The FTSE 250, consisting of the 101st to the 350th largest companies listed on the London Stock Exchange, is a significant trading gateway to the UK's flourishing mid-cap sector. Being less international than the FTSE 100, it provides a more direct reflection of domestic economic health, thus, harbouring more potential profits.With its growing popularity, more brokers choose to offer exposure to FTSE 250 derivatives. Therefore, we have gathered a list of the top-performing FTSE 250 brokers to equip you with superior choices. This selection is not a casual one. It is based on detailed se of evaluation of several dimensions including regulatory compliance, reputation, trading platforms, variety of tradable instruments, transparency of trading fees, and effectiveness of customer support. Sincerely, we hope this work serves as a practical guide to choose a proper broker.

6 Best FTSE 250 Forex Brokers

Offering traders access to over 17,000 markets,from forex pairs to indices, commodities, stocks, and more.

Comprehensive collection of educational materials, including detailed articles, webinars, and an IG Academy app, are excellent resources, especially for novice traders.

An array of risk management tools such as price alerts, stop-loss and stop-limit orders, quite helpful in managing trading risks.

Known for its simplicity and user-friendly design, Plus500 platform greatly enhancing the trading experience.

Next Generation platform highly intuitive and equipped with advanced charting packages, customisable layouts and multiple timeframes for a fine-tuned trading experience.

Providing a vast range of tradable instruments, providing traders a multitude of trading opportunities across various markets.

Volatility Protection provided by Admiral Markets minimises the risk during periods of significant volatility, a resource appreciated by traders who value prudent risk management.

Offering both MetaTrader 4 and 5, accounting for the vast majority of traders' preference.

Capital.com provides AI-driven news updates about market movements and potential investment opportunities.

Numerous learning materials, including video tutorials, articles, webinars, and a comprehensive knowledge glossary.

more

Comparison of the Best FTSE 250 Forex Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best FTSE 250 Forex Brokers Overall

| Brokers | Logos | Why are they listed as the Best FTSE 250 Forex Brokers? |

| IG |  |

✅ Regulated by major financial authorities globally, including the FCA in the UK, ASIC in Australia and more, providing strong client protection. ✅ A well-trusted broker that has operated for over 50 years, acquiring a solid reputation among global traders. ✅ Competitive in its fee structure, especially in Forex and indices trading, with low spreads and transparent costs. |

| Plus500 |  |

✅ Heavily regulated by the top-tier regulators, also publicly traded, which adds an extra layer of trust and transparency. ✅ Plus500's proprietary platform easy to use, featuring a clean design and offers risk management tools such as stop-loss and price alerts. ✅ Plus500 provides multiple risk management tools, such as stop loss, trailing stop, guaranteed stop, and limit orders to control potential losses. |

| CMC Markets |  |

✅ A well-regulated broker with extensive product offerings, giving clients more trading flexibilities. ✅ CMC Markets offers its own technologically advanced platform with impressive charting functions and a large product range. ✅ Trading fees are relatively low for Forex and CFDs, especially for frequent traders who may benefit from volume discount rates. |

| Admiral Markets |  |

✅ Regulated by top-tier regulators, including FCA in the UK, ASIC in Australia, operating in a secure and transparent way. ✅ Offering both MetaTrader 4 and 5 platforms, providing traders with a robust set of tools, technical analysis, and trade automation capabilities. ✅ Providing competitive spreads as well as the option for commission-based pricing for more active traders, offering flexibility. |

| Capital.com |  |

✅ $20 to enter real markets, making it more easily accessible for most traders, especially beginners. ✅Multiple trading platform choices, including MT4, Tradingview, as well as its properitary trading platforms, fast order execution, minimizing slippages. ✅ Combining user-friendly operations with an AI assistant that aids trading decisions, their unique platform help traders with technology without adding complexity. |

| XTB |  |

✅Negative Balance Protection offered, ensuring that traders can't lose more money than they have deposited in their account. ✅ Award-winning xStation 5 platform, promises superior execution speed, visual trading, advanced technical analyses, and progress tracking. ✅ Offering a competitive spread, presenting standard account holders with attractive spreads and pro account holders with even lower spreads, supplemented by a per-lot commission. |

Overview of the Best FTSE 250 Forex Brokers

IG

|

|

Broker |

IG |

Regulated by |

ASIC, FCA, FSA, NFA, AMF, FMA, MAS, DFSA |

Min. Deposit |

$250 |

Tradable Instruments |

Forex,Shares,Indices, Commodities, Thematic and basket,Options trading, Futures trading, Spot trading |

Trading Platforms |

Online, Mobile, Tablet & Apps |

FTSE 250 Trading Costs |

Spreads vary depending on markets, a commission from 0.20% |

Max. Leverage |

50:1 |

Demo accounts |

✅ |

Copy Trading |

❌ |

Bonus |

❌ |

Payment Methods |

Debit Card, Wire Transfer, Bank Transfer (Automated Clearing House (ACH)) |

Customer Support |

7/24 |

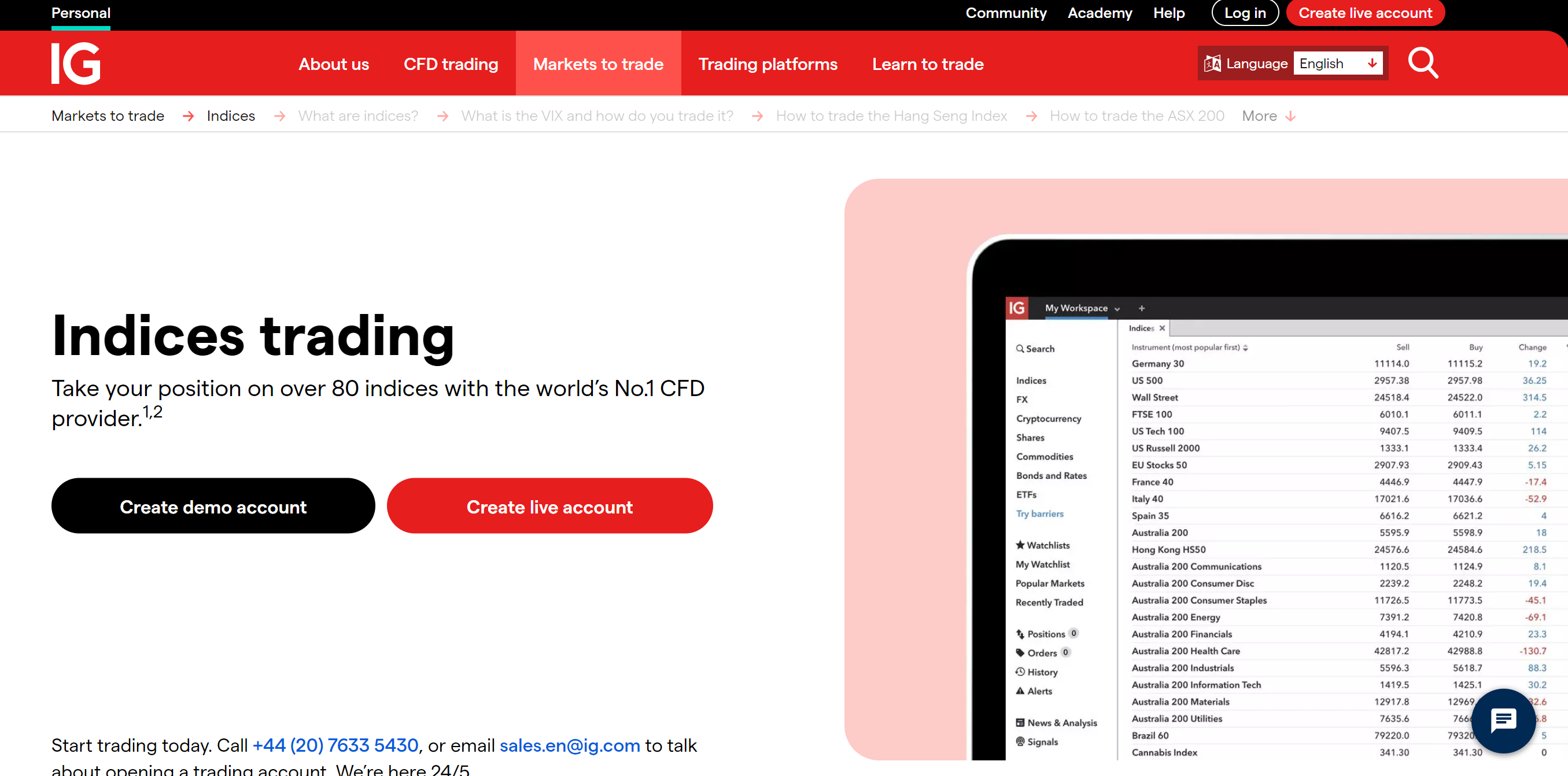

IG Group, founded in 1974, is a UK-based company providing trading in financial derivatives such as contracts for difference and financial spread betting, and stockbroking to retail traders. It is recognized and regulated in multiple countries, thereby ensuring a smooth global operation. IG Group's customers can trade vast instruments including currencies, indices, commodities, stocks, ETFs, and more on its proprietary platform. This user-friendly platform is technologically superior, offering fast and reliable execution, real-time market updates, and advanced charting tools, all accessible on mobile and desktop. IG Group's 24/7 customer support is commendable, with a highly responsive team providing assistance via phone, email, or live chat. Moreover, IG is known for its educational offerings, providing a vast array of financial webinars and detailed market outlook articles.

In the context of stock trading, it‘s notable to mention IG's competitive edge in FTSE 250 trading. As one of the top international brokers that support UK shares, IG delivers an optimal trading environment for those looking to trade stocks of companies listed on the FTSE 250 index. With an IG share trading account, you have the opportunity to gain exposure to the FTSE 250 through investments in ETFs and actual stocks.The platform offers tight spreads, direct market access, and real-time news regarding the FTSE stocks. IG’s transparent and competitive fee structure is one of their strengths. Their CFD trading-related fees are reportedly reasonable, with lower-than-average spreads.

✅ Where IG shines:

• Globally regulated, IG's services are accessible globally, making them a go-to source for international trading.

• Their proprietary platform stands out with its high reliability, speedy execution, and advanced charting tools.

• FTSE 250 trading is one of IG's standout offerings, with tight spreads, direct market access, and up-to-date FTSE-related news.

• Providing guaranteed stop-loss orders (GSLOs), which lock in a maximum loss limit in advance, which few other brokers can do this.

• 7/24 customer support, IGs attentive and widely accessible customer support sets them apart in addressing trader queries and issues.

❌Where IG Shorts :

• IG charges an inactivity fee of $12 per month after two years of inactivity, unfavourable for long-term investors who trade less frequently.

• Presently, its product range is limited in the U.S with focus largely on forex, causing them to miss out on traders interested in other instruments.

• Some users might find the desktop trading platform complex and difficult to navigate, especially beginners.

• Some superior research tools and features are available at an extra cost which could be discouraging for some traders.

Plus500

|

|

Broker |

Plus500 |

Regulated by |

ASIC, FCA, CYSEC, FSA |

Min. Deposit |

$100 |

Tradable Instruments |

currency pairs, cryptocurrencies, soft and hard commodities (such as wheat, gold and oil), shares, indices, ETFs, Options |

Trading Platforms |

Plus500 Trading Platform |

FTSE 250 Trading Costs |

No commissions, only spreads charged |

Max. Leverage |

30:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

Visa or MasterCard, PayPal or Skrill, Bank transfer |

Customer Support |

24/7 |

Plus500 is a widely recognized online brokerage founded in 2008, with roots in Israel and registered operations in the UK, Cyprus and Australia. It is regulated by highly reputable authorities, including the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC), ensuring a secure trading environment. Plus500's trading instruments cover a broad array of CFDs including shares, forex, commodities, indices, ETFs and options. The broker operates a proprietary trading platform that is known for its robustness, intuitive interface, and real-time financial market updates. It is available on multiple devices, including smartphones and tablets. Traders can rely on Plus500's support team available 24/7 via email and live chat, providing timely assistance and professional service.

In terms of trading UK shares, Plus500 is one of the leading platforms, particularly for FTSE 250 equities. On September 24, 2018, Plus500 offcially joined the FTSE 250 Index.They offer competitive spreads and leverage on these shares, making them a preferred choice for many traders aiming to profit from price movements in the FTSE 250 index. The broker upholds a straightforward fee structure with no commissions on trades. Instead, they primarily earn money from the spread. These low trading costs, along with the absence of deposit and withdrawal fees, make Plus500 an optimal and cost-efficient choice for many traders.

✅ Where Plus500 Shines:

• Regulated by top-tier financial authorities like FCA, CySEC, and ASIC, adding an extra layer of trust and security for traders.

• Offering an extensive range of CFD trading instruments, including forex, commodities, indices, shares, ETFs, and options.

• Their proprietary platform is known for its simplicity and intuitive design, making it an ideal choice for beginners.

• Plus500 operates on a no-commissions policy, earning primarily through the spread, which can make trading cost-effective.

• Plus500 offers a free demo account with virtual money, which is useful for beginners to practice trading strategies without financial risk.

❌Where Plus500 Shorts :

• Only offering its own proprietary platform and does not support third-party platforms like MetaTrader or cTrader.

• Plus500 charges an inactivity fee if you don't log in to your trading account for three months.

• Plus500s platform provides basic live feeds of news and economic events, but it lacks more detailed data like company balance sheets and income statements.

• Plus500 doesn't offer a phone line for customer support. This could cause inconvenience for some traders looking for immediate assistance.

CMC Markets

|

|

Broker |

CMC Markets |

Regulated by |

FCA, FMA, IIROC, MAS |

Min. Deposit |

$0 |

Tradable Instruments |

FX Pairs, Indices, Commodities, Shares, Cryptocurrencies, and Treasuries, International shares, ETFs, Options, mFunds, Warrants |

Trading Platforms |

Next Generation platform, MetaTrader 4 platform, Share trading standard platform, Share trading Pro platform |

FTSE 250 Trading Costs |

spreads starting at 0.6 pips |

Max. Leverage |

500:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

Payment Method (USD)Credit and Debit Card via Mastercard/VisaUOB Telegraphic TransferDBS (Over the Counter Transfer),and more |

Customer Support |

5/24 |

CMC Markets is a reputable brokerage firm, originally founded in 1989 in the UK. Over the years, it has firmly established itself as a global leader in providing online trading services and stands registered in numerous countries. The broker offers a broad spectrum of financial instruments that include, but are not limited to, Forex, commodities, indices like FTSE 250, and shares – enticing traders keen on diversifying their portfolio. Powered by a custom-built trading platform, referred to as Next Generation, CMC Markets delivers an innovative trading experience, enhanced by advanced charting tools, patterns recognition software, and a series of more analytical instruments.

CMC Markets allow traders to trade the FTSE 250 in two ways: CFD trading and spread betting, both offering access to this index of mid-cap UK companies. For the CFD way, commission-free for eligible accounts, making them ideal for frequent traders, spreads starting at 0.6 pips. For the spread betting method, wider spreads starting from 1 point, but no commissions.

✅ Where CMCMarkets shines:

• Offering a wide range of trading options, including Forex, commodities, shares, and indices like FTSE 250.

• A lower barrier to entry than some competitors due to its comparatively low minimum deposit requirement.

• In addition to the typical trading options, CMC Markets provides access to more exotic markets, which offers traders the opportunity to diversify their investments even further.

• Free demo account available, allowing new traders to test out the platform and practice their trading strategies without risking real money.

❌ Where CMCMarkets shines:

• An inactivity fee for users that are inactive for one year—the fee is $15 per month.

• While they offer plenty of technical analysis tools, some users find the fundamental data lacking in comparison.

Admiral Markets

|

|

Broker |

Admiral Markets |

Regulated by |

ASIC, FCA, CYSEC, FSA |

Min. Deposit |

$100 |

Tradable Instruments |

Forex pairs, CFDs on indices, commodities, cryptocurrencies, shares, ETFs, and bonds, and more |

Trading Platforms |

MetaTrader 4 & 5, |

FTSE 250 Trading Costs |

Commission-free, spreads charged |

Max. Leverage |

1000:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

Visa Credit and Debit Card. Mastercard Credit and Debit Card. Skrill, Neteller and PayPal (this one is available under Admiral Markets UK) SafetyPay, Klarna, Trustly and others |

Customer Support |

5/24 |

Admiral Markets is a well-established brokerage firm, found in 2001 and is registered in Australia. As a global trading provider, it offers extensive financial instruments including Forex, commodities, indices such as the FTSE 250, and equities. Additionally, the firm allows trading via technologically advanced platforms, namely MetaTrader 4 and 5, and also its own proprietary WebTrader and Mobile App. These platforms come equipped with analysis tools and other features to help traders make informed decisions. Moreover, Admiral Markets features a transparent pricing structure, competitive spreads, and comprehensive educational resources for all trading levels, thus making it a preferred trading platform for many.

With an investing account from Admirals, you can buy shares in the 3 FTSE 250 dividend stocks: ITV, Investec, and Tritax Big Box REIT. Admiral Markets currently has commission-free CFD trading on the FTSE 250 for eligible accounts. Traders will, however, pay for the spread, which is the difference between the buy and sell price offered by Admiral Markets, spreads on the FTSE 250 typically starting at 0.9 pips.

✅ Where Admiral Markets shines:

• Providing access to a vast array of markets, including Forex, indices like the FTSE 250, commodities, and equities.

• Competitively low spreads, which can potentially lead to reduced trading costs.

• Technologically Advanced Platforms, MetaTrader 4 and MetaTrader 5, as well as Admiral Mobile App, coupled with VPS.

• Solid educational and analytic content, useful for traders of all stages, from newbie to experienced.

• Transparent pricing structure, Admiral Markets offers competitive spreads and relatively low trading fees.

❌Where Admiral Markets Shorts :

• Some user reviews indicate limited tools for social trading and news updates.

• Although their customer service is generally well-reviewed, it is not available 24/7. This might pose issues for traders in different time zones or those who prefer trading during off-hours.

Capital.com

|

|

Broker |

Capital.com |

Regulated by |

ASIC, CYSEC, FCA, NBRB, FSA |

Min. Deposit |

$20 |

Tradable Instruments |

Shares, indices, forex pairs, commodities and cryptocurrencies, and more |

Trading Platforms |

TradingView, MetaTrader4, |

FTSE 250 Trading Costs |

zero commission, only spreads charged |

Max. Leverage |

30:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

Bank transfer, Credit/debit cards, Apple Pay, PayPal, Neteller, Skrill, Sofort, Trustly, and more |

Customer Support |

24/7 |

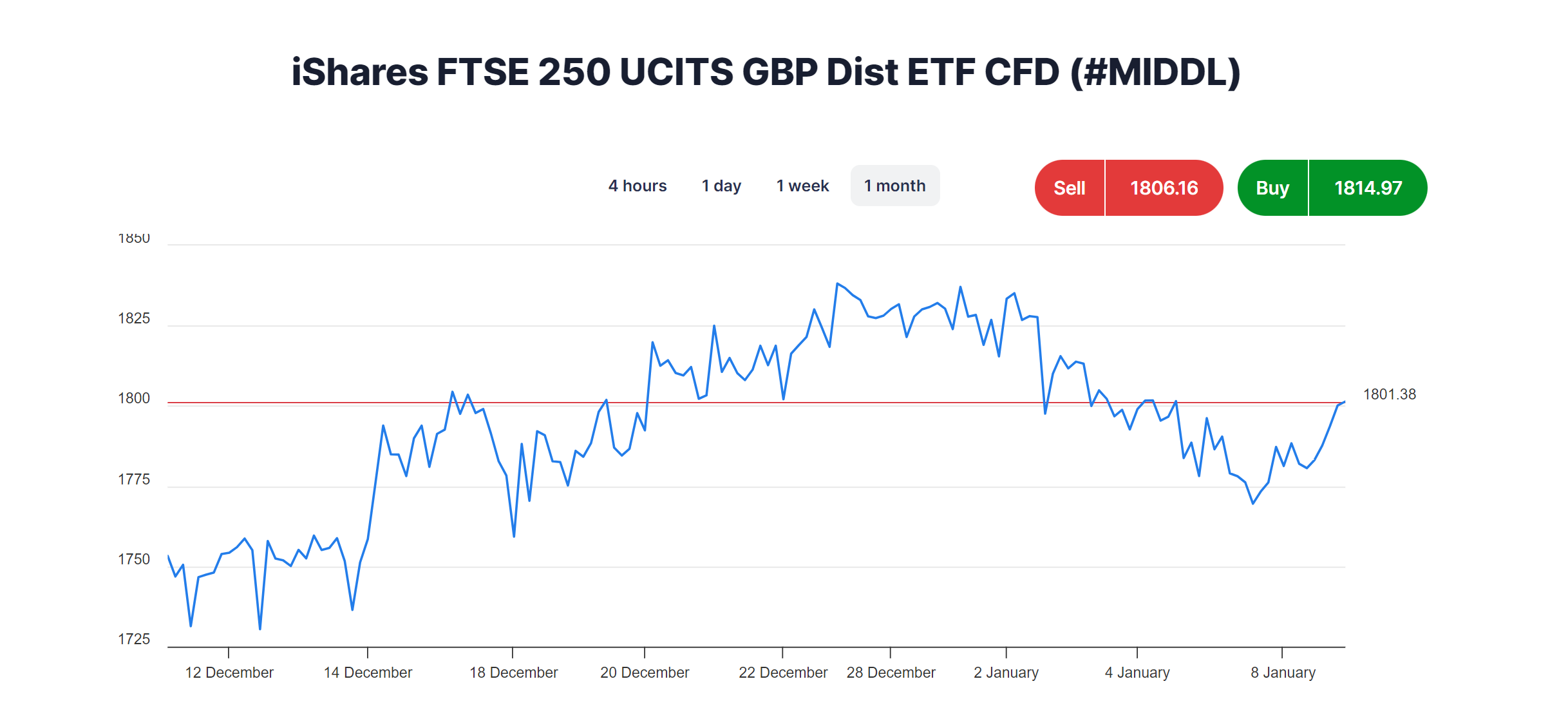

Capital.com, established in 2016 and headquartered in Cyprus, is a fast-growing online CFD brokerage. The platform is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the UK. Capital.com offers a broad range of tradable CFD instruments, covering 125 forex pairs, 2745 shares, 20 indices, 19 commodities, indices, and 111 cryptocurrencies. Its proprietary trading platform is applauded for its user-friendly interface. Additionally, the platform is available in web-based and mobile versions, catering to the needs of on-the-go traders. On the customer support front, Capital.com offers 24/7 assistance via live chat, email, and phone.

When it comes to FTSE 250 trading, Capital.com is a strong contender. It provides real-time quotes and highly competitive spreads on FTSE 250, making it attractive for traders interested in this asset. The broker maintains a transparent fee structure with zero commission on trades, earning primarily from the spread.

✅ Where Capital.com shines:

• Being regulated by top-tier authorities like ASIC and FCA, the platform operating in a secure and transparent way.

• Offering over 3,000 assets for trading, one of the most extensive selections in the industry.

• Multiple trading platform choices, including Tradingview, MT4 and its proprietary trading platforms, giving traders more flexibility.

• $20 to start real trading, making it easily accessible for most traders, especially beginners.

• Notably, in regard to FTSE 250 trading, Capital.com offers competitive spreads which can lead to lower trading costs.

❌Where Capital.com Shorts :

• As a pure CFD broker, Capital.com doesn't provide direct market access, and clients don't own the underlying assets.

• Advanced traders might find the range of technical analysis tools on Capital.com's proprietary platform barely sufficient compared to some other brokers.

• Like most CFD brokers, Capital.com charges an overnight funding fee which may become significant for positions held for an extended period.

• While they offer 24/7 support, it's worth noting that Capital.com does not provide customer support over the phone.

XTB

|

|

Broker |

XTB |

Regulated by |

CYSEC, FCA, CNMV |

Min. Deposit |

$0 |

Tradable Instruments |

Forex, Indices, Commodities, Stock and ETF CFDs |

Trading Platforms |

xStation 5, MT4 |

FTSE 250 Trading Costs |

Spreads vary depending on markets |

Max. Leverage |

500:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

Bank Transfers, Credit and Debit Cards, Paypal, and Paysafe |

Customer Support |

5/24 |

XTB, established in 2002 and headquartered in Warsaw, Poland, is a prominent online forex and CFD brokerage, regulated by various financial institutions worldwide, including the UK's Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CYSEC) in Cyprus. The range of tradable instruments offered by XTB is extensive, including over 1500 global stocks, 48 forex pairs, indices, commodities, ETFs, and cryptocurrencies. Their platform is available in two versions - the widely used MetaTrader 4 (MT4) and XTBs award-winning proprietary platform, xStation 5. Their platforms are known for superior execution speeds and providing innovative risk management tools. XTB prides itself on its comprehensive customer service, with localized support available in many countries.

When it comes to FTSE 250 trading, XTB provides traders with the opportunity to trade CFDs on FTSE 250 stocks as well as the FTSE 250 index itself. The broker operates on a commission-free model for index CFDs, deriving its income from the market spread.

✅ Where XTB shines:

• Over 2000 trading instruments across six asset classes, including Forex, Indices, Commodities, Stocks, ETFs and extreme Cryptocurrencies.

• Offering both a proprietary trading platform, xStation 5, and MetaTrader 4, giving traders more confidence.

• Providing solid educational materials including webinars, seminars, e-books and courses tailoring to traders of different experience levels.

• Afree demoaccount with virtual money for beginners to practice their trading strategies.

❌Where XTB Ameritrade Shorts:

• XTB's stock CFDs trading fees can be higher, compared to other brokers who specialize in these types of instruments.

• XTB charges an inactivity fee. If you do not log into your trading account and make a transaction for a period of 12 months, a fee will be charged.

• Notoffering support 24/5, an issue for some traders who operate in different timezones or over weekends.

Forex Trading Knowledge Questions and Answers

What is FTSE 250 Index?

The FTSE 250 Index is a capitalization-weighted index consisting of the 101st to the 350th largest companies listed on the London Stock Exchange. Regarded as a benchmark for mid-cap British businesses, it represents approximately 15% of the UK's market capitalisation. These companies may represent diverse industries but are generally more domestically focused compared to those in the FTSE 100 Index. The FTSE 250 Index's performance is considered a reliable indicator of the health of the UK economy.

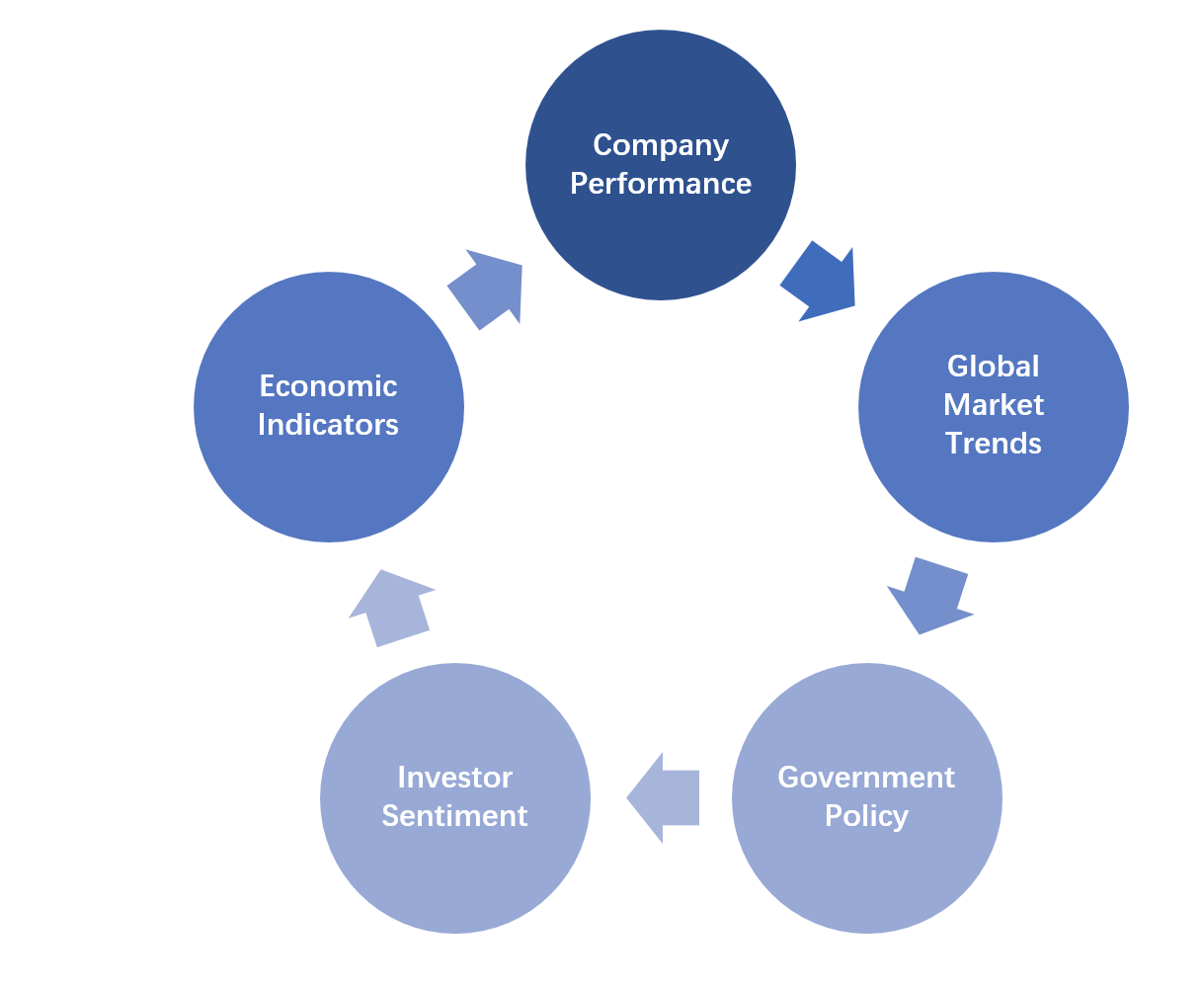

What factors influence the FTSE 250's value?

• Company Performance: The performance of the individual companies that make up the FTSE 250 plays a big role. If a company posts strong financial results, or positive news is announced, there can be increased buying interest in that company's stocks, which could lead to an increase in the FTSE 250's value. Conversely, weak financial results or negative news can lead to selling pressure, reducing the FTSE 250's value.

• Economic Indicators: Economic data such as employment figures, inflation rates, interest rates, and GDP growth can all impact the FTSE 250's value as they give an indication of the overall health of the UK economy.

• Global Market Trends: While the FTSE 250 is predominantly comprised of UK-based companies, global financial trends and macroeconomic news still have a significant impact, as many companies within the index operate internationally.

• Investor Sentiment: The prevailing mood of investors, sometimes called “market sentiment,” can also influence the index. If investors are generally positive about the future of the economy, they are likely to buy shares, pushing the FTSE 250's value upwards.

• Government Policy: Changes in government policy, both domestic and international, can affect businesses, for example, tax changes, trade agreements, or potential regulation alterations. If these changes are perceived negatively, it may lower the FTSE 250 value, while positive changes may boost it.

How often is FTSE 250 updated?

The FTSE 250 Index is updated in real-time during market hours, which are from 8:00 am to 4:30 pm GMT. Therefore, the index values fluctuate throughout the day in response to market trades. However, the list of companies included in the index is reviewed quarterly — in March, June, September, and December. Changes to the index constituents take place on the next trading day following the third Friday of these months.

How much do I need to start trading the FTSE 250?

The capital to begin trading the FTSE 250 varies, influenced by the chosen broker and account type. CFD accounts typically require a lower initial deposit than traditional brokerage accounts. And that's why investors tend to favor CFD brokerages when trading the FTSE 25. For instance, Plus500, a popular choice, only requires a $100 initial deposit to open a CFD account to trade FTSE 250. While with XTB, this amount much lower, traders can start trading FTSE250 for only $1.

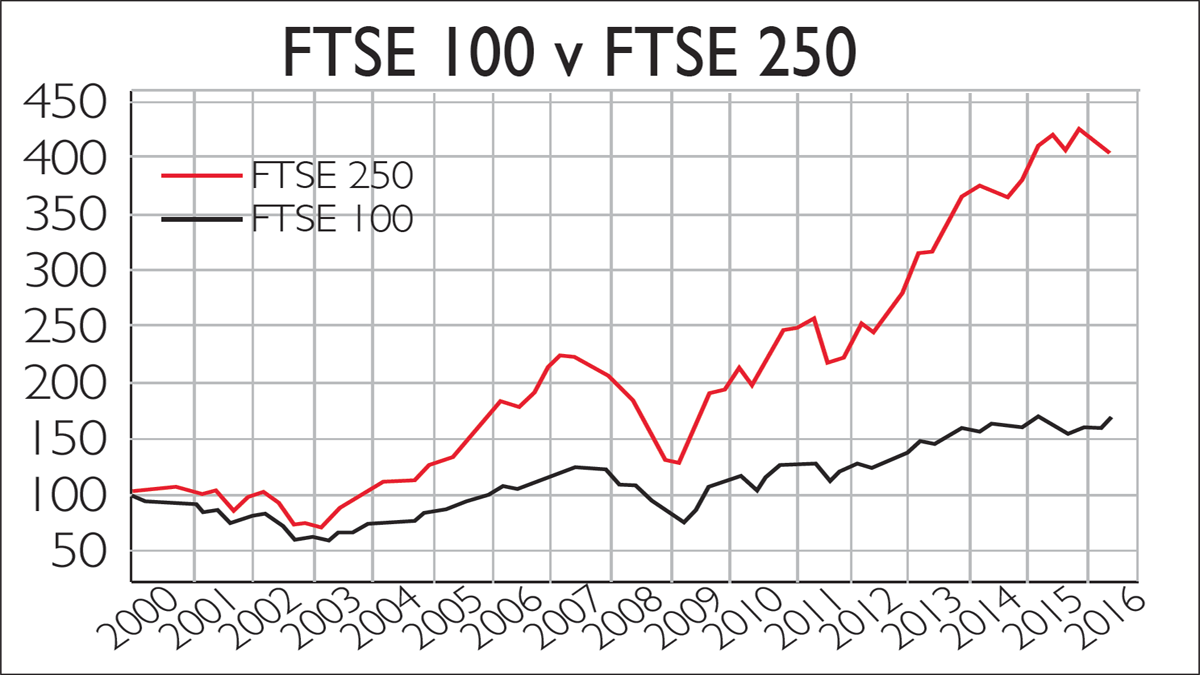

Which is better FTSE 100 or FTSE 250?

Genuinely, it is hard to say. Determining whether the FTSE 100 or FTSE 250 is “better” depends on an investor's financial goals and risk tolerance. The FTSE 100, consisting of the largest UK companies, is largely global in its revenue source and may offer more stability. While, the FTSE 250, on the other hand, is more domestically-focused. The FTSE 250 has frequently outperformed the FTSE 100 over a long time horizon, laregly in part, due to the domestic focus and nimbleness of the companies listed. However, as it gains larger exposure to the UK economyy, often more volatile and may be hit harder in a recession.

Is it good to invest in FTSE 250?

Investing in the FTSE 250 can be a good idea for investors looking for potential higher long-term growth and who are comfortable with higher volatility given the index's greater reliance on the UK economy. However, factors like the right entry and exit times, personal financial goals, and risk tolerance matter.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers. We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

Best Binary Options Brokers in 2026

Best Bitcoin Brokers for 2026

The text discusses Bitcoin brokers' role and criteria for selecting the top providers, emphasizing their key functionalities.

7 Best Crypto Brokers in 2026

Examine the top 5 futures trading platforms , considering user experience, tradable assets, educational resources, commissions, and more.

10 Best Forex Brokers for Professional Traders in 2026

Discover the '10 Best Forex Brokers for Professional Traders', your ultimate guide to thriving in the forex market.