Overview of Axim Trade

Axim Trade is a forex broker that was founded in 2020 and is registered in Saint Vincent and the Grenadines. The broker offers a range of account types, including Cent, Standard, ECN, Infinite, which cater to traders with different needs and experience levels. Trading leverage can go up to an unlimited level, allowing traders to potentially amplify their profits, though it's important to note that higher leverage also increases the risk of losses.

In terms of trading platforms, Axim Trade offers the popular MetaTrader 4 platform, which is known for its user-friendly interface and advanced trading tools. Traders can access the platform via desktop, web, and mobile devices, giving them flexibility and convenience in managing their trades.

Axim Trade also provides limited educational resources and trading tools to help traders make informed decisions. Customer support can be reached 24/5 through a phone number and email address for customer inquiries, as well as a live chat.

Is Axim Trade legit or a scam?

Axim Trade is an unregulated broker that is registered in Saint Vincent and the Grenadines, a place that has relatively loose regulations on forex trading. Although the lack of regulation does not necessarily make a broker a scam. However, traders should always exercise caution when dealing with unregulated brokers.

In terms of Axim Trade specifically, there have been some red flags raised by traders in the online community. Some have reported issues with withdrawals, while others have claimed that the broker engages in unethical business practices. Additionally, the lack of regulation and oversight can make it difficult for traders to have their complaints addressed.

Pros and Cons of Axim Trade

Here we've compiled a comprehensive list of the pros and cons of this broker to help you make an informed decision.Axim Trade offers a variety of account types to suit different trading styles, and they also provide high leverage options for experienced traders looking to maximize their profits. Their trading platforms are user-friendly and come equipped with advanced charting tools and technical indicators.

However, it's important to note that Axim Trade is not regulated, which may pose a risk to your investments. Their customer support is not available 24/7 and their educational resources are limited compared to other brokers. Additionally, their withdrawal process may take longer than expected.

Market Intruments

Axim Trade offers a diverse range of market instruments for its clients to trade, including forex currency pairs, precious metals such as gold and silver, energy commodities like crude oil and natural gas, global stock indices such as the S&P 500 and NASDAQ, popular cryptocurrencies like Bitcoin and Ethereum, and a variety of individual stocks and commodities from around the world.

Forex: Axim Trade offers a wide range of forex currency pairs for trading, including major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic currency pairs such as AUD/NZD, USD/TRY, and EUR/HUF.

Metals: Trading precious metals such as gold and silver is also available on Axim Trade's platform. This includes spot trading as well as futures contracts on these metals.

Energies: Axim Trade provides access to energy markets through CFDs (contracts for difference) on crude oil and natural gas. This allows traders to speculate on the price movements of these commodities without having to own the physical assets.

Indices: Axim Trade offers CFDs on a range of global stock market indices, including the S&P 500, Dow Jones, and NASDAQ in the US, the FTSE 100 in the UK, and the Nikkei 225 in Japan.

Cryptocurrency: In addition to traditional markets, Axim Trade also allows traders to access the exciting world of cryptocurrencies. You can trade major cryptocurrencies like Bitcoin, Ethereum, and Litecoin, as well as many other altcoins.

Stocks: With Axim Trade, you can trade stocks from some of the world's biggest companies. This includes companies listed on major stock exchanges such as the NYSE, NASDAQ, and London Stock Exchange.

Commodities: Finally, Axim Trade offers CFDs on a range of other commodities, including agricultural products such as wheat, corn, and soybeans, as well as industrial metals like copper and zinc.

Account Types

With Axim Trade, traders have the option to choose from four different types of trading accounts. For those who are just starting out or prefer to keep their initial investment small, the cent account may be the perfect fit with its minimum deposit requirement of just $1. The standard account also has a low minimum deposit of $1 but offers a wider range of trading instruments and features. The ECN account, with a minimum deposit of $50, offers tighter spreads and direct access to liquidity providers. For high-volume traders or those looking for exclusive benefits, the Infinite account may be the way to go with its personalized trading conditions and VIP support.

How to open an account?

Opening an account with Axim Trade is easy and straightforward.All you need to do is visit their website and click on the “CREATE PROFILE” button.

From there, you will be taken to a registration page where you will be required to provide your personal information, including your full name, email address, and phone number.

Once you have completed the registration process, you will need to verify your account by submitting the necessary documents, such as a valid ID and proof of address. After your account is verified, you can start funding it and begin trading.

Leverage

Leverage is a crucial factor in forex trading, and Axim Trade provides flexible leverage options to its clients. The leverage offered by Axim Trade ranges from 1:1000 to unlimited, depending on the trading account type.

For the Cent and Standard account types, the leverage is up to 1:1000, and 1:2000 respectively, which means that traders can open positions up to 1000 times or 2000 times the value of their account balance. For the ECN account type, the leverage is up to 1:1000. The Infinite account type, on the other hand, provides unlimited leverage, which allows traders to open positions of any size, even beyond their account balance.

While high leverage can increase the potential profit, it also amplifies the risk. Therefore, it is important to use leverage wisely and always keep in mind the potential risks involved in trading with high leverage. Axim Trade also provides margin calls and stop out levels to help manage risk, which will automatically close positions if the account equity falls below a certain level.

Spreads & Commissions (Trading Fees)

When it comes to trading, spreads and commissions are crucial factors that traders consider before choosing a broker. At Axim Trade, traders have the advantage of flexible spreads and low commissions. The broker offers competitive spreads that vary depending on the trading account type. For example, the Cent account and Standard account have floating spreads starting from 1.0 pips, while the ECN account has the tightest spreads, starting from 0 pips, and charges commissions ranging from $3 per lot.

Non-Trading Fees

Axim Trade charges some non-trading fees, not limited to deposit and withdrawal fees, inactivity fees, and currency conversion fees.

Regarding the deposit and withdrawal fees, Axim Trade supports a wide range of payment methods including bank transfers, credit cards, and e-wallets. Deposits are generally free of charge, while withdrawals may incur some fees depending on the payment method used. For example, a bank transfer withdrawal fee is $35, a credit card withdrawal fee is 3.5% of the amount, and an e-wallet withdrawal fee ranges from 0.5% to 3% of the amount.

In terms of account inactivity fees, Axim Trade charges $50 per month for accounts that have been inactive for more than 90 days. This fee is relatively high compared to other brokers in the industry.

As for currency conversion fees, Axim Trade charges a fixed fee of 2% for all currency conversions. This fee can add up over time, especially for traders who frequently trade different currency pairs.

Trading Platform

Axim Trade offers two trading platforms for its clients: MetaTrader 4 (MT4) and a mobile app. MT4 is a widely recognized platform in the forex industry and is known for its advanced charting capabilities, technical analysis tools, and customizable interface. It is available for download on desktops, laptops, and mobile devices.

In addition to the desktop MT4 platform, Axim Trade also offers a mobile app that is available for both iOS and Android devices. The mobile app allows clients to access their trading accounts on-the-go, monitor their positions, view charts, and execute trades directly from their smartphones or tablets.

Both the MT4 platform and the mobile app are user-friendly and provide a seamless trading experience for clients. With the MT4 platform, clients can also access a vast library of indicators, automated trading strategies, and other add-ons to enhance their trading experience.

Copy Trading

Axim Trade offers a copy trading service for its clients, which allows them to automatically replicate the trades of other successful traders in real-time. This service is known as “Axim Socia,” and it is available through the MetaTrader 4 platform.

To use Axim Socia, clients can browse a list of available signal providers, view their historical performance, and select which providers they want to follow. Once a provider is selected, all of their trades are automatically copied to the client's account.

One of the main benefits of copy trading is that it allows less experienced traders to benefit from the expertise of more seasoned traders. It can also be a useful tool for busy traders who don't have the time to closely monitor the markets themselves.

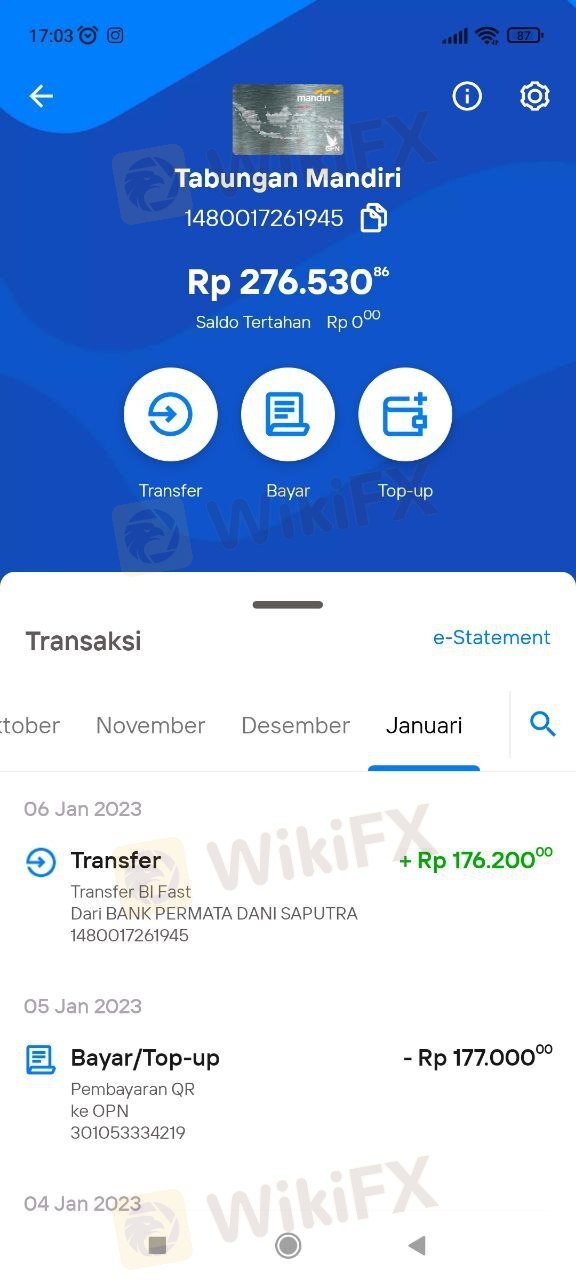

Deposits & Withdrawals

Axim Trade offers various payment methods for both deposits and withdrawals, including bank transfer, credit/debit cards, and e-wallets such as Skrill, Neteller, and Perfect Money. The minimum deposit amount for all account types is $1, and there are no deposit fees charged by Axim Trade. However, depending on the payment method used, there may be additional fees charged by the payment processor.

Withdrawal

For withdrawals, Axim Trade processes requests within 24 hours, and the time it takes for the funds to reach the client's account depends on the payment method used. Withdrawals via e-wallets and credit/debit cards are usually processed within 1-2 business days, while bank transfers may take up to 5 business days. There are no withdrawal fees charged by Axim Trade, but similar to deposits, there may be additional fees charged by the payment processor.

Please note Axim Trade only allows withdrawals to be made using the same payment method that was used to make the deposit, up to the deposited amount. Additionally, Axim Trade does not accept third-party payments, which means that clients can only withdraw funds from their own personal accounts.

Customer Support

Axim Trade offers several options for contacting support, including live chat, email, and phone support. Customer support is available 24/5, Monday through Friday, in multiple languages, including English, Spanish, Russian, and Chinese.

However, the lack of a FAQ section on Axim Trade's website could potentially make it difficult for traders to quickly find answers to their questions. Without a FAQ section, traders may need to contact customer support for even basic inquiries, which can be time-consuming and frustrating.

Conclusion

Axim Trade is a Forex and CFD broker that offers a wide range of trading instruments and account types, along with competitive trading conditions such as high leverage, and low minimum deposits . The broker provides access to the popular MT4 trading platform and a mobile app for traders on-the-go. However, it is important to note that Axim Trade is an offshore and unregulated broker, which may not be suitable for all traders. Additionally, limited educational resources and customer support may also be a drawback for some. Traders should carefully consider their options before deciding to trade with Axim Trade or any other broker.

FAQs

A: Axim Trade offers four types of trading accounts: Cent, Standard, ECN, and Infinite.

A: The minimum deposit requirement varies depending on the account type. For the Cent and Standard accounts, the minimum deposit is $1. For the ECN account, the minimum deposit is $50, and for the Infinite account, the minimum deposit is $1.

A: Axim Trade offers a wide range of trading instruments, including forex, metals, energies, indices, cryptocurrencies, stocks, and commodities.

A: Axim Trade offers leverage ranging from 1:1000 to unlimited, depending on the account type and trading instrument.

A: Axim Trade offers the popular MetaTrader 4 (MT4) trading platform and a mobile app for Android and iOS devices.

A: Axim Trade charges non-trading fees, including withdrawal fees, inactivity fees, and swap fees.

A: Yes, Axim Trade offers a copy trading service called AximSocial, which allows traders to copy the trades of other traders.

A: Axim Trade accepts a variety of deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets such as Skrill and Neteller.

A: Axim Trade offers customer support via email, phone, and live chat, 24/5.

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX