Company Summary

| 4XCReview Summary | |

| Founded | 2015 |

| Registered Country/Region | New Zealand |

| Regulation | FSC (Exceeded |

| Market Instruments | Forex, Metals, Indices, Oil, Cryptocurrencies, Forward Contracts |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 1.0 pips (Standard account) |

| Trading Platform | MT4, MT5, Trading View |

| Min Deposit | $50 |

| Customer Support | 24/5 live chat |

| Tel: +44 8000 488 033 (UK) | |

| WhatsApp: +44 8000 488 033 | |

| Toll-Free: 1800 914 5011 (Colombia) | |

| Email: support@4xc.com, info@4xc.com | |

| Social Media: Facebook, YouTube, Instagram, Twitter, Telegram, Discord, Linkedin | |

| Company Address: 1st Floor, BCI House, Avarua, Rarotonga, Cook Islands | |

| Regional Restrictions | The USA, Iraq, Iran, Myanmar, North Korea, and Portugal |

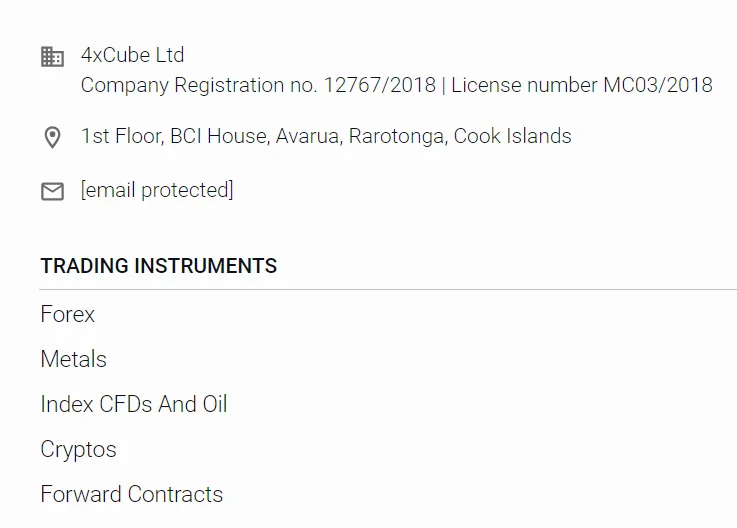

Founded in 2015, 4XC is a trademark of 4xCube Ltd, registered in the Cook Islands, New Zealand. It's an online trading platform operating without proper regulation. Its tradable products cover Forex, Metals, Indices, Oil, Cryptocurrencies, and Forward Contracts with flexible leverage up to 1:500 and spread from 1.0 pips on the Standard account through the MT4, MT5 and TradingView platform. 4XC offers a demo account and three types of real accounts with a minimum deposit requirement of $50.

Pros and Cons

| Pros | Cons |

| Various tradable assets | Exceeded FSC license |

| Demo accounts | Withdrawal fee charged |

| Three account types | |

| Commission-free accounts | |

| Flexible leverage ratios | |

| MT4 and MT5 offered | |

| Low minimum deposit | |

| Multiple payment options | |

| No deposit fees | |

| 24/5 live chat |

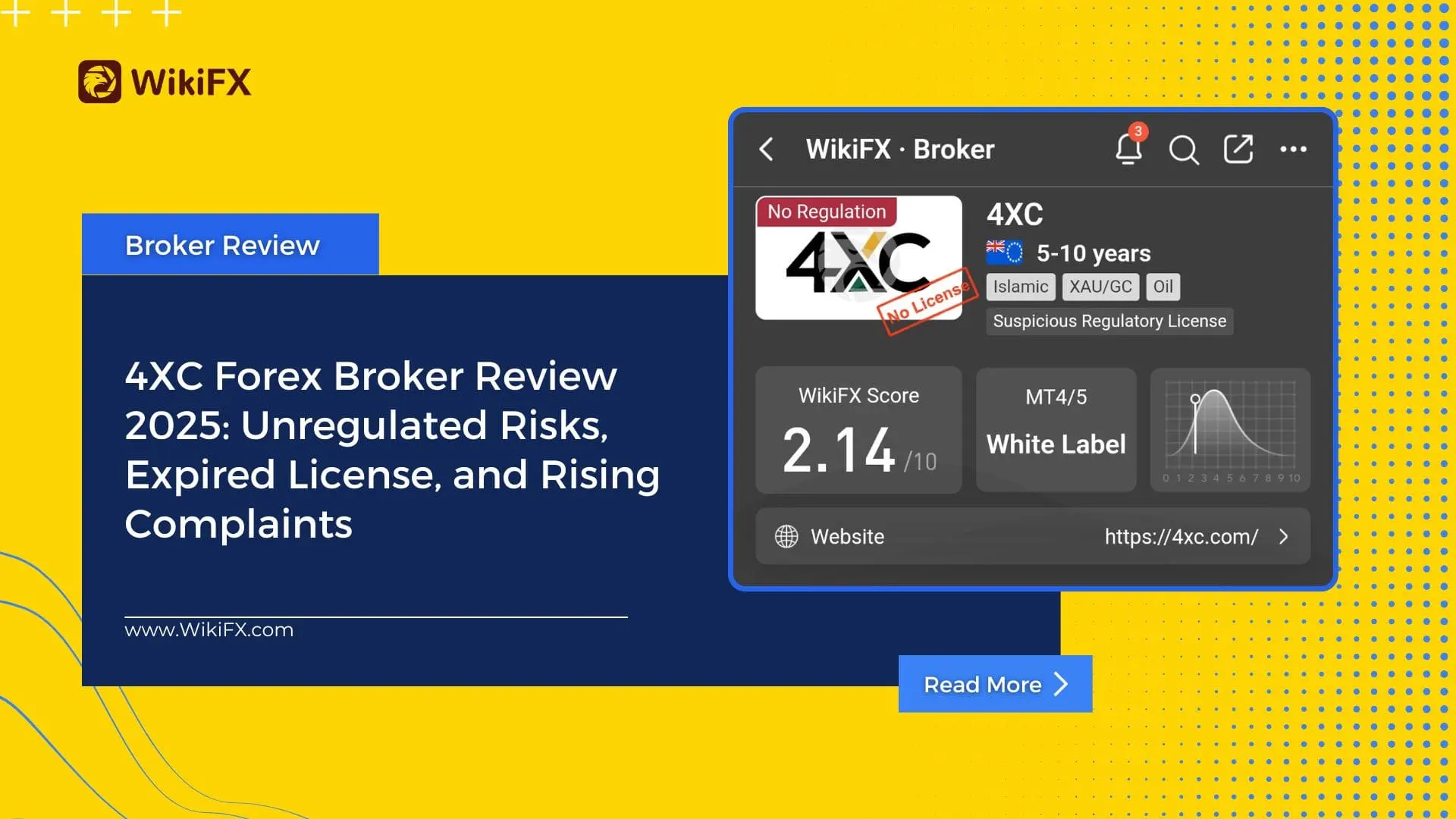

Is 4XC Legit?

No. 4XC currently has no valid regulations. It only holds an exceeded Common Business Registration license from the Financial Supervisory Commission (FSC).

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| The Financial Supervisory Commission (FSC) | Exceeded | 4XCUBE LIMITED | Common Business Registration | MC03/2018 |

What Can I Trade on 4XC?

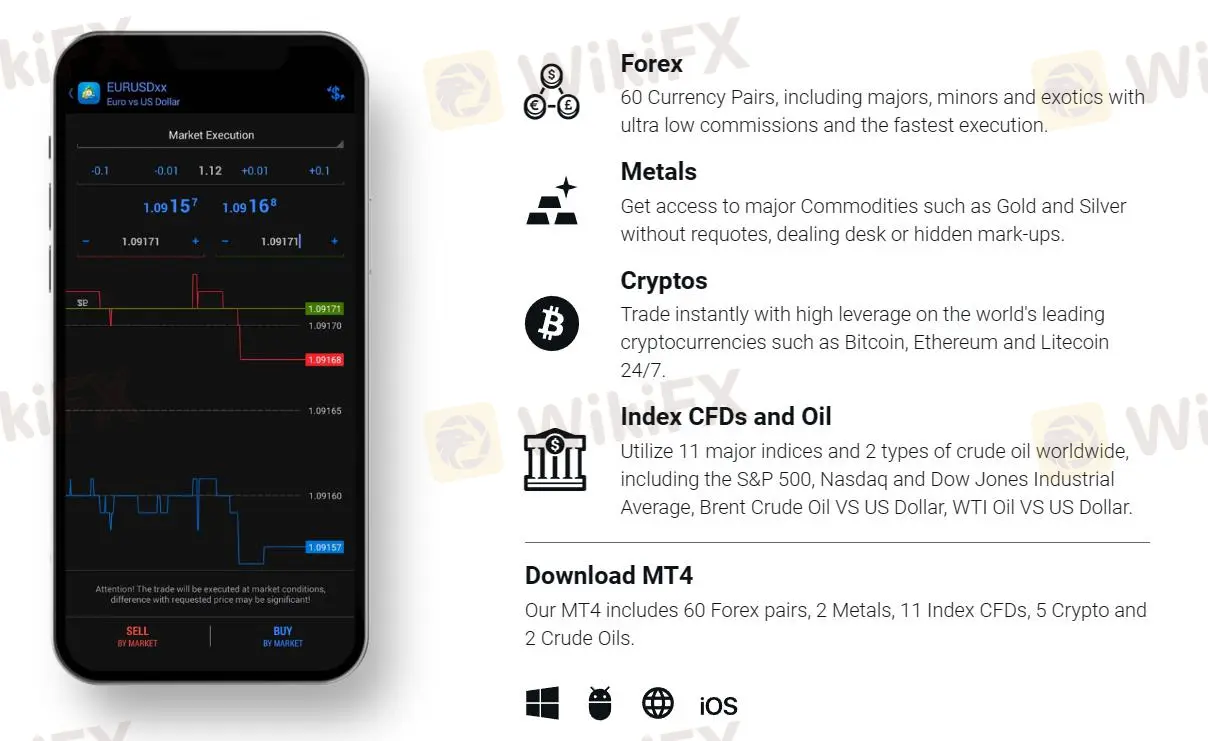

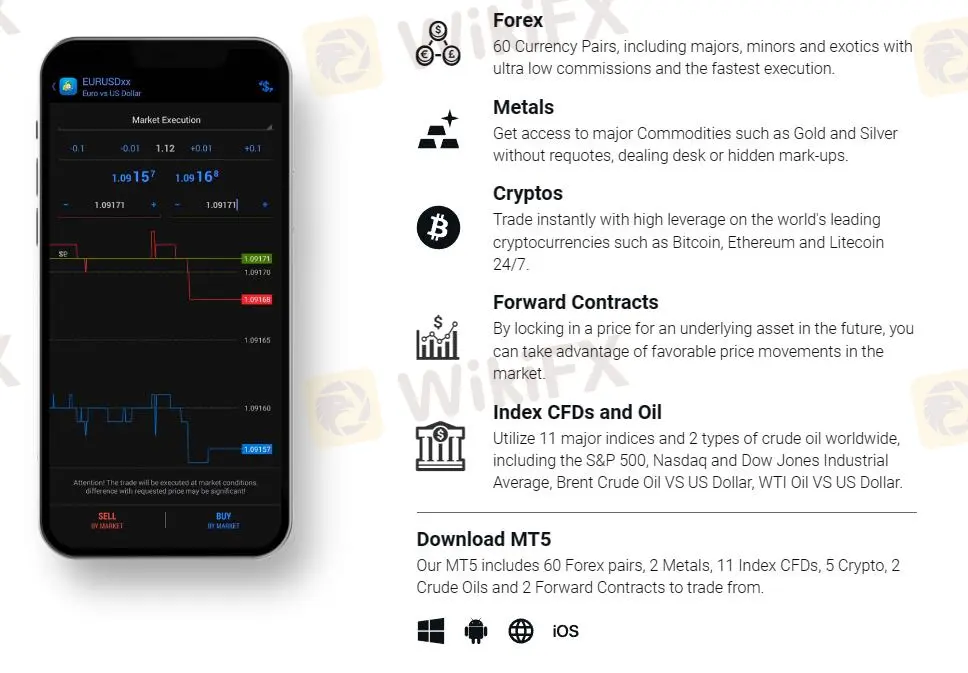

4XC offers a wide selection of tradable products, including forex, metals, index CFDs and oil, cryptocurrencies, and forward contracts.

| Trading Asset | Available |

| forex | ✔ |

| metals | ✔ |

| indices | ✔ |

| oil | ✔ |

| cryptocurrencies | ✔ |

| forward contracts | ✔ |

| stocks | ❌ |

| bonds | ❌ |

| options | ❌ |

| ETFs | ❌ |

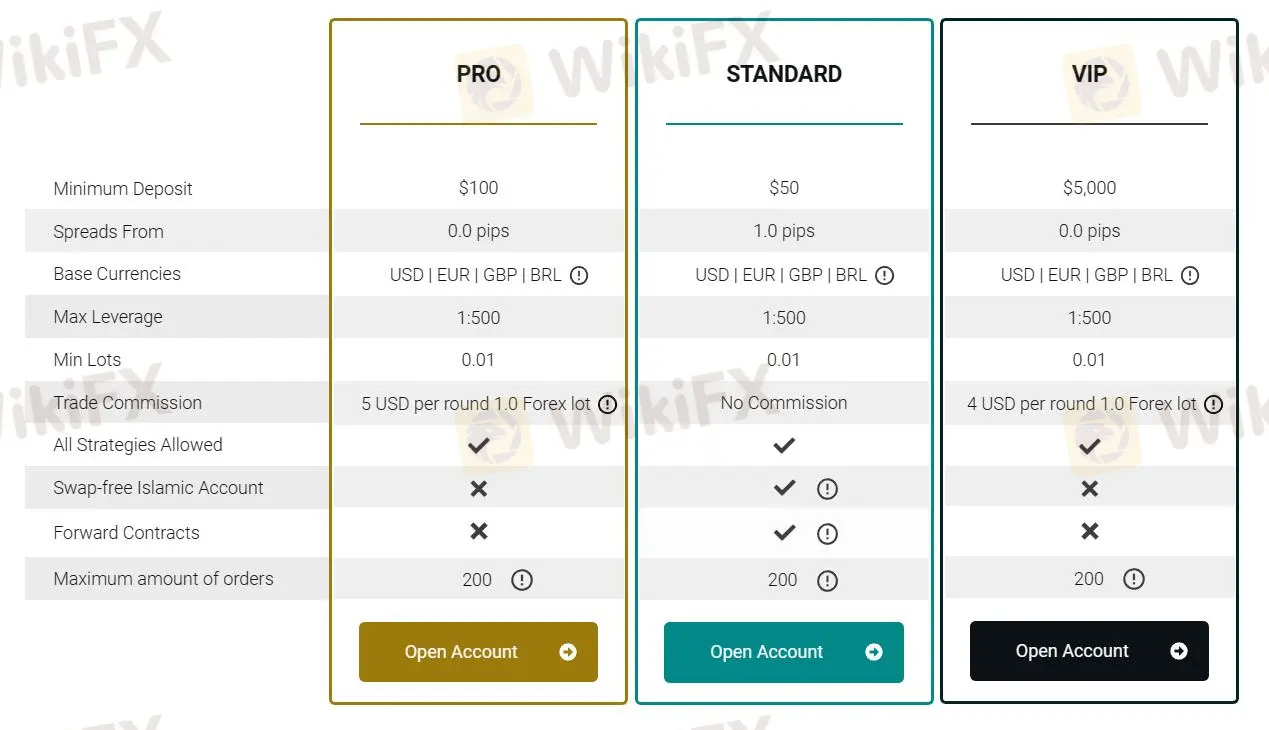

Account Type/Fees

A demo account and three types of live account are available on 4XC.

| Account Type | PRO | STANDARD | VIP |

| Base Currencies | USD | EUR | GBP |

| MinDeposit | $100 | $50 | $5,000 |

| Max Leverage | 1:500 | 1:500 | 1:500 |

| Spread | From 0.0 pips | From 1.0 pips | From 0.0 pips |

| Commission | 5 USD per round 1.0 Forex lot | ❌ | 4 USD per round 1.0 Forex lot |

| Swap-free Islamic Account | ❌ | ✔️ | ❌ |

| Forward Contracts | ❌ | ✔️ | ❌ |

Leverage

| Asset Class | Max Leverage |

| Forex | 1:500 |

| Metals | |

| Indices | 1:200 |

| Oil | |

| Cryptocurrencies | 1:20 |

| Futures Contracts | 1:200 |

Trading Platform

4XC offers both MT4 and MT5 as trading platform. Additionally, clients with Christmas Promos can access a free Trading View subscription during Christmas.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Desktop, Mobile, Web | Beginners |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

| Trading View | ✔ | Desktop, Mobile, Web | Beginner |

Deposit and Withdrawal

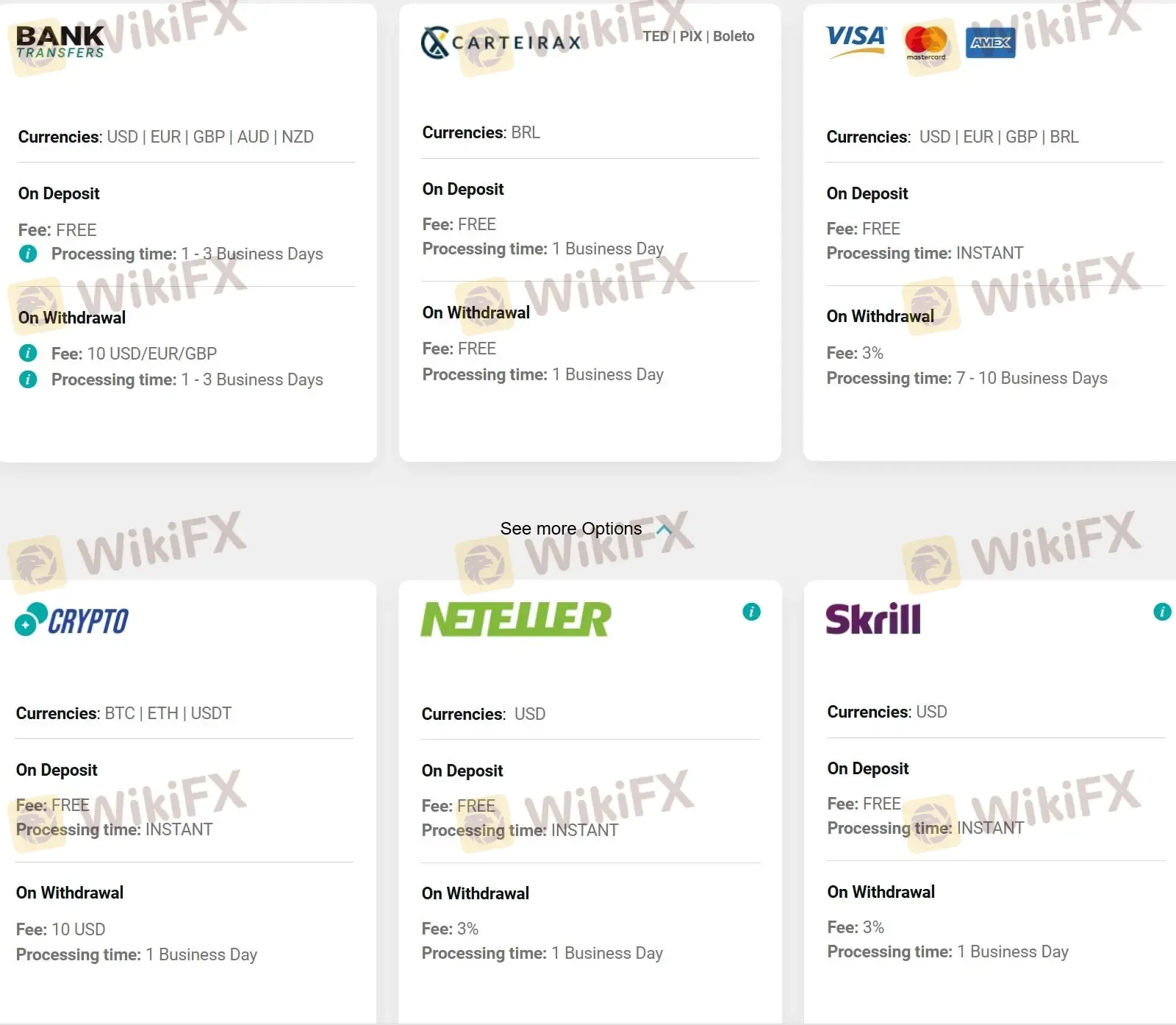

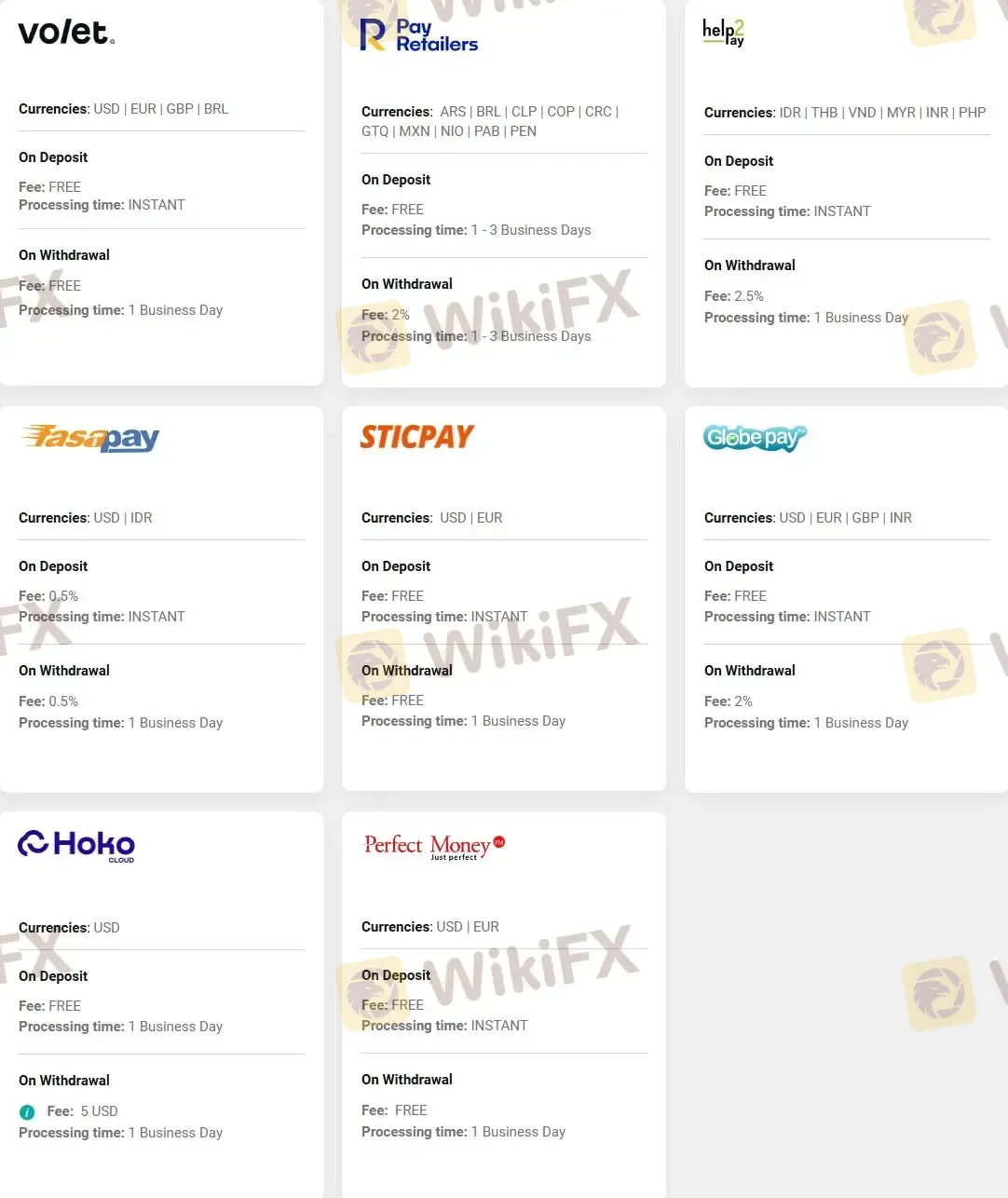

4XC accepts deposits and withdrawals via Bank transfers, CAPTEIRAX, VISA, MasterCard, American express, Crypto, Neteller, Skrill, Volet, Pay Retailers, helpay2, fasapay, Sticpay, Globepay, Hoko, and Perfect Money.

No fees for most deposits, while withdrawal fees vary on the method.

You can find more detailed info in the screenshots below.

FX1336827656

Switzerland

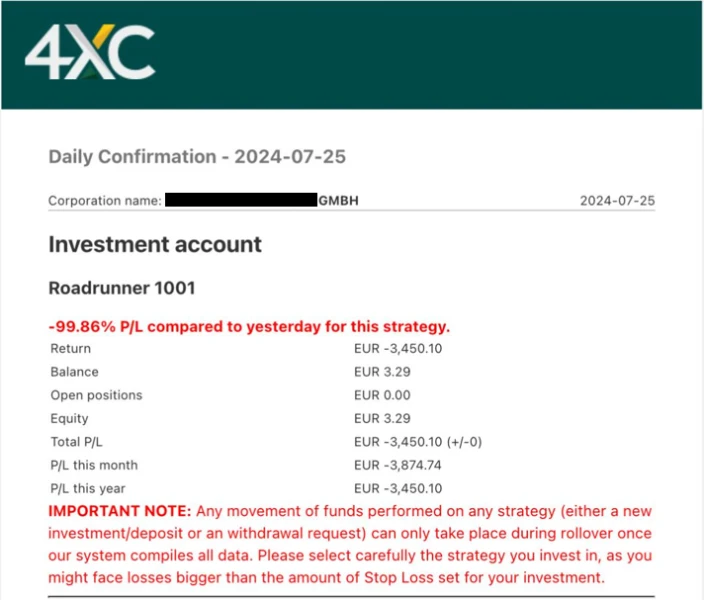

In February I opened a managed account with 3500 euros at MAG Markets through a friend. MAG Markets migrated to 4XC. The highest balance in 5 months was almost 4000 euros. Last week all positions were liquidated due to too much floating. The account is empty and in the end "the market" is to blame. So far I have not received a detailed statement of my trading account despite asking my friend, who is supposedly a co-owner of MAG Markets. When I asked earlier why I only see the numbers in the back office and cannot access my trading account via MT4 or MT5, I was told that they did not want to disclose the trades. Very dubious in my view. I was previously told of a low spread but there was no transparency. My conclusion: keep your hands off!

Exposure

FX6478027212

Venezuela

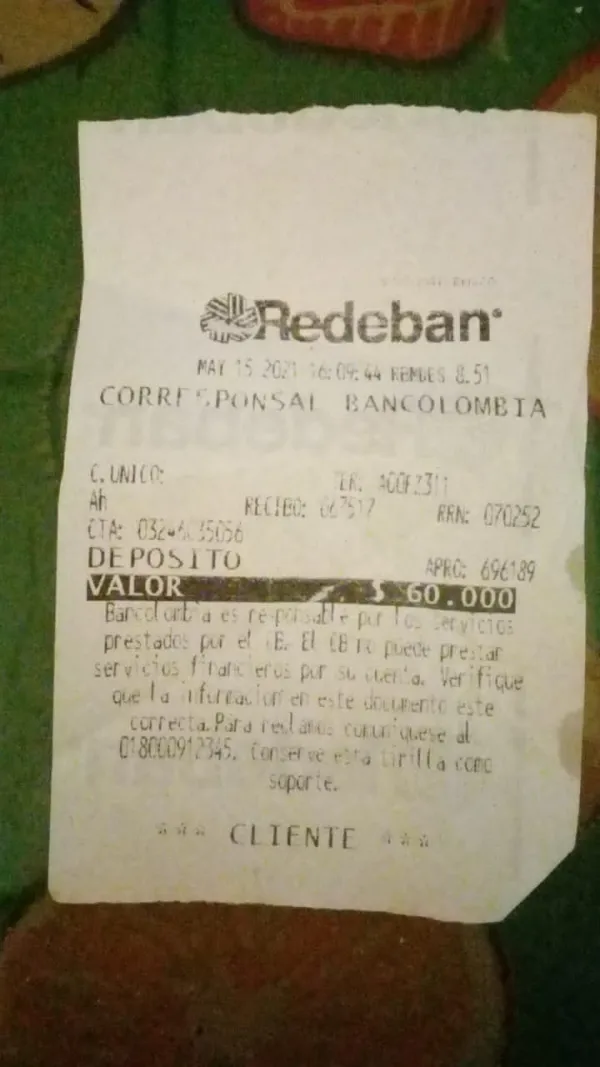

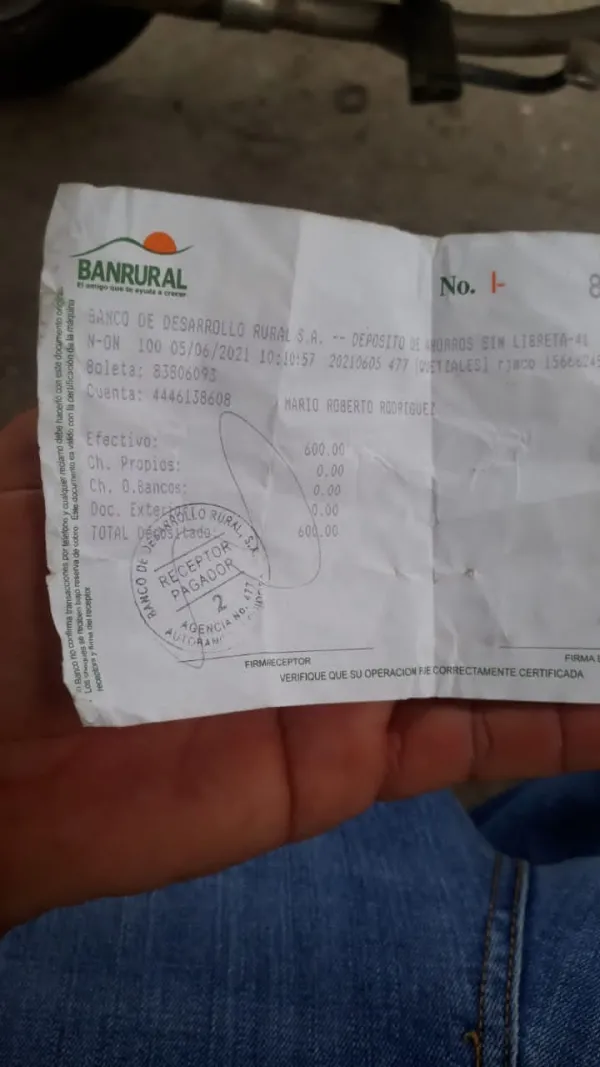

Hello, I am her mother/ She deposited $600 with a tax of $60

Exposure

FX3177909114

Venezuela

Someone told me I could earn 5% so I invested $8,000. Unluckily, when I attempted to withdraw funds, they refused

Exposure

Germer

Hong Kong

4XC, they've really got their market instruments dialed in. Plus, their customer support is top-shelf, always ready to lend a hand. If you're looking for a reliable platform, this is the one!

Positive

Broker43330

United Kingdom

Their response is timely when you have an issue. Though I have a problem with the payment method set for instance when you deposit using PayPal you can't withdraw the funds to mpesa. Ensure flexibility in withdrawal of funds, one should be able to withdraw funds using payment method of their choice regardless of which payment method they used to deposit.

Neutral

23308

Tunisia

Truly stand-out support, thanks to Andrei. 👍Smooth sign-up, quick deposit and withdrawal, and clear communication.

Positive

帅锅他爹

Australia

I have been trading on 4XC for some time now and I can not complain. My investment has borne fruits and I made withdrawals in just a short time. The best thing is you can trade both on the web and the app, meaning that you can place your trade and go out and track its progress from the app. That makes the experience great.

Positive

海纳百川21498

Hong Kong

It paid off for me to try a demo for a long time and test different options. Now I have been trading with a Standard account for about 3 months and everything works, a fast modern platform and very well-functioning customer support.

Positive

FX1059527891

Australia

It is easy to open a Standard account or a Pro account, a low minimum deposit… And its trading conditions seem attractive, 500 times leverage, tight spreads and more. I opened a demo account today, and it performs good. I was wondering if I should open a real trading next up.

Positive

FX3267844247

Spain

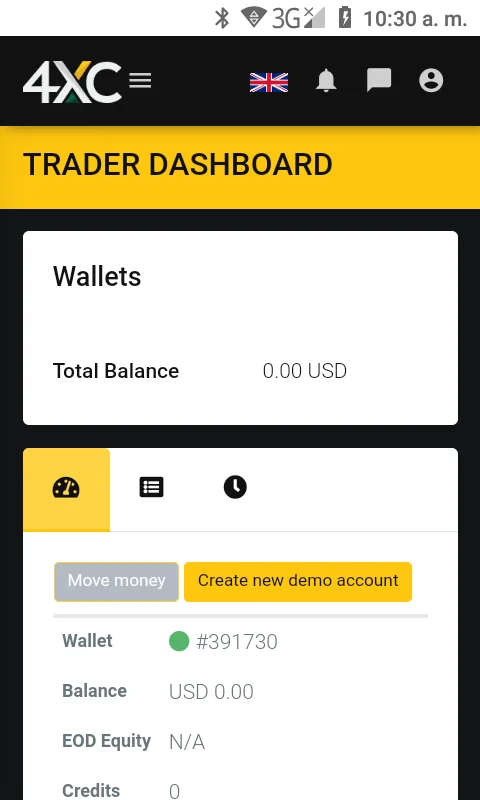

I deposited $392 and gained more than 40%. But later I found my balance disappeared.

Exposure