Company Summary

| eonefxReview Summary | |

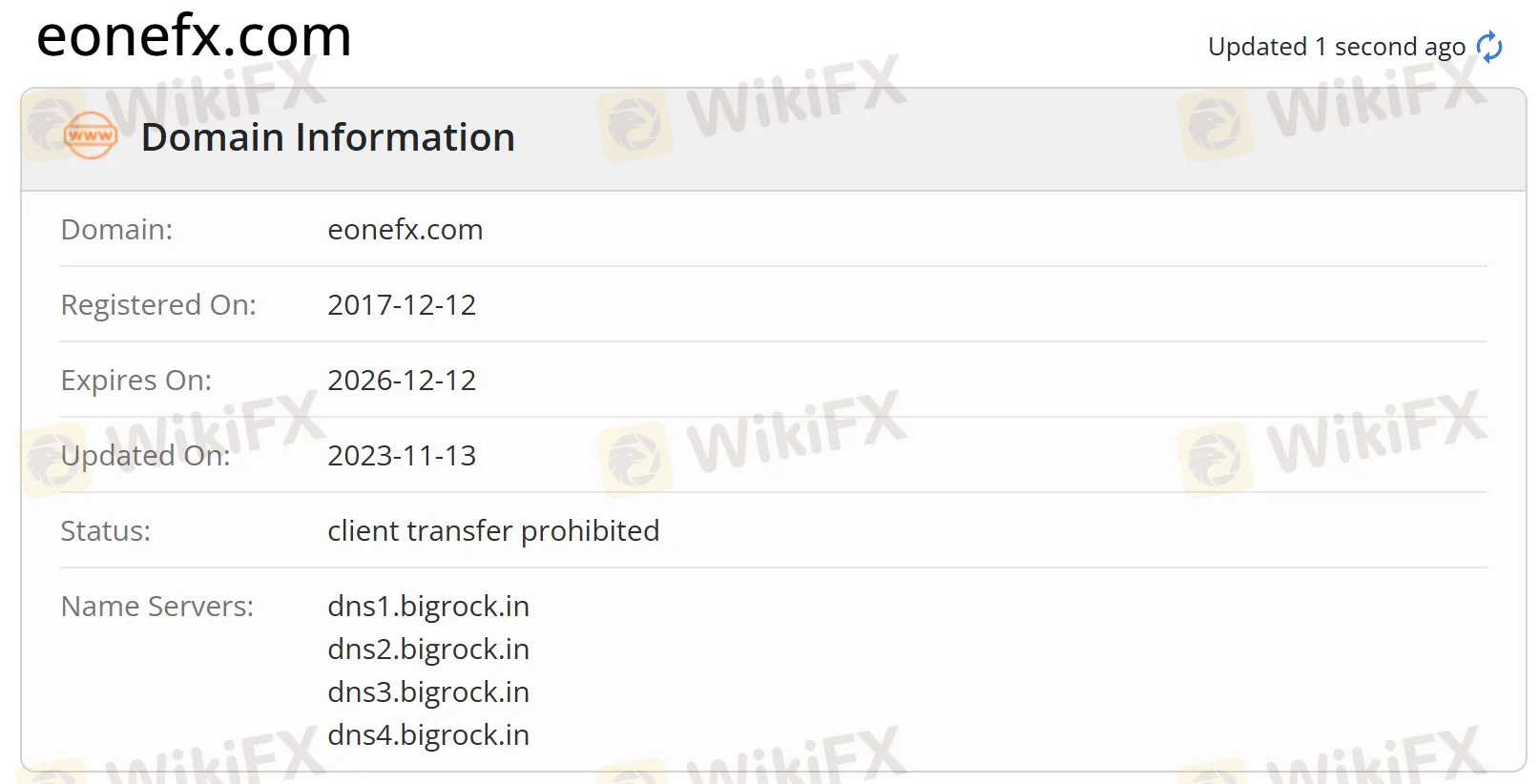

| Founded | 2017 |

| Registered Country/Region | Mauritius |

| Regulation | No regulation |

| Market Instruments | Forex, metals, cryptos, indices, commodities, ETFs, bonds |

| Demo Account | ❌ |

| Leverage | Up to 1:2000 |

| Spread | From 0 pips |

| Trading Platform | MT5, eonefx APP |

| Minimum Deposit | $100 |

| Copy Trading | ✅ |

| Customer Support | Live chat, contact form |

| Tel: +971 581 670 121 | |

| Email: support@eonefx.com | |

| Rep. Office: 1701 Nassima Tower, Sheikh Zayed Road, Trade Center, Dubai, UAE. | |

| Reg. Office: United Docks Business Park, Caudan, Port Louis, Mauritius. | |

| Social media: Instagram, Whatsapp, Facebook, LinkedIn | |

| Regional Restrictions | USA, Cuba, Iran, Syria, Sudan, North Korea, UK |

eonefx was registered in 2017 in Mauritius, specializing in the forex, metals, crypto, indices, commodities, and bonds markets. It provides four types of accounts, with a minimum deposit of $100 and a maximum leverage of 1:2000. Besides, it offers copy trading services. However, it should be noted that eonefx is not regulated and it does not provide services to certain regions.

Pros and Cons

| Pros | Cons |

| Copy trading offered | High leverage ratio |

| Tight spreads | No demo accounts |

| MT5 supported | Lack of regulation |

| Multiple channels for customer support | Regional restrictions |

| Diverse tradable assets | |

| Popular payment options | |

| No deposit and withdrawal commission |

Is eonefx Legit?

No, eonefx is not regulated by financial regulatory authorities in Mauritius, which means the company lacks regulation from its registration site. Therefore, potential risks cannot be ignored.

What Can I Trade on eonefx?

eonefx provides a number of products, including forex, metals, cryptos, indices, commodities, ETFs, and bonds.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptos | ✔ |

| Bonds | ✔ |

| ETFs | ✔ |

| Stocks | ❌ |

| Options | ❌ |

Account Type

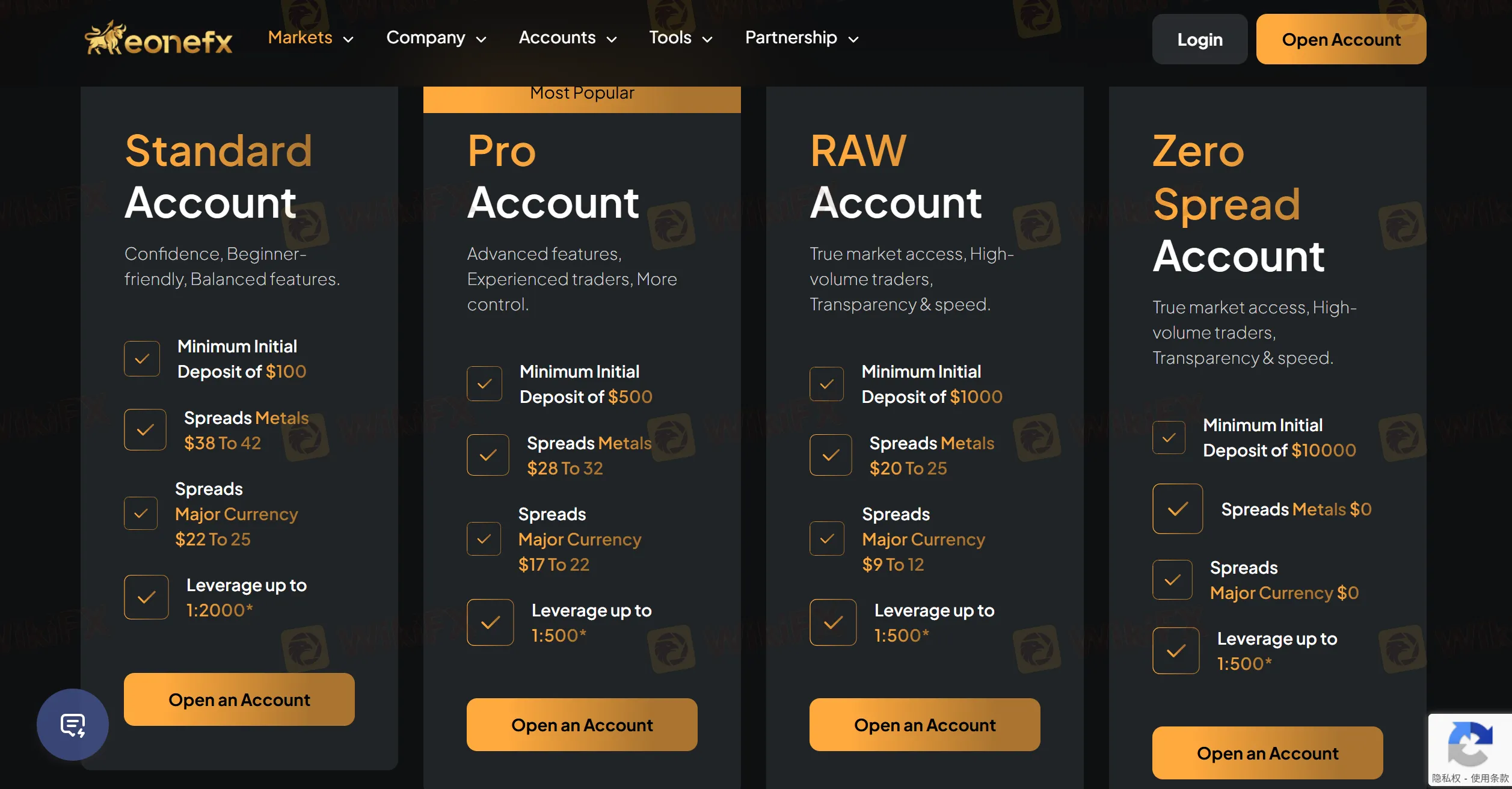

eonefx provides four types of accounts: Standard Account, Pro Account, RAW Account, and Zero Spread Account. However, it does not mention whether a free demo account is available or not.

| Account Type | Minimum Deposit | Maximum Leverage | Spread |

| Standard Account | $100 | 1:2000 | Metals: $38 - 42 |

| Currency: $22 - 25 | |||

| Pro Account | $500 | 1:500 | Metals: $28 - 32 |

| Currency: $17 - 22 | |||

| RAW Account | $1,000 | 1:500 | Metals: $20 - 25 |

| Currency: $9 - 12 | |||

| Zero Spread Account | $10,000 | 1:500 | Metals: $0 |

| Currency: $0 |

Leverage

The leverage ranges from 1:500 to 1:2000, which is not low. Traders need to consider carefully before investing, since high leverage is likely to bring high potential risks.

Trading Platform

eonefx uses MT5 and mobile APP as its trading platforms, and it does not support MT4.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | PC, web, mobile, mac | Experienced traders |

| eonefx APP | ✔ | Mobile | / |

| MT4 | ❌ | / | Beginners |

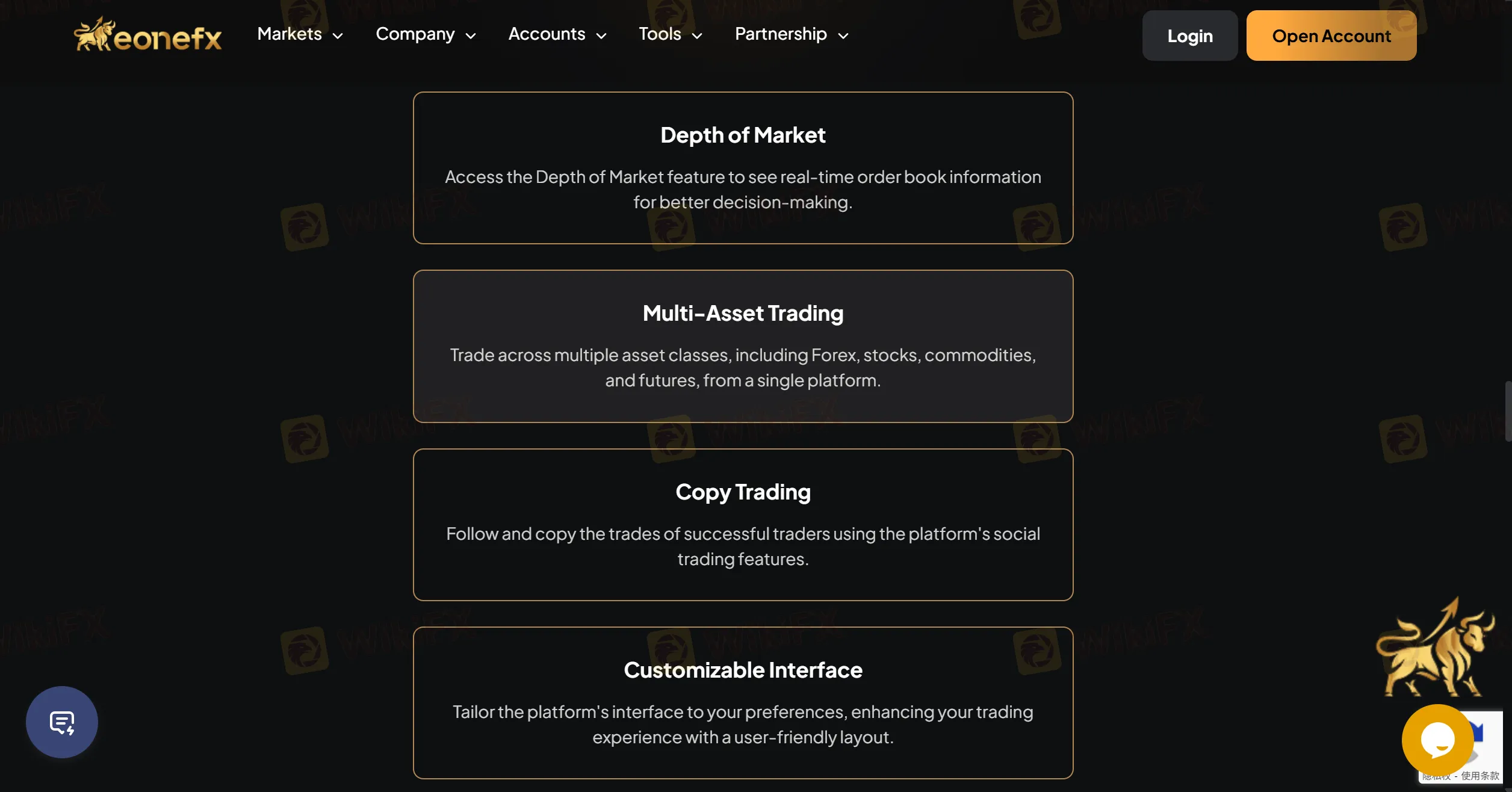

Copy Trading

eonefx provides copy trading service which enables clients to follow top traders and learn from their trading strategies. It is useful for beginners to start their trading and find their own strategies.

Deposit and Withdrawal

eonefx supports different types of payment options.

| Deposit Options | Accepted Currencies | Minimum Deposit | Deposit Fees | Deposit Processing Time |

| USDT | USD | 0.00037000 BTC | ❌ | 3-30 minutes |

| Local Banks | $350 | |||

| Bitcoin | BTC | 0.00037000 BTC | ||

| Ethereum | ETH | 0.02000000 ETH | ||

| Neteller | EUR, USD | 50 EUR | Instant | |

| Skrill | 50 USD | |||

| Mastercard | EUR | 50 EUR |

| Withdrawal Options | Accepted Currencies | Minimum Withdrawal | Withdrawal Fees | Withdrawal Processing Time |

| USDT | USD | 0.00009000 BTC | ❌ | 1-3 hours to approve the withdrawal and up to 30 minutes to transfer the funds |

| Local Banks | $350 | |||

| Bitcoin | BTC | 0.00009000 BTC | ||

| Ethereum | ETH | 0.00500000 ETH | ||

| Neteller | EUR, USD | $5 | ||

| Skrill | ||||

| Mastercard | EUR | 5 EUR |

Tiru

United Arab Emirates

EONE FX is a scam broker. They lure clients with fake trading profits, but withdrawals are never processed. Support only gives excuses and avoids responsibility. This company exists only to trap investors and steal deposits. Stay away at all costs

Exposure

Tiru

United Arab Emirates

EONE FX offers smooth execution, tight spreads, and quick support. Payments are fast and the platform is reliable even during high volatility. A trustworthy and trader-friendly broker.

Positive

Tiru

United Arab Emirates

I previously shared concerns about a delay in withdrawal from EONE FX due to some misunderstanding. I'm delighted to confirm the issue has been resolved swiftly. EONE FX demonstrated exceptional professionalism and dedication, ensuring a seamless trading experience. I highly commend their commitment to client satisfaction and recommend them to traders seeking a reliable broker. Thank you, EONE FX, for your outstanding service!

Positive

健康咨询与服务-格格

Singapore

EONE FX provides a very efficient service easy to use platform that allows even beginners to trade. I am a member and very happy with the service provided by EONE FX. Had no problem even customer support responded quickly.

Positive

FX1075643635

Colombia

When choosing a currency exchange company, I think the most important thing is security. If all your money is ripped off, what is the point of other trading conditions? Therefore, although the trading conditions provided by EONE are very attractive, I would not choose to trade with it because it does not have a regulatory license.

Neutral

FX1057293956

United States

I like the broker that offers live chat! A wide range of trading instruments are available and the mt4 platform is compatible with various devices. I want to open the most basic ONE MAKER account because it seems that I can have it with as little as $100, but the 1:1000 leverage of this type of account is too high for me. I worry that I can’t make any profits but lose a lot.

Neutral

煜成订制

Malaysia

Hi guys, I find this new platform with really attractive offerings, demo accounts, copy trading allowed, friendly minimum deposit. I’ve spent hours on trading on its demo accounts, and trading environment there is quite comfortable. I’ve registered my trading accounts here, will share with you my trading journey later…

Positive