Professional traders, in the forex world, are always looking to make substantial profits. They have more advantages of deep market understanding, smart trading tactics, plenty of trading capital, and resilience in market volatility. However, the choice of broker remains a crucial part of their trading success. This is why, to help these traders, we've picked the top 10 forex brokers, largely designed around the needs of professionals. The brokers were chosen based on various dimensions, which include the range of market offerings, the quality of trading tools and the platform, regulatory standards, customer service, and trading costs.

In the sections that follow, we'll delve into each broker's key strengths and assess them on various fronts. This practical content, free from irrelevant details, aims to efficiently assist professional traders in picking a broker that fully suits their needs. So, come along as we explore these top-grade brokers, ideal for professional traders.

Best Forex Brokers For Professional Traders Overall

- An exceptional range of markets, including shares, forex, commodities, indices, and cryptocurrencies.

IG platform integrates seamlessly with advanced charting software and algorithms for sophisticated analysis and trading.

- Extensive investment offerings, a wide variety of asset classes and global investment products.

- Saxo Bank’s user-friendly platforms offer a variety of features for in-depth market analysis.

Provideing direct access to stocks, options, futures, forex, bonds, ETFs in over 150 markets in 33 countries.

Their tools and platforms cater to both experienced traders and novices, enabling complex analysis and strategy building.

eToro offers a unique feature known as “social trading”, which allows users to follow and copy trades of expert investors.

eToro leads in cryptocurrency trading, offering a wide range of options.

- CMC Markets offers one of the broadest ranges of CFDs for traders to capitalize on market movements.

- CMC Markets has award-winning technology with sophisticated charting and precision pricing.

more

Comparison of the Best Forex Brokers for Professional Traders

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Overview of the best Forex Brokers for Professional Traders

IG

|

|

Broker |

IG |

Regulated by |

ASIC, FCA, FSA, NFA, AMF, FMA, MAS, DFSA |

Min. Deposit |

$250 |

Tradable Instruments |

Forex,Shares,Indices, Commodities, Thematic and basket,Options trading, Futures trading, Spot trading |

Trading Platforms |

Online, Mobile, Tablet & Apps |

Trading Costs |

Forex: Spreads on major FX from 0.6 pipsCFD shares: Spreads on UK and US shares start from £3 or $3 per trade |

Max. Leverage |

50:1 |

Demo accounts |

✅ |

Copy Trading |

❌ |

Bonus |

❌ |

Payment Methods |

Debit Card, Wire Transfer, Bank Transfer (Automated Clearing House (ACH)) |

Customer Support |

7/24 |

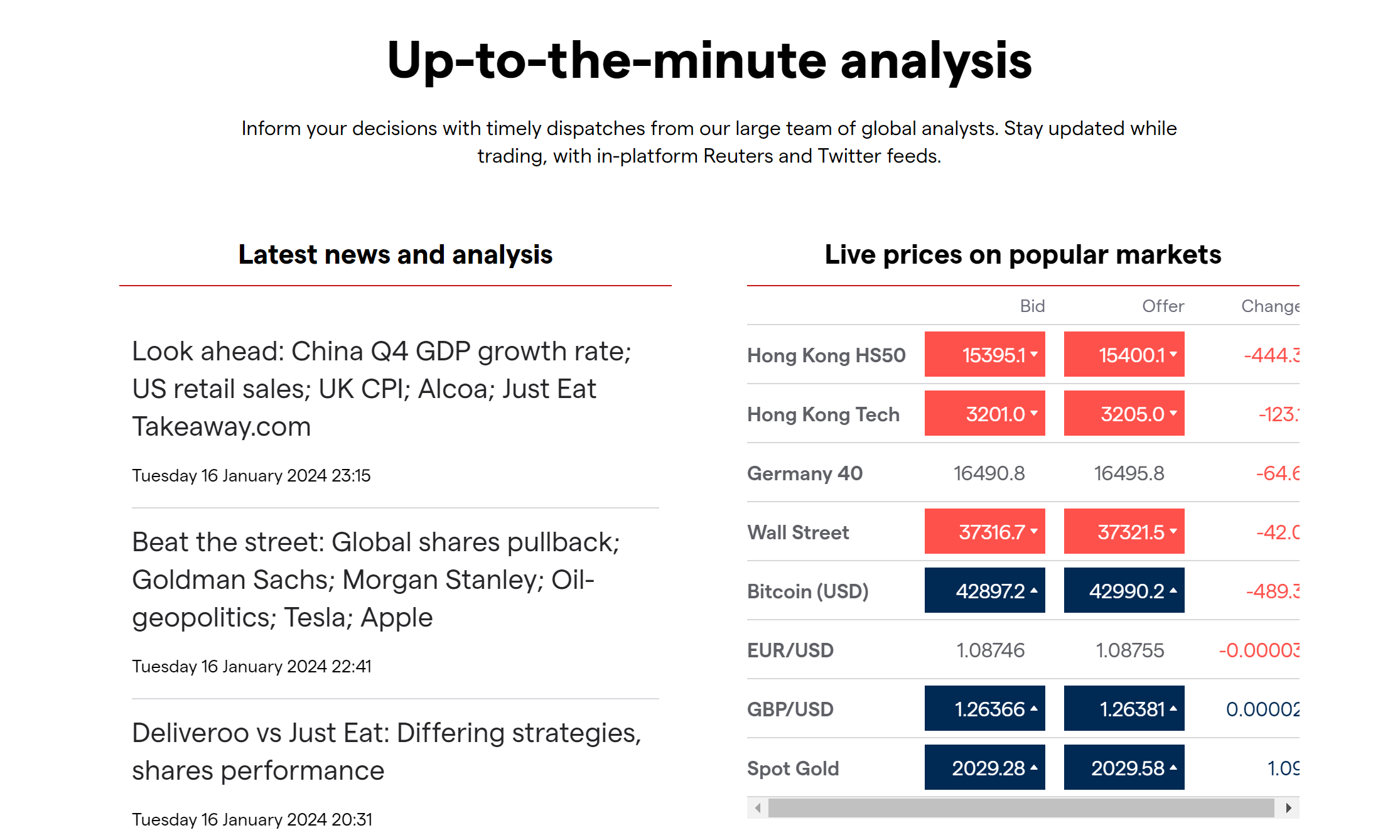

IG Group, founded in 1974, is a UK-based company providing trading in financial derivatives such as contracts for difference and financial spread betting, and stockbroking to retail traders. It is recognized and regulated in multiple countries, thereby ensuring a smooth global operation. IG's customers can trade vast instruments including currencies, indices, commodities, stocks, ETFs, and more on its proprietary platform. This user-friendly platform is technologically superior, offering fast and reliable execution, real-time market updates, and advanced charting tools, all accessible on mobile and desktop. IG Group's 24/7 customer support is commendable, with a highly responsive team providing assistance via phone, email, or live chat. Moreover, IG is known for its educational offerings, providing a vast array of financial webinars and detailed market outlook articles.

What makes IG suitable for professional traders also comes from multiple aspects. The diverse range of investment offerings on IG allows for comprehensive portfolio diversification, a feature that most professional traders are seeking. IG also offers direct market access (DMA), ensuring professional traders can trade at real market prices. The company provides sophisticated charting tools along with advanced trading technologies, ideal for experienced traders who need to carry out in-depth market analysis. Additionally, IG furnishes its clients with high-quality educational resources and market insights. This includes webinars, seminars, courses, and an expansive news and analysis section aimed to keep professional traders informed and updated.

✅ Where IG Shines:

• Globally regulated, IG's services are accessible globally, making them a go-to source for international trading.

• Their proprietary platform stands out with its high reliability, speedy execution, and advanced charting tools.

• FTSE 250 trading is one of IG's standout offerings, with tight spreads, direct market access, and up-to-date FTSE-related news.

• Providing guaranteed stop-loss orders (GSLOs), which lock in a maximum loss limit in advance, which few other brokers can do this.

• 7/24 customer support, IGs attentive and widely accessible customer support sets them apart in addressing trader queries and issues.

❌ Where IG Shorts:

• IG charges an inactivity fee of $12 per month after two years of inactivity, unfavourable for long-term investors who trade less frequently.

• Presently, its product range is limited in the U.S with focus largely on forex, causing them to miss out on traders interested in other instruments.

• Some users might find the desktop trading platform complex and difficult to navigate, especially beginners.

• Some superior research tools and features are available at an extra cost which could be discouraging for some traders.

Saxo Bank

|

|

Broker |

Saxo Bank |

Regulated by |

ASIC, FCA, FSA, SFC, AMF, CONSOB, FINMA, MAS |

Min. Deposit |

$0 |

Tradable Instruments |

CFDs, Forex, Options, Futures, Crypto FXForex options, CommoditiesStocks, ETFs, Crypto ETFsBonds, Mutual funds |

Trading Platforms |

SaxoInvestor, SaxoTraderGO, SaxoTraderPRO |

Trading Cost |

Forex: spreads varies depending on account, from 0.5 pipsCFD: variable commissionsShares: Variable spreads depending on the market and stock liquidity |

Max. Leverage |

30:1 |

Demo accounts |

✅ |

Copy Trading |

❌ |

Bonus |

❌ |

Payment Methods |

debit card deposit, bank/wire transfer, stock transfer |

Customer Support |

7/24 |

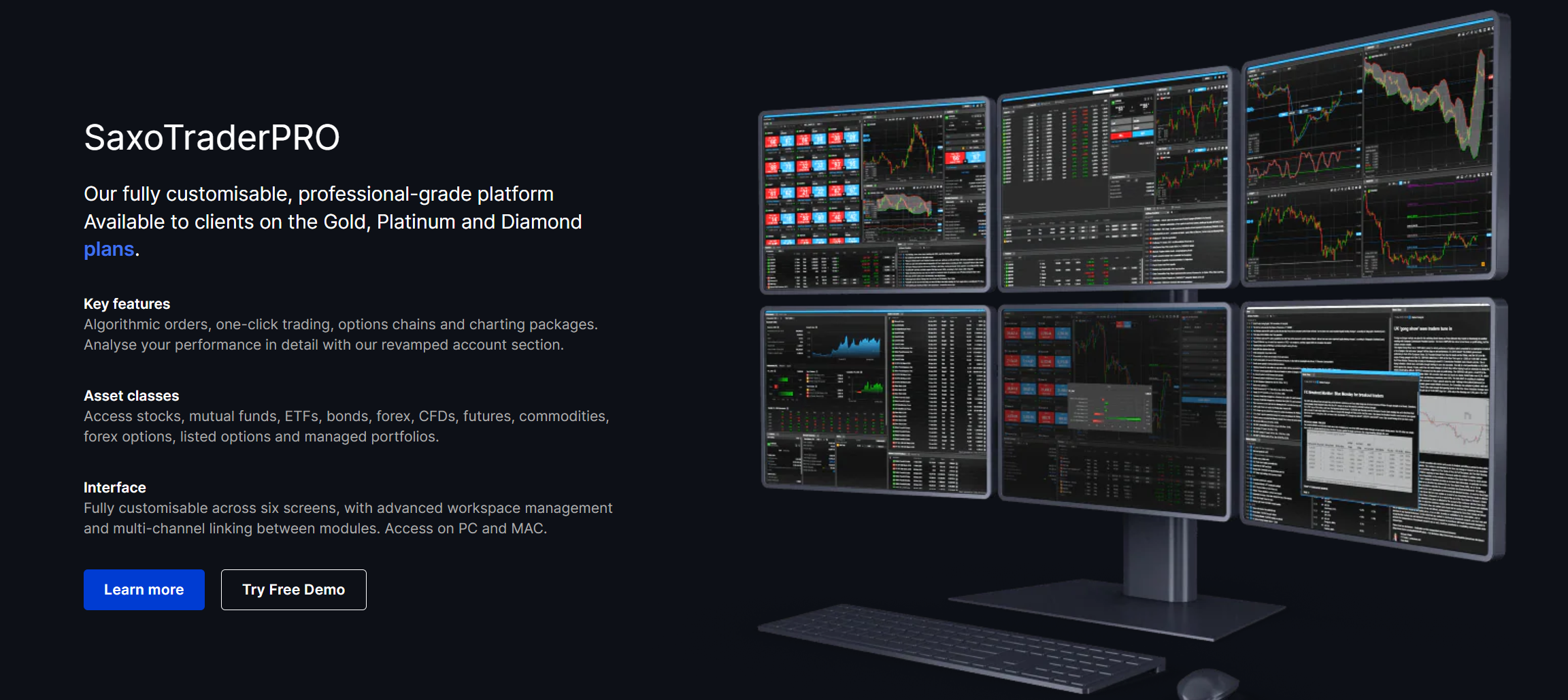

Saxo Bank, founded in 1992, is a globally recognized Danish investment bank,providing a wide range of tradable instruments, including but not limited to forex, stocks, CFDs, futures, options, ETFs, and bonds. Saxo Bank offers sophisticated trading platform SaxoTraderGO for web and mobile and SaxoTraderPRO for desktop. These platforms are equipped with groundbreaking technology and superior charting tools suitable for all types of traders. Their customer service is rated highly, offering support through email, phone, and live chat, with dedicated account managers for premium clients. The bank is recognized for its comprehensive product portfolio, competitive pricing, excellent trading platforms, and robust regulatory status.

For professional traders, Saxo Bank is a fitting choice for several reasons. Firstly, it provides access to a vast array of global markets, allowing for ample opportunities for diversification. The platform's advanced trading technologies, in-depth market insights, and professional-grade execution are traits highly attractive to professional traders. Saxo Bank's extensive research and market analysis coverage shed light on global financial trends and give traders an edge in decision-making. Additionally, the broker offers algorithmic orders for traders to automate their strategies. Lastly, Saxo Bank assigns a dedicated account manager for premium clients providing professional traders with personalized assistance.

✅ Where Saxo Bank Shines:

• Saxo Bank is regulated by multiple top-tier financial authorities worldwide, which confers a high level of trust and safety for professional traders.

• It offers powerful platforms that provide professional-grade execution and comprehensive charting tools.

• Premium clients receive dedicated account managers, providing personalized service.

• Saxo Bank boasts a large in-house research team, issuing regular market updates, economic forecasts, and in-depth strategy insights, vital to professional traders.

❌ Where Saxo Bank Shorts:

• Saxo Bank requires a relatively high minimum deposit to open an account, which may deter entry-level traders.

• Its pricing structure, including commissions, spreads, and other fees, can be somewhat complicated for beginners.

• Saxo Bank doesn't support trading in micro-lots in its forex offerings, which may not suit some trading strategies.

InteractiveBrokers

|

|

Broker |

InteractiveBrokers |

Regulated by |

ASIC, FCA, FSA, SFC, IIROC |

Min. Deposit |

$250 |

Tradable Instruments |

global stocks, options, futures, currencies, cryptocurrencies, and more |

Trading Platforms |

IBKR Trader Workstation (TWS)IBKR DesktopIBKR MobileIBKR GlobalTraderIBKR Client Portal |

Trading Costs |

Tiered fee structure |

Max. Leverage |

50:1 |

Demo accounts |

✅ |

Copy Trading |

❌ |

Bonus |

❌ |

Payment Methods |

ACH, Bank Wire, Bill Pay, Check, Transfer from Wise Balance |

Customer Support |

5/24 |

Interactive Brokers LLC, founded in 1978, is a U.S.-based brokerage firm registered in Greenwich, Connecticut. It's a leading platform that offers a vast range of tradable instruments including stocks, options, futures, forex, bonds, ETFs and mutual funds, across over 135 markets in 33 countries. The broker provides powerful trading platforms like Trader Workstation (TWS), IBKR Mobile, and Client Portal, featuring sophisticated tools, charts, and analytics for advanced trading. Customer support involves numerous channels including chat, email, phone, and an extensive library of FAQs and educational resources. Interactive Brokers is widely recognized for its competitive fees, broad product range, and robust trading technology, making it a preferred choice for many seasoned investors and traders worldwide.

InteractiveBrokers is particularly beneficial for professional traders. Firstly, the firm offers direct market access to numerous exchanges worldwide, catering to the global trading needs of professional traders. Secondly, its sophisticated trading platforms, especially the Trader Workstation (TWS), provide a range of advanced tools and features necessary for detailed market analysis and precise trade execution. In addition, Interactive Brokers offers low-cost pricing structures, which is a significant bonus for high-volume traders typically found amongst professionals. The firm also provides useful risk management tools, enabling professional traders to better manage their risk exposures. Furthermore, ongoing education and extensive market research resources offered by IC are enriching for professionals staying at the forefront of market trends.

✅ Where InteractiveBrokers Shines:

• Heavily regulated by ASIC, FCA, operating in a transparent way, adding extra layer of security.

• Features advanced trading platforms with powerful tools, efficient order routing, and high-speed execution.

• Its tiered pricing structure is favourable for frequent traders, featuring low commissions and margin rates.

• Interactive Brokers affords investing in different currencies and in international markets, which allows more opportunities for diversification over the long term.

❌ Where InteractiveBrokers Shorts:

• Charges monthly inactivity fees if certain commission thresholds aren't met, negatively impacting infrequent traders or beginners with smaller portfolios.

• Despite multiple channels, customer support has been reported to be slow at times, possibly impacting traders who require immediate assistance.

• While direct margin rates are relatively low, tiered rates can be higher for some balances compared to competitors.

eToro

|

|

Broker |

eToro |

Regulated by |

ASIC, FCA, CYSEC |

Min. Deposit |

$10 |

Tradable Instruments |

Cryptocurrencies, stocks, ETFs, and more |

Trading Platforms |

eToro trading platform |

Trading Costs |

1% fee for cryptoassets trading |

Max. Leverage |

30:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

Debit Card, Bank Account, PayPal, Wire Transfer |

Customer Support |

24/7 |

eToro, established in 2007, is a social trading platform based in Israel, with registered offices in Cyprus, the UK, and Australia. The platform provides a variety of tradable instruments like stocks, cryptocurrencies, commodities, forex, and ETFs among others. eToro is best known for its exceptional social trading platforms available both on web and mobile, where traders can copy trades from other investors automatically. eToros customer support includes assistance via phone and ticketing system, though it does not offer a 24/7 service. The broker is widely recognized for its innovative social trading features, free stock trading, and user-friendly interface.

For professional traders, eToro could be a strong choice because of several unique features. Primarily, its pioneering social trading platform provides traders with the opportunity to follow and replicate trades of top-performing investors, which might be beneficial for professional traders looking to diversify their strategies. The platform also offers ProCharts, a professional charting package, and advanced risk management tools, which are crucial for professional portfolio management. Furthermore, eToro‘s CopyPortfolio feature, allows automatic copying of portfolios created by professional traders, or portfolios oriented towards a specific strategy. However, it’s important to note that due to its social trading focus, eToro might be more beneficial to traders whose strategies involve social interaction and information gathering from others.

✅ Where eToro Shines:

• eToro's pioneering social trading platform allows traders to follow and copy the trades of successful investors.

• eToro's platform has a highly intuitive and user-friendly interface designed to make trading accessible for both novice and experienced traders.

• eToro is known as one of the pioneers in cryptocurrency trading, offering access to a wide range of crypto assets, a feature which many professional traders find attractive.

• Another key advantage for eToro is their offer of free stock trading, a benefit not seen across all trading platforms.

❌ Where eToro Shorts:

• eToro charges relatively high forex and CFD trading fees which can eat into trading profits, especially for high-volume traders.

• The platform's customer support is not available 24/7 and some users have reported slow response times.

• eToro charges a fixed withdrawal fee of $5, unlike many other brokers, which can be a drawback for active traders who need to move money frequently.

CMCMarkets

|

|

Broker |

CMCMarkets |

Regulated by |

FCA, FMA |

Min. Deposit |

$0 |

Tradable Instruments |

Shares, ETFs, Options, mFunds, warrants, FX Pairs, Indices, Commodities, Shares, Cryptocurrencies, and Treasuries |

Trading Platforms |

web-based platform, mobile app, MetaTrader 4, Next Generation |

Trading Costs |

Forex: from 0.7 pipsIndices: from 1.0 pipsCryptocurrencies: from 35 points for Bitcoin and 3 points for Ripple. |

Max. Leverage |

30:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

Credit/debit card, Online banking, Bank transfer |

Customer Support |

5/24 |

CMCMarkets, established in 1989, is a UK-based financial services company that operates as an online broker, offering vast tradable instrument options including forex, shares, indices, commodities, treasuries, and cryptocurrencies. CMCMarkets provides a proprietary trading platform known as 'Next Generation', which is available on both web and mobile, and it also supports MetaTrader 4 for forex trading. Its customer support is comprehensive, offering 24-hour support via phone, live chat, and email. CMC Markets is highly regarded for its advanced trading platform, competitive spreads, exceptional charting tools, and a strong regulatory reputation.

CMMarkets is often favored by professional traders for a number of reasons. Their 'Next Generation' platform is designed with advanced features such as customizable charting, automated trading strategies, and risk-management features. This comprehensive toolkit facilitates complex market analysis and high-level professional trading. The wide range of tradable instruments offered by CMC Markets ensures professionals can diversify their portfolios according to their own trading strategies effectively. Additionally, CMCMarkets offers competitive pricing and lower forex spreads, which can be vitally beneficial to professionals who often deal with high volume trades. The company also provides extensive educational resources and market analysis updates, that help professional traders stay updated on market trends and refine their trading strategies. So, with its advanced platform, diverse offerings, competitive spreads, and educational support, CMCMarkets is well equipped to meet the needs of professional traders.

✅ Where CMCMarkets Shines:

• Their 'Next Generation' platform is well-regarded for its powerful tools, customisable charts, and automated trading features catered towards professional traders.

• Competitive spread pricing is especially beneficial for high volume traders, often equating to significant cost savings.

• CMCMarkets supports a wide variety of order types, including guaranteed stop-loss orders, providing professionals with more control over their trading activities.

❌ Where CMCMarkets Shorts:

• CMCMarkets doesn't frequently offer promotions or bonuses, which can lessen its appeal compared to other brokers who do.

• While CMCMarketss Forex trading fees are competitive, their stock CFD fees tend to be on the higher side.

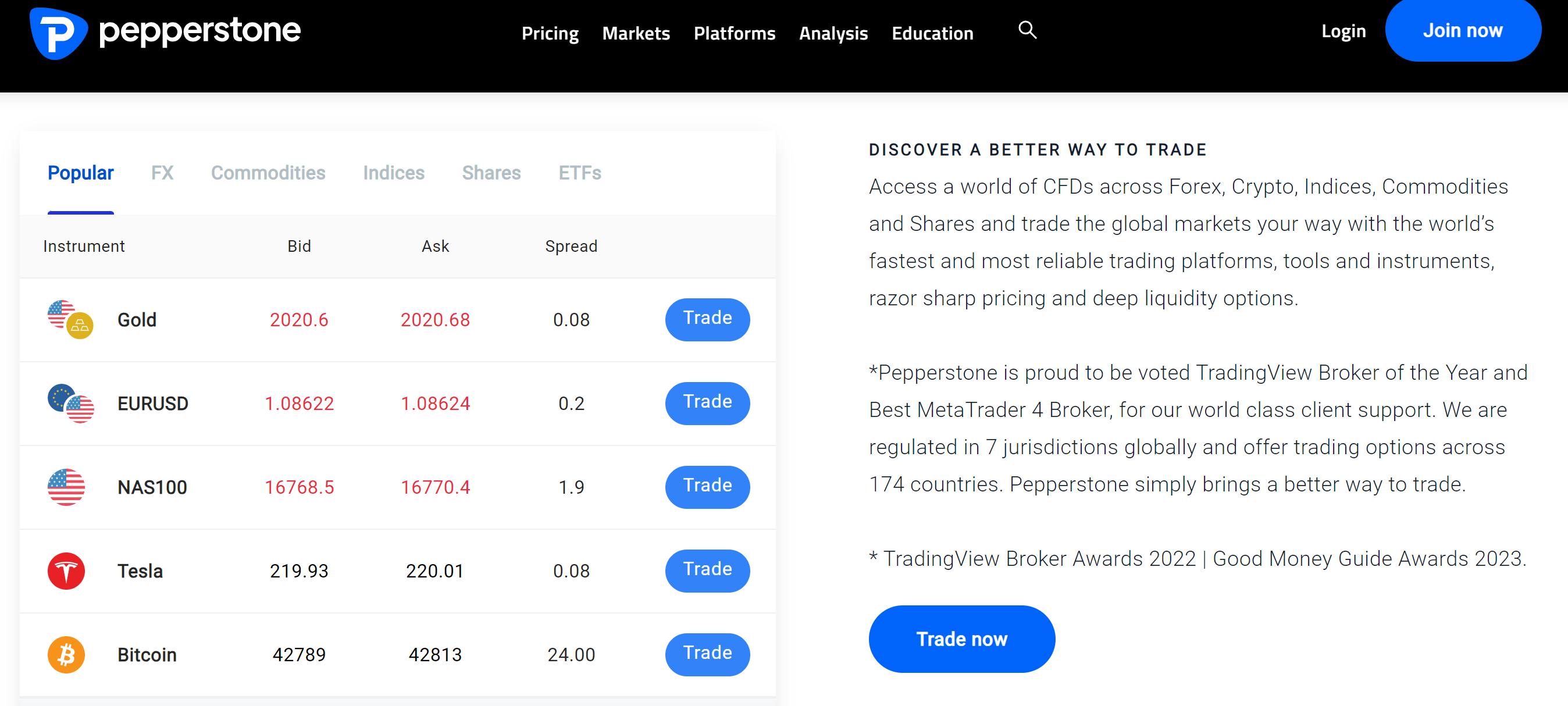

Pepperstone

|

|

Broker |

Pepperstone |

Regulated by |

ASIC, CYSEC, FCA, DFSA, SCB |

Min. Deposit |

$200 |

Tradable Instruments |

Forex, Commodities,Indices, Currency Indices,Cryptocurrencies,Shares, ETFs,CFD Forwards |

Trading Platforms |

cTrader, MetaTrader 4, TradingView, |

Trading Costs |

Forex markups of 0.70 pips, average costs of 0.84 pips or $7.00 and $8.40 per 1.0 standard round lot |

Max. Leverage |

500:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

Visa, Mastercard, Bank transfer; PayPal, Neteller, Skrill, Union Pay |

Customer Support |

24/7 |

Pepperstone, founded in 2010, is an online forex and CFD broker based in Australia, with additional operations in the UK. It provides trading in over 150 instruments, spanning forex, index CFDs, commodities, cryptocurrencies, and share CFDs. The broker offers multiple trading platforms including MetaTrader 4, MetaTrader 5, and cTrader available on web, desktop, and mobile for convenient access. Pepperstone's customer support extends to 24/7 live chat, phone, and email services. Pepperstone is recognized for its low-cost access to global forex markets, superior customer service, extensive educational resources, and transparent fee structure.

Pepperstone is a solid option among professional brokers. Firstly, it allows high-speed execution with ultra-low latency, a vital factor for those implementing high-frequency trading strategies. Secondly, Pepperstone's platform compatibility with MetaTrader and cTrader means professionals can utilize expert advisors (EAs) and cAlgo for automated trading. Furthermore, the broker provides robust analytical tools and technical indicators crucial for in-depth market analysis. Pepperstone also offers a competitive spread and pricing model, which can significantly lower costs for high-volume traders. Lastly, the availability of high leverage up to 500:1, an ideal choice for scalpers and high-frequency traders.

✅ Where Pepperstone Shines:

• Known for its ultra-low latency and swift trade execution, which is a significant benefit for high-frequency traders.

• Offers MetaTrader 4, MetaTrader 5, and cTrader platforms, all of which are suited to the needs of professional traders.

• Exceptionally competitive forex pricing with low spreads, reducing costs particularly for high-volume traders.

• Providing high leverage up to 500:1 (subject to eligibility), which can enlarge trading capacity.

• Offering robust analytical tools and technical indicators aiding comprehensive market analysis.

❌ Where Pepperstone Shorts:

• Although Pepperstone offers a broad range of forex pairs, its CFD offerings are not as extensive, which can restrict trading diversification for some traders.

• Pepperstone does not regularly offer bonuses or promotional campaigns, which can lessen its appeal compared to other brokers.

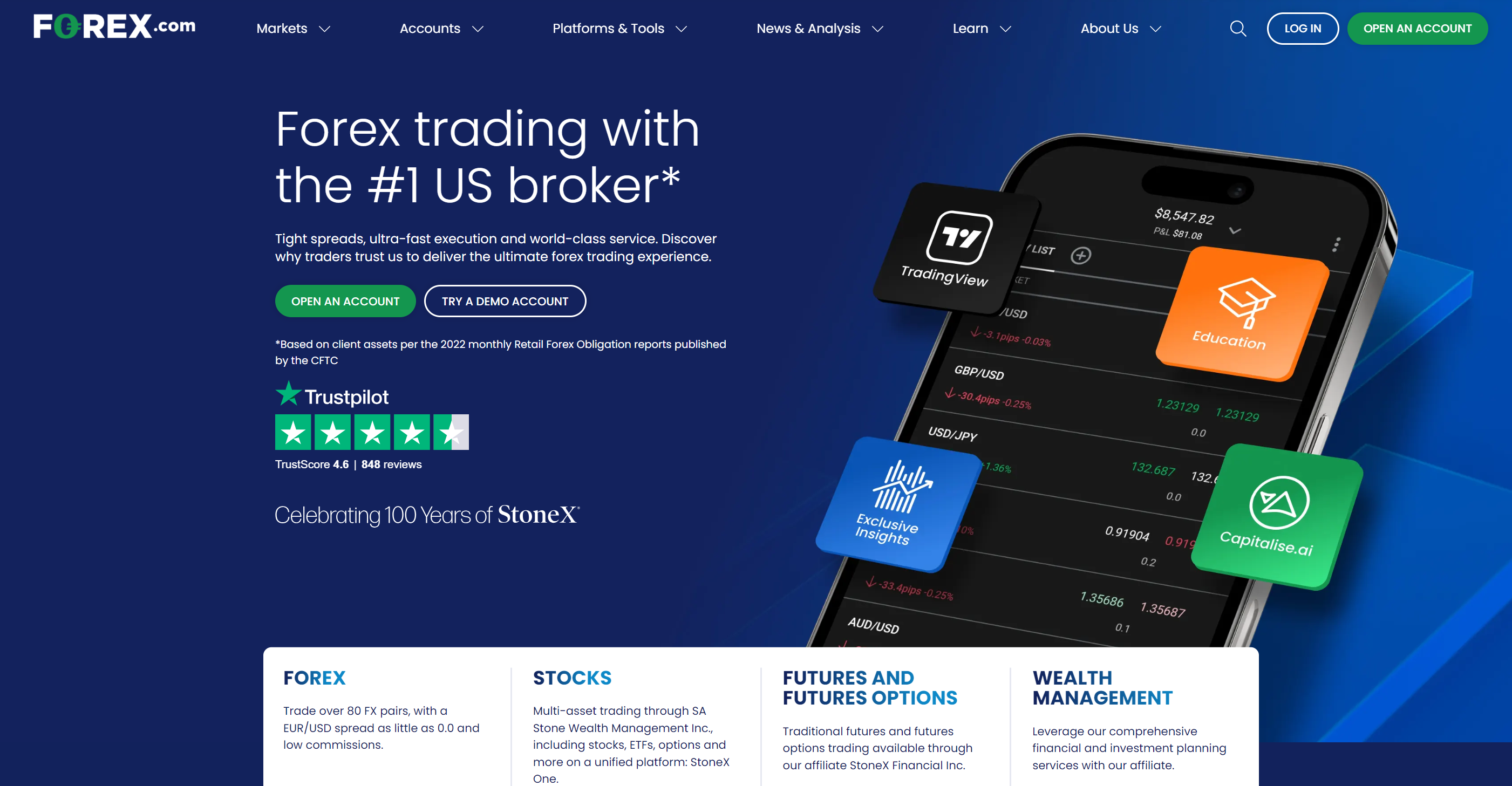

Forex.com

|

|

Broker |

Forex.com |

Regulated by |

ASIC, FCA, FSA, IIROC, NFA, MAS, CIMA |

Min. Deposit |

$100 |

Tradable Instruments |

forex, stock CFDs, indices or commodities, |

Trading Platforms |

MT4, MT5, Mobile App, Webtrader |

Trading Costs |

Standard account: No commissions are charged on any instruments.RAW account: $$7 per $$100,000 USD traded on all instruments. |

Max. Leverage |

50:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

credit card, debit card, Skrill and Neteller e-wallets and wire transfer |

Customer Support |

5/24 |

Forex.com, founded in 1999, is a US-based online broker that operates globally. The broker offers trading in over 80 currency pairs, along with numerous other instruments including indices, commodities, and stock CFDs. Forex.com provides a proprietary platform called “Advanced Trading”, and supports MetaTrader 4 platform, both accessible from web, desktop and mobile devices. Their customer support team is available 24/5 via phone, email, and live chat. The broker is recognized for its performance and reliability, comprehensive research tools, and a well-rounded service in general.

Appropriate for professional traders, Forex.com offers a number of benefits. Its integrated research tools, market commentary, and sophisticated charting capabilities allow professional traders to fully analyze market trends. The broker's proprietary “Advanced Trading” platform includes comprehensive trading features such as advanced order types, customizable charting tools, and automated trading options, which makes it suitable for sophisticated trading strategies. Moreover, Forex.com offers average-to-competitive spreads, and the chance to cut trading costs via an active trader program, which can be particularly advantageous for high-volume traders. Additionally, the broker's robust regulatory infrastructure across multiple jurisdictions brings peace of mind to the professionals.

✅ Where Forex.com Shines:

• Forex.coms robust regulatory infrastructure across multiple jurisdictions assures professional traders of a safe and secure trading environment.

• The average-to-competitive spreads coupled with an active trader program that cuts costs for high-volume traders is an advantageous offer.

• U.S. based clients cannot trade cryptocurrencies, restricting the options for traders based in the United States.

• Forex.com supports advanced order types such as trailing stops, stop loss, and limit orders, allowing professionals to implement complex strategies.

• Regular provision of market insights and technical analysis helps professional traders plan their strategy more accurately and stay informed about market trends.

❌ Where Forex.com Shorts:

• Although the broker offers over 80 currency pairs, it has a relatively limited range of other assets, which might deter traders seeking a diverse asset selection.

• Forex.com charges inactivity fees of $15 for accounts that have been dormant for a year, which can increase the costs for occasional traders.

AvaTrade

|

|

Broker |

AvaTrade |

Regulated by |

ASIC, FSA, FFAJ, CBI, FSCA |

Min. Deposit |

$100 |

Tradable Instruments |

currency pairs, major stock indices, Cryptocurrencies, commodities (such as gold, silver, sugar, coffee), bonds, individual shares and ETFs |

Trading Platforms |

AvaSocial, Web trader, AvaTradeGO, MetaTrader 4,MetaTrader 5 |

Trading Costs |

Spreads from 0.9 pips |

Max. Leverage |

30:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

credit/debit cards and wire transfers, Skrill, Neteller, and WebMoney, and more |

Customer Support |

24/5 |

AvaTrade, established in 2006, is a globally recognized online brokerage based in Dublin, Ireland. The broker provides trading in a diverse range of instruments including over 50 currency pairs, numerous CFDs on indices, stocks, commodities, cryptocurrencies, and bonds. It supports various trading platforms including MetaTrader 4, MetaTrader 5, and AvaTradeGo, available across web, desktop, and mobile devices. AvaTrade offers 24/5 customer support via live chat, telephone, and email, and boasts robust user recognition due to its wide range of educational resources, multiple trading platforms, and strict regulation.

For professional traders, AvaTrade's features fulfill many professional traders' requirements. Firstly, AvaTrade offers advanced charting tools and automated trading capabilities present in MetaTrader 4 and MetaTrader 5, featuring complex trading strategies. Besides, traders can also take advantage of AvaTradeGO, their proprietary app offering a user-friendly interface and management tools. AvaTrade's wide range of tradable instruments allows extensive market exposure, providing diversification opportunities. Additionally, they offer competitive spreads and up to 400:1 leverage, enabling traders to optimize their trading conditions. Furthermore, its strong regulatory oversight across five continents offers reassurance regarding safety and fairness of trade practices.

✅ Where AvaTrade Shines:

• With regulation across five continents, AvaTrade provides a high level of trustworthiness and security for its users.

• Offering extensive market exposures,including forex pairs, CFDs on indices, commodities, and stocks, providing traders with ample choices.

• AvaTrade supports MetaTrader 4, MetaTrader 5, and its proprietary AvaTradeGo, offering great flexibility and functionalities for professional traders.

• AvaTrade offers competitive spreads and up to 400:1 leverage, attractive for professional traders.

❌ Where AvaTrade Shorts:

• AvaTrade charges an inactivity fee of $50 after three months of non-use, which can be a disadvantage for traders who don't trade frequently.

• Unlike many other brokers, AvaTrade does not frequently offer promotions or bonuses, which could deter some traders.

OANDA

|

|

Broker |

OANDA |

Regulated by |

ASIC, FCA, FSA, NFA, IIROC, MAS |

Min. Deposit |

$0 |

Tradable Instruments |

forex (currencies), stock indices, commodities, CFD shares (US), CFD cryptocurrencies, ETFs |

Trading Platforms |

OANDA WebOANDA Mobile, TradingView, MetaTrader 4 |

Trading Costs |

Spreads from 0.0 pips, $50 commissions per 1M |

Max. Leverage |

50:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

debit card (backed by MasterCard, Visa or Discover), wire transfer and ACH bank transfer |

Customer Support |

5/24 |

OANDA, established in 1996, is a renowned forex broker based in the United States and regulated in multiple countries globally. The platform offers a broad array of assets to trade, encompassing over 120 currency pairs as well as CFDs for indices, commodities, interest rates, and bonds. Notable platforms supported by OANDA include its proprietary OANDA Trade, MetaTrader 4, and TradingView, all of which are accessible via web, desktop, and mobile devices. OANDA provides extensive customer support 24/5 through live chat, email, and over-the-phone assistance. This broker is highly recognized among users for its advanced charting tools, transparent pricing model, and strong regulatory backing.

OANDA remains a solid choice for professional traders. The platform's institutional-grade execution facilities and capability-rich trading platforms furnish tools for complex trading strategies along with sophisticated charting, technical analysis instruments, and auto-trading capabilities. A broad range of tradable assets facilitates extensive market exposure and diversification opportunities. Competitive spreads along with flexible leverage up to 300:1, varying per regulations of user's registered country, are another bonus. Traders also gain access to in-depth market insights and a vast suite of risk management tools. Moreover, the high level of regulatory oversight offers reassurance and ensures fairness in all trading practices.

✅ Where OANDA Shines:

• With multi-country regulation, OANDA offers a secure and reliable trading environment.

With over 120 currency pairs and various CFDs, OANDA provides ample options for diversification.

• OANDA supports a variety of platforms like MetaTrader 4, OANDA Trade and TradingView, giving professional traders enough room to play.

• OANDA supports API trading and automated trading strategies, which are excellent for advanced traders looking to automate their trading system.

• They provide Virtual Private Server (VPS) service for users with EA and algorithmic strategies, eliminating downtime due to internet or power failures.

• Tools like advanced charting, technical analysis and risk management measures help professional traders to better manage their trades and risks.

❌ Where OANDA Shorts:

• While OANDA has 24/5 customer support, it has received mixed reviews on the speed and quality of its client service.

• Inactivity fees will be applied to inactive accounts on the third last weekday of each month.

MetaTrader platforms only limited

ATC Brokers

|

|

Broker |

ATC Brokers |

Regulated by |

FCA |

Min. Deposit |

$2,000 |

Tradable Instruments |

Forex, Indices, Commodities |

Trading Platforms |

MetaTrader 4, MTPRO |

Spreads from 0.3 pips, fixed commission at USD 30 per USD 1,000,000 |

|

Max. Leverage |

200:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

Bank Wire, ACH, Debit card |

Customer Support |

5/24 |

ATC Brokers, founded in 2005, is a premier brokerage firm headquartered in the United Kingdom. The company provides forex trading with a focus on the MetaTrader platforms (including MT4 & MT5), offering more than 40 currency pairs and CFDs on indices, commodities, and metals. ATC Brokers' customer support is readily available through various channels, including phone, email, and live chat. Recognized for its strict adherence to regulatory standards, transparent pricing, and advanced trading tools, ATC Brokers has carved out a solid reputation in the trading community.

ATC Brokers is a good choice for professional traders. Firstly, its support for the industry-standard MetaTrader platforms ensures an environment that accommodates sophisticated trading tactics, arming traders with advanced analytical tools, Expert Advisors (EAs) for automated trading, and backtesting capabilities. The firm's Straight Through Processing (STP) model ensures speedy and transparent trade execution, eliminating any potential conflict of interest. Furthermore, the vast selection of tradable assets broadens the scope for portfolio diversification. ATC Brokers also offers a competitive pricing model with tight spreads, thus reducing trading costs – a key consideration for high-volume traders.

✅ Where ATC Brokers Shines:

• Employing an NDD model, ATC Brokers employs direct access to interbank rates, ensuring trades are executed without any dealer intervention.

• With their support for MetaTrader 4 and its proprietary trading platform MT Pro, traders gain access to sophisticated technical tools.

• Their Straight Through Processing execution model ensures quick and fair order execution.

• ATC Brokers allows trading techniques such as scalping and hedging, providing more versatility for trading strategies.

❌ Where ATC Brokers Shorts:

• ATC Brokers does not offer comprehensive educational content, which could be a drawback for novice traders.

• Limited trading platform choices, only MT4 and its own MT pro, not offering MT5 or Tradingview.

• Despite providing phone and email support, they lack live chat, which might slow resolution for pressing issues.

Forex Trading Knowledge Questions and Answers

How to define a professional trader and beginner trader?

A professional trader is generally defined as a person who trades in the financial markets as their primary occupation. They usually possess extensive experience, extensive financial knowledge, and are often licensed or registered with a regulatory body. They may work for financial institutions or trade independently. They typically employ complex strategies, handle significant trade volumes, and are comfortable taking on larger levels of risk.

On the other hand, a beginner trader is someone who is new to the world of trading. They may lack in-depth experience and knowledge about financial market operations, making them more susceptible to potential losses. They usually begin with smaller investments, focusing on learning about different securities, trading platforms, market indicators, and basic trading strategies. As beginners, their aim is often to build experience and confidence while trying to limit losses as much as possible. Many utilize demo accounts to practice trading without any financial risk.

Do professional traders tend to have a higher profitability rate?

Professional traders, given their expertise and unique strategies, typically produce more winning trades than beginner or part-time traders. Trading, yet, has an inherent risk and even professionals may face losses. The high profitability rate often associated with professional traders does not emerge overnight, and it is usually the result of years of experience, continuous learning, and rigorous discipline.

Consider a famous hedge fund manager and professional trader, Ray Dalio. As the founder of Bridgewater Associates, one of the world's largest hedge funds, Dalio has consistently achieved higher profitability rates due to his extensive experience, rigorous risk management, and innovative trading strategies. Bridgewater's Pure Alpha Strategy posted a return of 14.6% in 2018, a year when many individual and part-time traders struggled due to increased market volatility.

Meanwhile, a study published in the Quarterly Journal of Economics observed day traders in the Taiwan Stock Market over a 15-year period, revealing that less than 1% of these traders, who were predominantly part-time or amateur traders, could consistently earn profits over a year.

What are the main challenges faced by professionals today?

Professional traders today face quite a few challenges, including:

Market Volatility: Periods of increased market volatility can be challenging, making it difficult to predict market movements and make profitable trades.

Regulatory Changes: New laws, rules, and regulations sometimes can make trading more complicated or limit available trading options.

Technological Advancements: The constant evolution of trading technologies requires professionals to continually learn and adapt, which can be time-consuming.

High Competition: The rise of algorithmic trading and high-frequency trading has increased competition and can lead to narrower margins.

Risk Management: Managing risk effectively in diverse market conditions is a persistent challenge, as a poor decision can lead to significant financial loss.

Emotional Control: Maintaining emotional control under pressure, especially during losing streaks or in times of market uncertainty, is a significant challenge.

Work-life Balance: The demanding nature of trading, especially day trading, can lead to long hours and stress, making a healthy work-life balance hard to maintain.

These challenges vary in intensity for different individuals and market conditions, but they are central to the field of professional trading.

How do professionals manage risk?

Genuinely, managing risk is a core part of overall forex trading. Now, focusing specifically on how professional traders manage risk, we see that several precise and focused strategies come into play. By employing these strategies, they are not caught off-guard by market volatility and can limit their potential losses effectively.

Stop-Loss and Take-Profit Orders: Professional traders commonly use stop-loss orders to limit potential losses if the market goes against an open position. They can set a price level at which the trade will automatically close. Similarly, take-profit orders are used to lock in profits when the trade reaches a certain favorable point.

Diversification: Diversification is a tried-and-true method of mitigating risk. It involves spreading the investment across a variety of assets, markets, or sectors to avoid overexposure to a single asset. This way, even if a single asset performs poorly, the loss can be offset by gains from other assets.

Position Sizing: Professionals also limit the amount of their trading capital risked on a single trade, also known as position sizing. By defining a maximum percentage of their trading capital as the risk limit for each trade, they can ensure that potential loss from any single trade does not significantly impact their portfolio.

Adherence to a Trading Plan: Before entering a trade, professional traders have a well-defined trading plan that includes a clear risk-reward ratio, expected returns, stop-loss levels, and exit criteria. By rigorously sticking to this plan, they can ensure a disciplined trading approach that keeps risk to an agreed level.

Emotional Discipline: Trading can evoke strong emotions like fear and greed. Professionals cultivate the discipline to manage these emotions effectively, avoiding impulsive decisions and sticking to their trading plan.

Hedge Positions: Professionals often use hedging as a strategy to offset potential losses that may be incurred in a trade. This involves taking multiple positions that are likely to move in opposite directions, therefore reducing risk.

Continuous Learning and Analysis: Professional traders strive to stay updated about market trends, new financial products, and trading technologies. Being informed about market dynamics and potential risk factors helps them to finetune and adjust their strategies effectively.

Do professionals use special strategies?

Yes, professional traders often use some specifical strategies that they've developed over time based on their experience, market knowledge, analyses, and trading style. These may include strategies relying on technical analysis, fundamental analysis, price action, swing trading, position trading, day trading, or algorithmic trading, among others. The strategy likely varies based on the trader's goals, risk tolerance, and the specific trading situation. An important aspect of being a successful professional trader is being able to analyze the market accurately and adapt the chosen strategy as per the market conditions.

What professional traders concern most when choosing a forex broker?

• Regulatory Compliance: This is a cornerstone for traders when choosing a forex broker. They ensure brokers are compliant with regulatory authorities such as the U.S. Commodity Futures Trading Commission (CFTC), the UK's Financial Conduct Authority (FCA), or Australian Securities and Investment Commission (ASIC). These bodies offer protections from fraudulent activities and ensure the broker's operations comply with best practices.

• Trading Platform: The platform offered by the broker plays a huge role. It needs to be not only user-friendly but also rich in features like advanced analytical tools, complete studies, automatic trading capabilities, real-time quotes, and more. Stability and reliability, especially during times of high market volatility, are also crucial points.

• Trade Execution Speed: Rapid and accurate trade executions minimize slippage, which could lead to potential losses. Professional traders are concerned about whether the broker has direct market access or not. And whether their trades will be executed at the price shown at the time of placing an order.

• Spread and Commissions: Brokers offering tight spreads and low commissions are preferable. Brokers are wax or wane based on how economically they can be for high-volume trades. Any savings on these transactional costs can significantly bolster net profits.

• Leverage and Margin Requirements: Depending on their risk tolerance level, professional traders consider brokers who provide flexible leverage options. Even though high leverage can provide higher returns, it also can increase the risk of potential losses.

• Customer Service: Effective customer support is vital for traders, especially when it comes to resolving issues promptly. Professional traders need services that are available 24/7 and can provide quick, efficient solutions in critical moments.

• Deposit & Withdrawal: Fluid procedures for fund deposit & withdrawal, with no exorbitant fees or extended waiting periods, are also a driving factor in choosing a forex broker.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers. We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

Best Binary Options Brokers in 2026

Best Bitcoin Brokers for 2026

The text discusses Bitcoin brokers' role and criteria for selecting the top providers, emphasizing their key functionalities.

7 Best Crypto Brokers in 2026

Examine the top 5 futures trading platforms , considering user experience, tradable assets, educational resources, commissions, and more.

10 Best Forex Brokers for Professional Traders in 2026

Discover the '10 Best Forex Brokers for Professional Traders', your ultimate guide to thriving in the forex market.