expertise of successful traders. Copy trading allows traders to directly copy the positions opened and managed by another selected trader. Hence, when the copied trader makes a trade, the same trade is automatically executed in the copying trader's account.

This can be particularly beneficial for novice traders who are still learning the ropes or people who don't have the time to study and monitor the markets consistently. It provides a form of passive management and can be a way to learn and understand more about trading strategies in real-time.

However, it's crucial to remember that all trading involves risks and just because a trader was successful in the past does not guarantee they will be in the future. Always practice risk management and ensure to align copy trading actions with your risk tolerance and financial goals.

Trading Tools

STARTRADER offers a suite of impressive trading tools that contribute towards a comprehensive and efficient trading experience.

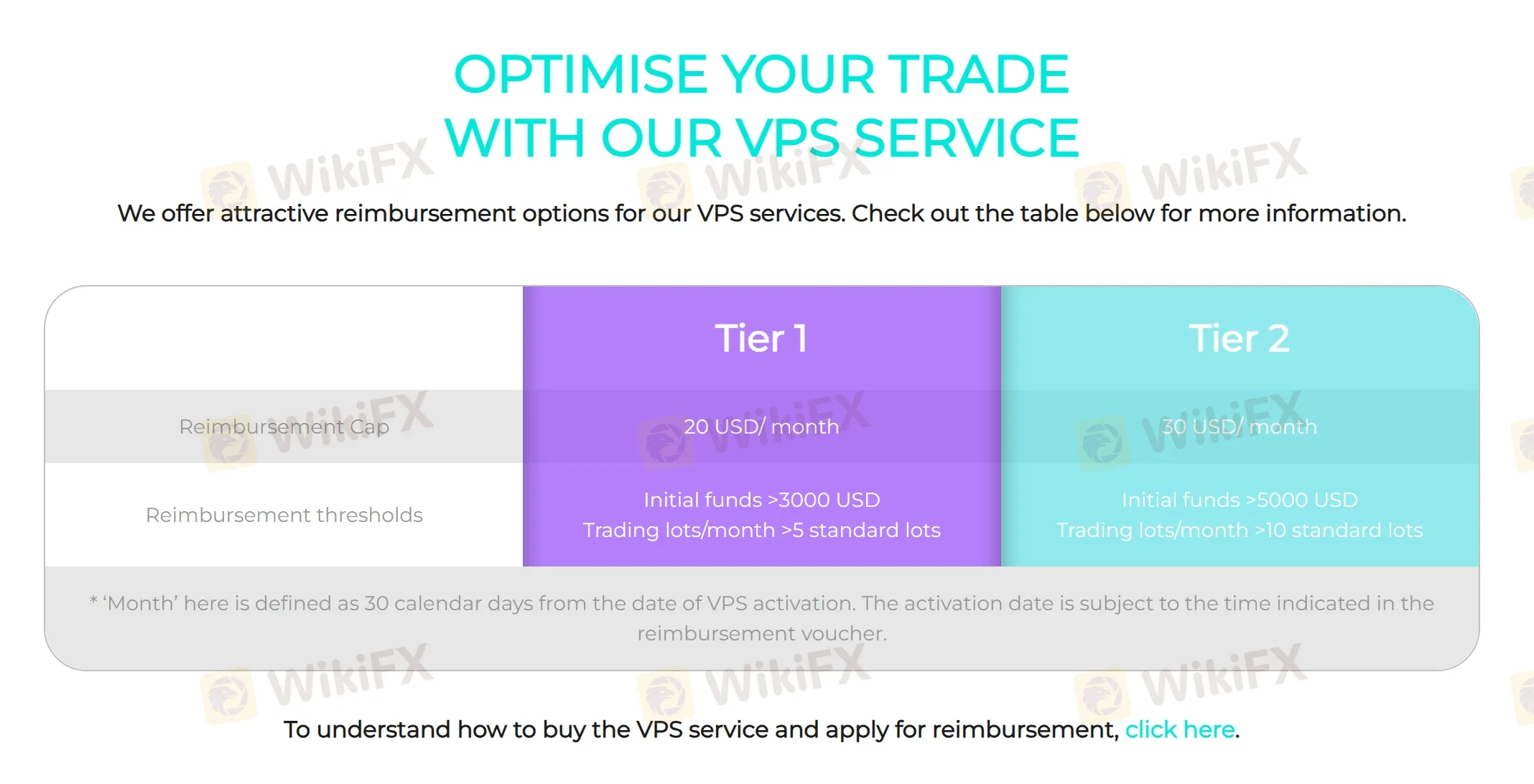

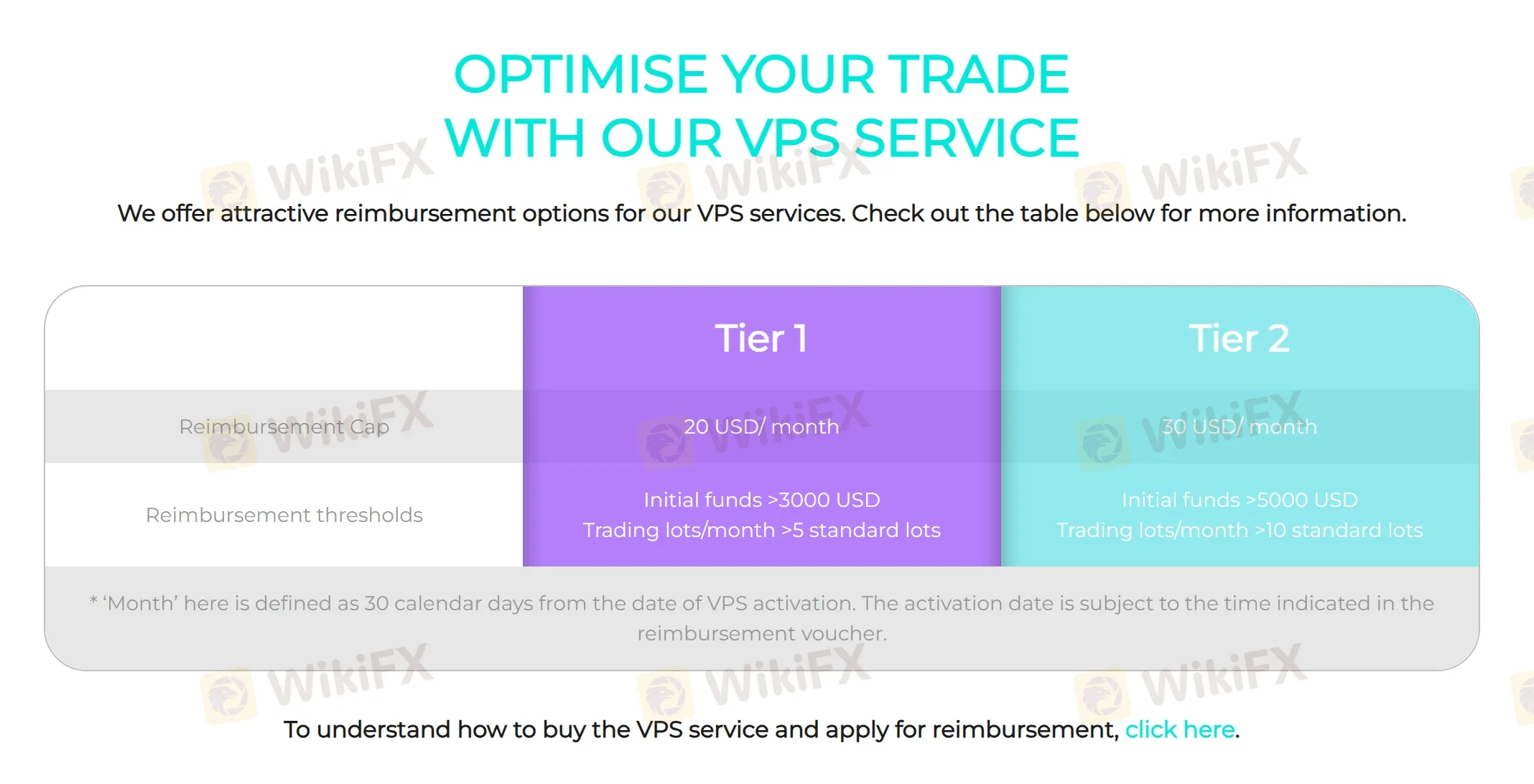

They provide a Virtual Private Server (VPS) service which allows traders to run automated algorithmic strategies continuously 24/7 on a virtual machine, facilitating more robust connectivity and faster order execution.

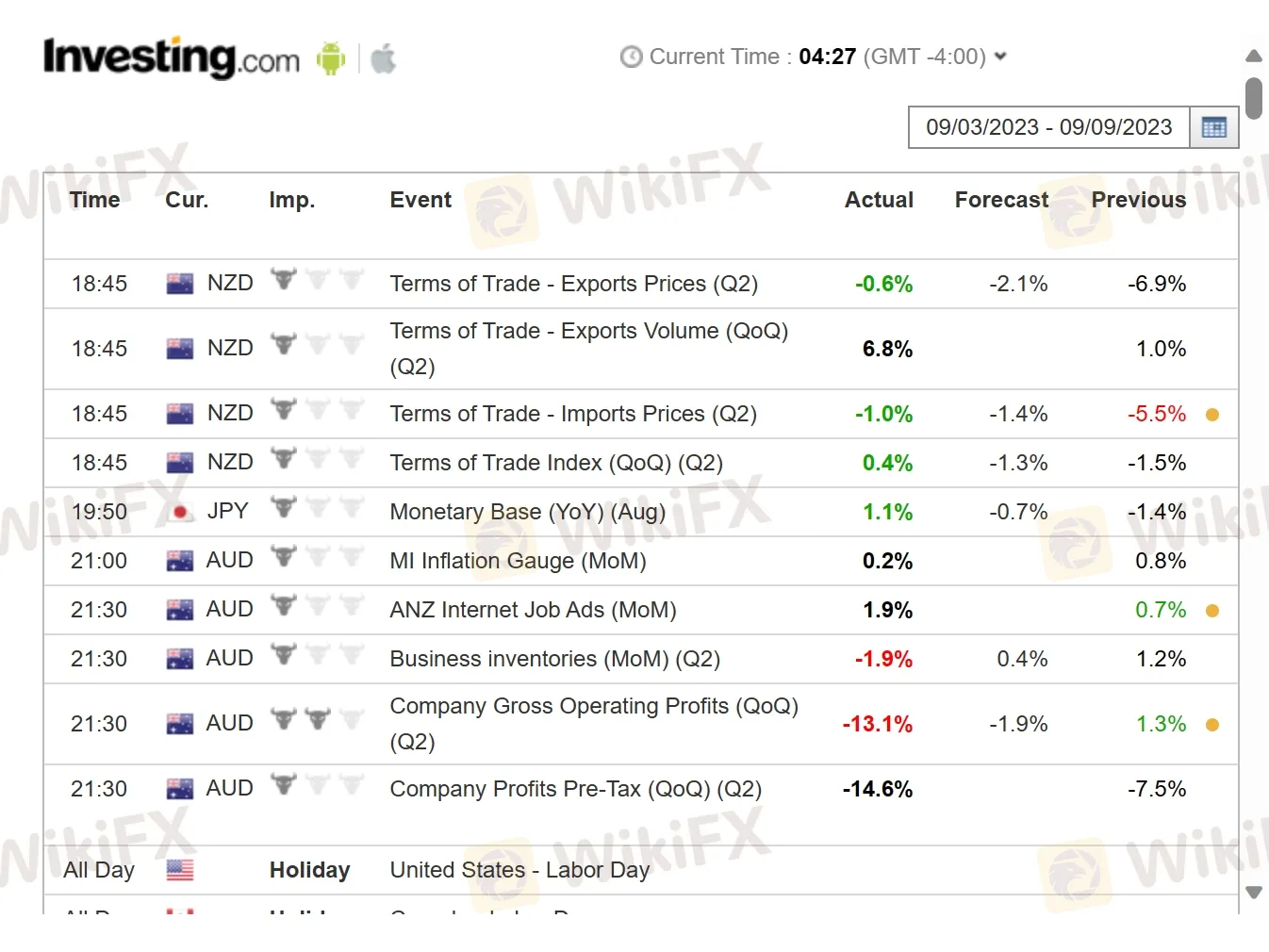

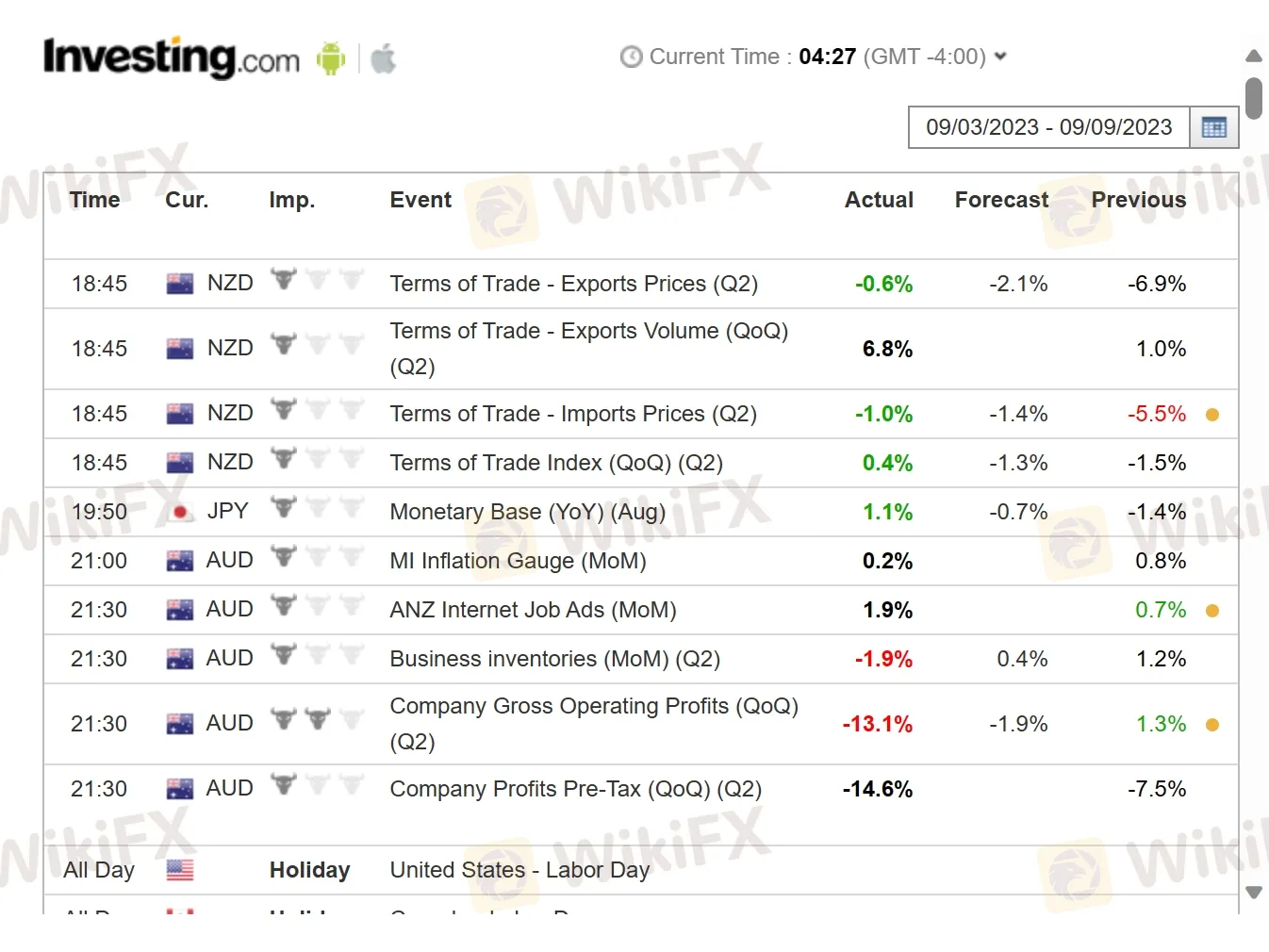

Their economic calendar is a vital tool for fundamental analysis, helping traders track important economic events that have the potential to impact financial markets. This can be beneficial for planning trades and managing risk.

In addition, their news room serves as a source for real-time market news, keeping traders updated about significant developments that can cause market volatility.

These three essential tools offered by STARTRADER reflect their commitment to providing their customers with resources that help to enhance their trading strategies and overall trading experience.

Deposit & Withdrawal

STARTRADER supports a variety of deposit and withdrawal methods for its clients, with a minimum deposit requirement of $50. The broker allows deposits via several methods, including Bank Wire Transfer, Visa/MasterCard, Sticpay, PerfectMoney, Skrill, Neteller, and more. There are zero deposit fees on most payment methods.

Deposits made via bank wire transfer can take 3-5 business days to clear, while deposits made via other methods are typically processed instantly. For withdrawals, clients can use the same methods as for deposits, with processing times varying depending on the chosen method.

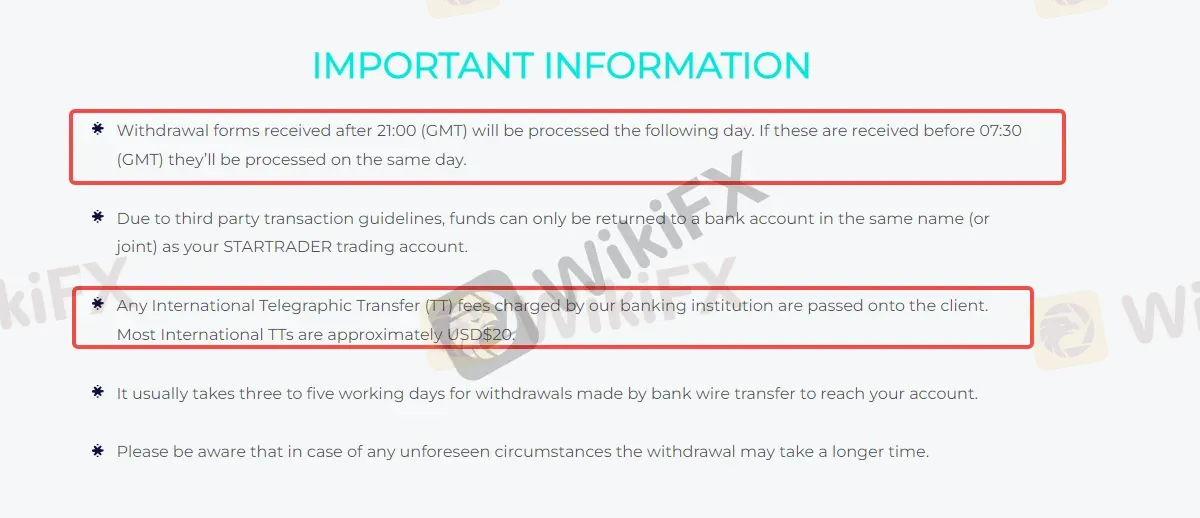

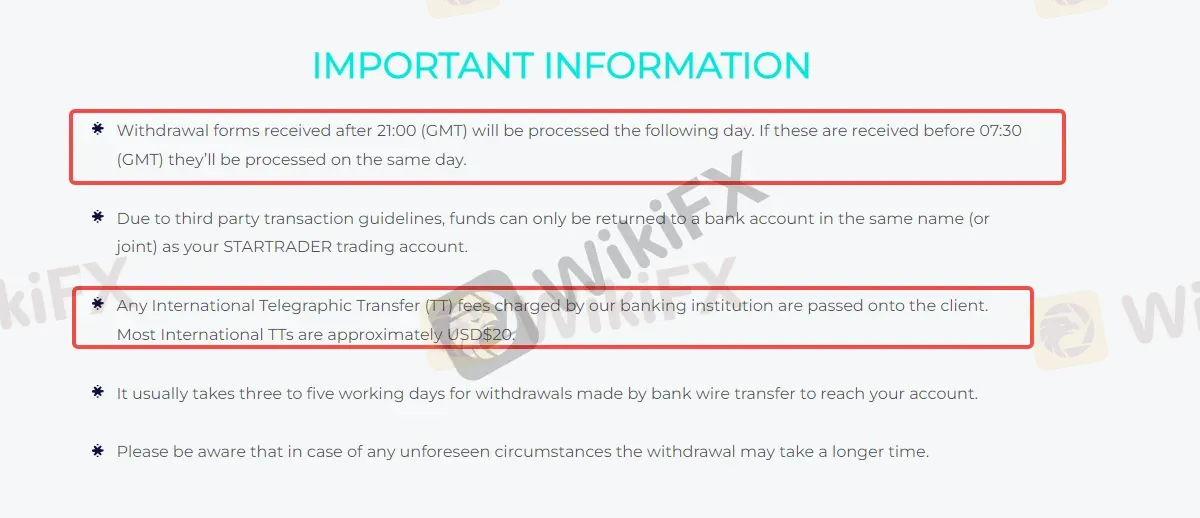

To withdraw funds, you should log to “My account” with your username and password. Initiate the request to withdraw funds. Here are some important notifications you should notice when withdrawing funds:

Educational Resources

STARTRADER offers some educational resources designed to help traders improve their knowledge and skills in the Forex and CFD markets. These resources include webinars and a knowledge center.

The educational webinars are conducted by market experts who provide traders with insights and analysis on a range of topics, from technical analysis to risk management. The webinars are designed to help traders stay up to date with market developments and make informed trading decisions.

In addition to webinars, STARTRADER also provides traders with a knowledge center, which includes some educational materials such as e-books, videos, and tutorials. These materials are aimed at traders of all levels, from beginners to advanced traders, and cover a wide range of topics such as trading strategies, market analysis, and risk management.

Customer Service

STARTRADER offers 24/5 customer support through a variety of channels, including live chat, email: INFO@STARTRADER.COM and a contact form on their website, as well as social media platforms like Facebook, Instagram, Twitter, LinkedIn, YouTube, Tiktok and Telegram.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX