No Regulation

Score

0 1 2 3 4 5 6 7 8 9

. 0 1 2 3 4 5 6 7 8 9

0 1 2 3 4 5 6 7 8 9

/10

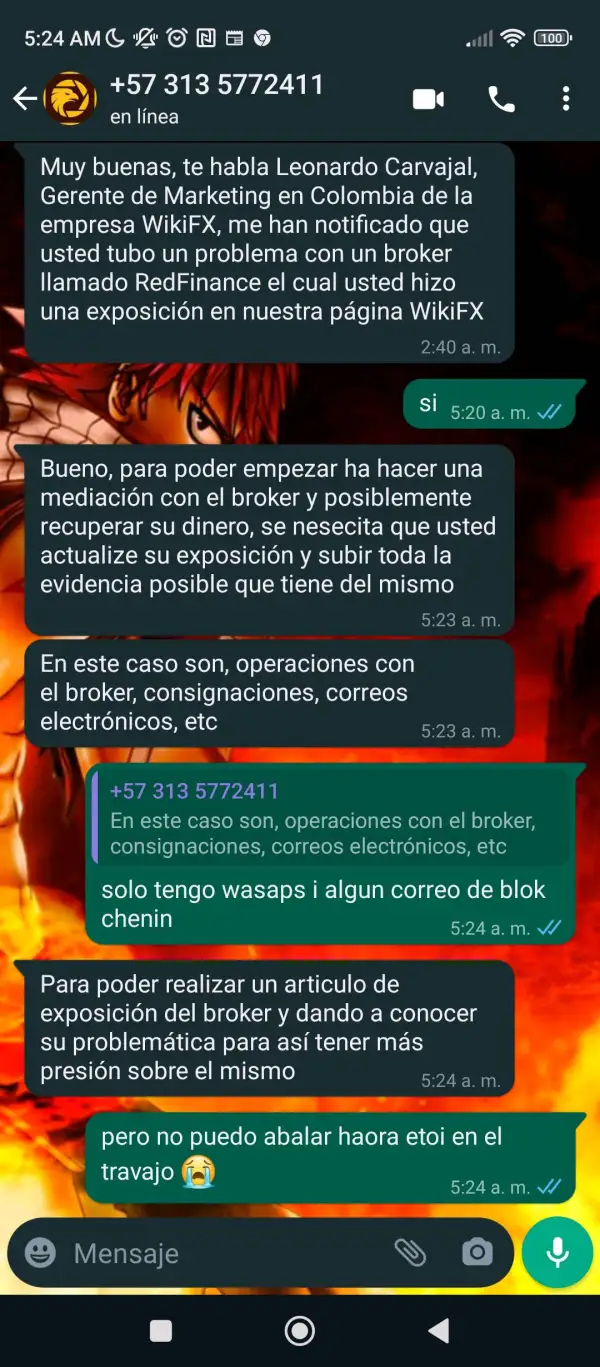

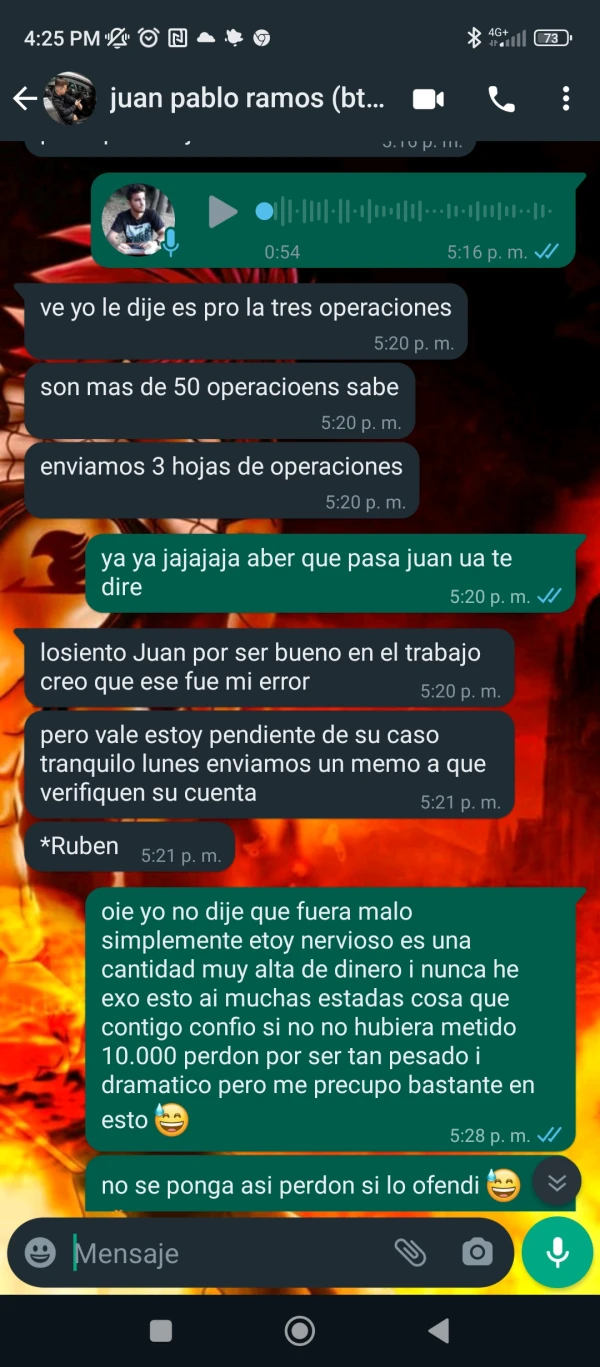

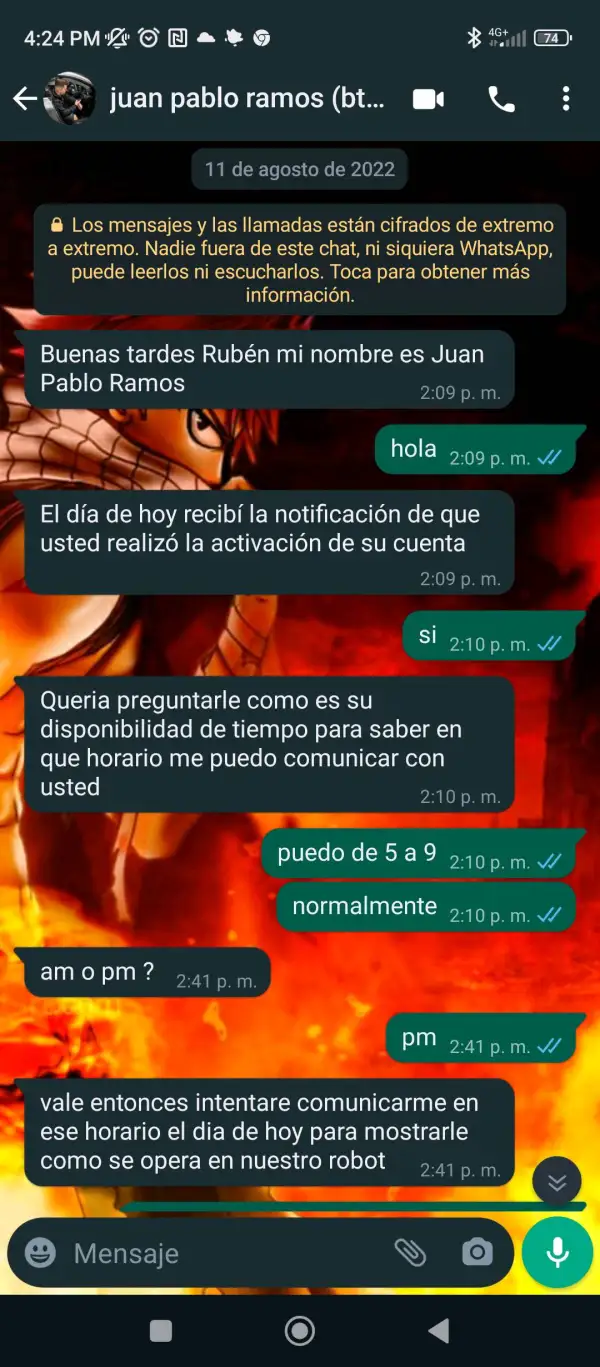

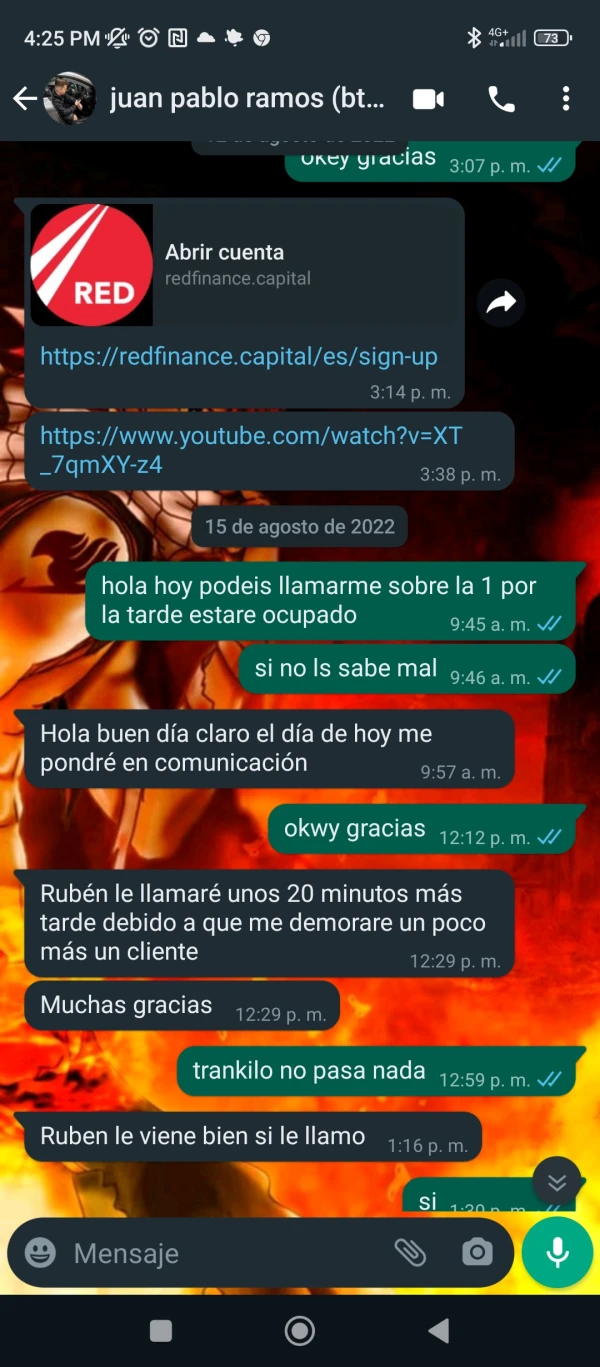

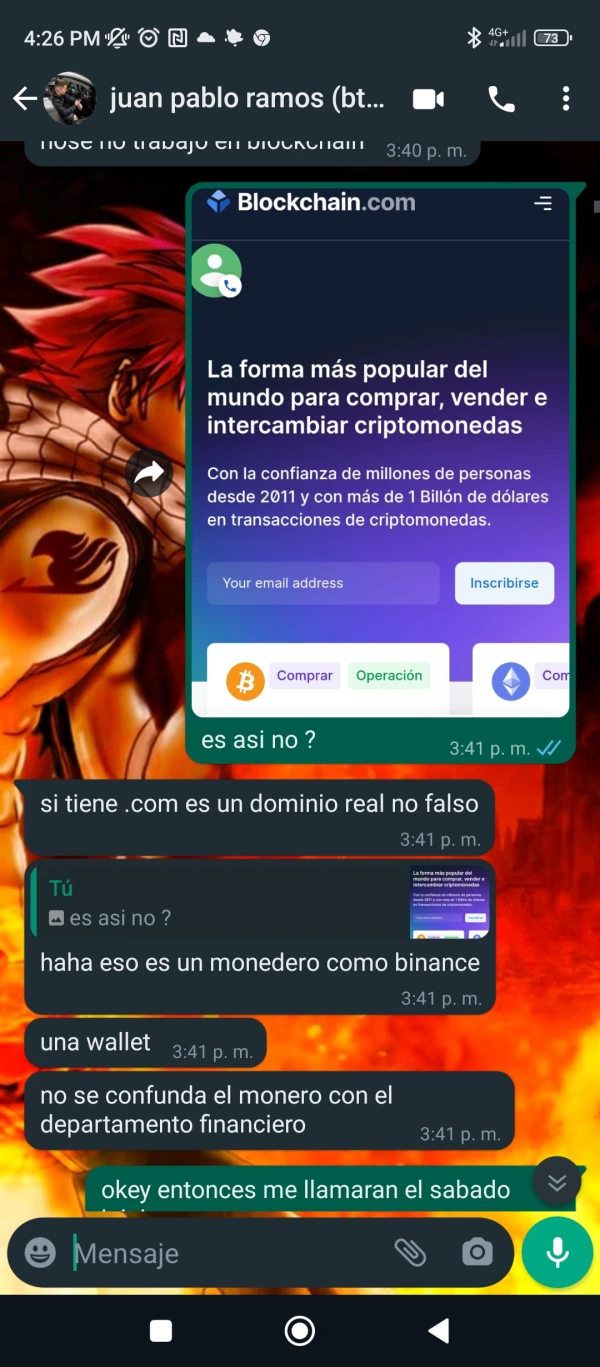

RedFinance

United Kingdom | 2-5 years |

United Kingdom | 2-5 years | Suspicious Regulatory License | Suspicious Scope of Business | High potential risk

https://redfinance.capital/

Website

Rating Index

Contact

https://redfinance.capital/

Suite 305, Griffith Corporate Center, Kingstown P.O. Box 1510 St. Vincent and the Grenadines

Forex License

Forex License

No forex trading license found. Please be aware of the risks.

Warning: Low score, please stay away!

- This broker lacks valid forex regulation. Please be aware of the risk!

2

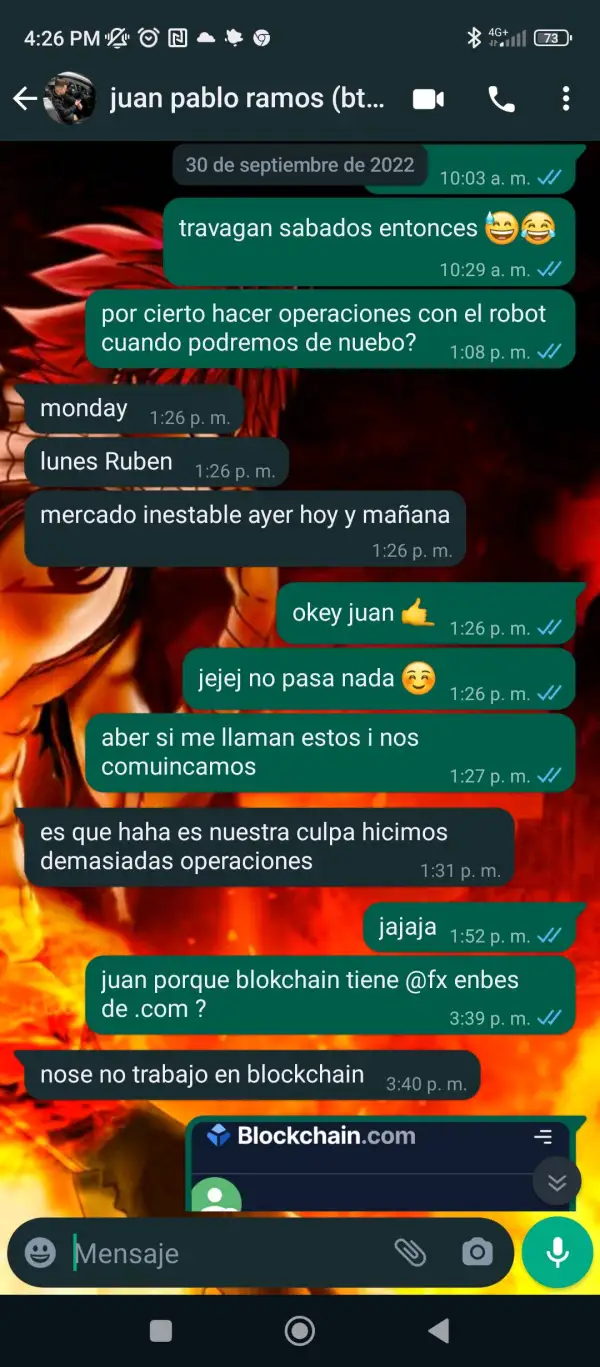

Basic Information

Registered Region  United Kingdom

United Kingdom

United Kingdom

United Kingdom Operating Period

2-5 years

Company Name

Shenanigans Consulting LTD

Customer Service Email Address

compliance.eng@redfinance.capital

Company Website

Company Address

Suite 305, Griffith Corporate Center, Kingstown P.O. Box 1510 St. Vincent and the Grenadines

Account

Website

Genealogy

Related Companies

Employees

Comment

Account

- Environment--

- Currency--

- Maximum Leverage1:100

- SupportedEA

- Minimum Deposit$50000

- Minimum Spread--

- Depositing Method--

- Withdrawal Method--

- Minimum Position0,01

- Commission--

- Products--

Updated:

Users who viewed RedFinance also viewed..

XM

9.10

Score ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

XM

Score

9.10

ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

CPT Markets

8.53

Score ECN Account15-20 yearsRegulated in United KingdomMarket Making License (MM)MT4 Full License

CPT Markets

Score

8.53

ECN Account15-20 yearsRegulated in United KingdomMarket Making License (MM)MT4 Full License

Official Website

AVATRADE

9.50

Score ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

AVATRADE

Score

9.50

ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

Neex

8.64

Score ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Neex

Score

8.64

ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

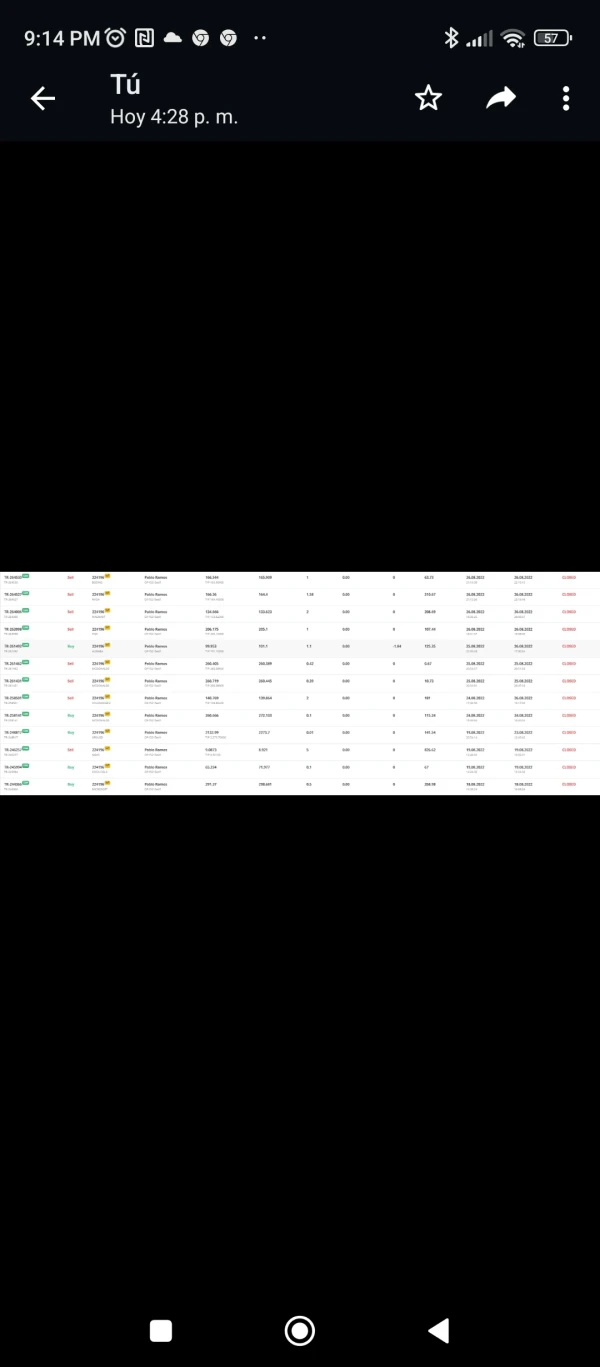

Website

redfinance.capital

104.21.35.147Server LocationUnited States

ICP registration--Most visited countries/areas--Domain Effective Date--Website--Company--

Genealogy

Download APP

Related Companies

SHENANIGANS BUSINESS CONSULTING LTD(United Kingdom)

Deregistered

United Kingdom

Registration No.13631130

Established

Related sourcesWebsite Announcement

Employees

User Reviews2

No more

Write a review

Exposure

Neutral

Positive

Content you want to comment

Please enter...

Submit now

Comment 2

Write a comment

2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now