Ally

United States

United States

Time Machine

Check whenever you want

Download App for complete information

Exposure

4 pieces of exposure in totalAlly · Company Summary

| Ally | Basic Information |

| Registered Country/Area | United States |

| Founded Year | 1-2 years ago |

| Company Name | Ally |

| Regulation | Suspicious Regulatory License |

| Minimum Deposit | $200 |

| Maximum Leverage | 1:1000 |

| Spreads | Variable |

| Trading Platforms | Proprietary trading platform |

| Tradable Assets | Forex, Metals, Indices, Cryptos |

| Account Types | Standard, Pro, VIP |

| Demo Account | Yes |

| Islamic Account | No |

| Customer Support | Company Address: Ally Detroit Center,500 Woodward Avenue,floor 10 |

| Payment Methods | VISA, MasterCard, Cryptos |

| Educational Tools | None |

Overview of Ally

Ally is a relatively new broker based in the United States, offering trading services in various financial markets. Established within the past 1-2 years, Ally operates under a suspicious regulatory license, which raises concerns about the level of oversight and investor protection. To open an account with Ally, a minimum deposit of $200 is required, providing access to maximum leverage of 1:1000. The spreads offered by Ally are variable, meaning they can fluctuate depending on market conditions. Traders can utilize Ally's proprietary trading platform to execute their trades across a range of assets, including Forex, metals, indices, and cryptocurrencies.

Ally offers multiple account types, namely Standard, Pro, and VIP, catering to different trading needs and preferences. Additionally, the broker provides a demo account, allowing users to practice their trading strategies without risking real funds. However, it's important to note that Ally does not offer Islamic accounts for clients seeking Sharia-compliant trading options.

In terms of customer support, Ally provides a physical company address located at Ally Detroit Center, 500 Woodward Avenue, floor 10. Payment methods accepted by Ally include VISA, MasterCard, and cryptocurrencies. It's worth mentioning that Ally does not offer extensive educational tools or resources to support traders' learning and development.

Pros and Cons

Ally is a brokerage firm that offers generous leverage of up to 1:1000, allowing traders to amplify their positions. They provide three types of trading accounts to cater to different needs. However, there are certain drawbacks to consider. The regulatory license of Ally raises suspicions due to the lack of verifiability. The broker also lacks educational tools, limiting the resources available for traders to enhance their knowledge and skills. Customer support options are limited, which may hinder timely assistance. There have been reports of withdrawal problems, indicating potential issues with accessing funds. Lastly, the high minimum deposit requirements can be the last straw to let traders lose their interests in this broker.

| Pros | Cons |

| Generous leverage up to 1:1000 | Suspicious regulatory license |

| Three types of trading accounts | Lack of educational tools |

| Demo accounts supported | Limited customer support options |

| Reports of withdrawal problems | |

| Lack of transparency on spreads and fees | |

| High minimum deposit requirements | |

| No Islamic accounts available | |

| Weak trading platform available |

Is Ally legit or a scam?

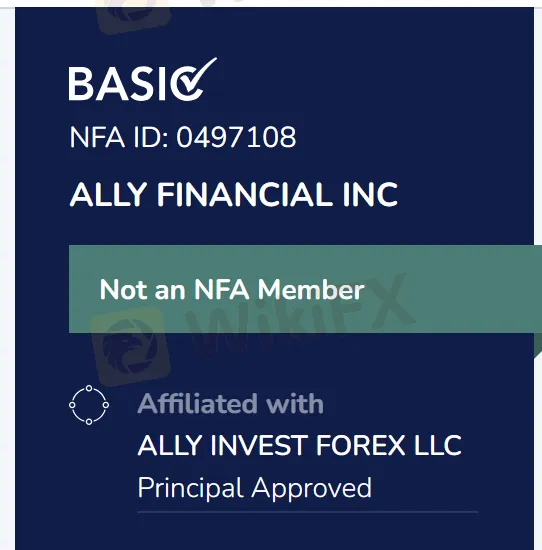

While Ally asserts that it is regulated by the NFA with a regulatory license number of 0497108, a search on the official website of the NFA does not yield any results for this particular license number. This discrepancy raises doubts about the regulatory status of Ally. Regulation is an important factor in the forex industry as it ensures that brokers adhere to certain standards and safeguards the interests of traders. Without clear evidence of regulation by recognized authorities, it becomes difficult to assess the credibility and reliability of Ally as a broker. Traders should exercise caution and consider alternative options that are regulated by reputable authorities to ensure the safety of their investments.

Market Intruments

Ally provides a range of market instruments for trading, including forex currency pairs, metals, indices, and cryptocurrencies. These instruments offer traders the opportunity to participate in various financial markets and diversify their investment portfolios. Forex allows traders to speculate on the exchange rates between different currency pairs, while metals offer exposure to precious metals such as gold and silver. Indices represent the performance of a group of stocks, providing traders with the ability to trade on broader market trends. Additionally, Ally offers cryptocurrencies, allowing traders to engage in the growing digital asset market. By offering a diverse selection of market instruments, Ally aims to cater to the trading preferences and strategies of its clients.

Account Types

Ally offers multiple account types to suit the varying needs and preferences of traders. The available account types include Standard, Pro, and VIP accounts.

Standard Account:

Minimum Deposit: $200

Maximum Leverage: 1:1000

This account type is suitable for traders who prefer a standard trading experience with competitive conditions. It offers access to a wide range of tradable instruments, including forex, metals, indices, and cryptocurrencies. Traders can benefit from variable spreads and utilize the proprietary trading platform provided by Ally.

Pro Account:

Minimum Deposit: $500

Maximum Leverage: 1:1000

The Pro account is designed for more experienced traders who require advanced trading tools and lower trading costs. It offers tighter spreads and lower commissions compared to the Standard account. Traders can take advantage of the maximum leverage of 1:1000 to potentially amplify their trading positions.

VIP Account:

Minimum Deposit: $10,000

Maximum Leverage: 1:1000

The VIP account is tailored for high-volume traders who seek premium services, personalized support, and enhanced trading conditions. It offers the tightest spreads, lowest commissions, and additional benefits such as priority customer support and exclusive trading resources. The maximum leverage of 1:1000 allows traders to maximize their trading potential.

| Account Type | Minimum Deposit | Maximum Leverage | Spreads | Trading Platform | Tradable Instruments | Special Features |

| Standard | $200 | 1:1000 | Variable | Proprietary | Forex, Metals, Indices, Cryptos | Standard trading conditions |

| Pro | $500 | 1:1000 | Variable | Proprietary | Forex, Metals, Indices, Cryptos | Lower trading costs |

| VIP | $10,000 | 1:1000 | Variable | Proprietary | Forex, Metals, Indices, Cryptos | Premium services and benefits |

When choosing an account type with Ally, traders should consider their trading goals, risk tolerance, and available capital. The different account types cater to traders with varying experience levels and trading preferences. The minimum deposit requirements provide flexibility for traders with different budget levels, while the maximum leverage options allow traders to adjust their risk exposure accordingly.

How to open an account?

To open an account with Ally, you can follow these steps:

Visit the official website of Ally and click on the “Open Account” or “Sign Up” button.

Fill out the registration form with your personal information and choose the type of account you want.

Provide any additional required information, such as your address and financial details.

Review and agree to the terms and conditions, as well as any risk disclosures.

Submit your application for account opening.

Once your application is approved, fund your account with the minimum deposit required.

Please note that the specific steps and details may vary, so it's important to follow the instructions provided on Ally's website during the account opening process.

Leverage

Ally offers a generous leverage option of up to 1:1000 for traders. Leverage allows traders to control larger positions in the market with a smaller initial investment. With a leverage ratio of 1:1000, traders have the potential to amplify their trading profits. However, it is important to exercise caution and manage risk effectively when trading with high leverage.

While leverage can enhance potential gains, it also increases the exposure to potential losses. Traders should carefully assess their risk tolerance and implement appropriate risk management strategies. It is recommended to thoroughly understand the concept of leverage and its implications before utilizing it in trading activities.

Spreads & Commissions (Trading Fees)

When it comes to spreads and commissions, Ally provides variable spreads. Variable spreads can fluctuate depending on market conditions, and they typically have a floating nature, meaning they can widen during times of high market volatility. However, specific details regarding the spreads and commissions charged by Ally are not provided, making it difficult to assess the cost of trading with this broker accurately.

Non-Trading Fees

In terms of non-trading fees, it's important to note that there is limited information available about the non-trading fees charged by Ally. Non-trading fees may include fees related to account maintenance, deposits, withdrawals, or inactivity. As these details are not explicitly provided, potential clients should seek further clarification from Ally's customer support or refer to the broker's terms and conditions for a comprehensive understanding of any applicable non-trading fees.

Trading Platform

Ally utilizes a proprietary trading platform, which is a platform developed in-house specifically for their clients and the specific features and functionalities of the platform are not elaborated upon. The lack of MT4 or MT5 trading platform can be a pity for most traders.

Deposit & Withdrawal

When it comes to deposit and withdrawal options, Ally accepts payments through VISA, MasterCard, and cryptocurrencies. Detailed information, however, like associated fees and processing times for deposits and withdrawals is not provided. Traders should consult with Ally or refer to their terms and conditions to understand any potential fees and timeframes associated with depositing and withdrawing funds.

Customer Support

Ally's customer support is relatively limited, as the only contact information provided is a company address: Ally Detroit Center, 500 Woodward Avenue, floor 10. This implies that direct communication channels such as phone, email, or live chat may not be readily available for clients to seek assistance or resolve any issues they may encounter.

The absence of comprehensive customer support options can be a significant drawback for traders who require prompt and efficient assistance. In today's fast-paced trading environment, having reliable customer support channels is crucial for addressing inquiries, technical difficulties, or account-related concerns in a timely manner

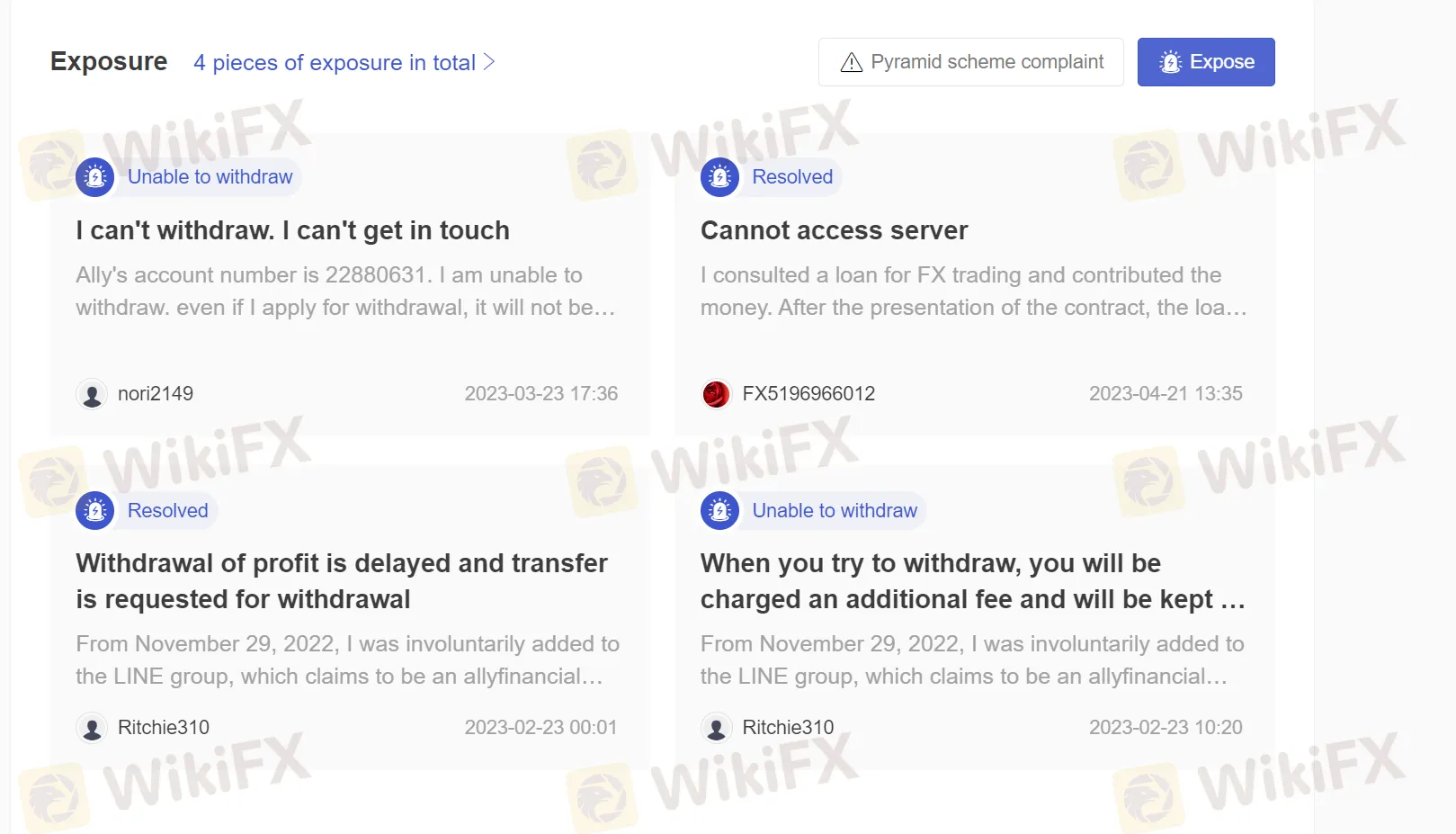

User Exposure

Ally has faced user exposure in the form of negative reviews, with frequent reports of withdrawal problems and difficulties accessing services. These issues highlight the challenges that some users have encountered while interacting with the broker. Complaints about delays in the withdrawal process raise concerns about the efficiency and reliability of Ally's fund transfer procedures. Such delays can cause frustration and inconvenience for traders who rely on timely access to their funds.

In addition to withdrawal problems, there have been complaints regarding difficulties accessing services. This could refer to instances where users have experienced technical issues, account login problems, or disruptions in platform availability. These issues can hinder traders' ability to execute trades and manage their accounts effectively, potentially resulting in missed opportunities or financial losses.

Is Ally suitable for beginners?

Ally may not be the most suitable choice for beginners due to several factors. Firstly, the lack of educational tools provided by brokers limits the learning resources available to novice traders. Secondly, although this broker offers demo accounts, the minimum deposit to open a basic account is higher compared with many other brokers. Lastly, user exposure issues reported by some traders, such as withdrawal problems and difficulties accessing services, further raise concerns for beginners. These issues can be particularly frustrating and discouraging for new traders who are still navigating the trading process and relying on smooth operations and reliable support.

Is Ally suitable for experienced traders?

Ally can be considered by experienced traders who value high leverage, a wide range of tradable assets, and multiple account types. With leverage of up to 1:1000 and the availability of standard, pro, and VIP accounts, Ally offers flexibility to cater to the varying needs of experienced traders. However, it is essential to weigh the pros and cons, including the lack of a popular trading platform such as MT4 or MT5 and reported user exposure issues, before making a decision. Experienced traders may want to assess their specific requirements and compare Ally with other reputable brokers in the market.

Conclusion

In conclusion, Ally offers traders several attractive features such as high leverage, a proprietary trading platform, and a diverse selection of tradable assets. The availability of different account types allows traders to choose an option that suits their individual needs. Additionally, the inclusion of a demo account provides beginners with a valuable opportunity to practice trading strategies without risking real money.

FAQs

Q: What trading instruments can I trade with Ally?

A: Ally offers a range of tradable assets, including forex, metals, indices, and cryptocurrencies.

Q: What types of trading accounts does Ally offer?

A: Ally provides three types of trading accounts: Standard, Pro, and VIP.

Q: Does Ally offer a demo account?

A: Yes, Ally offers a demo account that allows traders to practice trading strategies and explore the platform using virtual funds.

Q: Is there an Islamic account option available?

A: No, Ally does not provide an Islamic account option at the moment.

Q: What are the available payment methods for deposits and withdrawals?

A: Ally accepts payments through VISA, MasterCard, and cryptocurrencies.

Q: Does Ally provide educational resources for traders?

A: Unfortunately, Ally does not offer specific educational tools or resources for traders.

Q: What is the minimum deposit requirement?

A: The minimum deposit required to open an account with Ally is $200.

Q: What is the maximum leverage offered by Ally?

A: Ally provides a maximum leverage of 1:1000 for traders.

News

No Data