Company Summary

| Exclusive Markets Review Summary | |

| Founded | 2011 |

| Registered Country/Region | Seychelles |

| Regulation | FSA (Offshore regulated) |

| Market Instruments | Forex, indices, metals, commodities, CFD stocks, CFD cryptos, CFD ETFs & equities |

| Demo Account | ✅ |

| Spread | From 0.6 pips (Standard account) |

| Leverage | Up to 2000x |

| Trading Platform | MT4, MT5 |

| Social Trading | ✅ |

| Minimum Deposit | $10 |

| Customer Support | Contact ticket, live chat, LINE, WhatsApp, FAQ |

| Social platforms: Facebook, Instagram, Twitter, YouTube, LinkedIn, Tiktok | |

| Email: support@exclusivemarkets.com | |

| Tel: +44 20 8097 6094 | |

| Address: The Offices 3, Level 5, No. 547, One Central Dubai World Trade Centre, Sheikh Zayed Road, P.O Box 9573, Dubai, UAE | |

| Registered address: Suite 18, Third Floor, Vairam Building, Providence, Mahé, Seychelles | |

| Restricted Regions | Belarus, Canada, Cuba, Islamic Republic of Iran, Myanmar, North Korea, Russia, Sudan, Syria, and The United States |

Exclusive Markets Information

Exclusive Markets was registered in the Seychelles and has a global presence in 13 other countries, including Mexico, Dubai, Turkey, Thailand, etc. It offers trading services in more than 5000 instruments in forex, indices, metals, commodities, CFD stocks, CFD cryptos, CFD ETFs & equities.

It offers a demo account for you to get familiar with the platform and your trading strategy. Besides, five tiered live accounts are available to suit different levels of investors. Minimum deposit is affordable from $10 and starting spread is 0 pips, friendly for beginners as well.

In addition, traders can enjoy top-notch trading experience with the industry-leading MetaTrader 4 and 5 platforms. Trading tools such as VPS Hosting, economic calendar enhance trading efficiencies. And educational glossaries, videos equip investors with necessary knowledge for successful trading.

What's more, social trading allows beginners or less-experienced traders to follow mature predecessors to better understand financial trading.

However, one crucial point to note is that although the broker is regulated by the FSA, the regulation is offshore only, which indicates limited oversight by the authority.

Pros and Cons

| Pros | Cons |

| Demo accounts | Offshore FSA regulation |

| MT4 and MT5 platforms | |

| Affordable minimum deposit | |

| Tight starting spreads | |

| Multiple tiered accounts | |

| Rich educational resources | |

| Social trading | |

| Live chat support |

Is Exclusive Markets Legit?

Exclusive Markets is currently being regulated by FSA (The Seychelles Financial Services Authority) with license no. SD031.

However, you should be aware that the regulation status is offshore only, indicating weaker regulatory oversight.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| FSA | Offshore regulated | Exclusive Markets Ltd | Retail Forex License | SD031 |

What Can I Trade on Exclusive Markets?

| Trading Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Metals | ✔ |

| Commodities | ✔ |

| CFD Stocks | ✔ |

| CFD Cryptos | ✔ |

| CFD ETFs | ✔ |

| CFD Equities | ✔ |

| Bonds | ❌ |

| Options | ❌ |

Account Type

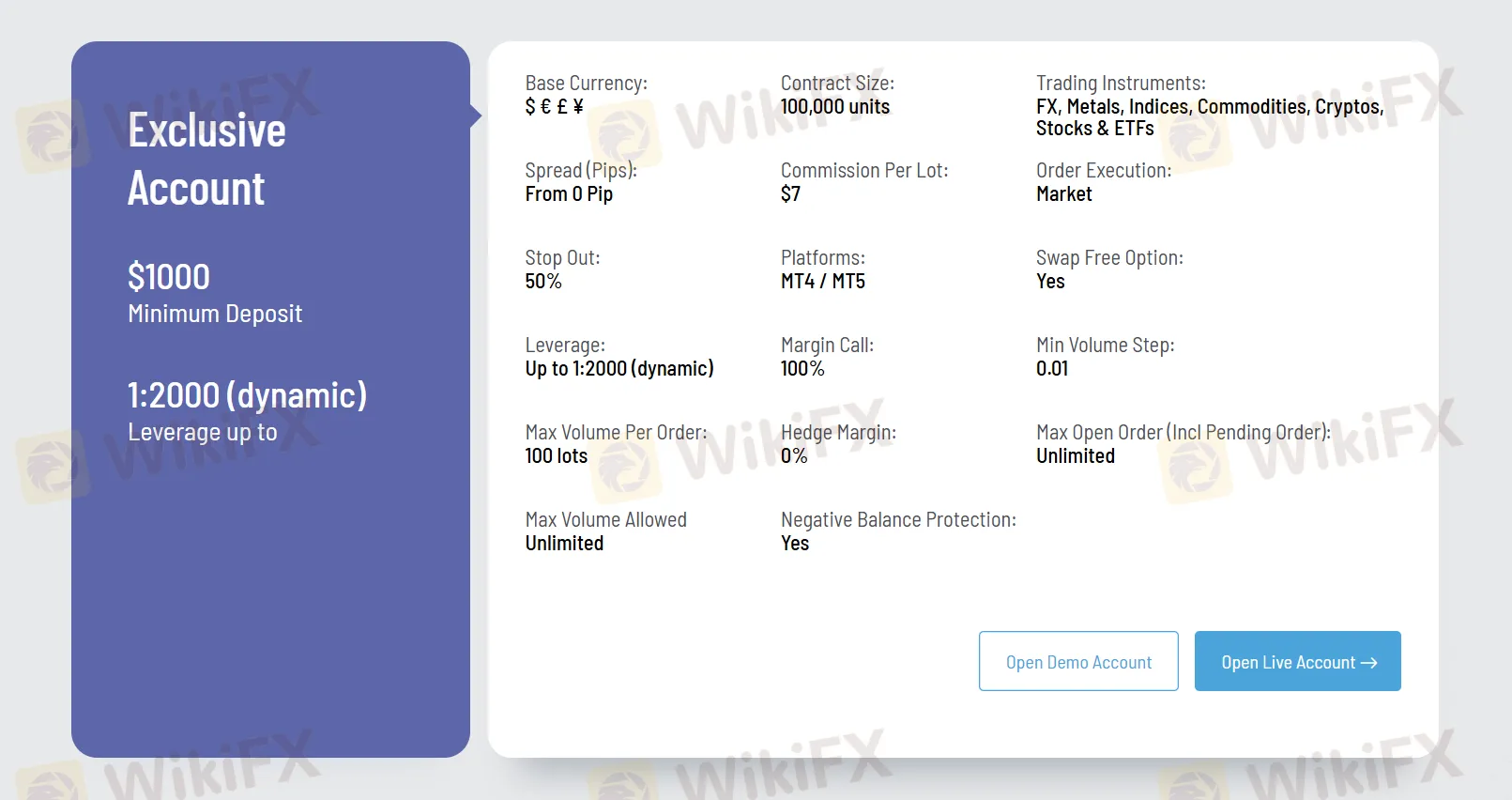

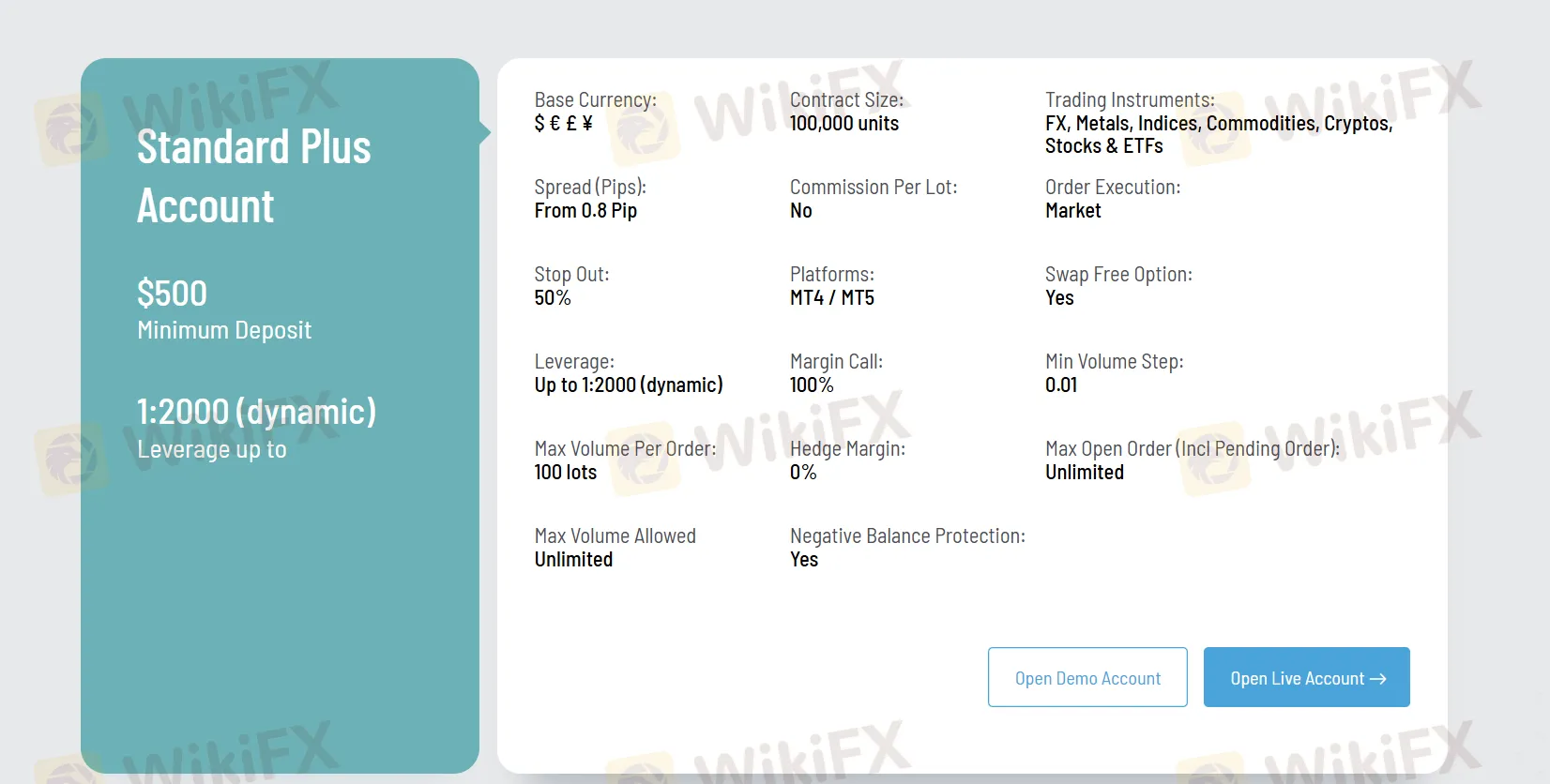

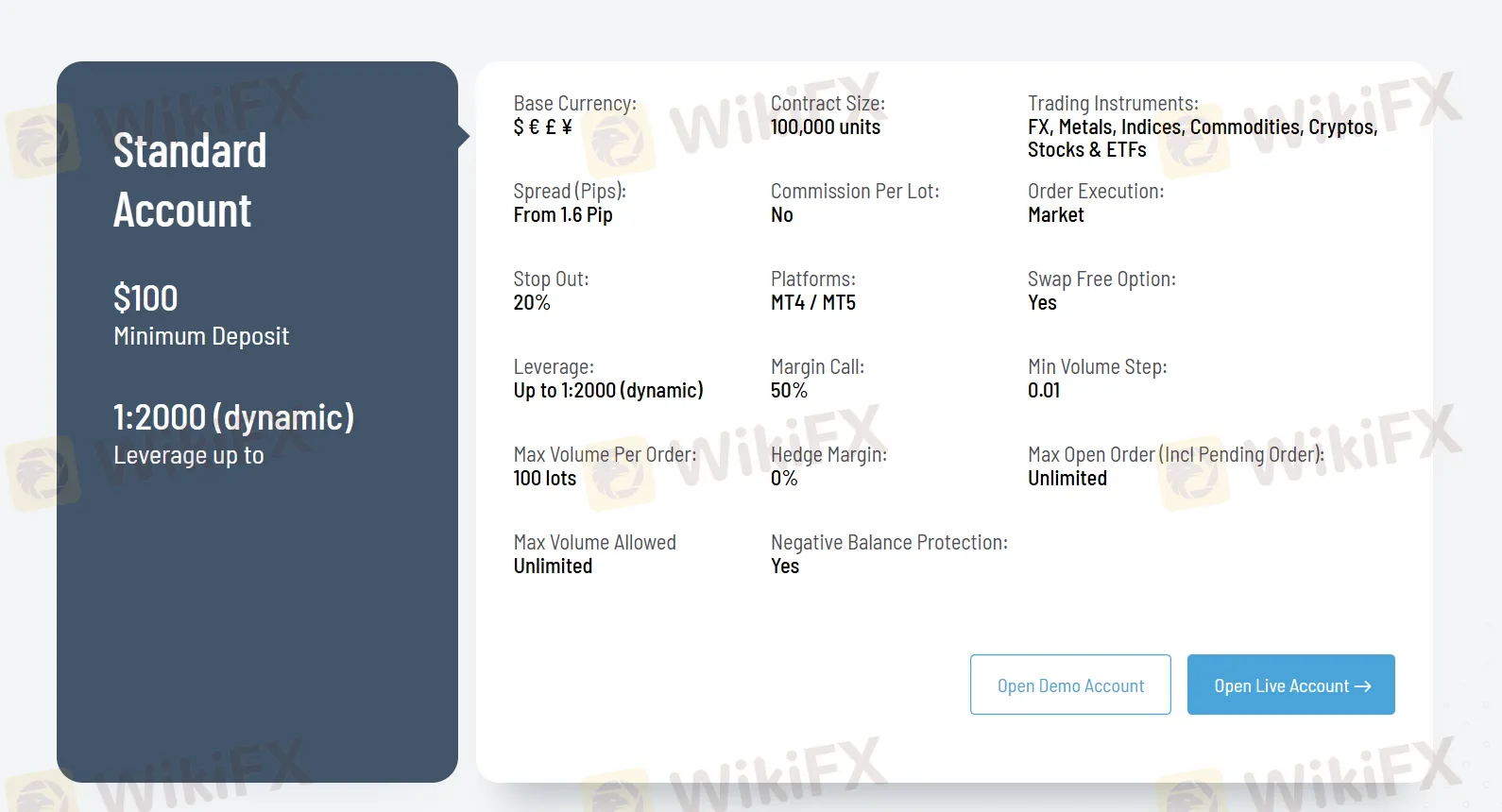

Exclusive Markets not only offers a demo account for you to simulating real trading with virtual funds before tapping into real trading, but also five tiered live accounts with different traidng conditions to suite various levels of investors and different products:

| Account Type | Minimum Deposit | Spread | Commission |

| Exclusive | $1,000 | From 0 pips | $7 per trade |

| Standard Plus | $500 | From 0.8 pips | ❌ |

| Standard | $100 | From 0.6 pips | ❌ |

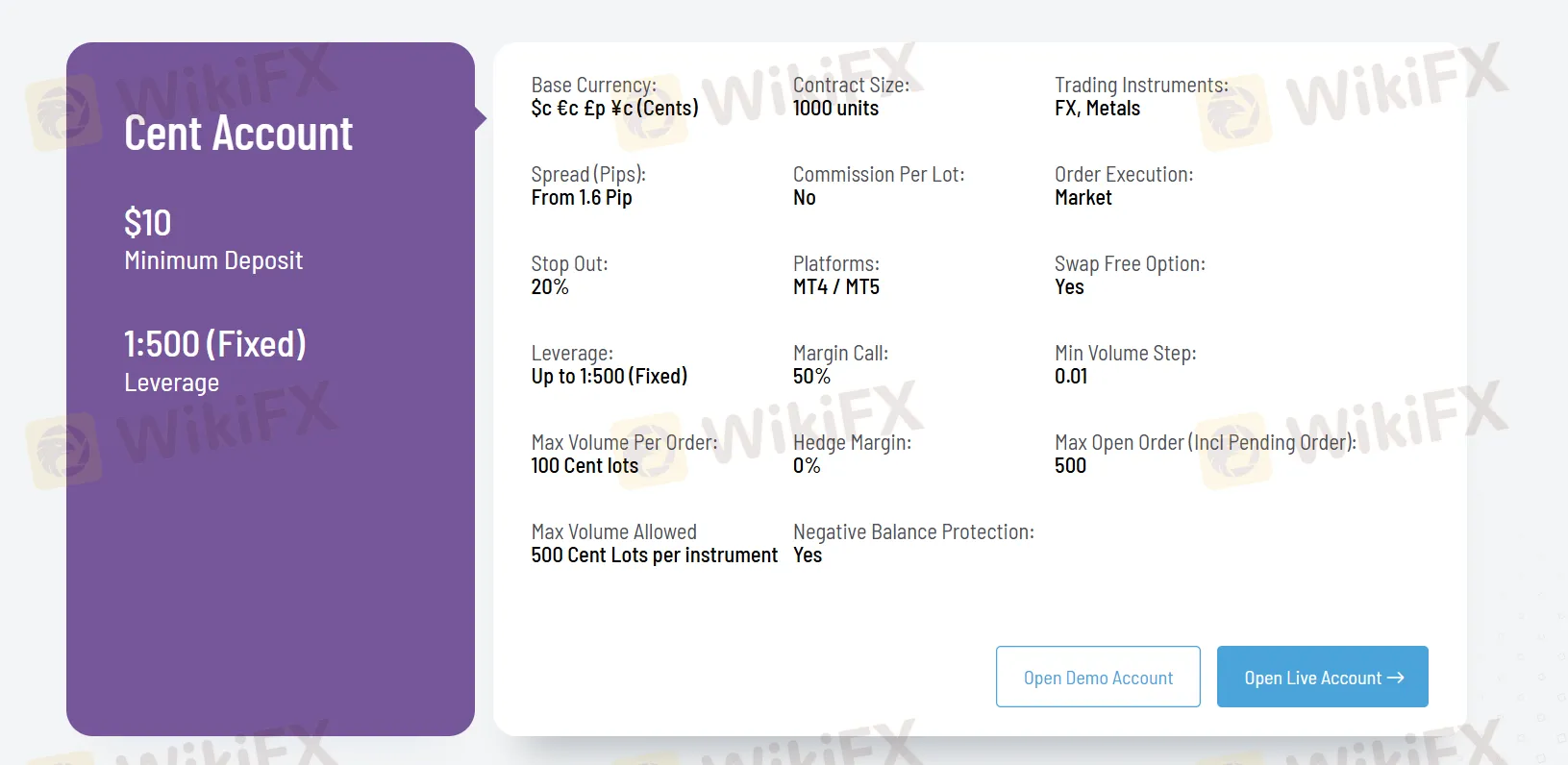

| Cent | $10 | From 1.6 pips | ❌ |

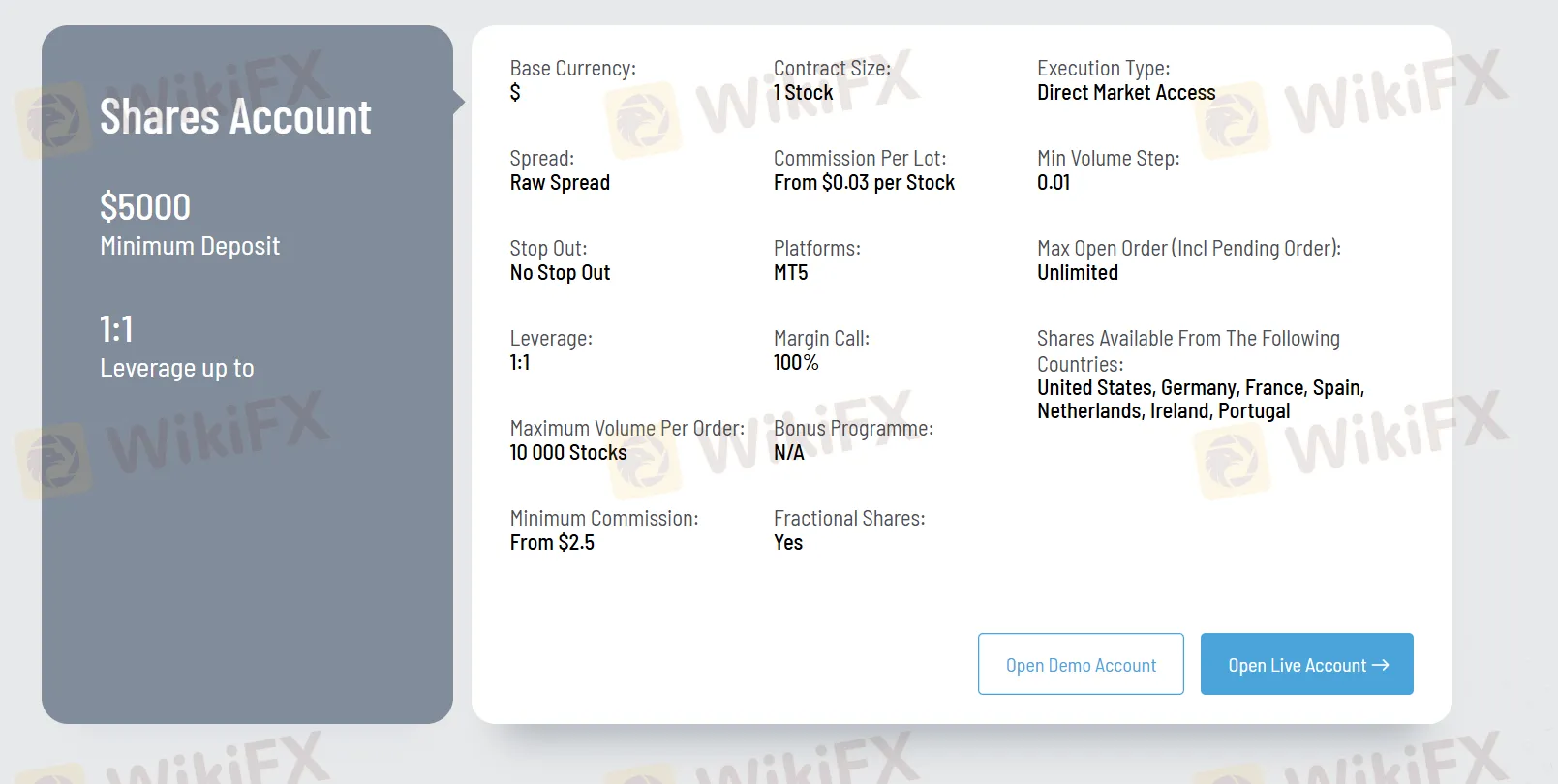

| Shares | $5000 | Raw spread | From $0.03 per Stock |

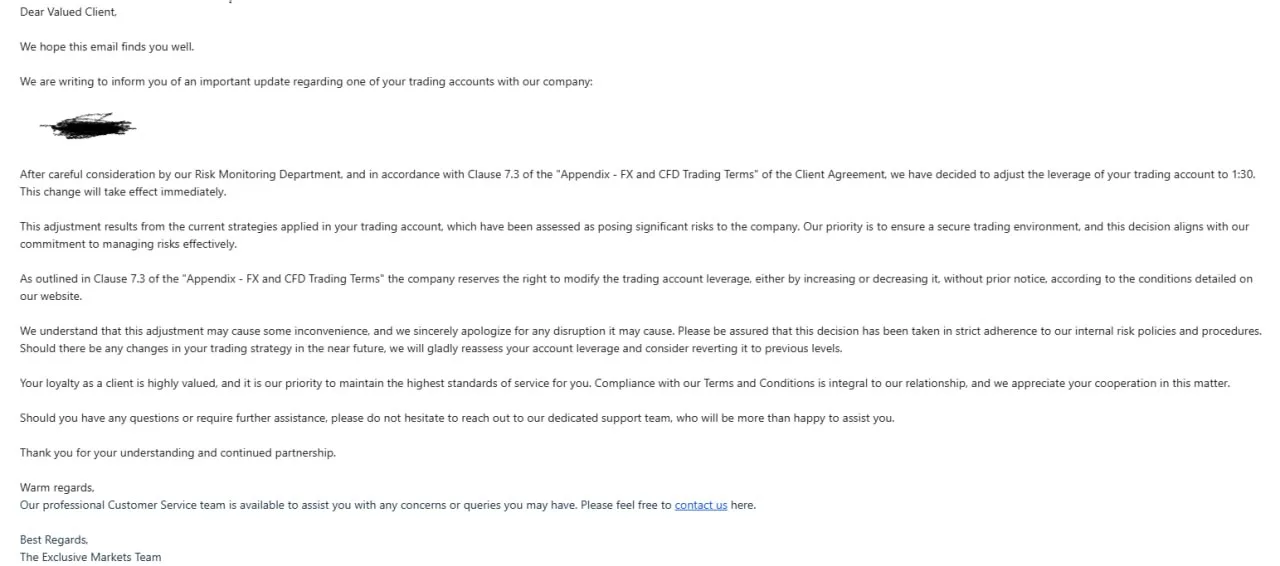

Leverage

Exclusive Markets offers different maximum leverage levels across different account types:

| Account Type | Maximum Leverage |

| Exclusive | 1:2000 (dynamic) |

| Standard Plus | |

| Standard | |

| Cent | 1:500 (fixed) |

| Shares | 1:1 |

Higher leverage can improve profit potential while also increasing risk, therefore appropriate risk management is crucial.

Trading Platform

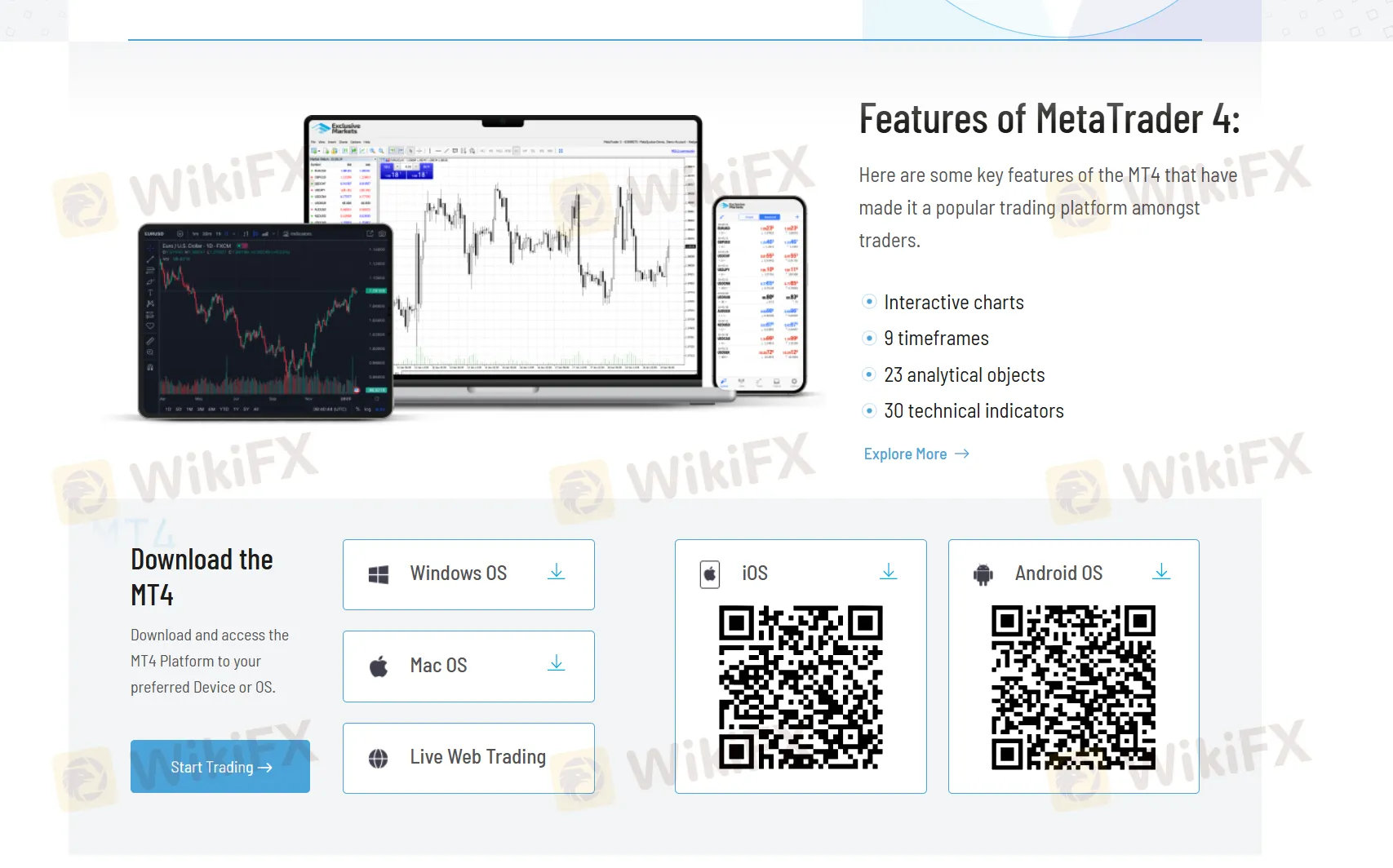

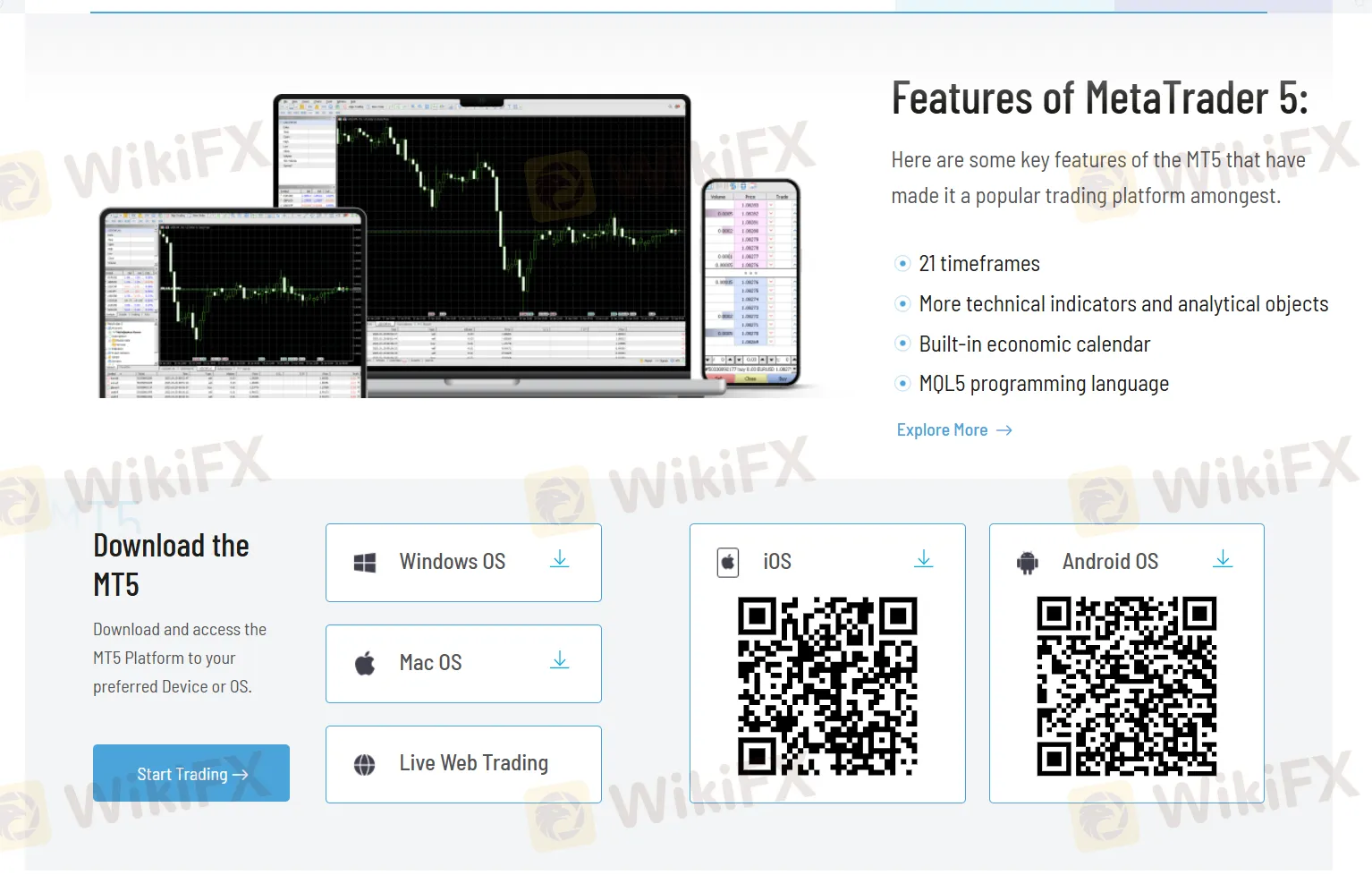

Exclusive Markets claims to use the world renowned MetaTrader 4 and 5 platforms, which are well-recognized by its advanced charting tools and robust functionalities.

You can reach the platform on web, or download app from Windows, mobiles phones and Mac.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web/Windows/Mobile phones/Mac | Beginners |

| MT5 | ✔ | Web/Windows/Mobile phones/Mac | Experienced traders |

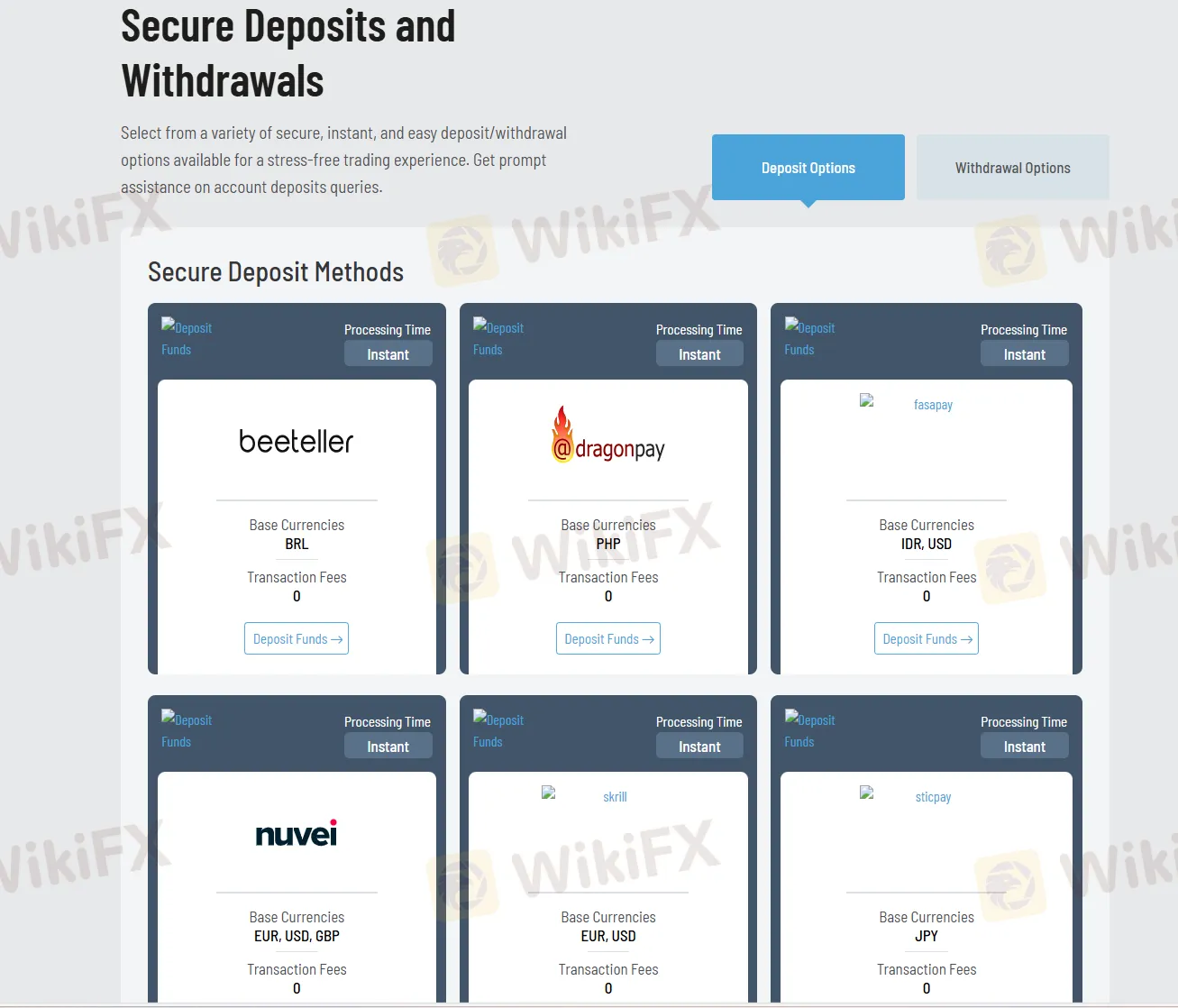

Deposit and Withdrawal

Exclusive Markets allows a wide range of funding methods, most with no transaction fees. Each method supports its own currencies:

| Funding Methods | Accepted Currencies | Transaction Fees |

| beeteller | BRL | ❌ |

| dragonpay | PHP | |

| fasapay | IDR, USD | |

| nuvei | EUR, USD, GBP | |

| skrill | EUR, USD | |

| sticpay | JPY | |

| xpay | IDR, THB, MYR, VND | |

| neteller | EUR, USD | |

| b2b | Cryptocurrencies | |

| BINANCEPAY | ||

| LetKnowPay | ||

| Local deposit | USD | Depending on local depositer |

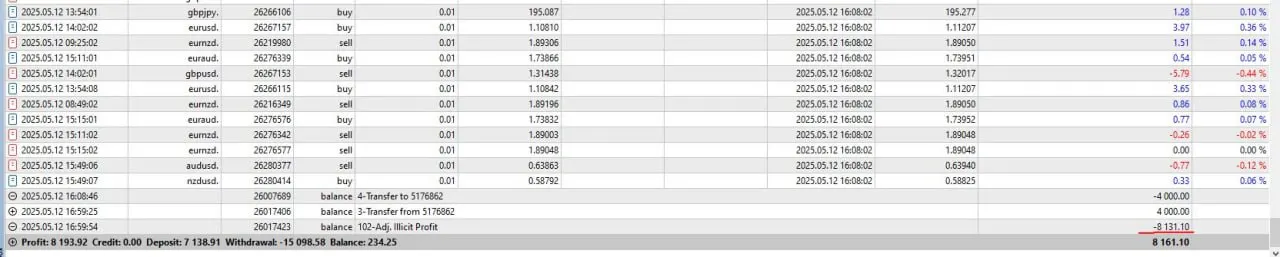

LucasQuant

Vietnam

Warning to other traders on this broker, my account has been remove profit trading and they pointed out that I took advantage of their leverage, while they clearly advertise and offer high leverage to their clients. Please be careful while you guys cooperate with this broker.

Exposure

FX4065223712

Saudi Arabia

We bought a challenge account more than once until we achieved the goal, and then they stopped responding like that 😡

Exposure

Quket

Netherlands

Exclusive Markets offers traders excellent leverage options, making it easy to amplify your trading potential. Plus, their minimum deposit is very reasonable, making it accessible to traders of all levels.

Positive

bobo1

Australia

At Exclusive Markets, I appreciate their top-notch customer service, especially Nec's expertise. Their platform is well-organised, making trading seamless. Their execution is quick, perfect for scalping traders. Efficient handling of transactions and timely customer support only add to their reliability. Exclusive Markets provides a professional and satisfying trading experience.

Positive

Dreams come True

United States

Exclusive Markets has its perks – low deposits, a variety of instruments, and MT4/5 support. But, the lack of regulation makes me nervous. It's a gamble, so tread carefully!

Neutral

Cocowu

Peru

The trading platforms, especially MT5, are pretty solid, and the fixed spreads are clear. Customer support is decent, and they're available when I need them. All in all, Exclusive Markets is in my good books.

Neutral

David4833

United Kingdom

I've been trading with Exclusive Markets for 2 years, and I must say, it has been an exceptional experience from day one. Here's why I highly recommend them Transparency: Exclusive Markets shines in terms of transparency. They provide real-time market data, accurate spreads, and a clear fee structure. No hidden surprises, ever. Customer Support: Their customer support team deserves applause. They are available 24/5, responsive, and knowledgeable. They've helped me through various trading challenges with patience.

Positive

我

South Africa

I love using Exclusive Markets’ VPS, which offers me the optimal execution speed, reducing latency and slippage. I strongly recommend that your guys should have a try.

Positive

媛乐

Hong Kong

Honestly, I benefited from Exclusive’s social trading a lot, and I did make some profits. One issue needs to be pointed out: they process withdrawal requests so slow. Averagely, it takes one week to get your money withdrawn.

Neutral

Hamzah Shahrin

Hong Kong

This platform’s trading conditions seem pretty good, rich trading assets, low initial investment amount… advanced mt5 trading platform, its demo account trading experience is also good, I haven’t made my decision yet, anybody give me some advice?

Positive

金鑫23788

Colombia

To choose forex brokers I appreciate more security! I know there are many scams in the forex industry and even some of my friends have been scammed!!! So I chose exclusive markets, a platform regulated by FSA, and it has not failed me. I love both the high leverage, MT4, MT5, wide range of traded products and the copy trading feature.

Positive