Global Broker Regulation & Inquiry App!

Tracks

JPY Topic Live Competition: Bringing Together Elites in The Forex Industry

In recent years, the yen has shown a continuous downward trend against the US dollar, with this year being particularly volatile. Investors are lacking bullish momentum for the yen against the dollar, leading to increased investment risks in yen forex, which has caused some investor concerns. This topic has garnered global attention, spreading like a storm worldwide.

IG Opens US Options and Futures Market to UK Traders

IG has launched trading for US-listed options and futures, targeting UK self-directed retail traders.

Wiki FINANCE EXPO 2024 TOKYO Station: Reward Campaign –Enter the Eye of the JPY Exchange Rate Storm

Since the beginning of this year, the US dollar has been on a continuous downward trend against the Japanese yen, drawing widespread global attention. The relevant topics have swept across the globe like a storm. As the epicenter of this "financial storm," Japan has become the focal point of discussion and attention for forex investors worldwide.

FXCM

XM

GO MARKETS

IC Markets

FP Markets

FBS

FXTRADING.com

Trade Nation

HYCM

VT Markets

BCR

Hantec

MultiBank Group

Blueberry Markets

STARTRADER

IG

VPS Standard

1*CPU/1G*RAM/40G*HDD/1M*ADSL

XM

2*CPU/2G*RAM/60G*HDD/2M*ADSL

OEXN

2*CPU/2G*RAM/60G*HDD/2M*ADSL

GTC

2*CPU/2G*RAM/60G*HDD/2M*ADSL

FXTM

2*CPU/2G*RAM/60G*HDD/2M*ADSL

DBG Markets

2*CPU/2G*RAM/60G*HDD/2M*ADSL

Latest

eToro Partners with X to Deliver Expert Financial Content

eToro collaborates with X to offer live and on-demand financial education, enhancing investment knowledge through videos, posts, and Spaces.

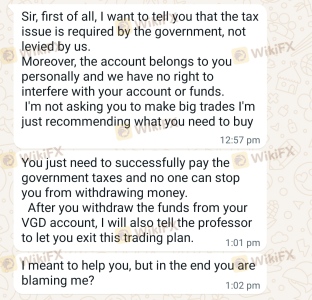

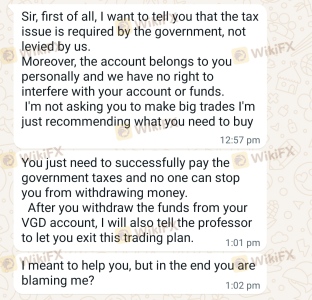

Unable to Withdraw

Unable to Withdraw unable to withdraw n force me to pay tax 4.5 lakh

dear sir my name is Rajkumar I am from Salem Tamilnadu, Sir I was being cheated by this VGD Vanguard group club firstly I don't know they are a forgery cheats now my life is totally miserable they have rob all my hard earnings life savings 2 months back I have invested 6 lakh in this Venguard lioring me to buy several stocks , block trades, IPO etc atlast i have 73lakh total in the Vanguard account 15days back I requested to the professor assistant Megan Finlay that I want to withdraw some money to solve my debt , n problems but she said no, you can't withdraw unless you pay the tax for the SIBI of 4.5 lakhs first , I told them I have no money to pay... I even request to the professor n the customer care to debit the tax amount from my vanguard account and pay the tax , they said it's against a law they are unable to debit from my account , sir for the past 15 days this Megan everyday sending message asking me to pay otherwise the account will be freeze , now 2days back the Venguard website is not working it's showing error , even their photos disappear on WhatsApp dear sir if you could please help us in this matter

JustMarkets Unveiled New Trading Features

JustMarkets, a well-known broker, recently turned twelve. To mark this occasion, the broker has revealed several amazing features to improve customer comfort and efficiency while trading.

Risk Management 101: Read This If You Want to Win

This must-read article emphasizes the importance of prioritizing risk management over chasing profits in online trading, outlining key strategies to protect capital and achieve long-term success.

FCA Cancels Global 4X Limited’s Authorization as Authorized Payment Institution

The UK Financial Conduct Authority (FCA) has announced the cancellation of the authorization granted to Global 4X Limited as an authorized payment institution (API). This decision comes after a thorough review revealed that the firm no longer meets the necessary conditions for holding such authorization.

Rights Protection Center

Deleno IFC

Deleno IFC

Deleno IFC

Deleno IFCFake broker

They are requesting money in order to withdraw

Deleno IFC

Deleno IFC

Deleno IFC

Deleno IFCno puedo retirar mi dinero

24 hours ago there was a problem with this platform, it had an alleged error where they deposited double our money. Now they won't let us withdraw our money until we deposit the entire amount. I attach the transfers I made from binance to the deleno platform usd$153 I hope I can get them back.

Zara FX

Zara FX

Zara FX

Zara FXfor help can be very underanding

I'm writing to follow up on my previous complaint about the withdrawal issue. Unfortunately, the situation has escalated, and I'm now unable to access the website due to an error message. The website fails to load, and I'm concerned about my funds. I've attached my deposit receipts below for your reference. I urge you to investigate this matter and resolve the issue as soon as possible. I appreciate your prompt attention to this matter, and I look forward to a swift resolution.

Deleno IFC

Deleno IFC

Deleno IFC

Deleno IFCDeleno IFC It claims to be legal and it is not.

2 or 1 day ago They Supposedly had a Global error in which their system Erroneously Deposited 270,000 users and among them is me Who deposited me, as you can see in the Tests, 9,080 dollars, which I reiterate is their problem, not ours, and now for that reason they want to force us to deposit the amount that arrived by mistake. and they do not want to take responsibility for their mistake and therefore they are demanding that that large amount be deposited when some of us had thousands of dollars and we earned them with a lot of sacrifice and we do not have the possibility of depositing them believing that we are all rich and we are not, losing around 10,000 dollars and they do not allow us to withdraw, demanding something impossible for much, estoy angustiado por mi dinero Cuando lo gane con mucho sacrificio cuando fue su error y no puedan plantear otra solución Más Lógica, Porfavor necesito su ayuda...

TRADING HUB

TRADING HUB

TRADING HUB

TRADING HUBContinue Scam Activities

After withdrawal denial, this platfrom continue to block my trading account and all amount of my account disappeared and I can not login this platform anymore

MUFG

MUFG

MUFG

MUFGQSNB

I can't get withdrawal. QSNB is stealing your money exactly.I was said that if I pay 30% of my money(1923$), they would accept my sending to safe account.But it's lie. I'm pretty sure they would have more money from me...What can I do now?Apple helps me?PLEASE!!!!!!!My money is important!!!!!!

Booc

Booc

Booc

Boocbain capital ruin scam with booc

You will not able to withdraw your money they will ask you handling fees after paying handling fees they will tell you your account is freeze so you have to pay another money for unfreeze your account. They ask more and more money but you will be not able to withdraw your money they ruin many WhatsApp group name of bain capital ventures broker grace taylor they trade on booc platform even booc customer service will not answering you that's means they all are together to ruin this scam. So guys pls be aware of this scammer

The Vanguard Group

The Vanguard Group

The Vanguard Group

The Vanguard Groupunable to withdraw n force me to pay tax 4.5 lakh

dear sir my name is Rajkumar I am from Salem Tamilnadu, Sir I was being cheated by this VGD Vanguard group club firstly I don't know they are a forgery cheats now my life is totally miserable they have rob all my hard earnings life savings 2 months back I have invested 6 lakh in this Venguard lioring me to buy several stocks , block trades, IPO etc atlast i have 73lakh total in the Vanguard account 15days back I requested to the professor assistant Megan Finlay that I want to withdraw some money to solve my debt , n problems but she said no, you can't withdraw unless you pay the tax for the SIBI of 4.5 lakhs first , I told them I have no money to pay... I even request to the professor n the customer care to debit the tax amount from my vanguard account and pay the tax , they said it's against a law they are unable to debit from my account , sir for the past 15 days this Megan everyday sending message asking me to pay otherwise the account will be freeze , now 2days back the Venguard website is not working it's showing error , even their photos disappear on WhatsApp dear sir if you could please help us in this matter

GTC MARKETS

GTC MARKETS

GTC MARKETS

GTC MARKETSunable to withdraw funds

i have been investigating since September, with a fund of 45k USDT, can never withdrawal. constantly being asked for verification payment. The account never releases customer services produce false regulation certificate. believe this is a scam site

DEUS

DEUS

DEUS

DEUSEscaping this fraud

A friend I met on the Internet induced me to invest in foreign exchange. At that time, small withdrawals went smoothly and the money was received in one day. But now I cannot withdraw money. My application for withdrawing money long ago has not been approved, and I have not responded to emails.

Zara FX

Zara FX

Zara FX

Zara FXReal money Stealers of Zara fx company owners

Zara fx owners and team iseal money looting from their own web page investment platform .. I had deposited and then they started trading with social trading Pamm account of copy trading. copy trading is doing Zara fx owners . they are making huge floating minus and keeping trading in that platform with out stopp loss or cutloss . after an year they had make slovey recovered all investment amount they withdrawal by Zara fx Scamming owners .. I asked them my money give back . they did refused after deleting mt4 account .. more then 75k usd balance in my account ..

JASFX

JASFX

JASFX

JASFXURGENT ALERT - The JasFX is illegally withholding investor assets

I am the account holder of MT5 account 157052, a customer of the JasFX since November 2023. I regret having to publicly complain that the JasFX has failed to process my withdrawal request, despite my numerous attempts to follow up on this matter.Specifically, I have sent 22 emails to the email support_vn@jasfx.com and contacted the hotline 1900 099 970 on 11 times from May 7, 2024 to June 5, 2024, requesting that JasFX process my withdrawal of $5,000. However, the JasFX has yet to fulfill this request.Despite my continuous reminders and emphasis on the urgency of this issue, the JasFX has only responded by "acknowledging the problem" and stating they will "investigate the informationand respond as soon as possible", without providing any specific reasons for the delay. I feel the JasFX is intentionally delaying and ignoring my request in order to misappropriate investor assets.The JasFX's failure to process my withdrawal has caused me significant harm. I have had to bearlosses from being unable to continue trading, and I have also faced difficulties in my daily expenses.This delay or refusal to process withdrawal orders not only violates the JasFX's commitments toinvestors, but also erodes the trust of the community in the financial market. I urge everyone who has, is, or plans to trade on the JasFX to be vigilant and carefully consider their decision.I have decided to publicly post this complaint on various online platforms to warn the community about JasFX's failure to process customer withdrawal requests. I hope this post will help other investors avoid similar troubles.Please share this post to alert as many investors as possible about the risks involved. We need to stand up and demand that JasFX immediately cease this unacceptable behavior

DEUS

DEUS

DEUS

DEUSScam

I haven’t made any withdrawals since i opened an account, and now I can't log in. I still have 103840.86US dollars in my account.My application for withdrawing money long ago has not been approved, and I have not been responded to i just find other way

Doo Prime

Doo Prime

Doo Prime

Doo Primewithdrawal of bonus profit ndb100$

I took part in yesterday's event for NDB 100$ new users, after registering and verifying my account and getting my account to trade according to the existing conditions. and in the evening I tried to withdraw profits, the next day I got an email that the account was suspended and it failed. what a strange event they gave.Very fraudulent for the 100$ ndb event and this is dangerous for others to join here.

ETO Markets

ETO Markets

ETO Markets

ETO Marketsmy account money all gone due to system error! Becareful!!!

I was introduce by one of the manager to register this ETO platform not more than a week. on 13/6/2024, my account suddenly cant log in and i was panic quickly call my manager and text him but he was no answer my phone or reply my message. I quickly open my laptop log in to ETO website and try change my password then finally i manage to log in back my mt4 but is too late which my money all gone and see back the record , the system show the record is open a lot big lot size to trade and want finish lost all the money inside within few minute.I try ask my manager why this thing happen and he told me is system error. i was surprise and this is the first time i meet for this platform got this issue happen which previously using a lot other different platform also no this such thing happen. Right now I'm still waiting them to solve my problem which my money all is gone.

X Charter

X Charter

X Charter

X CharterSimple SCAM turning into CRIMINAL conduct

Let me tell a complete story about the criminal practices of the X Charter Broker. Since X Charter Broker contacted me, I had to go through five weeks of this ordeal. They lured me in, promising a great future, and gave me VIP status that included matching my deposits and low fees. They let me withdraw some money to ensure that everything works as it should. After five days of light trading, my account disappeared from their site including the MT5 Platform. My initial deposit was $18,800 with open trades that could be profitable in the two days. Not knowing what to do, I turned to the help of case. Oh boy, was I wrong? After my exposure, agents who introduced themselves unacceptable offers to reinstate my account with only $15,000. They want me to move my complaint to a different Broker which happened to have the same name but have nothing in common with the original broker. They promised me to return the money if I did what they suggested me to do. Also, all communication on Telegram was deleted when I refused to accept. Time went by and they let me open a new account (924376) with the original balance of $18,800 with the condition to keep it for at least 15 days and make trade once a day. After that period, I have been promised, to be able to withdraw money. At this time no favors, no matching deposits, and no defined slippage. On June 10th, I received a message that X Charter was working on an upgrade of services, and all accounts needed to be reinstated. I contacted X Charter’s Support. Designated agent Le Phuc Hoang sent me a link to the Chrome Extension application to make my account work. This link to the application could not be for an unknown reason reinstated so he had to install it by himself by using an Ultra View application. He not only installed that application but also compromised my private access to my account and resolved the case for acc.923570 without my permission. I let him know that I knew what he did but he didn't express any reaction. My account 924376 was working again so I didn’t ask more questions, just waiting for the last day of the agreement to be able to withdraw my money to the bank. Two days later June 12th, my account was terminated again including the communication. The day after breaking into my account, I received notice from my newly established trading account support about several attempts to break in. Such a coincidence? Do not ever talk to them open an account and deposit money. These criminals need to be stopped.

Discover

Rajkumar 3247

+Telegram:YF8001

FX3239945048

Alpha Trade

TV03

FX6845073

EA

Tools Immortality

Income in last year +120.00%

This tool is an indicator that can display the net value change graph of the account in historical time and the opening and closing positions and connection graphs of all historical orders.

USD 0.99 USD 980.00PurchaseMartin ForexWorld

Income in last year +115.90%

Martin's strategy is mainly used in symbol market, mainly used in small period and shock market, keep trading back and forth, adding up.

USD 0.99 USD 980.00PurchaseComprehensive type Godness

Income in last year +261.86%

Expect to enlarge the market;Even if the direction is wrong, you can set a stop loss.and you can solve the problem of inaccurate opening positions by adding several positions before the stop loss is reached.

USD 0.99 USD 980.00PurchaseTrend type Aberration

Income in last year +173.36%

This is a classic CTA strategy, similar to the band line strategy, which makes a trend market and breaks through the shock range to buy. If the market continues to go, it will hold it until it goes long, falls below the midline of the band line, or closes short and rises above the middle rail of the band line.

USD 0.99 USD 280.00Purchase

Ranking List

- Total Margin

- Active Trading Ranking

- Total lots

- Stop Out

- Profit Order

- Brokers' Profitability

- New User

- Spread Cost

- Rollover Cost

- Net Deposit Ranking

- Net Withdrawal Ranking

- Active Funds Ranking

Total Margin

- 30 days

- 90 days

- 6 months

- Brokerage

- Total Asset%

- Ranking

- 1

Exness

- 34.90

- --

- 2

XM

- 14.77

- --

- 3

FBS

- 6.51

- 1

- 4

FXTM

- 5.79

- 1

- 5

GMI

- 5.41

- --

- 6

Doo Prime

- 4.41

- --

- 7

TMGM

- 2.27

- 1

- 8

IC Markets

- 2.15

- 1

- 9

Vantage

- 1.52

- --

- 10

ZFX

- 0.93

- --

Active Trading Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Activation rate%

- Ranking

- 1

Exness

- 59.26

- --

- 2

XM

- 49.44

- --

- 3

GMI

- 12.74

- --

- 4

FBS

- 12.39

- --

- 5

TMGM

- 9.06

- 2

- 6

IC Markets

- 6.95

- --

- 7

Doo Prime

- 6.08

- 1

- 8

FXTM

- 5.79

- 3

- 9

Vantage

- 2.75

- 2

- 10

ZFX

- 2.10

- 3

Total lots

- 30 days

- 90 days

- 6 months

- Brokerage

- Trading Volume%

- Ranking

- 1

FBS

- 66.67

- --

- 2

Exness

- 21.48

- 1

- 3

IC Markets

- 18.00

- 1

- 4

FXTM

- 16.11

- 2

- 5

USGFX

- 15.77

- 3

- 6

Tickmill

- 9.92

- 1

- 7

GMI

- 5.06

- 11

- 8

TMGM

- 3.25

- 2

- 9

ZFX

- 1.37

- 3

- 10

XM

- 1.16

- 1

Stop Out

- 30 days

- 90 days

- 6 months

- Brokerage

- Stop Out%

- Ranking

- 1

Alpari International

- 5.95

- 23

- 2

Forex Club

- 5.94

- 30

- 3

NCE

- 4.84

- 3

- 4

GKFX Prime

- 4.65

- 32

- 5

WeTrade

- 3.12

- 16

- 6

CPT Markets

- 2.98

- 1

- 7

STARTRADER

- 2.88

- 5

- 8

ThinkMarkets

- 2.88

- 5

- 9

USGFX

- 2.08

- 5

- 10

GMI

- 1.96

- 2

Profit Order

- 30 days

- 90 days

- 6 months

- Brokerage

- Win rate%

- Ranking

- 1

FBS

- 12.38

- 4

- 2

TMGM

- 4.64

- 1

- 3

IC Markets

- 1.56

- 3

- 4

Pepperstone

- 1.25

- 15

- 5

ZFX

- 0.95

- 4

- 6

AvaTrade

- 0.28

- 5

- 7

CWG Markets

- 0.27

- 3

- 8

Eightcap

- 0.23

- 34

- 9

Vantage

- 0.18

- 29

- 10

RockGlobal

- 0.15

- 3

Brokers' Profitability

- 30 days

- 90 days

- 6 months

- Brokerage

- Total Profit%

- Ranking

- 1

XM

- 33.27

- 47

- 2

GMI

- 8.70

- --

- 3

Doo Prime

- 5.35

- 3

- 4

Axitrader

- 4.14

- 42

- 5

VT Markets

- 2.54

- 2

- 6

CXM Trading

- 1.59

- 1

- 7

FXTM

- 1.22

- 6

- 8

CPT Markets

- 0.30

- 25

- 9

ACY Securities

- 0.12

- 2

- 10

Tickmill

- 0.08

- 2

New User

- 30 days

- 90 days

- 6 months

- Brokerage

- Growth value%

- Ranking

- 1

Exness

- 17.92

- --

- 2

XM

- 17.76

- --

- 3

FXTM

- 4.49

- --

- 4

FBS

- 4.47

- 2

- 5

GMI

- 4.07

- --

- 6

IC Markets

- 3.93

- 2

- 7

TMGM

- 3.16

- --

- 8

Doo Prime

- 2.47

- --

- 9

FXTRADING.com

- 1.22

- --

- 10

Vantage

- 1.12

- --

Spread Cost

- 30 days

- 90 days

- 6 months

- Brokerage

- Average Spread

- Ranking

- 1

XM

- 19.64

- 1

- 2

Exness

- 17.17

- 1

- 3

FBS

- 5.60

- 1

- 4

GMI

- 4.93

- 1

- 5

TMGM

- 3.70

- 2

- 6

IC Markets

- 2.82

- 1

- 7

FXTM

- 2.18

- 1

- 8

Doo Prime

- 2.06

- --

- 9

FXTRADING.com

- 1.23

- --

- 10

Vantage

- 0.95

- --

Rollover Cost

- 30 days

- 90 days

- 6 months

- Brokerage

- Average rollover

- Ranking

- 1

Exness

- 435.35

- --

- 2

XM

- 72.86

- --

- 3

FBS

- 33.42

- 39

- 4

FXDD

- 21.59

- 32

- 5

RockGlobal

- 9.45

- 29

- 6

ZFX

- 3.17

- 2

- 7

Pepperstone

- 3.02

- 13

- 8

Swissquote

- 2.34

- 5

- 9

Doo Prime

- 2.17

- 21

- 10

USGFX

- 1.50

- 7

Net Deposit Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Net Deposit%

- Ranking

- 1

MultiBank Group

- 94.26

- 40

- 2

AvaTrade

- 76.97

- 2

- 3

VT Markets

- 76.71

- 14

- 4

Vantage

- 74.64

- 1

- 5

Eightcap

- 72.29

- 2

- 6

FxPro

- 71.98

- 2

- 7

TMGM

- 71.92

- 22

- 8

CWG Markets

- 71.60

- 3

- 9

Alpari International

- 71.43

- 3

- 10

CXM Trading

- 71.28

- 13

Net Withdrawal Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Net Withdraw%

- Ranking

- 1

Doo Prime

- 7.00

- 3

- 2

Exness

- 7.00

- --

- 3

GO MARKETS

- 7.00

- --

- 4

Valutrades

- 8.00

- --

- 5

FBS

- 10.00

- 2

- 6

STARTRADER

- 11.00

- 4

- 7

ThinkMarkets

- 11.00

- 4

- 8

Axitrader

- 12.00

- 9

- 9

ACY Securities

- 12.00

- 16

- 10

IC Markets

- 13.00

- --

Active Funds Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Activation rate%

- Ranking

- 1

FXDD

- -0.60

- --

- 2

FXCM

- -0.80

- 4

- 3

AUS GLOBAL

- -0.86

- 1

- 4

GMI

- -0.95

- --

- 5

Doo Prime

- -1.36

- 2

- 6

FXPRIMUS

- -1.50

- --

- 7

FOREX.com

- -1.50

- 1

- 8

AvaTrade

- -2.56

- --

- 9

HYCM

- -2.60

- 2

- 10

Just2Trade

- -2.90

- --

Real-time spread comparison EURUSD

- Brokers

- Accounts

- Buy

- Sell

- Spread

- Average spread/day

- Long Position Swap USD/Lot

- Short Position Swap USD/Lot

To view more

Please download WikiFX APP

Know More and Enjoy More