Company Summary

| Pelliron Review Summary | |

| Founded | 2016 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Regulated |

| Market Instruments | Forex, Commodities and Stocks |

| Demo Account | ✅ |

| Leverage | 1:100 |

| EUR/USD Spread | 3 pips |

| Trading Platform | MT5 |

| Min Deposit | $5 000 |

| Customer Support | Tel: +44 2032906161 |

| Email: info@pelliron.com | |

| Registered address: First Floor, First St. Vincent Bank Ltd Building, James Street, Kingstown, VC0100, Saint Vincent and the Grenadines | |

| Business address: 160 London Road, Barking, London IG11 8BB, United Kingdom | |

| Regional Restriction | The United States |

Registered in Saint Vincent and the Grenadines in 2016, Pelliron serves as a financial brokerage firm, offering a range of trading options including Forex, Commodities, and Stocks through the MT5 trading platform. The company demands a significantly high minimum deposit of $5,000 and provides leverage up to 1:100. It's worth noting that this broker lacks legal regulation from any financial authorities.

Pros and Cons

| Pros | Cons |

| MT5 trading platform | Wide spreads |

| Popular payment options | High minimum deposit ($5,000) |

| US clients are not allowed |

Is Pelliron Legit?

Pelliron currently maintains a regulatory standing within offshore frameworks, classified under the “Business Registration” category, and is overseen by the authorities of Saint Vincent and the Grenadines, holding License No. 2146 LLC 2022.

What Can I Trade on Pelliron?

Pelliron only offers three classes of tradable instruments: Forex, Stocks and Commodities.

Stocks: Pelliron offers stocks on major US indices: on the New York Stock Exchange (NYSE) and the New York Mercantile Exchange (NYMEX).

Commodities:

- Agriculture: coffee, corn, cotton, sugar, soybeans, corn...

- Metals: platinum, silver, gold, aluminum, copper, palladium, nickel...

- Hydrocarbon group and energy carriers: oil, fuel oil, gas, coal and oil products.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Stocks | ✔ |

| Commodities | ✔ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Leverage

Pelliron only mentions that it offers a leverage of 1:100, which is relatively high in the industry. While such high leverage can potentially lead to significant profits in a single trade, it also amplifies losses.

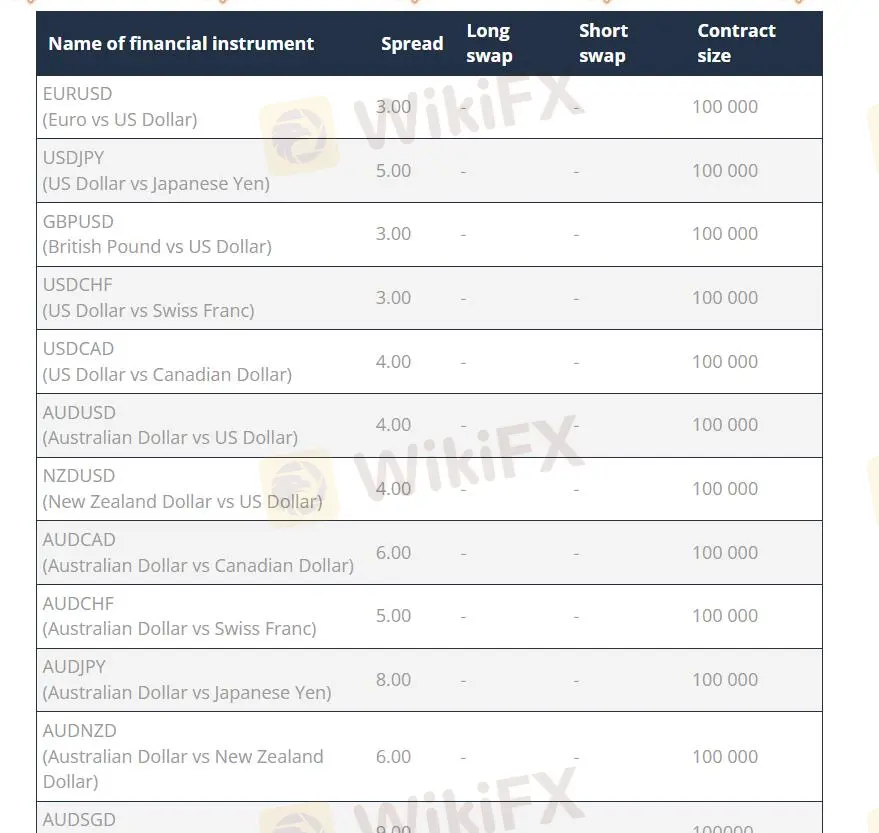

Spread

The spreads at Pelliron depend on the financial instruments you choose. For instance, for EUR/USD Pairs trading, the spread is 3pips, which is significantly higher than the industry average and uncompetitive. Even more excessively, the spread for JP225 (Nikkei 225 Index) is 1200pips, which is utterly unacceptable.

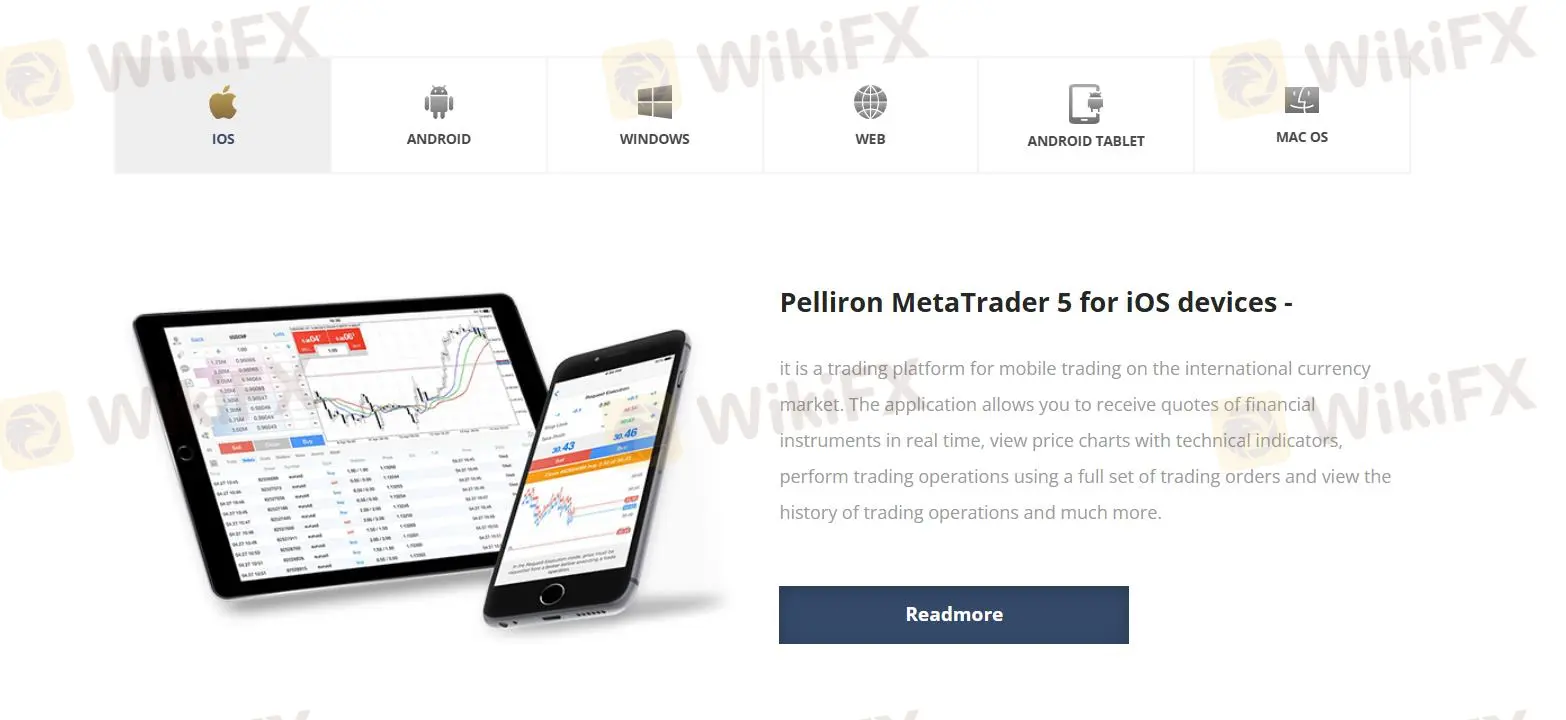

Trading Platform

Pelliron offers access to MetaTrader 5, an industry standard platform known for its high-tech indicators, charting tools, and other useful features. It can be accessed through PC, web, and mobile devices (iOS and Android). However, trading platforms provided by unregulated brokers have a high potential to be manipulated and pose a threat to your assets.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | iOS, Android, Windows, Web, Android Tablet, Mac OS | Experienced traders |

| MT4 | ❌ | / | Beginners |

Deposit and Withdrawal

Pelliron supports payments via bank transfers, bank cards, and e-currencies. However, they fail to disclose the fees associated with deposits and withdrawals.

Pongtai

Vietnam

This trading platform is very advanced, and the customer service is professional, super responsive!

Positive

FX3289088387

Ukraine

Broker quite normal, I have been working with him for over a year

Positive

Wlad19

Ukraine

Is very good broker with a wide rage options! Ideal for those who arenot yet very strong in traiding? sa well as investing in international markets both Forex and stock markets. Quite relevant and well-thought-out analytycs that help you undestand the trends that are currently on markets!

Positive

一念花开

Malaysia

Great account manager, well informed about the platform and trading in general, helpful and nice. About the platform, I like how easy to use it. A really good experience overall.

Positive