Exposure

Taxes had to be paid for various reasons, funds could not be withdrawn, and the service (exchange) was finally closed.

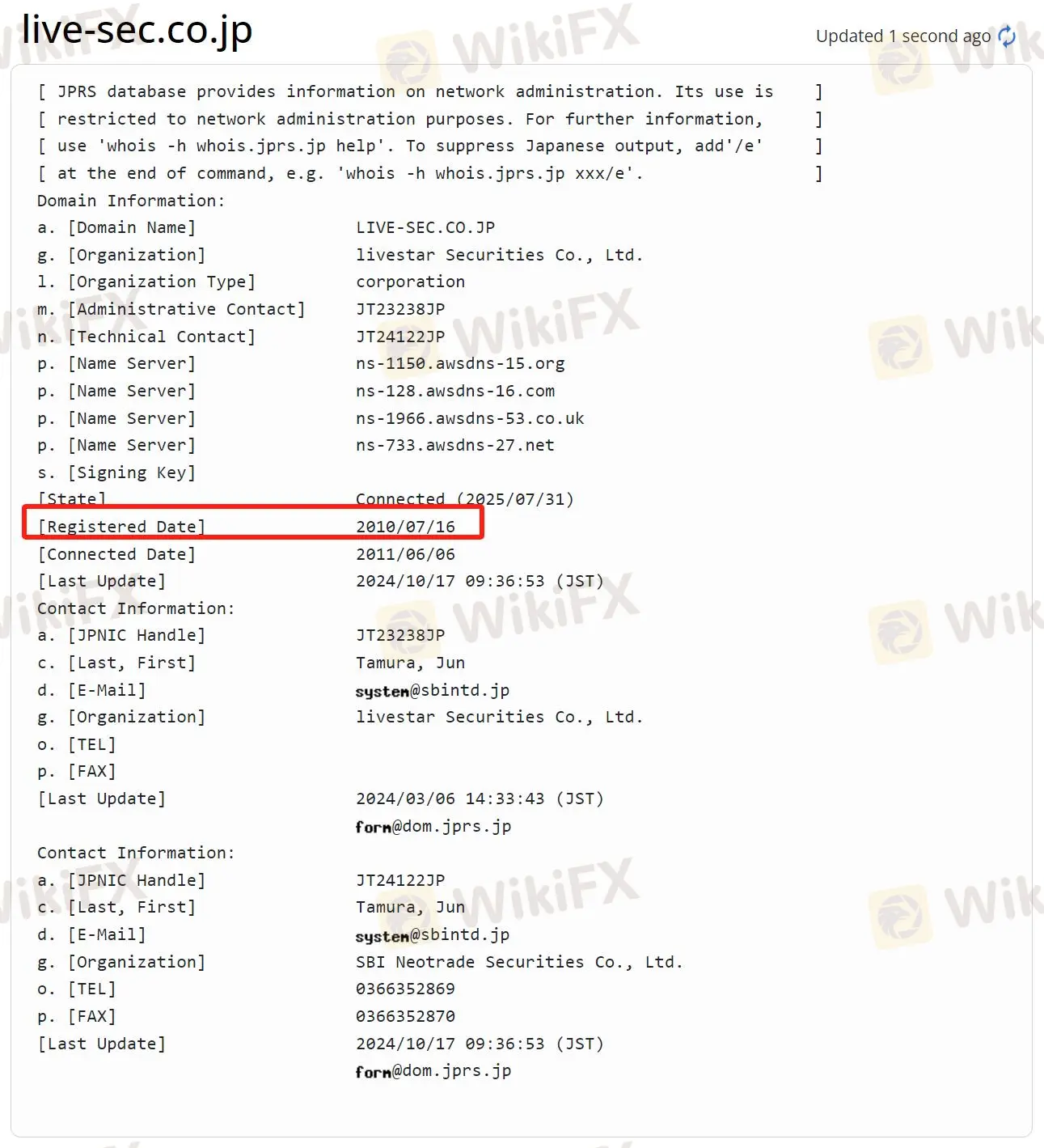

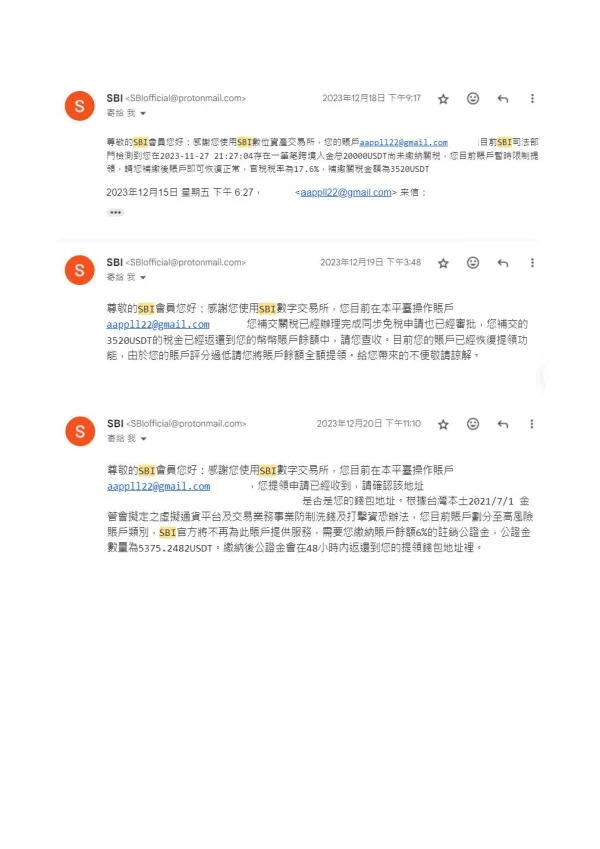

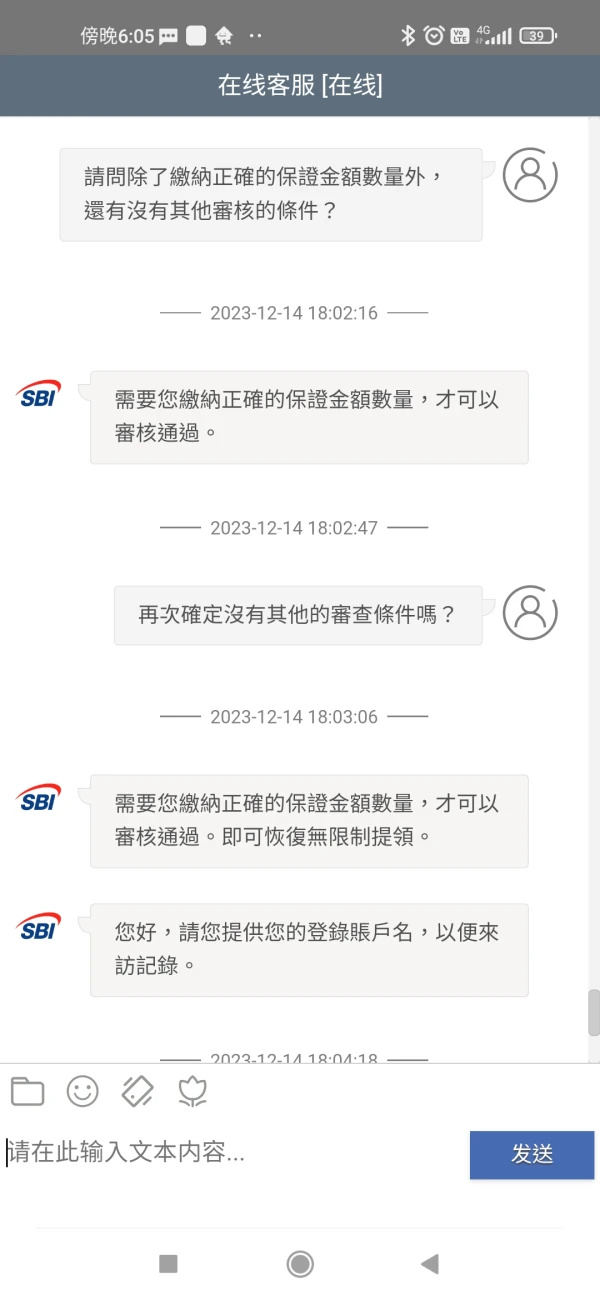

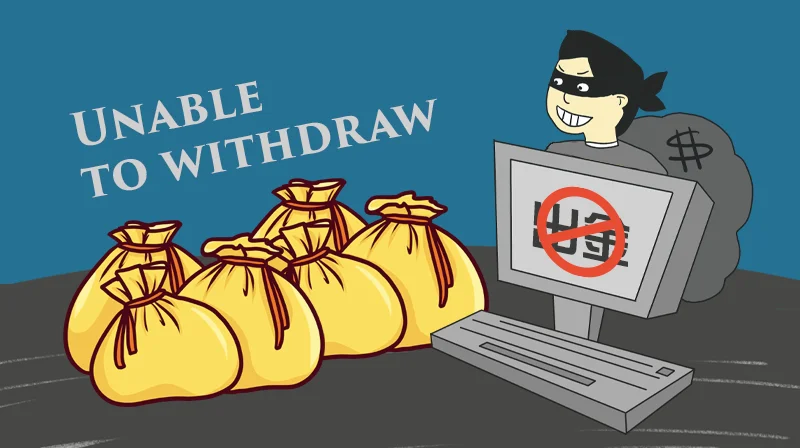

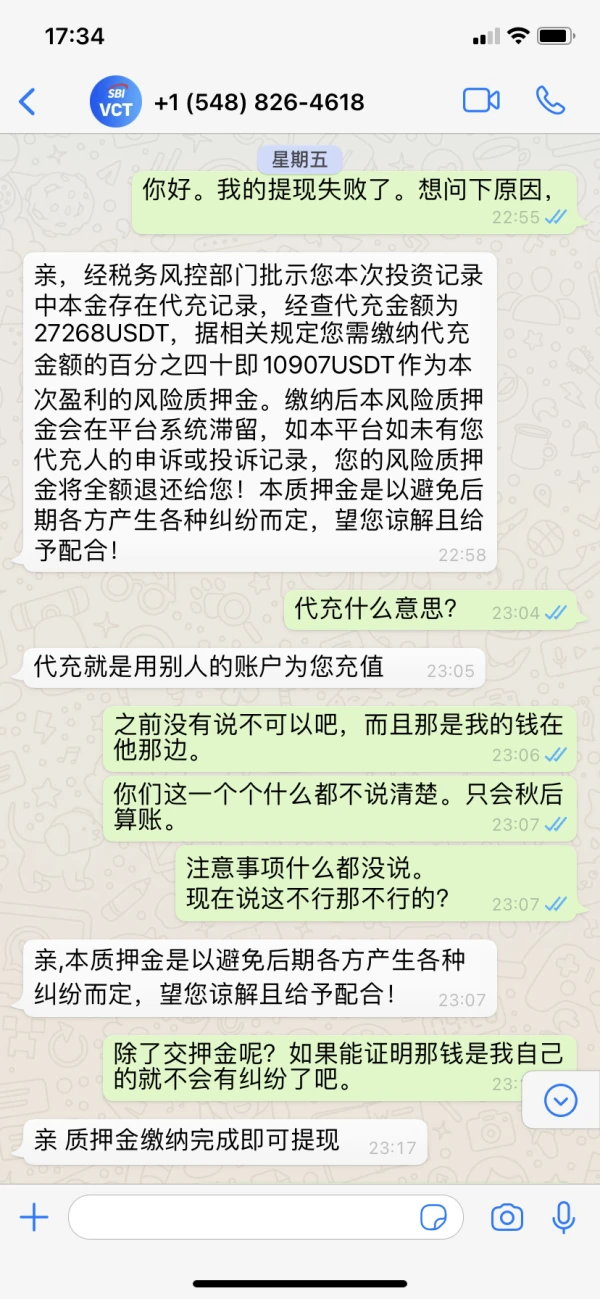

1. The exchange name is SBI and is registered in China and Japan. When I traded in November 2023 on the website www.sbicllwllslqw.com. I could not withdraw. Later I found that there were three other URLs on the platform that were the same. I can log in to www.sbigtr.com, www.sbilamkiedjroc.com, or www.sbiuuolehjne.com with the same account and password. The notification emails are all from SBIofficial@protonmail.com (the mailbox SBI sent me is the same). But in February 2024, All websites and apps were closed unexpectedly. Currently, it is no longer possible to log in. On February 22, a letter was sent to stop the service. 2. On 2023/11/3 and 2023/11/4, I deposited 1,000 USDT and 1,100 USDT respectively. I didn’t know how to operate and lost money. So on November 27, 2023, I deposited 11,696 USDT and 20,000 USDT respectively (I borrowed money from a friend to deposit) and earned 78,161.40 USDT. Then I wanted to withdraw 16,000 USDT. The nightmare began, they required me to pay taxes for various reasons (1) SBI requires The real-name certification of the account and a legal citizen of Taiwan must pay a 5% deposit of the account balance to verify the operation! Margin: 3908.07USDT. As a result, I deposited 3999 USDT, but the number was different from it, so I paid another 3908.07USDT. (2) The total cross-border deposit of 20,000USDT has not yet paid the customs duty. Your current account is temporarily restricted from withdrawal. Please make the additional payment and your account will be updated. It can return to normal, the official tax rate is 17.6%, and the amount of back-tax payment is: 3520 USDT. At this time, my account reached 89588.47 USDT (the exchange will credit the first three payments into the account) (3) According to Taiwan Mainland July. 1st “Preventing Money Laundering and Combating Terrorism Financing for Virtual Currency Platforms and Trading Business Enterprises” formulated by the Financial Supervisory Commission, your current account is classified into a high-risk account category. SBI officials will no longer provide services for this account, and you are required to pay 6% of the account balance as a fee for canceling. The amount of the notarized deposit is 5375.2482USDT (4) Several TRX handling fees are transferred from mainland funds. To avoid the money laundering risk of mainland users, SBI officials carry out risk control and require Taiwanese legal citizens to pay a 3% deposit of the account balance. Carry out verification operation! Guaranteed amount: 2687.3241USDT (5) The withdrawal address has been filed for you. To avoid the risk of money laundering for users, SBI officials have detected that your account has a low overall score and require you to pay 4% of your account balance as the filing address. The number of registered funds was 3583.4988USDT. (3)-(5) were not credited to my account, so the exchange withheld (6) cross-border deposits, totaling 20,000 USDT. Profit accounted for cross-border funds. Total recharge amount: 45.1528 % Recently, it has been discovered that a large number of people are laundering money, and the source of the funds is unknown. The International Financial Supervisory Commission will implement new regulations from February 1, 2023. Currently, your account is subject to risk control and withdrawals are temporarily restricted. You are required to pay the profit tax before the account can be restored. Normally, the official tax rate is 19.7%, and the amount of back-payment of duties is 3807.56 USDT; this amount has not been paid. 3. Every time I pay a tax, I ask customer service whether I can withdraw the amount after paying it and return the deposit and duties paid. , cancellation of notary funds, etc. The answer comes the same every time. Currently, my account only has this amount of funds that need to be paid, and there are no subsequent funds that need to be paid. As a result, there are new questions to pay after paying. 4. I left this detailed information and hope that no one will be deceived like me in the future. I found that its registration URL can be used until 2024/9/22, and I am afraid that it will appear and continue to accept registrations for fraud. The platform of the website is Gname.com Pte. Ltd.5.

安德斯

Taiwan

1. The exchange name is SBI and is registered in China and Japan. When I traded in November 2023 on the website www.sbicllwllslqw.com. I could not withdraw. Later I found that there were three other URLs on the platform that were the same. I can log in to www.sbigtr.com, www.sbilamkiedjroc.com, or www.sbiuuolehjne.com with the same account and password. The notification emails are all from SBIofficial@protonmail.com (the mailbox SBI sent me is the same). But in February 2024, All websites and apps were closed unexpectedly. Currently, it is no longer possible to log in. On February 22, a letter was sent to stop the service. 2. On 2023/11/3 and 2023/11/4, I deposited 1,000 USDT and 1,100 USDT respectively. I didn’t know how to operate and lost money. So on November 27, 2023, I deposited 11,696 USDT and 20,000 USDT respectively (I borrowed money from a friend to deposit) and earned 78,161.40 USDT. Then I wanted to withdraw 16,000 USDT. The nightmare began, they required me to pay taxes for various reasons (1) SBI requires The real-name certification of the account and a legal citizen of Taiwan must pay a 5% deposit of the account balance to verify the operation! Margin: 3908.07USDT. As a result, I deposited 3999 USDT, but the number was different from it, so I paid another 3908.07USDT. (2) The total cross-border deposit of 20,000USDT has not yet paid the customs duty. Your current account is temporarily restricted from withdrawal. Please make the additional payment and your account will be updated. It can return to normal, the official tax rate is 17.6%, and the amount of back-tax payment is: 3520 USDT. At this time, my account reached 89588.47 USDT (the exchange will credit the first three payments into the account) (3) According to Taiwan Mainland July. 1st “Preventing Money Laundering and Combating Terrorism Financing for Virtual Currency Platforms and Trading Business Enterprises” formulated by the Financial Supervisory Commission, your current account is classified into a high-risk account category. SBI officials will no longer provide services for this account, and you are required to pay 6% of the account balance as a fee for canceling. The amount of the notarized deposit is 5375.2482USDT (4) Several TRX handling fees are transferred from mainland funds. To avoid the money laundering risk of mainland users, SBI officials carry out risk control and require Taiwanese legal citizens to pay a 3% deposit of the account balance. Carry out verification operation! Guaranteed amount: 2687.3241USDT (5) The withdrawal address has been filed for you. To avoid the risk of money laundering for users, SBI officials have detected that your account has a low overall score and require you to pay 4% of your account balance as the filing address. The number of registered funds was 3583.4988USDT. (3)-(5) were not credited to my account, so the exchange withheld (6) cross-border deposits, totaling 20,000 USDT. Profit accounted for cross-border funds. Total recharge amount: 45.1528 % Recently, it has been discovered that a large number of people are laundering money, and the source of the funds is unknown. The International Financial Supervisory Commission will implement new regulations from February 1, 2023. Currently, your account is subject to risk control and withdrawals are temporarily restricted. You are required to pay the profit tax before the account can be restored. Normally, the official tax rate is 19.7%, and the amount of back-payment of duties is 3807.56 USDT; this amount has not been paid. 3. Every time I pay a tax, I ask customer service whether I can withdraw the amount after paying it and return the deposit and duties paid. , cancellation of notary funds, etc. The answer comes the same every time. Currently, my account only has this amount of funds that need to be paid, and there are no subsequent funds that need to be paid. As a result, there are new questions to pay after paying. 4. I left this detailed information and hope that no one will be deceived like me in the future. I found that its registration URL can be used until 2024/9/22, and I am afraid that it will appear and continue to accept registrations for fraud. The platform of the website is Gname.com Pte. Ltd.5.

Exposure

Angeli Tabin

Philippines

I downloaded the SBI VC Trade app through a link sent to me. I bought and sold cryptocurrencies and after earning 244,247.5606 USDT I tried to withdraw but customer service said I had to pay 6% tax amounting to 14,654.844 USDT in order to withdraw. I did that after 2 weeks. After getting my tax receipt, they said I can withdraw but when I tried to my pin wasn‘t working. They said they‘ll look into it then they told me someone was trying to hack my account so I need to send 3000 USDT.

Exposure

陈博5567

Spain

Sbivct.com was likely to be fake. It required deposit and other fees before withdrawal, which was not mentioned before.

Exposure

Saba Samuel

Nigeria

Although SBI appears well-regulated with a strong WikiFX score of 8.10 and a long operational history, I still have a few reservations after reviewing their profile. The platform shows a “Good” trading status, but that alone doesn't paint the full picture. Despite having a high capital ratio, there’s limited transparency on how the self-developed systems are maintained or audited. For retail traders, that lack of third-party verification can be concerning. Additionally, the lack of recent user feedback and reviews creates uncertainty about their current customer support and execution quality. Just because they’ve been around for 15-20 years doesn’t guarantee smooth service today. A clean interface is one thing—but without updated client experience reports, it’s hard to fully trust the performance behind the scenes. Before committing funds, I’d recommend anyone do deeper research, maybe test with a small account first, and ask them direct questions about

Neutral

邱浩銓

Colombia

First, I don’t tell lies. SBI is a great platform that's totally above board and transparent. Trading fees are reasonable and won't break the bank. The only drawback is that their customer service can be a bit slow to get back to you. Overall though, I'm really impressed with SBI Neotrade Securities and I'd definitely recommend it to any trader who wants a reliable and trustworthy platform.

Neutral

张浩32357

Taiwan

The website of this Japanese company looks good, but I feel that it will be troublesome to deal with it as a foreigner (the main reason is that the website does not have English or Chinese), so I may not have the opportunity to trade with it

Positive