Company Summary

| CFI Review Summary in 10 Points | |

| Founded | 1998 |

| Registered Country/Region | Cyprus |

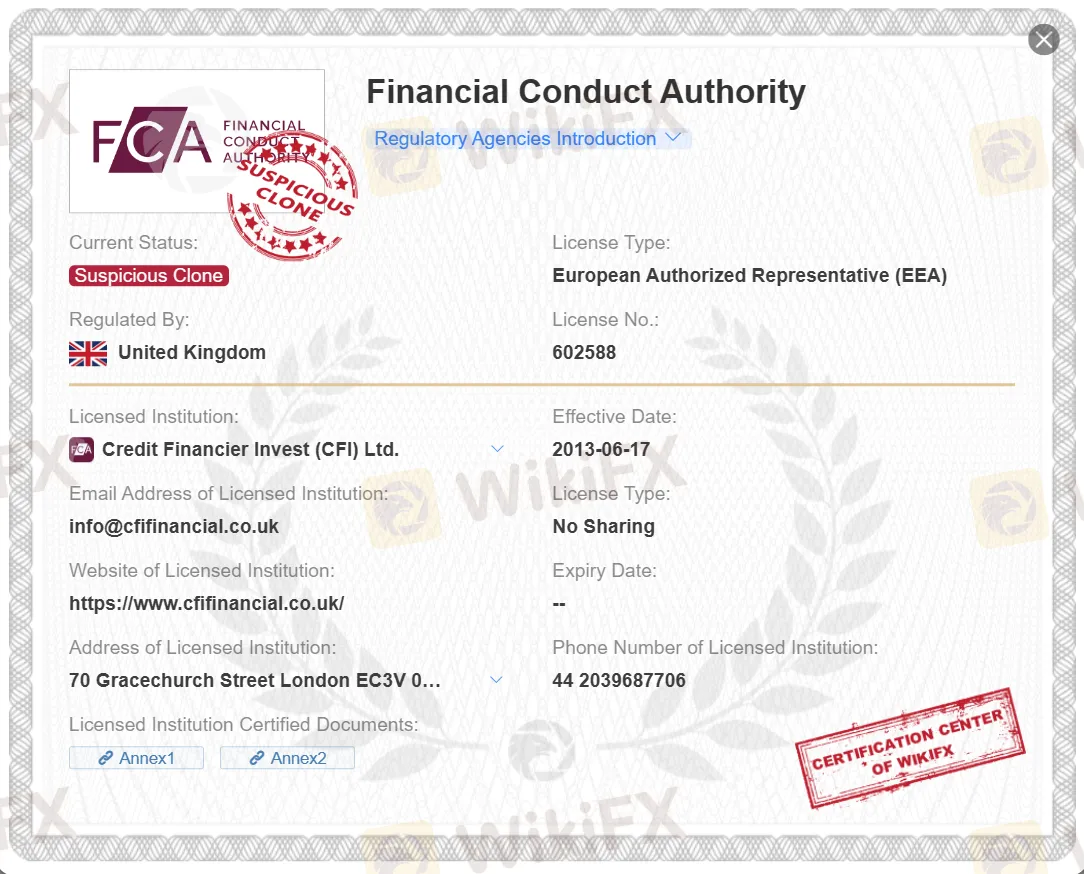

| Regulation | CYSEC regulated, suspicious FCA clone |

| Market Instruments | Forex, Indices, Equities, Commodities, ETFs |

| Demo Account | Available |

| Leverage | Up to 1:400 |

| EUR/USD Spread | Start from 0.0 pips |

| Trading Platforms | MT5, cTrader |

| Minimum Deposit | 0 |

| Customer Support | Email, Address, Phone, FAQ, Live chat, Social media |

What is CFI?

CFI, a brokerage firm based in Cyprus with operations spanning London, Seychelles, Larnaca, Dubai, Amman, Beirut, Port Louis, and Cairo, delivers multiple market instruments including Forex, Indices, Equities, Commodities, and ETFs to its traders. Despite holding a Market Making (MM) license number 179/12 from CYSEC (Cyprus Securities and Exchange Commission)—it lends some credibility, the firm's suspicious clone FCA (Financial Conduct Authority) license no. 602588 raises safety and trustworthiness concerns for traders.

In the subsequent discussion, we will dissect the traits of this broker from various perspectives, delivering information that is concise and structured. If this interests you, we encourage you to continue reading. A succinct summary will be provided at the conclusion of the article, allowing you a quick overview of the broker's distinct attributes.

Pros & Cons

| Pros | Cons |

| • Wide range of trading instruments across multiple asset classes | • Suspicious FCA clone |

| • MT5 trading platforms | • Not accept clients from some countries |

| • Low starting spread | |

| • Zero commissions for All Inclusive Account | |

| • Rich educational resources for traders of all levels | |

| • Demo account available | |

| • No minimum deposit requests | |

| • No deposit and withdrawal fees |

CFI provides a wide array of advantages for its clients. It offers a broad spectrum of trading instruments across multiple asset classes and utilizes the esteemed MT5 trading platform. The firm boasts low starting spread from 0.0 pips, coupled with zero commissions for those who use the All-Inclusive Account. The firm's rich educational resources, available for traders of all levels, and the option to use a demo account further add to its appeal. The firm also has no minimum deposit request and incurs no fees for deposits and withdrawals.

However, it does have a few disadvantages. There are suspicions surrounding a cloned FCA license, which can raise concerns about trustworthiness. Additionally, CFI does not accept clients from certain countries, which can limit its reach and accessibility.

Is CFI Safe or Scam?

When considering the safety of a brokerage like CFI or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: CFI possesses a Market Making (MM) license with number 179/12 from CYSEC (Cyprus Securities and Exchange Commission), implying a positive regulatory standing. However, suspicion surrounds its FCA (Financial Conduct Authority) license no. 602588, believed to be a clone, which carries implications that the platform's safety for trading cannot be ensured.

User feedback: View feedbacks and opinions from the brokers previous clients to understand their interactions with the brokerage. Be sure to conduct this review search on trustworthy websites and online forums.

Security measures: So far we cannot find any security measures info on Internet for this broker.

Ultimately, the decision of whether or not to trade with CFI is a personal one. You should weigh the risks and benefits carefully before making a decision.

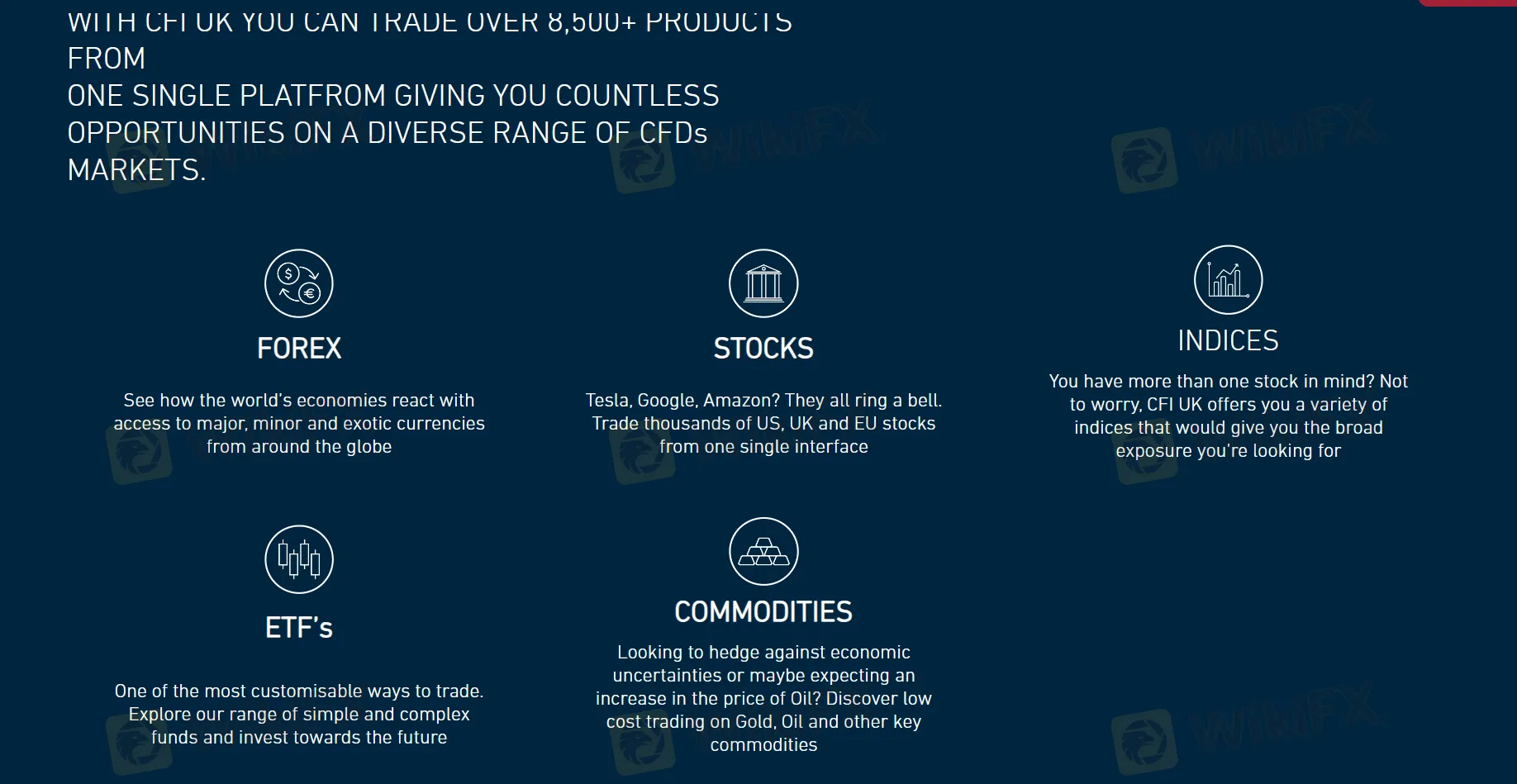

Market Instruments

CFI provides a range of market instruments to cater to diverse investment needs.

Firstly, it proffers Forex trading, enabling clients to participate in the dynamic foreign exchange market, which is marked by high liquidity and allows for trading in different currency pairs.

Secondly, the Indices offering allows traders to speculate on price movements in particular stock indices, simultaneously exposing them to an array of companies within a particular market.

Furthermore, CFI offers Equities as a part of its arsenal, providing customers the option to invest in public company shares and become a part of the company's ownership.

Fourthly, it offers traders the opportunity to trade Commodities, such as oil, gold, and other raw materials, popular for their potential as a hedge against inflation.

Finally, CFI offers ETFs, which are investment funds traded on stock exchanges, offering investors a way to pool their money in a variety of investments, duly catering to a spectrum of risk appetites and investment goals.

Account Types

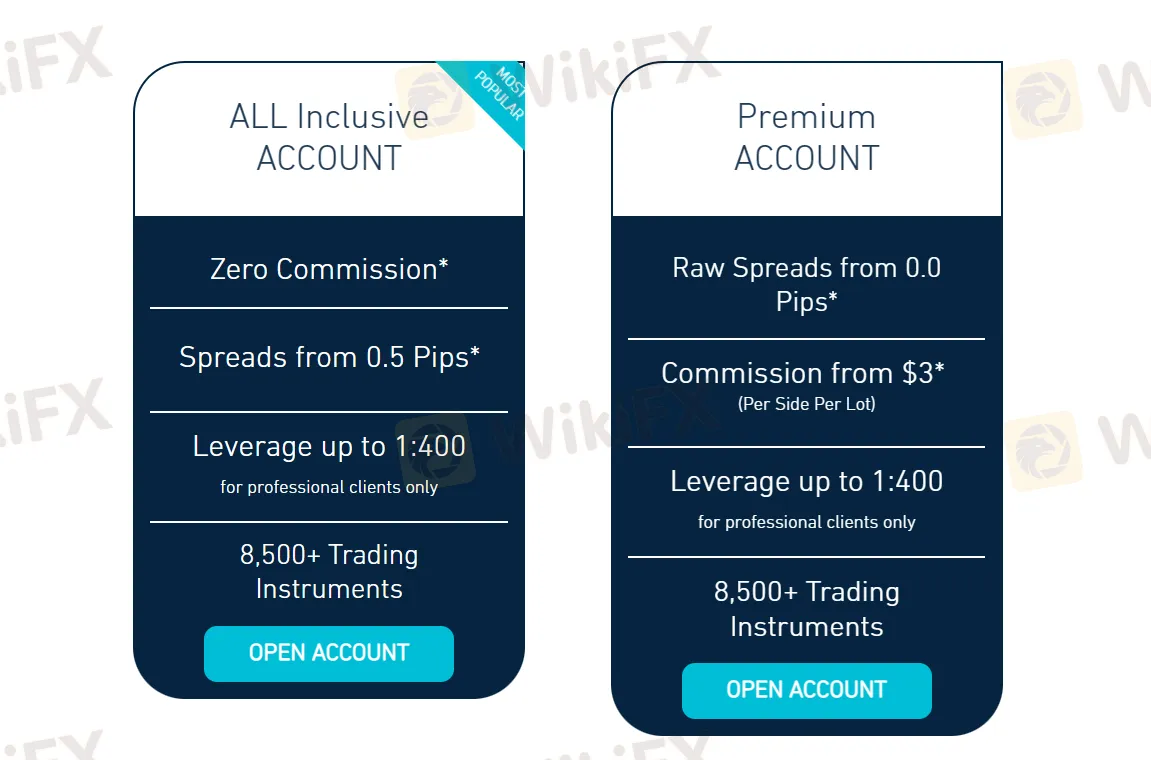

CFI caters to a range of traders with differing needs and experiences by offering several types of accounts.

The Demo Account allows beginners or those wishing to test the platform to engage in risk-free trading with virtual funds.

The All Inclusive Account is designed for both retail and professional traders, offering unimpeded access to all platforms, services, and trading instruments provided by CFI without mandating a minimum deposit.

The Premium Account is intended for more experienced, serious traders and comes with additional benefits and features, enhancing trading experience.

Leverage

CFI offers the benefit of leverages reaching up to 1:400 to its clients. Leverage is a potent tool enabling traders to manage larger market positions with comparatively less capital. Therefore, with a leverage ratio of 1:400, clients can significantly expand their trading position, thereby possibly inflating both their profits and losses.

Greater leverage can augment trading prospects, but it also heightens risk owing to potentially larger swings in account balances triggered by market variations. Therefore, traders should resort to leverage trading only after comprehensive comprehension of associated risks, and practice diligent risk management strategies.

Spreads & Commissions

CFI offers two unique live account types tailored to different trading styles.

The All-Inclusive Account features spreads from as low as 0.5 pips with the advantage of zero commission, making it an attractive option for cost-conscious traders who prefer transparency in trading costs.

On the other hand, the Premium Account offers ultra-tight spreads starting from 0.0 pips. Despite featuring a commission from $3 per side per lot, it provides a highly competitive pricing environment for high-volume and experienced traders, creating a balance between lower spreads and associated trading costs.

Trading Platforms

CFI provides its clients with two technologically advanced trading platforms, MT5 and Ctrader. Both these platforms are designed for flexibility and accessibility, available to use on multiple devices including Desktop, Web, iOS, and Android versions.

Their advanced trading features and analytical tools give enhanced control over trading strategies, while their multi-platform availability ensures traders enjoy the mobility of trading anytime, anywhere. Whether its the MetaTrader 5 (MT5) known for its in-depth analytic capabilities or CTrader popular for its user-friendly interface and sophisticated tools, it's the cross-platform accessibility that truly enhances trading experience by acknowledging the diverse needs of modern traders for flexibility and convenience.

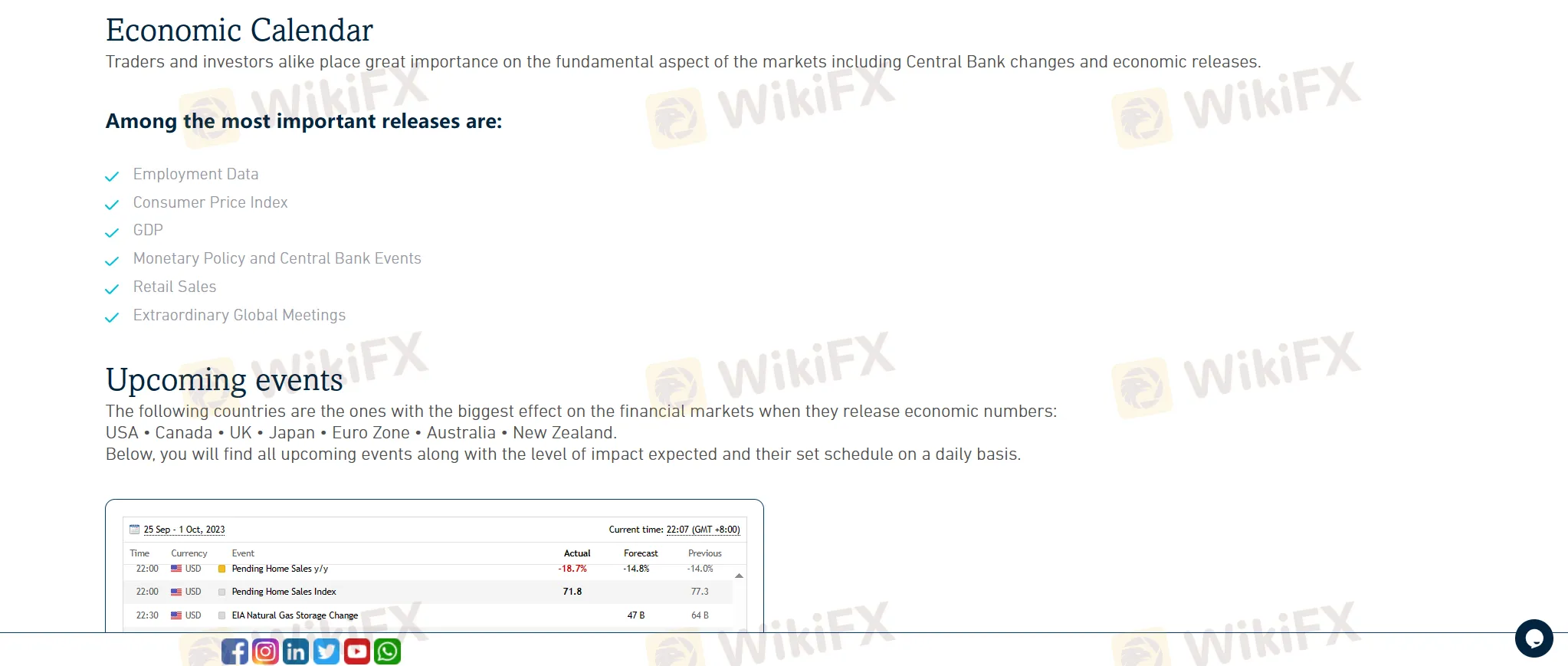

Trading Tools

CFI provides an economic calendar as one of its key trading tools, enabling traders to keep track of important economic events that may influence the markets. This calendar provides detailed information on upcoming macroeconomic events, earnings release schedules, central bank meetings, and more. The data is accurately timed and thoroughly explained for easy comprehension, making it a dependable guide for any serious trader. This tool can be invaluable in preparing trading strategies because significant economic indicators often result in market volatility.

Besides, CFI also provides Analytical Trading, an advanced trading tool that uses technical, fundamental and quantitative analysis, aiding traders in making well-informed decisions and predicting future market trends.

Deposits & Withdrawals

CFI offers various deposit and withdrawal methods to its clients aimed at convenience and flexibility.

For deposits, two options are available. The Bank Wire method imposes no minimum deposit amount and allows for an unlimited maximum deposit. It's important to note that CFI UK does not apply any fees on this, but charges may be incurred from the corresponding bank used. The second option is via debit/credit cards (Visa/Mastercard), which permits up to $10,000 per transaction with no minimum deposit amount. The advantage is that CFI imposes zero fees for these card transactions.

As for withdrawals, clients can use wire transfer. The processing time typically ranges between 2-5 working days, depending on the correspondent bank. While CFI UK does not apply any fees on its end, potential charges may be levied by the correspondent banks.

| Deposit method | Maximum deposit amount* | Minimum deposit amount | Fees |

| Bank wire | unlimited | no minimum | CFI UK does not apply any fees, charges are up to the corresponding Bank used |

| Debit/Credit Card via Visa/Master card | $ 10,000 per transact | no minimum | Zero fees |

| Withdrawal method | Minimum withdrawal amount | Time frame | Fees |

| Wire transfer | - | 2-5 working days depending on your correspondent bank | CFI UK does not apply any fees, charges are up to the corresponding Bank used. |

| Visa and Mastercard | - | 1-14 working days | Zero fees |

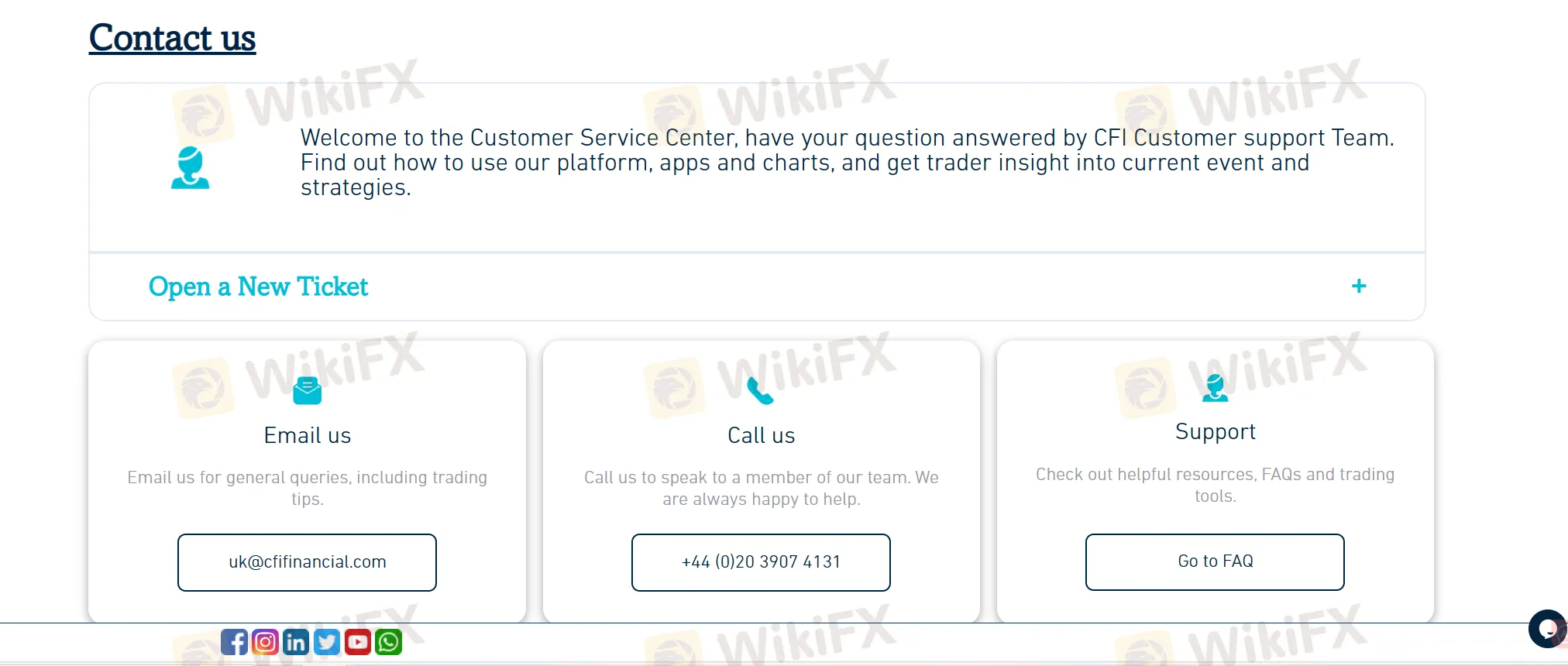

Customer Service

CFI offers an array of channels for customer support, ensuring hassle-free communication.

Clients can reach the support team through a variety of methods ranging from traditional Email and Phone to more modern approaches such as Live Chat and Social media such as Facebook, Linkedin, Twitter, WhatApp, Instagram and YouTube.

Additionally, a physical address is provided for those who prefer direct contact.

Email: uk@cfifinancial.com.

Phone: +44 (0)20 3907 4131.

Location: 16 Berkeley St, London W1J 8DZ, United Kingdom.

An online FAQ section is also available 24/7 for customers to quickly find general information or answers to commonly asked questions.

Education

CFI is committed to providing a wealth of educational resources to its clients. This includes Webinars that offer in-depth insights into various aspects of trading. Their Trading Blog contains analytical articles, market predictions and expert opinions. Educational articles on the platform cover a broad spectrum of trading related topics, offering valuable knowledge. The Glossary of Terms is an indispensable tool for traders to understand complex financial jargons. Last but not the least, their Educational videos provide visual and easy-to-understand tutorials for traders at all levels.

Conclusion

Based on information gathered, CFI is a Cyprus-based brokerage firm offering various market instruments including Forex, Indices, Equities, Commodities, and ETFs to traders.

Despite holding a Market Making (MM) license number 179/12 issued by CYSEC (Cyprus Securities and Exchange Commission) which adds a level of credibility, there is a raised concern due to the purported clone FCA (Financial Conduct Authority) license no. 602588 under its name.

Consequently, traders contemplating CFI as their brokerage firm should exercise due diligence and should consider exploring other regulated brokerage options that uphold transparency, security, and accountability.

Frequently Asked Questions (FAQs)

| Q 1: | Is CFI regulated? |

| A 1: | Yes. It has been verified that this broker is currently under CYSEC regulation. |

| Q 2: | What kind of trading instruments does CFI offer? |

| A 2: | CFI offers Forex, Indices, Equities, Commodities, ETFs as market instruments to traders. |

| Q 3: | Is CFI a good broker for beginners? |

| A3: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of the lack of transparency and limited customer support channels. |

| Q 4: | Does CFI offer the industry leading MT4 & MT5? |

| A 4: | Yes, it offers MT5 platform on web, windows, iOS and Android devices. |

| Q 5: | What is the minimum deposit for CFI? |

| A 5: | The minimum initial deposit to open an account is $ 0. |

| Q 6: | At CFI, are there any regional restrictions for traders? |

| A 6: | Yes. CFI does not currently offer our investment /ancillary services to residents of certain jurisdictions such as but not only USA, Sudan, Syria, Republic of Korea and Belgium. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Sarre

United States

Ease of cross-currency trading is a plus, but the minimum deposit requirement is a barrier for new traders. Hoping for more accessibility.

Neutral

A&~

Vietnam

been with CFI recently, mainly for their broad market access and super low spreads. So far, the platform's been slick and easy to handle. But, I'm keeping an eye on the chatter about their licensing issues—it's something to watch out for

Neutral

FX1670584849

Cyprus

I don't have any complain about the company, honestly I have done deposit and withdrawal many time, not any issue and I have received my withdrawals on time instantly, this my own and honest experience with CFI

Positive

阿权

Morocco

CFI is a regulated trading broker that offers a variety of trading tools and platforms, including Forex, Stocks, Commodities, Cryptocurrencies, and many more. The platform's website is clearly designed to be simple and easy to use, while also providing a variety of trader education and market analysis resources to help traders improve their skills and knowledge. The customer service team is also responsive and can respond to customer questions and needs in a timely manner.

Positive

是筱娜娜呀

Cambodia

Unexpectedly, large trading volumes are required to use its zero-commission account. I want to leave but they refused and kept asking me to put more money. Jesus!

Neutral