Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

General information and Regulation

JustMarkets is a Cyprus-based forex broker, regulated by FSA and CYSEC, offering a range of trading instruments, including forex, metals, energies, indices, and shares. They offer two account types with competitive spreads, a maximum leverage of up to 1:300 for professional clients, and multiple deposit and withdrawal options with low fees. The platform available for trading is the popular MetaTrader5, and they also provide a range of educational resources. JustMarkets prioritizes customer satisfaction by offering high-quality customer support through email, phone, and fax.

In the following article, we will analyse the characteristics of this broker in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

Pros and Cons

Pros:

STP broker model ensures no conflict of interest with clients.

Wide range of trading instruments available.

Low minimum deposit requirement for both account types.

Competitive spreads and commissions, with zero commissions for Pro account.

Islamic account option available.

MetaTrader5 platform available for trading.

High processing speed and low fees for deposits and withdrawals.

Various educational resources available for traders.

Responsive and multilingual customer support.

Cons:

Limited leverage options for retail clients.

No mention of negative balance protection.

Limited information available on the company's history and ownership.

Market instruments

JustMarkets offering 100+ trading instruments provides traders with a diverse range of options to choose from, including currency pairs, precious metals, energies, indices, and shares. This provides traders with flexibility and the opportunity to diversify their portfolio, reducing their overall risk exposure. The availability of various instruments also offers opportunities to capitalize on different market conditions and economic events.

However, traders must have a good understanding of the different markets and factors that influence the price movements of each instrument. Additionally, trading different instruments may require larger capital due to varying margin requirements, and some instruments may have lower liquidity and wider spreads, making it difficult to execute trades at desired prices.

Spreads & Commissions

JustMarkets offers competitive floating spreads starting from 0 pips on Raw Spread accounts and 0.1 pips on Pro accounts, which is an advantage for traders looking for low trading costs. While Raw Spread accounts have a commission of 3USD per lot, there is no commission on Pro accounts. This pricing model is transparent, with no hidden fees or charges, making it easier for traders to calculate their trading costs.

However, the range of account options with different spread and commission structures can be confusing for some traders. Additionally, there is no fixed spread account option available for traders who prefer this pricing model.

Trading Accounts

JustMarkets offers two different types of accounts for traders: Pro and Raw Spread. Both accounts require a minimum deposit of $100 and offer leverage of up to 1:30, with the main difference being the type of spread and commission charged. The Pro account has a spread starting from 0.1 pips with no commission, while the Raw Spread account offers spreads from 0 pips with a commission of 3 units of the base currency per lot/side. JustMarkets also offers an Islamic account option, which is free of swaps and interest charges, making it compliant with Sharia law. The main advantage of the account types is the flexibility it provides to traders with different preferences and trading styles, while the main disadvantage is the limited leverage options and account currency options.

Trading Platforms

JustMarkets offers the popular MetaTrader 5 (MetaTrader5) trading platform to its clients. This platform is highly advanced and provides a range of features and tools for traders to analyze and execute trades across multiple asset classes. The platform's advanced charting tools, depth of market feature, and ability to use custom indicators and expert advisors make it popular among experienced traders who rely on data to make informed decisions.

While it may have a steeper learning curve for beginners, the platform's improved back-testing capabilities and option to open multiple accounts within the platform make it a valuable tool for traders looking to develop and test their trading strategies.

Overall, MetaTrader5 is a powerful and versatile trading platform that can cater to the needs of a wide range of traders.

Leverage

In terms of leverage, JustMarkets offers up to 1:30 for retail clients and 1:300 for professional clients. While high leverage can increase the potential for profits, it also significantly increases the risk of losses. Traders should be careful when using high leverage and consider their risk tolerance, trading strategy, and financial situation. It's important to note that some regulatory bodies restrict the use of high leverage, so traders should check the regulations in their country or region.

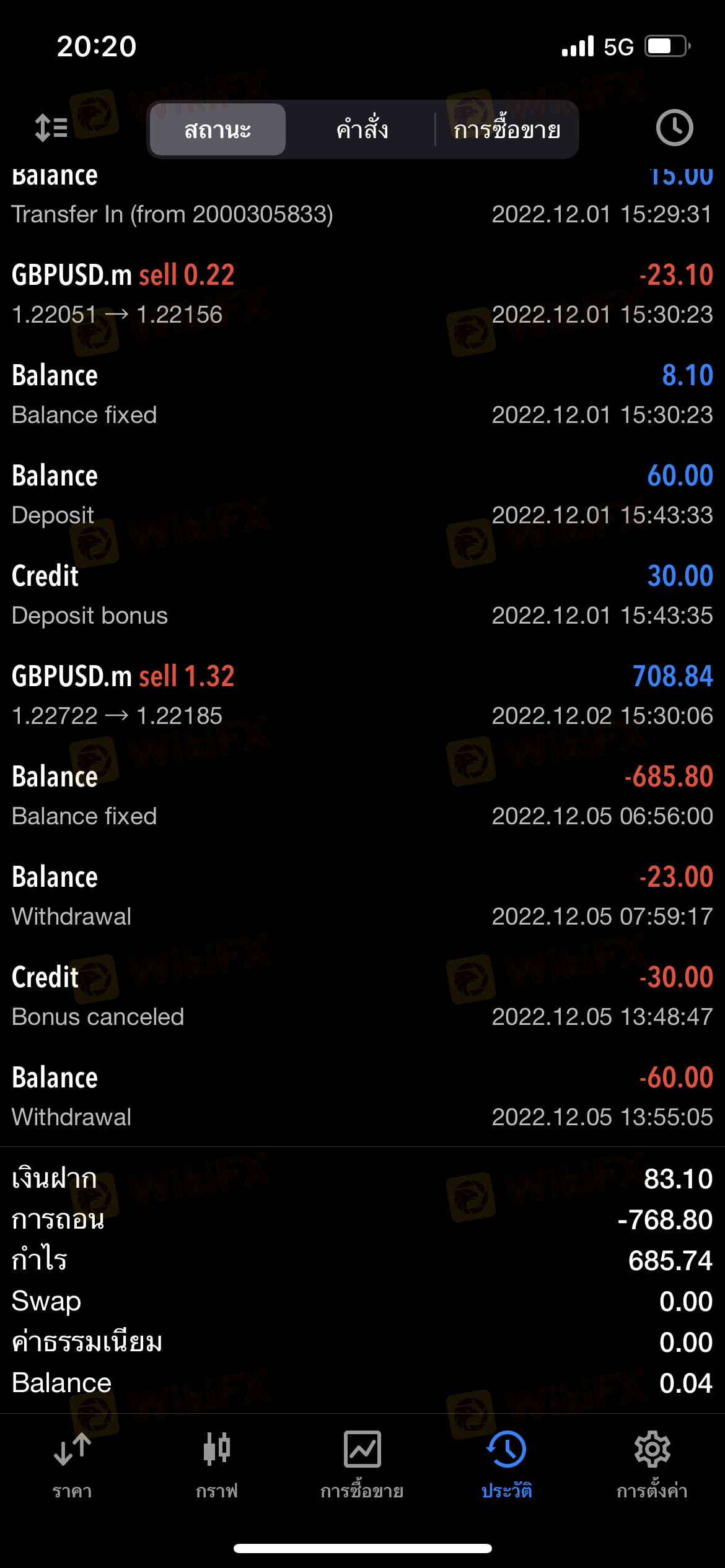

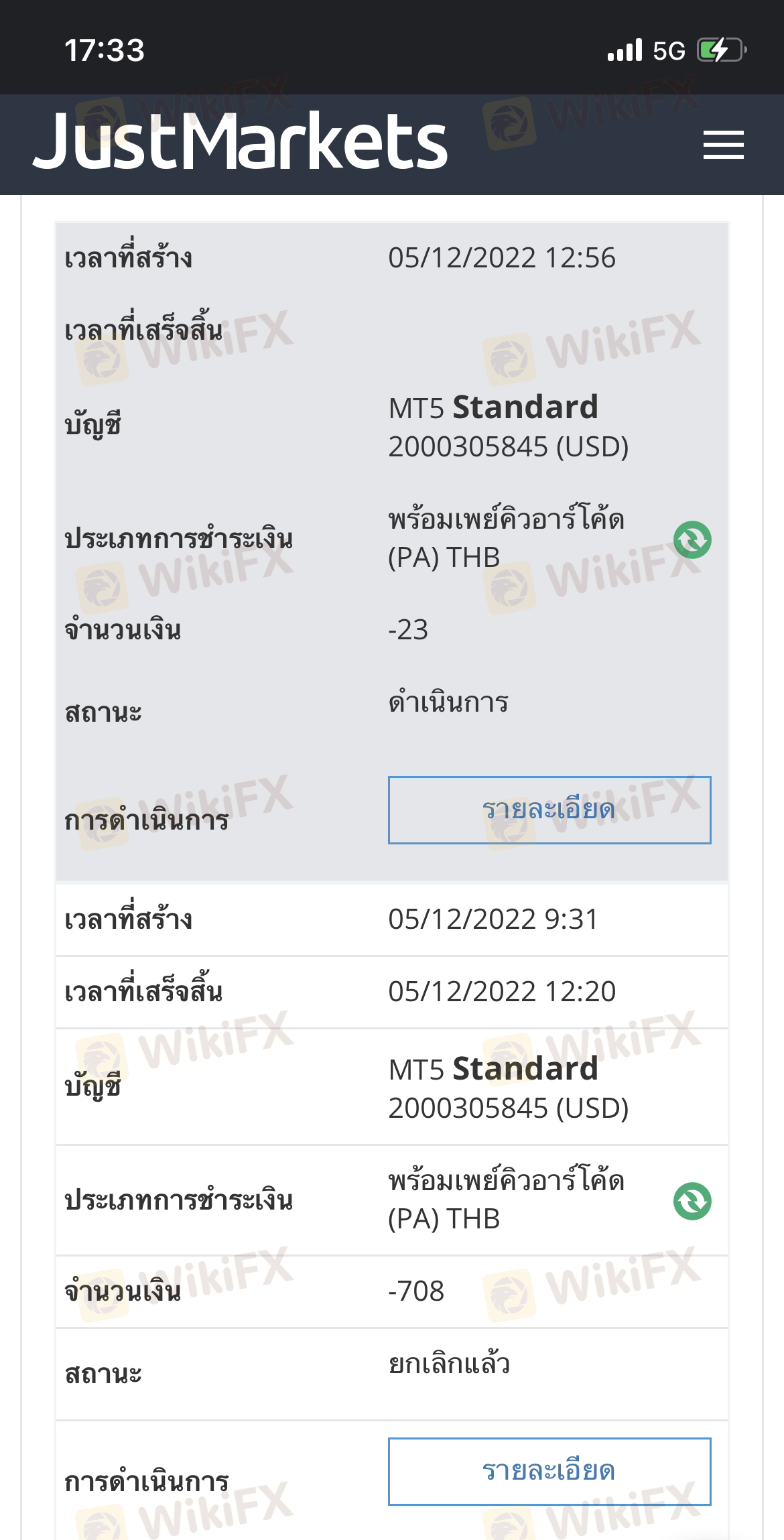

Deposit & Withdrawal

JustMarkets offers various payment methods for deposits and withdrawals, including bank wire transfer, Skrill, Neteller, VISA, MasterCard, and PayPal. The minimum deposit amount is low and the processing times are fast, making it easy for traders to quickly start trading. Additionally, there are little to no fees associated with deposits and withdrawals, and the user interface is user-friendly.

However, some payment methods may have withdrawal fees and deposits in certain currencies may also have fees.

Educational Resources

JustMarkets offers a variety of educational resources to its clients, which can be accessed for free on their website. These resources include an economic calendar, market reports, video tutorials, articles, and a glossary of trading terms. The economic calendar is especially useful for keeping track of important market events and releases, while the market reports offer detailed analysis and insights into current market conditions. The video tutorials cover a range of topics and can be helpful for both beginner and advanced traders.

However, JustMarkets does not offer personalized coaching or mentoring, structured courses or certification programs, or live webinars or seminars.

You may also see some educational videos on their official YouTube channel.

Customer Service

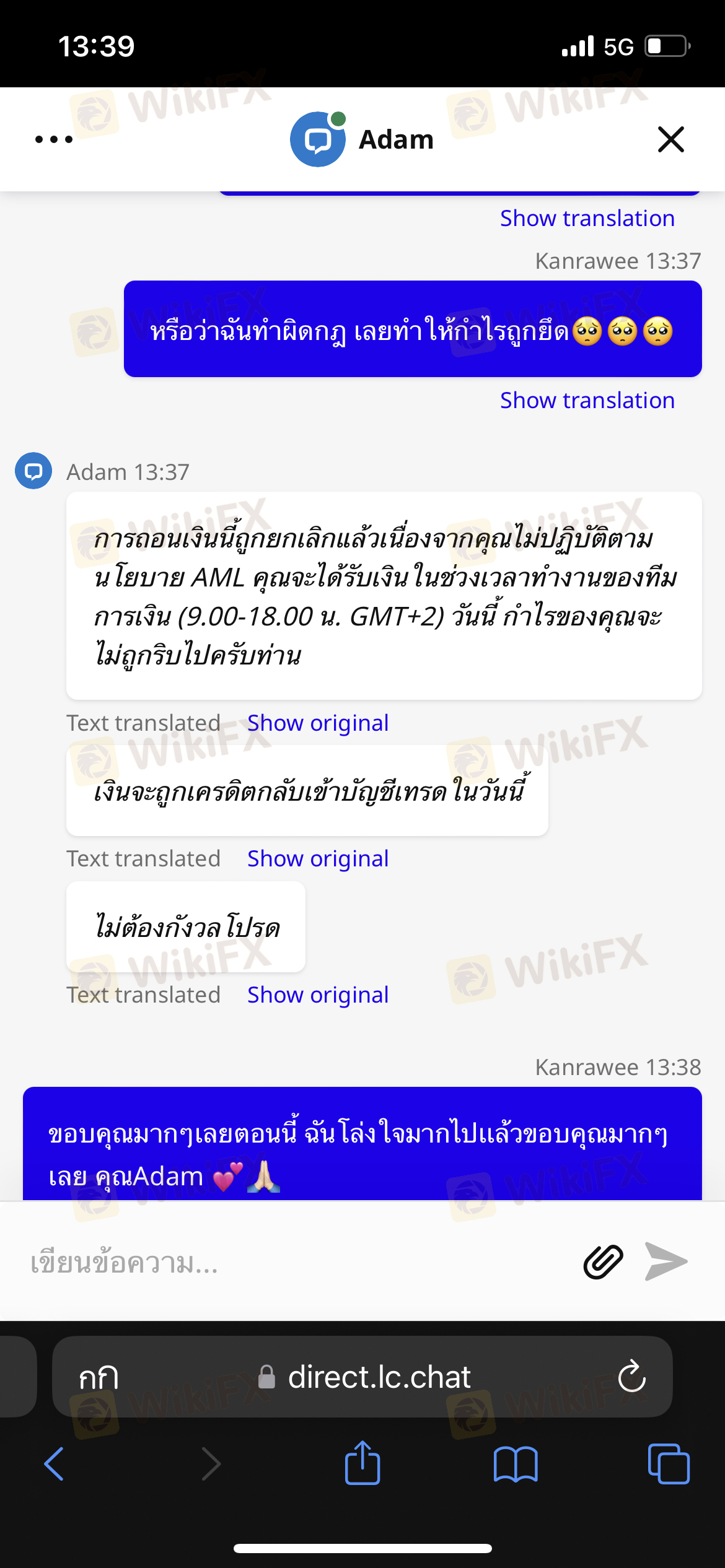

JustMarkets seems to prioritize customer care as evidenced by the various communication channels available for clients to reach out to them. They have an email address, phone numbers, and a physical office address where clients can visit for assistance. The broker also has a fast response time for customer queries and complaints. Additionally, a section with frequently asked questions (FAQs) is available on their website.

However, it should be noted that there is no live chat support available, customer support is not available 24/7, and limited language support for customer service may be a disadvantage for some clients. Moreover, there is no dedicated account manager for clients who may require personalized assistance.

Conclusion

In conclusion, JustMarkets is a reputable forex broker that offers a range of trading instruments and account types suitable for both retail and professional traders. With its STP execution model, clients can trade with minimal slippage and re-quotes. JustMarkets' MetaTrader 5 platform provides advanced charting tools and a customizable interface to enhance the trading experience. The availability of educational resources and excellent customer service also helps clients to make informed trading decisions.

While there are some limitations such as limited trading platforms and regional restrictions, the overall advantages outweigh the disadvantages. With a focus on transparency and client satisfaction, JustMarkets is a reliable option for traders looking for a regulated broker with competitive trading conditions.

Frequently Asked Questions (FAQs)

Q: What kind of trading accounts does JustMarkets offer?

A: JustMarkets offers two types of trading accounts - the Pro account and the Raw Spread account. Both accounts offer leverage up to 1:30 for retail clients and 1:300 for professional clients.

Q: What trading platforms are available at JustMarkets?

A: JustMarkets offers the popular trading platform MetaTrader5, which is available on desktop, web, and mobile devices.

Q: What is the minimum deposit requirement at JustMarkets?

A: The minimum deposit required to open an account with JustMarkets is $100.

Q: What are the available deposit and withdrawal methods at JustMarkets?

A: JustMarkets offers a variety of deposit and withdrawal methods, including bank wire transfer, Skrill, Neteller, VISA, MasterCard, and PayPal.

Q: Is JustMarkets a regulated broker?

A: Yes, JustMarkets is a Cyprus-registered company regulated by the FSA and CYSEC, ensuring the safety of client funds and adherence to industry standards.

Q: Does JustMarkets offer educational resources for traders?

A: Yes, JustMarkets provides various educational resources such as an economic calendar, market reports, video tutorials, articles, and a glossary to help traders improve their skills and knowledge.

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX