Pamamahala at pagtatanong ng Global Broker App!

Mga track

2023-2024 Indian union Budget and Crypto Industry

As we know India's 2023-2024 budget has passed on 1 februray of 2023 by India's Finance Minister Nirmala Sitharaman . People from all sectors had high hopes for this financial year. Though it fulfilled the expectations of people in some extent but Indian government did not offer no relief for Crypto Industry.

Is this really a comeback of Adani's Group and Adani?

First month of 2023 was disastrous month for Asia's richest man and chairman of Adani's Group Gautam Adani. As American research company Hindenburg published an exposed report with the title “How The World’s 3rd Richest Man Is Pulling The Largest Con In”

An Overview of Wiki Finance Expo HCMC 2022

Ho Chi Minh City - On June 12, 2022, The Wiki Finance EXPO HCMC 2022 was officially held by WikiEXPO at the Windsor Plaza Hotel. This is not the first time that Wiki Finance EXPO has been held in Vietnam. The Wiki Finance EXPO HCMC 2022 attracts more than 2,000 attendees and is supported by 21 sponsors. During the event, there will be more than 25 experts and gurus in the local financial community to deliver fascinating presentations.WikiFX has broadcast the event live.

FXCM

XM

GO MARKETS

IC Markets

FP Markets

FBS

FXTRADING.com

Trade Nation

HYCM

VT Markets

Hantec

BCR

MultiBank Group

STARTRADER

IG

easyMarkets

VPS Standard

1*CPU/1G*RAM/40G*HDD/1M*ADSL

VPS Pro

2*CPU/2G*RAM/60G*HDD/1M*ADSL

VPS cTrader

2*CPU/4G*RAM/100G*HDD/2M*ADSL

XM

2*CPU/2G*RAM/60G*HDD/2M*ADSL

OEXN

2*CPU/2G*RAM/60G*HDD/2M*ADSL

GTC

2*CPU/2G*RAM/60G*HDD/2M*ADSL

Pinakabagong

Hindi maalis

Hindi maalis Ang $998 kong pera ay hindi binayaran at hinarangan nila ang aking acco

Kumita ako sa 2 transaksyon at noong gusto kong i-withdraw ang aking pera, hindi makatarungang kinumpiska nila ang aking pera at pinagbawalan ang pag-access sa aking account. Hindi nila binabayaran ang 998 dollars ko. Ang lahat ay inaasahan mula sa naturang kumpanya na hindi man lang nagbabayad ng 998 dolyar. Gusto kong mabayaran nang madalian ang aking pera

Yaman1903

Yaman1903

Panloloko

Panloloko Hindi ko ma-withdraw ang pera ko

Ang kumpanyang tinatawag na Squared ay kinuha ang aking pera at hindi ako binabayaran. Nagsimula akong mag-trade noong Martes-Miyerkules at lugi ako sa gold chart at nalulugi ako, pagkatapos ay walang problema, pagkatapos ay palagi akong lugi hanggang Biyernes, at sa Biyernes sa 15:30 o 16: 30 may data sa US, hindi ko alam, at biglang may tubo sa screen, kaya isinara ko ang mga transaksyon, at pagkatapos ay inakusahan nila ako ng mga sitwasyon na hindi ko maintindihan ang walang kapararakan, pinutol ang komunikasyon at kinumpiska ang aking pera . Hindi sila nakakatulong sa anumang paraan, sila ay opisyal na mga scammer! Kung magpapatuloy ang sitwasyong ito, ang aking mga reklamo sa mga nauugnay na lisensya at meta system ay magpapatuloy nang walang tigil

xtradingx

xtradingx

Hindi maalis

Hindi maalis Nakain ang kita

Ang dealer na ito ay hindi nagbibigay ng magandang kapaligiran sa mga mangangalakal. Nang hindi ko ma-withdraw ang $45, humiling ako sa kanila na ayusin ang teknikal na problema, ngunit diretso na lang nila akong pinagbawalan. Isipin mo kung anong klaseng dealer ang kukuha ng $45 ng mga mangangalakal, talagang hindi etikal. Hindi ko talaga inirerekomenda sa sinuman ang gamitin ang platform na ito, ito ay isang hindi etikal na platform na ginagamit para sa money laundering.

Hindi maalis

Hindi maalis Pandarayang kumpanya. Hindi makapag-withdraw.

Ang Gold Elephant ay isang mapanlinlang na kumpanya. Hindi makapag-withdraw. Hindi ako pinansin ng customer service.

TIANKONG9242

TIANKONG9242

Hindi maalis

Hindi maalis Ang broker ay tumakas. Ponzi scheme.

Ngayon hindi ako makapag-log in sa account. Hindi ma-withdraw ang pera sa loob nito. Tulungan nyo po ako. May paraan ba para ma-withdraw ang pera ko? Kahit kalahati lang nito.

NAOXIN

NAOXIN

Hindi maalis

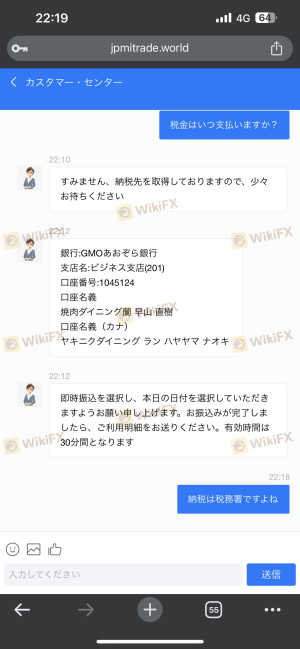

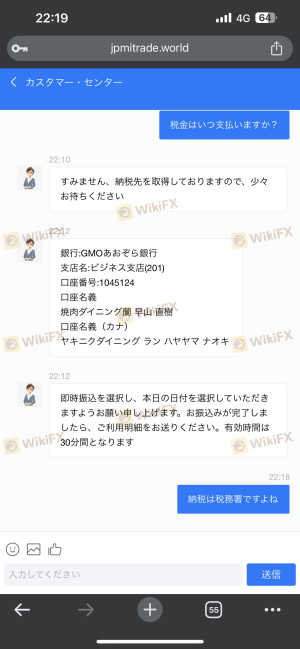

Hindi maalis Hindi ako makakapag-withdraw ng pera dahil kailangan kong magbayad ng buwis sa aking personal na account.

Kapag sinusubukan mong mag-withdraw ng pera, hinihiling sa iyo na makipag-ugnayan sa isang kinatawan ng customer at hinihiling na magbayad ng buwis sa iyong personal na account. Sinabihan ako na hindi ko mababayaran ang prinsipal maliban kung ideposito ko ang pera sa aking personal na account. Sa oras ng withdrawal, mayroong pagsusuri para sa hindi malinaw na dahilan, at ang pagsusuri ay tinanggihan at hindi maaaring mag-withdraw. Hinihiling sa iyo na gamitin ang iyong personal na account para sa mga withdrawal at deposito. Mas mataas ang halaga, mas kaunti kang makakapag-withdraw ng pera. Mangyaring huwag itong gamitin.

Hindi maalis

Hindi maalis Hindi makakapag-withdraw ng pondo

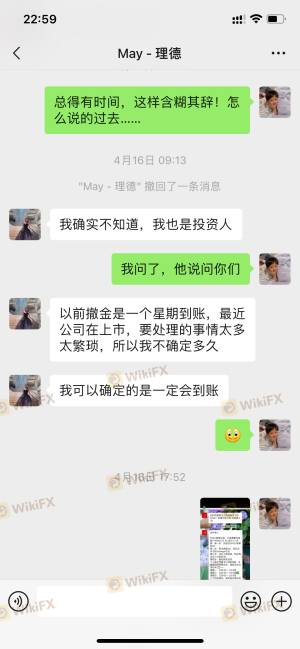

Huminto ang pagtitinda noong Abril at nag-apply ako para sa pag-withdraw. Minsan sinasabi na isang buwan ito, at minsan sinasabi na walang tiyak na panahon. Ngayon sinasabi sa tawag na tatagal ito ng 3 hanggang 6 na buwan. Wala akong masabi! Walang anunsyo bago ang paghinto ng pagtitinda. Walang paliwanag, at walang pag-asa para sa pag-withdraw...

XIAOHAILUO

XIAOHAILUO

Hindi maalis

Hindi maalis Ang pag-withdraw ay tinanggihan dahil sa patunay ng tirahan.

Kailangan nila ng patunay ng aking address na ibinigay ng aking kumpanya, kung hindi ay hindi gagawin ang pagbabayad. Ang aking address ay kinikilala ng gobyerno, mga bangko, atbp. Ngunit ang plataporma ay nangangailangan pa rin na patunayan ng kumpanya ang aking address, at kahit na ibigay ko ang sertipiko ng kumpanya, walang garantiya na maaari kong i-withdraw ang pera.

Hindi maalis

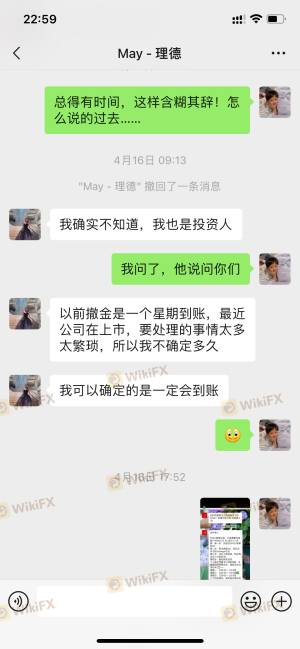

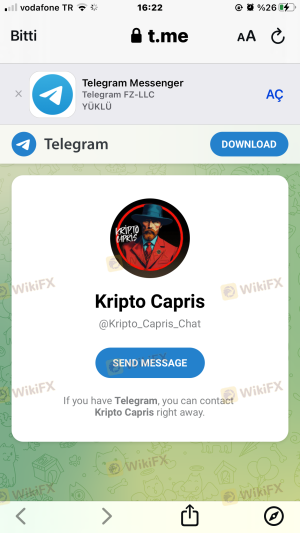

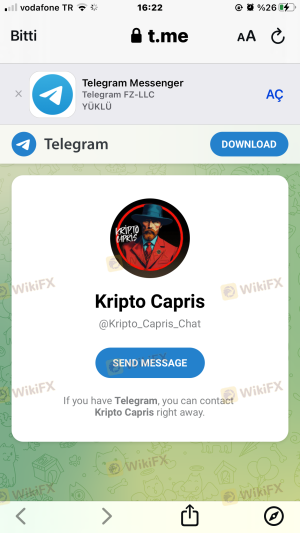

Hindi maalis @crypto_capris

Ang user na may pangalang @kripto_capris sa Twitter ay peke! Ang account ay para sa mga layuning pang-invest, Nag-invest ako sa ilalim ng pangalan na Crypto Exchange Mining, Hindi ko maipapalabas ang aking pera, walang katapusang proseso ng pagdedeposito, tulungan naman po

Hindi maalis

Hindi maalis Hindi maipapalabas ang pera

Mag-ingat kayo. Ako ay na-insulto at niloko dito, at nagdagdag na ng aking personal na impormasyon.

Hindi maalis

Hindi maalis Scam. Hindi makapag-withdraw.

Ang Go4rex ay isang scam, sila ay nang-aabuso sa mga taong nagdeposito ng 2,700 dolyar at ano ang nangyayari kapag sinasabi nila sa akin na kailangan kong magdeposito ng karagdagang 4,000 dolyar upang maipapalabas ang aking puhunan. At sinasabi nilang hindi nila maibabalik ang pera dahil hindi nila ito ginagawa. Ngunit sinabi ng entidad ng pamumuhunan na wala silang access sa aking account. Ngunit isinara nila ang mga operasyon na aking binuksan. Tulungan ninyo ako dito. Nagpautang ako upang kumita na nag-iisip na ang platapormang ito ay tutulong sa akin at hindi ganun ang nangyari. Gusto ko lamang makuha ang hindi bababa sa aking ini-deposito.

Panloloko

Panloloko Hindi ko maipapalabas ang aking pera.

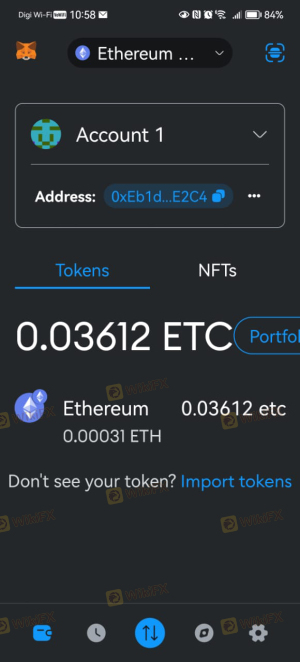

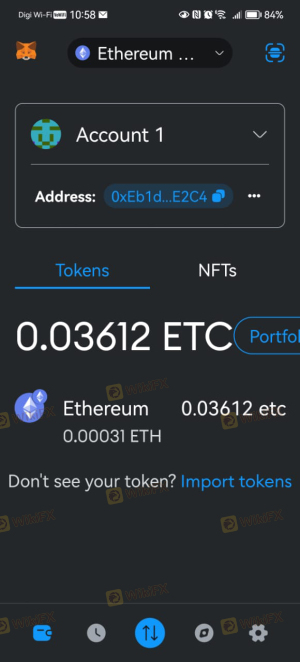

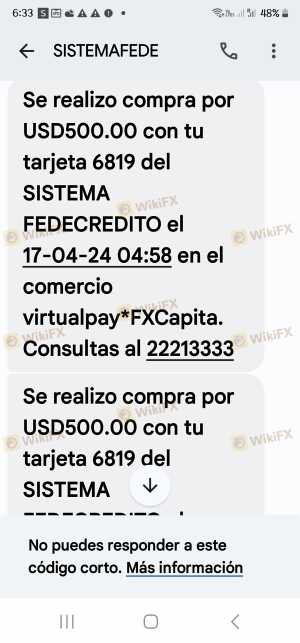

Invested ako sa Crypto Exchange Mining Company. Ang pera ko ay nasa cmtradingfx.com. Kapag gusto kong i-withdraw ang pera ko, hinihingan nila ako ng walang katapusang deposits. Walang refund para sa mga deposits, tulungan ninyo po ako. Ito ang mga manloloko: Crypto Exchange Mining, Cmtradingfx.com. Crypto capris, mga manloloko ito, pakiusap imbestigahan

Panloloko

Panloloko Ako ay na-scam ng isang pekeng transaksyon.

Panloloko. Ako ay niloko tulad ng ibang tao na niloloko.

tikk

tikk

Hindi maalis

Hindi maalis Tingnan ang pag-withdraw ng aking account

Isang buwan na mula nang hilingin ko ang pag-withdraw ng 3800 dolyar at nagbayad ako ng withdrawal fee na 350 dolyar ayon sa kahilingan ng network, ngunit hindi pa naaprubahan ang withdrawal mula sa aking account, pakisabi sa akin.

m2945

m2945

Hindi maalis

Hindi maalis Panloloko sa Pag-ibig

Ang scam na kumpanya ay papayagan kang magdeposito ng pera sa kanila, at sa huli sasabihin nila na ikaw ay naglalaba ng pera at i-freeze ang iyong account. Hinihiling din nila na mag-invest ka ng mas maraming pera upang ma-unblock ang iyong account.

MO5957

MO5957

Hindi maalis

Hindi maalis Ang Jppro ay isang scam, hindi pinapayagan ang pag-withdraw, at pag-aappropriation

Jprro, jppro.com ay nag-scam sa akin at inappropriately ang aking pera sa mt5 account: 401585, ang broker ay walang etika, at iniulat ko ang pandaraya na ito sa pulisya at mga institusyon sa pananalapi. sa buong mundo at sa Vietnam tungkol sa pag-appropriate ng pera, pandarayang pag-manipula ng mga presyo sa mt5, at pandaraya sa mga customer; Upang hindi na makapag-operate at magkaroon ng walang konsiyensiyang mga gawain ng pag-appropriate ng pera mula sa mga customer sa Vietnam, ang broker ay sinadyang kanselahin ang mga order ng pag-withdraw kapag ako ay nag-withdraw, tulad ng mayroong order ng pag-withdraw na 8000usd, 25000usd.. ang broker ay kanselasyon at hindi pinahihintulutan ang pag-withdraw. Pinapayagan ang mga tauhan ng broker na manggulo at magdulot ng pinsala sa mga trading customer. Ang pangyayaring ito ay nagdulot ng paghinto ng operasyon ng jppro sa Vietnam.

Ttc372

Ttc372Sentro ng Proteksyong Pangkarapatan

GUANGZHOU FINANCE

GUANGZHOU FINANCE

GUANGZHOU FINANCE

GUANGZHOU FINANCEAko ay na-scam ng isang pekeng transaksyon.

Panloloko. Ako ay niloko tulad ng ibang tao na niloloko.

Binary Global Profit

Binary Global Profit

Binary Global Profit

Binary Global ProfitTingnan ang pag-withdraw ng aking account

Isang buwan na mula nang hilingin ko ang pag-withdraw ng 3800 dolyar at nagbayad ako ng withdrawal fee na 350 dolyar ayon sa kahilingan ng network, ngunit hindi pa naaprubahan ang withdrawal mula sa aking account, pakisabi sa akin.

Cmtradingfx

Cmtradingfx

Cmtradingfx

CmtradingfxHindi ko maipapalabas ang aking pera.

Invested ako sa Crypto Exchange Mining Company. Ang pera ko ay nasa cmtradingfx.com. Kapag gusto kong i-withdraw ang pera ko, hinihingan nila ako ng walang katapusang deposits. Walang refund para sa mga deposits, tulungan ninyo po ako. Ito ang mga manloloko: Crypto Exchange Mining, Cmtradingfx.com. Crypto capris, mga manloloko ito, pakiusap imbestigahan

MiTRADE

MiTRADE

MiTRADE

MiTRADEHindi ako makakapag-withdraw ng pera dahil kailangan kong magbayad ng buwis sa aking personal na account.

Kapag sinusubukan mong mag-withdraw ng pera, hinihiling sa iyo na makipag-ugnayan sa isang kinatawan ng customer at hinihiling na magbayad ng buwis sa iyong personal na account. Sinabihan ako na hindi ko mababayaran ang prinsipal maliban kung ideposito ko ang pera sa aking personal na account. Sa oras ng withdrawal, mayroong pagsusuri para sa hindi malinaw na dahilan, at ang pagsusuri ay tinanggihan at hindi maaaring mag-withdraw. Hinihiling sa iyo na gamitin ang iyong personal na account para sa mga withdrawal at deposito. Mas mataas ang halaga, mas kaunti kang makakapag-withdraw ng pera. Mangyaring huwag itong gamitin.

XeOne

XeOne

XeOne

XeOneHindi maipapalabas ang pera

Mag-ingat kayo. Ako ay na-insulto at niloko dito, at nagdagdag na ng aking personal na impormasyon.

RIF-CAPITAL

RIF-CAPITAL

RIF-CAPITAL

RIF-CAPITALPanloloko sa Pag-ibig

Ang scam na kumpanya ay papayagan kang magdeposito ng pera sa kanila, at sa huli sasabihin nila na ikaw ay naglalaba ng pera at i-freeze ang iyong account. Hinihiling din nila na mag-invest ka ng mas maraming pera upang ma-unblock ang iyong account.

Doo Prime

Doo Prime

Doo Prime

Doo PrimeAng $998 kong pera ay hindi binayaran at hinarangan nila ang aking acco

Kumita ako sa 2 transaksyon at noong gusto kong i-withdraw ang aking pera, hindi makatarungang kinumpiska nila ang aking pera at pinagbawalan ang pag-access sa aking account. Hindi nila binabayaran ang 998 dollars ko. Ang lahat ay inaasahan mula sa naturang kumpanya na hindi man lang nagbabayad ng 998 dolyar. Gusto kong mabayaran nang madalian ang aking pera

GO4REX

GO4REX

GO4REX

GO4REXScam. Hindi makapag-withdraw.

Ang Go4rex ay isang scam, sila ay nang-aabuso sa mga taong nagdeposito ng 2,700 dolyar at ano ang nangyayari kapag sinasabi nila sa akin na kailangan kong magdeposito ng karagdagang 4,000 dolyar upang maipapalabas ang aking puhunan. At sinasabi nilang hindi nila maibabalik ang pera dahil hindi nila ito ginagawa. Ngunit sinabi ng entidad ng pamumuhunan na wala silang access sa aking account. Ngunit isinara nila ang mga operasyon na aking binuksan. Tulungan ninyo ako dito. Nagpautang ako upang kumita na nag-iisip na ang platapormang ito ay tutulong sa akin at hindi ganun ang nangyari. Gusto ko lamang makuha ang hindi bababa sa aking ini-deposito.

Gold Elephant Limited

Gold Elephant Limited

Gold Elephant Limited

Gold Elephant LimitedPandarayang kumpanya. Hindi makapag-withdraw.

Ang Gold Elephant ay isang mapanlinlang na kumpanya. Hindi makapag-withdraw. Hindi ako pinansin ng customer service.

Cmtradingfx

Cmtradingfx

Cmtradingfx

Cmtradingfx@crypto_capris

Ang user na may pangalang @kripto_capris sa Twitter ay peke! Ang account ay para sa mga layuning pang-invest, Nag-invest ako sa ilalim ng pangalan na Crypto Exchange Mining, Hindi ko maipapalabas ang aking pera, walang katapusang proseso ng pagdedeposito, tulungan naman po

XTrend Speed

XTrend Speed

XTrend Speed

XTrend SpeedAng pag-withdraw ay tinanggihan dahil sa patunay ng tirahan.

Kailangan nila ng patunay ng aking address na ibinigay ng aking kumpanya, kung hindi ay hindi gagawin ang pagbabayad. Ang aking address ay kinikilala ng gobyerno, mga bangko, atbp. Ngunit ang plataporma ay nangangailangan pa rin na patunayan ng kumpanya ang aking address, at kahit na ibigay ko ang sertipiko ng kumpanya, walang garantiya na maaari kong i-withdraw ang pera.

SQUAREDFINANCIAL

SQUAREDFINANCIAL

SQUAREDFINANCIAL

SQUAREDFINANCIALHindi ko ma-withdraw ang pera ko

Ang kumpanyang tinatawag na Squared ay kinuha ang aking pera at hindi ako binabayaran. Nagsimula akong mag-trade noong Martes-Miyerkules at lugi ako sa gold chart at nalulugi ako, pagkatapos ay walang problema, pagkatapos ay palagi akong lugi hanggang Biyernes, at sa Biyernes sa 15:30 o 16: 30 may data sa US, hindi ko alam, at biglang may tubo sa screen, kaya isinara ko ang mga transaksyon, at pagkatapos ay inakusahan nila ako ng mga sitwasyon na hindi ko maintindihan ang walang kapararakan, pinutol ang komunikasyon at kinumpiska ang aking pera . Hindi sila nakakatulong sa anumang paraan, sila ay opisyal na mga scammer! Kung magpapatuloy ang sitwasyong ito, ang aking mga reklamo sa mga nauugnay na lisensya at meta system ay magpapatuloy nang walang tigil

HERO

HERO

HERO

HEROAng broker ay tumakas. Ponzi scheme.

Ngayon hindi ako makapag-log in sa account. Hindi ma-withdraw ang pera sa loob nito. Tulungan nyo po ako. May paraan ba para ma-withdraw ang pera ko? Kahit kalahati lang nito.

Ridder Trader

Ridder Trader

Ridder Trader

Ridder TraderHindi makakapag-withdraw ng pondo

Huminto ang pagtitinda noong Abril at nag-apply ako para sa pag-withdraw. Minsan sinasabi na isang buwan ito, at minsan sinasabi na walang tiyak na panahon. Ngayon sinasabi sa tawag na tatagal ito ng 3 hanggang 6 na buwan. Wala akong masabi! Walang anunsyo bago ang paghinto ng pagtitinda. Walang paliwanag, at walang pag-asa para sa pag-withdraw...

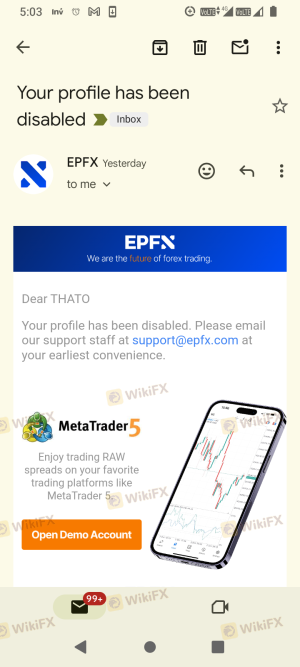

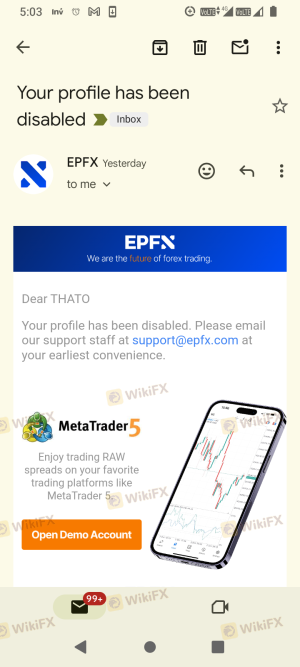

EPFX

EPFX

EPFX

EPFXNakain ang kita

Ang dealer na ito ay hindi nagbibigay ng magandang kapaligiran sa mga mangangalakal. Nang hindi ko ma-withdraw ang $45, humiling ako sa kanila na ayusin ang teknikal na problema, ngunit diretso na lang nila akong pinagbawalan. Isipin mo kung anong klaseng dealer ang kukuha ng $45 ng mga mangangalakal, talagang hindi etikal. Hindi ko talaga inirerekomenda sa sinuman ang gamitin ang platform na ito, ito ay isang hindi etikal na platform na ginagamit para sa money laundering.

JP PRO

JP PRO

JP PRO

JP PROAng Jppro ay isang scam, hindi pinapayagan ang pag-withdraw, at pag-aappropriation

Jprro, jppro.com ay nag-scam sa akin at inappropriately ang aking pera sa mt5 account: 401585, ang broker ay walang etika, at iniulat ko ang pandaraya na ito sa pulisya at mga institusyon sa pananalapi. sa buong mundo at sa Vietnam tungkol sa pag-appropriate ng pera, pandarayang pag-manipula ng mga presyo sa mt5, at pandaraya sa mga customer; Upang hindi na makapag-operate at magkaroon ng walang konsiyensiyang mga gawain ng pag-appropriate ng pera mula sa mga customer sa Vietnam, ang broker ay sinadyang kanselahin ang mga order ng pag-withdraw kapag ako ay nag-withdraw, tulad ng mayroong order ng pag-withdraw na 8000usd, 25000usd.. ang broker ay kanselasyon at hindi pinahihintulutan ang pag-withdraw. Pinapayagan ang mga tauhan ng broker na manggulo at magdulot ng pinsala sa mga trading customer. Ang pangyayaring ito ay nagdulot ng paghinto ng operasyon ng jppro sa Vietnam.

Tuklasin

FX1466364929

Pagsuri sa Patlang

EA

Tools Immortality

Pinakamababang kita sa nakaraang taon +120.00%

This tool is an indicator that can display the net value change graph of the account in historical time and the opening and closing positions and connection graphs of all historical orders.

USD 0.99 USD 980.00PagbiliMartin ForexWorld

Pinakamababang kita sa nakaraang taon +115.90%

Martin's strategy is mainly used in symbol market, mainly used in small period and shock market, keep trading back and forth, adding up.

USD 0.99 USD 980.00PagbiliComprehensive type Godness

Pinakamababang kita sa nakaraang taon +261.86%

Expect to enlarge the market;Even if the direction is wrong, you can set a stop loss.and you can solve the problem of inaccurate opening positions by adding several positions before the stop loss is reached.

USD 0.99 USD 980.00PagbiliTrend type Aberration

Pinakamababang kita sa nakaraang taon +173.36%

This is a classic CTA strategy, similar to the band line strategy, which makes a trend market and breaks through the shock range to buy. If the market continues to go, it will hold it until it goes long, falls below the midline of the band line, or closes short and rises above the middle rail of the band line.

USD 0.99 USD 280.00Pagbili

Listahan ng Ranggo

- Kabuuang Margin

- Pagraranggo ng Aktibo sa Trading

- Kabuuang Transaksyon

- ihinto ang rate

- Kumikitang Order

- Kakayahang kita ng Mga Broker

- Bagong Gumagamit

- Gastos ng pagkalat

- Gastos ng Rollover

- Ranggo ng Net Deposit

- Pagraranggo ng Net Withdrawal

- Pagraranggo ng Mga Aktibong Pondo

Kabuuang Margin

- 30 araw

- 90 na Araw

- 6 na buwan

- market istraktura ng Broker

- Kabuuang Asset%

- Pagraranggo

- 1

Exness

- 34.90

- --

- 2

XM

- 14.77

- --

- 3

FBS

- 6.51

- 1

- 4

FXTM

- 5.79

- 1

- 5

GMI

- 5.41

- --

- 6

Doo Prime

- 4.41

- --

- 7

TMGM

- 2.27

- 1

- 8

IC Markets

- 2.15

- 1

- 9

Vantage

- 1.52

- --

- 10

ZFX

- 0.93

- --

Pagraranggo ng Aktibo sa Trading

- 30 araw

- 90 na Araw

- 6 na buwan

- market istraktura ng Broker

- Rate ng pag-aktibo%

- Pagraranggo

- 1

Exness

- 59.26

- --

- 2

XM

- 49.44

- --

- 3

GMI

- 12.74

- --

- 4

FBS

- 12.39

- --

- 5

TMGM

- 9.06

- 2

- 6

IC Markets

- 6.95

- --

- 7

Doo Prime

- 6.08

- 1

- 8

FXTM

- 5.79

- 3

- 9

Vantage

- 2.75

- 2

- 10

ZFX

- 2.10

- 3

Kabuuang Transaksyon

- 30 araw

- 90 na Araw

- 6 na buwan

- market istraktura ng Broker

- Dami ng kalakalan%

- Pagraranggo

- 1

FBS

- 66.67

- --

- 2

Exness

- 21.48

- 1

- 3

IC Markets

- 18.00

- 1

- 4

FXTM

- 16.11

- 2

- 5

USGFX

- 15.77

- 3

- 6

Tickmill

- 9.92

- 1

- 7

GMI

- 5.06

- 11

- 8

TMGM

- 3.25

- 2

- 9

ZFX

- 1.37

- 3

- 10

XM

- 1.16

- 1

ihinto ang rate

- 30 araw

- 90 na Araw

- 6 na buwan

- market istraktura ng Broker

- ihinto ang rate%

- Pagraranggo

- 1

Alpari International

- 5.95

- 23

- 2

Forex Club

- 5.94

- 30

- 3

NCE

- 4.84

- 3

- 4

GKFX Prime

- 4.65

- 32

- 5

WeTrade

- 3.12

- 16

- 6

CPT Markets

- 2.98

- 1

- 7

ThinkMarkets

- 2.88

- 5

- 8

USGFX

- 2.08

- 5

- 9

GMI

- 1.96

- 2

- 10

Valutrades

- 1.59

- 13

Kumikitang Order

- 30 araw

- 90 na Araw

- 6 na buwan

- market istraktura ng Broker

- Kabayaran ng panalo%

- Pagraranggo

- 1

FBS

- 12.38

- 4

- 2

TMGM

- 4.64

- 1

- 3

IC Markets

- 1.56

- 3

- 4

Pepperstone

- 1.25

- 15

- 5

ZFX

- 0.95

- 4

- 6

AvaTrade

- 0.28

- 5

- 7

CWG Markets

- 0.27

- 3

- 8

EightCap

- 0.23

- 34

- 9

Vantage

- 0.18

- 29

- 10

RockGlobal

- 0.15

- 3

Kakayahang kita ng Mga Broker

- 30 araw

- 90 na Araw

- 6 na buwan

- market istraktura ng Broker

- Kabuuang kita%

- Pagraranggo

- 1

XM

- 33.27

- 47

- 2

GMI

- 8.70

- --

- 3

Doo Prime

- 5.35

- 3

- 4

Axitrader

- 4.14

- 42

- 5

VT Markets

- 2.54

- 2

- 6

CXM Trading

- 1.59

- 1

- 7

FXTM

- 1.22

- 6

- 8

CPT Markets

- 0.30

- 25

- 9

ACY Securities

- 0.12

- 2

- 10

Tickmill

- 0.08

- 2

Bagong Gumagamit

- 30 araw

- 90 na Araw

- 6 na buwan

- market istraktura ng Broker

- Halaga ng paglago%

- Pagraranggo

- 1

Exness

- 17.92

- --

- 2

XM

- 17.76

- --

- 3

FXTM

- 4.49

- --

- 4

FBS

- 4.47

- 2

- 5

GMI

- 4.07

- --

- 6

IC Markets

- 3.93

- 2

- 7

TMGM

- 3.16

- --

- 8

Doo Prime

- 2.47

- --

- 9

FXTRADING.com

- 1.22

- --

- 10

Vantage

- 1.12

- --

Gastos ng pagkalat

- 30 araw

- 90 na Araw

- 6 na buwan

- market istraktura ng Broker

- Average na Pagkalat

- Pagraranggo

- 1

XM

- 19.64

- 1

- 2

Exness

- 17.17

- 1

- 3

FBS

- 5.60

- 1

- 4

GMI

- 4.93

- 1

- 5

TMGM

- 3.70

- 2

- 6

IC Markets

- 2.82

- 1

- 7

FXTM

- 2.18

- 1

- 8

Doo Prime

- 2.06

- --

- 9

FXTRADING.com

- 1.23

- --

- 10

Vantage

- 0.95

- --

Gastos ng Rollover

- 30 araw

- 90 na Araw

- 6 na buwan

- market istraktura ng Broker

- Wala

- Pagraranggo

- 1

Exness

- 435.35

- --

- 2

XM

- 72.86

- --

- 3

FBS

- 33.42

- 39

- 4

FXDD

- 21.59

- 32

- 5

RockGlobal

- 9.45

- 29

- 6

ZFX

- 3.17

- 2

- 7

Pepperstone

- 3.02

- 13

- 8

Swissquote

- 2.34

- 5

- 9

Doo Prime

- 2.17

- 21

- 10

USGFX

- 1.50

- 7

Ranggo ng Net Deposit

- 30 araw

- 90 na Araw

- 6 na buwan

- market istraktura ng Broker

- Kabuoang na Deposit%

- Pagraranggo

- 1

MultiBank Group

- 94.26

- 40

- 2

AvaTrade

- 76.97

- 2

- 3

VT Markets

- 76.71

- 14

- 4

Vantage

- 74.64

- 1

- 5

EightCap

- 72.29

- 2

- 6

FxPro

- 71.98

- 2

- 7

TMGM

- 71.92

- 22

- 8

CWG Markets

- 71.60

- 3

- 9

Alpari International

- 71.43

- 3

- 10

CXM Trading

- 71.28

- 13

Pagraranggo ng Net Withdrawal

- 30 araw

- 90 na Araw

- 6 na buwan

- market istraktura ng Broker

- Kabuoang na Withdraw%

- Pagraranggo

- 1

Exness

- 7.00

- --

- 2

Doo Prime

- 7.00

- 3

- 3

GO MARKETS

- 7.00

- --

- 4

Valutrades

- 8.00

- --

- 5

FBS

- 10.00

- 2

- 6

ThinkMarkets

- 11.00

- 4

- 7

Axitrader

- 12.00

- 9

- 8

ACY Securities

- 12.00

- 16

- 9

AvaTrade

- 13.00

- 1

- 10

IC Markets

- 13.00

- --

Pagraranggo ng Mga Aktibong Pondo

- 30 araw

- 90 na Araw

- 6 na buwan

- market istraktura ng Broker

- Rate ng pag-aktibo%

- Pagraranggo

- 1

FXDD

- -0.60

- --

- 2

FXCM

- -0.80

- 4

- 3

AUS GLOBAL

- -0.86

- 1

- 4

GMI

- -0.95

- --

- 5

Doo Prime

- -1.36

- 2

- 6

FXPRIMUS

- -1.50

- --

- 7

FOREX.com

- -1.50

- 1

- 8

AvaTrade

- -2.56

- --

- 9

HYCM

- -2.60

- 2

- 10

Just2Trade

- -2.90

- --

Real-time na paghahambing ng spread EURUSD

- Mga broker

- Mga Account

- Bumili

- Ibenta

- Kumalat

- Average na spread/araw

- Long Position Swap USD/Lot

- Maikling Posisyon Swap USD/Lot

Upang tingnan ang higit pa

Mangyaring i-download ang WikiFX APP

Mas Malaman at Masisiyahan pa