Welcome to the exhilarating world of Forex trading! As we anticipate the opportunities and challenges that 2024 brings, it's time to cast our gaze over the horizon and explore the potential movers and shakers in the foreign exchange market.

This article will delve into the expected Top 10 Most Volatile Forex Pairs. From the well-trodden paths of Major pairs to the less explored territories of Crosses and Exotics, let's embark on this journey to uncover where the greatest fluctuations are likely to occur.

Whether you're a seasoned trader looking to fine-tune your strategy, or a novice eager to further your understanding, this insight into volatility could prove invaluable. So without further ado, let us venture into the fascinating landscape of the most volatile Forex pairs for 2024.

Typically, the most volatile forex pairs will have a higher average daily percentage change due to the greater degree of fluctuation in their exchange rates. The pairs we've listed are known to have broader swings and have an average daily change of around 1%.

| Top 10 Most Volatile Forex Pairs in 2024 | |

| AUD/USD | Australian Dollar/US Dollar |

| AUD/JPY | Australian Dollar/Japanese Yen |

| NZD/JPY | New Zealand Dollar/Japanese Yen |

| USD/TRY | US Dollar/Turkish Lira |

| GBP/AUD | British Pound/Australian Dollar |

| USD/ZAR | US Dollar/South African Rand |

| USD/BRL | US Dollar/Brazilian Real |

| CAD/JPY | British Pound/Japanese Yen |

| GBP/JPY | British Pound/Japanese Yen |

| USD/MXN | US Dollar/Mexican Peso |

On the contrary, the less volatile pairs will naturally have a smaller average daily percentage change. Around 0.5% for pairs that are considered least volatile. These pairs usually include the major currency pairs that feature the most liquid and widely traded currencies.

What is Volatility in Forex Trading?

Volatility in Forex trading refers to the degree of variation or fluctuation in a currency pair's exchange rate over a certain period of time. It essentially reflects how much the price of a currency pair changes and how fast these changes are happening.

Forex markets are considered to be very volatile as exchange rates can fluctuate rapidly in very short periods, influenced by a myriad of factors like economic news, political events, financial reports, and even natural disasters.

These fluctuations can lead to significant price movements in the Foreign Exchange market, creating potential trading opportunities. High volatility means that the price of a currency pair can change rapidly in a very short time, dramatically increasing the potential for profits but also increasing risk. Conversely, low volatility implies smaller price movements and lower trading risks, but also lesser opportunities for profit as the price changes are lesser.

Currency volatility is seen as a crucial aspect by Forex traders, providing the potential for high returns but requiring a good strategy and risk management to navigate the potential downsides of volatile markets. Note that volatility can be a double-edged sword where the potential for gains, as well as losses, could be significant.

What are the Most volatile Currency Pairs? (Top 10)

Before delving into the specifics of the most volatile Forex pairs, it's crucial to familiarise ourselves with the various types of forex pairs that exist in the trading landscape. Understanding their distinctive characteristics will serve as a solid foundation upon which we can build our knowledge of volatility in the Forex market

Forex pairs are categorized into three main types:

Major Pairs

These are the most traded currency pairs in the Forex market and generally include the US Dollar on one side. Examples of major pairs include EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, USD/CAD, and NZD/USD. The major pairs are characterized by high liquidity and lower spreads due to their high trading volume.

Minor/Cross Pairs

Minor pairs don't include the US Dollar. These pairs represent major economies' currencies against each other, excluding the US. Examples include EUR/GBP, EUR/AUD, GBP/JPY, CHF/JPY, and EUR/JPY. Spreads on minor pairs are generally larger than on major pairs, and they also may have less liquidity.

Exotic Pairs

Exotic pairs are currency pairs that include a major currency and a currency from a small or emerging economy. Examples include USD/PLN (US Dollar/Polish Zloty), GBP/ZAR (British Pound/South African Rand), and JPY/NOK (Japanese Yen/Norwegian Krone). Exotic pairs often have less liquidity and wider spreads compared to major or minor pairs. They often present opportunities for large moves due to higher volatility, but can also come with more risk.

Taking into account our previous discussions, we can organize the Top 10 Most Volatile Forex Pairs anticipated for 2024 into three categories: Major pairs, Cross/Minor pairs, and Exotic pairs, as follows:

| Major Pair | Minor/Cross Pairs | Exotic Pairs |

| AUD/USD | AUD/JPY | USD/TRY |

| NZD/JPY | USD/ZAR | |

| GBP/AUD | USD/BRL | |

| CAD/JPY | USD/MXN | |

| GBP/JPY |

You can discern the distribution among the categories: a single Major pair, a compelling group of five Minor/Cross pairs, and an intriguing set of four Exotic pairs make up the list.

AUD/USD (Australian Dollar/US Dollar): This pair can be influenced by various factors like commodity prices, particularly gold and metals, as Australia is a major exporter.

AUD/JPY (Australian Dollar/Japanese Yen): The pair often carries a high-interest differential and can be influenced by factors affecting Australia's economics like commodity prices and risk sentiment globally.

NZD/JPY (New Zealand Dollar/Japanese Yen): This pair can carry a high-interest differential and is often sensitive to changes in risk sentiment and dairy prices, a significant part of New Zealand's economy.

USD/TRY (US Dollar/Turkish Lira): Known for its extreme volatility, this pair may be influenced by a mix of geopolitical events, monetary policy decisions, and Turkey's economic situation.

GBP/AUD (British Pound/Australian Dollar): This pair sees volatility from economic changes in both the UK and Australia, including specific commodity price shifts and political events, such as Brexit-related news.

USD/ZAR (US Dollar/South African Rand): This emergent market pair can swing widely based on factors like commodity prices, particularly gold, and economic and political conditions in South Africa.

USD/BRL (US Dollar/Brazilian Real): This pair can be highly volatile, especially considering economic indicators from Brazil, an emergent market, and fluctuating commodity prices, particularly related to agriculture.

CAD/JPY (Canadian Dollar/Japanese Yen): Influenced by the health of global crude oil markets as Canada is one of the world's leading oil exporters.

GBP/JPY (British Pound/Japanese Yen): Known as the “Beast” due to its potential for rapid price shifts. It's influenced by the economic changes in both the UK and Japan, including interest rate differences and political instability.

USD/MXN (US Dollar/Mexican Peso): An emergent market pair subject to political changes and economic events in Latin America and the U.S., including commodity price shifts.

What Makes a Forex Pair Volatile?

Economic Data and Indicators

Economic data such as GDP, employment rates, inflation reports, and other significant economic indicators can have a considerable impact on a Forex pair's volatility. When these indicators are better or worse than expected, they can cause significant price swings.

Central Bank Decisions

Decisions made by central banks, such as changes to interest rates or quantitative easing programs, can have a profound impact on currency volatility. These decisions can change investors' attitudes towards a currency, leading to price fluctuations.

Political Events

Major political events such as elections, changes in government, or significant geopolitical conflicts can lead to changes in a country's economic outlook, which in turn can cause fluctuations in the currency pair's volatility.

Market Sentiment

Market sentiment, driven by traders' perception and attitudes towards certain economic or political conditions, can drive demand for a currency higher or lower, thereby influencing its volatility.

Market Liquidity

In Forex, major currency pairs like EUR/USD, GBP/USD, and USD/JPY generally have high liquidity, which means they can absorb large trades without significantly impacting the price. However, lower liquidity pairs tend to be more volatile due to price sensitivity to trading activity.

Major News Events

Unexpected news, such as natural disasters or crises, can quickly change market conditions and increase a currency pair's volatility.

Lastly, it's also worth mentioning that volatility is often higher during certain trading sessions where markets overlap, such as the London-New York overlap period, due to higher trading volume. Understanding these factors is key to navigating the volatile Forex market effectively.

High Volatile vs Low Volatile Currency Pairs - What's the Difference?

The difference between high volatile and low volatile currency pairs lies in the degree of price fluctuations that each undergoes within a specific timeframe.

| High Volatile Forex Pairs | Low Volatile Forex Pairs | |

| Price Change | Average 1% (daily) | Average 0.5% (daily) |

| Trading Opportunities | More | Fewer |

| Potential for Profits | Higher | Holding positions over longer periods to gain appreciable profits |

| Risk | Higher | Lower |

| Suitable for | More aggressive traders who are comfortable with taking risks | More risk-averse traders or those employing longer-term trading strategies |

High Volatile Currency Pairs

High volatility pairs are subject to significant price changes in very short time periods. This volatility is influenced by several factors including economic data releases, geopolitical events, changes in market sentiment, and liquidity among others.

For instance, pairs like GBP/USD, USD/JPY, EUR/USD, and pairs involving emerging market currencies like USD/ZAR or USD/MXN can often witness high volatility.

High volatility can mean potential for higher profits as the significant price changes provide more opportunities for traders to capitalize on.

However, this can also mean higher risk. The currency pair's price could move against the trader's position leading to potential losses. Therefore, trading high volatile pairs requires a clear understanding of market conditions, as well as the application of robust risk management strategies.

Low Volatile Currency Pairs

On the other hand, low volatility pairs experience smaller price changes over a given period of time. This is often seen in pairs involving currencies from stable economies with similar performance patterns. An example could be EUR/GBP or AUD/NZD.

Traders may find these pairs more predictable and easier to manage as they do not experience the sharp price fluctuations commonly seen in high volatility pairs.

However, the trading opportunities with low volatile pairs might be fewer and may require holding positions over longer periods to gain appreciable profits.

While the risk with low volatility pairs is typically lower than high volatility pairs, one should not ignore risk management as significant price moves can occur in these pairs as well.

Note: High volatility pairs might suit more aggressive traders who are comfortable with taking risks, while low volatility pairs might be better suited for more risk-averse traders or those employing longer-term trading strategies.

How to Measure Volatility in Currency Pairs?

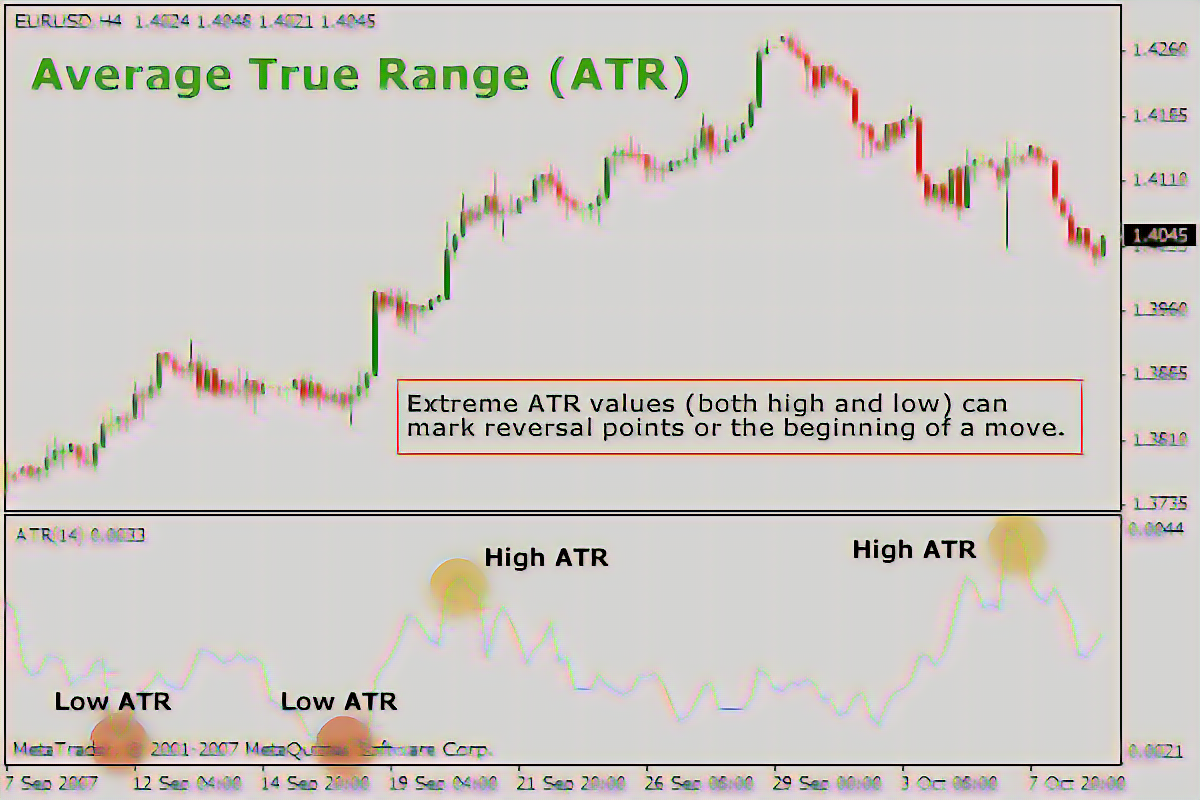

Average True Range (ATR)

This is a commonly used indicator that measures volatility. Developed by J. Welles Wilder, the ATR calculates the average range between the high and low price over a certain number of periods, commonly 14. A higher ATR indicates higher volatility and a lower ATR indicates lower volatility. It's important to note that the ATR does not indicate price direction.

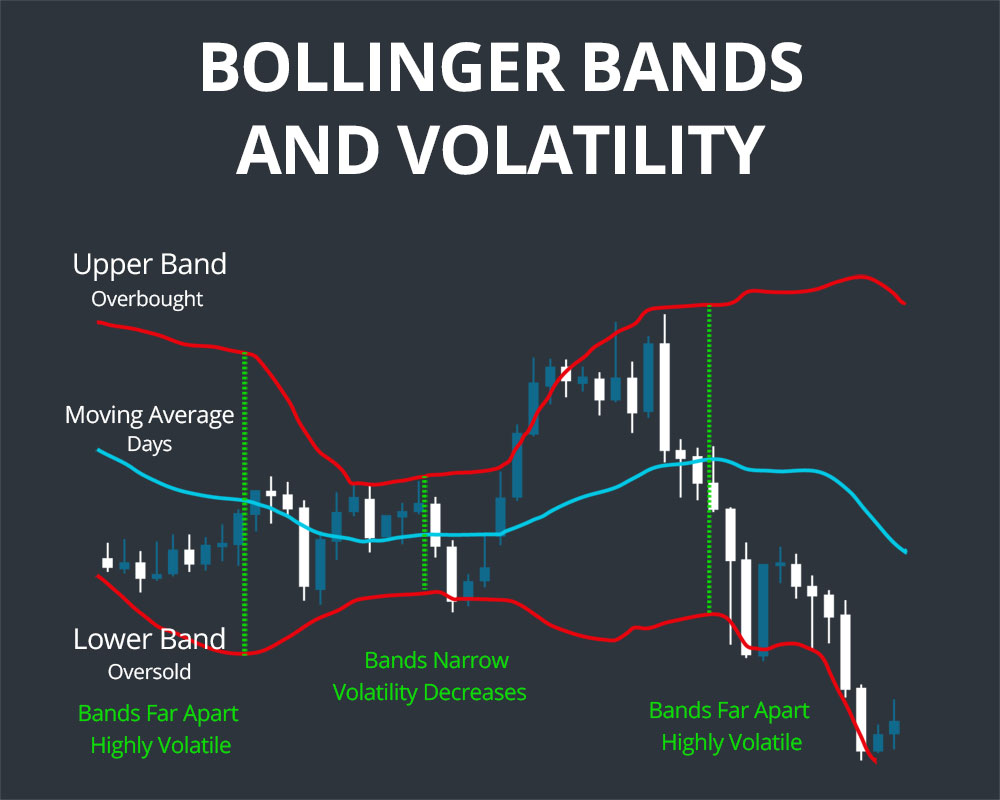

Bollinger Bands

Introduced by John Bollinger, this is a volatility indicator that plots levels of standard deviations above and below a moving average, which often represents the 'mean' price. When the Bollinger Bands are close to each other (a 'squeeze'), it signifies low volatility. When the bands widen, it signifies a period of high volatility.

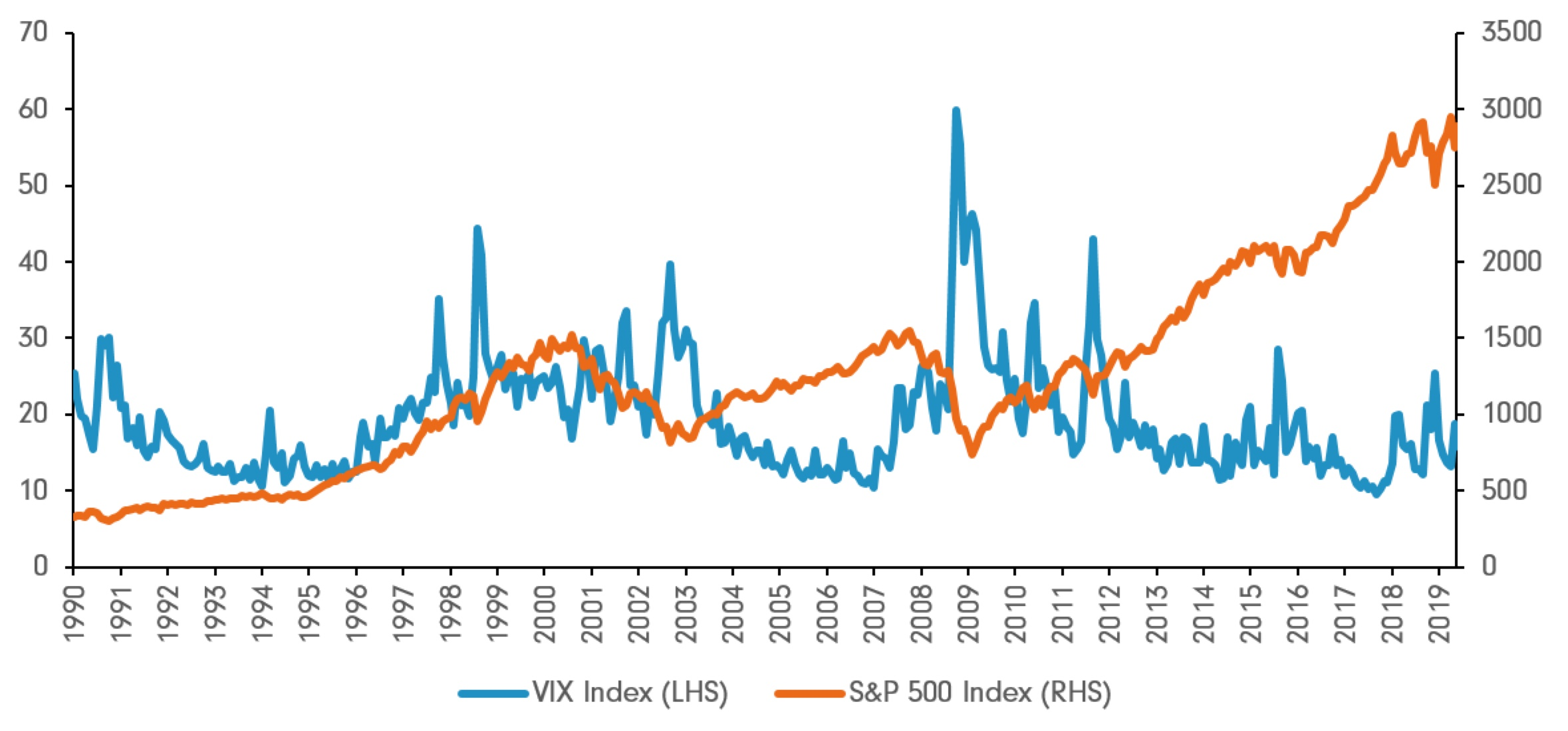

Volatility Index (VIX)

Although not specifically related to Forex markets, the Volatility Index (or the VIX) reflects a market estimate of future volatility. Derived from S&P 500 index options, it is often referred to as the “fear gauge” or “fear index.” Traders use the VIX to understand market sentiment and anticipate potentially large market moves.

Currencies Implied Volatility

This is a measure used by traders to monitor market expectations for price fluctuations in the future. It's derived from the prices of options associated with a particular currency pair.

Historical Volatility

This measure uses historical price data to calculate and gauge past volatility. It looks at the standard deviation or variance of a currency pair price from its average value, over a specific period of time.

These techniques often work in tandem and provide traders with a holistic understanding of the market's volatility. Using them effectively is a crucial aspect of technical analysis, helping traders understand market conditions and inform their trading strategies.

How to Trade Volatile Currency Pairs?

Trading volatile Forex pairs requires a deep understanding of the market conditions, sound technical and fundamental analysis, and robust risk management strategies.

Stay Informed: Keep abreast of global economic events, financial news, and market sentiment, which are strong driving forces behind Forex markets' volatility. Central bank decisions, economic data releases, or geopolitical factors could influence volatility significantly.

Use Technical Analysis: Chart patterns, trend lines, support and resistance levels, and technical indicators can help traders identify potential entry and exit points. Volatility indicators like the Average True Range (ATR) or Bollinger Bands can help assess the volatility of a Forex pair.

Apply Risk Management: Always use stop-loss and take-profit orders to manage your risk. Remember that while high volatility can mean significant profit potential, it also carries increased risk of loss. So, always calculate the risk/reward ratio before entering a position.

Consider Market Timing: Volatility tends to be higher during specific trading sessions where markets overlap, such as the London-New York overlap. These periods may provide trading opportunities for volatile pairs.

Adapt Your Strategy: Consider that scalping, day trading, and swing trading strategies each have their perks and challenges when facing volatile pairs. Choose wisely according to your own risk appetite, viewing the market conditions and the level of volatility.

Have A Trading Plan: Stick to a well-tested trading plan. Impulsive decisions can often lead to significant losses in a volatile market.

Maintain Emotional Control: It's essential to stay composed, patient, and not let fear or greed guide your trading decisions.

Always remember that past market performance is not indicative of future results. Volatile markets present numerous trading opportunities but they are not suitable for all individuals due to the high degree of risk involved.

Where to Trade Volatile Currency Pairs? (Best Brokers)

Choosing the right broker to trade volatile currency pairs involves considering factors like regulation, trading conditions, and the platform's ease of use.

Interactive Brokers (IB)

Known for its wide range of offerings and sophisticated trading tools, Interactive Brokers can be an excellent choice for Forex trading. Keep in mind, it's better suited for experienced traders due to its sophisticated offerings.

IG

IG is commonly used due to its wide range of pairs offered, quality educational resources, and an easy-to-use platform

eToro

This platform is known for its social trading feature allowing traders to follow and copy the trades of experienced traders. It also provides a large number of pairs for trading.

XTB

XTB is a well-regulated platform providing a good range of pairs and a proprietary trading platform known for its speed and performance. It's also reputed for its educational material.

Plus500

Plus500 is recognized for its intuitive and user-friendly platform suitable for beginner traders. The broker offers competitive spreads but lacks extensive educational resources.

|

|

|

|

|

While our focus remains on the five top-rated forex brokers, it's worth mentioning that there are numerous other commendable options for trading. At WikiFX, we've meticulously compiled a variety of ranking lists influenced by factors such as geographical location and trading conditions, among others. Follow us for further insights and to deepen your understanding of forex trading.

Is It Advisable for Beginners to Trade Volatile Currency Pairs?

Trading volatile currency pairs as a beginner can be quite challenging due to the high levels of risk involved. The price of these currency pairs can fluctuate significantly in very short time periods, meaning the potential for both profit and loss is substantial.

If you are a beginner and you want to trade volatile forex pairs, please make sure that you have read the following tips:

Understanding of Forex Market: Beginners should have a thorough understanding of how the Forex market operates, including the factors that affect currency pair price movements.

Risk Management: It is crucial to learn and apply strong risk management strategies to protect any potential downside. This includes, setting stop-loss and take-profit levels, avoiding over-leveraging, and never risking more than you can afford to lose.

Economic Events: Beginners should be aware of the economic calendar as high-impact economic events can lead to increased volatility.

Emotional Control: Trading in volatile markets can be stressful. Beginners should be mentally prepared and maintain strict control of their emotions.

Education: Continuous education is key. Beginners should invest time in learning about financial markets, trading strategies, and continually be updated with financial news.

Demo Account Practice: Before diving into live trading, beginners should practice trading on demo accounts. This allows traders to understand market dynamics and test their trading strategies without risking real money.

In conclusion, while it's not impossible for beginners to trade volatile Forex pairs, it's essential to approach it with caution, preparation, and knowledge. Understanding the dynamics of the Forex market, applying effective trading strategies, and managing risk are all vital parts of trading volatile Forex pairs successfully.

Forex Risk Disclaimer

Trading Forex (foreign exchange) carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, risk appetite, and the possibility of incurring losses. There is a possibility that you may sustain a loss of some or all of your initial investment and therefore you should not invest money that you can not afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

You Also Like

Best Binary Options Brokers in 2024

Beginners’ Guide to Forex Exotic Currency Pairs

Discover the thrill of trading Exotic Currency Pairs; explore their unique dynamics, risks, rewards, and strategies!

Top 10 Most Volatile Currency Pairs in 2024

Discover lucrative opportunities in Forex Trading by exploring our comprehensive guide on the Top 10 Most Volatile Forex Pairs.

10 Largest Forex Brokers in the World by Volume (2024)

Unlock your trading dream with our detailed guide on the top 10 Forex big players, chosen for their high trading action and more.