Welcome to the dynamic world of Exchange Traded Funds (ETFs), a revolutionary investment concept gaining significant traction among investors in recent years. ETFs, short for Exchange Traded Funds, represent a paradigm shift in the financial landscape. The popularity can be attributed to their combination of lower costs and reduced risks, achieved through comprehensive diversification.

However, amidst the plethora of brokerage options vying to provide ETF services, the task of making an informed decision can be daunting. Fear not, for this article serves as a guiding beacon. WikiFX meticulously evaluates ETF brokers, scrutinizing key factors such as fees, minimum initial investment requirements, overall broker profiles, regulatory standings, and the responsiveness of customer service. Embark on this enlightening journey as we unravel the intricacies of ETFs and navigate the path to finding your ideal investment partner.

Reasons for listing the 7 Best ETF Brokers

Offering 0 commission fees and supporting over 150 free ETFs

Excellent regulatory status and responsive customer service

Over 2,000 ETFs across a range of asset classes and fund companies

All listed ETFs traded on U.S. exchange are $0 per trade online

Real-time Level 2 stock and options market data

Low fees, including $0 commission for U.S. stock trades and $0 for stock options contracts

Offering diversified portfolio

FX fee for currency conversion is capped at 0.15%

more

Comparison of Best ETF Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best ETF Brokers Overall

①IB - Best Overall

| (Interactive Brokers)IB |  |

| Overall Rating |

⭐⭐⭐⭐⭐ |

| Regulated by | ASIC, FCA, FSA, SFC |

| ETFs | 150+ |

| Minimum Deposit | $0 |

| Comissions | $0 |

| Copy Trading | ✅ |

| Demo Accounts | ✅ |

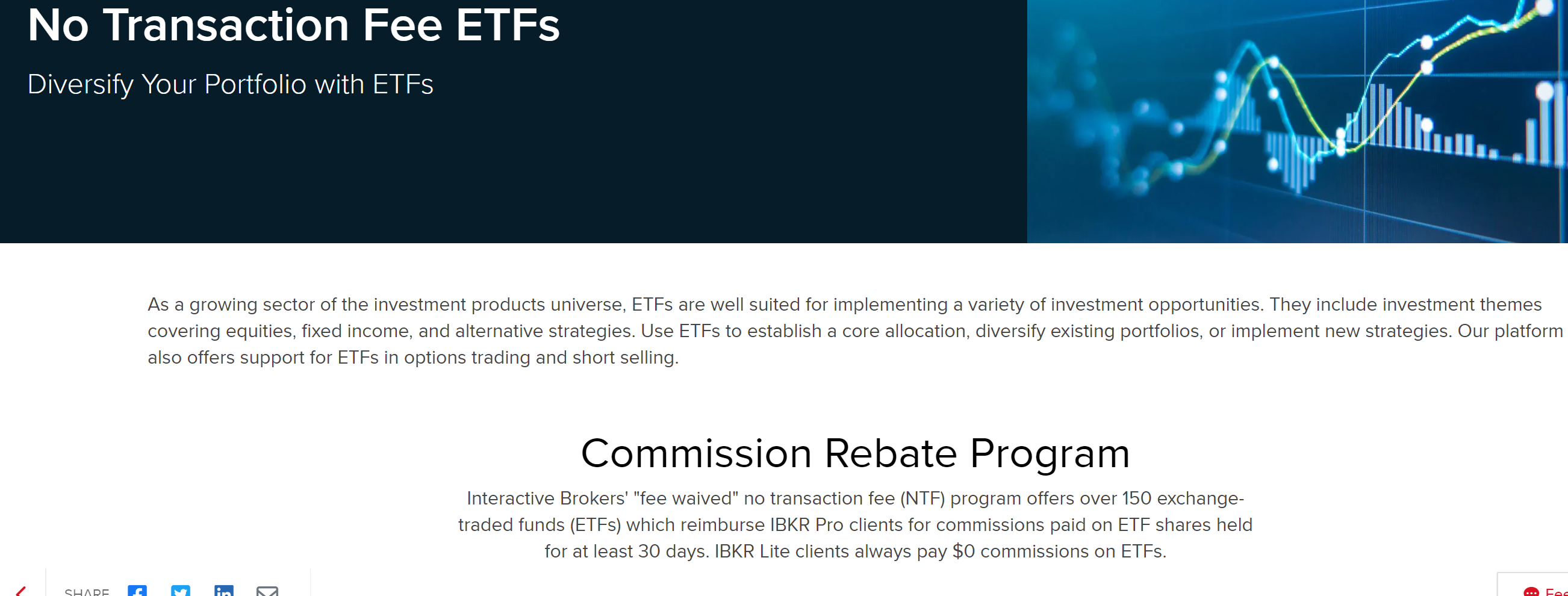

Interactive Brokers (IB) is list at multiple WikiFX“best brokers”lists, consistently outperforms due to its overall functionality and regulated status. In the ETF domain, IB offers commission-free trading with over 150 ETFs.

IB's unique “fee-waived” program refunds IBKR Pro clients for commissions on ETF shares held for minimum 30 days. Moreover, IBKR Lite clients benefit from continuous $0 ETF commissions, with the liberty to choose from major ETF providers, including Wisdom Tree, GlobalX, PIMCO, and KraneShares.

IB Pro & Cons

Pros:

√ Over 150 free ETFs: Interactive Brokers' “fee-waived” no transaction fee program encompasses over 150 exchange-traded funds

√ Competitive Commissions: It provides a commission fee of $0, which is competitive.

√ A wide range of platforms: IBKR Trader Workstation (TWS), IBKR Desktop, IBKR Mobile, IBKR Client Portal, IBKR API—each intricately designed for effective futures trading.

Cons:

× Inactivity Fee: An inactivity fee is applicable, but it can be avoided by maintaining specific levels of trade activity.

②Fidelity - Best ETF Brokers for Wide Range of ETFs and Advanced Tools

| Fidelity |  |

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Regulated by | FSA |

| ETFs | 7000+ U.S. stocks and ETFs |

| Minimum Deposit | $0 |

| Comissions | $0 |

| Copy Trading | ❌ |

| Demo Accounts | ✅ |

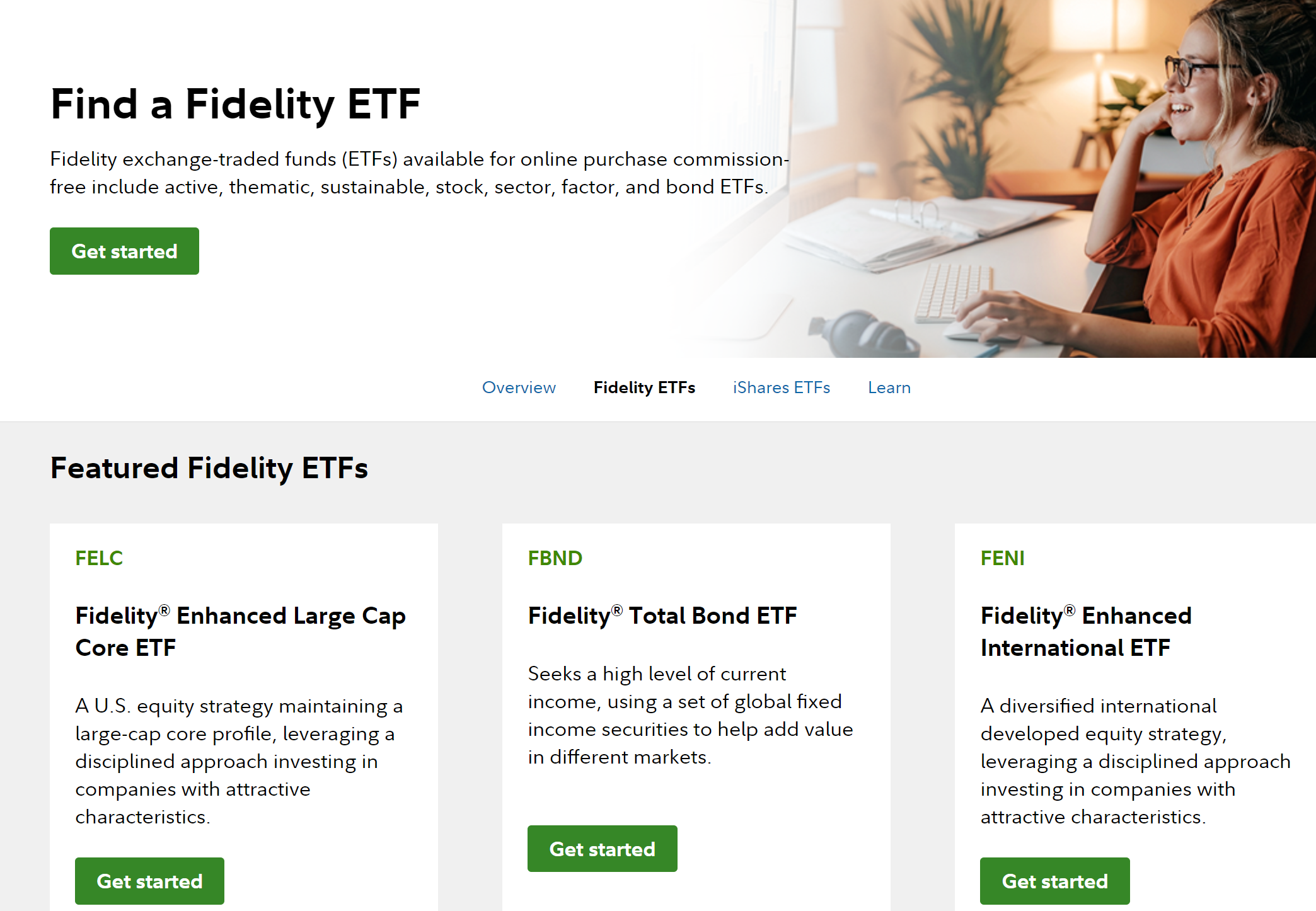

Fidelity earns its spot among the best ETF trading platforms due to its competitive $4.95 per trade rate, approximately 100 commission-free ETFs for active traders, and advanced tools like Active Trader Pro and Wealth-Lab Pro.

The platform's commitment to accessibility is reflected in its user-friendly mobile interface. Fidelity also stands out for providing market research from 20 providers, although the information presentation may be dense. Its combination of competitive pricing, diverse ETF options, and advanced tools make it a top choice for investors.

Fidelity offers a comprehensive selection of commission-free exchange-traded funds (ETFs) available for online purchase. The range includes active, thematic, sustainable, stock, sector, factor, and bond ETFs. Featured ETFs include Fidelity® Enhanced Large Cap Core (FELC), Fidelity® Total Bond (FBND), and Fidelity® Enhanced International (FENI). These ETFs cater to various investment objectives, such as large-cap U.S. equities, global fixed income securities, and diversified international developed equities. Investors can easily get started with Fidelity's diverse ETF options.

Fidelity Pro & Cons

Pros:

√ A variety of ETFs:Fidelity provides many types of ETFs for traders to choose the one suitable for themselves.

√ Commission-Free Trading: Fidelity offers commission-free trading for stocks, ETFs, and options, providing cost savings for investors.

√ Abundant Research Providers: Users have access to a wealth of research providers, enhancing the depth and breadth of market insights available.

√ Robust Customer Service: Fidelity is known for its strong customer service, providing support and assistance to clients.

Cons: × Relatively High Transaction Costs:

Transaction costs on Fidelity are noted to be relatively high, and investors should be mindful of these expenses.

③Webull - Best ETF Brokers for Beginners

| Webull |  |

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Regulated by | FSA |

| ETFs | 3,300 |

| Minimum Deposit | $0 or $5 |

| Comissions | $0 |

| Copy Trading | ✅ |

| Demo Accounts | ✅ |

Webull is a US-based stock broker that is regulated by FSA and supports more than 3,300 ETFs. This includes ETFs from popular fund managers like iShares, SPDR, Vanguard, and Fidelity. Do note that Webull only supports US-listed ETFs, which will limit your ability to diversify into international markets.

All ETFs supported by Webull can be bought and sold without paying any commission. Fractional ETF investments are supported – a minimum of $5 applies to each trade. This is also the case with stocks and options, meaning Webull is ideal for budget investors.

Webull Pros & Cons

Pros:

√ Extensive Variety of ETFs: Webull provides access to a vast selection of over 3,300 ETFs, offering users ample choices for diversifying their portfolios.

√ Detailed Fund Profiles: Users can access comprehensive fund profiles, including information on dividends, split records, and net asset value (NAV) records. This transparency aids investors in making well-informed decisions.

√ Asset Allocation Insights: Webull offers traders insights into the asset allocation of each ETF, providing users with a clear understanding of their investment deployment and facilitating effective portfolio management.

√ Professional Fund Ratings: Collaboration with independent and professional fund rating partners ensures users receive reliable information on the performance and quality of different funds, enhancing trust in available ETFs.

Cons:

× Complex Information Presentation: While Webull provides extensive market research, some users may find the presentation of this information dense, requiring effort to navigate.

× Be Mindful of Fees: Users should be aware of any associated fees, including early redemption fees for specific funds, to make fully informed investment decisions.

④TD Ameritrade - Best ETF Brokers for Over 2,000 ETFs

| TD Ameritrade |  |

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Regulated by | SFC |

| ETFs | 2,000+ |

| Minimum Deposit | $0 |

| Comissions | $0 |

| Trading Platforms | Thinkorswim® |

| Copy Trading | ✅ |

| Demo Accounts | ✅ |

TD Ameritrade earns its accolade as one of the Best ETF Brokers through a compelling combination of features. Boasting a diverse selection of over 2,000 ETFs, including 22 Schwab ETFs with $0 trading fees, the platform provides cost-effective options for building well-tailored portfolios. Decision-support tools simplify the selection process, while the advanced features of thinkorswim satisfy seasoned traders. The availability of 24/5 Trading adds flexibility for investors, further solidifying TD Ameritrade's position as a top choice for a comprehensive and flexible ETF trading experience.

TD Ameritrade Pros & Cons

Pros:

√ Helpful tools: The platform offers tools like the ETF Comparison Tool, aiding users in identifying ETFs aligned with their trading goals based on performance, cost, and analyst rankings.

√ Comprehensive education:Users can access a wealth of educational resources, including articles, videos, webcasts, in-person events, and immersive courses covering various topics, from ETF basics to advanced subjects like leveraging risks and liquidity measurement.

√ Objective research:TD Ameritrade provides in-depth research on historical and expected fund performance through reputable sources like Morningstar and CFRA, empowering traders to make informed decisions.

√ More trading hours: With 24/5 Trading, users can trade select securities 24 hours a day, five days a week, excluding market holidays, providing flexibility and extended trading opportunities.

√ $0 ETFs from credible sources: The platform allows users to trade exchange-traded funds (ETFs) from trustworthy and credible financial institutions without incurring transaction fees.

Cons:

× High margin rates:One notable drawback is the presence of high margin rates on the platform. Margin trading involves borrowing funds to invest, and the elevated rates may discourage some investors due to the potential increase in overall trading costs.

* TD Ameritrade has been acquired by Charles Schwab.

⑤Hibiki(Moomoo) - Best ETF Broker with Lowest Fees

| Hibiki(Moomoo) |  |

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Regulated by | FSA |

| ETFs | 3,300 |

| Minimum Deposit | $0 |

| Comissions | Less than $12.5, 0 commission; More than $12.5, Contract Price ×0.088% (tax included) |

| Copy Trading | ✅ |

| Demo Accounts | ✅ |

| Customer Support | Weekdays 8:30-17:00 |

Moomoo is also a well-known Japanese securities company, and its name on our website is Hibiki. It is an intuitive investment and trading platform that offers professional-grade tools, user-friendly features, data, and insights, creating a professional-level trading experience for traders at all levels.

Hibiki(Moomoo) Pros & Cons

Pros:

√ Commission-Free Trading and Competitive Margin Rate: Users benefit from commission-free trading and a competitive 6.8% margin rate, enhancing cost-effectiveness.

√ Lucrative Cash Sweep Program: The cash sweep program offers an appealing annual interest rate of 5.1% for new and eligible customers, providing an attractive option for cash management.

√ Free Level 2 Data for Brokerage Accounts: Brokerage accounts enjoy free access to Level 2 data, providing valuable market insights for users.

√ Advanced Charting Tools: The platform offers advanced charting tools with a robust set of features, including over 100 indicators, more than 37 drawing tools, and 20 candlestick patterns, empowering users with comprehensive analytical capabilities.

√ No Minimum Deposit Requirement: There is no minimum deposit requirement for account opening, promoting accessibility for a wide range of investors.

Cons:

× Lack of Support for Fractional Stocks and Cryptocurrencies: The platform does not support fractional stocks and cryptocurrencies, limiting flexibility in investment strategies.

× Limited Support for Mutual Funds and Retirement Accounts: Mutual funds and retirement accounts are not supported, potentially restricting the range of investment options for users.

⑥Trading212 - Best ETF Brokers with Over 13,000 Global Stocks & ETFs

| Trading212 |  |

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Regulated by | FCA, CYSEC |

| ETFs | 13000+ |

| Minimum Deposit | $0 |

| Comissions | <0.15% |

| Copy Trading | ✅ |

| Demo Accounts | ✅ |

Trading 212 is a versatile investment platform providing access to over 13,000 ETFs with commission-free trades in ETFs, stock mutual funds, and options, and no account minimums. The platform also offers a user-friendly robo-advisor, Core Portfolios, for automated portfolio management. Notably, Trading 212 ensures transparency in currency conversion with a capped FX fee of 0.15%, applicable even on weekends. Deposits via bank transfers are free, while card and digital payments are free up to €2000/$2000 cumulative, with a 0.7% fee thereafter.

Trading 212 Pros & Cons

Pros:

√ Variety of Investments: Offering more than 13,000 ETFs, Trading212 provides a vast array of investment options, including $0 commission trades for ETFs, stocks, mutual funds, and options with no account minimums, making it highly accessible for everyone.

√ Robo-Advisor Option: The Core Portfolios, their Robo-Advisor product, provides an easy, automated portfolio management option for investors looking for simplicity.

√ Low FX Fee:The currency conversion fee is capped at a maximum of 0.15%, ensuring no unexpected costs, even on weekends.

√ Free Deposits & Withdrawals: Deposits via bank transfers are free. Card-based and digital payments are free up to an accumulative sum of €2000/$2000, making it inexpensive to fund your account compared to many other platforms. Withdrawals are also free.

Cons:

× Deposit Fee Above a Limit:For deposits via cards and digital payment methods exceeding €2000/$2000, a fee of 0.7% is incurred, adding an additional expense for larger transactions.

× Limited Advanced Features: For experienced traders seeking sophisticated trading tools and advanced charting options, Trading212 may seem somewhat basic relative to some competitors.

⑦E trade - Best ETF Broker without Commissions

| E trade |  |

| Overall Rating | ⭐⭐⭐⭐ |

| Regulated by | Unregulated |

| ETFs | 100+ free ETFs |

| Minimum Deposit | $0 |

| Comissions | $0 |

| Copy Trading | ✅ |

| Demo Accounts | ✅ |

The firm stands out for its provision of advanced trading platforms, user-friendly tools, and guidance. Notably, ETRADE offers commission-free trading for stocks, options, and exchange-traded funds, making it an attractive choice for investors. What's more, the platform boasts an extensive selection of mutual funds, all available with no transaction fees. Etrade is one of the best ETF brokers, but its regulatory status is a suspected clone, so it is placed last.

E trade Pros & Cons

Pros:

√ Wide Selection of Free ETFs: This platform boasts a broad variety of free ETFs, providing investors with plenty of choices and the possibility of diversification without extra expense.

√ Quality Research: The platform offers high-quality research tools and resources, simplifying the process of decision-making in the trading of ETFs.

√ Flexible Buying and Selling Options: It provides flexible ways for investors to buy and sell, improving user experience and trade execution.

√ Valuable ETF Knowledge Section: An education section specifically for ETF knowledge assists users in better understanding of ETFs, which is beneficial for both novice and expert traders.

Cons:

× Higher Rate on Fee-Paying ETFs: It seems that the platform charges higher fees than expected or typical on ETFs that aren't free. This might raise the total cost of trading for investors who are interested in these ETFs

Forex Trading Knowledge Questions and Answers

What are ETFs?

Exchange-Traded Funds (ETFs) are a type of investment funds and exchange-trade products, publicly listed on a stock exchange. Their purpose is to track the performance of a specified index like the S&P 500, or a particular sector, commodity, or asset such as gold or oil. Each ETF owns the underlying assets it tracks and divides ownership of those assets into shares, which investors can buy or sell.

Throughout the trading day, these shares are purchased and sold on the exchange, making ETFs quite liquid. Prices change throughout the day as they're bought and sold. ETFs provide an efficient way for investors to diversify their portfolios, without the need to buy each individual security in the index or sector, effectively balancing risk and return.

Comparison of ETFs, Mutual Funds, and Stocks

Exchange-traded funds (ETFs) stand out in many aspects when compared to other investments. This includes lower investment costs, better diversification, and an increasingly wide range of choices.

ETFs vs Mutual Funds

Generally, ETFs have lower costs than mutual funds.

ETFs also offer better tax efficiency than mutual funds. Compared to ETFs, mutual funds typically have a higher turnover rate, which can generate capital gains. Similarly, capital gains can be generated when investors sell mutual funds. In either case, investors will bear these tax responsibilities.

These two products also have different management structures (mutual funds are usually actively managed, while ETFs are passively managed, though actively managed ETFs do indeed exist).

ETFs vs Stocks

ETFs consist of individual stocks and other investments. You can purchase shares of ETFs, but you cannot purchase stocks of ETFs.

Like stocks, ETFs can be traded on exchanges and have unique ticker codes that let you track their price movements. Unlike stocks, which only represent one company, ETFs represent a basket of stocks. As ETFs contain multiple assets, they might offer better diversification than individual stocks. This diversification can help to limit the risk exposure of your portfolio.

| ETFs | Mutual Funds | Stocks | |

|---|---|---|---|

| Costs and Fees | Generally lower | Generally higher | Cost depends on the individual stock and broker fees |

| Tax Efficiency | More tax efficient due to lower turnover rate | Less tax efficient due to higher turnover rate, leading to higher capital gains | Individual circumstances may vary |

| Management Structure | Mainly passively managed (though actively managed ETFs do exist) | Usually actively managed | N/A for individual stocks |

| Trading and Ticker Codes | Traded on exchanges with unique ticker codes | Traded only at the end of the day at the net asset value (NAV) price | Traded on exchanges with unique ticker codes |

| Diversification and Risk Exposure | ETFs contain multiple assets for better diversification which can limit risk exposure | Depends on the fund's specific assets and strategy | Stocks represent a single company, so diversification would require buying different stocks |

How to buy ETFs?

With a clear roadmap, embarking on this investment journey can become remarkably simpler. Here are the general steps to purchase ETFs:

Opening a Brokerage Account: You'll first need a brokerage account where you can buy and sell securities like ETFs. This can be done online, and many brokerage firms don't have minimum account balances, transaction fees or idle fees.

Depositing Funds: Once your account is set up, you'll need to fund it. You can usually do this by transferring money directly from your bank account.

Researching and Filtering ETFs: Now, you'll need to decide which ETFs to buy. Most brokerage firms provide powerful tools for filtering available ETFs based on asset type, geographic location, industry, trading performance, or fund provider, among other criteria. These filters are crucial for finding the ETFs you need among the thousands listed in the United States.

Trading: Once you've decided which ETFs to buy, you can purchase them directly in your brokerage account. You'll need to decide what type of trade you want to place, such as a market order (buying at the current market price) or a limit order (setting the price you want to pay).

Monitoring Your Investments: After purchasing your ETFs, it's important to keep an eye on their performance. This will also help you make buy-and-sell decisions in the future.

What Constitutes the Cost of ETFs?

There are two potential costs associated with investing in ETFs: Commissions and Expense Ratios.

ETF Commissions:

Almost all brokers have eliminated commissions for stock trades. Since ETFs trade like stocks on the major exchanges, most of the best stock brokers are commission-free.

ETF Expense Ratios:

Another cost associated with ETF investing is the expense ratio. This is the ongoing cost of investing in an exchange-traded fund. The expense ratio of an ETF is a fee that covers the cost of running the fund. This includes fees paid to the fund manager, administrative costs, and other expenses associated with running the business. It is represented as a percentage of the fund's annual assets.

Minimum Investment for ETFs:

Unlike mutual funds, ETFs do not have a minimum investment requirement. In fact, the minimum investment for an ETF is the cost of a single share, but many brokers allow investors to purchase fractional shares of stocks, including ETFs. This results in the minimum investment for certain ETFs being as low as $1.

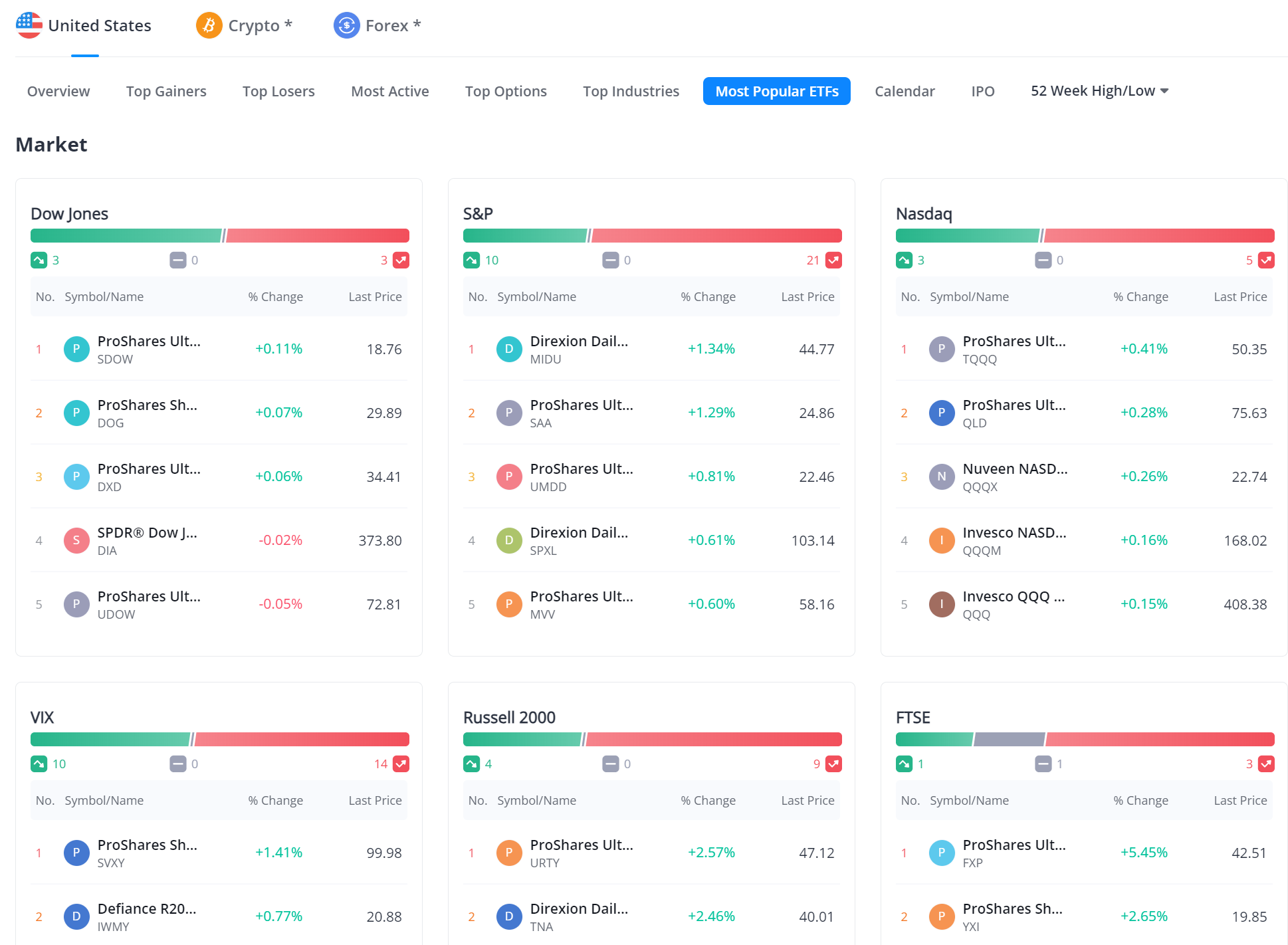

What are Leveraged and Inverse ETFs?

Leveraged and inverse ETFs are two types of Exchange Traded Funds (ETFs) that are built using derivatives and debt instruments to achieve their objectives.

A leveraged ETF aims to deliver multiples of the performance of the index or benchmark they track. For example, a 2x (two times) leveraged ETF aims to deliver double the performance of its underlying benchmark.

Inverse ETFs (also called “short” funds) seek to deliver the opposite of the performance of the index or benchmark they track. For example, if a particular index decreases in value, an inverse ETF tied to that index would increase in value, and vice versa.

Potential Risks of Investing ETFs

Exchange Traded Funds (ETFs), while offering an effective investment strategy to some, come with their own set of limitations and risks that investors should consider. Let's delve into some of these potential drawbacks:

Trading Costs:

Since ETFs trade on an exchange, you may have to pay commissions to online brokers. Many brokers have decided to waive commissions on ETFs, but not all of them have done so.

Potential Liquidity Issues:

As with any security, when you need to sell, you will be subject to the current market price, and it may be harder to sell ETFs that aren't frequently traded.

Risk of ETF Closure:

The main reason this happens is that the fund does not attract enough assets to cover management costs. The biggest impact of this is that investors may have to sell sooner than expected and possibly at a loss. There is also the inconvenience of having to reinvest that money and the potential tax implications.

About WikiFX

In general, when choosing an ETF broker, it is paramount to thoroughly understand its regulatory status, trading platform, size of the stock pool, rates, and other factors. In this process, you may find it challenging to conduct independent research, and this is where the WikiFX website comes in handy, providing a one-stop information inquiry service.

As a one-stop regulatory information query service platform, WikiFX is committed to provide a more approachable way to conduct financial research and timely updates on the latest and most comprehensive financial information. We firmly believe that only when investors understand what they are doing and understand all the risks of trading can they make the best decisions.

We hope this article will assist you in making wise decisions when selecting an ETF broker. Whether you are a professional trader or a stock trading novice, we will provide you with the most precise and real-time information. To ensure a more steady and clear journey of your investment, please remember our website and consult it anytime.

In conclusion of this article, we look forward to your ETF trading journey on WikiFX. If you have any questions or need further financial analysis, our professional financial editing team is always ready to offer you support.

You Also Like

Best Binary Options Brokers in 2026

Best Bitcoin Brokers for 2026

The text discusses Bitcoin brokers' role and criteria for selecting the top providers, emphasizing their key functionalities.

7 Best Crypto Brokers in 2026

Examine the top 5 futures trading platforms , considering user experience, tradable assets, educational resources, commissions, and more.

10 Best Forex Brokers for Professional Traders in 2026

Discover the '10 Best Forex Brokers for Professional Traders', your ultimate guide to thriving in the forex market.