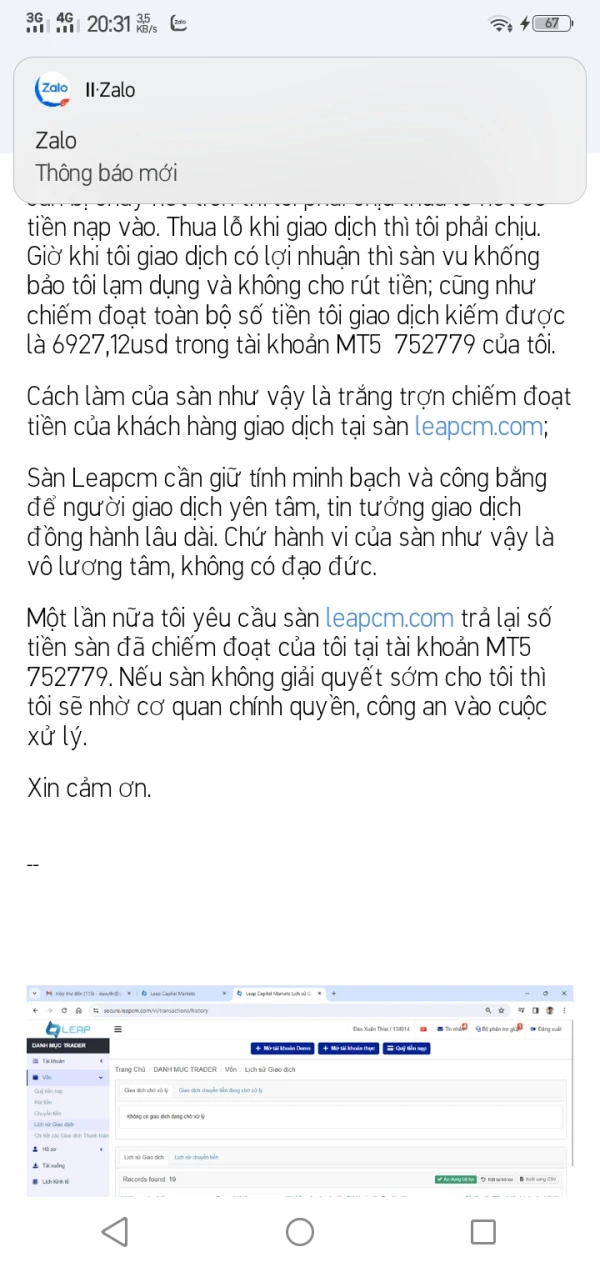

No Regulation

Score

0 1 2 3 4 5 6 7 8 9

. 0 1 2 3 4 5 6 7 8 9

0 1 2 3 4 5 6 7 8 9

/10

Leap Capital Markets

China | 2-5 years |

China | 2-5 years | Suspicious Regulatory License | Suspicious Scope of Business | High potential risk

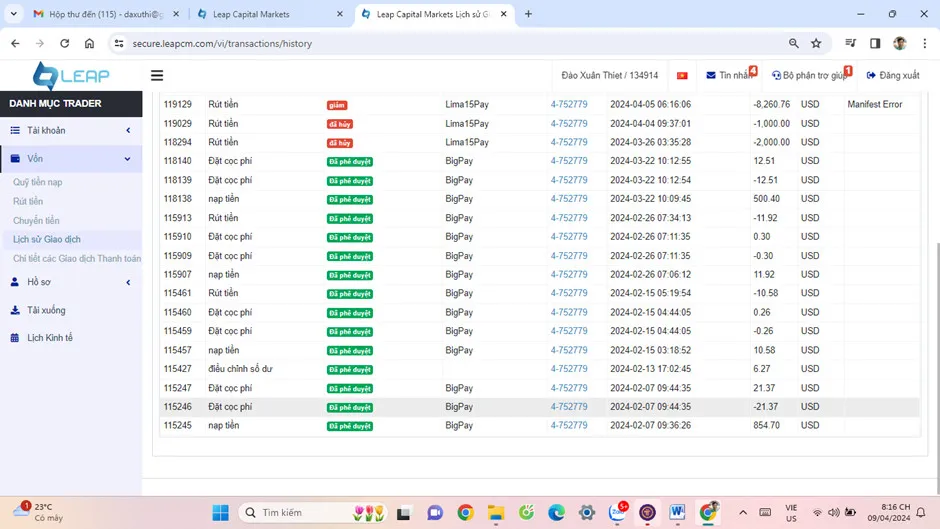

https://leapcm.com/

Website

Rating Index

Contact

https://leapcm.com/

Forex License

Forex License

No forex trading license found. Please be aware of the risks.

Warning: Low score, please stay away!

- This broker lacks valid forex regulation. Please be aware of the risk!

2

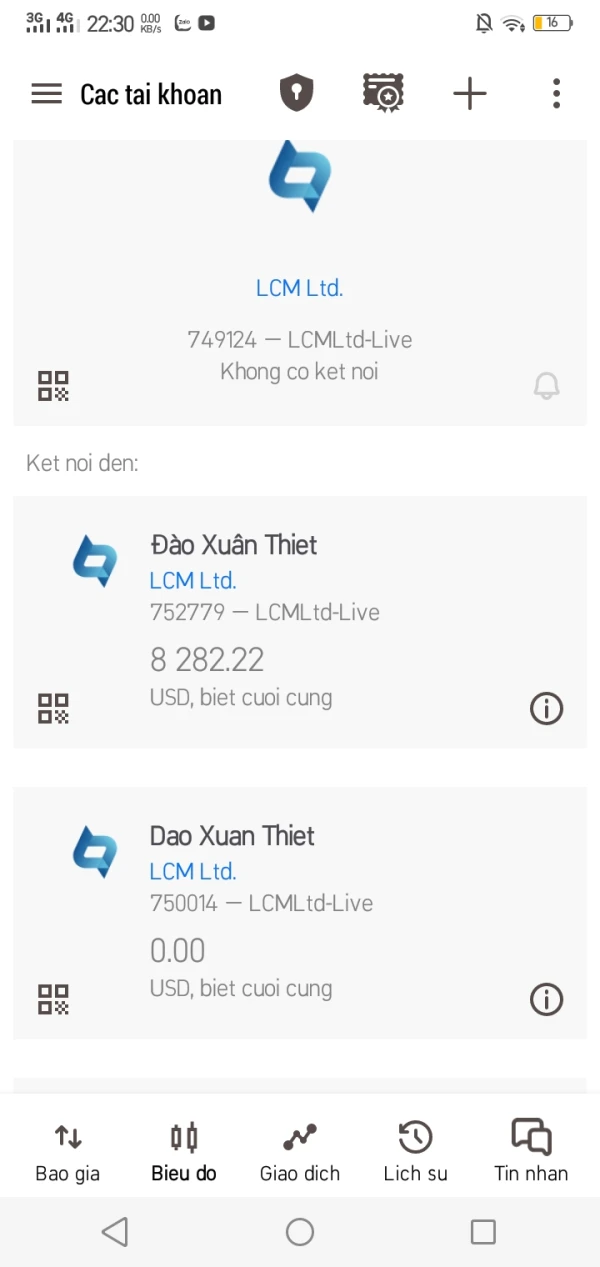

Basic Information

Registered Region  China

China

China

China Operating Period

2-5 years

Company Name

Leap Capital Markets LTD

Customer Service Email Address

support@leapcm.com

Company Website

Account

Comment

Account

- Environment--

- Currency--

- Maximum Leverage1:1000

- SupportedEA

- Minimum Deposit$0

- Minimum Spread--

- Depositing Method--

- Withdrawal Method--

- Minimum Position--

- Commission$0

- Products--

Updated:

Users who viewed Leap Capital Markets also viewed..

PUPRIME

8.46

Score ECN Account5-10 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

PUPRIME

Score

8.46

ECN Account5-10 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

CXM

8.11

Score ECN Account10-15 yearsRegulated in United KingdomInst Market Making (MM)MT4 Full License

CXM

Score

8.11

ECN Account10-15 yearsRegulated in United KingdomInst Market Making (MM)MT4 Full License

Official Website

VT Markets

8.68

Score ECN Account10-15 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

VT Markets

Score

8.68

ECN Account10-15 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

AVATRADE

9.50

Score ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

AVATRADE

Score

9.50

ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

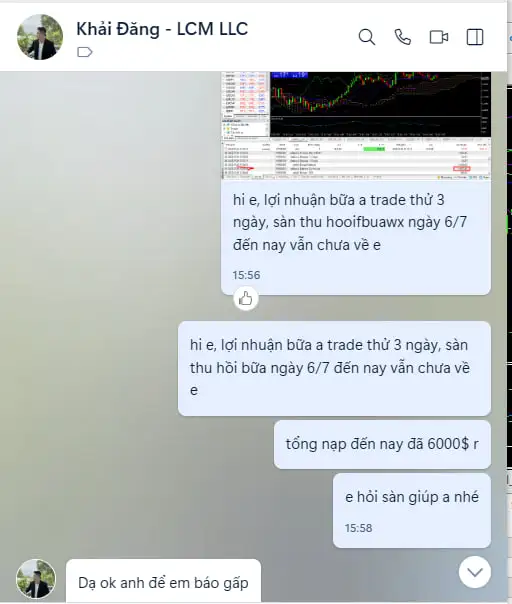

User Reviews3

No more

Write a review

Exposure

Neutral

Positive

Content you want to comment

Please enter...

Submit now

Comment 3

Write a comment

3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now