Score

Afterprime

Seychelles|1-2 years| Benchmark AA|

Seychelles|1-2 years| Benchmark AA|https://afterprime.com/

Website

Rating Index

Benchmark

Speed:AA

Slippage:A

Cost:AA

Disconnected:A

Rollover:B

Contact

Licenses

Single Core

1G

40G

Contact number

+61 (02) 9138 0640

Broker Information

More

Afterprime Ltd

Afterprime

Seychelles

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The Seychelles FSA regulation with license number: SD057 is an offshore regulation. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

Users who viewed Afterprime also viewed..

XM

AUS GLOBAL

STARTRADER

FP Markets

Afterprime · Company Summary

| Aspect | Information |

| Registered Country/Area | Seychelles |

| Company Name | Afterprime |

| Regulation | Suspicious Clone |

| Maximum Leverage | Up to 1:100 (most asset classes), 1:3 (Cryptocurrencies) |

| Spreads | Varies by asset class |

| Trading Platforms | MetaTrader 4 (MT4), TradingView Broker Integration, TraderEvolution |

| Tradable Assets | Forex, Commodities, Indices, Stocks, Bonds, Digital Currencies |

| Account Types | Live Trading Account, Demo Trading Account |

| Demo Account | Available |

| Customer Support | Help Center, Live Chat, Social Media, Email, Phone |

| Payment Methods | Credit & Debit Cards, FasaPay, GATE8, DragonPay, VNPAY, PromptPay, Pagsmile, Bank Wire, PerfectMoney, BinancePay, Finrax, Interac |

| Educational Tools | No |

Overview

Afterprime is a brokerage firm based in Seychelles that offers a range of trading instruments, including Forex, Commodities, Indices, Stocks, Bonds, and Digital Currencies. They provide a maximum leverage of up to 1:100 for most asset classes, except for Cryptocurrencies, where the maximum leverage is 1:3. Spreads vary depending on the asset class, and traders can access their markets through MetaTrader 4 (MT4), TradingView Broker Integration, and TraderEvolution trading platforms. Afterprime offers both Live Trading and Demo Trading accounts, making it suitable for traders of all levels. They provide multiple customer support channels, including a Help Center, Live Chat, social media, email, and phone support. Payment methods include Credit & Debit Cards, FasaPay, GATE8, DragonPay, VNPAY, PromptPay, Pagsmile, Bank Wire, PerfectMoney, BinancePay, Finrax, and Interac. However, specific details about educational tools were not provided.

Regulation

Suspicious Clone.A “Suspicious Clone License” refers to a counterfeit or unauthorized copy of a legitimate license or permit. These forged documents are created without permission, with the intent to deceive others into believing they hold a valid license. They are typically used for illegal activities and can lead to legal consequences, including criminal charges and fines. Detecting and verifying the authenticity of licenses is crucial to prevent the use of suspicious clone licenses.

Pros and Cons

| Pros | Cons |

| Wide Range of Trading Instruments | Suspicion of Clone License |

| Multiple Leverage Options | Lack of Regulatory Information |

| Versatile Trading Platforms | Lack of Educational Resources |

| Demo and Live Trading Accounts | |

| Various Customer Support Channels | |

| Fee-Free or Minimal Fee Deposits and Withdrawals | |

| Competitive Spreads and Execution Speed | |

| Accessible on Various Devices |

Afterprime, a Seychelles-based brokerage firm, provides traders with access to a diverse range of trading instruments, including Forex, Commodities, Indices, Stocks, Bonds, and Digital Currencies. The broker offers a variety of leverage options and supports multiple trading platforms, including MetaTrader 4, TradingView Broker Integration, and TraderEvolution. They offer both demo and live trading accounts and provide customer support through various channels.

However, there are certain concerns to consider. The mention of a “Suspicion of Clone License” raises potential issues related to regulatory compliance and the authenticity of licenses. The lack of specific information about regulatory oversight and educational resources might be a drawback for traders seeking more transparency and educational support.

In conclusion, Afterprime offers a wide array of trading opportunities and user-friendly platforms, making it appealing to traders. However, due to the uncertainties regarding the “Suspicion of Clone License” and the absence of detailed regulatory information and educational resources, traders should exercise caution and conduct thorough research before considering this broker as their trading partner.

Market Instruments

Afterprime is a brokerage firm that provides a wide range of trading instruments to cater to the diverse needs of its clients. These market instruments encompass various financial assets, offering traders opportunities for diversification and potential profit in different market conditions.

Forex (Foreign Exchange): Afterprime offers Forex trading, allowing clients to engage in the foreign exchange market. Forex trading involves the buying and selling of currency pairs, making it one of the largest and most liquid financial markets globally. Traders can speculate on the price movements of currency pairs like EUR/USD, GBP/JPY, and more.

Commodities: Clients of Afterprime can trade commodities, including precious metals like gold and silver, energy resources such as crude oil, and agricultural products like wheat and corn. Commodity trading is influenced by global supply and demand dynamics, making it attractive to traders looking to diversify their portfolios.

Indices: Afterprime offers index trading, enabling clients to invest in stock market indices. This allows traders to gain exposure to the performance of entire markets or specific sectors. Popular indices like the S&P 500, FTSE 100, and Nikkei 225 are available for trading.

Stocks: Afterprime provides access to equity markets, allowing clients to buy and sell shares of publicly traded companies. This includes a wide range of stocks from various sectors and regions, giving traders the opportunity to invest in individual companies.

Bonds: Afterprime offers bond trading, allowing clients to invest in fixed-income securities. Bonds are debt instruments issued by governments and corporations, providing regular interest payments to bondholders. Bond trading can be a suitable choice for income-focused investors.

Digital Currencies: In addition to traditional financial instruments, Afterprime offers trading in digital currencies, also known as cryptocurrencies. This includes well-known cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and other altcoins. Cryptocurrency trading has gained popularity due to its potential for high volatility and substantial price movements.

Here is a detailed table summarizing the market instruments offered by Afterprime:

| Market Instrument | Description |

| Forex | Trade currency pairs in the foreign exchange market. |

| Commodities | Trade precious metals, energy resources, and agriculture. |

| Indices | Invest in stock market indices from around the world. |

| Stocks | Buy and sell shares of publicly traded companies. |

| Bonds | Invest in fixed-income securities from governments and corporations. |

| Digital Currencies | Trade cryptocurrencies like Bitcoin, Ethereum, and more. |

Account Types:

Afterprime offers two main types of trading accounts:

Demo Trading Account: Ideal for new traders to practice risk-free with virtual money. It simulates real market conditions and helps users become familiar with the platform's features.

Live Trading Account: Designed for traders ready to invest real capital in live markets. It offers profit potential but comes with the risk of financial loss. Live account holders access real markets and receive additional support and services.

Leverage

This broker offers a maximum trading leverage of up to 1:100 for most asset classes, including Forex, Metals, Indices, and Commodities. This means that traders are only required to put up 1% of their trade's total value as margin to open a position, while they can control a position size up to 100 times the margin they've put up.

However, for Cryptocurrency trading, the maximum leverage is lower at 1:3, which means that traders need to put up 33.3% of the trade's total value as margin to open a position in the cryptocurrency market.

For Shares, the maximum leverage is up to 1:20, and for Bonds, it's also up to 1:100. Leverage allows traders to amplify their trading positions, potentially increasing both profits and losses, so it's essential for traders to understand the risks associated with different leverage levels and use them wisely in their trading strategies.

Afterprime's diverse range of market instruments allows traders to build a well-rounded portfolio, manage risk, and take advantage of various market opportunities. Whether clients are interested in forex, commodities, indices, stocks, bonds, or digital currencies, they can access these instruments through the brokerage's platform.

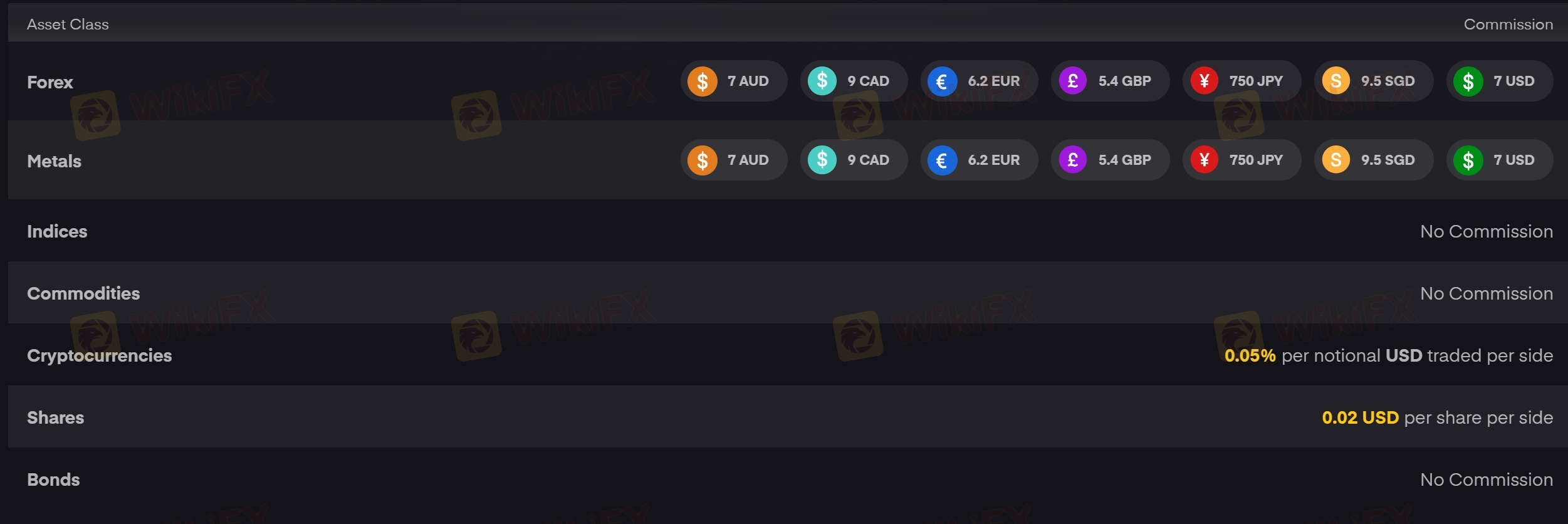

Spreads & Commissions

The spreads and commissions offered by this broker vary depending on the specific trading accounts and asset classes. Here's a breakdown of the costs associated with each asset class:

Forex:

Spreads: The spread cost is not explicitly mentioned but can be inferred as the difference between the buying (ask) and selling (bid) prices. Spreads typically vary depending on the currency pair being traded.

Commissions: Commissions for Forex trading range from 5.4 EUR to 9 USD, depending on the currency pair.

Metals:

Spreads: Similar to Forex, specific spread values are not provided, but they may vary for different metals.

Commissions: Commissions for trading metals are the same as for Forex and range from 5.4 EUR to 9 USD.

Indices and Commodities:

No Commission: Trading in Indices and Commodities does not incur any commission costs.

Cryptocurrencies:

Commissions: Cryptocurrency trading incurs a commission of 0.05% per notional USD traded per side. This commission is calculated based on the trade's size and notional value.

Shares:

Commissions: Shares trading involves a commission of 0.02 USD per share per side. The total commission cost will depend on the number of shares traded.

Bonds:

No Commission: Trading in Bonds does not involve any commission costs.

It's important to note that the spread cost can vary widely depending on market conditions, volatility, and the specific broker's pricing model. Traders should consider both spreads and commissions when evaluating the overall cost of trading with this broker. Additionally, as mentioned, the actual costs may vary depending on the specific trading accounts offered by the broker.

Deposit & Withdrawal

Afterprime provides its clients with a variety of deposit methods to facilitate funding their trading accounts. These methods include Credit & Debit Cards, FasaPay, GATE8, DragonPay, VNPAY, PromptPay, Pagsmile, Bank Wire, PerfectMoney, BinancePay, Finrax, and Interac. Depending on the chosen method, clients can deposit funds in multiple base currencies, such as AUD, EUR, USD, GBP, CAD, and SGD. The processing times for these deposits vary, with some methods offering instant transfers. Notably, many of these deposit options are fee-free, ensuring that clients can fund their accounts without incurring additional costs.

On the withdrawal side, Afterprime offers three convenient methods for clients to access their funds: Bank Wire, Credit & Debit Cards, and Neteller. These withdrawal options support various base currencies, including AUD, EUR, USD, GBP, CAD, and SGD. The processing times for withdrawals differ, with Bank Wire transfers typically taking 1-5 business days, while Credit & Debit Card and Neteller withdrawals are instant. Importantly, the broker does not charge fees for withdrawals, making it easier for clients to access their profits and manage their finances efficiently.

| Method | Type | Accepted Currencies | Processing Time | Fee |

| Credit & Debit Cards | Deposit | AUD, EUR, USD, GBP, CAD, SGD | Instant | $0 |

| FasaPay | Deposit | USD | Instant | $0 |

| GATE8 | Deposit | EUR, USD | DUITNOW - Instant, IBG 24-48 hours | $0 |

| DragonPay | Deposit | USD | Within 1-2 hours | $0 |

| VNPAY | Deposit | EUR, USD | Within 1-2 hours | $0 |

| PromptPay | Deposit | EUR, USD | Within 1-2 hours | $0 |

| Pagsmile | Deposit | AUD, EUR, USD, GBP, CAD, SGD | Within 1-2 hours | $0 |

| Bank Wire | Deposit | AUD, EUR, USD, GBP, CAD, SGD | Instant | $0 |

| PerfectMoney | Deposit | EUR, USD | Instant | $0 |

| BinancePay | Deposit | AUD, EUR, USD, GBP, CAD, JPY, SGD | Almost Instant | $0 |

| Finrax | Deposit | AUD, EUR, USD, GBP, CAD, JPY, SGD | Almost Instant | $0 |

| Interac | Deposit | CAD | Within 1-2 hours | $0* |

| Bank Wire | Withdrawal | AUD, EUR, USD, GBP, CAD, SGD | 1-5 Business Days | $0 |

| Credit & Debit Cards | Withdrawal | AUD, EUR, USD, GBP, CAD, SGD | Instant | $0 |

| Neteller | Withdrawal | AUD, EUR, USD, GBP, CAD, SGD | Instant | $0 |

Trading Platforms

Afterprime delivers a comprehensive array of trading platforms, ensuring that traders, whether novice or professional, have access to a versatile and seamless trading experience. These platforms encompass:

MetaTrader 4 (MT4) for Professionals: At Afterprime, traders can harness the power of MetaTrader 4, a platform revered by professionals worldwide. MT4 offers competitive spreads starting from 0.0 Pips, enabling cost-effective trading across an extensive selection of over 300 markets. This platform excels in execution speed, with orders processed in less than 1 millisecond (< 1ms). With 24/7 availability, traders can seize opportunities in global markets while benefitting from the best fills and low costs, even in challenging market conditions.

TradingView Broker Integration: Afterprime takes trading to the next level by seamlessly combining the capabilities of TradingView and TraderEvolution platforms. This integration allows traders to efficiently manage their orders on either platform, with the added advantage of competitive spreads starting from 0.0 Pips and rapid execution in under 1 millisecond (< 1ms). The platform operates around the clock, providing access to a diverse portfolio of over 300 markets.

TraderEvolution for Professionals: TraderEvolution caters to seasoned traders who wish to navigate global markets alongside banks, High-Frequency Traders (HFTs), ECNs, and Dark pools. With spreads commencing at 0.0 Pips and execution times of less than 1 millisecond (< 1ms), it ensures cost-effective trading and optimal fills regardless of market conditions. This platform offers access to a vast array of more than 300 markets and operates 24/7, allowing traders to stay agile and responsive.

Trade Anywhere, Anytime: Afterprime prioritizes accessibility by offering its trading platforms across various devices. These platforms are accessible on web browsers, iPhone, Android, Windows, and Mac, ensuring that traders can engage in the markets wherever they are. Whether through TradingView Web, MetaTrader 4 Web, or TraderEvolution Web, traders have the flexibility to choose a platform that suits their preferences and needs.

Institutional FIX API: For professional traders seeking even greater control and flexibility, Afterprime provides an Institutional FIX API. This protocol ensures low-latency connectivity, with execution times of less than 1 millisecond (< 1ms). Traders can customize their liquidity to align with their unique trading strategies, and the web-based Order Management System (OMS) interface simplifies the process. With this offering, clients can directly communicate with traders, investment funds, brokers, and liquidity providers in real-time, eliminating the need for intermediary software.

In summary, Afterprime's suite of trading platforms empowers traders of all levels with competitive spreads, rapid execution, and the freedom to trade on their preferred devices. These platforms provide the tools and resources needed to navigate global markets efficiently, offering optimal fills and low costs even during challenging market conditions.

Customer Support:

At Afterprime, customer support is readily available through multiple channels for your convenience:

Help Center: Access in-depth information about trading terminals, deposits, and more in the Afterprime Help Center.

Live Chat: Get immediate assistance from our support team through live chat if you can't find the answers you need.

Social Media: Connect with us via Messenger and Instagram for quick responses.

Email Support: Reach out to our dedicated email addresses for general support (support@afterprime.com) or account-related inquiries (accounts@afterprime.com).

Phone Support: Speak directly to our friendly support team by calling +61 (02) 9138 0640.

Our diverse support options ensure that you can get the help you need, whether you prefer self-service or direct assistance.

Educational Resources:Information regarding Afterprime's educational resources is not provided. These resources typically include tutorials, webinars, articles, videos, and guides aimed at improving traders' skills and market knowledge. To learn more about Afterprime's educational offerings, it's advisable to visit their website or contact their customer support for details.

Summary:

Afterprime, a brokerage firm, offers a wide array of market instruments, including Forex, Commodities, Indices, Stocks, Bonds, and Digital Currencies, catering to diverse trading needs. Traders can access these markets with competitive leverage options. The broker provides several deposit and withdrawal methods with minimal or no fees, ensuring efficient fund management. Traders can choose from versatile trading platforms like MetaTrader 4, TradingView Broker Integration, and TraderEvolution, offering competitive spreads and execution speed. Customer support is readily available through various channels, and although specific details about educational resources are not provided, traders can likely find useful materials to enhance their trading skills on the broker's website or by contacting their support team for more information.

FAQs:

Q1: What is the maximum leverage offered by Afterprime?

A1: Afterprime provides a maximum trading leverage of up to 1:100 for most asset classes, allowing traders to control a position size up to 100 times the margin they've put up. However, for cryptocurrency trading, the maximum leverage is lower at 1:3.

Q2: Are there any fees for depositing or withdrawing funds with Afterprime?

A2: Afterprime offers many deposit options with minimal or no fees. Most withdrawal methods also come with no fees. However, it's essential to check specific details for each method and any potential intermediary bank charges, especially for international transfers.

Q3: What trading platforms does Afterprime offer?

A3: Afterprime provides traders with a choice of versatile trading platforms, including MetaTrader 4 (MT4), TradingView Broker Integration, and TraderEvolution. These platforms cater to various trading styles and preferences, offering competitive spreads and execution speeds.

Q4: Can I open a demo account with Afterprime to practice trading?

A4: Yes, Afterprime offers a demo trading account, allowing new traders to practice with virtual money in a risk-free environment. It simulates real market conditions and helps traders become familiar with the platform's features and functions.

Q5: How can I contact Afterprime's customer support if I have questions or need assistance?

A5: Afterprime offers multiple channels for customer support, including live chat, email support, phone support, and access to a Help Center with detailed information. You can also connect with them via social media platforms like Messenger and Instagram for quick responses to your inquiries.

User Reviews

Sort by content

- Sort by content

- Sort by time

User comment

3

CommentsWrite a review

2024-03-14 16:39

2024-03-14 16:39 2023-06-30 04:32

2023-06-30 04:32 2023-05-08 06:26

2023-05-08 06:26