Choosing the right broker for trading the Nasdaq 100 can significantly impact your trading success. In this article, well guide you through the best Nasdaq 100 brokers for 2026, highlighting platforms that offer competitive fees, advanced trading tools, and reliable access to this high-performing index. Whether you're an experienced trader or just getting started, these brokers are well-equipped to help you capitalize on the opportunities within the Nasdaq 100.

Best Nasdaq 100 Brokers

more

Best Nasdaq 100 Brokers Compared

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Nasdaq 100 Brokers Reviewed

① IG

Premier Nasdaq 100 forex broker 2025

IG is a leading global broker, offering 17,000+ trading instruments, including forex, indices, shares, commodities, and cryptocurrencies. Established in 1974, IG was the worlds first financial spread betting firm and now provides CFDs, spread betting, and share investing. Known for its high-quality platform and educational resources, IG is regulated by top-tier authorities like the FCA and ASIC. It also offers free demo accounts, making it a great choice for both beginners and experienced traders.

|

||

| Overall Rating | ⭐⭐⭐⭐⭐ | |

| Min. Deposit | $0 | |

| Regulators | ASIC, FCA, FSA, FMA, MAS, DFSA | |

| Trading Instruments | 17,000+, forex, indices, shares, commodities, cryptocurrencies | |

| Demo Account | ✅ ($20,000 in virtual capital) | |

| Max. Leverage | 1:400 | |

| Trading Platforms | L2 dealer, ProRealTime, MT4, TradingView | |

| Copy Trading | ✅ | |

| Stock Fee | 2 cents per US shares, and 0.18% on Hong Kong shares | |

| Customer Support | 24 hours a day, except 6 am - 4pm on Saturday (UTC+8) - live chat |

|

| Restricted Regions | USA | |

Pros

Regulated well

Wide range of markets to trade

Advanced trading platforms

A wealth of educational resources

Demo accounts

No minimum deposit requirement

Cons

No 24/7 customer support

② Interactive Brokers (IB)

Noted for discounted NASDAQ trading, low fees, and high-interest returns

Interactive Brokers (IB), founded in 1978, is a globally respected brokerage known for its advanced platform, broad market access, and low-cost pricing. Serving traders and investors in over 200 countries, IB offers 150 markets including stocks/ETFs, options, futures, spot currencies, bonds, and mutual funds. The firm is renowned for its Trader WorkStation (TWS), a feature-rich platform ideal for experienced traders. Regulated by top authorities like the FCA and ASIC, IB also provides a mobile app and web platform for more casual investors, though its complex features cater more to seasoned traders.

|

||

| Overall Rating | ⭐⭐⭐⭐⭐ | |

| Min. Deposit | $0 | |

| Regulators | ASIC, FCA, FSA, SFC, CIRO | |

| Trading Instruments | 150 markets, stocks/ETFs, options, futures, spot currencies, bonds, mutual funds | |

| Demo Account | ✅ | |

| Max. Leverage | 1:400 | |

| Trading Platforms | IBKR GlobalTrader (Mobile), Client Portal (Web), IBKR Desktop, IBKR Mobile, Trader Workstation (TWS) (Desktop), IBKR APIs (Desktop), IBKR ForecastTrader (Web), IMPACT (Mobile) | |

| Inactivity Fee | ❌ | |

| Customer Support | Live chat, phone, email, FAQs | |

Pros

Wide range of products

Low trading costs and competitive commission structure

Advanced Trader WorkStation (TWS) trading platforms

Regulated by several top-tier financial authorities globally

Cons

TWS platform has a steep learning curve

Complex pricing structure

③ RoboForex

Great for both beginner traders and experienced investors

RoboForex, an international broker since 2009, offers various trading instruments across stocks, indices, futures, ETFs, soft commodities, energies, metals, and currencies. Known for its advanced technology, RoboForex supports platforms like MT4/5, WebTrader, MobileTrader, and StocksTrader, with tools for algorithmic trading. It provides a variety of account types, including ECN for low spreads, Pro-Standard for everyday trading, and Prime for advanced conditions. RoboForex is regulated by the CySEC in Cyprus, NBRB in Belarus, and FSC in Belize.

|

||

| Overall Rating | ⭐⭐⭐⭐⭐ | |

| Min. Deposit | $/€10 | |

| Regulators | CySEC, NBRB, FSC (Offshore) | |

| Trading Instruments | Stocks, indices, futures, ETFs, soft commodities, energies, metals, currencies | |

| Demo Account | ✅ | |

| Max. Leverage | 1:2000 | |

| Trading Platforms | MT4/5, WebTrader, MobileTrader, StocksTrader | |

| Copy Trading | ✅ | |

| Fees | Stock Fee | Vary on the symbol and region |

| Deposit Fee | ❌ | |

| Withdrawal Fee | Free withdrawal twice a month | |

| Customer Support | 24/7 - live chat, contact form, WhatsApp, phone | |

| Restricted Regions | The USA, Canada, Japan, Australia, Bonaire, Brazil, Curaçao, East Timor, Indonesia, Iran, Liberia, Saipan, Russia, Sint Eustatius, Tahiti, Turkey, Guinea-Bissau, Micronesia, Northern Mariana Islands, Svalbard and Jan Mayen, South Sudan, Ukraine, Belarus | |

Pros

Multiple trading platforms including MetaTrader 4, MetaTrader 5, WebTrader, MobileTrader, and StocksTrader

Variety of account types

Wide range of financial instruments

Cons

Complex fee structure

Limited educational resources

④ AvaTrade

Recognized as the CFD broker with lower CFD fees

AvaTrade, established in 2006, is a globally recognized online broker offering trading across forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, and FX options. Regulated by top-tier authorities like FSA and ASIC, AvaTrade serves over 150 countries. The broker provides a range of platforms, including AvaTrade Mobile App, Mobile WebTrader, AvaSocial, AvaOptions, DupliTrade, and MT4/5. AvaTrade also offers comprehensive educational resources, including video tutorials, eBooks, and webinars.

|

||

| Overall Rating | ⭐⭐⭐⭐⭐ | |

| Min. Deposit | $100 | |

| Regulators | ASIC, FSA, FFAJ, ADGM, CBI, FSCA | |

| Trading Instruments | Forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, FX options | |

| Demo Account | ✅ ($10,000 in virtual capital, lasts for 21 days and can be renewed upon request) | |

| Max. Leverage | 1:30 (retail)/1:400 (professional) | |

| Trading Platforms | AvaTrade Mobile App, Mobile WebTrader, AvaSocial, AvaOptions, DupliTrade, MT4/5 | |

| Fees | Stock Fee | ❌ |

| Inactivity Fee | $/€/£50 after 3 consecutive months of non-use | |

| Customer Support | Live chat, contact form, WhatsApp, phone | |

Pros

Overseen by several high-profile financial authorities, including the FSA and ASIC

Wide array of trading platforms

Variety of financial Instruments

Comprehensive educational content

Cons

High inactivity fee

Slow withdrawal processing

Limited analysis tools

No 24/7 customer support

⑤ XM

Low-spread CFD platform, trusted for Nasdaq 100 trading

XM, founded in 2009, is a well-known online broker offering trading in forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, and thematic indices. The broker is recognized for client-friendly policies, including negative balance protection and support for automated trading. XM provides MetaTrader 4 and MetaTrader 5 platforms, accessible on both web and mobile. XM Group operates under multiple regulations, including CySEC in Cyprus and ASIC in Australia, ensuring robust oversight across various jurisdictions.

|

||

| Overall Rating | ⭐⭐⭐⭐⭐ | |

| Min. Deposit | $5 | |

| Regulators | ASIC, CySEC, DFSA, FSC (Offshore) | |

| Trading Instruments | 1,400+, forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, thematic indices | |

| Demo Account | ✅ (30 days) | |

| Max. Leverage | 1:1000 | |

| Trading Platforms | MT4/5, XM App | |

| Fees | Stock Fee | US shares: $0.04 per share, min $1 per transaction |

| UK shares: 0.10% per transaction, min $9 per transaction | ||

| German shares: 0.10% per transaction, min $5 per transaction | ||

| Withdrawal Fee | ❌ | |

| Customer Support | Live chat, phone, Help Center | |

| Restricted Regions | The United States of America, Canada, Argentina, Israel and the Islamic Republic of Iran | |

Pros

Regulated by a number of top-tier financial authorities

Support the MetaTrader 4 and MetaTrader 5 platforms

Negative balance protection

No hidden fees

Cons

Clients from the United States of America, Canada, Argentina, Israel and the Islamic Republic of Iran are not allowed

Delays in responses

⑥ Pepperstone

Renowned for facilitating automated NASDAQ trading on MT4

Pepperstone, founded in 2010, is an online forex and CFD broker offering 1,200+ tradable instruments, including forex, commodities, indices, currency indices, cryptocurrencies, shares, and ETFs. Known for competitive spreads, fast execution, and personalized support, Pepperstone supports various trading platforms like Pepperstone App, MT4/5, cTrader, and TradingView. The broker is regulated by top authorities, including ASIC and the FCA. Additionally, Pepperstone provides accessible educational resources like webinars and guides for traders of all levels.

|

||

| Overall Rating | ⭐⭐⭐⭐ | |

| Min. Deposit | $0 | |

| Regulators | ASIC, CySEC, FCA, DFSA, SCB (Offshore) | |

| Trading Instruments | Forex, shares, ETFs, indices, commodities, currency indices, cryptocurrencies, CFD forwards | |

| Demo Account | ✅(30 days, $50,000 virtual funds) | |

| Max. Leverage | 1:200 (Retail)/1:500 (Professional) | |

| Trading Platforms | TradingView, MT4/5, Pepperstone platform, cTrader | |

| Stock Fee | US Share and ETF CFDs: $0.02 per share | |

| UK Share CFDs: 0.1% | ||

| German Share CFDs: 0.1% | ||

| Australia Share CFDs: 0.07% | ||

| Hong Kong Share CFDs: 0.2%, min 45 HKD | ||

| Customer Support | 24/7 - phone, email, Help & Support | |

Pros

Regulated by several top-tier financial institutions, including ASIC and FCA

Competitive spreads

Offer multiple trading platforms, including Pepperstone App, MT4/5, cTrader, and TradingView (iPhone, Android, tablet, dekstop, web)

Excellent customer support

Educational content

Cons

High minimum deposit for swap-free accounts

Limited options for fundamental analysis

⑦ CMC Markets

Known for advanced research tools and NASDAQ CFD trading

CMC Markets, a UK-based broker established in 1989, offers trading in forex, indices, commodities, shares, and cryptocurrencies. Known for its proprietary platform, praised for advanced tools and user experience, the broker also provides access to MetaTrader 4/5 on desktop and mobile. CMC Markets covers over 10,000 products with extensive market analysis and educational resources. Regulated by top authorities like the FCA and MAS, it remains a reputable choice in the industry.

|

||

| Overall Rating | ⭐⭐⭐⭐ | |

| Min. Deposit | $0 | |

| Regulators | FCA, FMA, CIRO, MAS | |

| Trading Instruments | 10,000+, forex, indices, commodities, shares, ETFs, treasuries, shares baskets | |

| Demo Account | ✅ | |

| Max. Leverage | 1:200 (Retail) | |

| Trading Platforms | MT4/5, CMC NextGen | |

| Stock Fee | US Shares: 2 cents per unit, min. $10 | |

| UK Shares: 0.08%, min £9 | ||

| Australia Shares: 0.09%, min A$7 | ||

| Customer Support | 24 hours, Monday - Saturday morning - live chat, contact form, phone | |

Pros

Regulated by several top-tier financial authorities

Wide range of financial instruments

MetaTrader 4/5 platform

A variety of educational materials and market analyses

Cons

No 24/7 customer support

Limited account types to choose from

⑧ XTB

Appraised for NASDAQ trading education and commission-free stocks and ETFs

XTB, established in 2002, is a global forex and CFD broker offering 6,898 markets, including stocks, ETFs, forex, indices, and commodities. It provides advanced tools, charting, and a user-friendly interface. The broker is highly regarded for transparency, excellent customer service, and extensive educational resources. XTB is regulated by top authorities, including the FCA and CySEC.

|

||

| Overall Rating | ⭐⭐⭐⭐ | |

| Min. Deposit | £0 | |

| Regulators | CySEC, FCA | |

| Trading Instruments | 6,898, stocks, ETFs, forex, indices, commodities | |

| Demo Account | ✅ | |

| Max. Leverage | 1:500 | |

| Trading Platforms | xStation5 (Mobile, Desktop, Tablet) | |

| Fees | Stock Fee | Vary on the symbol and region |

| Deposit Fee | ❌ | |

| Withdrawal Fee | Free for withdrawal above 50 USD/EUR/GBP | |

| 5 USD/EUR/GBP for withdrawal below 50 USD/EUR/GBP | ||

| Inactivity Fee | A monthly fee of 10 GBP will be charged if no purchase or sale transaction within 365 days | |

| Customer Support | 24/5 live chat, phone, email | |

Pros

Regulated by FCA and CySEC

Wide range of financial instruments

Outstanding customer support and education

Cons

Withdrawal and inactivity fees charged

No MetaTrader 4/5 available

⑨ eToro

Highly regulated and ideal for following others' NASDAQ trading strategies

eToro, launched in 2007, is a global trading platform known for its social trading feature, allowing users to follow and copy experienced investors. It supports 7,000+ tradable instrumemts, including 6,202 stocks, 703 ETFs, 42 commodities, 55 currences, 18 indices, and 106 cryptocurrencies. eToro also provides extensive educational resources, including webinars, courses, and a demo account for beginners. The platform is regulated by top-tier authorities like CySEC, FCA, and ASIC.

|

||

| Overall Rating | ⭐⭐⭐⭐ | |

| Min. Deposit | $10 | |

| Regulators | ASIC, CySEC, FCA | |

| Trading Instruments | 7,000+, 6,202 stocks, 703 ETFs, 42 commodities, 55 currences, 18 indices, 106 cryptocurrencies | |

| Demo Account | ✅ ($100,000 in virtual funds) | |

| Max. Leverage | 1:30 (retail)/1:400 (professional) | |

| Trading Platforms | MT4, eToro proprietary platform | |

| Fees | Stock Fee | ❌ but not apply to CFD stock positions |

| Withdrawal Fee | Free (GBP and EUR accounts) or $5 (USD investment account) | |

| Inactivity Fee | $10/month applies to accounts with no logins in the previous 12 months | |

| Customer Support | 24/5 live chat, email | |

Pros

Social trading allows users to follow and copy trades of other successful traders

Offer over 7,000 financial instruments to trade

Regulated by top financial authorities like the FCA, CySEC, and ASIC

Simple and intuitive platform design

Cons

Charges a flat fee for withdrawals

If an account is inactive for 12 months, eToro charges an inactivity fee

Accounts can only be opened in USD

High spread fees for certain assets

⑩ IC Markets Global

Best bet for scalping strategies

IC Markets Global, an Australian-based ECN broker founded in 2007, is renowned for its high-speed execution and tight spreads across CFDs on 61 currency pairs, 24 commodities, 2,100+ stocks, 25 indexes, 9 bonds, 21 cryptocurrencies, and 4 futures. The broker offers MetaTrader 4, MetaTrader 5, cTrader, and TradingView platforms, accessible on both desktop and mobile. It supports algorithmic trading through integration with tools like ZuluTrade and Myfxbook. IC Markets boasts deep liquidity from over 50 banks and dark pools, ensuring low latency and minimal order rejections. The broker is regulated by ASIC and CySEC.

|

||

| Overall Rating | ⭐⭐⭐⭐ | |

| Min. Deposit | $200 | |

| Regulators | ASIC, CySEC | |

| Trading Instruments | 2,250+, CFDs on 61 currency pairs, 24 commodities, 2,100+ stocks, 25 indexes, 9 bonds, 21 cryptocurrencies, 4 futures | |

| Demo Account | ✅ (free for 30 days) | |

| Max. Leverage | 1:1000 | |

| Trading Platforms | MT4/5, cTrader, TradingView (Windows, Web, Android, Mac, iOS) | |

| Fees | Stock Fee | Vary on the symbol and region |

| Deposit Fee | ❌ | |

| Withdrawal Fee | ❌ | |

| Customer Support | 24/7 - live chat, contact form, phone, email, Help Centre | |

| Restricted Regions | The United States of America, Canada, Brazil, Israel, New Zealand, Iran and North Korea (Democratic People's Republic of Korea) | |

Pros

Regulated by ASIC and CySEC

Support MetaTrader 4, MetaTrader 5, cTrader and TradingView platforms

Low spreads and high-speed execution

Deep liquidity

Cons

No proprietary platform

Limited educational resources

Nasdaq 100 Brokers FAQs

What is the Nasdaq 100?

The full name of Nasdaq is actually the National Association of Securities Dealers Automatic Quotations. The NASDAQ 100 is a stock market index made up of equity securities issued by 100 of the largest non-financial companies listed on the NASDAQ. It's a modified capitalization-weighted index.

Composition of the Nasdaq 100

The composition of the Nasdaq 100 is diverse, representing numerous sectors, including technology, health care, consumer services, and communication services, excluding financial companies. However, it is heavily dominated by the technology sector. Companies like Apple, Microsoft, Amazon, Alphabet (Google), Facebook, and Tesla constitute a substantial chunk of the index due to their high market capitalization.

The exact composition can change from time to time as companies are periodically added or removed based on their market capitalization, trading volume, and other factors. For the latest composition of the Nasdaq 100, you can visit the official Nasdaq website - https://www.nasdaq.com/

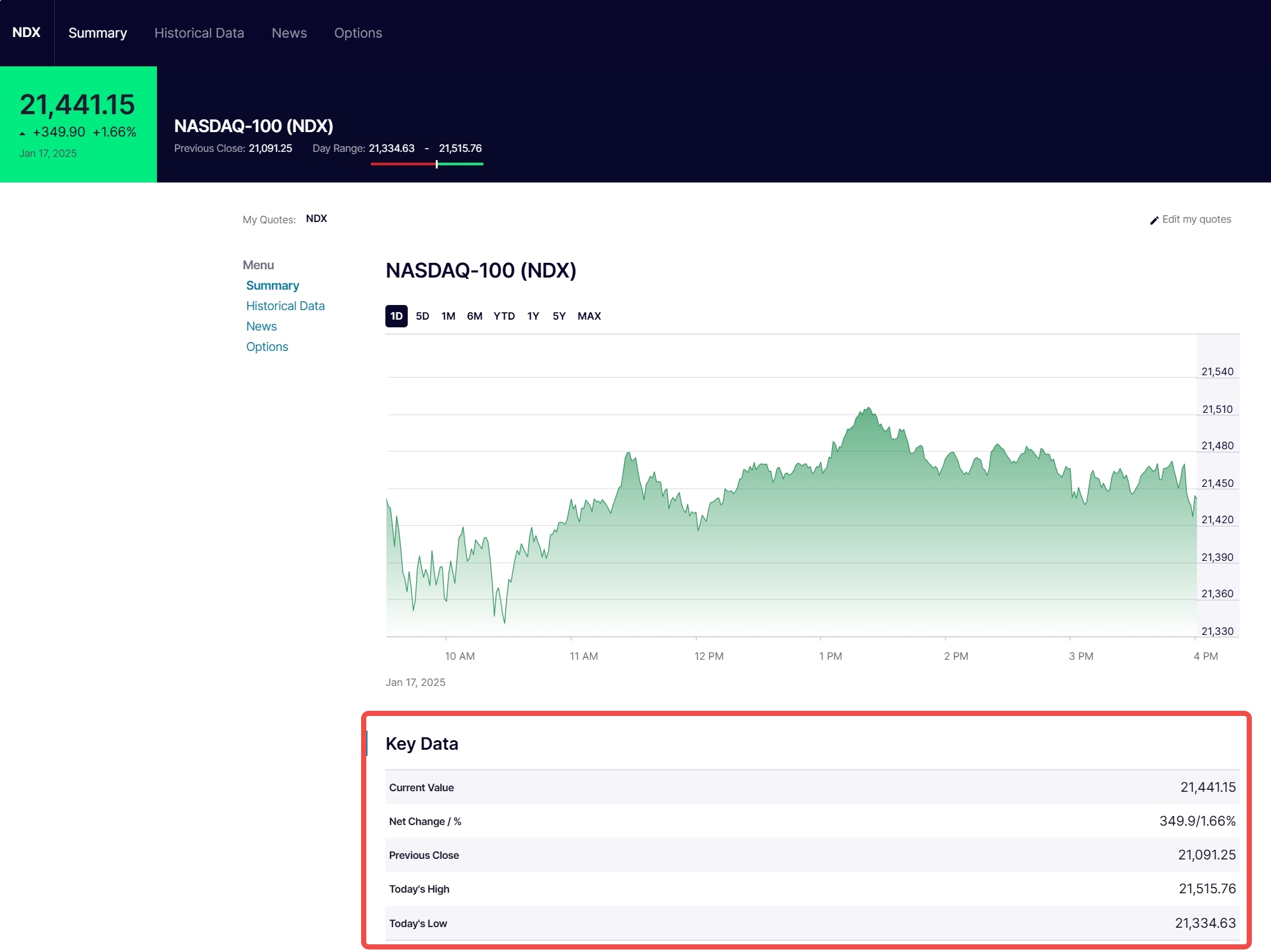

Current value of the Nasdaq 100

According to the data observed from the Nasdaq website - https://www.nasdaq.com/market-activity/index/ndx, the current value is 21441.15. The website also provides detailed information on market activity, news updates, helpful solutions, and more.

| Current Value | 21441.15 |

| Net Change | 349.9/1.66% |

| Previous Close | 21091.25 |

| Today's High | 21515.76 |

| Today's Low | 21334.63 |

Which broker offers the most advanced tools for Nasdaq 100 trading?

Interactive Brokers (IB) and CMC Markets are highly regarded for their advanced trading platforms and tools, suitable for experienced traders.

Are these brokers regulated and safe to use?

Yes, all listed brokers are regulated by top-tier financial authorities, ensuring a high level of safety and security for traders.

| Broker | Regulators |

| IG | ASIC, FCA, FSA, FMA, MAS, DFSA |

| Interactive Brokers (IB) | ASIC, FCA, FSA, SFC, CIRO |

| RoboForex | CySEC, NBRB, FSC (Offshore) |

| AvaTrade | ASIC, FSA, FFAJ, ADGM, CBI, FSCA |

| XM | ASIC, CySEC, DFSA, FSCA, FSC (Offshore) |

| Pepperstone | ASIC, CySEC, FCA, DFSA, SCB (Offshore) |

| CMC Markets | FCA, FMA, CIRO, MAS |

| XTB | CySEC, FCA |

| eToro | ASIC, CySEC, FCA |

| IC Markets Global | ASIC, CySEC |

What are the Best Nasdaq 100 Brokers for 2025?

You Also Like

Best Binary Options Brokers in 2026

Best Bitcoin Brokers for 2026

The text discusses Bitcoin brokers' role and criteria for selecting the top providers, emphasizing their key functionalities.

7 Best Crypto Brokers in 2026

Examine the top 5 futures trading platforms , considering user experience, tradable assets, educational resources, commissions, and more.

10 Best Forex Brokers for Professional Traders in 2026

Discover the '10 Best Forex Brokers for Professional Traders', your ultimate guide to thriving in the forex market.